Is Dayang one of the better Bursa stocks?

Value Investing Case Study 07-4. Is Dayang Enterprise Holdings Berhad a worthwhile investment? I first covered Dayang in Dec 2020. That analysis was based on the Annual Reports till 2019. This is an updated fundamental analysis and valuation incorporating the FYE 2022 results.

When I first wrote about Dayang Enterprise Holdings Berhad (Dayang or the Group) in Dec 2020, it was trading at RM 1.24 per share. The market price has since increased to RM 1.92 per share (as of 3 Nov 2023).

- For FYE Dec 2020, Dayang made about RM 0.05 per share. This is equal to a PE ratio of 25. Based on the LTM performance, the Group would make RM 0.10 per share for FYE 2023. This is about a PE ratio of 19.

- In Dec 2020, Brent crude oil was trading around USD 48 per barrel compared to the early Nov 2023 price of USD 85 per barrel.

Why has the PE ratio dropped from 25 to 19? Is the market projecting that the high crude oil prices will not hold and expect Dayang's performance to deteriorate accordingly?

Join me to explore whether Dayang is one of the better Bursa stocks to invest in.

Crude oil prices are cyclical with the last 2 peak-to-peak cycles from 2011 to 2022. As such I will analyse and value the Group from 2011 to 2022.

Where relevant I have also incorporated some of the analysis from my earlier articles. If you had tried to access my previous articles, you would have been redirected here.

Should you go and sell it? Well, read my Disclaimer.

Contents

- Investment thesis

- Rationale

- Business background

- Operating trend

- Financial position

- Risks

- Valuation

- Dayang is not one of the better Bursa stocks

- Appendix 1. Malaysia's Oil and gas sector

|

Investment Thesis

The Group has 2 business segments – topside maintenance and marine charter. The former used about 1/3 of the total capital employed and was profitable every year over the past 12 years. The latter which used up most of the balance incurred losses on a cumulative basis over the past 12 years.

As such the Group achieved an average ROE of 7 % over the past 12 years. While financially sound, I have concerns about its business fundamentals. Better returns will depend on how it turns around the marine charter business.

A valuation of the Group based on its performance over 2 oil price cycles showed only a 22 % margin of safety. This was based on its Earnings Value taking into account 4 % perpetual growth. I do not consider this one of the better Bursa stocks to invest in.

|

Rationale

- Dayang is financially sound with a 22 % debt-equity ratio with 20% of its assets as cash and marketing securities.

- Over the past 12 years, its ROE ranged from – 29 % to + 22 % with an average of 7 %. Its performance had been dragged down by the performance of the marine charter segment.

- The marine charter business is a relatively capital-intensive one with low vessel utilization for the past 12 years. The challenge is to turn this around through higher utilization.

- The Group has a good capital allocation track record. But I would rate its track record for creating shareholders' value as average.

- There is only a 22 % margin of safety based on the Earnings Value with growth.

The supporting details are presented in the following sections.

|

|

Business background

The Group is an oilfield services company - a major provider of offshore platform services in Malaysia.

The chart below shows the current corporate structure of the Group.

|

| Chart 1: Corporate structure |

The Group's initial business in the 80s was the trading of hardware materials and supply of manpower for the offshore oil & gas industry. Today the Group has two main business segments:

- Topside maintenance services where it is one of the big boys in the offshore hook-up and commissioning business.

- Marine offshore support services with the charter of marine vessels to the oil & gas industry. This is via its marine vessels as well as through its 64% ownership of Bursa-listed Perdana Petroleum Berhad (PPB).

The Group customers included Petronas Carigali, Sarawak Shell Berhad, and ExxonMobil.

Over the past 12 years, the Group’s order book and revenue have been cyclical as can be seen from Chart 2. As an oilfield services company, you may think that there is some link between these metrics and crude oil prices.

However, there is a negative 0.38 correlation between Dayang’s revenue and Brent crude oil prices. It is a negative 0.11 correlation for the order book.

The correlations were low so I would not consider them significant. One way to interpret this is that Dayang services are not directly dependent on crude oil prices.

The other feature is the discrepancy between the order book and revenue. The cumulative order book over the past 12 years far exceeded the cumulative revenue.

This meant that the actual work orders issued by the customers were less than the order book secured. In other words, the order book for the year may not translate 100% into revenue for the coming years.

|

| Chart 2: Revenue vs Order Book and Crude Oil Prices |

Growth history

In looking at the history of the Group, you have to separate it into 2 parts - pre and post-PPB.

PPB first came into the picture in 2013 as an associate. It then became a subsidiary (ie its accounts were consolidated) in 2015.

During the first few years after listing, the Group's main business was topside maintenance.

Although it had 4 vessels by 2009, the Group only reported its first external marine charter revenue in 2010. Thus in 2008 and 2009, the vessels supported the topside maintenance activities.

The growth of the Group was driven by the massive contracts it secured in 2013. Refer to Chart 2. Thus, its order book for that year was more than 3 times the average order book for 2009 to 2011.

To fulfill these orders, the Group:

- Aggressively hired increasing its headcount from 1,867 employees at the beginning of 2013 to 3,996 as of 31 March 2014.

- Doubled the size of its fabrication yards.

- Added new vessels.

- Had a more strategic tie-up with PPB that eventually resulted in PPB becoming a subsidiary of DEHB.

Marine charter and PPB

From the onset, it would appear that DEHB wanted to expand into the marine charter business as a way to expand the Group’s business.

- It expanded its in-house fleet from 3 vessels in 2008 to 8 vessels by 2022.

- In 2009, DEHB acquired 40% of Borcos. It owns 33 offshore support vessels, including fast crew boats and anchor-handling tugs.

- It was not clear why Borcos was disposed of in 2011. It could be because of the low market vessel utilization in 2010. By 2011 DEHB had 7 vessels in its in-house fleet.

- Also, in Nov 2011, DEHB had subscribed to a 10% private placement of shares by PPB and had built this up to 11.53 % through open market purchases by the end of 2011.

- Over the next couple of years, DEHB acquired more shares of PPB so that by May 2015, it had amassed more than a 33% stake. This triggered a Mandatory General Offer for DEHB to purchase the rest of PPB’s shares from the open market.

- To comply with the public shareholding spread after the General Offer, DEHB re-distributed some of PPB shares to the shareholders of DEHB so that today DEHB owns 64.0 % of PPB.

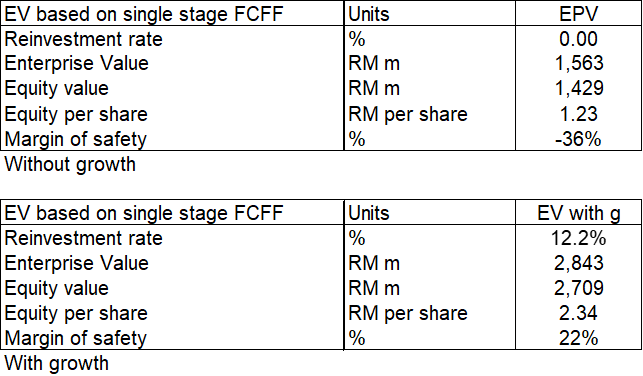

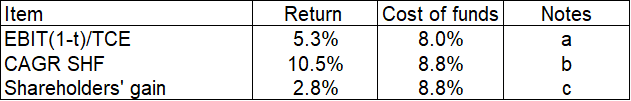

The marine charter business is more capital-intensive than topside maintenance. Refer to Table 1. It shows the segment revenue to total capital employed (TCE) ratio for both segments based on the 2022 segment performance.

You can see that that the marine charter segment deployed about 10 times more capital to generate the same level of revenue. At the same time, the return as measured by EBIT/TCE for the marine segment was very low compared to that for the topside maintenance segment.

The other key features of the marine charter business are:

- There are two market segments - greenfield and brownfield segments.

- The revenue is dependent on both utilization and charter rates.

- There is a cut-off age for vessels participating in Petronas tender.

Although both the topside maintenance and marine charter segments serve the offshore oil & gas fields, they are driven by different business economics.

The marine charter segment suffers from low utilization rates. The Group reported 49 % utilization for the first half of 2023. It was 60 % and 44 % for 2022 and 2021 respectively.

Petronas had a 15 years cut-off age for vessels. However, there is news that this has been extended to 20 years. Source: The Edge Dec 2022

Operating trends

I looked at 3 metrics to get an overview of the overall performance – revenue, PAT, and gross profitability (gross profits / total assets). Refer to Chart 3.

Revenue over the past 12 years showed a cyclical pattern. Revenue grew at 9.0 % CAGR.

PAT was relatively volatile with the Group incurring losses in 2017, and 2021.

- The 2017 losses were due to the prolonged and depressed prices of crude oil. This led to a significant reduction in work orders and contracts across the value chain.

- The 2021 loss was mainly attributed to impairments and one-off additional depreciation charges. The depreciation charges were due to the change in accounting treatment of 8 vessels' useful lives from 25 years to 15 years.

The concern was the declining gross profitability. The 2022 gross profitability was lower than that in 2011.

|

| Chart 3: Performance Index |

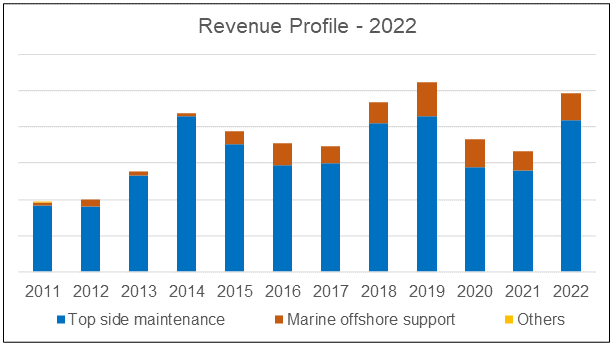

Revenue

The chart below shows the Group’s external sales profile over the past 12 years.

- The majority of the DEHB Group’s revenue was from the topside maintenance segment. In 2022, this segment accounted for 85 % of the Group’s revenue.

- The marine charter business became significant in 2015 after DEHB became the major shareholder of PPB. DEHB then consolidated PPB financials into DEHB Group financials.

|

| Chart 4: Revenue profile |

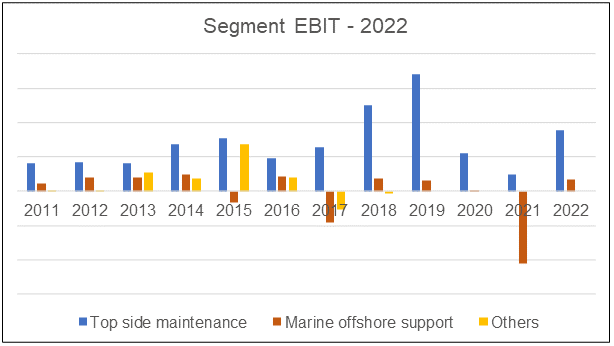

EBIT

The topside maintenance business has been profitable throughout the past 12 years. Refer to Chart 5. In 2022, this segment accounted for about 84% of the Group’s EBIT.

The marine charter business suffered losses in 2015, 2017, and 2021. On a cumulative basis, over the past 12 years, it was not profitable.

- Before 2013, all the marine charter segment EBIT excluded those from PPB Group.

- For 2013 and 2014, PPB Group’s charter business was accounted for as associate profits and formed part of the “Others” in the chart below.

- The “Others” for 2010 included the profits from its 40% share of Syarikat Borcos Shipping Sdn Bhd (Borcos). This is an associate company that owns a fleet of 33 offshore support vessels. Borcos was disposed of in April 2011.

- The losses in 2021 were due to the low vessel utilization rate.

- This was mainly due to stop-work orders issued by clients due to Covid-19 infections at work vessels.

|

| Chart 5: EBIT Profile |

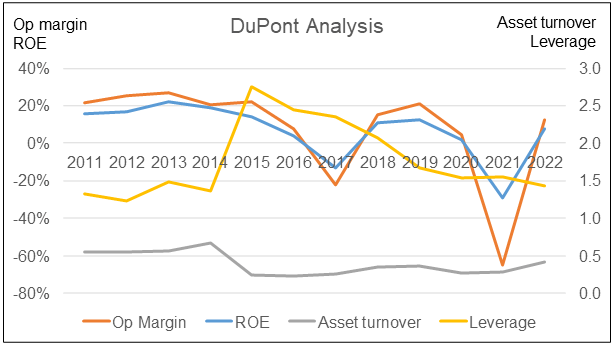

DuPont Analysis

The volatile PAT resulted in a volatile ROE. Over the past 12 years, the ROE ranged from – 29 % to + 22 % with an average of 7 %.

A DuPont analysis as per Chart 6 showed that the bulk of the ROE volatility can be linked to the volatile Op Margin.

Asset turnover also showed a declining trend from 2014. Together with the declining gross profitability, they showed that there were no improvements in the operating efficiencies.

But leverage had improved from 2015 as shown by the declining trend line. It jumped in 2015 following the acquisition of PPB.

|

| Chart 6: DuPont Analysis |

I had earlier shown in Table 1 that the Group return was low due to the low return by the marine charter segment. Any improvement in the Group return would depend on turning around the marine charter business.

IH 2023

The revenue and PAT for the first six months of 2023 were about the same as those for the same period last year.

The Group explained the performance as follows:

“The slightly lower revenue… is mainly attributable to the unfavorable oil price in early year of 2023, as compared to the oil price in early year of 2022. Despite the impact of oil prices, it is still manageable with robust and consistent revenue growth. The improved daily charter rates and higher vessel utilization rates of 49% as compared to 46% in the corresponding period boost up the revenue in the current period to be in line with the revenue in the corresponding period.

The profit before tax…in the current period is arrived at, after taking into account a reversal of impairment loss on financial assets… however, been negated by the unfavorable impact from net realized/unrealized foreign exchange loss...”

I am a long-term value investor and I consider quarterly performance as “noisy”. As such I focus on long-term trends.

Competitive profile

There are about 2 dozen Bursa listed companies under the Energy Infrastructure, Equipment & Services sector.

To have an apple-to-apple comparison, I excluded the following:

- Those in the drilling business.

- Those in the floating production and operations (FPO) sector.

Rather I focussed on those with significant topside maintenance business. The ideal peers would be those with topside maintenance and marine charter.

I have selected the following as the peer companies to benchmark against.

- Carimin Petroleum.

- Deleum.

- Petra Energy.

- T7 Global

|

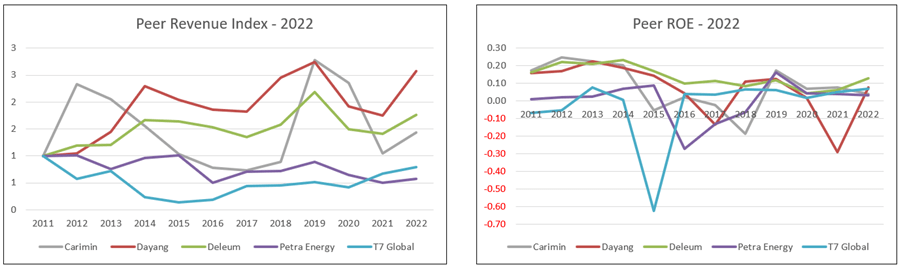

| Chart 7: Peer Performance |

The results of the comparisons are shown in Chart 7.

Revenue-wise, the Group is way ahead of its peers in terms of size and growth rate. Dayang achieved 9.0 CAGR from 2011 to 2022 whereas the peers’ growth rate ranged from – 5.0 % to + 5.3 %.

ROE-wise, the Group achieved an average of 6.9 % from 2011 to 2022 and is ranked in the middle. The average ROE for the peers ranged from – 2.7 % to 13.7 %.

- The best performance was by Deleum but I suspect that this was because it did not have any marine charter business.

- All the peer companies had turned around their respective ROEs in 2022.

Financial position

I would rate Dayang as financially sound based on the following:

- As of the end of Jun 2023, it had RM 471 million cash and short-term securities. This was equivalent to 20 % of its total assets.

- It had a debt-equity ratio of 22 % as of Jun 2023. This is much lower than its peak debt-equity ratio of 60 % in 2015.

- Over the past 12 years, it generated positive cash flow from operations every year.

- Over the past 12 years, it generated RM 2.6 billion cash from the cash flow from operations compared to RM 0.6 billion of PAT. This is a very good cash conversion ratio.

The Group also had a good capital allocation track record as shown in Table 2. You can see that its cash flow from operations was well deployed for CAPEX and dividends.

|

| Table 2: Sources and Uses of Funds - 2012 to 2022 |

Expansion into the marine charter segment

The Group had looked at expanding into the marine charter sector as part of its growth plans

- In 2009, it spent RM 135 million to acquire a stake in Syarikat Borcos Shipping Sdn Bhd (Borcos) although the Board did not state why it decided to dispose of Borcos after a year.

- In 2011, it subscribed to a private placement of PPB. DEHB then went on to acquire more shares in the open market so that it held 11.53% of PPB by the end of 2011.

- By 2015, DEHB had spent RM 1,056 million for 98% of PPB which had shareholders’ funds of RM 744 million as of the end of 2015.

- The shareholders’ funds of PPB had reduced to RM 585 million by the end of 2022. DEHB only had 64% of PPB by then. This was due to the distribution of PPB shares to the shareholders of DEHB to meet the shareholding spread.

With hindsight, given the current marine charter excess capacity, the RM 1 billion could have been better spent elsewhere.

DEHB attributed its recent contract wins to having in-house vessels. However given the excess offshore supply vessel's capacity, there would be lots of willing strategic allies in its tender bids.

At this juncture, the payback period for its RM 1 billion marine charter investment is likely to stretch beyond 10 years.

The positive thing is the Group was able to generate sufficient cash flow over the past 12 years to cover the cost of entry into the marine charter business. The challenge is how to turn this into a profitable venture.

Reinvestment

Growth needs to be funded and one metric for this is the Reinvestment rate. This is defined as:

Reinvestment with acquisitions = CAPEX & Acquisitions – Depreciation & Amortization + Net Changes in Working Capital.

I then determined the Reinvestment rate = Reinvestment / after-tax EBIT.

Acquisitions are an integral growth driver for the company. As such I have included the annual acquisition expenditure as part of the CAPEX.

Over the past 11 years, the total Reinvestment amounted to RM 492 million. The after-tax EBIT for the same period came to RM 1,502 million. This resulted in a Reinvestment rate of 12 %. This is a good rate.

Note that the low Reinvestment rate was because of the low Reinvestments. This in turn was because there were several years when the Depreciation & Amortization far exceeded what was spent on CAPEX and Net Changes in Working Capital.

Shareholders’ value creation

I looked at the following metrics when assessing shareholders’ value creation:

- Comparing returns with the cost of funds.

- Comparing the gains by an investor who bought a share at the end of 2011 with the cost of equity.

- Looking at the Q Rating which is based on several valuation metrics. A high score relative to the panel meant that the company had the potential to create shareholders’ value.

Overall, I would assess Dayang as average in terms of creating shareholders' value as not all metrics achieved positive results.

As can be seen from Table 3, Dayang returns were lower than the respective cost of funds for 2 metrics. It only did well when it came to looking at the growth in SHF.

|

| Table 4. Estimating the shareholders’ gain |

At the same time, Dayang had an overall Q Rating of 0.44. This places it at the average position among the panel companies. You can see that it did well in the financial ratings. On the negative side, the Q Rating had declined from 0.47 in 2020.

|

| Chart 8: Q Rating |

Risks

I look at risks through the following lenses:

- Crude oil prices.

- Privatization.

- Depletion of Malaysian oil reserves.

Link to crude oil prices

Oil prices have been cyclical as can be seen from Chart 9. While prices in 2023 have been high, it was not the historical high which occurred in 2012/14.

|

| Chart 9: Brent Crude Oil Price. Source: Statista |

Crude oil prices and CAPEX by oil and gas companies are interrelated. When oil prices are high, companies are more likely to increase their CAPEX to take advantage of the favorable pricing environment and expand their operations.

Conversely, in periods of low oil prices, CAPEX tends to be reduced to manage costs and conserve capital. These dynamics can contribute to the cyclical nature of the oil and gas industry and have a significant impact on the performance of the oilfield services companies.

The Malaysia oilfield services and marine charter companies suffered from 2015 to 2020 when oil prices were low. We are now experiencing high oil prices. Will this last?

The US Administration expects the average Brent crude prices to be:

- USD 61 per barrel in 2025.

- USD 88 per barrel in 2035.

- USD 91 per barrel in 2045.

Looking at the above forecast for the price of crude oil, it does not look much different from the past 12 years. The Group should not do any worse than what it achieved over the past 12 years.

Secondly, we should look at the performance over the cycle when determining the margin of safety.

In mitigation, I have earlier shown that the correlations between Dayang’s order book and revenue with crude oil prices were low. This probably meant that not all of Dayang’s business is tied to the oil and gas companies' CAPEX. Dayang probably had some maintenance and upkeep work.

Privatization

In the case of DEHB, I would rate the privatization risk as low for the following reasons:

- It undertook a private placement and a rights issue of shares in 2019. The rights issue was offered at RM 0.92 per share which is lower than the current market price.

- Apart from the Executive Directors, the other major shareholder is Naim Holdings Bhd (Naim) which holds about 24 % of DEHB. Naim is in the property and construction sector that has been facing a soft market for the past few years. I doubt Naim would want to spend its money on a privatization exercise.

- Given DEHB's February 2020 price of RM 3.00, there would not be many minority shareholders who would be happy for DEHB to be privatized at the current market price

Depletion of Malaysian oil reserves

The main concern here is the depletion of Malaysian oil & gas reserves and the excess marine chart capacity. Refer to Appendix 1 for more in-depth discussions.

The latter may cause charter rates to be low for some time. As for the former, historically the Group revenue came from Malaysia. The question then is whether the Group can expand to other countries. Alternatively, will it be able to seek a new business direction before the oil wells dry out?

The positive side is that the Malaysian oil reserves can probably provide the Group with another decade-plus of work. This should give it time to seek alternative ventures.

Valuation

In valuing the Group, I assumed that the size of the business is represented by the 2022 revenue. However because it is a cyclical company, I used the average 2011 to 2022 margins to represent its performance over the cycle.

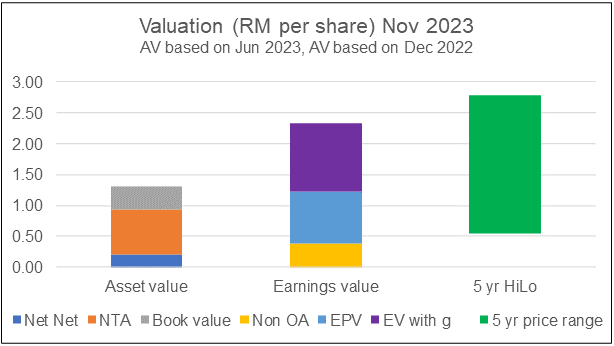

My value of Dayang is summarized in Chart 10.

- I estimated its Asset Value as RM 1.31 per share broken down into Graham Net Net, NTA, and Book Value.

- I estimated its Earnings Value as RM 2.34 per share. This was broken down into non-operating assets, EPV, and Earnings value with growth.

At RM 1.92 per share, Dayang is trading above its Book Value and EPV of RM 1.23 per share.

There is a 22 % margin of safety based on the Earnings value with growth. Whether this can be considered a reasonable margin of safety would depend on whether you agree with my assumptions.

|

| Chart 10: Valuation |

Valuation model

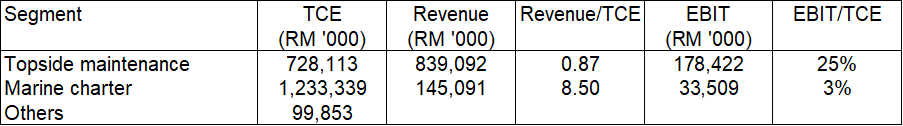

My Earnings Value of the company was derived based on a single-stage Free Cash Flow to the Firm (FCFF) model as per Damodaran.

Value of Firm = FCFF X (1 + g) / (WACC – g).

g = growth rate = Return X Reinvestment rate. I assumed that this growth rate was 4 % based on the long-term GDP growth rate.

WACC = weighted average cost of capital. The cost of capital used in the model was based on the Capital Asset Pricing Model. I followed Damodaran’s approach to determine the Beta and the risk premiums. These resulted in an 8.8 % cost of equity and an 8.0 % WACC.

Value of Equity = Value of Firm + Cash – Total Debt – Minority interests.

FCFF = EBIT(1-t) X (1 – Reinvestment Rate).

t = tax rate. I assume a 24 % nominal tax rate.

The Reinvestment rate was derived from the fundamental growth equation. This came to 12 % which was about the historical rate.

I assumed that the 2022 revenue represented the current size of the business

.

To determine the EBIT, I used the average gross profit margins and SGA margins from 2011 to 2022. These covered at least 2 price cycles. I also factored in the average write-offs incurred over the past 12 years.

The other assumptions used in my valuation are shown in Tables 5 and 6.

|

| Table 5: Valuation assumptions |

|

| Table 6: Deriving the EBIT |

The first step was to derive the EBIT as shown in Table 6. I then used this EBIT to determine the FCFF and then the intrinsic value as shown in Table 7.

|

| Table 7: Estimating the EPV and EV with growth |

Valuation risks and limitations

You should consider the following when looking at my valuation.

- Cost of capital.

- Cyclical sector.

The cost of capital was derived based on the risk-free rate and equity risk premium as of 2022. We currently have the Ukraine invasion and the Israel-Gaza conflict. The parameters do not reflect the higher-risk situation.

As such you should see the Earnings Value as an optimistic one.

Secondly, I assumed that Dayang is a cyclical stock. According to Damodaran

“Cyclical and commodity companies share a common feature, insofar as their value is often more dependent on the movement of a macro variable (the commodity price or the growth in the underlying economy) than it is on firm-specific characteristics…the biggest problem we face in valuing companies tied to either is that the earnings and cash flows reported in the most recent year are a function of where we are in the cycle, and extrapolating those numbers into the future can result in serious misvaluation.”

To overcome the cyclical issue, we have to normalize the performance over the cycle. I have assumed that the 2011 to 2022 period is a good representation of the business performance over the cycle.

The key issue here is that during this period, PPB became a subsidiary of DEHB. I would argue that this was at great cost to DEHB. If you assumed that there would not be another such acquisition in the future, the earnings would be higher. In other words, the current valuation is conservative.

|

Dayang is not one of the better Bursa stocks

My analysis of Dayang showed that it is not one of the better Bursa stocks to invest in. There are some fundamental concerns and there is not enough margin of safety.

My rationale can be summarized as follows.

Although it started the past 12 years ago as mainly a top-side maintenance company, it today has a significant marine charter segment. But this marine charter business is not only relatively asset intensive but incurred losses on a cumulative basis over the past 12 years.

The Group was not always profitable. The average ROE over the past 12 years was 7%. This low ROE is the result of the poor performance of the marine charter segment which used a larger proportion of the capital.

The Group needs to turn around the marine segment which in turn depends on achieving higher vessel utilization at good charter rates. This could be challenging in the immediate future given the excess vessel capacity in the market.

I would also rate Dayang as average from a shareholders’ value creation perspective. But the Group is financially sound.

It is a cyclical business and I value it as such. My valuation showed that there is only a 22 % margin of safety based on the Earnings Value with growth.

Appendix 1. Malaysia's Oil and gas sector

The oil & gas industry can be broken down into three segments:

- Upstream, or exploration and production (E&P) companies. These find reservoirs and drill oil and gas wells.

- Midstream companies that are responsible for transportation from the wells to refineries.

- Downstream companies. These are responsible for refining and the sale of the finished products.

The oilfield services companies support the E&P companies and depend on the capital and operating expenditure of the E&P companies. This is in turn governed by the current and future price of oil and natural gas.

Malaysia's oilfield services sector

In Malaysia, all the upstream activities are offshore. Hence Malaysian oilfield services are geared towards offshore exploration and production.

The marine charter or offshore supply vessel (OSV) industry grew to support offshore oilfield services.

Furthermore, Petronas played a strong role in developing the Malaysian oilfield services industry.

Under the Petroleum Development Act, Petronas has exclusive rights to all the oil & gas rights in the country. Petronas has used its licensing and other regulatory powers to develop the local industry.

The Group has benefited from this. It is not surprising that its business has been focused on Malaysia. I would expect that in the immediate to mid-term, this focus will continue.

To a very large extent, the immediate to mid-term future of DEHB depends on Petronas' upstream program.

According to Petronas Activity Outlook 2020 to 2022:

“Malaysia has more than 12 billion barrels of oil equivalent (bboe) of undeveloped resources awaiting to be monetized. This presents great opportunities for new entrants and existing players to invest in marginal fields or Discovered Resource Opportunities (DRO) and extend the value of Late Life Assets (LLA) until abandonment”

According to Petronas, Malaysia produced an average daily production of over 1.7 million barrels of oil equivalent in 2018. At this production rate, the 12 bboe of undeveloped resources will last for about 19 years.

This simplistic analysis shows that even with a focus on Malaysia, there will still be business opportunities for the next decade or so. This should provide Dayang with enough time to plan its business direction for when the oil dries up.

In its 2023 to 2025 Activity Outlook:

- Petronas talked about the transition to clean energy. This would add further pressure on the Group to look at new business directions.

- Petronas projected a steady outlook for Malaysian offshore activities, including an increase in drilling and development project activities. This augurs well for domestic OSV operator.

But the Group is one of the big boys in the hook-up and commissioning segment. So DEHB topside maintenance segment will do well both in the immediate term to mid-term.

The are several challenges for the marine charter business. There is currently overcapacity and ageing vessels among Malaysian players in this segment.

- The Malaysian OSV Owners’ Association (MOSVA) reported that the industry had a capacity of 300 vessels in 2019. From 2016 to 2019, only 170 vessels have been occupied from 300 previously.

- In the first half of 2020, MOSVA prepared a proposal for Petronas to set up a special-purpose vehicle to take over the assets of ailing oil and gas (O&G) companies. But there is no further news on this.

- There is news report that in 2023, while about 230 vessels were operating, most are ageing, with the majority more than 10 years old. Source: Riveria

There is another view of the dire condition. In 2020 several Bursa-listed OSV companies have undertaken corporate restructuring or even delisting.

- Alam Maritim

- Bumi Armada

- Icon Offshore

- Marine and General

- Perisai Petroleum

- Scomi Group

Of these, as of today, Perisai Petroleum has been delisted. Next, when you look at the revenue and ROE for the others, you can see that there were no significant changes compared to those in 2016.

|

| Chart 11: Bursa OSV Companies performance |

Going beyond Malaysia

Several Bursa-listed oil & gas companies in the Energy Infrastructure, Equipment, and Services sector have ventured out of Malaysia.

In some cases, the entry has been based on some Petronas international program.

The Group claimed to have started on this international journey. In November 2018, the Group together with Gujurly Inzener, its Turkmenistan partner, won a USD 100 million contract. This was for providing facilities maintenance support for Petronas Carigali (Turkmenistan) Sdn Bhd.

However, in its 2019 to 2022 Annual Reports, Dayang reported that all of its revenue for these periods was from Malaysia. I have not dug deeper to find out what happened.

The conclusion is that Malaysia remains the Group's source of revenue.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment