Wing Tai is still not a value trap

Value Investing Case Study 10-4. I initially covered Wing Tai in Mac 2021 based on the Annual Reports till FYE June 2020. This post is an update taking into account the Annual Report till FYE June 2023.

I first covered Wing Tai Holdings Ltd (Wing Tai or the Group), Singapore's leading property and lifestyle group in 2021. At that juncture, it was trading at SGD 1.91 per share (as of 26 Feb 2021) compared to its Book Value of SGD 4.15 per share (as of the end of Dec 2020).

As a property group, a significant part of the value is tied up in the assets. With a price that is about half of the Book Value, the first thing that came to mind was whether this was a value trap.

To dismiss a company as a value trap, you have to show that its assets are not going to be impaired and that it will continue to generate positive free cash flows. Next, you have to show that there is an ample margin of safety between the current price and its intrinsic value.

On such a basis I concluded then that Wing Tai was not a value trap. The market price of Wing Tai is currently SGD 1.32 per share (12 Dec 2023) while its Book Value has remained about the same at SGD 4.13 per share (as of the end of FYE June 2023).

Did I make a mistake or has the market been irrational for the past 2 years? Join me as I re-look at my fundamental analysis. Where appropriate, I have incorporated the analyses from my earlier articles. If you had inadvertently tried to access them, you would be redirected here.

The conclusion is that Wing Tai is still not a value trap.

Should you go and buy it? Read my Disclaimer!

Contents

- Investment Thesis

- Business background

- Operating trends

- Growth and prospects

- Valuation

- Risk

- Conclusion

|

Investment Thesis

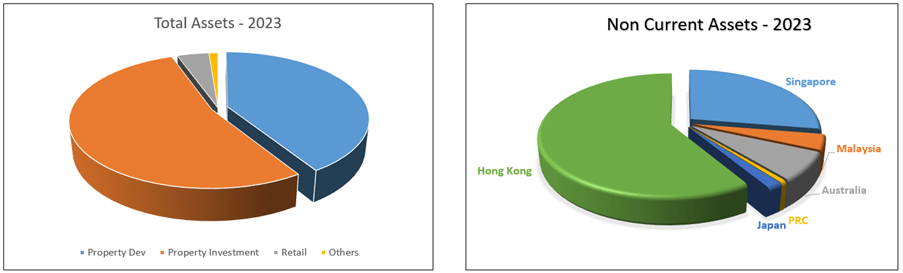

Wing Tai is a property group with about 55 % of its total assets in 2023 tied up in investment properties. The bulk of the balance is tied up in property development.

About 59 % of the non-current assets are invested in Hong Kong with another 28 % in Singapore. The diversity has provided the Group with some protection against any slowdown in the property market.

While its performance had declined from the 2013/14 peak, the Group seemed to have arrested this decline. I do not expect losses going forward. Wing Tai is currently trading at a significant discount to its Book Value and EPV. There is a sufficient margin of safety to invest in Wing Tai.

|

Business background

Wing Tai was founded in 1955 in Hong Kong as a small garment manufacturer. It eventually extended its operations into Singapore and Malaysia in the 1960s. (Source: Singapore Infopedia).

In 1984 it ventured into the retailing of ready-made garments in Singapore and extended this to Malaysia in 1989. Currently, it is one of the largest fashion retail companies in Singapore and Malaysia.

Wing Tai ventured into the property sector in 1978 with its first residential project in Singapore. Today its property activities in Singapore and Malaysia are far larger than the retailing operations.

It added investment properties to its portfolio in 1991 with the completion of Winsland House, a grade-A office block in Singapore.

Since then, the Group has expanded both regionally and sector-wise so that today it has 3 main business segments:

- Property Development with both residential and commercial properties. Current projects are in Singapore, Malaysia, and China.

- Property Investments with serviced residences, office buildings, data centers, and hotels. These were developed across several geographical locations.

- Lifestyle Retail. The Group has many branded stores in Singapore and Malaysia with many lifestyle brands such as Uniqlo and Mango.

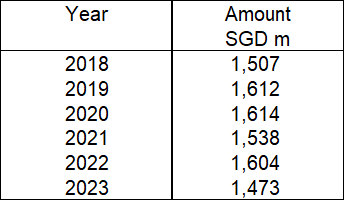

This is a property group with Property Development as the main revenue contributor. Refer to Chart 1. Although it has operations across several countries, the bulk of the revenue comes from Singapore.

|

| Chart 1: Segment profile |

From a corporate structure perspective, there are 2 listed entities within the Group:

- Wing Tai Ltd (Wing Tai) which is listed on SGX.

- Wing Tai Properties Ltd (WTPL) which is listed on HKEX. Wing Tai owns 33 % of WTPL.

Before 2017, the Group comprised 3 listed entities - Wing Tai Holdings Ltd, WTPL, and Wing Tai Malaysia Bhd. In 2017, Wing Tai Malaysia was successfully privatized and delisted and its results are now consolidated as part of the Group results.

Wing Tai has a long history of forming strategic alliances to expand its business. For example:

- In 1984, it formed a joint venture to retail clothes designed under the G2000 brand.

- In 1993 it entered into 2 Singapore government-back consortia to develop properties in China.

- In 2000 it established a real estate fund with AIG to develop 2 prime properties for sale in Singapore.

One such result is that Wing Tai's investments in associates and joint ventures accounted for 39 % of its Total Assets in 2023. It was only 19 % in 2008.

Given the large investments in associates and joint ventures, looking at accounting revenue would not give you a true picture of the Group activities. We are fortunate in that in its Annual Report Wing Tai provided a breakdown of the assets including those of the associates.

This “Look-Thru” profile will provide a more realistic picture of the focus of the business. Refer to Chart 2.

Based on these, you can see that the majority of the assets have been allocated to the Property Investment segment. Secondly, the bulk of the non-current assets have been deployed in Hong Kong.

|

| Chart 2: Look Thru Asset Profile |

You will get another picture looking at the floor area under development or leased based on a Look Thru basis. In this analysis, I took the proportionate ownership of the respective projects/buildings. On such a basis,

- The bigger development area came from Malaysia.

- Hong Kong contributed the largest rental area. But you can see an increase in floor area from other regions (UK) from 2018.

|

| Chart 3: Look Thru Floor area |

I have not provided a breakdown by property type (residential, commercial, or office). However, the group covered several categories

The key takeaway is that this is a diversified property group in terms of business segments, regions, and product categories (eg residential vs commercial).

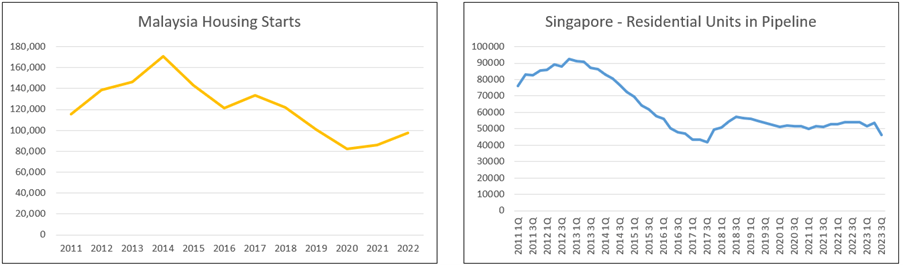

I found that not all the segments were pulling the same weight. Refer to Chart 4 which shows the average performance over the past 12 years.

- While Retail was the smallest in terms of capital deployed, it generated the best returns.

- The Property Investment segment generated the lowest return.

The Group performance seemed to be pulled down by the low returns of the Property Investment and Others segments. The bulk of the Others segment is also in Property Investment. As such, I would attribute the bulk of the low returns to the investment properties.

| ||||

| Chart 4: Segment performance Notes Capital = Equity + Debt as of 2023. Average Revenue and EBIT based on past 12 years' average. Return = Average EBIT / Capital. Margins = Average EBIT / Average Revenue. Investment, Others cover the associates, JV, and other operations.

|

Operating trends

I looked at 3 metrics to get an overview of the overall performance – revenue, PAT, and gross profitability (gross profits / total assets). Refer to the Performance Index of Chart 5.

You can see that all 3 metrics peaked in 2013 and declined thereafter. The values in 2023 were lower than those in 2012.

- Looking at Chart 1, you can see that the declining revenue post-2014 was due to the declining property development revenue from Singapore and Malaysia. The turnaround in 2018/19 coincided with the improvement in the property development activities in these 2 countries.

- The decline in PAT was partly due to the declining revenue as well as declining gross profit margins. In 20112/13, the average gross profit margin was 45%. This had declined to an average of 31 % in 2022/23. The jump in profits in 2018 was due to a one-off gain from the disposal of a project in China.

- Without any significant changes in the total assets, you should not be surprised that gross profitability mirrored the revenue and PAT trends.

|

| Chart 5: Performance Index and EBIT |

You can see from the EBIT part of Chart 5 that:

- The majority of the profits came from property development activities.

- The Property Investment profits have not been consistent with losses in 2023 from fair value losses.

- The Retail segment profits became more significant over the past 2 years.

Given the declining PAT, you should not be surprised to see a decline in ROE. I also tracked the Operating return defined as after-tax Operating profit / Total Capital Employed where:

Total Capital Employed = Equity + Debt – Cash

As shown in Chart 6, both the ROE and Operating Return showed a declining trend. There was an operating loss in 2017 due to the low revenue. Over the past 12 years, it achieved an average 5.3 % ROE and 1.9 % Operating Return.

A DuPont Analysis of the Operating Return showed that Operating margin accounted for the bulk of the changes in returns. The positive sign was the improving Leverage (declining trend).

|

| Chart 6: Return and DuPont Note: In the years where the tax rate was negative, I took the past 12 years' average tax rate in determining the after-tax operating profit. |

|

Peer comparisons

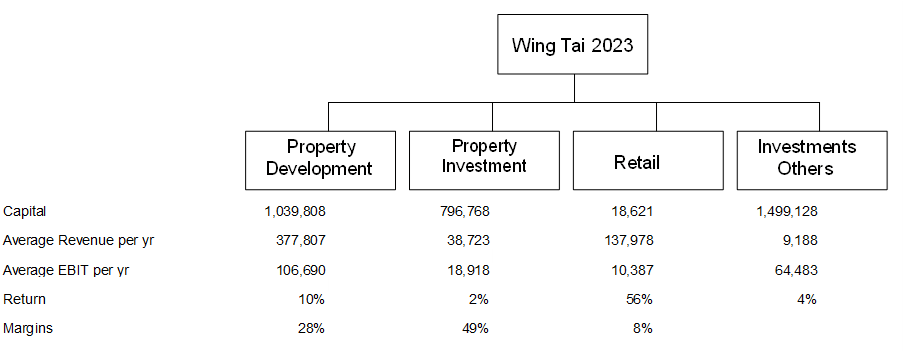

To assess management performance, I usually compare the company's performance with those of its listed peers.

The challenge here is that there is no other SGX-listed company with property and retail operations. Secondly, it would be difficult to find SGX property companies with similar geographical spread.

As such, I selected the top SGX-listed property companies with large overseas investment properties as peers. These are:

- Guoco Land (F17).

- CapitaLand (C31).

- HongKong Land (H78).

- City Development (C09).

I looked at 2 metrics – revenue growth and ROA. Refer to Chart 7 and Table 1.

- Wing Tai had the worst revenue growth results. The revenue of both City Development and Wing Tai shrank over the past 12 years.

- Wing Tai had the worst average ROA. It also had the largest drop from 2012 to 2022.

|

| Chart 7: Peer Comparisons |

|

| Table 1: Peer Performance |

Do remember that Wing Tai property business operates in different regions compared to the peers. As such, you should not be surprised to see different performances. The role of management is to make strategic choices about where to invest. Given this, you should not dismiss Wing Tai comparative poor performance outright.

Growth and prospects

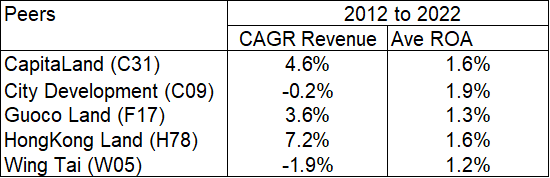

Over the past 12 years, revenue declined. This is reflected in Chart 3 which showed a reduction in the gross floor area developed. At the same time, there was not much growth in the lettable floor area.

This is more a function of the property market condition.

Based on the profile in the earlier charts, I would break up the Group’s property market into 2:

- Residential market - property development. These are especially important for Singapore, Malaysia, and Hong Kong.

- Office rental market - These are relevant for the Property Investment portfolio in Hong Kong and UK.

I thus focus on these markets when looking at the prospects. Chart 8 shows that over the past 12 years, the housing starts in Singapore and Malaysia have been declining.

Chart 9 shows the rental position for Hong Kong and the UK.

- The rental rates for Hong Kong increased from 2011 to peak in 2019 before declining.

- Wing Tai started its operation in the UK in the early part of the last decade. But it became significant in 2018.

|

| Chart 8: Malaysia and Singapore Housing Starts |

|

| Chart 9: Hong Kong and UK Rentals |

Comparing Charts 1, 5, and 8, I would conclude that when the property development market was good (such as in 2013/14), the Group was able to deliver a good performance from the Property Development segment.

Reinvestments

I defined Reinvestments as:

Reinvestment with acquisitions = CAPEX & Acquisitions – Depreciation & Amortization + Net Changes in Working Capital.

Over the past 12 years, the total Reinvestment was negative SGD 268 million. This meant that instead of investing in the business, cash was thrown out from divestiture. Furthermore, this meant that the amount incurred for Net CAPEX was less than the Depreciation and amortization.

I would not expect to have this situation if the business is growing.

The key takeaway is that it may be more appropriate to value Wing Tai based on the Earnings Power Value (EPV). This will assume that there is no growth and that the Reinvestment = zero.

Financial position

I assessed Wing Tai's financial position based on the following metrics. Overall, I would rate it as average as there were both positive and negative performances.

It has a 0.2 Debt Equity ratio as of the end of Jun 2023. The ratio had declined from the 12-year peak of 0.52 in 2012.

As of the end of June 2023, it had SGD 404 million in cash and short-term investments. This was about 10 % of its total assets.

Over the past 12 years, there were only 2 years with negative cash flow from operation. It generated about SGD 923 million in cash flow from operations compared to the total PAT of USD 1.85 billion. This is not exactly a good cash conversion ratio.

Over the past 12 years, it generated SGD 923 million cash flow from operations. But it spent SGD 849 million on dividends and share buyback. This meant that there was not enough for CAPEX. Refer to Table 2. I would not consider this a good capital allocation plan.

|

| Table 2: Sources and Uses of Funds |

Over the past 12 years, it achieved an average after-tax operating return of 1.9 %. This was lower than the WACC of 6.2 % as per Table 3. This meant that it had not been able to create shareholders’ value.

|

| Table 3: WACC Note: Based on a Google search for the term “Wing Tai Holdings WACC”. |

Wing Tai Malaysia Bhd (WTMB)

At the beginning of 2017, WTMB was a 66.2 % subsidiary of Wing Tai. It had property development, property investment, and fashion retail operations in Malaysia.

In May 2017, a voluntary unconditional cash offer was made for all the remaining shares in WTMB not already owned by the Group at a cash offer price of RM 1.80 per share.

On 8 August the compulsory acquisition threshold was crossed and WTMB became a subsidiary of Wing Tai. WTMB was delisted from Bursa Malaysia on 30 August 2017.

The offer price of RM 1.80 per share was about 48 % to 71 % premium to the various volume-weighted average market prices of WTMB. (The periods ranged from 5 days to 6 months of full trading days before the service of the Notice of Unconditional Take Over Offer.)

In reality, the offer price was actually below the intrinsic value of WTMB.

- The Net Asset was RM 2.73 per share at that juncture.

- The Independent Adviser estimated that the fair value of WTMB ranged from RM 3.55 to RM 3.59 per share (Source: WTMB Independent Advice Circular).

- Another minority shareholder (Pangolin) estimated that the Revised Net Asset Value of WTMB to be RM 3.63 per share.

You can see that the acquisition was at a price that was lower than the intrinsic value of WTMB. As such it added value to the shareholders of Wing Tai.

You would commend Wing Tai from a capital allocation perspective. They took advantage of the market conditions to privatize WTMB at such a price.

|

Valuation

The property sector is cyclical as can be seen from the earlier charts.

Damodaran opined that cyclical companies’ performance depends on where they are in the cycle. Extrapolating the performance based on the current earnings and cash flows can lead to misleading valuations.

To overcome the cyclical issue, we have to normalize the performance over the cycle. To reflect the current size of the business, Damodaran suggested that we should take the current revenue and determine the earnings by multiplying it with the normalized margins.

I will develop my financial model of Wing Tai based on this approach. Unfortunately, when you look at Charts 8 and 9, you can see that 2012 to 2023 does not cover a full cycle ie peak-to-peak, or the equivalent.

I used 2 key approaches to triangulate the intrinsic value of Wing Tai:

- Asset Value. I used the Book Value here.

- Earnings Value. I consider the EPV case with 2 Scenarios. For Scenario 1 (EPV 1), I assumed the 2012 to 2023 average earnings. For Scenario 2 (EPV 2), I assumed that 2018 to 2023 average earnings.

Chart 5 summarizes the picture. With the current market price of SGA 1.32 per share (as of 12 Dec 2023) you can see that there is a sufficient margin of safety under both the Asset Value and EPV.

|

| Chart 10: Valuation Note: The orange column under EPV 1 and EPV 2 represents the net non-operating assets. They are the investment in associates/JV. |

I estimate the Asset Value to be SGD 4.13 per share. This is looking at the assets of the company as a store of value. The Asset Value does not take into account the possible further fair value losses from the investment properties.

There had not been very significant fair value losses at Wing Tai level compared to WTPL. There had been substantial fair value losses at the WTPL level over the past few years. However, because of the 33% ownership, the impact has been limited as shown in Table 4.

Note that the reduction in the carrying value from 2022 to 2023 is about SGD 0.17 per share or about 4 % of the 2023 Book Value. As such the Asset Value provides a large margin of safety from the impairment perspective.

|

| Table 4: WTPL carrying amount in Wing Tai books Note that the changes in the carrying amount are also due to dividends and forex apart from profit or loss. |

I prefer to focus on the Earnings Value of SGD 3.09 per share under EVP 1 and SGD 2.29 per share under EPV 2.

- EPV 2 is a very conservative one as it assumes that the future earnings will be at the 2018 to 2023 performance level.

- I am more inclined to see the future earnings to be the average of the past 12 years' performance as per EPV 1.

Note that a very large part of the EPV comprises the non-operating assets. These comprise mainly the investment in associates and JV. As such, the potential fair value losses mentioned earlier are also applicable here. However, the margin of safety under EVP 1 is large enough to cater to this.

EPV Valuation models

I estimated the EPV based on Damodaran Free Cash Flow to the Firm (FCFF) model where:

FCFF = EBIT(1-t) under the Earnings Power Value case.

Value = FCFF / WACC

The above model valued the operating assets. To estimate the Value of the firm, I added the Value of non-operating assets. In the case of Wing Tai, the non-operating assets were very large as they amount to SGD 1.73 billion. They comprise the investment in associates/JV and cash.

The Value of Equity was then determined based to the following equation:

Value of Equity = Value of the firm – Debt – Minority Interest.

In interpreting the EPV you should note that I have assumed that the future performance is equal to that of the past. If you believe that the future would be better, then my valuation is low.

Risks

I normally look at two types of risks - privatization and business risks.

In the SGX context, the privatization rules are different than those for Bursa Malaysia. SGX rules require any privatization to be fair and reasonable. This means that the offer price should reflect the value of the securities and not just the market price.

This is unlike Bursa Malaysia where an offer can be unfair but reasonable. It does not reflect the value of the securities but is in line with the market price.

For example, the privatization of WTMB was deemed as “unfair” but “reasonable” by the Independent Adviser. This was because the offer price was less than fair value but at premiums to market prices.

As such if you invested at a discount to intrinsic value, there is less concern about suffering a loss through the privatization of Wing Tai.

The main risk for investing in Wing Tai is the business risk. The key questions in this context are

- Is property development and/or property investment a sunset industry?

- Is fashion retailing going to be disrupted by digital technology?

I believe that there will still be a demand for residential properties in Singapore and Malaysia. As such this is not a sunset industry.

However, there are risk issues with property investments and retailing.

Property investment

One of the most significant impacts of the Covid-19 pandemic has been on the work-from-home trend. According to a recent article by McKinsey:

“Hybrid work is here to stay. As a result, office attendance has stabilized at 30 percent below pre-pandemic norms… The ripple effects of hybrid work are substantial.”

While the above refers to the US market, I expect this work-from-home to be eventually a global trend. There are two possible scenarios for Wing Tai:

- Move into a co-working space.

- More investments in non-office spaces eg data centers.

This will affect the occupancy of the investment properties. In 2023, Wing Tai recognized a fair value loss of SGD 4.9 million. But this was for Wing Tai's investment properties.

WTPL had its share of fair value losses as follows:

- HKD 527 million (about SGD 90 million) for FYE 2021.

- HKD 1,199 million (about SGD 204 million) for FYE 2022.

- HKD 290 million (about SGD 49 million) for the first half of FYE 2023

I would not be surprised to see further fair value losses until the demand or rental rates stabilize, especially in Hong Kong.

What is the potential loss? In the mid-90s to mid-2000s property cycle, property values in Hong Kong dropped by about half.

Properties accounted for about 80 % of WTPL Total Assets. If history repeats itself, we could have 50 % impairment of this 80 %. But Wing Tai exposure is limited to its 33 % share. I estimated that this would result in a fair value loss of SGD 680 million Wing Tai ie about SGD 0.90 per share.

If this worst case happens, the Asset Value would be reduced by about ¼. And there would still be a margin of safety under EPV 1.

But then you are assuming that the property market would not recover. Historically there have be reversal of fair value losses. If you are a long-term investor, this fair value loss is not the end of the story.

Digital disruption and fashion retailing

It is generally accepted that fashion is one of the key industries that is currently being redefined by digital disruption. According to the consulting group BCG in "Why Fashion Must Go Digital - End to End",

“Fashion, an industry of craft and creativity, needs to go digital both to survive attack and to thrive in the next decade….”

Another consulting group, McKinsey opined that some apparel, fashion, and luxury companies won’t survive the current crisis; others will emerge better positioned for the future. Much will depend on their digital and analytics capabilities.

As one of the leading fashion retailers in Singapore and Malaysia, Wing Tai is not immune from this threat.

At this juncture, there is no sign of how the Group is going to meet the challenge of digital technology. It will have to address this if it is to remain a leading player in this sector.

About 3 decades ago, the Group reinvented itself from garment manufacturing to fashion retailing. It will have to reinvent itself if it wants to continue to be in the fashion retailing sector.

In mitigation, the fashion retailing segment is a small part of the Group.

Conclusion

Wing Tai's revenue over the past 12 years declined. This was partly due to the soft property market in those regions where it operated. But part of the decline can also be attributed to its business model as some of its peers managed to grow their revenues.

The bulk of the profit came from property development. As such the Group’s profit declined in tandem with the slowdown of the property development sector in Singapore and Malaysia.

However, the property development sector is cyclical. The Group has the assets and track record to rebuild the Property Development segment revenue when this happens.

The advantage is that the Group has a Retail segment that did very well over the past 2 years following the COVID-19 disruption. At the same time, the Group's low debt and strong cash position meant that it had the financial resources to scale up the property development business.

The positive side is that there are margins of safety from both the Asset Value and Earning Power Value perspectives.

Wing Tai does not look like a company that is going under. Property development is not a sunset sector and while there is a threat of digital disruption to its retailing business, this is a small contributor.

The main challenge is the Property Investment portfolio. If the rental market in Hong Kong and the UK takes a longer time to recover, we may see further fair value losses. But this can be covered by the large margin of safety.

Given the above, Wing Tai is not a value trap. I had a similar conclusion in 2021. The unknown is how long an investor has to wait for the market to re-rate Wing Tai. But the wait is not a value trap issue. It is a holding power and the size of the investment return issue.

I am a long-term value investor holding onto stocks for 6 to 8 years. My analysis and valuation are from this perspective. And you can understand why I consider this an investment opportunity.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment