Expanding your company analysis toolbox with relative fundamental analysis.

Fundamentals 11: This is a quantitative technique for comparing fundamentals. To illustrate how to use it, I have compared the performance of Tempur-Sealy with those of its peers.

Value investing is about :

- Analyzing a company’s fundamentals.

- Estimating its value and comparing it with the market price.

- Adopting a host of risk mitigation measures.

While each stage is important, I would like to focus on the company analysis stage in this post. There are two goals when I analyze a company:

- Determining whether it is fundamentally sound.

- Ensuring that the assumptions I used in the valuation are realistic.

This post is about the former. We all have various techniques and methods to undertake this. I used a combination of qualitative and quantitative analysis.

However, what I present here is one very specific quantitative analysis method. I called it relative fundamental analysis. It is about comparing a company's (target) fundamentals with those of its peers (benchmark).

Think of relative fundamental analysis as a sub-set of the conventional fundamental analysis. Join me as I illustrate how I carry out a relative fundamental analysis.

Contents

- Conventional fundamental analysis

- Relative fundamental analysis

- Case study - Tempur-Sealy

- Overall performance - putting the pieces together

- Conclusion

|

“In business and economics, fundamentals represent the primary characteristics and financial data necessary to determine the stability and health of an asset. This data can include macroeconomic… and microeconomic… For businesses, information such as profitability, revenue, assets, liabilities, and growth potential are considered fundamentals.” Investopedia

Fundamental analysis considers qualitative and quantitative information to assess the company’s performance. For want of a better word, I will refer to this as “conventional fundamental analysis”.

In the assessment, we sometimes compare the company's performance with its historical performance. At other times, we compare it with the industry. We may also compare it with its peers.

The main difference between relative fundamental analysis and conventional fundamental analysis is the focus.

Relative fundamental analysis focuses on quantitatively comparing a company’s fundamentals with those of a benchmark.

Conventional fundamental analysis

Fundamental analysis uses qualitative and quantitative information to judge investment prospects.

Different people will have different approaches in undertaking a fundamental analysis. For this post, I will use my fundamental analysis approach as a reference.

My approach is to read the past 12 years Annual Reports. I study the financials, review the Chairman’s message, and the Management and Discussions Analysis. I support these with industry/market research reports as well as analyst reports.

My fundamental analysis tends to be desk-type research. If you have the resources, you could extend the analysis to include:

- Fieldwork or what is referred to as “scuttlebutt”.

- Surveys eg customer satisfaction with the company's products.

The goal of the fundamental analysis is to get a picture of:

- How the company got to where it is today?

- Where is the company heading given its performance?

- Where does it want to go?

- What are its plans to get there?

This helps me to determine how a company makes money, its uniqueness versus the competition, and its prospects.

The extent to which I can get a full picture depends on how transparent the company is. I have covered both ASEAN and US companies and in general, I would say that US companies provide much more information than the ASEAN ones.

I have found that many ASEAN companies provided more information to analysts than what management presented in their Annual Reports. So I always look at analyst's reports as another source of information.

If you have been following my case studies, you will know that I organized the results of my analysis under the following headings.

- Expertise. This is to identify whether there is anything special about the company. It provides insights into its competitive edge or moat. This tends to be a qualitative analysis.

- Sources and Uses of Funds. While quantitative in nature, the goal is to see how effective it has deployed its funds. It provides an insight into management capital allocation capabilities.

- Current Performance. I assessed the company's current performance relative to its historical performance. This can throw light into how it will perform in the immediate future. This is usually a numerical analysis.

- History. This is to provide a picture of how the company got to be where it is today. It covers both qualitative and numerical analyses.

- Future. I also performed an industry analysis and assessed the challenges faced by the company. There is a lot of market research data here and is both quantitative and quantitative in nature.

- Management. This is to assess its track record as an operator and capital allocator. I also assessed whether management interests were aligned with those of the shareholders. I used both qualitative and quantitative analysis.

- Growth in Shareholders’ Value. This is a quantitative look at the company performance from a shareholders’ value creation perspective.

- Risks. I covered the key investment risk as well as the key business risks. This is mainly a qualitative view.

My conventional fundamental analysis covers both qualitative and quantitative analysis. But, the quantitative analysis is not standardized. Depending on the subject matter, I sometimes compared:

- The target metrics with the industry. The industry will involve more companies than the benchmark.

- The target current performance with its own historical performance.

- The target metrics with the benchmark ones.

Relative fundamental analysis

The focus of relative fundamental analysis is comprehensive peer comparison. I compared the target company performance based on a set of metrics with those of a selected group of companies.

The concept of the relative fundamental analysis is like the Rating Agencies concept of rating the credit standing of companies. The difference is that the focus of relative fundamental analysis is to determine the investment prospects of a company.

We are all familiar with relative valuation. You compare the worth of a target relative to a comparable group of companies. You then judge whether it is cheap or expensive relative to the group.

If you are going to use relative valuation, shouldn’t you also take performance comparison to its logical conclusion? In other words, shouldn’t relative valuation have a corresponding relative fundamental analysis?

This is the rationale behind the relative fundamental analysis.

The focus is on numerical analysis usually based on data extracted from the company’s financial statements. While there are many factors and metrics to consider, I focussed on those that affect the intrinsic value of a company.

The rationale in selecting the factors and metrics

Consider the following 2 versions for computing the intrinsic value:

1) Based on Free cash flow to the firm model as per Damodaran.

Intrinsic value = [ Free cash flow X (1 + g) ] / (r - g)

where:

- Free cash flow = EBIT X (1 - tax rate) - Reinvestment.

- EBIT = earnings before interest and tax.

- Reinvestment = Capex + Changes in Working Capital - Depreciation & Amortization.

- r = cost of funds.

- g = growth rate.

2) Based on the transformation of the Dividend Discount Model into the following format.

Intrinsic value = Book Value X [ (ROE - g) / (r - g) ]

As you can see, the factors that affect the intrinsic value of a company can be grouped into:

- Profitability - earnings and returns.

- Growth - growth rate and reinvestments.

- Cost of funds. This is the discount rate which in turn is affected by risks.

I have chosen the following factors and metrics to use in the fundamental quantitative analysis. This is because they affect one or more profitability, growth, or risk factors.

|

| Chart 1: Factors and metrics |

You will notice that they are all based on information extracted from the financial statements. Some of the metrics are based on the latest financial position. Others are based on data over a period of time.

Some of the metrics are applicable to more than one factor. For example, the Debt/Equity ratio can represent the capital structure, financial strength, and risks. Rather than repeat it for the 3 factors, I have just used it once.

The companies making up the benchmark are of different sizes. As such, I scaled the metrics where appropriate rather than look at the absolute number. This meant creating indices for certain metrics and using ratios for others.

My focus is on long-term performance. While I use the current values for Balance Sheet based metrics, I considered the performance over some period of time for the P&L and Cash Flow metrics. Usually, I covered 10 to 12 years.

Case Study - Tempur-Sealy

I recently published a fundamental analysis and valuation of Tempur-Sealy International Inc (TPX). This is a US-listed bedding group.

Refer to these 2 posts so that you can better see the differences between the conventional and the relative fundamental analysis.

To illustrate the relative fundamental analysis approach, I analyzed TPX relative to the following peers (benchmark).

- LEG - Leggett & Platt Inc (FYE 31 Dec).

- SNBR - Sleep Number Corporation (FYE 2 Jan).

- LZB - La-Z-Boy Inc (FYE 25 Apr).

- CSPR - Casper Sleep Inc (FYE 31 Dec). It IPO in 2020 but its financials were available from 2017. Note that whenever I mentioned that the analysis covered the past 11 years or 2010 to 2020, it referred to the past 4 years for CSPR.

To help undertake the analysis, I used a platform/app called TIKR.com. It has been described as “The 1 Stop Platform To Do All Your Stock Market Research On”.

To be transparent, TIKR reached out to me some time back to test the app and provide feedback. TIKR has been in its building stages for almost 2 years now and has finally decided to soft launch their site in beta.

The following sections provide a brief description of the various factors and metrics. For each metric, I also tabulated the figures for each company where appropriate.

Sources and Uses of Funds

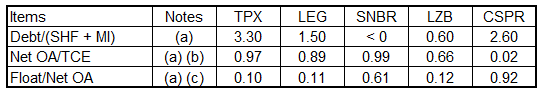

I looked at 3 metrics here - capital structure, % of operating assets, and the % of "float". They provide a picture of how effective the funds have been deployed and the financial strength.

- For this analysis, I considered low leverage as the better performance rather than looking at the optimal Debt Equity ratio. In theory, you could compute the optimal ratio taking into account the company’s Beta and determining the lowest WACC.

- In terms of uses of funds, I would like to see that most of the funds were deployed for the net operating assets.

- Warren Buffett has attributed Berkshire Hathaway's success to float. You can think of float as a source of interest-free funds. For a manufacturing company, float arises from Deferred Taxes, Pension Liabilities, and Other Unearned Revenue.

Financial strengths and returns

In general, the financial strength of a company can be measured in three key areas: profitability, solvency, and liquidity. I used the following metrics.

- Return on Assets = profitability.

- Debt/(SHF + MI) = solvency.

- EBIT/interest = liquidity.

For the returns, I did not look at ROE because of the TPX share buyback programme. Rather I looked at the returns in the context of the total funds employed.

In addition to looking at the absolute ROA and Return on capital, I also considered the ROA trendline when it comes to growth. However, I considered the period from 2017 to 2020 for the growth analysis.

|

| Chart 2: ROA Source: TIKR.com |

Revenue

I used the revenue to gauge both competitive positions as well as growth potential.

The past 11 years' revenue for TPX and the benchmark as shown in the chart below. I would rate TPX as good both in terms of the size of the revenue as well as in revenue growth.

Of course, the revenue of TPX was boosted by its acquisition of Sealy.

Note that for revenue growth comparison, I considered only the period from 2017 to 2020.

|

| Chart 3: Total Revenue Source: TIKR.com |

Gross margins and SGA

To assess efficiency and cost-effectiveness, I used gross profit margins and Selling, General and Admin (SGA) expenses as the metrics.

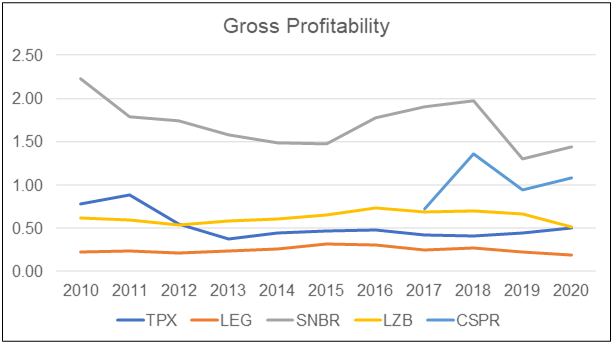

|

| Chart 4: Gross Profitability |

Gross profitability is an indicator introduced by Professor Robert Novy-Marx, University of Rochester. It is computed by dividing gross profits by the total assets. A high ratio is an evidence that a company has sustainable competitive advantages. I looked at gross profitability in an absolute term as well as the trendline.

|

| Chart 5: Gross margins Source: TIKR.com |

SGA expenses are generally either fixed or semi-variable costs. The SGA margin is defined as the SGA expenses as a % of the total revenue. It is a measure of cost-efficiency.

I used this metric to assess a company’s competitiveness. Of course, metrics like returns and gross profitability also measures competitiveness.

|

| Chart 6: SGA margins Source: TIKR.com |

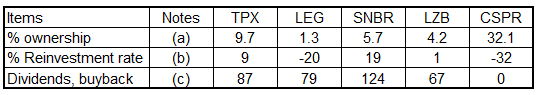

Management

To assess management, I looked at whether their interests are aligned with those of the shareholders. I also gauged their performance from an operational and capital allocation perspective.

With regards to the former, I looked at the current % ownership of the Board and Executives. I would like to see a figure as high as possible.

For capital allocation performance, I looked at the reinvestment rate and the proportion spent on dividends and share buybacks.

- The reinvestment rate should be between 50 % to 70%.

- The total dividends and buybacks should be less than 100% and be as high as possible.

Note that as I have used return metrics elsewhere, I did not cover them here.

Shareholders’ value creation

I looked at 3 metrics to gauge whether a company has created shareholders value.

- Whether the returns are greater than their cost of funds. Except for SBNR, all the companies’ returns were lower than the cost of funds for this comparison.

- Whether the growth in shareholders’ funds is greater than the cost of funds. Except for CSPR, all the companies achieved this measure.

- Whether the gain by a shareholder who bought a share 10 years ago is better than the cost of funds.

The respective items and the results when compared to the appropriate cost of funds are shown below.

|

Notes a) From FinBox as of 22 May 2021. I used the average of the high and low values. a) From FinBox as of 22 May 2021. I used the average of the high and low values. c) EBIT and tax based on the past 11 years average. TCE = current SHF + MI + Debt + Leases - Cash. d) CAGR based on (2010 SHF + 2011 to 2020 Net income to shareholders) / (2010 SHF) e) Gain = [The capital gain of share prices from Jan 2010 to end 2020] plus [cum dividend per share from Jan 2010 to Dec 2020]. Of course for CSPR, the starting point is its IPO year. |

Risks

The financial position of a company is generally considered as one risk indicator. As I have already covered this, I considered 3 other risk metrics from academia.

- Beneish M Score. This is used to indicated whether a company has manipulated its earnings.

- Piotroski F Score. This ranged from 0 to 9 to indicate the strength of a company’s financial position with 9 being the best.

- Altman Z -Score. This is to denote whether a company is heading into bankruptcy. TPX had numerically the best score.

Note that I computed these 3 risk metrics with reference to the latest financial year. Depending on the formula, some of the metrics compared the current year's performance with those of the previous periods.

Overall Fundamentals - putting the pieces together

It is relatively straightforward to compare individual metrics. The challenge is looking at all the metrics as a whole.

To get an overall picture, I used a ranking approach as follows:

- I ranked all the companies for each of the metrics. The best performance is ranked No 1 with the next best as No 2 and so on.

- If there is a tie, both companies share the same rank. Then I skipped one rank when it comes to the next company.

- I assumed all the metrics have equal weights when computing the overall rank. The overall rank is based on a simple average.

I then used the overall rank to provide a picture of how the target performed relative to the benchmark.

The ranks for each metric and the overall results for the case study are shown in the table below.

|

| Chart 7: Ranking of metrics |

The results show that TPX together with SNBR were the ones with the low ranking ie the better performers. CSPR had the worst performance.

The chart below illustrates the overall ranking of TXP relative to the benchmark companies.

|

| Chart 8: Relative overall rank |

Conclusion

Relative fundamental analysis is a structured numerical peer comparison. It provides a picture of the target companies performance relative to the benchmark.

However, it is not without its challenges:

- It is tough for handling qualitative assessments. For example, I thought that it would be good if I could also compare moats and business strategies. But I found it difficult to ranked such factors.

- While it is easy to compare individual metrics, it is difficult to get an overall picture. I have used the average rank to get the overall picture. But is this the best way?

- Some metrics eg Debt/Equity can represent more than one factor. By employing them, indirectly I have caused some factors to have more weight compared to others when looking at the overall picture.

- The ranking method does not consider the actual difference between the companies. For example, TPX has a ROA of 11.4 % whereas LEG and LZB have 7.3% and 7.2 % respectively. TPX is ranked No 2. LEG is ranked No 3 and LZB is ranked No 4. Note that the difference between TPX and LEG is 4.1 % whereas the difference between LEG and LZB is only 0.1 %.

- There are several metrics that you can use to represent a particular factor. For simplicity, I have selected 3 metrics per factor. With today’s computing power, it is possible to consider more metrics. The question then arises on whether all the metrics carry equal weights.

Notwithstanding the challenges, I believe that relative fundamental analysis can complement conventional fundamental analysis. It is a structured approach that can be automated. With this, you can dedicate more time to qualitative analysis.

If nothing else, this article has demonstrated that there are many ways to carry out a fundamental analysis.

If you want to invest based on fundamentals, but you don't have the skills or time to do it yourself, you have to rely on third parties to do them for you. Those who do this well include people like Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can tap into their business analysis and valuation.

Your feedback

Relative fundamental analysis can be an important tool in our analysis toolbox. The challenge is ensuring that the factors and metrics employed are the appropriate ones.

As you can see from my article, I have selected a number of factors and metrics based on my own experience. I would like to get your thoughts to improve the approach. Specifically:

- What are other factors that should be considered?

- Should we have more than one metric to represent a factor?

Email your thoughts to i4valueasia@gmail.com.

For my blog subscribers who email me their thoughts by June 2021, I will carry out a relative fundamental analysis for a group of listed companies of your choice. But this is only restricted to either the US-listed companies and/or Bursa Malaysia main board companies. So please include the panel companies in your email.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Could do backtesting to so historically which metric is actually playing a role in stock price, otherwise it's just noise.

ReplyDeleteThe metrics were chosen to represent earnings, growth, and risk. These are factors that affect the intrinsic values based on the discounted free cash flow valuation model. I am not trying to forecast stock price. The basis of value investing is that price will eventually reflect the fundamentals but we don't know when. So I am sure that if I back test with various historical periods, I will find one that fits. The challenge is still to find the best metrics to use. Remember that I am not a quant. The relative fundamental analysis is to provide another perspective to the fundamental analysis.

Delete