Baby steps in assessing real estate risks as financial risks

Case Notes 07: Real estate is often seen as an alternative investment for many retail investors. But if you want to invest in real estate, you then have to view its risk as another financial risk. This post provides one way to undertake such an analysis.

Like any investment, there are risks when investing in real estate.

While there are several ways to look at real estate risks, this article looks at risks from a financial investment perspective.

“Risk is defined in financial terms as the chance that an outcome or investment's actual gains will differ from an expected outcome or return. Risk includes the possibility of losing some or all of an original investment.” Investopedia

Thus, real estate investment risk is the likelihood that what you make from both capital gain and rent is less than your original investment.

We can then adopt the risk management framework to identify and mitigate negative returns when investing in real estate.

I hope that the article can provide a framework for real estate investors to

- Compare risks between different locations and/or types of properties.

- Establish the mitigations measures to protect against getting negative returns.

|

Contents

- Financial returns from investing in real estate

- Risk management framework

- Identifying the risks when investing in real estate

- Assessing the threats when investing in real estate

- Comparing risks when investing in real estate

- Risk mitigation when investing in real estate

- Pros and Cons of the framework

- Pulling it all together

|

Financial returns from investing in real estate

I will analyze risk from the perspective of someone buying a property for long-term investment ie. your second or third property. This will ensure that the analysis is not skewed by issues related to buying a property to live in.

The returns from investing in real estate are the result of the following:

- The capital gains. This is the difference between the selling price and the purchased cost as reflected in the Sale and Purchase Agreements (SPA). The capital gain will be net of the various transaction costs such as legal fees, agency commissions, and property gain taxes.

- Net operating income. This is the difference between the rents and the various running expenses. These could be statutory charges, agency commission, building repairs, and income tax.

- Financing charges. In this article, I will treat the financing charges as separate items by themselves as this is applicable only to those who invest using loans. The financing component will reduce total returns.

The financial returns from investment can then be represented as

Financial return = Capital gain + Net operating income - Finance charges

The financial risk in investing in real estate is then the possibility that you suffer a loss in your original investment. It does not matter whether the loss is due to the capital part, or the income part as long as it is not a positive financial return.

In this context, I would like to point out that there are some characteristics that should not be considered as risks. This is because they do not cause any negative returns. These are

- Real estate is capital intensive.

- Real estate is long-term investing in that it may take years for property prices to change.

- It is an asset with limited liquidity ie it takes time to sell.

- Many tax systems treat rental income differently from capital gains.

I am also coming from the perspective that if you are a prudent investor, you do not invest in real estate if

- You do not have the necessary financial resources.

- You do not have a long-term investment horizon.

- You are not going to abide by the tax code.

If you chose to speculate because you do not have the capital or other reasons, no amount of risk management is going to help you.

Risk management framework

The risk management process involves the following:

- Identifying the causes that can lead to the risk.

- Assessing the risk in the context of the impact and the likelihood of the occurrence.

- Planning the mitigation measure to manage the risk.

Once the risks have been identified, there are 4 main strategies to manage them. They involve:

- Avoid - what to do to prevent it from happening.

- Reduce - how to minimize the impact of any risks.

- Transfer - is there a way to transfer the risk and/or the consequences to another party.

- Accept - in some instances where the cost of mitigation outweighs the benefit of the mitigation strategies, it may be better to live with the risk.

The article will illustrate how the above risk management approach can be used to manage real estate investment risk. It will

- Identify all the causes that can lead to negative returns when investing in properties.

- Assess each threat in the property investment process.

- Plan the mitigation measures for the property investment process based on the 4 risk management strategies.

Identifying the risks when investing in real estate

While there are many ways to classify the risks that can cause a financial loss, I have grouped the threats into 5 groups as follows:

- Owner’s behaviour

- Capital gain

- Financing

- Rental income

- Operating expenses

It is obvious that there are other underlying reasons for some of the above threats.

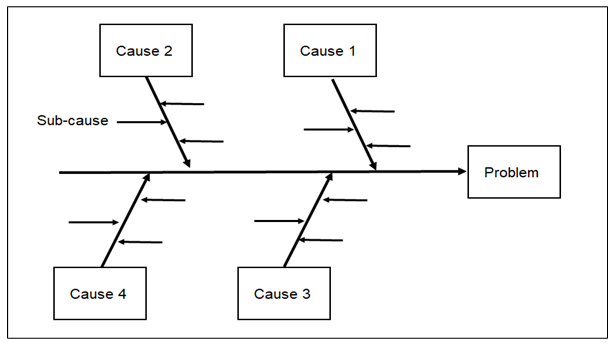

To identify the various root causes for each of the above, I used the Ishikawa or fishbone diagram to depict the risk structure as shown below. (Refer to Note 1 for a description of the Ishikawa diagram).

While there could be common underlying causes eg changes in economic conditions, the impact on each of the groups of risks may be different.

BTW I classified the risks based on my Malaysian experience. Other countries will have different market and statutory characteristics. These will influence the cause and effect as presented in the Ishikawa diagram. But the concepts and principles should still apply.

A brief description of each of the threats is presented below.

Owner’s Behaviour

The owner’s behaviour affects the capital gain and rent. Like all investments, success comes from knowing what you are doing. So be prepared to do the necessary research.

- Having a high expectation of the selling price or rental may affect how long it takes to sell or rent the property.

- The selling price and rent will also be affected by how well the property is marketed.

- The financial position of the owner will also affect the capital gain and/or rental. A person without a strong financial standing may be forced to sell at a lower price because of cash flow needs. The asking rent could be lower if the owner has liquidity problems.

Capital gain

Capital gain results from the difference between the selling and purchase price. This is of course after accounting for transaction costs and taxes.

- In Malaysia, real property gains tax varies with how long you have held the property. At the same time, the Malaysian government has in the past amended the tax rate.

- Type of properties. The capital gains are also affected by the type of properties as can be seen from the chart below. It shows how the Malaysian National Housing Price Index for different types of properties has changed over the past 3 decades.

|

| Chart 2: Malaysian National Housing Price Index by types of properties |

- Economy. The property market is cyclical and property prices will be affected by when you transact the property. Refer to "Determining the best time to buy your house."

- Competition - this refers to whether there are many more developments coming up in your neighbourhood. This will affect the supply of units and hence your selling price. It is possible that new properties may make your property less attractive as they may not have the same facilities.

- New/Old - If you are buying a house that is currently under construction, there is then the construction and completion risk to consider. Or, if you are buying from an existing owner, you need to check the building compliance.

- Location - the chart below illustrates the point that the location of the property will affect the capital gain. In the Malaysian context, properties in KL have higher capital gain than those in Johore.

|

| Chart 3: How property prices have varied for the different Malaysian States |

Financing

Investing in real estate is one of those investments that need a huge amount of capital. If you don’t have enough capital, you may have to take a loan to invest.

- Changes in the loan structure due to dire economic situations may affect the total amount of financing charges. Imagine the impact if you do not have interest protection clauses in your financing scheme.

- There could also be changes to the government policy on credit thereby affecting your financing charges.

Rental income

The risk of lower rent can be the result of low rental rates and/or longer vacancy periods between rents. These, in turn, are affected by the following:

- Location. Property price is also a function of the rent. Being in the “wrong” location affects the rent as well as the potential selling price of the property.

- Economy. The economic situation may impact the demand for the properties thereby impacting the asking rent.

- Competition. Rental rates are affected by supply and demand. If there are new properties in your neighbourhood, it may affect your asking rent.

- Property type. Some types of properties are easier to rent and this could impact both the occupancy and rental rates.

Running expenses

The risks here relate to higher expenses due to the following:

- Different statutory charges eg quit rent and assessment in the Malaysian context.

- Unforeseen upkeep. If you own properties long enough, you will meet some form of disaster. Examples are burst water pipes, water tank leaking, electrical wiring problems, roof leaks.

- Problems tenants. These could be from:

- Damaging properties

- Rent default. The creditworthiness of tenants can affect the rental income.

- Illegal use of premises

Summary

The above Ishikawa diagram is based on one view of financial risks. It is obvious that there are several ways in which to classify the risks.

I will not be surprised if you have a different way to frame the various causes and effects or if you want to go more in-depth in some of the causes and effects. The key point is the framework allows you to identify the root causes.

Assessing the threats when investing in real estate

The goal of threat assessment is to evaluate the likelihood of occurrence of each of the threats and their impacts.

I classify each cause in the Ishikawa diagram into one of the following 4 coloured cells as per the Threat Matrix chart below based on:

- The assessment of its impact.

- The likelihood of it occurring.

|

| Chart 4: Threat assessment |

The above is a visual and qualitative approach. You now have a way to identify and assess the various threats. You can next use them in 2 main ways

- Compare the risks between different locations and/or types of properties.

- Identify the various risk mitigation measures.

I will show how each of them can be carried out in the following sections.

While I have used some examples to illustrate them, the article is not about whether a particular property is less risky or whether the risk mitigation plan as shown is comprehensive.

Rather it is to illustrate the approach so that you can adapt it for your own analysis.

Comparing risks when investing in real estate

One way to use the Threat Matrix is to compare the risks between several properties.

I have compared the risk of investing in a double story terrace house in 2 different locations in Malaysia with the following assumptions

- Both properties are currently tenanted and you will continue with the tenancy.

- One property is located in an established part of Bangsar where the tenant has paid all the rent on time.

- The other property is located in one of the newer townships in the outskirt of Klang where the rent has been paid late occasionally.

The focus of this example is not whether which property will generate better returns, but rather which has lower risks. The chart below summarizes the comparison for each of the threat looking at them from the combination of

- Probability of the event happening.

- The impact should the event occurs.

You would see that there are more risks in investing in the house in Klang compared to investing in the one in Bangsar.

(Note that the comparison is for illustration only and is not meant to suggest that one area is riskier than another.)

|

| Chart 5: Comparing the real estate risk for 2 properties |

Some comments on my rationale for the risk comparisons are presented below:

|

| Chart 6: Rationale for the threat analysis |

Risk mitigation when investing in real estate

Apart from enabling you to compare risks, another use of the analysis is to develop the risk mitigation plan by

- First listing the various items that can lead to negative returns.

- Then identifying the various measures to manage them based on the 4 mitigation strategies.

I use a matrix to help do this with the various threats on the vertical axis and the 4 mitigation strategies on the horizontal axis.

The chart below summarizes the various measures that I have identified categorized based on the 4 strategies of:

- Avoiding threats.

- Reducing the likelihood or impact of the threats.

- Accepting the threat.

- Transferring the threat

You will notice that some measures cut across several risk mitigation categories.

Furthermore, if you view the threat as a function of both the likelihood of the event and the impact of the event, then depending on the nature of the threat,

- Some of the measures focus on the likelihood.

- Some focus on the impact.

- Some cover both likelihood and impact

While the mitigation measures are self-explanatory, I have picked up the 5 most common things:

- Do your due diligence at the buying stage on the location, developer, and type of properties.

- Don’t’ rush to buy or sell. If possible, buy during an over-supply situation.

- Financing - have an emergency fund and don’t overleverage.

- At the tenancy stage - focus on occupancy rather than rent as you will lose more waiting for another month or so to get an extra 10% rent.

- Tenants - vet tenants and have a proper tenancy agreement

|

| Chart 7: Risk mitigation measures Note: The risk item numbers in the chart corresponds with the item numbers in Chart 5 and 6 so that you can relate the mitigation measures with the threat assessment. |

The chart above covered the risk mitigation measures related to investing in real estate.

An important point about the above risk mitigation measures is that they should be part of a wider asset allocation plan. Along this line, some of your savings/net worth should also be invested in other assets eg stocks. These have a different risk profile than those of properties so you are transferring some of the risks.

Pulling it all together

If the goal of buying properties is for investments, there is a need to view them as financial investments. As such they should also be assessed from a financial risk perspective.

I have shown one risk analysis framework. To be able to use this framework, you need a good understanding of the investment. This could include its location, rental and capital gains potential, and the financing challenge.

This should not be a surprise because successful investors in other financial assets eg stocks are experts in their respective fields. The advice for any investor is that you should not invest blindly.

Another point is that the analysis and threat assessment is based on my classification of the causes and effects. It is obvious that if you have a different classification and/or a more in-depth analysis of the causes and effects than what is illustrated you can have a more in-depth assessment.

But to be able to do this, you need to have a good understanding of the real estate investment process.

To summarize then:

- Investing in real estate has financial risks.

- The real estate financial risk is the threat that the financial returns from capital gain and rent, net of financing charges may be negative.

- You can adapt the risk management framework to identify, assess, and mitigate real estate investment risks.

- The article illustrates how you can use the framework to:

- Compare the risks when investing in different locations and/or properties.

- Identify the measures that can be taken to minimize the risk.

|

END

Note

1) Ishikawa diagram

An Ishikawa diagram shows the causes of an event and is often used in manufacturing to show where quality control issues might arise.

It is sometimes referred to as a fishbone diagram. It resembles a fish skeleton, with the "ribs" representing the causes of an event and the final outcome appearing at the head of the skeleton. In such a diagram:

- The head of the fish is created by listing the problem and drawing a box around it.

- A horizontal arrow is then drawn across the page with an arrow pointing to the head, this acts as the backbone of the fish.

- The key “causes” are identified that might contribute to the problem. These causes are then drawn to branch off from the backbone with arrows, making the first bones of the fish.

- For each key cause, the root causes of the problem are identified. These contributing factors are written down to branch off their corresponding key cause.

|

| Chart 8: Ishikawa or Fishbone diagram |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

The subject of mortgage interest rates for those with bad credit is contentious. Potential borrowers who have previously been rejected home loans or other sorts of credit will readily accept the rationale. Many lenders desired mortgage approval since they would not have mortgages on their own houses if they were not linked together. Predatory lenders may prey on clients with poor credit histories, charging them high-interest rates and fees on a bad credit mortgage.

ReplyDeleteNice blog I have been read your all blog , all the blogs are good and informative . If anyone need aluminium products then visitchequered plate.

ReplyDeleteAs well as having individuals attempt to track down you rather than you attempting to find them, there is one more advantage to promoting to produce real estate leads.

ReplyDelete道路用地買賣平台

While buying your own property, it is essential to watch out.

ReplyDeleteDistrict Realty

There are without a doubt alternate approaches to creating real estate leads too, yet these are the most widely recognized strategies.

ReplyDeleteDistrictRealty

The Federal Reserve's interest rate policies can influence mortgage rates.

ReplyDeletecommuterchallengebc.ca