Is UOA Ltd one of the better SGX stocks?

Value Investing Case Study 03. This is an updated fundamental analysis and valuation of UOA Ltd incorporating the FYE 2022 results. You would also be re-directed here if you tried to access the earlier articles on UOA. Revision date: 16 Jul 2023.

I first covered United Overseas Australia Ltd (UOA or the Group) in Aug 2020. At that juncture, the company was trading at AUD 0.68 per share compared to its end 2019 NTA of AUD 1.06 per share. Currently it is trading at AUD 0.55 per share (19 Jun 2023) compared to its end 2022 NTA of 1.12 per share.

While the NTA had increased, the market price had dropped. Is this an investment opportunity?

For the "tik-tok" generation, the video provides any overview of the updated fundamental analysis.

There are two questions when it comes to considering a company to invest in:

- Is it a good company?

- Is it a good investment?

A good company can be a bad investment if the price is such that you are not likely to see further price increases.

A bad company can be a good investment if the price is such that even based on a liquidation basis, there is a sufficient margin of safety.

I would classify a stock as one of the better ones for investment if it is both a good company and a good investment.

I generally assess a stock first to determine whether it is a good company based on its fundamentals. Only then do I proceed with valuing it. This is because all valuations are based on assumptions. A fundamental analysis of UOA will ensure that the assumptions are realistic.

United Overseas Australia Ltd (UOA or the Group) comprise 3 listed entities:

- United Overseas Australia Ltd is dual-listed on ASX and SGX.

- UOA Development Berhad is listed on Bursa Malaysia.

- UOA REIT is listed on Bursa Malaysia.

The steps to be taken to determine whether UOA Ltd is an investment opportunity then follow the above steps. Join me as I present my Investment Thesis on why UOA Ltd is one of the better stocks to invest in.

For clarification:

- Unless specified otherwise, the currency used in this article is AUD.

- I have pulled together all my previous articles on the Group so that you can have the company profile, history and risk profile in one article. Where appropriate, I have updated them.

- The Group comprise 3 listed entities:

- United Overseas Australia Ltd that is dual-listed on ASX and SGX. In this article UOA or the Group refers to all the companies within UOA Ltd. These included those under UOA Development Berhad and UOA REIT.

- UOA Development Berhad that is listed on Bursa Malaysia. UOA Dev refers to only those companies within UOA Development Berhad.

- UOA REIT that is listed on Bursa Malaysia. UOA REIT refers to only those companies within UOA Real Estate Investment Trust.

Should you go and buy it? Read my Disclaimer.

Contents

- Summary

- Investment Thesis

- Rationale

- Background

- Performance

- Valuation

- Risks

- How to Gain from the Case Study

|

Summary

- The Group comprises 3 listed entities. Although UOA Ltd is dual-listed in Australia and Singapore, the bulk of the operations and earnings are from Malaysia.

- The Malaysian property market has been soft over the past few years. This has resulted in a decline in revenue and earnings for the industry. UOA performance followed similar downtrends. But while there are signs of a turnaround over the past 2 years, UOA performance has yet to follow

- UOA is one of the bigger players in the Malaysian property sector in terms of shareholders' funds, revenue, and earnings. It has been able to maintain its performance relative to the industry.

- While UOA performance had deteriorated over the past few years, I would still rate it as fundamentally sound. This was based on its performance relative to its peers for a number of metrics. The Group is also financially healthy.

- At the same time, the current market price does not reflect its Asset Value or its Earning Power Value. It is an investment opportunity. At AUD 0.55 per share, it is even below its end Dec 2022 Graham Net Net of AUD 0.64 per share.

|

Investment Thesis

The Malaysian property market has been soft over the past few years. Covid-19 has prolonged the downturn. But UOA is a fundamentally strong Group with the financial resources to outlast a slow recovery in the property sector.

The Malaysian property sector is slowly turning around and I would expect UOA performance to follow suit.

It is trading at a price that is well below its Asset Value. There is also a significant margin of safety based on the Earning Power Value (EPV) and the Graham Net Net.

|

Rationale

- UOA business fundamentals in the context of earnings, growth, and financial health relative to its peers are still good. Note that these are the metrics that have a direct impact on its intrinsic value.

- The returns achieved by the Group exceeded its cost of funds. This meant that it had created shareholders’ value.

- The Group is financially strong with a Debt Equity ratio of 0.1 as of the end of 2022. Its cash holding was about 40 % of the Total Capital Employed (TCE) while its debt only amounted to 12 % of the TCE. It had also been generating positive cash flow from operations.

- About 42 % of the Total Assets are in investment properties. These do not look at if they are going to be impaired. However, the demand for office space is going to be challenging.

- About ¾ of the Group's revenue came from property development. The building blocks for this activity are land held for development, inventory, and land under development. These are currently still higher compared to those in 2009, the year just after the US Sub-prime Crisis.

- The valuation of UOA showed that there is a sufficient margin of safety both from both an Asset Value and EPV basis. As of 19 Jun 2023, it is even trading below its Graham Net Net which many consider as a shorthand for its liquidation value.

|

| Table 1: Summary of UOA valuation |

- Based on the above, I would consider UOA Ltd as one of the better stocks to invest in.

|

Background

The Group operates mainly in Malaysia. UOA Ltd has 2 listed subsidiaries with the following total shareholdings (direct and indirect) as of end 2022.

|

| Chart 1: UOA Ltd Corporate structure |

What is so unique about the Group?

The Group was founded in 1987 by 2 Malaysian engineers Kong Chong Soon and Kong Pak Lim.

Since then, it has grown to be a property development and investment property Group.

The Group focuses on the middle to high-end residential and commercial property development.

Based in Kuala Lumpur, Malaysia the Group’s current operations include:

- The development and sales of properties.

- Receiving rental from self-owned properties (commercial, offices, co-sharing facilities and residential).

- The operation of hotels and associated food and beverage outlets and convention facilities.

The Group is unique in that it handles all the stages of the property development process.

At the same time, the Group has an in-house construction company, Allied Engineering Construction (AEC). ACE has been the main contractor for all the Group's development projects.

AEC has more than 1 million square feet of facilities and plant yard. Since 2008, AEC has handled projects worth over RM 3 billion (AUD 1 billion). There are currently some 10 million square feet of on-going development projects.

When looking at the Group performance, note that

- Group Investment Property portfolio included investment properties under UOA Development and UOA REIT. I estimated that UOA REIT accounted for about 39% of the Investment Property revenue of the Group.

- UOA Dev handles the majority of the property development activities as well as the hospitality operations.

- The majority of the UOA Group’s operations are in Malaysia. But, in 2017 the Group ventured into Australia and Vietnam. In 2022, the Group also reported revenue from Singapore. I estimated that in 2022, the non-Malaysian operations accounted for less than 4 % of the Group revenue.

- ACE financials are not reported in the segment section of the Group’s and UOA Dev’s Annual Reports .

Is there a Rich and Unique History?

The Group maiden development project began with La Villas in Kuala Lumpur in 1989.

It then went to develop Desa Bangsar Ria. The UOA Centre, its first commercial development came next. These laid the roots of the Group business model:

- Developing residential units for sale.

- Developing commercial units partly for sale and partly for long term investments.

By focussing on the Klang Valley where land is scarce, UOA did not pursue township developments that need thousands of acres of land.

Rather in its early days, it acquired small plots for once-off residential or commercial projects.

- In its first decade of development, the largest plot was about 10 acres.

- In the second decade, the largest plot was about 33 acres for the development of Taman Megah Kepong Baru Phase 1 – 3.

- The largest plot of land that the Group has developed so far is the 50 odd acres for Bangsar South. This came about after 2 decades of property development track record. The development of Bangsar South commenced in 2007.

Over the past 14 years, the Group revenue had grown and shrunk as shown in Chart 2. You can see that this was due to the Property Development segment performance.

Chart 2: UOA Group Revenue

Rental revenue will always be much smaller than revenue from sales of properties. It is more meaningful to look at segment profits as shown in Chart 3.

- In certain years eg 2009 and 2016, Investment Property profits are a large part of the Group’s profits.

- Investment Property's profits are from rental income as well and revaluation surplus. The gain from the revaluation of properties is larger than the rental profits.

|

| Chart 3: UOA Group P&L Components |

Property development and investments in properties are capital intensive in nature. But the Group has been able to manage this process by:

- Retaining some of the commercial units. The sale of properties financed commercial property investments.

- Subsequently, unlocking some of the assets with the listing of UOA REIT.

- Listing of UOA Dev in 2011.

UOA Dev

UOA Dev was listed on Bursa Malaysia in 2011. This was after consolidating the property development, construction and property investment activities. Note that the consolidation excluded those under UOA REIT of the then UOA Ltd.

This was merely a continuation of the Group's property development another listed entity.

UOA Dev currently accounted for almost all UOA Group's Property Development segment revenue.

In the context of Investment Property:

- In 2022, UOA Dev also accounted for about 59 % the Group Investment Property rental revenue.

- From 2012 to 2020, 91 % of the UOA Group re-valuation surplus came from UOA Dev.

- UOA Dev continues to build up its investment property portfolio. From about RM 407 million (AUD 126 million) in 2012, it grew to RM 1,624 million (AUD 539 million) in 2022.

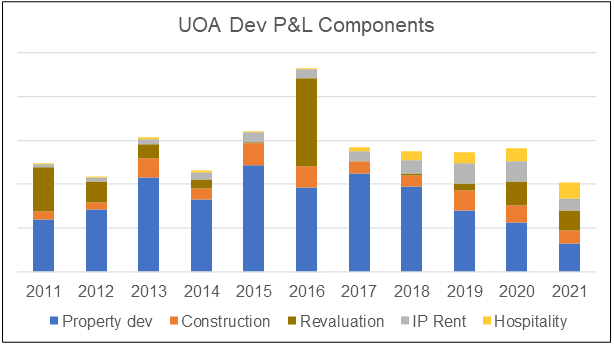

What are the key features of UOA Dev (looking from its own business activities)?

- About 67 % of the 2022 Total Equity is tied up for property development.

- About 71 % of the profits are from property development. The majority of the balance from the investment property operations

Note that the following are not reflected in the revenue of UOA Dev:

- Earnings from the investment properties and/or those from the hospitality operations.

- About 15 % of profits over the past 12 years were from a revaluation of the investment properties.

- About 17 % of the property development profits came from the construction division.

A more informative way is to look at the profit profile as shown in the chart:

- The sales of properties were the biggest contributor. It accounted for about 60 % of the past 12 years of earning.

- In certain years eg in 2011 and 2016, the revaluation gain accounted for a big chunk of the profits.

|

| Chart 4: UOA Dev Profit Profile |

UOA REIT

UOA Real Estate Investment Trust (UOA REIT) was listed on Bursa Malaysia on 30 December 2005.

Over the past 12 years about 40% of the Group's Investment Properties PBT came from UOA REIT.

But UOA REIT's Annual Report provided much better information about its activities. This provides more insights into what drove Investment Property performance.

The UOB REIT started off with 4 commercial properties that were developed by UOA Ltd.

- UOA Centre.

- UOA II.

- UOA Damansara.

- Wisma UOA Bangsar.

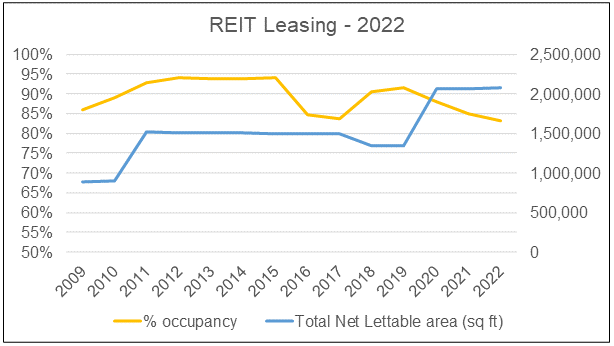

Over the years, it had acquired other commercial properties developed by the Group. The REIT had also sold some properties so that by the end of 2022, it owned about 2.1 million sq ft of Net Lettable Areas. Compare this with 0.8 million when it first started.

How has the REIT performed?

- The revenue has grown from RM 42.1 million (AUD 17.2 million) in 2008 to RM 88.2 million (AUD 29.3 million) in 2022.

- The PAT was RM 25.2 million (AUD 10.3 million) in 2008 c/w with RM 60.9 million (AUD 20.2 million) in 2022.

It has not been a steady growth with a decline from 2015 to 2020 as shown in Chart 5.

|

| Chart 5: UOA REIT Performance |

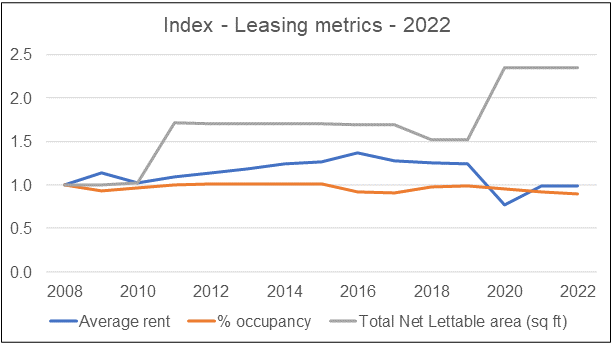

What has driven revenue and/or profit growth?

- It is not occupancy which an average ranging for 75 % to 95 %.

- It is a party from an increase in net lettable areas as well as an increase in average rents. Chart 6 shows the components driving the growth.

- Over the past 12 years, 10% of the profits from UOA REIT came from revaluation surplus and/or the sale of properties. Note that revaluation surplus was not a big part of the total gain. Of course, the revaluation gain does not occur every year but when it does, it is a sizeable chunk of the profits.

|

| Chart 6: UOA REIT Leasing Metrics |

Performance

Over the past few years, the Malaysian property sector had been experiencing some slowdown.

UOA performance reflects this as can be seen from the Performance Index chart below. . You can see that all 3 metrics – revenue, PAT and gross profitability have been on downtrends since the mid-2010s.

|

| Chart 7: UOA Performance Index |

The Group reported its performance under 3 segments:

- Land Development and Sales. These cover the Property development and construction activities.

- Investment properties. This includes the holding of investment properties to generate rental income, capital appreciation or both.

- Others which include operations of hotel and food and beverage outlets, provision of facilities support services and carpark operations, revenue from money lending services and provision of management services.

The Investment properties segment utilized the highest portion of the capital. However, the best returns came from Land development and sale. Refer to Table 2

|

| Table 2: Segment performance Notes a) TCE = Total Capital Employed = Equity + Debt - Cash b) 2011 to 2022 time-weighted average c) 2011 to 2022 time-weighted segment results before tax d) c / a |

Given the slowdown in the Malaysian property sector, one way to gauge UOA performance is to compare them with the industry.

In my article “Will the Malaysian property industry turn around by 2024” I had shown that, while the industry has been experiencing a decline in revenue and earnings long before Covid-19, there are signs of a turnaround since 2020.

- Large with shareholders' funds > RM 1 billion.

- Medium with shareholders' funds between RM 300 million and RM 1 billion.

- Small with shareholders' funds less than RM 300 million.

The UOA Group with about RM 4 billion shareholders' funds falls within the Large Group. As such, I compared its performance with those in this category. For the purpose of this article, I will refer to them as UOA peers.

As can be seen from the chart below, UOA Total Assets rank above the upper quartile of the peers.

|

| Chart 8: Total Asset comparison |

UOA financials are reported in AUD. For the peer comparisons, I have converted them to RM based on the respective year-end exchange rate extracted from Currency Converter.

Revenue

In terms of revenue, UOA ranked among the top over the past decade. However, its revenue has declined over the past few years.

|

| Chart 9: Revenue comparison |

Profits

In terms of PAT, UOA far outranked its peers. This was driven by better gross margins and profit margins.

|

| Chart 10: PAT comparison |

However, the larger revenue and earnings were due to UOA having a large asset base. The result is that its gross profitability was only about the peer median. In fact, this has declined over the past few years to rank within the lower quartile.

|

| Chart 11: Gross Profitability comparison |

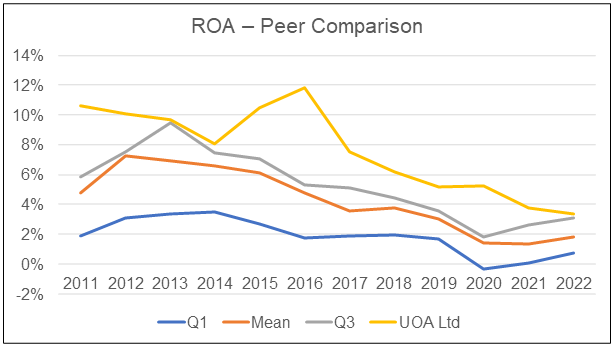

Returns

I considered 2 return metrics - ROE and ROA. In both of the cases, UOA ranked among the upper quartile.

As can be seen from the chart below, although the peer performance has declined since 2014/15, UOA has managed to maintain its relative ranking.

On an overall basis, I would rate UOA performance in terms of generating earnings as good.

|

| Chart 12: ROE comparison |

|

| Chart 13: ROA comparison |

Over the past 12 years, UOA achieved a return that exceeded its cost of funds. I used several metrics to come to this conclusion.

- UOA had a time-weighted average EBIT(1-t)/TCE of 9.1 %. The cost of funds estimated as the WACC in 2020 was 7.3 %.

- The time-weighted ROE was 7.9 % compared to the cost of equity of 7.8 %.

- Assuming that no dividend was paid, the shareholder's funds would have grown at a CAGR of 14.9 % from 2007 to 2022. Compare this with the 7.8 % cost of equity.

Note that time-weighted here refers to placing greater weights on recent values compared to those a decade ago.

Financial position

I would rate the Group as financially sound based on the following:

- As of the end of Dec 2022, it had cash of AUD 803 million. This is equal to AUD 0.52 per share and represented 27 % of the total assets.

- As of the end of Dec 2022, it had a Debt Equity ratio of 0.1. If its Debt was rated, it would have a triple A rating. This was derived based on Damodaran synthetic rating approach based on the interest coverage ratio.

- It had generated positive Cash Flows from Operation every year over the past 12 years. On average it generated AUD 105 million Cash Flow from Operations per year compared to the average annual PAT of AUD 155 million.

Investment Properties

As of the end of 2022, Investment Properties accounted for about 42 % of the Group's Total Assets. In 2022, fair value adjustment (an additional value) amounted to about 0.4 % of the value of the Investment Properties.

The fair value method was applied to all its Investment Properties. In other words, the current Book Value reflects the fair value of the properties.

The biggest threat to the Investment Properties segment is the excess supply of office space in the Greater Kuala Lumpur area. The worst would be an impairment of the assets if this leads to low occupancy and low rental.

At this stage, there is no indication of this happening as can be seen from the chart below of the Group leasing situation.

|

| Chart 14: Leasing Index |

However, the future for office space in the Greater KL area is challenging. I quote the following from JLL report (Source: Real Estate Asia)

“Kuala Lumpur’s new supply pipeline is expected to deliver over 3 million sq ft by 2023. This will likely push rental rates to decline further and keep vacancy rates elevated. With hybrid working practices and flight-to-quality movements expected to remain in the mid- to long-term period, demand recovery is anticipated to remain slow and staggered”

Development pipeline

Property development is still the bigger component of UOA revenue accounting for about 66 % of the revenue in 2022.

The Group land bank only accounted for about 5 % of the Total Assets in 2022. There is thus no large tract of vacant land waiting for development. In fact, the land held for development is only 27 acres and the bulk of it relates to the Bangsar South development.

This means low landholding cost in the event there is a prolonged downturn in development activities.

Board and Management

This is basically a founder-controlled Group. Two of the members are executive directors who are also substantial shareholders. Together they still control about 73% of the company (as of 19 Mac 2021). As founder directors, they have been associated with the Group since the start.

“I think you can learn a lot about that by reading about both what they’ve accomplished and what their competitors have accomplished, and seeing how they have allocated capital over time,” Warren Buffett.

I have earlier showed how the Group had performed relative to the large property companies. Any way to assess the performance is to look at the Q Rating as per the chart below.

- On an overall basis, the Group is in the upper quartile position relative to my panel of Malaysia companies.

- You can see that the 2022 Rating is better than that in 2020.

I would conclude that UAO Ltd has done well.

|

| Chart 16: Q-Rating |

When it comes to capital allocation, I would consider that the Group has a reasonable plan. From 2011 to 2022, it generated AUD 424 million Cash Flow from Operations. Of this;

- 29 % was paid out as Dividends.

- 40 % was deployed as Cash Flow in Investments.

- The balance was used to increase the cash position and other items.

Growth in Shareholders’ Value

One of the key tasks of management is to grow shareholders value. The high Q-Rating demonstrated that management had been able to do this.

I like to illustrate what drives shareholders value by a simple valuation model. This model assumes that there is no growth as per Damodaran;

Where:

- V = Value of the company.

- BV = Book value.

- ROE = Return on equity.

- r = Cost of capital.

If you slept during math class while in school, don’t worry.

What the equation says is the shareholders’ value (represented by V) is equal to Book Value multiplied by a return factor

This return factor is a ratio of the Return on equity over the Cost of capital

The point I want to illustrate is that to grow shareholders value you need:

- To have the Return on equity greater than the Cost of capital.

- Anything that improves the return eg better margins, would increase shareholders value.

- Anything that reduces the Cost of capital increases shareholders value eg lower risks.

This equation is the basic building block for my Q Rating. Of course, it is a more elaborate model in practice as I also incorporate growth.

It let me link valuation with the various factors that drive shareholders’ value

But you get the idea that I am looking for factors that improves return while reducing the cost of capital.

How do you reduce the cost of capital? Well, anything that reduces risks will reduce the cost of capital. This can range from business risk to financial risks as well the business model.

Valuation

I used 3 methods to determine the value of UOA Ltd.

- Based on the consolidated method. This looks at the Group as one with several operating segments. Under this approach, we ignore that it has 2 listed subsidiaries.

- Based on the sum-of-parts method.

- Based on a “Look-Thru” method. This takes the perspective of a shareholder in UOA Ltd saying that he owns 72 % of UOA Dev and 34 % of UOA REIT. The value to him is 72 % value of UOA Dev, 34 % of UOA REIT, and 100 % of the balance.

The table below summarizes UOA valuation. You can see that UOA is trading below its intrinsic value. It is even trading below the Graham Net Net which many consider as a shorthand for the liquidation value.

Overall, there is a high margin of safety. I would also like to point out that this high margin of safety situation is supported by a 5.8 Acquirers’ Multiple.

|

| Table 1 (Reproduced): Summary of UOA valuation |

Consolidated method

Here I used the consolidated earnings as the key metric. I used 2 valuation methods to derive the intrinsic value:

- The discounted Free Cash Flow method as per Damodaran.

- The discounted Residual Income method as per Penman.

I then took the average from both methods as the final computed intrinsic value. This applied to both the EPV and the Earning value with growth. When it came to growth:

- I used the fundamental growth equation to derive growth for the Discounted Free Cash Flow method. This is Return X Reinvestment rate = growth.

- For the Residual Income method, I computed the growth trendline based on the historical residual income.

- In both cases, I capped the growth at 5%.

|

| Chart 17: UOA Valuations |

You can see that the current market price of UOA is below its Asset Value and significantly below its Earning Power Value.

In deriving the Earnings value, I had assumed that the past 12 years’ average performance represented the future. This meant that:

- If you believe that the future is better, then its Earnings Power value would be higher than that derived.

- However, if you think that it will be worst, then the intrinsic value derived is over-estimated.

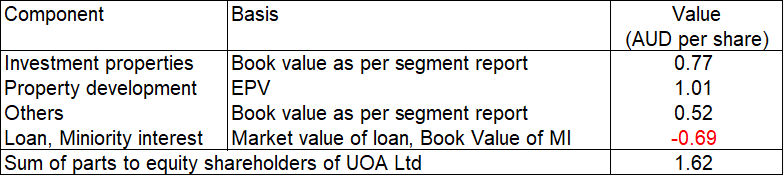

Sum of Parts

Another perspective is to decompose the Group into 3 segments. We can identify the Total Capital Employed for each segment and the respective earnings/cash flows.

|

| Chart 18: UOA segment |

We first value each segment and then get the Group value by summing them up.

- Investment Properties – the book values are already marked to market. So we took book value as the relevant one rather than try to estimate it from the profits and/or cash flows.

- Property Development – we took the higher of the Earning Value or Asset Value.

- Others (cash, securities) – we took book value as these are financial assets. As such they would have been “marked to market”

The Sum of Parts value for UOA Group would then be AUD 1.62 per share as follows.

Look Thru method

This Look Thus basis is inspired by Warren Buffet.

Warren Buffett created a metric for the average investor known as look-through earnings to account for both the money paid out to investors and the money retained by the business.

The theory behind his look-through earnings concept is that all corporate profits benefit shareholders, whether they are paid out as cash dividends or ploughed back into the company.

Look-through earnings can be calculated by taking an investor's pro-rated share of a company's profits and deducting the taxes that would be due if all profits were received as cash dividends.

Accordingly, my Look Thru basis is to include the pro-rated share of the associate/joint venture company’s revenue and profits as part of the Group revenue and profits.

The basis of my valuation is as follows:

- UOA REIT. As a REIT, its properties would have been based on registered valuer assessments. The book value should then reflect the value of the REIT.

- UOA Dev. We adopted the same analytical approach as that for UOA Group. This is because it has both investment properties and property development. Due to the soft property market, I have used the Earnings Power Value as the appropriate measure.

Risks

I like to think of risk as the possibility of a range of negative financial outcome that matters to you.

In this context, I tend to segregate them into:

- Investment risks. Your investment value might rise or fall because of market conditions. It will also be affected by how easy or hard it is to cash out of an investment, and how many stocks you hold.

- Business risks – These are due to business decisions, such as whether to expand into a new area of business. Changes in the economic outlook can affect the value of your investments.

The only investment risk I have covered so far has been the risk of privatization.

I don’t think this would be an issue here given the size of the Group. Remember that the Group undertook several corporate exercises over the past 15 years. These were UOA Ltd in SGX, UOA REIT and UOA Dev both on Bursa Malaysia.

Rather the main risk in investing in UOA Group is the business risk.

Also, my approach to using the past 12 years results have an in-built “recession-like” period.

Remember the US financial crisis of 2007/2008?

Malaysia was not spared from the impact of this crisis. I would like to think that the current Covid-19 situation would have similar effects.

This does not mean that we don’t’ have to worry about other trends that may further impact the property sector.

There are two other risks/issues that should be considered.

- Development model.

- Digital technology.

Development model

Most of the property for sales in Malaysia are developed under the “sell then build” model. Properties are sold while under construction.

Progress payments are then collected during the construction stage. This helps to fund a significant part of the development costs.

The key advantage is that developers can minimize cash flow problems during construction. In return, the selling price during launch might be lower to attract buyers.

But house buyers are subject to higher risks. These could be untimely delivery of the house, defect issues and abandoned projects.

The government has been trying to change to a “build then sell” model like in many developed countries.

Under the “build then sell” approach, the buyers don't face construction risks.

But, developers would need to bear higher risk, and this might affect the property selling price.

The “sell then build” approach has long been used in the Malaysian housing sector. But the government has been trying to get the industry to adopt the “build then sell” approach.

Not happening yet!

The industry is still working with the “sell then build” approach.

Digital Technology

I am sure you have heard of the term “Fintech”. Digital technology companies play in space operated by financial institutions.

A similar trend has emerged in the property sector.

It is more than the digitalization of real estate. It is placing customer experience first at the very heart of all aspects of the property process.

These could be fintech in real estate and virtual reality. It could use blockchain and artificial intelligence.

All these innovations and Proptech at large is seen as a ‘disruption’. It is intended to change the way industry stakeholders operate.

According to Wikipedia, in the first six months of 2019, $12.9 billion was poured into real-estate tech start-ups. This surpassed the $12.7 billion record for all of 2017.

Think about how Paypal and Alipay are competing with traditional financial services companies.

I would expect that within a decade, some kid in a garage somewhere is developing a “real estate killer model”. This would disrupt the traditional property development and property investment process.

In the Malaysian context:

- Crowdfunding and other digital-tech funding concepts have been set up.

- There is even a Malaysian Proptech association.

Secondly, the development of the self-driving car due to advances in digital technology will also impact the property sector.

For most of us who own cars, the majority of the time the car is parked. That is why we have high car parking requirements in Malaysia.

Now imagine a stage where the self-driving car becomes very cheap. We may then have a “Grab-type” environment where instead of owning cars, we rent cars ie

- It is self-driven to us.

- After we use it, it is self-driven away.

If this really turns out, there will be less need for car parks. Imagine the impact on residential design, high rise design and commercial car parks

What has all these trends to do with investing in UOA?

If you are a long-term investor, you have to look beyond the coming decade.

- Will property companies be disrupted by digital tech like the media and taxi sectors.

- Will UOA Group be able to reinvent itself to face the “build then sell” model?

My valuation assumptions are based on a repeat of history. I assume that there is no impact and/or the Group is able to overcome them. Is this reasonable?

How to Gain from the Case Study

While the Group comprises 3 listed entities, the case study is focussed on UOA Group. In practical equity investment lingo, you are considering investing in UOA Ltd.

What have we found?

- The Group has both a recurring income stream as well as a more cyclical project-based one.

- As of the end of 2022, about 1/3 of the Group’s capital has been allocated to the cyclical project-based one (Property Development segment).

- Over the past 12 years, the Property Development profits are about 3 times that from Investment Property.

- The Property Development segment seemed to have better prospects than Investment Property.

- At the current market price of AUD 0.55 per share, there is an ample margin of safety.

- Our fundamental analysis has not suggested that there will be any impairment of the assets. There is a low risk of reducing its intrinsic value.

- While growth will be challenging, the Group would be able to sustain its performance. This means that the Earning Power Value is a reliable indicator of the intrinsic value.

- It will still be able to grow shareholders’ value

Are you more interested in business growth or in the growth of shareholders’ value?

They are not necessarily the same. I hope the UOA case study has highlighted the difference. Factor this in when thinking about investing in UOA Ltd

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment