How to identify property cycles for equity investment opportunities

Case Notes 20. This article looked at the various ways to identify a property cycle. In the context of investing in Bursa Malaysia property companies, the Housing Price Index is the best metric to use for identifying the Malaysian property cycle.

According to Professor Damodaran, cyclical and commodity companies share a common feature. Their value is often more dependent on the movement of a macro variable - commodity price - than on the firm’s specific characteristics.

The biggest problem in analysing and valuing property companies is that the earnings reported in the most recent year are a function of where they are in the cycle. Extrapolating those numbers into the future can result in wrong valuations.

One way around this is to “normalize” the earnings and cash flows over the cycle. This requires you to have an understanding of the performance over the cycle. But what exactly is a property cycle?

“A property cycle is a sequence of recurrent events reflected in demographic, economic and emotional factors that affect supply and demand for property subsequently influencing the property market.” Wikipedia “The property cycle follows a predictable pattern. This pattern reveals three distinct phases being Boom followed by Slump followed by Recovery before the next Boom commences.”

There are of course other descriptions of the phases. For example, some use Recovery, Explosive and Recession to describe them.

For a retail investor, the question is not the description of the phases. The more important question is what are the metrics or indicators to use to identify the pattern? In other words, how do you identify the start and end of the current cycle in real time?

Join me as I looked at the Malaysian property cycles and suggest the best metric to identify the cycle in real time. Once you have this information, you can then determine the performance of property companies over the cycle. This is an important input when assessing whether there is a stock market investment opportunity. Alternatively, if you are a property buyer hunting for bargains, knowing when is the trough of a cycle will be useful.

Should you go and use this approach to identify the Bursa Malaysia property counters to invest in? Well, read my Disclaimer.

Summary

- I looked at 3 metrics to identify the Malaysian property cycle - House Price Index (HPI), Residential Starts and Residential Transactions.

- How many property cycles were there in Malaysia from 2002 to 2020? These 3 metrics do not give the same answer. It also varies depending on whether you look at trendlines or % annual changes. Refer to Charts 1 and 2.

|

| Chart 1: Identifying Property Cycles with Trendlines |

|

| Chart 2: Identifying Property Cycles with Annual Changes |

- From an equity investment perspective, which metric had the best link with the revenue of the property companies? The HPI had the best correlation at 0.87 or higher.

Contents

- A survey of Malaysian definitions

- US Housing Market Indicators

- Performance of the Malaysian metrics

- Property cycle metrics vs the property sector revenue

- Shortcomings

- Conclusion

- Appendix 1 - Google search results for “Malaysian Property Cycle”

- Appendix 2 - Methodology

|

A survey of Malaysian definitions

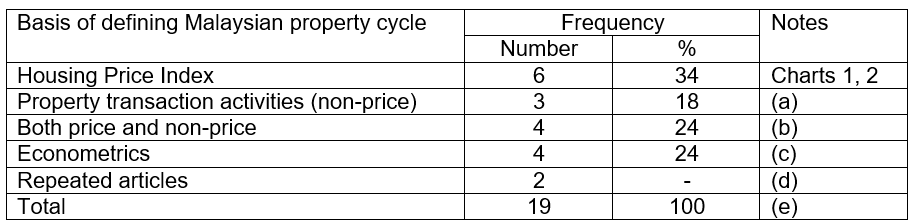

A Google search of the term “Malaysian property cycle” resulted in 19 articles in the top 2 result pages. Refer to Appendix 1 for the details. Note that this excluded the advertised articles. I then looked at how these articles defined a property cycle.

The majority of the articles used price as the way to identify the property cycle. Of course, price was not the only way. Some looked at property activities. The more academic articles constructed their own econometric indicators.

Table 1 summarizes the results of this ‘back-of-envelope” survey.

An example of how prices are used to identify the Malaysian property cycle is the 2019 iProperty.com article “What is the 18-year property cycle & how will it make you a better investor?” The article used the annual change in the Malaysian House Price Index to identify the Malaysian Property cycle as illustrated below.

|

| Chart 3: Malaysian Property Cycle Source:iProperty.com |

There are even econometric models that build on the House Price Index to create a metric to identify the cycle as illustrated in Chart 4.

|

| Chart 4: Malaysian Property Cycle - Econometric Model Source: Forecasting Malaysian Property Cycle: An Indicator-Based Approach |

But is the House Price Index the only way to define a property cycle? This article looks at alternative ways to identify the property cycle.

There are of course several components of the property market - residential, retail, industrial. For the purpose of this article, I will focus on the residential market since it is the largest component in Malaysia.

According to Savills, China and the US together make up 42 per cent of global property value alone. China is home to more of the world real estate market assets (by value) than any other country at USD 42.7 trillion, just ahead of the US at USD 42.1 trillion. However, as there are more online resources about the US, it was natural that I looked at the US for references.

US Housing Market Indicators

Investopedia opined that there are 4 key factors that drive the real estate market:

- Demographics such as the age and income. The makeup of the population, and major shifts in this population makeup, can also drive a market significantly.

- Interest rates impact the price and demand of real estate. For example, lower rates bring in more buyers, reflecting the lower cost of getting a mortgage, but also expand the demand for real estate.

- General economy. Real estate prices often follow the cycles of the economy.

- Government policies and legislation. These including tax incentives, deductions, and subsidies can boost or hinder demand for real estate.

Given the above you should not be surprised to find that there are several metrics than can be used to track the performance of the property sector. Investopedia listed the following as the top US Housing Market indicators:

- Construction spending. This covers construction work done on new structures. It also includes improvements to existing structures in both private and public sectors.

- Housing Starts. This focus on the houses that builders have just started to work on.

- Home sales. Various realtors such as the National Association of Realtors (NAR) provides a report on the number of used homes sold every month. There are also pending sales reports.

- Housing Market Index. For example, the National Association of Home Builders (NAHB) puts out a monthly NAHB/Wells Fargo Housing Market Index that looks at the level of confidence that builders have in the single-family housing market. The AEI Housing Market Indicators present a comprehensive picture of the state of the housing market in America. Their metrics included home prices and supply, new construction sales and additions to the housing stock, lending standards, housing affordability and land prices.

- Housing Price Indices. These included those by FRED and the S&P/Case-Shiller US National Home Price Index.

In the Malaysian context, not all the above information is readily available to the retail investor. I would rank the ease of getting the Malaysian data as follows:

- House Price Index. The Malaysian National Property Information Centre, Valuation and Property Services Department, Ministry of Finance is responsible for publishing the House Price Index.

- Residential transactions data are provided in the Property Market Report published by the Valuation and Property Services Department. Data are available in number of units and value. I would consider these as equivalent to the US Home sales information.

- Residential Starts. The same Property Market Reports have sections on the Residential Starts. I would equate these to the US Housing Starts data. To a certain extent the Residential Starts reflects the housing construction activities.

Refer to Appendix 2 on the method used to derive the various metrics analysed.

Performance of the Malaysian metrics

Chart 3 illustrated how pricing information had been used to identify the property cycle. How would the Residential transactions and Residential Starts perform compared to the House Price Index?

I compared these 3 metrics using 2 approaches

- Looking at the trends of the metrics from 2002 to 2020 as shown in Chart 1. Note that for ease of comparison, I constructed the index for each metric. For the respective index, the value in 2002 was assumed to be 100. The index value for the various years were then computed relative to this base 100.

- Looking at the annual percentage changes of the respective indices as shown in Chart 2

Referring to Chart 3, the period 2002 to 2020 represented one property cycle. However, Residential Starts and Residential Transactions showed a different picture.

- Looking at House Price Index (HPI) trend in Chart 1, you could not see the cyclical pattern. Part of the reason for this is because the value of the HPI was also increasing over time. Thus the growth had masked the cyclical pattern. But you could make out the cyclical pattern with the % annual change in the HPI in Chart 2.

- Based on the Residential Starts Index, you could see more than one cycles during this period. This can be seen from both the trend and annual change charts. Note that the relatively "horizontal" Residential Starts Index trendline meant that there has not been a significant growth in the number of Residential Starts. In fact, the 2020 Residential Starts was lower than that in 2002.

- Looking at the number of Residential Transactions, Chart 1 shows one cycle. But looking at the % annual change of this metric indicates more than one cycle during the 2002 to 2020 period. I would also like to point our that the "horizontal" Transaction trendline meant that there has not been any growth in the number of Residential Transactions in 2020 compared to 2002.

The challenge then is deciding which of these metrics show the real picture. Remember than you are trying to determine the start and end of the cycle in real time.

I would argue that the property cycle is the result of 4 key factors - demographics, interest rates, general economy and government policies. As such looking at only one metric eg price alone may not show an accurate picture.

18 years cycle

The iProperty.com article cited earlier talked about an 18 years cycle.

“Sometime in the early 20th century, Homer Hoyt, a real estate professional discovered that property prices are cyclical. He also realized that these cycles happened in almost perfect 18-year cycles. Hoyt’s research was popularised by economist, Fred Harrison, in his book “Boom Bust.” Interestingly, this book which was written in 2005, predicted the 2008 housing crash in the USA.”

According to the article the current cycle started in 2000 and the end of the cycle is then 2018. But I am sure you would all agree that given the Covid-19 impact, the current cycle is far from over.

I have another example to illustrate that the shortcomings of the 18 years cycle concept. The chart below shows the US Housing Starts over the last 70 years. You can see the cyclical pattern.

- Based on starting from the peak, the current cycle is now about 18 years old and it does not look like it has reached its latest peak.

- From 1968 to 1980, there appeared to be at least two cycles. This meant that the average cycle duration is about 6 years.

|

| Chart 5: Housing Starts. Source: Trading Economics |

The point I am making is that the 18 years cycle is not cast in stone. As such it is even more important to be able to identify the start and end of the current cycle in real time.

Property cycle metrics vs the property sector revenue

The 3 metrics do not provide the same answer about when a property cycle starts and finishes. One way to decided which is the best one to use is to then relate it to the purpose of identifying the cycle.

My perspective is that of a retail stock market investor. You are trying to determine where you are in the cycle in real time so that you can assess the cyclical performance. This in turn is because you are trying to determine whether there is an opportunity to invest in the property companies.

As such, I next assessed which of the metrics had the best link with the performance of the Malaysian property companies. To do this, I compared the performance of these 3 metrics with the revenue of the Bursa Malaysia property counters.

I had already determined the performance of the Bursa Malaysia property companies in my article “Will the Malaysian Property industry turn around by 2024?”. In that article, I used the performance of 85 Bursa Malaysia companies under the property sector to represent the industry. Refer to the article for details of the companies and the methodology.

Unfortunately, I did not have the property sector data going back to 2002. Rather the data I had only went back 11 years ie from 2010 to 2020. This is about half the cycle represented in Chart 3.

Even with this half cycle comparison, you can see some links as shown in Charts 6 and 7.

|

| Chart 6: Property Cycle Metrics vs Property Sector Performance - Trendlines |

|

| Chart 7: Property Cycles Metrics vs Property Sector Performance - Annual Changes |

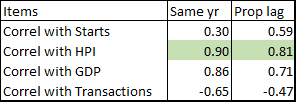

Which of the property cycle metrics had the best link with the revenue of the property companies? To answer this question, I carried out 2 correlation analysis:

- Correlating the Property sector revenue trendline with the 3 metrics trendlines.

- Correlating the annual changes in the Property sector revenue with the annual changes in the 3 metrics.

For each of the analysis, I compared:

- The same year performance between the Property sector revenue and the metrics.

- The Property sector revenue lagging the metrics by one year. For example, the 2010 Residential Starts was compared with the 2011 Property sector revenue.

The results of the correlation analysis are shown in Tables 2 and 3. Generally, correlations are only meaningful if we have values > 0.7. I have highlighted the meaningful values in green in the tables.

|

| Table 2: Correlation based on Trendlines |

|

| Table 3: Correlation based on Annual Changes |

The analysis suggests that the HPI is the best indicator on how the Property sector will perform. This is looking at both the trendlines and the % annual changes. The results show that this can be a leading indicator for the performance of the Malaysian Property sector revenue.

The next best metric is the Residential Starts. I would use this as a leading indicator for both the trendlines and % annual changes.

The surprise was that the low correlation between the Transactions and the Malaysian Property sector revenue. One possible explanation is that the Transactions covered the following parties:

- Individual and individual.

- Developer and individual.

- Company and individual.

- Company and company.

- Others.

In other words, the Transactions between the Property companies (Developers) and the buyers was only part of the total Transactions. For example, in 2020, the Developer and Individual transactions represented about 20 % of the Total Transactions.

However, I also did a correlation analysis between the Property sector revenue and just the Transactions between the Developer and Individual. The results were not meaningful.

I had earlier quoted Investopedia on the link between the property cycle and that of the general economy. The correlation between the Malaysian GDP and the Property sector revenue based on the 11 years period were:

- 0.86 based on the trendlines.

- 0.54 based on the % annual changes.

You should not be surprised by the findings.

Shortcomings

When you look at the analysis and correlations, you must consider some of the shortcomings of the analysis. I present some of my concerns here.

According to the Valuation and Property Services Department the HPI is based on the following:

“Price change is estimated by pricing a basket of house characteristics of the “average” house transacted in the current period and comparing this price with the price of the same basket of house characteristics in the base year (2010). Fundamentally, it is a ratio that shows how much the cost of housing has changed between two periods (the base and the current periods) if the house buyers maintain the standard of living in the latter period.”

Going by this definition, the HPI do not directly represent the prices transacted between the Developers and the Individuals. Based on my property development experience, Developers take several factors into consideration when pricing their houses. The changes in the HPI have some influence but it is not the only factor.

As such I was surprised by the high correlation between the HPI and the Property sector revenue.

Secondly, the property companies making up the Property sector are not just involved in residential developments. Many also develop commercial properties such as shop-houses, offices and even shopping malls. As such I did not expect a high correlation between the HPI and the Property sector revenue.

I would have thought that there would be a better correlation between the Residential Starts and the Property sector revenue compared to the HPI.

One way to interpret this “anomaly” is that 11 years of data may not be sufficient enough for a good analysis.

Another explanation for the anomaly is that 2010 to 2020 only covered part of the “Explosive and Recession” phases. These phases could have a higher correlation between the HPI and the Property sector revenue compared to a full cycle comparison.

The trendline and annual changes for each metric illustrated in Charts 1 and 2 were based on the same data. Technically both charts should give the same answer when it comes to determining the number of cycles between 2002 and 2020. However, as a retail investor, you would be looking for patterns visually. I see a different picture when looking at trendlines compared to looking at annual changes. It could be due to the way I process visual information. I am not sure whether you have the same issue.

Having said the above, I would state that investing is always based on incomplete data. As a value investor, you are trying to project the future performance and invest based on your outlook. Any tool to help provide an evidence-based approach should be considered.

Note that the findings are based on looking at the Property sector as a group. If you want to draw any conclusion about individual property companies, you should undertake a similar analysis for the individual company.

Conclusion

The property sector is a cyclical one. To get an accurate picture of property companies, you should look at the performance over the cycle. This requires you to be able to identify the cycle in real time.

I looked at 3 metrics that are readily available to identify the Malaysian property cycle:

- House Price Index (HPI).

- Residential Starts.

- Residential Transactions.

The HPI is the best indicator when it comes to using the metrics to gauge the performance of the Malaysian Property sector. When using this metric, it really does not matter whether you use the trendlines or the % annual changes.

In real time, it may not be very clear on where you are in the cycle. As such I recommend that you complement the HPI with the Residential Starts.

To identify the starting point and ending point of a cycle, you chart the metrics. The values of the metrics are on the y-axis and time is on the x-axis. You then look at the pattern to identify the wave form.

If you want to see how I have used the Housing Starts metric to analyze and value property companies, look at the following articles (Note: they are all US homebuilders):

- Is MDC one of the better NYSE stocks? (i4value.asia blog)

- Lennar is not a growth stock but a cyclical one (ValueWalk)

- The market is not pricing D.R. Horton as a cyclical group (Seeking Alpha*)

Appendix 1 - Google search results for “Malaysian Property Cycle”

|

| Page 1 results |

|

| Page 2 results |

Notes

Items 8 and 12 referred to the iProperty.com article of item 2. As such these were not included in the analysis

Appendix 2 - Methodology

There were 2 sources of information:

- Malaysian House Price Index. I had actually used the various annual reports to establish the index from 1990 for my article “In Malaysia, which has better returns - Stock market or Property?”. I then used the same index for this article.

- Property Market Report. I extracted the information from 2 sets of tables:

- Number of Property Transactions by Category of Transferor and Transferee.

- Supply of Residential Units in Malaysia.

For the Property Market Reports, I focused on the volume data rather than value as I already had price information from the House Price Index.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment