Case Notes 06: When is the best time to buy your house in order to get the best capital gain? This article looked at the historical evidence in Malaysia and found that if you had bought a house a year after an economic downturn, you will get the best capital gain.

For those who are planning to buy properties in Malaysia in 2021,

“… industry experts predict that it’s going to be a buyers’ market for the next few years so don’t pass up this advantage to get a better deal…” iproperty.com

For many buying a live-in property, one of the considerations is whether the property will achieve a good capital gain in the future.

There are of course many factors that affect capital gain, from location to economic conditions.

But I would argue that historically in Malaysia, the year the property was bought makes a significant difference to the capital gain.

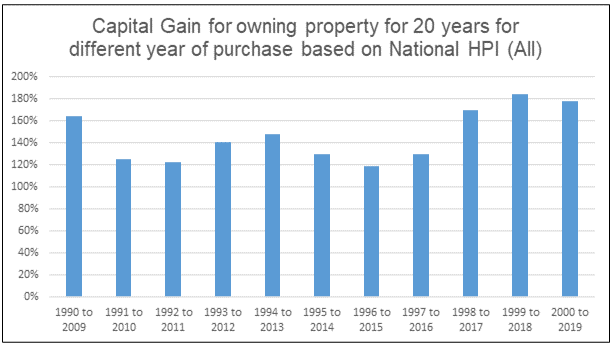

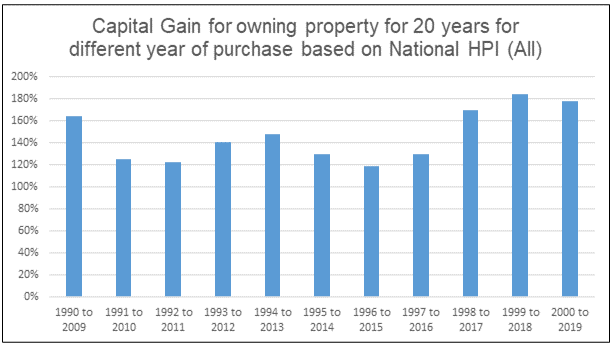

To illustrate this, I analyzed the capital gain over several 20 years periods for several house types in 4 regions in Malaysia.

The results showed that the best capital gain came from buying the property in 1999, a year after the 1998 economic recession.

If history repeats itself, 2021 is then a good time to buy a property in Malaysia.

|

| Chart 1: Capital gain based on the National Housing Price Index (HPI) |

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you. Learn more. |

|

|

|

Contents

- Capital gain and GDP growth

- The largest impact is from timing the purchase

When it comes to buying a property in Malaysia, the common advice is that 2020 or 2021 is a favourable time for the following reasons:

- You can get a lower interest rate for your housing loan.

- You can get the stamp duty exemption depending on when you buy and what you buy.

- You may get a higher loan % relative to the price of the house.

All the above will affect the potential returns from the investment.

But the potential return will also be dependent on the capital gain. This comes from the difference between the market value of the property in the future and the current purchased price.

While you do not know the future market value of the property, you have a choice about the purchase price by buying at the "best" time.

The best time is when there is an over-supply situation or when people have a wait-and-see attitude about buying properties.

This generally coincides with an economic downturn.

I will show that in Malaysia:

- Historically, the best capital gain came from buying a property when the economy was recovering from a situation with negative GDP growth.

- The capital gain from buying at the correct time far outweighed the gain from other transaction costs and lower interest rates.

20 years’ capital gain

To derive the capital gain from investing in real estate, I compared the Malaysian Housing Price Index (HPI) over various 20 years periods. (Refer to Note 1)

I used the HPI for the relevant region for 4 types of houses - Terrace, Semi-D, Detached and High rise.

For example, I derived the capital gain for the National Terrace house for a particular 20 years period as follows:

- 1990 to 2009. It was based on the difference between the National Terrace Housing Price Index in 2009 compared to that for 1990.

- 1991 to 2010. It was based on the difference between the National Terrace Housing Price Index in 2010 compared to that for 1991.

Based on the data available, there were 11 rolling 20 years periods from 1990 to 2019.

I computed the capital gain for each of the 20 years periods and compared them as shown in Chart 2.

|

| Chart 2: Capital gain for various types of houses National |

The analysis showed that the best capital gain for these 11 periods came from buying a property in 1999. The results are quite consistent for the various types of properties.

The analysis, of course, excluded transaction costs eg brokerage fees, legal fees, and other statutory charges.

Although the focus of the article is about when to buy a property to get the best capital gain, you should note that even in the worst-case scenario ie buying a National High rise in 1990, there is still some capital gain.

Asian Financial Crisis

What was so special about 1999?

It was a year after the Asian Financial Crisis. The 1997 to 1998 Asian Financial Crisis began in Thailand and then spread to the rest of the neighbouring countries.

- In July 1997 the Malaysian ringgit was traded by speculators. The overnight rate jumped from under 8% to over 40%. This led to rating downgrades and a general sell-off on the stock and currency markets.

- By end of 1997, the KLSE had lost more than 50% from above 1,200 to under 600, and the ringgit had lost 50% of its value.

|

| Chart 3: Malaysia GDP growth vs Housing Price Index (HPI) |

The then prime minister, Tun Dr. Mahathir Mohamad imposed strict capital controls and introduced a 3.80 peg against the U.S. dollar.

In 1998, the output of the real economy declined to plunge the country into its first recession for many years. The country's gross domestic product (GDP) plunged to -7.6 % in 1998.

Not surprisingly, the 1998 National Housing Price Index contracted by 9.4 % compared to the 1997 level. Refer to Chart 3.

Capital gain and GDP growth

Comparing Charts 2 and 3, I would conclude that the best capital gain came from buying a property a year after the negative GDP growth year.

For the period 1990 to 2009, it meant buying the property in 1999.

The next negative GDP period was in 2009 due to the US Sub-Prime Crisis. But there are not enough 20 years of data ie 2010 to 2029 to enable analysis.

You should not be surprised by this finding for 1999.

- During an economic downturn, prices of assets including properties are likely to decline.

- If you believe that prices will recover and even go up higher, then buying at the market low will boost the capital gain.

I would argue that 2021 would be another “best” time to buy properties as this is after a negative growth year.

- In August 2020, Bank Negara Malaysia (BNM) revised its official GDP growth forecast for 2020 to between -3.5% and -5.5%. This was due to changes in world growth forecasts and the length of the movement control order to manage Covid-19.

- BNM is forecasting a growth range of between 5.5% and 8% for 2021. This is due to the improvements in the external conditions and a gradual normalization in economic activities.

My point is that the extent of the negative GDP growth is not so critical. What is important is that 2021 is a recovery year.

If history repeats itself, 2021 would be the best time to buy properties from a capital gain perspective.

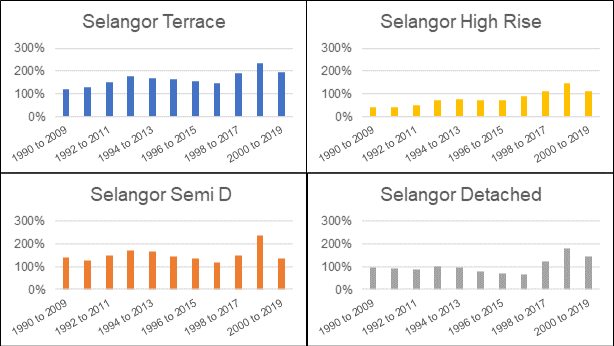

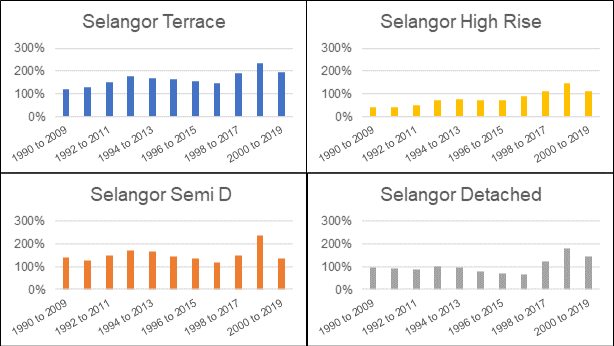

Capital gain by regions

To get a picture of whether the results would be different by regions, I compared the results for the following regions for Terrace, Semi-D, Detached and High rise.

Generally, the analyses showed that the best capital gain came from buying properties in 1999. Refer to the charts below that show the capital gains for each type of property within each region.

|

| Chart 4: Capital gain for various types of houses in Kuala Lumpur |

|

| Chart 5: Capital gain for various types of houses in Selangor |

|

| Chart 6: Capital gain for various types of houses in Johore |

|

| Chart 7: Capital gain for various types of houses in Penang |

However, there were a few surprising contradictions as shown in the table below.

- Most of them are for purchases a year earlier.

- You may argue that a year earlier or later from the best year is something that is likely to happen in reality as one cannot always pick the bottom. But, the results for Semi-D and Detached houses for Kuala Lumpur are anomalies.

|

Region

|

Terrace

|

Semi-D

|

Detached

|

High rise

|

|

Kuala Lumpur

|

|

1990

|

1990

|

1998

|

|

Johore

|

|

1998

|

2000

|

|

|

Penang

|

1998

|

|

|

1998

|

Table 1: Best year to buy properties. The default is 1999

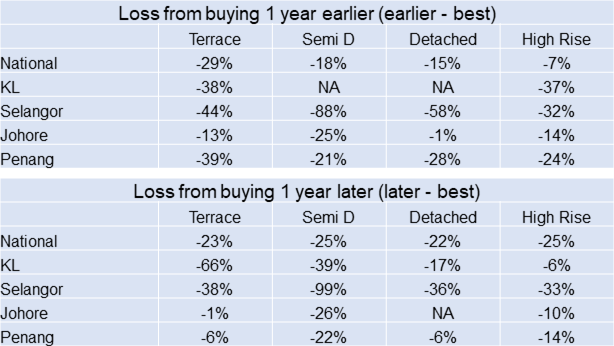

Sensitivity analysis

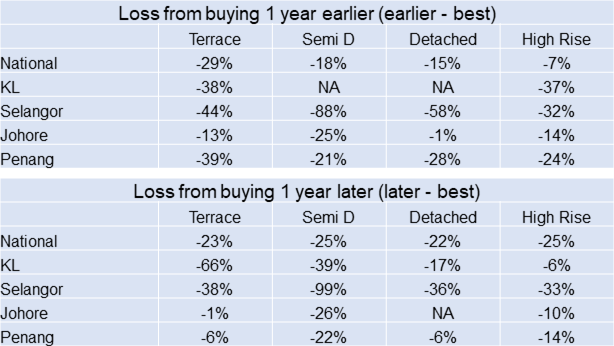

Not everyone is able to buy a property in the best year. The table below shows the losses that would result if you had bought it a year earlier or a year later.

The losses can be quite significant depending on the type of properties or the location.

If you are in Kuala Lumpur or Selangor, missing out on the best year can make a significant difference to the capital gain

|

| Chart 8: Loss from buying 1 yr earlier or later: National |

|

Table 2: Losses if buying a year earlier or later than the best year

Note that the best year is not necessarily 1999 as can be seen in Table 1. The NA refers to the situation where no data was available as the relevant year was outside the study periods. |

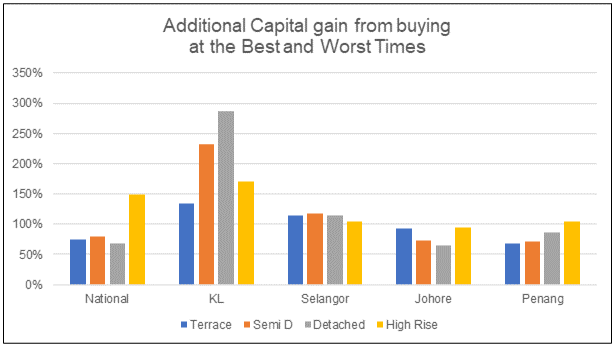

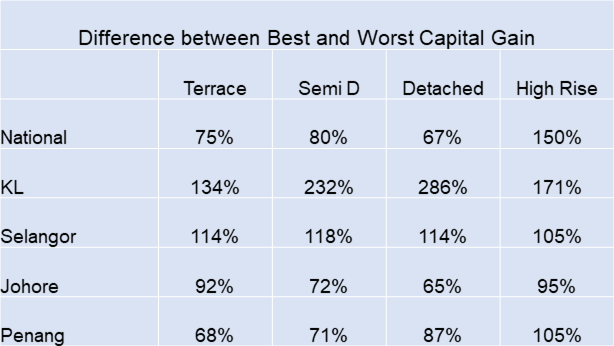

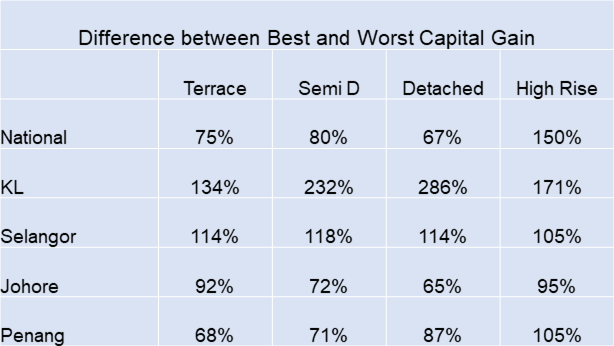

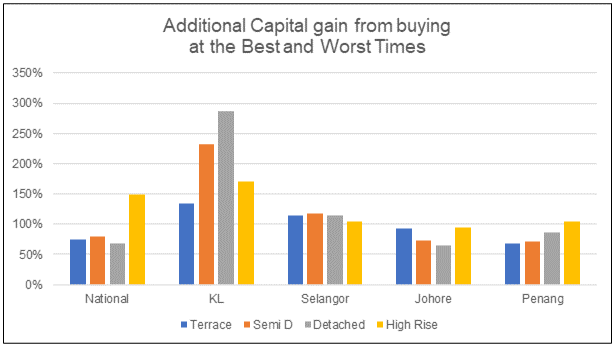

If you were able to select the best time to buy a property compared to the worst time, would there be significant differences in the capital gain?

The results are actually significant. You would be able to make about at least 2/3 more if you have bought at the best time compared to buying at the worst time.

The differences of course varied by regions and property types as shown in the table and chart below

- The best result is almost a fourfold gain - from Detached houses in Kuala Lumpur

- The lowest is 2/3 gain - from Detached houses in Johore

|

| Chart 9: Additional capital gain |

|

| Table 3: Additional capital gain between the best and worst year to buy a property |

The largest impact is from timing the purchase

The financial gain from buying a live-in property would be dependent on the following:

- Capital gain resulting from the difference between the market price in the future and the purchased price.

- The financing costs incurred in borrowing to fund the house purchase.

- The various transaction costs eg brokerage fees, legal fees, stamp duties

I would argue that the capital gain due to timing is so large that it overshadows the other transaction costs associated with buying a property eg stamp duty.

At the same time, as taxes are generally based on a percentage of the gain, it would not be as significant as the capital gain.

Of course, the major cost generally associated with buying a property is the interest charges. Over a 20 years period, the amount of interest paid can be substantial. And it would vary depending on the interest rate.

Bank interest rates tend to vary with economic situations as can be seen from Chart 10.

You can take advantage of this to have a variable rate mortgage. But even if you have a fixed interest rate loan, you can re-finance to take advantage of any significant decline in the interest rate.

The differences in the interest charges are not as significant as the capital gain.

- This is because the interest rates in Malaysia over the past 20 years have mostly ranged from about 4 % to 6 %.

- In contrast, if you consider the average capital gain of about 147 % over 20 years, this is equal to slightly above 7 % per annum.

|

Chart 10: Historical bank lending rate. Source: tradingeconomics.com

|

The conclusion is that the capital gain far outweighs the gains from other costs.

Since the capital gain is affected by the timing of the purchase, house buyers should focus on timing their purchase. This is especially if the goal is maximizing the financial return.

Minimum capital gain to breakeven

While the focus of this article is on the best time to buy your house, the analyses showed that if you have taken a loan to finance the purchase, there are certain situations where you would not have broken even.

Assuming that you took an 80 % loan for 20 years, you will need the following capital gain to break even.

In other words, assuming no tax and transaction costs, you needed the following capital gain to offset the total cash outlay to repay the loan and the down payment.

|

Interest rate

|

Capital gain

to break even

|

|

3.0 %

|

28 %

|

|

4.0 %

|

38 %

|

|

5.0 %

|

48 %

|

|

6.0 %

|

60 %

|

Table 4: Mortgage interest rate vs Capital Gain to break even

Using this as the benchmark, you would have “lost money” if you had bought under the following conditions

- High rise in Kuala Lumpur and Selangor in 1990, 1991 and 1992

- All types of properties in Johore in 1990, 1991 and 1992

- Detached house in Johore in 1995, 1996 and 1997

- High rise in Johore in 1995 and 1996

- Detached house in Penang in 1992 and 1993.

The above is a simplistic analysis as most people who have bought a live-in property will likely hold onto it for more than 20 years. Besides, there are other benefits from house ownership rather than just financial gain.

But it does emphasize the point that there is a benefit in buying a property during the “best” year.

Limitations

The analysis looks at capital gain based on the Malaysian Housing Price Index from 1990 to 2019.

- Unfortunately, the data was only available to cover 11 rolling 20 years periods which covered only the 1998 economic downturn. I was not able to cover the 2010 economic downturn.

- At the same time, around 2013 to 2019 the Housing Price Index increased at a rate that was about doubled that from 2002 to 2008 as can be seen from Chart 3. I am not sure whether this is phenomenon will continue in the future.

- Also, there is not enough data to see whether the conclusion holds if a longer ownership period was considered eg 30 years instead of 20 years.

It is clear that the recommendation for 2021 is on the basis that history repeats itself.

Notwithstanding the limitations, the analyses show that you can benefit if you buy a property at the start of an economic recovery.

- 2021 is probably the best time

- But you could also do well if you had bought in 2020

Investment tips

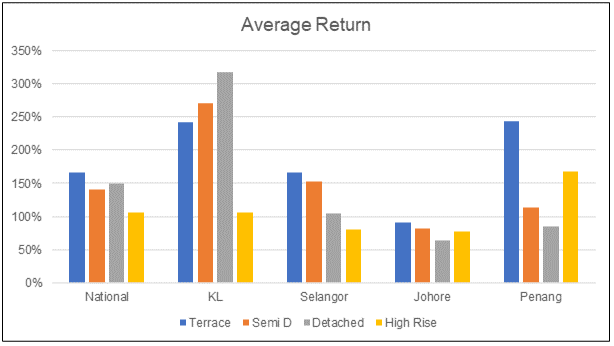

This article is not about where to invest to get the best returns.

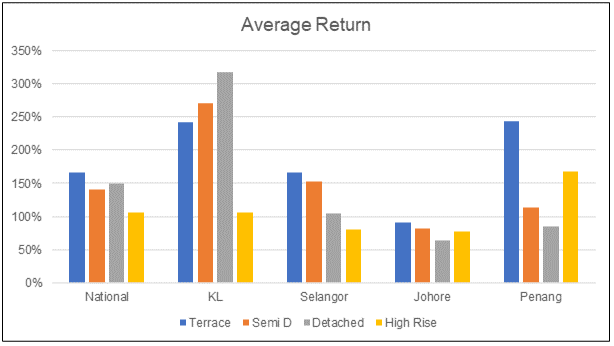

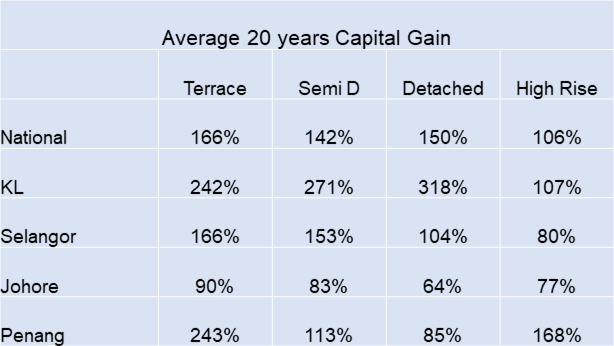

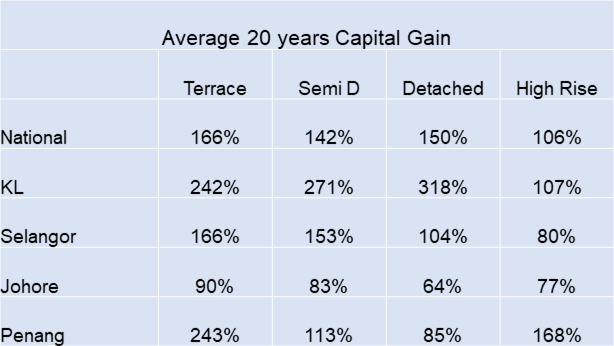

However, if you ignore timing and consider the average capital gain for each of the 11 rolling 20 years periods, the best capital gain would be as follows:

- In the case of the Terrace house, it would either be in Kuala Lumpur or Penang

- In the case of the Semi-D and/or Detached house it would be in Kuala Lumpur

- For High rise, it would either be in Penang

- The worst place to invest in the context of capital gain is Johore

|

| Chart 11: Average capital gain |

|

| Table 5: Average capital gain for various types of houses by region |

Timing in real estate compared with the stock market

“If you are in Selangor, Johore, and Penang and you want to hold for 20 years or less, you get better returns from the stock market. The only exception is holding the Terrace house in Penang for 20 years.”

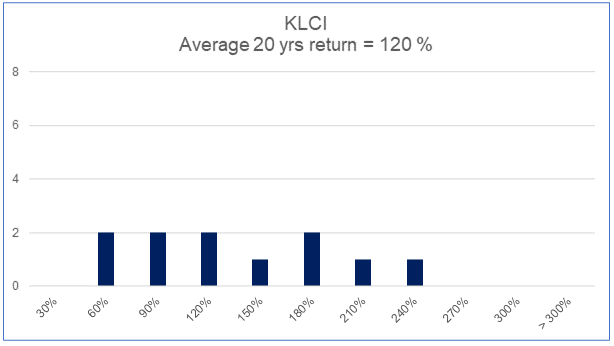

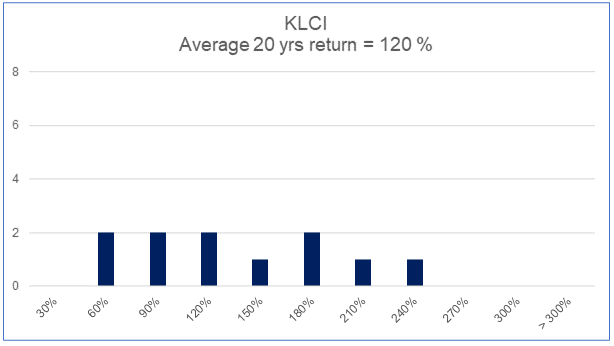

However, the above conclusion looks only at the average return. If you consider another dimension and look at the distribution of the return, you will find that the stock market has a wider range of outcomes.

The chart below shows the frequency distribution of the returns from investing in the Bursa Malaysia KL Composite Index (KLCI). It is based on various 20 years holding periods.

You will notice that for the 11 periods, the returns ranged from the 30 % - 60 % category to the 210 % - 240 % category.

You will conclude that the returns are volatile

|

| Chart 12: Histogram of KLCI average returns |

Case Notes

When you invest in the stock market, you have to worry about risks in addition to thinking about returns.

Potential returns come from understanding the business and buying at a discount to the intrinsic value. This assumes that you are able to analyze and value companies. On the other hand, risk mitigation comes from understanding how risks enter the investment process and taking the appropriate measures to minimize the chance of the threats happening, and/or reducing the impact of the threats.

If you are just starting out to analyze and value companies, all these may sound very challenging. One way to provide some peace of mind is to supplement your assessment with those by experienced advisers such as Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services during your initial investment years, there is a good chance that you can cut down your learning curve if not reduce potential losses.

|

In contrast, the frequency distribution of the capital gain from investing in properties shows a smaller range. It is less volatile with the exception of the High rise in Kuala Lumpur.

If you follow the school of thought that equates risk with volatility, then the stock market is riskier.

- From a statistical perspective, the returns from the KLCI have a Coefficient of Variation (defined as the standard deviation divided by the mean) of 49 %.

- The Coefficient of Variation for the capital gain from investing in properties varied from 10 % to 57% as can be seen from the table below.

- Except for the National and Kuala Lumpur High rise, the Coefficient of Variation for the rest of the properties are significantly below that of the stock market.

|

| Table 6: Coefficient of variation for 20 years' capital gain |

The charts below show the frequency distribution of the capital gain for the various regions and property types.

|

| Chart 13: Histogram of capital return for Kuala Lumpur |

|

| Chart 14: Histogram of capital return for Selangor |

|

| Chart 15: Histogram of capital return for Johore |

|

| Chart 16: Histogram of capital return for Penang |

Pulling it all together

An analysis of the capital gain for properties in Malaysia based on the Malaysia Housing Price Index showed the following

- Based on 20 years ownership period, the best time to buy a property is generally in 1999, a year after an economic downturn.

- For some types of properties in certain regions, the best time would be 1998.

- The significant exception is for Semi-D and Detached houses in Kuala Lumpur when the best time is in 1990.

- If you are not able to buy during the best year and had bought the property one year earlier or later, the "losses" can be quite significant depending on the type of properties or the location.

- If you want to more than break even taking into account your housing loan, picking the best time to buy is important.

- From an investment perspective, properties in Johore had the lowest capital gain compared to those in Kuala Lumpur, Selangor, and Penang.

If history repeats itself, from the perspective of maximizing capital gain

- 2021 would be a good time to buy properties.

- You would probably be OK if you had bought your property in 2020.

Capital gain also far outweighed the benefits from savings in transaction costs, taxes, or interest rates. You should focus on timing your purchase if the goal is maximizing capital.

END

Notes

1) There were 3 series of the Malaysian Housing Price Index - 1990 to 2000, 2000 to 2010, and 2010 to 2019. The start of each series had an index of 100. To derive a continuation over the 30 years period, I used the 1990 base of 100 as the starting point. For further details on how this was derived refer to the notes in “In Malaysia, which has better returns; Stock Market or Property:

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

|

|

|

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Your link text

Thanks for a very interesting blog. What else may I get that kind of info written in such a perfect approach? I’ve a undertaking that I am simply now operating on, and I have been at the look out for such info. Buy houses in mi

ReplyDelete