Is Dominan one of the better Bursa Malaysia stocks?

Value Investing Case Study 21-1. Dominan Enterprise: A cigar-butt investment in Bursa Malaysia?

Dominant Enterprise Berhad (Dominan or the Group) manufactures and sells engineered wood mouldings and laminated wood panel products worldwide.

Dominan is currently trading at RM 1.06 per share (as of 9 Nov 2021) compared to its NTA of RM 1.92 per share (as of the end of Jun 2021).

Does this price imply that Dominan is one of the better Bursa Malaysia stocks to invest in?

We have to differentiate between a good company and a good investment. A good company is one that is fundamentally strong. A good investment is one that enables you to make money.

You would think that a good company is then a good stock. But it is not always the case. You can have a company that is facing some problems. But if the share price is such that there is a margin of safety even with the poor fundamentals, it would be a good investment.

Join me as I show that while Dominan is not a good company based on its historical performance, it is a good investment.

Should you go and buy it? Read my Disclaimer.

Contents

- Investment Thesis

- Rationale

- Supporting details

- Pulling it all together

|

Investment Thesis

Dominan is in the furniture sector. This is not a sunset industry and thus there is the potential for Dominan to continue to grow. While the Group was able to grow its revenue, its gross profit margins had been declining. The result is that its returns had been declining.

Dominan had the revenue growth track record. At the same time, it was able to increase the contribution from the Manufacturing segment. This segment is the one with the better returns. The Group is also sound financially.

The Group had identified a number of strategies to address the operating issues. Given its financial strengths and revenue growth track record, this should give it time to address the operating issues.

There is currently a margin of safety based on the historical EPV. I see Dominan as a cigar-butt investment with the upside from the improvement in the operations. This is why I consider it one of the better Bursa Malaysia stocks to invest in even if its fundamentals are not so great.

|

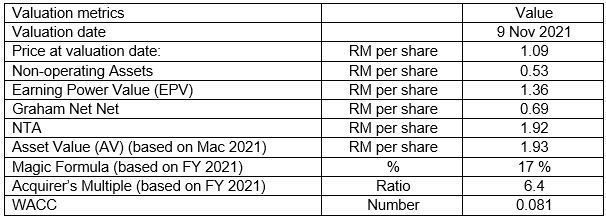

| Chart 1: Valuation |

|

Rationale

- From 2010 to 2021, the Group revenue had grown at a 6.2 % CAGR. The bulk of the growth came from Malaysia. At the same time, Dominan had been able to increase the contribution from the Manufacturing segment. This is the one with the better returns.

- Despite the revenue growth, there is no discerning profit trend. But gross profitability had been declining. The result is that the ROE had been declining.

- The main reason for the declining ROE is that profits had not kept up with the increase in equity. This in turn was caused by the declining gross profit margins. The declining gross profit margin with an increasing Total Assets also led to the declining gross profitability.

- The declining ROE meant that over the past 12 years, Dominan had not been able to create shareholders’ value.

- Management had identified strategies to address the issues. My concern here is that the issues relate to improvement in operations where the track record is poor.

- The Group is financially healthy with a Debt Equity ratio of 0.67. Over the past 12 years, it had generated RM 204 million Cash Glow from Operations. This had been sufficient to fund the dividends and about 80 % of the investments.

- There is 28% margin of safety based on the EPV. At the same time, the Book Value is 82 % higher than the market price.

Supporting details

|

Background

The Group started in 1992 in Singapore as a supplier of plywood and other wood-based products. It initially focused on the local building industry and furniture manufacturers.

Dominan ventured into the Malaysian market in 1993 with its first operation in Kuala Lumpur. Over the years the Group expanded its distribution network in Malaysia. This was via setting up of new offices as well as acquisition of existing distributors.

The Group also had a number of distribution operations overseas.

- In 2005, it set up a representative office in Vietnam. It expanded to the production of laminated wood panel in 2009. The main market then was the Vietnamese furniture and building material industries.

- Dominan established a distribution subsidiary in Australia in 2005. Wood panel products are obtained from countries such as such as Malaysia, Indonesia and China.

- In 2011 it set up a representative office in Thailand. It imports and distributes wood panel products such as plywood, MDF and particleboard within Thailand. Currently, the wood panel products are obtained from Malaysia, China and Vietnam.

Malaysia accounted for the majority of the Group’s revenue as shown in Chart 2. The revenue contribution by the various regions in 2021 were:

- Malaysia - 85 %

- Asia excluding Malaysia - 12 %

- Australia - 1 %

- Others - 2%

|

| Chart 2: Revenue by Regions |

Dominan first ventured into manufacturing in 1994. It produced primed MDF mouldings and wrapped mouldings. In 2000, the Group started to produce laminated wood panel in Muar, Johore. Muar is the heart of the Malaysian furniture industry.

The Group continued to expand its production facilities in various part of Malaysia. By 2021 the Manufacturing segment accounted for 33 % of the Group revenue.

In 2010, the Manufacturing segment accounted for about 21 % of the Group revenue. The segment had grown by a CAGR of 10.7 % from 2010 to 2021.

The bulk of the manufactured products are sold in the respective local markets.

|

| Chart 3: Revenue by Segments |

In 2003, the Group was successfully listed on the Second Board of the Kuala Lumpur Stock Exchange. It was transferred to the Main Board in 2005.

The Group today has 2 operating segments:

- Manufacturing. The Group has 4 fully owned subsidiaries involved in the production of a range of furniture components. One of the subsidiaries operates in Vietnam while the rest are in Malaysia.

- Distribution. Apart from Malaysia, the Group has distribution operations Singapore, Australia and Thailand. In each country, apart from sourcing the products locally, the Group also imported products.

Current Performance

As of the end of June 2021, the Group achieved revenue of RM 140 million compared to RM 75 million revenue for the same period last year. Profit after tax for Q1 2022 was RM 6.9 million compared to a loss of RM 2.0 million for Q1 2021. Note that Dominan financial year is from April to March of the following year.

The better performance in 2021 was due to the poor performance in 2020. The 2020 performance was very much impacted by the imposition of the Movement Control Order to tackle the COVID-19 pandemic. Overseas operations were also affected by weak market sentiments and pandemic-related restrictions.

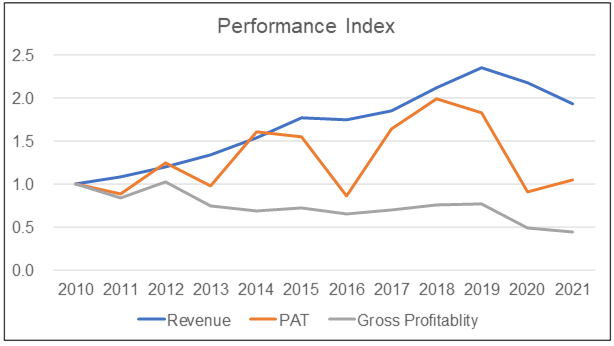

The quarterly results are in line with the historical performance as shown in the Performance Index chart.

- Revenue had grown at a CAGR of 6.2 % from 2010 to 2021.

- The Group had been profitable every year since its listing in 2003. However, I could not see any profit trends.

- Gross profitability had been declining since 2010.

|

| Chart 4: Performance Index |

Profit after tax had been volatile.

- The drop in PAT in 2016 was partly because there was a RM 4.6 m gain in 2015 from the disposal of property. At the same time the effective tax rate in 2016 was 30% compared to 25 % in 2015.

- The drop in PAT in 2020 was due to a slowdown in market demand amid strong competition. This affected the Distribution segment’s performance significantly. Gross profit margins declined from 7.8 % in 2019 to 5.6 % in 2020.

The decline in the gross profitability was due to both increasing Total Assets and declining Gross Profit Margins as can be seen from Chart 5.

|

| Chart 5: Drivers of Gross Profitability |

Returns

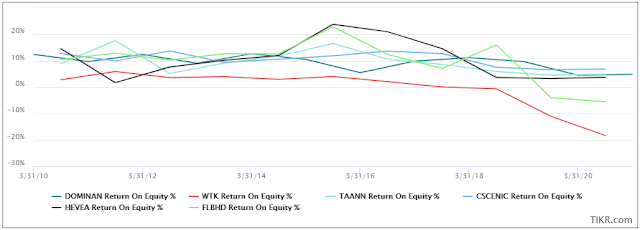

The returns for the Group as measured by the ROE had been declining since 2010.

- ROE averaged 11 % from 2010 to 2012.

- ROE averaged 6 % from 2019 to 2021.

A DuPont analysis showed that a large part of the decline was due to declining PAT margin. Asset Turnover had also declined as revenue growth did not kept pace with the growth in Total Assets. Refer to Chart 6.

|

| Chart 6: DuPont Analysis |

The analysis in Table 1 showed that the Manufacturing segment return is much larger than that for the Distribution segment. You should not be surprised by the results as distribution tended to be a large volume low margin business.

Shareholders’ value creation

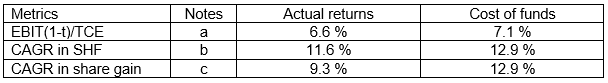

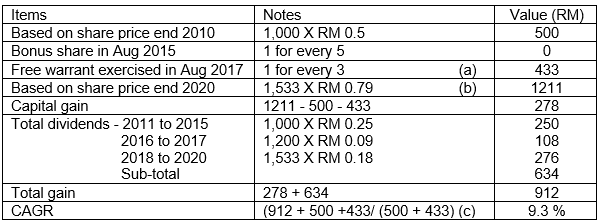

Given the poor returns it is not a surprise to find that shareholders’ value was not created since 2010. I looked at the metrics shown in Table 2 and the Q Rating to judge shareholders value creation. The metrics compared the actual returns with the appropriate cost of funds while the Q Rating ranked Dominan with the panel.

Finally, from the Q Rating perspective, the results for Dominan placed it at the half way point in terms of the panel. As can be seen, Dominan did well for risk and financial performance, but had low profitability score. Note that the panel comprises of 90 Bursa Malaysia companies from various sectors.

|

| Chart 7: Q Rating |

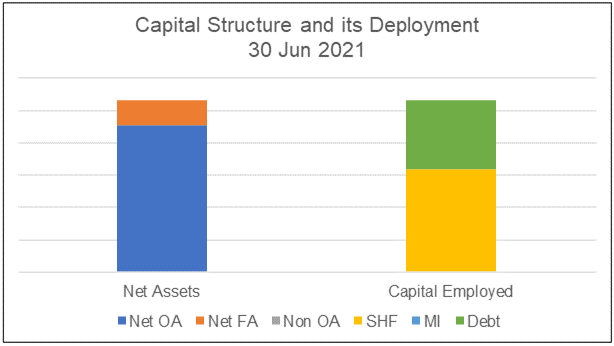

Sources and Uses of Funds

The Group has a Total Capital Employed (TCE) of RM 532 million as of the end of June 2021. Of this, 60 % was funded by shareholders funds with most of the balance from Debt. This is equal to a Debt Equity ratio of 0.67.

|

| Chart 8: Sources and Uses of Funds |

About 85 % of the TCE was used for the operations while cash and short-term investments accounted for the balance.

I would rate the sources and uses of funds as good.

Capital Allocation

During the period from 2010 to 2021, the Group generated RM 204 million Cash Flow from Operations. Dominan also increased its debt by RM 121 million during the same period.

The Cash Flow from Operations is a good sign of the cash-generating ability of the operations. Of these, RM 88 million was spent on dividends. Considering that the total PAT generated during this period was about RM 222 million, this was equal to a 40 % payout.

During this period, the net Cash outflow for Investments amounted to RM 149 million. Given the RM 204 million Cash from Operations, the Free Cash Flow is about RM 55 million.

I would rate the capital allocation plan as good as the cash increased by RM 72 million.

Management

The Board in 2021 comprises of 4 Executive Directors and 5 Non-Executive Directors.

- The 4 Executive Directors are on average 48 years old. They have served as Board members from 2 to 18 years with an average of 11 years.

- There were 3 Independent Non-Executive Directors with an average age of 60. They are relatively new to the Group with an average of 3 years of service as Board members.

- There were 2 Non-Independent Non-Executive Directors. One is the Non-Executive Chairman. They have an average age of 53 and have served an average of 14 years as Board members.

The senior management team comprises all the Executive Directors, one of which acts as the Managing Director.

3 of the Board members are related to the controlling shareholders of Dominion. I estimated that the controlling shareholders and related parties probably owned about 50% of Dominan.

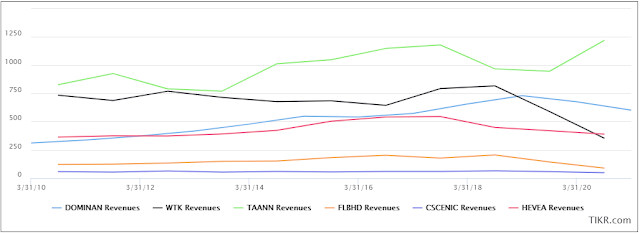

How did management perform? I looked at the peer revenue and returns to gauge this.

- In terms of revenue growth from 2010 to 2020, Dominan had the best CAGR. In fact, several of the peers had declining revenue.

- In terms of average ROE, Dominan performed among the worst.

It would appear that the Group had been able to face the external challenges but did not do so well internally. I would not rate management performance as good.

|

| Table 4: Peer Comparisons Notes (a) CAGR from 2010 to 2020 for others. CAGR from 2011 to 2021 for Dominan. (b) Average ROE from 2010 to 2020 for others. For Dominan it is average ROE from 2011 to 2021. |

|

| Chart 9: Peer Revenue Notes a) The Peers were based on the list as per Finbox but excluding Jawala Inc as Jawala Inc business was very much smalller than the rest. |

|

| Chart 10: Peer ROE |

Valuation

I valued Dominan based on its Asset Value and Earnings Value. The chart and table sum up the valuation.

The Earning value is lower than the Asset Value. It indicates a situation with poor utilization of the assets. You should not be surprised given its poor returns.

At its current price of RM 1.06 per share (as of 9 Nov 2021), Dominan is even trading below its EPV of RM 1.36 per share (as of 31 Mac 2021). There is a 28 % margin of safety based on the EPV. At the same time, the Acquirer’s Multiple of 6.4 makes it an attractive takeover target.

|

| Table 5: Valuation Metrics |

In deriving the EPV, I have assumed that the past 12 years weighted average performance represented the future. This meant that:

- If you believe that the future is better, then its Earnings Power value will be higher than RM 1.36 per share.

- However, if you think that it will be worst, then the RM 1.36 per share is over-estimated.

Key risks

I normally looked at privatization and business risks.

For Dominan to be privatized at the current market price, the controlling shareholders need to spend about RM 88 million. Given its cash holdings, it is possible for it to be privatized via some capital repayment scheme. The question is whether the controlling shareholders would want to privatize it.

In 2020, Dominan share price was around RM 0.70 for more than 6 months. If there was any interest to privatize it, it should have been done then. Given that the current price is about 50 % higher than that of last year, it would be more expensive to privatize it today. It does not make financial sense to privatize it now. As such the privatization risk is lower today.

As for the business risk, while the Group revenue had been growing, its gross profitability had been declining. As shown earlier, this is the result of declining gross profit margins. Unless Dominan addresses this issue, it would not be able to generate a return that is at least equal to its cost of funds.

At the same time, with EPV less than Asset Value, the Group had under-utilized assets. The most obvious is cash which accounted for 15% of the TCE.

The Group had recognized these issues and in its 2021 Annual Report, it identified a number of strategies to address them. These included new products, providing a one-stop shop service and adoption of new technologies. We will have to wait and see whether management is able to deliver the improvements in the operations as its track record had not been encouraging.

Pulling it all together

Based on the above analysis, I would rate the Group performance as poor.

The Group returns are low relative to the cost of funds and had been declining over the past 12 years. The main cause for this was the declining gross profit margins. The poor returns meant that Dominan had not been able to create shareholders’ value over the past 12 years.

The positive points are that Dominan has a strong capital structure and a track record of revenue growth. At the same time, it had been able to increase the contribution from the Manufacturing segment. This segment had the better returns.

The furniture sector is not a sunset industry. The challenge then is about improving its operations. I see this as the main business risk as there is no track record in this area.

As such I would not consider Dominan as one of the better Bursa stocks in terms of fundamentals.

However, from an investment perspective, there is sufficient margin based on the EPV and Acquirer’s Multiple. As such it is one of the better Bursa stocks to invest in.

It is a cigar-butt type of investment with the potential to turn into a quality stock if it can improve its gross profit margins.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment