Better to invest or pay off mortgage? - the evidence.

- One was “Properties vs stocks: Which is a better investment in Malaysia?” which showed that over a 20 years period, the return from investing in properties is about the same as that from investing in the stock market.

- We knew of how house prices have changed over a 20 years period.

- We knew how the KLCI has performed over a 20 years period.

- We also knew the historical housing loan interest rates.

Summary

- The 4 types of houses covered were Terrace, Semi-Detached, Detached and High Rise.

- The 4 regions were Kuala Lumpur, Selangor, Johore, and Penang.

- The results were independent of the type of houses and the location. This meant that the purchased price of the house and the potential capital gain from the house are not factors to consider.

- Based on the historical evidence, you are better off investing any extra monies in the stock market instead of paying more for the housing loan.

- This is because the gain from having a reduced total amount paid to the bank is more than offset by the lower gain from investing in the stock market. This is illustrated in the chart below.

|

| Chart 1: Terrace House - Invest or pay off the Mortgage? |

- It did not matter whether you were thinking of a large lump sum payment or several annual payments.

- It also did not matter when you make the extra payment.

|

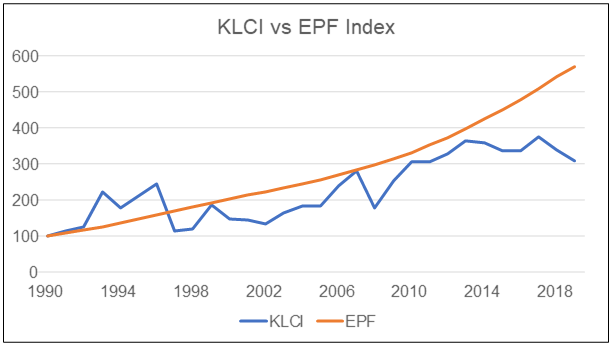

| Chart 2: Amount achieved by KLCI vs EPF with both starting at 100 in 1990 |

The reverse conclusion applies. If you had the opportunity to withdraw a lump sum to pay off some of the housing loans, the historical evidence suggests that you should not do this. You are better off leaving the money in the EPF to let the savings compound.

Contents

|

1. Comparative analysis

- Scenario A - Invest the extra money in the stock market.

- Scenario B - Pay extra to the bank to reduce the loan repayment period.

- When you first start to have the extra money. I covered 3 periods - in year 6, year 8, and year 10 after the purchase of the house. The house is assumed to be purchased in year 1.

- The housing loan interest rate. I looked at 4 interest rates situations - 3%, 4%, 5% and 6%. These should cover the range of Malaysian housing loan interest rates as shown below.

|

| Chart 3: MBB Lending rates. Source: Trading Economics |

- The extra money. I have assumed that a buyer would have bought the appropriate type of house based on his ability to repay the loan. As such, I looked at the extra money as a % of the house value. For my analysis, I looked at 3 situations - extra money based on 4%, 5%, and 6% of the house purchase price.

1.1. Cash flow gain under Scenario A

- Capital gain from the house. This is the difference between the house price at the end of the loan period (ie year 20) and the monies paid to the bank as well as the down payment for the house. Refer to section 2.

- Gain from investing in the stock market. This covers both the capital gain from the increase in the stock market index and the dividends received. Refer to section 3.

1.2. Cash flow gain under Scenario B

- Capital gain from the house as per Section 4. This is likely to be more than under Scenario A as you have paid less to the bank.

- Gain from investing in the stock market. You may argue that if you are using the extra money to repay the bank, where would you have the money to invest in the stock market?

2. Gain from the house purchase

- 20 years housing loan.

- The house was purchased based on a 20 % down payment from savings and 80% from a bank loan.

- I ignored sales commission, legal fees, and stamp duties in my analysis.

- The House price in year 20 = House purchase price X average gain over 20 years.

- The total amount paid to the bank will depend on the interest rate and the loan amount. The loan amount is dependent on the purchase price of the house.

- The 20 % down payment is dependent on the purchase price.

- How I derived the house purchase price.

- The average gain in house price over 20 years

2.1 Purchased house price

|

| Chart 4: House Prices |

2.2 Average gain in house prices over a 20 years period

|

| Chart 5: Capital Gain by Types of Houses in KL |

- Terrace House - 242 %

- High Rise - 107 %

- Semi-Detached House - 271 %

- Detached House - 318 %

3. Stock market gain

- Capital gain - refer to Section 3.1

- Dividends - refer to Section 3.2

3.1 KLCI capital gain

- If you invest for 1 year, the average gain for a 1-year period is the average annual gain from 1990 to 2019.

- If you invest for 2 years, the average gain for a 2-years period is the average gain for all the 2 years rolling gain from 1990 to 2019.

- If you invest for 10 years, the average gain for a 10-years period is the average gain for all the 10 years rolling gain from 1990 to 2019. To elaborate there are twenty 10-years periods as shown below with an average gain of 56 %

Periods

Gain

1990 to 2000

46 %

1991 to 2001

26%

1992 to 2002

7%

1993 to 2003

-26%

1994 to 2004

4%

1995 to 2005

-13%

1996 to 2006

-2%

1997 to 2007

144%

1998 to 2008

50%

1999 to 2009

37%

2000 to 2010

109%

2001 to 2011

112%

2002 to 2012

145%

2003 to 2013

120%

2004 to 2014

94%

2005 to 2015

82%

2006 to 2016

41%

2007 to 2017

34%

2008 to 2018

90%

2009 to 2019

22%

Average

56%

|

| Chart 6: KLCI Capital Gain - best fit line |

3.2 Dividends

|

| Chart 7: KLCI Dividends Source: CEICDATA |

4. Financial Model

- 4 categories of houses - Terrace, Semi-Detached, Detached, High Rise.

- 4 regions - Kuala Lumpur, Selangor, Johore, Penang.

- 4 housing loan interest rates - 3%, 4%, 5%, 6%.

- 3 points in time to start the additional loan payment - after 6 years, 8 years, and 10 years.

- 3 additional loan payments as a % of the housing loan - 4%, 5%, 6%

- When you start to pay the additional amount.

- The quantum of the additional payment.

|

| Chart 8: KL Semi-D. Invest or pay off Mortgage? |

4.1 Reviewing the results

- The type of house.

- Where it is located.

- The housing capital gain achieved.

- Starting the extra payment in year 6 with the extra amount based on 4% or 5% of the housing loan.

- Starting the extra payment in year 8 with the extra amount based on 4 %.

- When you start to pay off.

- How much additional you pay off

5. Malaysian Employee Provident Fund (EPF)

|

| Chart 9: EPF Returns |

|

| Chart 10: Amount achieved by KLCI vs EPF with both starting at 100 in 1990 |

|

| Chart 11: EPF return - best fit line |

6. Limitations

7. Pulling it all together

- Lump-sum vs annual payments.

- When you start the additional repayment.

- The amount of the additional repayment

- The type of houses.

- Where the houses are located.

- How you use the “spare money” to repay the loan.

END

Appendix 1

|

Item |

Item |

Comments |

|

House price at the start |

P |

Original house price - varies with the type

and region |

|

House price in yr 20

|

Q |

House price at the end of the 20 years loan period. Varies depending on type and region |

|

Loan amount

|

0.8P |

Based on 80 % of the value of the house |

|

Down payment

|

0.2P |

Based on 20 % of the value of the house |

|

Scenario A total paid to the bank |

R |

Payment for 20 years. Varies with

interest rates and loan amount |

|

Scenario A extra money |

aP |

a % of original house price |

|

Scenario A housing gain |

Q - R - 0.2P |

|

|

Scenario A Stock market gain |

S |

Varies depending on “a” and investment

period. The period is 20 minus the start of the year with extra money. |

|

Scenario A total gain

|

Q - R - 0.2P + S |

Housing gain and Stock market gain |

|

|

|

|

|

Scenario B total paid to the bank |

T |

This is less than R |

|

Scenario B available for the stock market |

R - T

|

|

|

Scenario B housing gain |

Q - T - 0.2P |

|

|

Scenario Stock market gain |

U |

Varies depending on (R - T) and

investment period |

|

Scenario B total gain |

Q - T - 0.2P + U |

|

|

|

|

|

|

Scenario B - Scenario A

|

[R - T] - [S -U] |

|

- [R - T] which is the difference in the total amount paid to the bank under the two scenarios.

- [S - U] which is the difference in the stock market gain under the two scenarios.

|

For the most significant information and help available anywhere, give them a call if you're looking to buy a new house in Oshawa, ON. Using the services of Mortgage Intelligence, you may be able to get a low-cost mortgage that is well within your financial reach. Many of the most excellent mortgage agents in the business have years of expertise, and we work with a large number of lenders to guarantee that you get the ideal interest rate possible on your loan.

ReplyDeleteThe most vital phase in wealth management is to comprehend that the genuine wellspring of wealth really exists in you!

ReplyDeleteExponent Investment Management