The ultimate look at how long to hold onto stocks

Fundamentals 07: This post looks at how long to hold onto stocks from various perspectives. Factors considered include capital gains, income tax, dividends, investment styles, winners, and losers. It explores whether there is a minimum holding period and what is considered a long time.

|

| “You need to know very well when to move away, or give up the loss, and not allow the anxiety to trick you into trying again.” Warren Buffett |

How long do you hold onto your stock? Are we talking minutes, days, weeks, or months?

This is a very common question and has caused a lot of confusion among newbies.

It is actually putting the cart before the horse as the holding period is a function of your investing style. For clarity, I define the holding period as starting from the time you bought the share till the time it is sold.

The holding period is not something that you decide on upfront. You don’t say that you want to hold for a day and then find the investing approach to enable this.

Rather you chose the investing style based on your interest, risk tolerance, mindset, and other demographics. I have seldom seen holding period being a factor in deciding the best investment style for a person.

Once you have chosen an investing style, then the holding period timeframe is more or less set.

- If you are a day trader, then you think minutes.

- If you are a swing trader your holding periods could be days or weeks.

- If you are a fundamental investor, you could hold for months or even years.

Conclusion?

How long you hold would depend on your investment style. Within a particular style, the duration will depend on the respective timeframe.

In deciding how long to hold, you will have to consider many factors and issues. Some factors are common to all the styles while others are relevant to only a particular style.

I will explore these in the following sections. I am looking at holding individual stocks rather than an ETF, mutual fund, or index.

Of course, to be a successful stock-picker, you need a certain level of expertise. If you do not have such expertise but still want to select individual stocks you should rely on the advice of those with such expertise.

Those who can help include people like Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can tap into their business analysis and valuation.

Contents

1. When to sell a stock?

2. Are there other reasons for selling a stock?

3. How long to hold a stock to be taxed under capital gains rather than income?

4. Is there a minimum holding period for stocks and what is considered a long time?

5. Can you hold onto stocks forever?

6. How long do you hold onto your winning stocks?

7. How long do you hold onto your losing stocks?

8. Do you have to hold onto a stock to get dividends?

9. Compounding and holding period

10. How long do you stay invested in the stock market?

11. What is the actual average holding period for stocks?

12. Conclusion

|

1. When to sell a stock?

How long you hold a stock is linked to when or why you should sell. Irrespective of your investment style, there are two main reasons to sell a stock.

- When you have made a mistake in selecting the stock.

- When the reasons for you to buy the stock are longer there.

If you are a day trader or swing trader, it is likely that you would have a market sentiments-driven approach. Most likely your investing concept is equal to buying and selling pieces of paper. You focus on crowd behavior and you rely on charts and technical indicators to gauge market sentiments.

A mistake in your context would be thinking that a particular stock is popular only to find out that no one is chasing the stock. Your charts and technical indicators would signal this mistake.

If you are a fundamental investor, you invest based on your assessment of the prospects of the company. When you find out that you have made a mistake in the assessment, you get out.

Irrespective of your investment style, you sell immediately the moment you realize your mistake. If you have not made a mistake, you would hold onto the stock until the reason for you to buy is no longer there.

- If you are a day or swing trader, this is likely to be a situation when the stock is no longer popular. Your charts and indicators would signal this point.

- If you are a fundamental investor, you would have bought when the price was less than the value of the underlying business. This is of course determined by the fundamentals. When the price exceeds the fundamental value, it is time to exit.

2. Are there other reasons for selling a stock?

We all engage with the stock market for different reasons and under different circumstances.

You usually sell when the reasons for buying the stock no longer exist. However, there are sometimes other reasons for selling.

Firstly, if you do not have an appropriate asset allocation or investment plan, you may not have the funds to handle an emergency. Most people under such circumstances are then forced to sell the shares.

Unfortunately, you are then selling at the wrong time and may incur losses. The best way to avoid such a selling situation is to ensure that your stock investment is part of a well-thought-out asset allocation plan.

Secondly, even if you have an asset allocation plan, the plan will need periodic review. If during the review you find out that you have breached some of the portfolio criteria you may have to rebalance.

For example, your asset allocation plan may have certain stocks to bonds ratio. When this ratio is exceeded because of the increase in the share prices, you may want to divert some of the money from the stocks to bonds. So, you may sell some shares even though the reasons why you bought them in the first place have not changed.

For these reasons, how long you hold onto a stock will sometimes be determined by your financial needs and your asset allocation plan. Such timing may mean that the holding period is not related to maximizing the returns.

3. How long to hold a stock to be taxed under capital gains rather than income?

Many countries have different tax rates for capital gains and income. Generally, the tax rate for capital gain is lower than for income.

For many countries, how long you hold onto the share is one factor in deciding whether a transaction is classified as a capital gain or income. It is common to have one year holding period as the differentiating factor. In other words, if you hold for less than a year, the profit from the sale is classified as income.

If you are a day or swing trader, this tax rule is irrelevant. But if you hold the stocks for months, many advise that you aim for the transaction to be categorized as a capital gain rather than income.

It is not a piece of practical advice because if you hold for long periods of time, most likely you are a fundamental investor. Unless you are holding onto the stocks forever, you would sell when the price exceeds the fundamental value.

While fundamental values don’t change within a short period, market prices do. If you do not sell when the price exceeds the fundamental value (hoping to be classified as a capital gain), you may miss the boat. The stock price may not say elevated long enough for you to profit from the sale and have the profit fall under capital gain for tax purposes.

I am a long-term value investor holding onto my stocks for 5 to 8 years. Once in a blue moon, the market gives me an exit opportunity when I have held onto the stocks for only a few months. I don’t worry about taxes. I focus on the gain.

I would also point out that how long you hold is not the only criteria to determine whether the transaction comes under capital gains or income. Many tax codes also consider the intent. For example, if you are investing as a business, the likelihood is that the gain would be considered as income.

Again, this issue of tax is like putting the cart before the horse. You should first choose the investment style based on interest, risk tolerance, and other profile. Only then do you consider tax planning issues.

And when you consider tax planning, you should also consider “tax-loss harvesting”. Tax-loss harvesting is the practice of selling a security that has experienced a loss. By realizing, or "harvesting" a loss, you are able to offset taxes on both gains and income. Of course, this is dependent on the tax code in which you live.

Given the above, I would say that tax planning is very low down on the list of things to consider in developing your investment plan.

3.1 How long to hold onto stocks to avoid “wash-sale”?

Certain countries have specific tax codes to prevent investors from “gaming” the tax code. A good example is the “wash-sale” rule in the US.

A wash-sale occurs when you sell a security at a loss and then purchase that same security or “substantially identical” securities within 30 days.

To comply with the wash-sale rule, you must therefore wait at least 31 days before repurchasing the same investment.

Even if the securities you repurchase are the same ones you sold, they might be deemed to be “substantially identical” if the two securities are sufficiently similar.

The wash-sale rule was designed to discourage people from selling securities at a loss to claim a tax benefit. If you end up being affected by the wash-sale rule, your loss will be disallowed.

4. Is there a minimum holding period for stocks and what is considered a long time?

There is no minimum holding period.

- If you have made a mistake in selecting the stocks, you get out the moment you realize the mistake.

- If you have not made a mistake, you hold for as long as it takes to achieve your investment objective.

What is the duration of your holding period to be classified as a long time?

This has to be seen in the context of your investment timeframe. If you are a day trader with a timeframe counted in minutes, a long holding period is probably holding for 24 hours.

This presupposes that there is an average or “normal” duration for each investment style or timeframe.

Investopedia opined that there really is no such thing as a "typical" day in the life of a trader and tabulated the following.

|

Trading style |

Holding period |

|

Position trading |

Months to years |

|

Swing trading |

Days to weeks |

|

Day trading |

Day only |

|

Scalp trading |

Seconds to minutes |

|

High-frequency trading |

Seconds to minutes |

I am a long-term value investor and I have about 10 % to 15 % annual stock turnover. This works out to about a 7 to 10 years holding period.

5. Can you hold onto stocks forever?

This question is only relevant to the long-term fundamental investor.

Warren Buffett has said that his holding period is “forever”. But he has sold stocks and his “forever” term is meant to illustrate his long-term investment horizon. Many forget that his “long-term” is the result of him picking good companies.

When I think of Kodak and Nokia, I worry about holding onto stocks forever. To hold onto a stock forever, it must mean that every time you review your portfolio, the “forever” stock will always come up as the best stock.

Unless you have Warren Buffett stock-picking skills, you are unlikely to have a portfolio of “forever” stocks.

But this does not mean that you cannot grow the value of your portfolio. To grow the value of your portfolio, sell those that have become overvalued and then reinvest the money into other undervalued stocks.

You will find that as you repeat the cycle, the value of your portfolio will grow over time.

6. How long do you hold onto your winning stocks?

This is a good problem to have. This stock price has risen and you are making money. The question is whether to exit based on some profit target or do you let the winner run for as long as possible.

There are two common trading mantras:

- “Let your profits run" is an expression that encourages traders to resist the tendency to sell profitable positions too early.

- Locking in profits with some form of saying such as “You never go broke taking a profit.”

One of the characteristics of investing in stocks is there is a long right tail of winners.

A Study by the Black Star Fund (guest posted in Meb Faber) showed that there are fat tails in the distribution of winners and losers. If you lock in your profit, you cut yourself off from the potential gain.

In practice when the stock price has risen to my profit target, I scale-out. I locked in some of the profits and hope that I can ride the price higher.

My track record has been mixed. I had cases where the price went higher after I thought I rode it high enough. There were also cases where the price declined after my first tranche of sale.

The technical analysts will advise that if the price action signal is strong, you should continue the ride. Unfortunately, this presupposes an ability to read signals about market sentiments.

As I said, this is a good problem to have since it is about how much money you leave on the table rather than how much loss you have to suffer.

7. How long do you hold onto your losing stocks?

You know that you are losing money as the stock price has dropped below your purchased price.

How long you hold onto your losers will depend on:

- Whether you see it as real losers.

- How much you can afford to lose.

- Whether you can get any tax benefit from the loss.

If you are a fundamental investor, your first step is to check your analysis and valuation. Make sure that the stock price is still below the fundamental value. If so, you hold on as this is only a temporary and “paper loss”. You actually hold onto your losers until there is a change in the fundamentals.

Unfortunately. this “checking” to see whether it is a real loss is only applicable to fundamental investors.

If you have bought based on buying and selling pieces of paper, your decision depends on whether there is a change in the market sentiment.

If you are a trader, you would have translated this change into a “stop-loss”. This stop-loss would have been established based on your investing and risk mitigation plan.

I would suggest that you don’t override this plan ie do not sell before the stock price hits the stop-loss.

As for tax-loss harvesting, I do not think anyone would advise you to incur a loss to enjoy the tax loss. Any tax loss plan is something you consider after the effect. In practice, ignore the tax issue when deciding on how long to hold onto your losses.

8. Do you have to hold onto a stock to get dividends?

The question of dividend is not relevant if you are a day trader or swing trader. If you are buying and selling pieces of paper based on popularity, your focus is on making money from the market.

A dividend is getting a payment from the company.

If you are a long-term investor, your investment return can come from:

- The market - gain from buying and selling.

- The company - dividends and other cash payments.

There are two conditions to benefit from dividends:

- The company must be in a position to declare dividends.

- You must hold the stocks long enough to cover the dividend payment time.

The former is dependent on the “quality” of the company. It is must profitable enough to be able to declare dividends. This is not a function of your holding period.

The latter is dependent on your holding period which in turn is dependent on your investment approach.

I have not come across an investment style where you buy a stock just before dividends are paid and then sell after receiving the payments.

Most of the time, if you buy a stock for its dividends, you are likely to hold onto it for a long time. You benefit from a stream of dividend payments ie a dividend king investor.

Even if you are not a dividend king investor, as a fundamental investor you can benefit from the dividend.

I am a long-term value investor and dividends accounted for about 1/3 of the total returns. Total returns here are defined as both capital gain (difference between the selling price and purchase price) and dividends.

9. Compounding and holding period

"Compounding is the process whereby interest is credited to an existing principal amount as well as to interest already paid. Compounding can thus be construed as interest on interest. The effect of which is to magnify returns to interest over time, the so-called miracle of compounding." Investopedia.

In the context of stock investing, you can think of compounding as generating earnings from previous earnings. Whatever gain you generated from the stock portfolio is reinvested to generate earnings.

From this perspective, you can benefit from compounding as long as you reinvest all the profits from the stock investments.

- It does not matter whether you are a short-term day trader or a long-term fundamental investor.

- You compound the value of the amount allocated to investment.

For example, if you are a swing trader, you compound your investments by reinvesting all the monies from your sale. But if you also gain from dividends, you reinvest the proceeds from the sale of shares and dividends. In fact, you reinvest whatever money you receive from the stock investments.

There are 2 requirements to benefit from the effect of compounding:

- You need consistent returns.

- You need to reinvest over a long period of time.

When you consider compounding from these conditions, you will conclude that it is not a function of the holding period. You compound not by holding onto a stock for a long time. You compound by reinvesting the gains and achieving the same rate of returns for the reinvested stocks.

You can compound your investments with day trading or with momentum trading. It is not dependent on your investment style, timeframe, or holding period.

10. How long do you stay invested in the stock market?

I think this is a very different question than asking how long you should hold onto stocks.

This relates to how long you should invest in stocks as an asset class. I follow the 3 Buckets strategy of asset allocation where I have my net worth invested into 3 groups of assets:

- Liquid assets eg bank savings.

- Safe assets eg those that protect the principal such as government bonds.

- Risky or volatile assets eg stocks. These generate better returns among the three asset classes but can be volatile in the short term.

Asset allocation is about balancing risk and return. Historically stocks have been one asset class that generated the better returns. As long as this continues to be the case, you should stay invested in the stock market.

In practice, this means being invested in the stock market forever. The issue is not really about the duration, but rather about the amount to be allocated to stocks.

10.1. How long to hold onto a stock bought on margin?

Margin trading occurs when you borrow money from your stockbroker to pay for stocks.

You have more buying power for stocks than your cash alone would provide. Your account, including any assets held within it, then serves as collateral for that loan.

You have to pay the interest on your loan. Over time, your debt level increases as interest charges accrue against you. As debt increases, the interest charges increase, and so on.

The longer you hold an investment, the greater the return that is needed to break even. Buying on margin is a short-term investment activity.

11. What is the actual average holding period for stocks?

Reuters did an analysis of the holding period based on New York stock exchange data. It showed the average holding period for U.S. shares was 5-1/2 months in June 2020, versus 8-1/2 months at the end-2019.

As the chart below shows, the holding period for stocks in the US has been reducing.

11.1 Do the actual holding periods for stocks vary across regions?

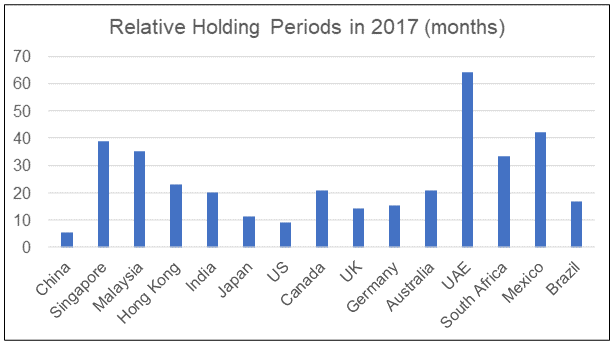

The chart below shows the relative stock holding period for a sample of countries in each continent for 2017.

|

| Source: FRED. The statistics are for the stock market turnover ratio (value traded / capitalization). I converted these into months of holding period by inverting them. |

You can see that for most of the developed countries, the holding period is less than a year. The exception is China which is not exactly a developed nation.

12. Conclusion

This article looks at the question “How long to hold onto stocks”.

The holding period is a function of your investment style. You do not choose your investment style by considering how long you should hold an investment. Rather your choice is dependent on your interests, risk tolerance, mindset, and other demographics.

How long you hold onto a stock is subject to your investment timeframe. This in turn depends on your investment approach. A day trader would consider 24 hours as a long time. A value investor would consider weeks as a short time.

There are other articles about the holding period that also discusses:

- The benefits of having a long-term investment horizon. eg history shows this provides the best return as we are poor market timers. Furthermore, you will benefit from lower capital gains and fewer trading fees. But I would argue that this is putting the cart before the horse.

- Buy and sell strategy vs buy and hold. But this is a debate about investing style rather than how long to hold stocks.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment