New Toyo International – a fundamental analysis using the moomoo platform

Value Investing Case Study 09. This is an updated fundamental analysis of New Toyo where I have incorporated all the relevant points from my previous 3 articles. If you have tried to access the earlier articles, you would be re-directed here. I have also taken the opportunity to illustrate how I used the moomoo platform to extract various data.

I first covered New Toyo International Holdings Ltd (New Toyo or the Group) in early 2021. At that juncture the company was trading at SGD 0.175 per share (as of 29 Jan 2021) compared to its Asset Value of SGD 0.35 per share. I had classified New Toyo as a “turnaround”.

My investment thesis then was that the packaging industry was not a sunset one. New Toyo losses were due to one-off problems that management had addressed. The first half results of 2020 showed signs of a turnaround.

I had concluded then that New Toyo was not a value trap. However, there were some concerns so that New Toyo may be a cigar-butt type investment opportunity.

For those who want a quick overview, I have 3 minute video on my investment thesis.

New Toyo is currently (18 Jul 2023) trading at SGD 0.21 per share compared to its Asset Value of SGD 0.33 per share (end Dec 2022). The share price had gone up by about 20% while its Asset Value had declined by about 6%.

Is Mr. Market being rational? Or has New Toyo moved away from being a cigar-butt investment opportunity?

Join me as I try to answer this question. Should you go and buy it? Well, read my Disclaimer!

Contents

- Summary

- Investment thesis

- Rationale

- Background

- Performance

- Management

- Valuation

- Risks

- Conclusion

|

Summary

- New Toyo is facing challenges in its legacy packaging printing business, a mature sector, and needs growth from new ventures.

- The company is considered a cigar-butt investment, with a margin of safety based on its Asset Value, but overall returns are lower than the cost of capital due to underperforming segments.

- The management's turnaround efforts seem sustainable, but there are concerns about its ability to diversify successfully. They have a poor diversification track record.

- New Toyo has a strong customer concentration risk, with a single customer contributing about half of its revenue, likely in the tobacco industry.

- The company's financial position is relatively strong, with low Debt Equity ratio and positive Cash Flow from Operations, but its growth prospects remain uncertain.

Investment thesis

New Toyo faces two challenges:

- Its legacy packaging printing business is undergoing a turnaround. But this is a “mature” sector.

- Growth will have to come from new ventures. But it has a poor track record in venturing out of the tobacco sector.

With its margin of safety based on its Asset Value, I consider New Toyo a cigar-butt type investment. This is due to the following reasons:

- Even if the packaging printing business is turned around, the overall returns are still lower than the cost of capital. This is because about 18% of its total capital is not delivering good returns.

- Management had tried to address this by diversifying into new areas. But the track record has been poor.

But it is not a value trap as the turnaround seemed sustainable. It also has the financial resources to withstand a longer than expected turnaround.

|

Rationale

The rationale for the investment thesis and the thrust of my fundamental analysis can be summarized as follows:

- The Group is undergoing a turnaround as illustrated by the PAT and gross profitability trends. The bottom was in 2019 and the past 3 years’ performance was better than those in 2019.

- The legacy packaging printing business comprising the Specialty Papers segment, and the Printed Cartons and Labels segment. These accounted for about 80% of the total capital employed. But only the former had delivered a return that is greater than the cost of capital.

- Even if the Printed Cartons and Labels segment is turned around, the overall return is still lower than the cost of funds. The packaging printing sector is a mature one with global growth projected to be 4 % to 5 % CAGR over the coming decade.

- Management tried to address this by diversifying into other sectors. But its diversification track record has been poor. The current management team is still the same as that of the past few years. There is no evidence to suggest that management had gotten new capabilities to tackle this concern.

- Management performance was not the best when comparing revenue growth and ROA with those of its peers. While I would rate its capital allocation plan as good, there is a poor diversification track record.

- The Group has a strong customer concentration risk. Over the past 4 years, the top 2 customers accounted for about 38 % to 53 % of the Group revenue. However, this customer concentration has been a feature of the business.

- A valuation of New Toyo showed that there is a margin of safety under the Asset-Value and Acquirer’s Multiple. But there is no margin of safety based on the Earnings Power Value. You should not be surprised as I assumed the future earnings to be equal to this past 12 years weighted-average earnings.

- As such I consider New Toyo a cigar-butt investment. While there are risks for this type of investment, I see the following mitigation measure:

- Gross profitability had improved giving me greater confidence in the turnaround.

- The economic recovery from Covid-19 may take longer than expected. But. I found that it has a low Debt Equity ratio and a good track record of generating Cash Flow from Operations.

The details of the analysis and valuations are described in the subsequent sections.

|

Background

Founded in 1975, the Group is one of the largest producers of specialty packaging materials in the Asia Pacific region today.

The chart below shows the current corporate structure of the Group.

- It has 2 entities in the Group – one under SGX and the other under Bursa Malaysia.

- The Group operates in Singapore, Malaysia, Vietnam, Dubai, and China serving multinationals and local customers

|

| Chart 1: New Toyo Corporate Structure |

|

The Group today has the following business segments:

- Specialty Papers. This segment produces mainly coated, printed, and laminated papers and paperboards for packaging industries. Its key manufacturing sites in Singapore, Malaysia, Vietnam, and Dubai.

- Printed Cartons and Labels division produces mainly gravure and offsets printed materials for fast-moving consumer goods. The division operates in Malaysia Vietnam, Indonesia, and Dubai.

- A trading segment that focuses on the sale of raw materials, paper products, and equipment.

- The Tissue Paper Business is currently focused on trading tissue paper products after the cessation of tissue jumbo reel production in 2019.

Growth path

The Group started its laminated paper operations in 1975 when the current founder Chairman set up a factory in Jurong, Singapore. The Group subsequently:

- Diversified into printing and the manufacturing of corrugated containers and tissue paper.

- Expanded its operations to other countries in the region.

This diversification and expansion program was undertaken through organic growth, joint ventures as well as acquisitions.

For example, in 2004, the Group acquired a 24.44 % holding in the Bursa Malaysia listed Tien Wah which was in the similar lamination and gravure printing business. At the same time, the Group frequently closed or divested unprofitable units. For example:

- The Group completely divested the corrugated carton box business by 2015.

- In 2017 the Group ceased the Australian and Malaysian production plants and relocated their operations to Vietnam and Indonesia.

- The Group ceased the tissue manufacturing operations in September 2019 after operating for less than 2 years.

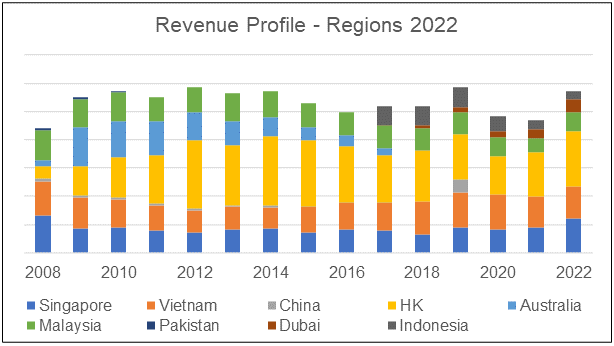

Charts 2 and 3 below show how the Group revenue profile has changed over the past 15 years.

|

| Chart 2: Segment Profile |

- On average the Trading and Others segments accounted for about 1/4 of the Group revenue.

- The Singapore and Malaysian revenues have declined from 54% of the Group revenue in 2008 to 33 % by 2022.

- The Group no longer has any revenue from Pakistan (by 2011) and Australia (by 2019).

- Since 2018, the Group has been building up its presence in Indonesia and the Middle East.

|

| Chart 3: Geographical Profile |

Despite the diversification efforts, the legacy packaging printing businesses still account for the bulk of the Group revenue. But the Group has a better track record in reducing exposure to Malaysia and Singapore.

Performance

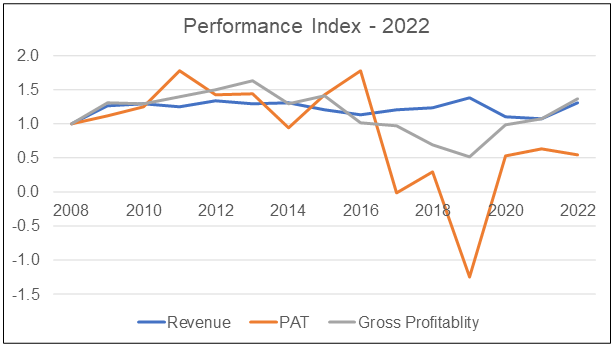

I used 3 metrics to track New Toyo’s performance – revenue, PAT, and gross profitability (gross profits/total assets).

Chart 4 illustrates New Toyo’s performance based on these 3 metrics;

|

| Chart 4: Performance Index |

The Group is undergoing a turnaround as can be seen from the Performance Index chart.

- Revenue only grew at 1.9 % CAGR from 2008 to 2022.

- Gross profitability has been declining since 2013 but it reached bottom in 2019. The positive sign is that the past 2 years’ performance is better than that in 2008.

- While the Group suffered losses in 2017 and 2019, you can see improved profits over the past 3 years. The consolidation of the operations affected the 2017 bottom line by as much as SGD 12.7 million. In 2019, the Tissue segment had a loss of SGD 11.2 million.

Note that the profits in 2016 and 2018 were boosted by SGD 12.9 million and SGD 7.9 million from the sale of properties. Without these, the 2016 PAT would be at the 2008 level and there would be a loss after tax in 2018.

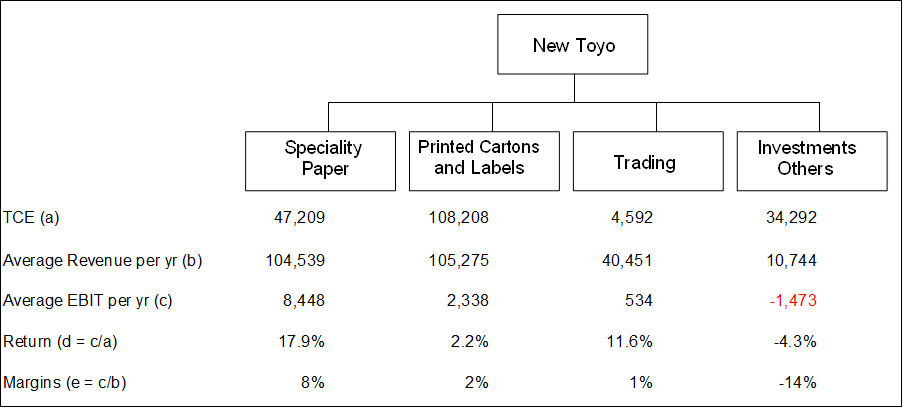

To see whether all the business segments have been pulling their weight, I analyzed the segment performance as shown in Chart 5. Note the following in the analysis:

- As the Tissue business has been discontinued, I have grouped it with the Investments and Other unallocated items.

- The Trading segment also acts as the central group procurement but only the external revenue is considered.

|

| Chart 5: Segment Performance Notes a) TCE = Total Capital Employed = Equity + Debt. b) 2011 to 2022 time-weighted average revenue. c) 2011 to 2022 time-weighted average EBIT. |

The analysis showed that the poor return for the Group is because only the Specialty Paper segment has generated an acceptable return (EBIT/TCE).

- The Printed Cartons and Label segment which accounted for 56 % of the Group’s funds in 2022 only achieved a 2.2 % return.

- The Specialty Paper segment which employed about 24 % of the Group funds in 2022 achieved a 17.9 % return.

- The Investments and Others segment which accounted for 18% of the group’s funds in 2022 was not profitable. Note that this segment included cash and investments in Associates/JV.

Financial position

I would rate the Group as financially strong based on the following:

- As of the end of Dec 2022, it had cash and cash equivalent of SGD 28.5 m. This is about 12% of the total assets.

- Over the past 15 years, there was only 1 year when it had negative Cash Flow from Operations.

- Over the past 15 years, it generated on average SGD 24.4 million of Cash Flow from Operations per year compared to the average annual PAT of SGD 11.2 million. This represents a 2.2 Cash Flow from Operations to PAT ratio.

- As of the end of Dec 2022, it had a Debt Equity ratio of 0.1

Is there a Great Future?

New Toyo operates in the packaging printing industry. Although the Group revenue has only grown at a CAGR of 1.9 % from 2008 to 2022, this is not a sunset industry.

According to Markets and Markets, the global market for packaging printing is projected to grow from USD 352.1 billion in 2021 to USD 433.4 billion by 2026. This is an estimated CAGR of 4.2%.

The Asia Pacific region is expected to be the fastest-growing region during the forecast period.

This growth opportunity is supported by Precedence Research. They opined that the global printing packaging market will register a growth rate of 4.91% between 2023 and 2032.

New Toyo is not in a sunset industry. But after more than 40 years in the industry, I do not expect the industry to provide a quantum leap for the Group.

While there are other geographical and application segments that New Toyo could tap into, it would be expanding into an established industry.

As such I would expect the current business to provide a “steady base” in earnings.

Tobacco

Although New Toyo did not provide any breakdown, based on its single customer contribution, I estimated that about half of the Group revenue is tied to the tobacco industry.

Given this link, it is useful to note that the tobacco industry is expected to grow about 2% to 4 % per annum as per the following:

“The global tobacco market was valued at USD 729.90 billion in 2020 and is expected to grow at a rate of 3.78% during the forecast period to reach USD908.29 billion by 2026.” Research and Markets

“The global tobacco market size was estimated at USD 867.55 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.1% from 2023 to 2030 due to the rising tobacco consumption in the developing regions of Asia and Africa.” Grand View Research

Property development

I would also like to point out that New Toyo also has a property development opportunity at its former factory site of Tien Wah in Petaling Jaya, Malaysia. In 2016 it formed a joint venture with Lum Chang Holding Ltd, an established SGX-listed property developer to develop the site into a mixed commercial project.

The project looks promising as several successful mixed development projects have been on former factory sites within a stone’s throw of the Tien Wah’s land.

At that juncture, I estimated that the project would contribute at best about SGD 15 million to its bottom line over a 5 years development period. This was based on the size of the land and that New Toyo has about 27% ownership interest in the joint venture.

Unfortunately, this project has been delayed due to the soft property market in Malaysia. Still, this should provide a one-off profit source for the Group when the market recovers.

Management

New Toyo is a founder-managed Group. The Chairman and his family own about 52% of New Toyo International Holdings Ltd.

Of the 4 senior managers featured in the 2022 Annual Report, 3 are long-serving staff.

- The Group CEO joined the Group in the 1970s.

- The CEO of Tien Wah Press Holding Bhd joined the Group in 2005.

- The CEO of Specialty Paper joined the Group in 2007.

- Only the CFO was new having joined the Group in August 2022.

How did they perform given their experience? According to Warren Buffett, you can assess management by:

“…by reading about both what they’ve accomplished and what their competitors have accomplished, and seeing how they have allocated capital over time…”

Table 1 compared New Toyo’s revenue and ROA with those of its peers from 2008 to 2022. The peers were the related stocks obtained from the moomoo platform.

|

| Table 1: Peer Comparison |

New Toyo’s revenue growth rate was below the panel average. I would rate New Toyo as the worst. You can see from Chart 6 that in 2009, New Toyo was ranked 3rd in terms of revenue. By 2022, it ranked the lowest.

But New Toyo’s average ROA was about the panel average.

|

| Chart 6: Peer Revenue |

|

Capital allocation

I look at two metrics when it comes to assessing capital allocation:

- The current capital structure.

- How the Cash Flow from Operations has been used.

The Group has a total capital employed (TCE) of SGD 194 million as of the end of Dec 2022, with SHF and loan accounting for about 75 % and 6 % of it respectively.

About 80 % of the TCE is deployed for its operations with the majority of the balance tied up in cash.

As you can see from Chart 7, it has deployed its funds effectively.

|

| Chart 7: Sources and Uses of Funds |

From 2008 to 2022, New Toyo generated about SGD 365 million in Cash Flow from Operations. Of this,

- SGD 110 million was paid out as dividends.

- SGD 159 million was spent on net CAPEX (CAPEX less sales of PPE).

- SGD 60 million was on other asset acquisitions including intangibles.

I would consider this a good asset allocation plan. But I have a concern here. The new Toyo business model has resulted in frequent disposals and acquisitions of new plants and businesses as well as new ventures.

Over the past 8 years, there have been occasions where such investments have not worked out. The Group reported the following:

- 2014 - There were SGD 2.3 m one-off sales rebates and SGD 0.8m redundancy costs in the Printed Cartons and Label segment.

- 2017 - Apart from the consolidation expenses of SGD 12.7 million, admin expenses were higher by SGD 3.5 m due to the set-up costs in Indonesia and Dubai.

- 2018 - The learning curve affected productivity in Indonesia and Vietnam. There were start-up costs for Dubai and the Tissue operations.

- 2019 - apart from SGD 11.2 million in losses from the closure of the tissue business, there was SGD 6.2 retrenchment and impairment cost for the Dubai operations.

- 2020. The Group took back management of its Dubai-based startups and made provisions of SGD 3.6 m for impairment losses in 2022.

The reported costs and losses amounted to SGD 40.3 million, equal to about SGD 5 million per year. This is significant as, without such costs, the average PAT for the past 8 years would double.

To be fair not all the ventures ended with negative results.

In 2016 the Group acquired PT Bintang Persona Jagat (BJP) in Indonesia for SGD 33.48 million making the Malaysian operations redundant. The Malaysian operation ceased with SGD 3.8 million retrenchment and PPE impairment expenses.

The BJP acquisition came with a 6-year exclusive supply agreement commencing from 1 Jan 2017 to 31 Dec 2020. The BJP contract should prove to be beneficial to the Group like the Anzpac acquisition in 2008.

Anzpac was acquired from British American Tobacco (BAT) for SGD 61.8 million. This was together with a 7 + 3 years agreement to supply BAT with cigarette packs and cartons.

Over the 10 years, the Group experienced a positive net cash flow from the Anzpac acquisition. At the same time, the Anzpac equipment has been relocated to the Group Vietnam operations and is still in use.

Looking at the above projects and ventures, I would conclude that:

- The top management has a good track record for investments within the tobacco sector and/or within the ASEAN regions.

- There is concern about the track record outside the tobacco industry and or the ASEAN regions.

Considering the peer performance and capital allocation plans, I would rate management performance at best an average one.

Valuation

Table 2 and Chart 8 illustrate the valuation and margins of safety for New Toyo. You can see that there is only a sufficient margin of safety from the Asset Value and Acquirer’s Multiple.

|

| Table 2: Valuation Summary Notes a) Margin of safety = Value/Market price. b) Margin of safety = Value/Target value of 6. |

When it comes to Asset Value, it may be more appropriate to base it on the NTA. In this context, there is a 34 % margin of safety.

Pulling the company analysis and valuation together, I would conclude that New Toyo is a cigar-butt type of investment opportunity.

- The Book Value and NTA provide sufficient margins of safety. Given that the Group will continue to be profitable, I do not expect these Asset Values to reduce over time.

- While financially sound, there are concerns about how much the existing legacy businesses can contribute. To grow, the Group has to diversify. This is where there is a concern given its poor track record.

|

| Chart 8: Valuation |

Earnings Value

My Earnings Value was derived based on the average of 2 methods:

- The Free Cash Flow to the Firm method as per Damodaran.

- The Residual Income method as per Penman.

The key assumptions I used are:

- The average past 12 years' performance represents the future. I ignored the gain from the sale of properties in 2016 and 2018 in the cash flow analysis.

- Ignore growth. In other words, I considered the intrinsic value as equal to the Earnings Power Value (EPV).

- New Toyo business model has resulted in frequent disposal and acquisitions of new plants and businesses. As such impairment and retrenchment costs were viewed as part of the “normal” operating expenses rather than one-off expenses.

- A Cost of Equity of 7.8 % and a WACC of 7.4 % that was derived following Damodaran’s built-up approach.

For companies like New Toyo undergoing a turnaround, the EPV would be a very conservative one. In a turnaround, you would assume that the future should be better than the historical performance.

The above EPV is of course a simplistic valuation analysis.

- If you believe that the future would be better than that projected, the EPV would be higher than that computed.

- If you believe that the future would be worse than the base case, then the EPV would be lower than that computed

It is a conservative approach as I have yet to take into account the contribution from any turnaround performance.

I have shown that over the past 8 years, these costs equal to SGD 5 million per year due to redundancies, impairments, and one-off business losses. On an after-tax basis, this is about SGD 4 million.

This is sizeable as the EBIT(1-t) in my valuation model is about SGD 8 million. If I add this, the EPV increases to SGD 0.23 per share.

Greenwald analysis

According to Professor Bruce Greenwald, you can get strategic insights by comparing the Asset Value and Earnings Power Value. I had estimated the following for New Toyo:

- Asset Value – SGD 0.33 per share.

- EPV – 0.19 per share.

With the EPV < Asset Value, this reinforces the point that the assets are under-utilized and New Toyo is likely to be a cigar-butt investment.

In order not to be a cigar-butt we should have the EPV = Asset Value.

The question then is whether there are opportunities for New Toyo to improve its asset utilization. I had shown that not all the business segments were operating effectively.

I am confident that management would be able to continue to improve the performance of legacy businesses. These are the Specialty Papers and Printed Carton & Labels segments. The challenges then are:

- If the Others remain as they are, would the improved legacy businesses more than makeup for the “shortfall”? In other words, would the Group then generate a return > cost of funds?

- Alternatively, would the Group be able to venture into new business successfully so that we have all “cylinders firing?”

To answer the former, I looked at the past 15 years’ history. The best results from these 2 segments were in 2010 when they had total revenue of SGD 239 m and an 8 % segment margin. Based on these segment performances and the other being on a standstill, I projected the following:

|

| Table 3: Projected ROE vs Cost of Equity Notes a) This analysis assumed that the funds allocated to each segment remain unchanged even if there are better profits |

This back-of-the-envelope analysis indicates that it is unlikely for New Toyo to generate a return greater than its cost of equity via the legacy businesses. The assumption here is that the Specialty Papers and Printed Carton & Label segments returned their historical best performance.

The other option then is to deploy the funds under Others into new ventures. This is where I have concerns as management do not have a good track record here.

The conclusion is that New Toyo is still a cigar-butt investment.

Is there an investment opportunity?

Once I have identified a potential value investment stock, I would next look at technical to see the best time to enter. I would not go into details here as the focus of this article is on fundamental analysis.

But to give you a flavor of what I looked at Chart 9 shows the peer price trends over the past 3 years as extracted from the moomoo platform. You can see the New Toyo prices have been trending up since 2020 with those of its peers seeming to have “stabilized”.

Is this a sign that Mr. Market has recognized what I have said in this article?

|

| Chart 9: Peer Price Trends |

Risk

When I look at the risks of investing in New Toyo, I would see the main ones as

- Privatization.

- Turnaround and New ventures.

- Single customer.

- Tobacco.

Privatization

The Chairman and his family owning about 52 % of New Toyo International Holdings Ltd. They would need about SGD 48 million to take it private at the current market price of SGD 0.21 per share.

I do not think that this could be done with a capital reduction exercise even though the Group has SGD 28 million cash as of the end of Dec 2022. This is because the Group has financial liabilities of SGD 12 million as of the end of Dec 2022.

Would the Chairman and his family then spend SGD 37 million to take it private?

To benefit from privatization, either:

- The shareholders could extract cash from the private company. This could involve asset sales and extracting cash from the company without disrupting the operations.

- The company could be relisted again after it has been turned around. The shareholder would benefit from a higher market price on re-listing.

I am not sure whether the former could be pursued as there are not many non-operating assets.

As for the latter, the numbers don’t make a compelling case for privatization.

Firstly, the privatization offer would probably have to be at a price higher than the current market price. SGX privatization rules require the offer to be made at a fair and reasonable price. I think this would make any offer price to be closer to the book value of SDG 0.33.

Secondly, if you assume that the Group can achieve a steady 10 % ROE, it would result in an EPS of SGD 0.033. I would think that it would take about 5 years to generate the track record for relisting. The total cost (acquisition price plus interest) by then assuming 7 % interest per annum would be about SGD 0.48 per share. To cover this cost, the shares would have to be re-listed at least at PE 15 multiples based on an EPS of SGD 0.033. There is not much margin of safety.

Turnaround and New Venture

In a narrow sense, turnaround here is about returning the current business to profitability. This should present the lowest risk for New Toyo as the current management team has managed to achieve better performance in the past.

At the same time, the industry is not experiencing any secular decline or digital technology threats. In a sense the current results to positive signs of a turnaround.

However, to generate a quantum leap in performance, New Toyo has to diversify ie venture into new business areas. But its track record has not been very encouraging given the Dubai and Tissue paper experience. Furthermore, while opportunistic, its venture into property development has yet to see any results.

I would consider this the biggest risk for New Toyo - whether it can develop the expertise to assess new ventures and to operate profitability.

The risk mitigation here is that I have not imputed any growth into the New Toyo valuation.

Single customer

The Group has a large customer concentration risk looking at the following contribution by the top 2 customers to the Group revenue:

- 2022 – 38 %.

- 2021 – 46 %.

- 2020 – 52 %.

- 2019 – 53 %.

Over the past 15 years when the information was reported, a single customer contributed an average of 48% of the Group revenue. Although not specifically mentioned, I believe that this is the BAT.

A loss of this customer would impact the Group. This was the rationale for the return of the founder as Chairman in 2016 - to help renew the supply contract.

This risk remains. The main risk mitigation is that the Group has managed to serve the customer for a very long time. I would expect the Group to go all out (and possibly affect its margins) to keep this source of revenue.

Tobacco focus

The business model of the Group involved continuous streamlining of its operations and seeking new markets.

Despite the diversification efforts, about half of the Group’s revenue came from a single customer in the tobacco industry.

This meant that the Group performance, especially for the Printed Carton and Label segment has been tied to that of the tobacco industry.

Conclusion

This is a company undergoing a turnaround for its legacy business. If you look at Chart 5, you can see that its current under-performance is because not all its cylinders are firing.

Even if it could turn around the Printed Cartons and Label division, there is still the challenge of what to do with Investments and Others segment. This accounted for 18% of the total capital in 2022.

The Group has a dilemma. The company had a poor track record in diversifying out of the tobacco business. But it has to do this to generate growth. Rather than try to guesstimate the growth, I have valued it based on its EPV.

I believe that the Q-Rating as per Chart 10 sums up New Toyo’s position well.

- The Group is financially sound but with low growth prospects. This is not surprising given the poor track record of its expansion into Dubai and the Tissue paper business.

- Its overall rating of 0.52 places it at the upper quartile of the panel.

I will interpret the rating to mean that New Toyo would be able to sustain its earnings but does not expect to see significant earnings growth.

|

| Chart 10: Q Rating |

You should not be surprised that I consider New Toyo a cigar-butt type of investment opportunity. The Asset Value provides a margin of safety currently. Even if the turnaround is very successful, the returns would be less than the cost of funds.

The challenge for the Group is how to grow. And this has to come from diversification which the Group had a poor track record.

I would not look down on cigar-butt investments. If you have limited growth companies, cigar-butt investments backed by strong Asset Values are good options.

|

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment