Eksons is now a value trap (Oct 2023)

Value Investing Case Study 01-4: Eksons: A case study in value trap evolution. An updated fundamental analysis of Eksons based on the financial results till FYE Mac 2023. It also pulls together the relevant sections of my earlier articles on Eksons. You would also be re-directed here if you have tried to access the earlier posts.

I first covered Eksons Corporation Bhd (Eksons or the Group) in June 2020. At that juncture, the Group had two operating segments – timber (plywood) and property development. I found that Eksons was a Graham Net Net and concluded that it was not a value trap.

But Eksons today is no longer an operating company. It had ceased the timber operations and completed its property development projects. There is no other property development project in the pipeline. But it is holding onto RM 259 million cash.

Eksons is currently a cash holding company that is still a Graham Net Net. But due to the lack of significant operations, I have revised my view and concluded that it is now a value trap.

I have a 3-mins video that provides an overview of this thesis.

Should you sell Eksons? See my Disclaimer.

Contents

- Investment thesis

- Thrust of my analysis

- Financial position

- No significant operations

- Capital allocation

- Inflation and market dynamics

- Management

- Valuation

- Conclusion

- Appendix 1 – Timber prospects

- Appendix 2 – Was shareholders’ value created?

|

When I first covered Eskons in June 2020, it was trading at RM 0.57 per share compared to its cash and marketable securities of RM 1.27 per share. I concluded that Eksons was a Graham Net Net. It was also not a value trap.

In May 2021, I carried out an updated analysis. The market price had gone up to RM 0.835 per share (as of April 2021). But it was still below the latest cash and marketable securities of RM 1.32 per share (as of the end of Dec 2020). I maintained that Eksons was still a Graham Net Net and not a value trap.

In its 2023 Annual Report, Eksons stated that it had ceased its plywood (timber) operations in Jan 2023. The assets of the timber segment would be deployed as investment properties. The Group would continue with its property development business as well as identify key business opportunities.

This is my latest update of Ekson taking into account the change in the business direction. Where appropriate I have also pulled together the analyses of the earlier articles.

Investment Thesis

In Jan 2023, the Group ceased its plywood operations and rented out the facilities. This rental operation was reported as part of the property and investment holdings segment. But there is nothing to suggest that the Group would acquire other investment properties as part of this segment.

The Group is thus left with property development as the ongoing operation. But there are no development projects and the Group is just selling off its inventory of completed units.

However, the Group is cash rich with RM 259 million in cash or cash equivalent (investment securities) as of June Jun 2023. It does not look as if this will be returned to shareholders and is probably earmarked for new business opportunities.

Eksons is currently trading at RM 0.54 per share (12 Sep 2023) compared to its Graham Net Net of RM 2.02 per share (as of end Mac 2023). There is a sufficient margin of safety.

However, without any significant operations, the Group is essentially a cash-holding company. I consider this a value trap unless and until the Group builds up its operations.

|

Thrust of my analysis

A value trap occurs if you buy a company because it is cheap only to find out that the assets are not what you think they are and/or there is no future. In other words, it is cheap for fundamental reasons.

To avoid value traps in such a situation, you determine the intrinsic value based on its business fundamentals. If the price is less than the intrinsic value, I would conclude that the stock is not a value trap.

This was what I did in my earlier analyses and valuations of Eksons. At those junctures, the Group still had substantial business operations.

Ekons currently does not have any substantial business operations. It is essentially clearing stocks and holding onto cash while looking for new opportunities.

There is an alternative perspective of a value trap that applies to a cash-holding company such as Eksons.

The cash can make it seem like a good investment opportunity. However, several factors can turn it into a value trap:

- Capital Allocation. If management is unable to allocate the cash to generate returns for shareholders, the cash can become a liability rather than an asset. This can happen if the company fails to identify profitable investment opportunities.

- Transparency. Some companies may have undisclosed or unclear plans for their cash holdings. This makes it difficult for investors to assess the company's prospects.

- Erosion of purchasing power. Inflation can erode the value of cash holdings over time. If the cash is not invested to keep up with inflation, the purchasing power of that cash can decline, and shareholders may not benefit.

- Dividend and share buyback. You may invest in a cash-rich company expecting it to distribute the excess cash. If the company does not have a clear policy or willingness to return cash to shareholders, your expectations will not be met.

- Market dynamics. External factors, such as changes in interest rates or shifts in market sentiment, can also impact the valuation. If interest rates rise, for example, the opportunity cost of holding cash increases, which can negatively affect the company's stock price.

I will show that Eksons falls into the cash-holding company category. To assess whether it is a value trap, I will assess its capital allocation strategy, and its plans for the cash. Apart from evaluating its transparency, I will also look at its track record in managing its cash reserves and generating returns.

|

Financial position

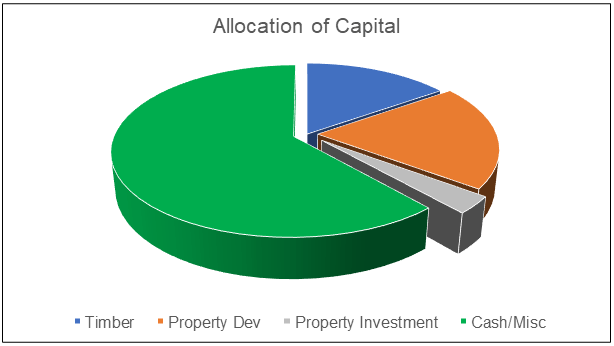

As of the end of Mac 2023, the Group had a Total Capital Employed (TCE = total Equity + total Debt) of RM 382 million. About 37% of the TCE was deployed for the operations with the balance as financial/non-operating assets. Refer to Chart 1.

|

| Chart 1: Sources and Uses of Funds |

To understand how the net operating assets were deployed, I re-allocated the Balance Sheet items as shown in Chart 2. I have also shown the past 12 years' average revenue and PBT to give you a sense of the returns.

You can see that:

- The property development segment used about half of the net operating assets. It generated about 7 % return as measured by the PBT/Total Equity. It is not exactly a fantastic return.

- There are net operating assets in the timber (plywood) segment as there is still about RM 37 million of inventory. The Group stated that it may take more than a year to clear them. I have also allocated all the Property, Plant & Equipment (PPE) amounting to RM 23 million to this segment. This segment was not profitable for the past 6 years of the 12 years resulting in a weighted average loss.

- I do not expect any significant profit contribution from the rental of the plywood facilities as the monthly rental has to cover depreciation and insurance. In the past, the rental of unsold properties was also classified as part of this segment.

- The Misc segment is the balancing segment and comprises mainly the cash and investment in securities.

I would expect that there would be more cash converted from the timber net operating assets when the operation is fully run down. As such I expect the amount of cash and investment securities to increase in the coming year or so.

I will show that the property investment and property development operations are not substantial operations. This means that effectively Eksons today is a cash holding company. Chart 3 illustrates this.

Current Performance

For the first financial quarter ended Jun 2023, the Group reported revenue of RM 5 million and PAT of RM 10 million. The bulk of the revenue came from the sale of the Affinity Residence project.

As for the profits, the Group benefited from a forex gain of RM 11 million. Without the forex gain, the Group would probably break even.

I would expect the Group to continue to break even at best for FYE 2024 and onwards until it can build up a substantial operation. Refer to my analysis of the investment property and property development operations.

No significant operations

As per Chart 2, you can see that the Group currently has 3 operating segments. However, I do not consider these to be significant operations.

- The timber (plywood) segment ceased operations in Jan 2023 and is now clearing stocks. After the stocks have been cleared, there will not be any operations.

- The property investment segment is a rental recovery operation and I would not consider this a substantial operation. Refer to the next section for details.

- As shown in the subsequent section, the property development segment is not exactly an operating segment.

Property investment

The Group does not own major investment properties. In the past, the investment properties and rental income were from the unsold units in The Atmosphere. Eksons has now extended this to include the rental of the plywood factory.

It is good that management is extracting some revenue from inventory and unused facilities. But you can see that this segment is a by-product of operating challenges rather than a business that is pursued separately.

This looks like a break-even type of business and I do not expect more funds to be deployed here. Rather some of the assets here could be converted to cash.

Property development

The Group currently does not have any projects under development.

- Its 2 projects - The Atmosphere and Affinity Residences – have been completed. The Group has unsold units amounting to RM 60 million as of the end of Mac 2023.

- The Group has a 66-acre plot in Seremban for development that was acquired in 2012. But there is no news about developing this. This land is reported in its books at RM 17.3 million. It is possible that the land value could be higher today.

With RM 75 million net assets currently deployed for the property development segment, it is a small operation. Eksons could of course allocate more of its net assets to this segment.

But as can be seen from Chart 2, its returns have not been fantastic. To give you a better sense of this, it is instructive to look at its property development history.

The Atmosphere

Eksons’ property development started in 2006/07 with The Atmosphere. This was undertaken via separate joint ventures with the project manager and the landowner to overcome the issue of expertise and to minimize start-up costs.

Then in 2008 to 2010 the Group acquired the Atmosphere land to cap the land cost.

The Atmosphere approved master layout plan comprised:

- 9 acres hypermarket zone.

- 12.5 acres stratified community with shops and a medium-sized entertainment center.

- 14.5 acres commercial component with a retail complex, hotel, serviced apartments, and office towers.

In 2009, the Group successfully launched the shop offices and boulevard shops component of The Atmosphere with 90% of the units sold.

Unfortunately, the Malaysian property market started to turn soft in 2014 affecting its property development plans. This affected not only the sales of units in The Atmosphere but also led to the re-timing of the Affinity Residences that were originally planned for the 2016 launch.

The jump in the revenue for the Property Development segment in 2015 was due to a one-off sale of 14.64 acres of land which was part of The Atmosphere project.

While technically correct to count the land sale as revenue for the property business, you want revenue from development. After all, Eksons is not a land trader.

In terms of Eskons's property development activities, the Group only developed the 12.5 acre acres as:

- The 9 acres of land hypermarket zone was sold in 2009 (on which a Giant Hypermarket was set up) contributing to the maiden segment revenue of RM 23.5 million.

- The 14.5 acres of land were sold in 2015 for RM 140.3 million.

With 55 acres of land, the Group only developed less than a 1/4. It sold most of it. Well, selling off land is a good opportunistic move. But this is not a long-term plan for a property developer.

With most of the 12.5-acre plot of The Atmosphere developed, any future contribution from this development will be from the unsold properties currently held as inventory.

The positive part is that with the opening of the MRT station at Putra Permai in March 2023, there would be increased interest in The Atmosphere.

Affinity Residences

This is a RM 155 million gross development value (GDV) project comprising 23 Grand Villas and 70 Duplex Villas that was officially launched in June 2018. As of the end of FY 2019, about RM 43 million out of the RM 155 million GDV had been sold.

To be fair, this was launched when the property market was soft.

In its 2023 Annual Report, Eksons stated that it delivered vacant possession in Jan 2023. The Group recorded a loss for the property development segment in 2023 due to “the recognition of all anticipated contract costs at the point of completion.”

Key takeaways

Without any property development pipeline, the Group is relying on sales of stocks to generate profits from this segment. The Group has about RM 60 million of unsold properties where half is at net realizable value. As such I am not confident that this segment will be a significant profit contributor over the next few years.

In reality, the property development segment was a small revenue contributor compared to the timber segment. If you ignore the sale of land, the property sales over the past 12 years were only around RM 30 million a year. This is only about 1/10 the size of that from the timber segment in its good years.

More importantly, property development is a long-term activity. So even if the Group develops the 66 acres of Seremban land, it will be another 2 or 3 years before we see income being recognized. Besides the Group has yet to assess the gross development value of the Seremban land.

You can see why I don’t see the property development segment as a significant profit contributor in the next few years.

Capital allocation

I look at the following to assess whether Eksons has a good capital allocation plan.

- Financial health. A financially sound company points to good capital allocation.

- Business strategy. A good capital allocation plan should align with the company's strategic goals and growth prospects.

- Historical performance. Did its past investments, acquisitions, and divestitures create value for shareholders?

- Return. A high return indicates efficient capital allocation.

- Dividend and share buyback. Many consider returns of capital to shareholders through dividends or buybacks as prudent if the company has excess cash.

- Risk management. A well-balanced capital allocation plan should not overly expose the company to unnecessary risks.

- Transparency and communication. Was the company transparent in its asset allocation plans?

- Peer comparison. Did the company perform better than its peers? This can provide insights into whether the company is making relatively better or worse decisions.

- Shareholder value creation. Ultimately, the goal of a good capital allocation plan is to create value for shareholders.

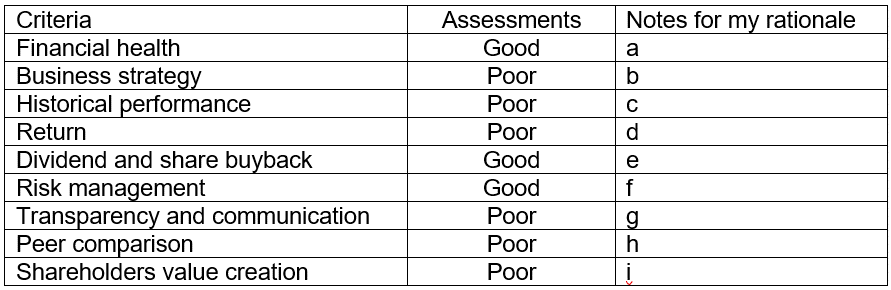

My assessment of Eksons is summarized in Table 1 where I have rated each of the criteria as Good, Average, and Poor. You can see that there were many more Poor-ratings compared to the Good-ratings.

I have rated the business strategy and historical performance as poor as the company took too long to cease the timber (plywood) business. My earlier articles pointed out the precarious situation of Eksons. I reproduced this in Appendix 1.

|

| Table 1: Assessment of Esksons as a cash holding value trap |

Notes to Table 1.

a) The Group has about 59% of the total assets held in cash and cash equivalents. Over the past 12 years, it generated RM 228 million cash flow from operations. It is a good cash conversion ratio compared to the RM 77 million profits for the same period.

b) The Group has not articulated its path moving forward.

c) While it ventured into property development, the return was not exciting. Furthermore, it took too long for the company to cease the timber (plywood) operations. In my earlier analysis, I indicated that it would have difficulty turning the business around unless the Group could forge some strategic alliance with the timber companies. Refer to Appendix 1.

d) The Group had a negative average ROE over the past 12 years.

e) Over the past 12 years, Eksons used about half of its PAT for dividends and share buyback.

f) The excess cash before the closure of the timber (plywood) operations was because the operations were scaled down. The cash was kept pending deployment when the business picked up. The Group also took a cautious approach when venturing into property development

g) The Annual Reports do not provide a clear picture of its property operations. It is not clearly stated that the Group don’t have any more property projects by 2023. If you don’t dig deep, you could be misled into thinking that the Group have a strong investment property portfolio. In reality, the investment property operation is due to its inability to sell its property development units and unused facilities.

h) Chart 4 compared Ekson's ROE for the past 12 years with 19 other Bursa companies in the plywood, wood mouldings, and timber products sector. You can see that Eksons return (shown in bold blue) was lower than most of the peers.

|

| Chart 4: Peer ROE |

i) I looked at 2 metrics. Was the average past 12-year return greater than the cost of capital? Was the compounded annual growth in intrinsic value over the past 15 years greater than the cost of capital? The answers were “no” for both. I have not tabulated the details of the analyses as these are very similar to my May 2021 analyses where I had arrived at the same conclusion. Refer to Appendix 2 for the May 2021 analyses.

Inflation and market dynamics

Over the past 2 decades, Malaysia's annual inflation rate seems to be between 2 % to 4 % as can be seen in Chart 5.

Over the past 12 years, the returns from the interests and dividends from the cash and investment securities averaged about 2.2 %. Also, the Group reported a total fair value losses of about RM 17 million during the same period.

Looking at the numbers, I would conclude that the Group had not been able to protect its cash from being eroded by inflation.

I am not an economist so I would not forecast the direction of interest rates, forex, or other economic factors that affect cash purchasing power.

To be fair to the Group, I suspect that the objective of investing the excess cash into investment securities is to protect it against inflation. The company did not approach it from the Warren Buffett perspective of deploying the cash to generate better returns.

|

| Chart 5: Malaysian Inflation |

Management

Comparing the 2023 Annual Report with that of 2020, I noticed the following changes to the Board of Directors.

- Mr Tang Seng Fatt who was Executive Director since 2006 resigned from the Board in May 2022. Eksons did not provide any reason for this but he would have been 55 in 2022.

- Ms Hew Mei Ying was appointed as the Independent Non-Executive Director in Nov 2021 to replace Mr. Koay Kah Ee

The key players – Chairman, Deputy Executive Chairman, and MD – remained the same.

The Chairman and The Deputy Executive Chairman still controlled about the same number of shares in 2020 as in 2019. They controlled about 57 % of Eksons (direct and indirect)

Given the above, I do not think that there is any significant change in the way the Group is being managed.

- I do not expect changes in the way the cash is managed. It is unlikely that the cash would be returned to shareholders.

- The Group would still be cautious about new ventures.

- In terms of reporting, I do not expect more transparency or clarity in the Annual Reports.

These are important takeaways when assessing Eksons as a cash-holding value trap.

Valuation

Since the Group does not have any significant operations, it does not make sense to value it based on its earnings power. In other words, the conventional intrinsic value calculation based on the Free Cash Flow is not applicable here.

It is more realistic to value it based on its asset value.

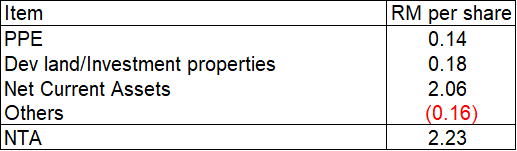

As of the of end March 2023, Group had an NTA of RM 2.23 per share. This can be broken down into the following as shown in Table 2.

The question is whether the PPE will be further impaired when the plywood operations fully cease. On the other hand, the land and building under the PPE as well as the development land and investment properties are at historical costs.

As such I would take the asset value as not less than RM 2.00 per share. This is close to its Graham Net Net of RM 2.02 per share.

The market price of Eksons as of 12 Sept 2023 was RM 0.54 per share. The Graham Net Net thus provides more than a 30 % margin of safety.

|

| Table 2: Analysis of NTA |

|

Is Eksons a value trap?

If Eksons was an operating company, a margin of safety based on the Graham Net Net would mean that this is not a value trap.

I have shown that the Group is an inventory-clearing and cash-holding company. As such you have to assess the value trap differently.

The table below summarizes my assessment of whether Eksons is a value trap from a cash-holding perspective. Based on this I would conclude that Eksons is a value trap.

|

| Table 3: Value trap assessment of Eksons |

This value trap assessment is on the basis that the purchasing power of cash would be eroded by inflation while waiting for management to look for new ventures.

- It assumes that the cash would not be returned to shareholders. Note that this cash came from the cessation of the business rather than cash generated by the operations.

- Management has been cautious in looking for new ventures and as such I do not expect the funds to be deployed quickly.

- Management has a good custodian track record in that the funds are not likely to be squandered away. But they are not good investors that can generate high returns from investments.

There are no clear plans to use the cash to generate better returns.

Conclusion

In the mid-2000s, the timber segment was the core business. At its peak in 2007 and 2008, this segment had an average annual revenue of RM 345 million with about 15 % return on the SHF + MI utilized by the segment.

The Group then diversified into property development in 2006/07. However, this was a relatively small segment compared to the timber segment

However, the timber segment started to decline from 2007/08 due to log supply, labor shortages, and escalating production costs. By Jan 2023, the Group had ceased the timber (plywood) operations. The unused facilities have been rented out to generate income under the investment property segment.

However, this investment property segment is an unsold asset utilization program. The company has not indicated that it would build up a significant investment property portfolio.

At the same time, the property segment had completed all its development. The Group at this stage is merely clearing the unsold units from its two projects – The Atmosphere and Affinity Residences.

While the Group has 60-odd acres of land in Seremban, it has not announced any development plans.

The Group is essentially a cash-holding group trading at a significant discount to its Graham Net Net. As of mid-Sept 2023, its market price was RM 0.54 per share compared to its Graham Net Net of RM 2.02 per share.

But is this a value trap? With no significant operations, it has to be assessed differently from a value trap perspective.

Based on my cash holding assessment, I concluded that Eksons is now a value trap. There are no clear plans to deploy the cash into operations that can generate better returns. To exit the value trap, Eksons will have to build up a significant operation. There is currently no indication of this. Looking at its history, this can be a long wait

If you are a conservative value investor, there are currently better opportunities than Eksons. If you are a speculator, Eksons looks like a good bet. The challenge for the speculator is how long you have to wait before Eksons builds up its operations.

It would appear that assessing whether a stock is a value trap is not so straightforward after all. If you are new to fundamental analysis, all this may prove very challenging.

One way to overcome this is to complement your analysis with those of other experienced advisers. Those who do this well include people like Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can tap into their business analysis and valuation.

Appendix 1 – Timber prospects

The Timber segment has to address 3 issues to return to profitability – log supply, production costs, and new markets.

Conceptually you can think of the wood-based industry as comprising:

- The upstream logging.

- The mid-stream primary processed wood products such as sawmilling, veneering, plywood, and panel production.

- The downstream secondary processed wood products such as moulding, builders’ carpentry, and joinery production as well as the furniture and its component manufacturing.

Eksons is a stand-alone mid-stream player, unlike some other Malaysian groups with integrated upstream and midstream operations. It thus has to purchase logs.

Log supply has been a major challenge to Eksons over the past few years partly due to bad weather for some years and partly due to the reduction in logging activities.

You can argue that Eksons had faced similar log supply problems before as in 2005/06. But this time may be different.

This time the supply problem is also due to the national policy of reducing the natural forest logging areas. While this is supposed to be offset by the increase in forest plantation areas, the planted forest areas have not met this goal.

Implication? There will be a continuing reduction in the supply of logs from within the country so log supply will be a mid to long-term issue for Eksons.

Sadly, there are other bad implications. The log supply problem has increased its raw material costs.

At the same time, Eksons experienced other cost increases. All these could mean that a standalone mid-stream timber processing sector may no longer be viable.

Finally, to make a comeback, Eksons has to win back the confidence of all the customers it lost over the past few years.

Turnaround

The Board and key senior managers have a long history in the plywood sector and would be in a strong position to address the key issues of log supply, cost control, and regaining sales.

If I tell you that at its peak the Timber segment generated about a 15 % return on capital, you would agree that there is a good economic reason to try to turn it around.

Are there reasons not to undertake a turnaround?

Probably. Unless there is a paradigm shift in the Malaysian mid-stream wood processing industry, the Group could be wasting its time. Think of an analogy with the palm oil industry. In Malaysia, palm oil mills that process the palm fruit bunches are integrated with the plantation activities.

Eksons’ plywood operations are not integrated with any logging activities.

It will have to join the other independent plywood factories to fight for the reduced supply of logs. I think the integrated plywood factories would have an advantage.

The government policy is not very encouraging.

“.. the production of logs from these forested areas would decline… the policy on the ban of exports of logs by several timber-producing countries would further affect the supply… Hence, the industry would have to adjust their operations to the limited supply of both domestic and imported timber resources.” National Timber Industry Policy, 2009-2020

If you look at Chart 6, you can get a sense of what the timber mid-stream sector is facing from the revenue index of several listed timber companies with mid-stream manufacturing. It is not an encouraging picture as the revenue for all of them has not grown since 2008.

|

| Chart 6: Peer Companies Revenue Index |

Unless the Group forms some strategic alliance with a logging group for long-term log supply, I think that Eksons’ efforts would be better spent on scaling down and/or divesting from this sector.

OK, this is a very strong view, but not unrealistic.

Appendix 2 - Was shareholders’ value created?

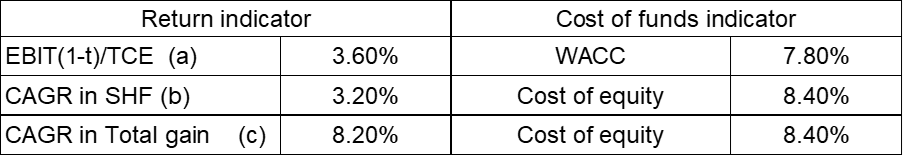

I used the following 3 metrics in my May 2021 analysis:

- Comparing the after-tax return on Total Capital Employed (TCE) with the WACC.

- Comparing the return assuming no dividend or share buyback i.e. CAGR in SHF with the cost of equity.

- Looking at total shareholders' gain from investing in the shares of Eksons.

As can be seen from the analyses below, the returns were less than the respective cost of funds. In other words, there was no shareholder value created during this period. We should not be surprised by the results as the Group was not profitable for 5 years out of the 12 years analysis period.

Total gain for shareholder

This is the return that a shareholder would have obtained if he had bought RM 1,000 of Eksons shares at the start of 2009 as shown below.

|

| Table 5: Computing the total gain by a shareholder |

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

hi

ReplyDelete