HouzKEY - an unintended financing scheme for investors

Case Notes 13. This article looks at how a creative investor can make use of the HouzKEY scheme to finance his stock investments.

In Nov 2017, Maybank Islamic launched its Rent-to-own (RTO) scheme, the first bank in Malaysia to do so. The scheme was designed to ease the burden of potential buyers from securing a loan, by waiving the required down payment.

While RTO schemes are new to Malaysia, it has been around overseas for decades. The RTO plans allow the buyer the option to buy the rental property at a future date.

There are many articles about the pros and cons of the RTO scheme. It is generally agreed that the RTO scheme will mean a total higher cost for the property owner compared to the conventional mortgage. But for those with cash flow problems, especially for the initial down payment, the RTO offers one way to own the property.

Furthermore, in the initial rental period, there would be some savings under the RTO scheme. The Aug 2020 Maybank HouzKEY Product Disclosure Sheet gave an example where the difference in payment between the HouzKEY scheme and a mortgage was about RM 120,000 less. This was for a RM 500,000 property during the initial 5 years of the loan.

A couple of months ago iProperty.com published a summary of the RTO scheme in Malaysia titled “A Complete Guide on Rent-To-Own (RTO) scheme in Malaysia”. Look up the article if you are not familiar with the benefits and how it works.

All these articles focus on the cost side. There is an alternate perspective - the opportunity side that has not been talked about.

Don’t get me wrong. The RTO is a good scheme for those with cash flow problems. But like all ideas, there are unintended benefits and I would like to point out one such possibility. This is a contrarian view but given the economic climate, this is an option worth considering.

This is for those who have the means to pay for the down payment and make the monthly payments under the conventional mortgage. But:

- Instead of using the money for the down payments and monthly mortgage payments, a person can use the RTO scheme to finance his home purchase.

- The savings from the down payments and monthly mortgage payments during the rental period can then be channeled to make money from stock investments.

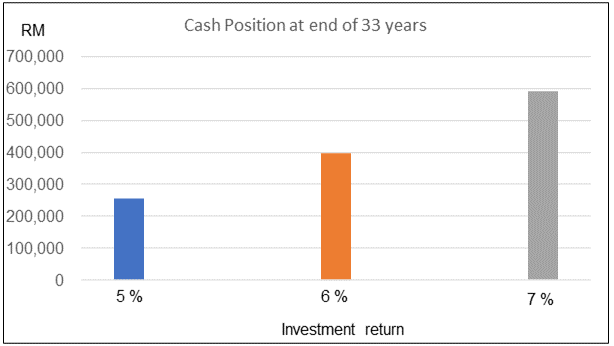

An analysis using the HouzeKEY example shows that you gain by investing the RM 120,000 with a 5 % annual return. At the end of the 33 years period (3 years construction and 30 years loan), you will have about RM 256,000 in your bank account. Compare this with the situation considering only the cost where you lose money.

Getting a 5 % return should not be an issue as the EPF had an average annual dividend of 5.6 % from 2000 to 2020. Also, Amanah Saham Malaysia had an average annual dividend of 6.5 % for the same period.

The amount of gain will of course depend on your investment returns. The chart below illustrates the amount of cash you will have for 5 % to 7 % annual investment returns.

|

| Chart 1: Final cash position |

How did I arrive at these conclusions? By comparing the cash flows under HouzKEY with those under the conventional mortgage.

Contents

- Comparison between HouzeKEY and normal mortgage

- Sensitivity analysis

- Alternative investments

- Methodology

- Limitations

- Appendix 1

Comparison between HouzeKEY and normal mortgage.

Since the launch of the HouzKEY scheme in 2017, there have been some amendments by Maybank. Appendix 1 details the HouzKEY Product Disclosure Sheets dated Feb 2018 and Aug 2020.

The aim of this article is not to talk about the terms and conditions and/or the pros and cons of the RTO. Rather I want to illustrate that it can be looked at as a way to finance your stock investments.

I will illustrate my point using the Maybank HouzKEY scheme as per Maybank Product Disclosure Sheet dated Aug 2020.

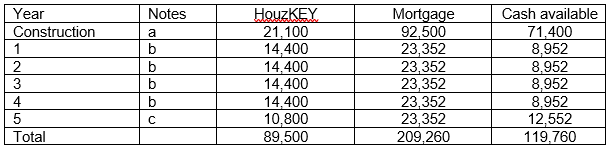

The table below compares the payment between HouzKEY and a conventional mortgage based on a RM 500,000 property.

|

| Chart 2: HouzKEY compared to mortgage Source: Maybank Product Disclosure Sheet Aug 2020 |

The annual cash flow for the 5 years period can be summarized as per the table below. The cash available is the difference between the mortgage and the HouzKEY. You can see that over the construction and initial 5 years period, there is a total of RM 119,760 of cash available.

Based on the table above, the cash available looks like a financing scheme. Now, what happens if you use the cash available to invest in the stock market?

The gain will of course depend on your stock investing skills. But let us take the simple case of investing in the KLCI.

The gain from the stock market investment was derived as follows:

- First, I computed the annual cash flow required under a full mortgage plan. I assumed 3 years construction period and a 30 years loan period.

- Next, I computed the annual cash flow under HouzKEY. I assumed that the HouzKEY scheme covered a 3 years construction period and a 5 years rental period. Thereafter it was converted into a conventional mortgage. For an apple-to-apple comparison, I assumed that the mortgage was for 25 years to have a total of 33 years.

- I then derived the annual cash flow difference between the full mortgage and the HousKEY combo. These differences for the construction and rental period were treated as funds available for investing.

- I assumed that the available funds were invested in the KLCI.

Based on the rates in Aug 2020 HouzKEY Product Disclosure Sheet and assuming a 5 % annual return from the KLCI, you will have RM 256,205 at the end of the 33 years period.

So instead of having to pay more under the HouzKEY you actually have more money.

The cash position will of course depend on the investment returns. The table below illustrates what is possible under various KLCI returns.

|

| Table 2: Final cash position under various KLCI annual returns |

The details of the computation and assumptions are described in the Methodology section.

Sensitivity analysis

Assuming the 33 years period, there are 3 variables that can affect the final cash position:

- The mortgage rate.

- The campaign interest rate. My analysis is based on a campaign interest rate that is 10 % lower than the mortgage rate.

- The return from the stock market. Note that this comprises the capital gain (from changes in the KLCI) and dividends.

Over the past 20 years, the Malaysian banks' lending rate had varied from about 3 % to 8 % as can be seen from the chart below. The median seemed to range from 5 % to 6 %.

|

| Chart 3: Bank lending rate Source: Trading Economic |

From 1990 to 2020, the KLCI had a CAGR of 3.9 %. This is before you factor in any dividends. Historically the median annual dividend ranged from 2.75 % to 3 %.

As such a total annual return of 5 % from the stock market seemed very conservative. I would expect a realistic total return to range from 5 % to 7 %.

|

| Chart 4: KLCI movement with 1990 as base |

|

| Chart 5: Bursa Malaysia Dividend Yield |

A sensitivity analysis based on various combinations of these 3 factors was carried out. The final cash position under the various scenarios is shown below.

|

| Table 3: Final cash position under various scenarios |

As can be seen, in all scenarios, you are better off taking up the HouzKEY combo plan. The lowest return came from when the campaign rate = mortgage rate = 6 %. In fact, the breakeven under this scenario is when the KLCI annual total return = 2.6 %.

Alternative investments

You may argue that investing in the stock market can be risky. If you think so, I would suggest that you consider alternative investments. You could invest in Amanah Saham Malaysia or even make additional contributions to the Employee Provident Fund (EPF).

The chart below shows the historical returns from Amanah Saham and EPF. From 2001 to 2020, the average annual dividends were:

- 6.52 % for Amanah Saham Malaysia.

- 5.57 % for the EPF.

As you can see achieving a 5 % return over the long term is not so difficult.

Given the findings, you should not withdraw your EPF savings to reduce the mortgage amount or even to part re-finance the HouzeKEY. This advice is consistent with what I have said in my article “Better to invest or pay off mortgage? - the evidence.”

|

| Chart 6: Annual returns from ASM and EPF |

Methodology

The financial model comprises 3 components:

- Mortgage plan with 33 years cash flow.

- HouzeKEY combo. This involved 5 years under HouzKey with another 25 years refinancing with a conventional mortgage.

- Investment of the “excess cash”. This is based on 33 years of investment in the KLCI.

The 33 years = 3 years construction period + 30 years loan period.

The 25 years refinancing is to have the same 33 years as the full mortgage plan.

Mortgage

I assumed the following parameters to develop the financial model for the mortgage plan. These were based on the HouzeKEY Product Disclosure Sheet.

|

| Chart 7: Mortgage parameters |

I assumed the following payment formula. Refer to Table 4 below.

- Upfront payment = Down payment + Upfront costs = RM 50,000 + RM 17,500 = RM 67,500. Refer to Chart 2 for the details.

- Interest = Interest payable for the year = O Bal X interest rate.

- Payment = Payment for the year = Monthly payment X 12.

- C Bal = O Bal + Interest - Payment.

- O Bal for Year 1 to 4 = Cumulative progress payment. The cumulative progress payment for each year is assumed to be based on some progress payment schedule as shown in the financial model.

- O Bal for Year 5 onwards = Closing balance the previous year

The total payment you make during the construction period is only for the interest and the total is equal to RM 25,000 as per the HouzKEY Product Disclosure Sheet.

The total payment period = 3 years construction + 30 years loan = 33 years

You will note that the financial model has about RM 10,034 at the end of year 33. I assumed that this is paid in one lump sum at the end of the 33 years.

Overall total payment = Upfront + Payments for 33 years + Final lump sum = RM 67,500 + RM 725,560 + RM 10,034 = RM 803,094

|

| Table 4: Mortgage worksheet |

HouzKEY combo

This covers 5 years under the HouzKEY and 25 years under a conventional mortgage. The parameters for the rental part of this plan were based on the HouzKey Product Disclosure Sheet.

The monthly repayment for the 25 years mortgage plan was RM 2,375. With this, you get about the same Closing Balance at the end of year 33 as that under the full mortgage plan.

|

| Chart 8: HouzKEY combo parameters |

In this part of the financial model (Refer to Table 5):

- The Upfront payment = Security deposit + Upfront costs = RM 3,600 + RM 17,500 = RM 21,100.

- Year 1 to 3 is the construction period with the same progress payment as the full mortgage scenario. However, you do not incur any cost for the progress payments.

- Once you take vacant possession at the start of Year 4, you pay the monthly “rent”. This is based on property value X interest rate = RM 500,000 X 0.0288 = RM 14,400 per year. This rental is payable for years 4 to 8 ie 5 years.

- The payment in Year 8 is reduced because you get back the security deposit. Payment = RM 14,000 - RM 3,600 = RM 10,800. Note that the Closing balance is still RM 500,000.

- I assumed that after the end of Year 8 (ie the end of the 5 year RTO plan), you refinance the property based on the same interest rate as for the full mortgage plan. The interest for Year 9 = RM 500,000 X 0.032 = RM 16,000.

- The payment in Year 9 = monthly mortgage + refinancing charges = (RM 2,375 X 12) + RM 10,360

- Since the loan period is 25 years instead of 30 years, the monthly payment is higher. The monthly payment of the interest plus some principal = RM 2,375.

- The annual payment for Year 9 to Year 33 = RM 2,375 X 12 = RM 28,500.

- Note the Closing balance at the end of year 33 = RM 10,033. This is almost the same as that under the full mortgage plan.

- The interest in Year 9 = RM 500,000 X mortgage interest rate.

|

| Table 5: HouzKEY combo worksheet |

Note that under this plan there are refinancing charges. I assumed these to be as per the HouzKey Product Disclosure Sheet as shown below. This is payable when you refinance in Year 9.

|

| Chart 9: Refinancing charges |

Overall total payment = Upfront + Payments for the 33 years including the Refinancing charges + Final Payment = RM 21,100 + RM 791,263 + RM 10,033 = RM 822,396

Investment in the stock market

I assumed that you have the money for the Upfront costs and monthly financing payments required under the full mortgage plan.

Instead of using the full mortgage plan to finance your house, you use the HouzKEY for Years 1 to 8. At the end of Year 8, you refinance under the conventional mortgage.

For Year 1 to Year 8, you have excess cash. This is from the difference in the payment under the full mortgage and the HouzeKEY combo. This is reported under the Excess column in the worksheet. Refer to Table 6.

- Upfront = The difference in the Upfront = RM 67,500 - RM 21,100 = RM 46,400.

- O Bal for Year 1 onwards = C Bal + Excess for the Year. For example, for Year 3 this is = RM 66,660 + RM 12,800 = RM 79,460.

- Gain = O Bal X Stock market return. For Year 4 assuming 5 % annual gain this is = RM 92,385 X 5 % = RM 4,619.

- C Bal = O Bal + Gain

Note that from Year 9 onwards, the Excess is negative. In other words, you need to pay more and you do this by drawing down from the C Bal.

|

| Table 6: Investment worksheet |

Conclusion

The results of the financial model are as follows:

- The Excess becomes negative from Year 9 onwards. This is because you are paying an additional monthly sum under the refinancing scheme.

- The Closing Balance increases every year including the period when the Excess is negative. This is because the gain from the investments more than offset the shortfall in the Excess.

- At the end of 33 years, the cash position in the example is RM 256,205.

In summary:

- Overall cash payment under the full mortgage = RM 803,094.

- Overall cash payment under the HouzKEY combo = RM 822,396.

- Additional cash payment under the HouzKEY combo compared to the full mortgage = RM 822,396 - RM 803,094 = RM 19,302. You can see why the general view is that you pay more overall with the HouzKEY scheme.

- But if you invest the initial savings, at the end of the 33 years, you have cash of 256,205. You have made money.

The final cash position will of course depends on the investment returns. The table below summarized the final cash position at the end of 33 years under different return scenarios.

Limitations

This analysis assumed that the purchase price of the house remained unchanged at RM 500,000 in Year 9 when you transitioned to the mortgage plan. I also assumed that there was no downpayment.

When the RTO scheme was first unveiled by Maybank, the house purchase price was fixed at RM 500,000. Refer to the Feb 2018 Product Disclosure Sheet. However, there was no mention of the house purchase price under the Aug 2020 Product Disclosure Sheet. I have assumed it to be the same as for the 2018 scheme.

I have done a similar analysis assuming RM 500,000 house price but with a 10 % downpayment in Year 9. The result is still that you are better off with the HouzKEY combo.

You will break even with the HouzKEY combo if the house purchase price goes up to about RM 580,000 during the transition year. If this happens, it defeats the purpose of the RTO.

The main reason why you are better off with the HouzKEY combo is because of the compounding effect. You benefit by re-investing your annual gain. Effectively it is an interest-on-interest effect.

The benefits of compounding come from two factors:

- Long-term investment.

- Consistent annual returns.

Do you benefit from a shorter investment period?

Consider the case where you invest for only the first 8 years rental tenure period (3 years construction + 5 years rental).

- Total amount available for investment = RM 119,760 (as per Table 1)

- Cash at the end of Year 8 = RM 162,203. You have made money from the amount available for investment.

You are still better off with the HouzKEY combo. This of course assumed that you are able to achieve a 5 % return annually over the 8 years period.

Some may argue that this could be challenging because of the pandemic outlook. I would argue that it would be socio-economically difficult for EPF or Amanah Saham to deliver less than 5 % average dividends.

The whole investment scheme is viable because the amount of "savings" from the HouzKEY scheme is very large. The accumulated cash is more than enough to offset paying a larger monthly sum when you transition from the rental stage to the mortgage stage. You can see from Table 6 that the closing cash every year keeps on increasing from Year 9. No doubt there is a drop in the cash position from Year 8 to Year 9. But if you invest for the long term, this drop is negligible.

Of course, the RTO scheme was not set up to finance stock investments. But I think this is a loophole that has yet to be addressed. Until then, there is still the opportunity to take advantage of it.

Appendix 1

Maybank HouzKEY Product Disclosure Sheet - Aug 2020

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Our network of private lenders can help you get the lowest possible interest rate on a home loan. Agents from the organization can aid you in finding the best place to live. If you're looking for mortgage brokers Oshawa, check out the Mortgage Intelligence website to see what they have to offer.

ReplyDelete