Is Lohakit Metal one of the better SET steel companies?

Value Investing Case Study 26-1. I had identified Lohakit Metal as a potential candidate in my Feb 2022 article on the Thai steel sector. This is my investment thesis on Lohakit Metal.

In my article Jan 2022 article, "Hunting for Thai steel and metal companies", I had identified 4 potential steel companies under the Stock Exchange of Thailand (SET). In this article, I will focus on one of them - Lohakit Metal PLC (LHK or the Group).

LHK started as a distributor of stainless products. It has since diversified into the production of stainless steel tubes and pipes. It had also widened its offerings to include aluminum and copper coils and sheets.

The price of LHK has been rising since its low of Mac 2020 to peak at TBH 4.38 per share around mid-February 2022. This price has been declining since then to TBH 3.98 per share as of 7 Mac 2022.

There is an investment opportunity looking at LHK through a cyclical lens even at the Feb peak price.

Contents

- Summary

- Investment Thesis

- Business background

- Business fundamentals

- Valuation

- Risks

- Conclusion

|

Summary

- LHK is fundamentally strong. It is financially sound with a strong performance track record.

- Management has a good track record as an operator and capital allocator. The Group had been able to create shareholders’ value.

- There is a sufficient margin of safety based on the valuation of LHK through a cyclical lens.

Investment Thesis

LHK is a fundamentally strong Group in the steel industry. While the current performance of the Group has been affected by the Covid-19 measures, it had a good performance track record over 2 price cycles.

The performance of cyclical companies will mean revert. As such any fundamental analysis should be based on its performance over the cycle. A valuation of LHK on such a basis showed that there is a sufficient margin of safety based on the EPV.

|

Business background

LHK was founded in 1989 to engage in the trading of stainless-steel products in Thailand. It IPO in SET in 2008. The Group is principally engaged in the processing, distribution, and shearing of stainless steel, steel, and metal products. The Group models itself as a supply chain management company to manage the raw material, the procurement, the distribution, and the services provided to the customers.

The business goals of the Group can be summarized as:

- To become the leader in stainless steel processing.

- To expand the customer base to the multinational companies whose production hubs are in Thailand.

- There are plans to expand the distribution channel of the special grade stainless steel abroad.

LHK operates mainly in Thailand through 3 factories. I would classify LHK businesses into 2 main categories:

- Manufacturing and sales of stainless-steel tubes and pipes. This accounted for about 35 % of the Group 2021 revenue.

- Procuring and distributing a variety of metal coils and sheets. Stainless steel accounted for 40 % of the 2021 products in this category. The balance was from galvanized steel, copper, brass, and aluminum products.

Chart 1 shows the business profile of the Group over the past 12 years. You can see the impact of the Covid-19 measures on the 2020 and 2021 revenues.

|

| Chart 1: Revenue Profile |

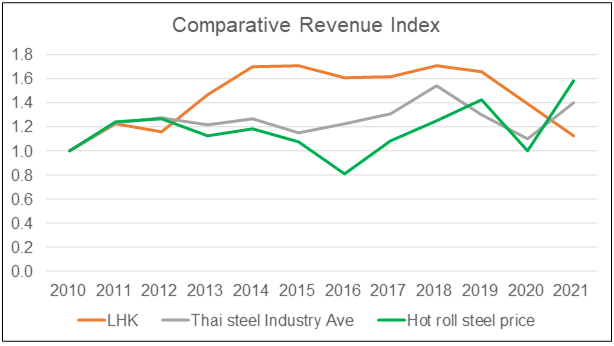

Overall, I estimated that steel accounted for about 2/3 of the Group 2021 revenue. In analyzing and valuing LHK, I would thus focus on the performance over the steel cycle. From 2010 to 2021, the steel industry had gone through at least 2 cycles. The chart below gives you a sense of LHK revenue over this period relative to the steel cycle.

Business fundamentals

LHK is a fundamentally sound company based on several perspectives:

- It is financially sound.

- It has a strong performance track record.

- Management has a good track record as an operator and capital allocator.

- It has created shareholders' value.

The rationale for the above are presented in the following sections.

Financially sound

LHK is a financially sound Group.

- It has a Total Capital Employed (TCE) of TBH 1.7 billion as of the end Dec 2021. 83 % of the TCE was tied up in the operations with the balance held as cash and/or cash equivalent.

- It had a low Debt Equity ratio of about 0.05 in 2021 compared to the Thai steel industry’s mean Debt Equity of 0.54. LHK Debt Equity ratio had been declining for the past 12 years as shown in Chart 3 below.

|

| Chart 3: Debt Equity |

- The Group had generated positive cash flow from operations every year during the past 12 years. On average its cash flow from operations is about 1.5 times the average annual net income.

Strong performance track record

For the 9 months ended Dec 2021 (for FYE 2022), the Group achieved a revenue of TBH 2.0 billion and PAT of THB 189 million. This was 26 % and 172 % higher than the 9 months revenue and PAT of the last financial year.

If nothing else, the current performance demonstrated the impact of Covid-19 on the past 2 years’ results. Of course, the spike in steel prices in 2021 has also boosted the 9 monthly performance for FYE 2022. The current performance illustrates the strong performance track record of the Group. This can be seen from the Performance Index chart.

|

| Chart 4: Performance Index |

Because of the Covid-19 measures as well as the cyclical nature of the steel industry, LHK revenue only grew at a CAGR of 1.1 % from 2010 to 2021.

But LHK managed to be profitable every year with an average ROE of 12 % from 2010 to 2021. However, the ROE had been declining with an average of 9 % over the past 3 years compared to 14 % from 2010 to 2012.

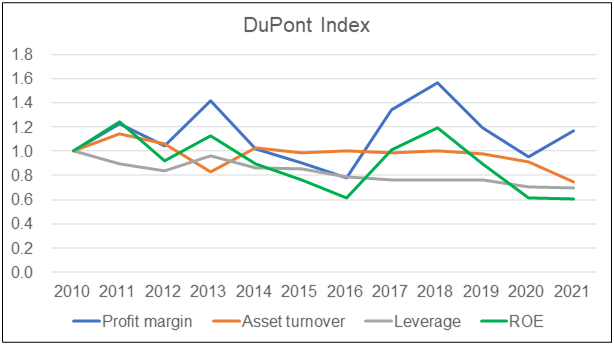

A DuPont analysis showed that the changes in the ROE mirror the changes in the profit margin. However as can be seen from Chart 5, the declining ROE was driven by the decline in Asset Turnover and Leverage. I would consider a declining Leverage as positive. While the profit margin was volatile, most of the time it was better than that of 2010.

Given the cyclical nature of the industry, I would rate LHK performance as good.

|

| Chart 5: DuPont Analysis |

Management had a good record as an operator and capital allocator.

LHK is a family-controlled Group. The major shareholders as of March 31, 2020, are the Akarapongpisak family with 71.81% of the total shares of the public listed company.

The Board comprises 6 members. 4 are Independent Directors with the other 2 - the CEO and Deputy CEO - from the Akarapongpisak family. The CEO and Deputy CEO constitute the Executive Committee.

How did senior management perform? I assessed management based on 2 parameters:

- How they performed relative to their peers.

- How they allocated capital.

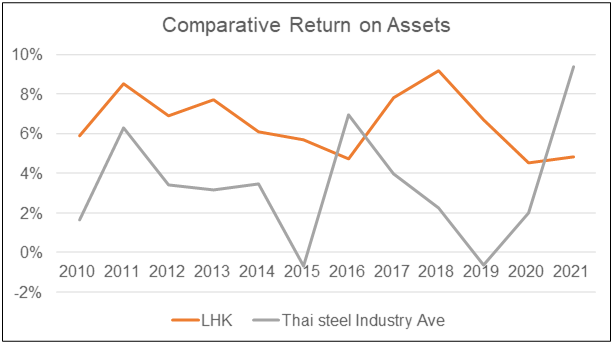

In Chart 2, I had shown that the LHK revenue trend was better than that of the industry. Chart 6 below showed that the Group generally achieved better ROA than the industry.

|

| Chart 6: Comparative ROA |

In terms of capital allocation, the Group generated about TBH 3.0 billion in cash flow from operations from 2010 to 2021. Of this:

- THB 0.8 billion was spent on net CAPEX.

- THB 1.1 billion was paid out as dividends. Considering that the Group generated TBH 2.0 billion net income during this period, this was equal to a 55 % payout ratio.

- The balance of the cash flow went to increase its cash, reduce debt, and for working capital requirements.

Overall, I would rate management as a good operator and capital allocator.

Creating shareholders value

I judge shareholders’ value creation based on 3 metrics:

- Comparing returns with the WACC.

- Comparing the gain in SHF assuming no dividend was paid with the cost of equity.

- Comparing the gains by an investor who bought a share at the end of 2010 with the cost of equity.

As can be seen from the table below, LHK returns (from a business perspective) were higher than the respective cost of funds. But it failed when looking at total returns (capital gain plus dividend) from an investor’s perspective. But this gap is small. Overall, I would conclude that the Group had been able to create shareholders’ value.

Valuation

My valuation of LKH was based on a single-stage model with the following.

EBIT = Gross Profit - SGA.

Free cash flow to the firm FCFF = EBIT(1-t) X (1 - Reinvestment rate).

Value = FCFF X (1 + g) / ( r - g).

Where:

Reinvestment rate = growth rate/return.

r = WACC

g = growth rate

I considered 2 scenarios:

- A EPV Scenario where the revenue is based on the past 12 years’ average.

- An Earnings with growth Scenario where the revenue is based on the past 12 years’ average. I then assumed a 1.1 % annual growth rate based on what the Group had achieved.

The other assumptions are shown below. I took the 2010 to 2021 average values for the Gross Profit margins and SGA margins to represent cyclical values.

|

| Table 3: Valuation Assumptions |

The results of the valuation are summarized as follows:

|

| Table 4: Valuation Metrics |

|

| Chart 7: Valuation |

In my valuation, I had assumed that the future = historical performance over the past 12 years. The steel industry is a cyclical one with mean reversion. By basing the valuation on the historical data, I have taken a very conservative approach.

|

Risks

In its 2020 Annual Report (for FYE 2021), the Group listed the following risks:

- Economic and industrial risk in Thailand in 2020 and 2021. To mitigate them the Group will focus on diversifying its business risks to cover the various industries in the country.

- Risk of depreciation in Baht currency. The Group hedges its foreign exchange risks.

- Risk from the price volatility of nickel, copper, and aluminum. The focus is on inventory control to manage these risks.

- Risk from reliance on the producers and distributors of main materials. The Group relies on its supply chain management model and good relationships with its suppliers to manage these risks. Until now, there has never been a case of material shortage.

- Risk from the relocation of the customers’ production in various industries. This is mitigated by supplying to various industries.

- Risk from the entry of new competitors. Its product knowledge, expertise, and business relationship will give it a competitive advantage.

- Specific risk in associating with a company. These are the inventory and receivable risks. These are mitigated by its supply chain management model and its financial strengths.

When I looked at the 2011 Annual Report, I see essentially the same risks listed. In order words, these are operational risks that management would have to deal with on a day-to-day basis.

From a long-term investment perspective, the concern would be whether this is a sunset sector. Or whether the business model would be disrupted by digital technology. I do not see such risks for the steel industry or LHK.

Note that by valuing LHK through a cyclical lens, I have mitigated the steel cycle risk.

Conclusion

LHK is fundamentally a strong company.

- It is financially strong.

- It had a strong performance track record.

- Management had a good track record as an operator and capital allocator.

- It had been able to create shareholders’ value.

A valuation of LHK showed sufficient margins of safety under the EPV and EV with growth scenarios. In my valuation, I have assumed that the future = past 12 years. If you believe that the future would be better, then of course there is even a greater margin of safety. If you believe that due to the current geopolitical situation, the future would be worst, then you need a bigger margin of safety.

My view is that with little borrowing, the Group would be able to withstand any negative economic scenarios without any impairment of its assets. In other words, the Asset Value provides a floor value and I am happy with more than a 30% margin of safety based on the EPV.

I would conclude that LHK is one of the better SET steel stocks to invest in if you are looking for companies in emerging markets.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment