Will the Malaysian Property industry turn around by 2024?

Case Notes 10. This article shows how Malaysian property developers have performed over the past decade. It is intended to serve as the base rate for assessing property companies in Malaysia. Revision date: 4 June 2023

Property development involves many stages. It starts with acquiring the land, getting planning approval to handing over the completed property. Depending on the type of project, it can take 4 to 6 years to complete one cycle.

Because of this long cycle, the impact of a particular policy or action may only be seen a few years down the road. It takes time for changes to flow through the pipeline.

For this reason, I view the property sector as a big ship. A big tanker with full gear in reverse may require as much as 5 km to come to a stop. A 500 ft, 8000 tons ship needs over a third of a mile to turn around.

If a property developer stops launching new projects for a year or two, you would not see the impact of this until 2 to 3 years down the road.

If you are going to invest in the property sector, you have to appreciate this “big ship” analogy. You need to think long-term rather than looking at just current results.

2020 has been a very challenging year for the Malaysian property sector because of Covid-19 and the measures taken to control it.

But with the “big ship” approach, you cannot just look at just the past year's performance. I would argue that you need to look at the past decade.

The past decade had been very challenging for the industry. The industry started the decade on a very positive note. However, the government soon instituted several cooling measures to reduce speculation. For example:

- The Developer Interest Bearing Scheme (DIBS) was banned.

- Real Property Gains Tax (RPGT) was increased.

- The minimum property purchase price for foreigners was raised from RM 500,000 to RM 1 million.

- The was a cap on the loan-to-value ratio for the third house.

Many of these measures were implemented in the first half of the decade. But the big ship effect meant that the impact was felt years down the road.

Join me as I explored how the industry fared during the past decade.

The original article was published in mid 2021. Much has changed since then. In the video, I present an update on the large companies’ performance till the end of 2022. I hope that by looking at how this category had performed over the past 2 years you can get insights into the sector as a whole.

The conclusion is that the sector had turned around. But it will need several more years to get back to the 2011 levels.

Contents

- How did the Malaysian property sector fare over the past decade?

- Malaysian property companies’ base rates.

- Methodology

- Appendix

How did the Malaysian property sector fare over the past decade?

To answer this question, I tracked the performance of all the companies under the Bursa Malaysia property sector from 2010 to 2020.

There are 99 companies in the property sector in 2021. However, there were only 85 publicly available financial statements from 2010 to 2020. The rest did not have 10 years of listing history.

I divided the companies into 3 groups based on their 2021 shareholders’ funds.

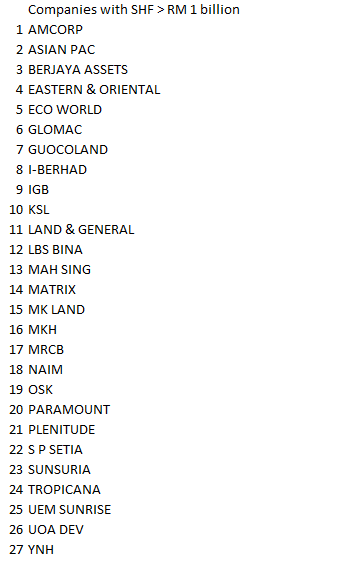

- Large - those with shareholders’ funds greater than RM 1 billion. There were 27 sample companies in this group.

- Medium - those with shareholders’ funds between RM 300 million and RM 1 billion in 2021. There were 32 companies here.

- Small - there were 26 companies with shareholders’ funds of less than RM 300 million.

To cater to the different sample sizes in each group, I have used the average value (RM per company) when comparing the metrics for the various groups.

|

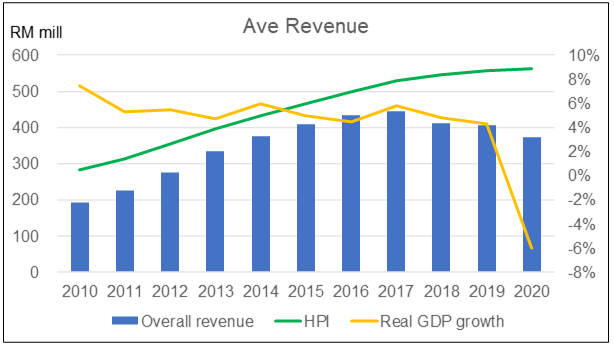

| Chart 1: Average Revenue vs HPI and GDP Note: a) Average revenue refers to the average revenue per company. b) The HPI is a relative measure with 2010 as the base. |

Summary

The key findings based on these 85 companies are:

- Industry revenue has been declining since 2017. Nevertheless, the industry revenue has grown at a CAGR of 6.8 % from 2010 to 2020.

- The industry earnings were at a standstill. The industry average PAT in 2020 is about the same as that in 2010.

- The growth in revenue and earnings was driven by the large company group.

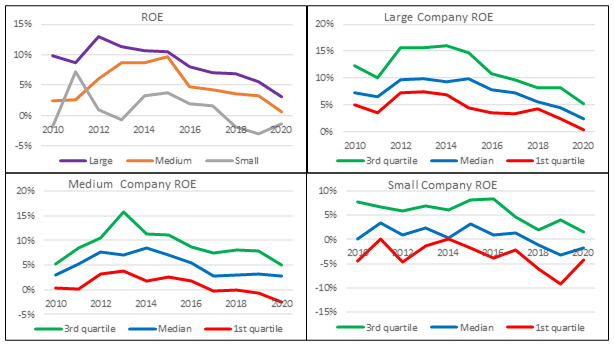

- The industry performance in terms of Return on Equity peaked in 2012 and it has gone downhill since then. The 2020 ROE is about 1/3 that of 2010.

- The industry funding in terms of equity and debt appeared to have increased despite the decline in earnings. This has resulted in a decline in the Return on Equity. On the positive side, the industry Debt-Equity ratio for the sector appears to be quite stable.

- I do not see the industry performance turning around until another 2 to 3 years. If we are lucky, we may see the start of an uptrend in 2024. This is based on the declining revenue, declining gross profitability, and the big ship effect.

The rationale for the above is presented in the following sections.

|

| Chart 2: Average Revenue |

|

Revenue

Based on the results of these 85 companies, the sector revenue in 2020 was 8% lower compared to that in 2019.

As shown in Chart 1, you can see that the industry revenue had grown since 2010 to peak in 2017. Thereafter it experienced a decline so that the revenue in 2020 is 16 % lower than in 2017.

On the positive side, the 2020 revenue is still about double that of 2010.

The cooling measures were introduced in the first half of the decade - most of them in 2013/14. But the industry revenue continued to grow during this introduction period. House prices as represented by the Housing Price Index continued to rise.

As can be seen from Chart 2, the bulk of the revenue growth was driven by large companies.

Profitability

When it comes to earnings, the industry average PAT in 2020 is about the same as that in 2010. Effectively earnings were at a standstill. Refer to Chart 3.

The biggest contribution was by the large group. The small group incurred losses for the past 3 years.

|

| Chart 4: Average ROE |

However, when you looked at Return on Equity (ROE), the industry performance peaked in 2012 and it has gone downhill since then. The 2020 ROE is about 1/3 that of 2010. This is a sobering thought if you are an investor in property companies.

The picture is the same when you look at returns from the Return on Asset (ROA) basis.

|

| Chart 5: Average ROA |

Gross profit margins

However, the gross profit margins (gross profit/revenue) for the sector appear to be less volatile than the earnings or revenue.

|

| Chart 6: Average Gross Profit Margins |

I interpret the results to mean that as the revenue declined, the gross profit declined almost proportionately. However, despite the declining revenue and earnings, the funds to finance the business grew larger. This has resulted in a decline in the ROE and ROA.

This is supported by the charts showing how the equity and debt of the industry have grown over the decade.

|

| Chart 7: Average Equity |

Funding

The large companies group accounted for the majority of the increase in funding, both in terms of equity and debt.

|

| Chart 8: Average Debt |

The only positive side from an investor’s perspective is that the average Debt Equity ratio is less than 1 and has been quite stable.

|

| Chart 9: Average Debt Equity ratio |

Prospects

2021 would also be another year where business operations are going to be disrupted by the Covid-19 pandemic measures.

Many property developers have reported a slowdown or postponement of property launches in 2020. We may now have the same scenario for 2021.

As shown in the revenue chart, the industry has seen a declining revenue since 2017. With 2020 and 2021 as periods with lower property launches, the development pipeline is being depleted.

So even if 2022 reverts to the pre-pandemic “normal”, the big ship effect means that we are not likely to see any improvement in the sector profits or returns until a few years down the road.

The other basis for my view is based on the gross profitability trend. Gross profitability is defined as gross profit divided by total assets.

Professor Robert Novy-Max, University of Rochester, has done considerable research into this metric.

According to him, it has roughly the same power as book-to-market in predicting the cross-section of average returns. Profitable firms generate significantly higher returns than unprofitable firms. This is despite having significantly higher valuation ratios.

I used this as one of the indicators to gauge the prospects of companies. As can be seen from the chart below, the gross profitability of the industry has been declining for the past 6 years.

|

| Chart 10: Average Gross Profitability |

The frightening thing is that the performance of all the 3 groups looked very similar. This is very unlike all the other metrics that I have presented.

Given the reduced launches last year and possibly for 2021, I do not expect any improvement in this metric.

I do not have a crystal ball to see the future. Gross profitability peaked in 2013/204. But:

- The industry revenue peaked in 2017.

- The industry PAT peaked in 2015.

- Industry gross profit margins were quite stable.

For the gross profitability to turn around, revenue must turn around first. And this has to occur without any substantial increase in the total assets used for the gross profitability to turn around.

Based on Professor Robert Novy-Max's theory, I don’t expect any turnaround in the sector profits or returns till 2024.

But it is not all doom and gloom. The industry debt-to-equity ratio is less than 1 and it does not seem to be increasing.

Secondly, cash flow which is key in the property sector has positive trends. As you can see from the chart below, the overall Cash flow from Ops as a % of the Revenue has been growing. This is despite the declining revenue.

However, this Cash flow from Ops picture does not look too good for small companies.

|

| Chart 11: Average Cash Flow from Ops/Revenue |

Final remarks

I have not attempted to relate the industry performance with the various measures taken by the government to manage the sector. There have been several articles about the efficacy of the cooling measures and what needs to be done next so I won’t go into this.

But for those investing in the property sector, the results show that the performances of the small companies were the most volatile. I would focus on investing in large companies as they were the main drivers of the industry.

I invest in property companies and I undertook the study to provide base rates for my analysis. However, in looking at the results, bear the following in mind.

- The companies under the Bursa Malaysia property sector do not represent all the property companies in the country. There are also private developers. Then there are also developers under Bursa Malaysia construction or industrial products and services sectors. Examples are WCT for the former and Sunway for the latter. But I doubt that these developers have different business trends than what I have presented.

- Many of the sample companies have other property-related businesses in addition to property development. These could be investment properties and hotels. Others have non-property activities such as education and palm oil plantation. This meant that part of the revenue and earnings will come from non-property sources. These can help to cushion any negative impact due to property development.

- Furthermore, many of the developers are also involved in the non-residential sectors. This may provide some diversification.

The data for the analysis were extracted from the financial statements from an online platform/app known as TIKR.com. Unfortunately, it does not cover the following property development KPIs - launches, property sales, and unbilled sales. We would be able to get a better picture of the current pipeline if such data were available.

Malaysian property companies’ base rates

In his book “Think Twice: Harnessing the Power of Counterintuition”, Michael Mauboussin discusses how we can

“...fall victim to simplified mental routines that prevent us from coping with the complex realities inherent in important judgment calls.”

One of the routines is the inside view. The inside view is how we view our situation, relying on our narrow experiences and intuition to make decisions.

“The inside view is the one that all of us … adopted to assess the future of our project. We focused on our specific circumstances and searched for evidence in our own experiences.” Daniel Kahneman

There is another way to view things called the outside view. The outside view is how we view other people's situations. It considers similar situations that can provide a basis for making a decision. The outside view looks at other experiences (base rates) so that we can have a more realistic expectation.

The above is the inspiration for this post. I have compiled the base rates of Malaysian property companies for revenue, returns, margin, and debt for the past decade.

I have a significant investment in property companies because of my background. These base rates served as references when assessing the performance of a company.

I hope you can use it for the same purpose.

I have presented the base rates in chart format for this blog. However, if you need specific data, you can email me at i4valueasia@gmail.com.

BTW, I would suggest that you read the Methodology first if you are going into an in-depth review of the charts presented in the following section.

Base Rate Fallacy

Just because we have base rates does not mean that we can make better decisions.

This is because of the behavioral bias known as the base rate fallacy. The base rate fallacy is the tendency of human beings to prefer one set of information above the other.

For instance, when deciding to invest, you receive different information at different points in time. Because of the base rate fallacy, you tend to ignore important information and end up basing your decisions on irrelevant information.

This fallacy was discovered by Nobel Prize-winning psychologists Kahneman and Tversky.

One consequence of this base rate fallacy is an overreaction to certain market events. This may lead you to make quick buy and sell decisions based on recent events.

Traditional financial theories assume that new information is immediately reflected in the stock price. In many cases, people tend to overreact and price swings more in the opposite direction. These surges are not permanent and over time these changes are eroded.

Investors with base rate fallacies tend to suffer losses because of their hasty decision-making.

There are several explanations for why the base rate fallacy occurs. One of the main theories is that it is a matter of relevance. We ignore base rate information because we classify it as irrelevant and therefore feel that it should be ignored.

It has also been suggested that the base rate fallacy results from the representativeness heuristic. In layman terms, this is the mental shortcut that individuals use when making judgments or decisions. It involves relying on the degree of similarity between a specific object or event and a mental prototype or stereotype of that category.

What can we do to avoid this behavioral bias? The following measures have been suggested:

- Avoid making decisions based on recent events alone. The recent events should be viewed from a long-term perspective.

- Avoid making all decisions by yourself. Getting input and feedback from other parties can provide another perspective.

- Avoid investing with a short-term mindset. From a long-term perspective, the short-term events may look like a small blip.

The key point is that the base rate fallacy can unwittingly influence our thinking. We need to take the above steps to reduce it.

How do I use the base rates?

I am a long-term value investor holding onto stocks for 6 to 8 years. You should not be surprised that my base rates cover more than a decade of performance.

Secondly, I don't look at quarterly results. Rather I focus on annual performances. In other words, don't use my base rates to see what is going to happen next quarter.

Over the years I have used base rates for the following purposes:

- Reality check. Base rates can help to set expectations. This is achieved by looking at the range of possible outcomes. They also help to ensure that my assumptions are grounded in reality in my valuation models.

- Risk assessment. Historical performances can give an idea of the worst-case scenario. Furthermore, sector performances can show negative trends that may not be obvious when looking at an individual company's performance.

- Inputs for my models. There are times when I am not able to use a company's historical data. For example, the company is undergoing a turnaround. In such cases, I use sector base rates to estimate the turnaround performance.

Revenue - base rates

Of the 3 groups, the large company group has the most dramatic revenue changes. Revenue increased from 2010 to about 2017 and then declined thereafter.

|

| Chart 12: Average Revenue |

Gross Profit - base rates

When you look at gross profit, you have to compare it with revenue. You can then gauge whether the changes in the gross profit are due to changes in the revenue or changes in the margins or both.

|

| Chart 13: Average Gross Profits |

PAT - base rates

Profits are affected not only by gross profits but also the Selling, General, and Admin (SGA) expenditure, and financing charges.

|

| Chart 14: Average PAT |

Margins - base rates

The analyses provided here were extracted from the financial statements. As such we do not have a granular view of the productivity and efficiency of the sector.

|

| Chart 16: Average PAT Margins |

Returns - base rates

Returns measure how effectively companies have deployed their funds. There are several metrics that you can use to gauge this. I have focussed on Return on Equity, Return on Assets, and gross profitability.

Gross profitability, measured by gross profits-to-assets, was popularized by Robert Novy-Marx. According to him, it has roughly the same power as book-to-market in predicting the cross-section of average returns. Profitable firms generate significantly higher returns than unprofitable firms. This is despite having significantly higher valuation ratios

|

| Chart 17: Average ROE |

|

| Chart 18: Average ROA |

|

| Chart 19: Average Gross Profitability |

Funding - base rates

I covered 2 funding sources - equity and debt.

Property developers in Malaysia also rely on progress payments to fund the development. Such sources are not captured in the financial statements. Thus the debt-equity ratio of Malaysian developers differs from those in other countries with a build-then-sell model.

|

| Chart 20: Average Debt |

|

| Chart 21: Average Debt Equity ratio |

Total Assets - base rates

The total assets of property companies are boosted by the land bank. However, often the values of the land bank are recorded at historical prices. The asset value of many property developers could be understated in the financial statements due to this.

The bulk of the asset growth can be accounted for by the large company group.

|

| Chart 22: Average Total Assets |

|

| Chart 23: Average Asset Turnover |

Cash flow - base rates

The property sector is an industry where cash flow is critical. Note that as time went by, the interquartile range for the large company grew larger.

|

| Chart 24: Average Cash Flow from Ops |

|

| Chart 25: Average Cash Flow from Ops/Revenue |

Methodology

There are 99 companies in the Property sector in Bursa Malaysia in 2021. These have shareholder funds (SHF) ranging from RM 15 million to RM 19 billion. I have categorized them into 3 groups based on the shareholders’ funds.

- Large - SHF greater than RM 1 billion. There are 31 companies here.

- Medium - SHF between RM 300 million and under RM 1 billion. There are 37 companies in this group.

- Small - SHF less than RM 300 million. The balance 31 companies are in this group.

My focus was to track the performance of these companies from 2010 to 2020. As such I had to leave out the following:

- Those that did not have 11 years of listing history. There were 9 companies left out because of this.

- 3 companies were left out because they did not provide gross profit figures in their Financial Statements. Although they had other information, to ensure consistency in my comparisons, I left them out.

- 1 was left out because of a change in the financial year and hence there was one year where no data was available. I did not want to extrapolate the date for the missing year and hence left it out.

The final sample thus comprised the following profile. Refer to Appendix 1 for the list of the companies.

- 27 Large companies.

- 32 Medium ones.

- 26 Small companies

Because of the different sample sizes in each group, I have used the average value (RM per company) when comparing the metrics for the various groups. This will ensure an apple-to-apple comparison

Data analysis

The data for the base rates were extracted from the Financial Statements for each company for the period 2010 to 2020. Note that it is comprised of companies with different financial year ends.

The Financial Statements were taken from a platform/app called TIKR. It has been described as “The 1 Stop Platform To Do All Your Stock Market Research On”.

To be transparent, TIKR reached out to me some time back to test the app and provide feedback. TIKR has been in its building stages for almost 2 years now and has finally decided to soft launch its site in beta.

I have 2 types of analyses

- The average of each group (Large, Medium, Small).

- The distribution of individual companies within each group. For these, the quartiles and median were based on the respective metric ranking for each year.

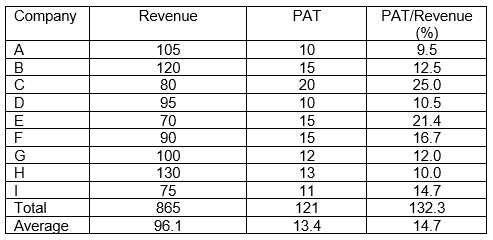

I have the following example to illustrate the difference between these 2 types of analysis.

Suppose that there are 9 companies in the country with the revenue, PAT, and profit margin (PAT/Revenue) as shown in the table below.

To get the distribution of the profit margin, the companies are ranked (from largest to smallest) based on profit margin with the results below.

This is then used to determine the quartile and median values.

|

- 1st quartile position - 20 % below and 80 % above

- Median position - 50 % below and 50 % above

- 3rd quartile position - 80 % below and 20 % above

The average profit margin for the country is derived by dividing the total PAT for the country by the total revenue for the country

Country profit margin = 121 / 865

= 14.0 %

You can also get the average profit margin by adding up individual company profit margin (132.3) and dividing by 9 = 14.7 as shown in the table.

There are then 2 average profit margins for the country.

- The 14.0 % is looking at the performance of the companies as a whole.

- The 14.7 % is looking at the distribution of individual profit margins.

The values are different because we are looking from different viewpoints.

Presentation of results

To capture both views, I have presented my results in the following manner using the sample tables above.

I did not illustrate the computation of the quartiles for revenue and PAT. In practice, the ranking and quartile analysis is carried out by the computer.

I have presented the information in chart format as illustrated below. Each chart covers a particular metric.

|

| Chart 26: Average Revenue |

- The upper left quadrant shows the average metrics from 2010 to 2020 for the 3 groups of companies - Large, Medium, and Small.

- The upper right quadrant shows the distribution of the individual companies’ metrics for 2010 to 2020 for those in the Large Company group.

- The bottom left quadrant shows the distribution of the individual companies’ metrics for 2010 to 2020 for those in the Medium Company group.

- The bottom right quadrant shows the distribution of the individual companies’ metrics for 2010 to 2020 for those in the Small Company group.

The information to construct the charts was extracted from the tables as illustrated below.

|

| Chart 27: Sample worksheet |

I would not be providing the details for each of the metrics. Instead, I will only provide the charts for all the metrics. If you require specific information, contact me at i4valueasia@gmail.com.

Appendix 1

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

I like your post. It is good to see you verbalize from the heart and clarity on this important subject can be easily observed... Investment opportunities in south africa

ReplyDeleteThe location of your property is of primal importance. If you are looking for a place of your own, you will go for one that is accessible to basic amenities and travel points. Groundwork Contractors Wrexham

ReplyDeletePreparing your home for viewers is important. It will not only ensure your property sells faster but for a higher sale price. If you need more information, check out propertyoso.com

ReplyDelete