Heitech Padu - my investment dilemma

Value Investing Case Study 27-1. This is a different approach from the other companies that I have analyzed. It is a combination of fundamental analysis of HTPadu and my investment history in the company.

I first bought Heitech Padu (HTPadu or the Group) in 2007 at an average price of RM 1.14 per share. I sold them all in mid-2019 but bought back a lot more in Oct 2019. The price then started to spike a year later and I sold a large part of my shareholdings.

I was a bit greedy and I held back about 10 lots hoping for the price to ride higher. The price has since declined and the Group had declared a loss in 2021.

You can see from Chart 1 that the price over the past 20 years had been very volatile. But overall, I achieved an average return of 39 % per annum.

|

| Chart 1: HTPadu Price Chart |

The price over the past few weeks has started to move up by about 20 % from about RM 1.00 per share in the early part of March 2022. I was curious about what was happening and decided to have an in-depth look at the business. The question at the back of my mind was what to do with the remaining shares.

Do I wait for it to go higher? Or do I sell now and look for other better opportunities? Join me as I looked at the prospects and valuation of HTPadu and decide what to do next.

Should go and buy the stock? Well, read my Disclaimer.

Contents

- Investment Dilemma

- HTPadu background

- HTPadu performance

- Conclusion

|

Investment Dilemma

I first bought 20 lots of HTPadu in 2007 at an average cost of RM 1.14 per share. Although it was trading at a significant discount to its then NTA of RM 1.60 per share, I bought it for its dividend yield. Based on the dividends paid from 2001 to 2006, I estimated that the purchase price would provide about a 10 % dividend yield per annum. At that juncture, the revenue of the Group was still growing. But I saw growth as a bonus.

For the first 5 years after my initial purchase, I achieved an average annual dividend yield of 12 %. But the Group stopped paying dividends in 2012. However, I continued to hold onto the stock as I thought that the Group was facing a temporary blip. I sold the 20 lots in mid-2019 when the price went above my purchase cost.

I thought then that there was an opportunity for a sale-and-buyback. In order words, get some capital gain while still holding onto it for the dividends.

The bet was that this was a temporary price spike and I would have an opportunity to buy it back later when the price dropped. I was willing to bet that if the price did not drop, I would have achieved an annual return of about 5 % from 2007 to 2019. While not a fantastic return, it was OK from a Dividend Yield perspective.

When the price dropped to my 2007 purchase cost a few months later, I decided to invest in the company again. The interim results at that juncture indicated that the Group had managed to return to profitability. I thought that it could revert to being a dividend-paying stock. At that juncture, I had also sold my investments in Mesiniaga. I thought HTPadu would be a suitable replacement from a portfolio perspective.

But I held onto it for only a year because the price had ramped up in Sept/Oct 2020. This was following news that one of its subsidiaries was awarded an e-government contract very much like that awarded to MyEG.

I sold off a substantial part of my holdings as I estimated that it had overshot its intrinsic value. But I held back 10 lots in case I was wrong about my assessment. In other words, I did not want to lose out in case the price went up higher.

Since then, the price had declined. The question then is whether I should exit and look for opportunities elsewhere or still bet on HTPadu.

I have decided to exit when the price hits RM 1.30 per share. My rationale for this is presented in the following sections.

My HTPadu investment history

My actual investments in HTPadu can be summarized as follows:

- I bought 20 lots in 2007 at an average price of RM 1.14 per share and sold all in mid-2019 at an average price of RM 1.29 per share.

- When the price declined subsequently, I bought 70 lots in Oct 2019 at an average price of RM 1.04 per share. 60 lots of these were sold in Oct 2020 at an average price of RM 1.62 per share when the price spiked up.

- I am still holding the balance of 10 lots bought in Oct 2019.

Conceptually, I had 3 tranches of investment with different gains and holding periods. To estimate the total returns from the investment, I computed the weighted average return as summarized in the table below. Note that I defined the return from a total gain perspective where total gain = capital gain plus dividends.

You can see that I achieved a CAGR of 39 %. This was mainly because of the 2019 purchases and sales.

- For the 2007 tranche. I achieved about the same return as that with money kept with the EPF because of the dividends.

- The largest return came from the 2019 purchase because the price ramped up within a year.

- The balance of 10 lots is still generating an acceptable return of about 6 % per annum.

HTPadu background

The Group began its journey as an electronic data processing division of Permodalan Nasional Berhad (PNB). The division was then incorporated in 1994 as a wholly-owned subsidiary of PNB. In 1997, the Company underwent a Management Buy-Out, with management acquiring 65% of shares from PNB.

In 1999, The Company changed its name to HeiTech Padu Sdn Bhd. It secured an IT outsourcing contract from PNB. In 2000 the Company changed its name to HeiTech Padu Berhad line with its listing company on the main board of the Kuala Lumpur Stock Exchange.

The Group is today an ICT systems and technology services provider. The Group claimed that it is a global company serving the government agencies and commercial sectors. I tend to be wary of what companies claim. HTPadu is a good illustration.

We all have different ideas of what a global company does. My view is that a global company is one with diversified global operations from a revenue or earnings perspective. In 2020, Malaysia accounted for about 99 % of the Group revenue. You judge for yourself whether this global claim can be justified.

The Group specializes in developing ICT systems and infrastructure for the public and private sectors. The Group has had more than 20 years of experience. It stands as one of the nation’s major IT players in delivering mission-critical projects for the Malaysian Government.

Historically the Group was very reliant on the public sector for the bulk of its revenue. The Group started to diversify its customer base away from the public sector in 2012. For example, in 2014, the public sector accounted for 63 % of its revenue. The Group had in its 2014 Annual Report stated:

“…Efforts have been doubled to increase contribution from the private sector and to reduce dependency on the Public Sector...”

The Group has not provided any breakdown of its customers’ profiles over the past few years. Looking at its current products and services, I would guess that the majority of its sales have been to the government sector.

|

| Chart 2: HTPadu Products and Services |

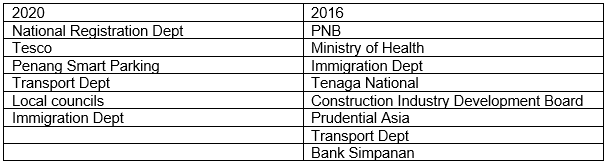

Another way to look at the public sector’s contribution is shown in the table below. It shows the major projects secured by the Group. You can see the strong public sector projects secured.

|

| Table 2: Projects Secured |

However, I think some progress has been made to reduce its dependency on the public sector. This can be deduced by looking at how the trade receivables have changed.

- Approximately 73% (2019: 86%) of the Group’s trade receivables were due from commercial sector agencies in Malaysia. 2020 Annual Report.

- Approximately 67% (2015: 64%) of the Group's trade receivables were due from public sector agencies in Malaysia. Notes in the 2016 Annual Report.

Of course, trade receivables may not reflect the revenue position. During the Covid-19 periods, the private sector may have a much more challenging payment environment. But I hope it shows some success in its diversification plan.

HTPadu performance

When I bought HTPadu in 2007, its revenue had been growing since 2001 and it was paying good dividends. Since then, its performance has deteriorated.

In the table below, I have divided the 2001 to 2020 performance into 4 periods. I have computed the average values for several metrics to show how the performance of the Group had deteriorated since 2001.

|

| Table 3: HTPadu Performance |

The revenue seemed to peak in 2009. After hovering around this level for a couple of years, it began to decline in 2015. Its profit performance was worse with declining profits since 2001. There were even losses in 5 out of the past 10 years.

You can see that while the average revenue from 2016 to 2020 was higher than that from 2001 to 2005, the Group was not profitable. This was because the gross margins had declined significantly.

Gross profitability (defined as gross profit divided by total assets) is a metric developed by Professor Novy-Marx. According to him, it has roughly the same power as book-to-market predicting the cross-section of average returns.

Chart 3 shows that in the past few years, the Group’s gross profitability were lower than that in 2001. The lack of any improvement does not augur well for the immediate to short-term future.

|

| Chart 3: HTPadu Performance Index |

HTPadu products and services

In 2018, the Group changed its segment reporting format. Historically, it has classified its segments based on its products and services. However, from 2018, the Group classified its segments as follows:

- Core 1 - Strengthening of IT business and continuing to support the customers’ business via innovative products, quality delivery, and services.

- Core 2 - Maximising return from investee companies.

- Core 3 - Exploring new business and opportunities

The Group continued to report the respective products and services revenue but grouped into the 3 Cores in the segment report.

The products and services in Core 1 seemed to be from the following:

- System application and development.

- Maintenance.

- Disaster recovery and facility management.

The balance of the existing products and services seemed to be classified under Core 2. Core 3 seemed to be dedicated to new ventures.

The Core segmentation idea seemed to be based on a corporate ownership perspective. Core 1 seemed to consist of those operations where HTPadu has large ownership or control. Core 2 seemed to be from those which are considered investments ie associates and joint ventures. And of course, Core 3 is about new ventures.

I do not agree that this is the best way to analyze the Group’s performance from an investment perspective. I rather looked at them from the products and services perspectives.

I have broken down the analysis into 2 - product groups and recurring vs project-based revenue.

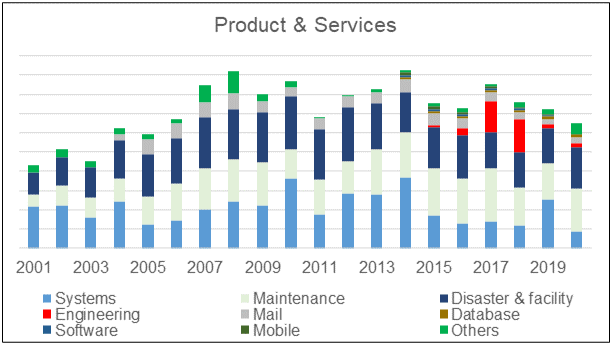

Chart 4 and Table 4 show the analysis by product groups.

|

| Chart 4: HTPadu Revenue Profile |

As can be seen from the chart and table, the 3 biggest contributions were from the products and services under Core 1. They accounted for about 78 % of the Group revenue (based on the 2001 to 2020 average).

The sad part is that they had low or even negative growth from 2001 to 2020. Even looking at the period from 2014 to 2020, they all had negative growth.

HTPadu business can also be classified into recurring income type and project-based type. I would classify the following as recurring income type

- Disaster recovery & facilities.

- Maintenance.

- Mailing

Those not falling into the above 3 are deemed project-based type. You can see from Chart 5 below that:

- The revenue from the recurring income type grew in the early half of the analysis period but has sort of “stabilized” since peaking in 2008.

- In the second half of the period, the recurring income product and services contributed about 2/3 of the Group revenue.

I hope that the above analyses provided insights into why the Group revenue did not exhibit significant growth in the second half of the period.

|

| Chart 5: HTPadu Revenue by Business Type |

What is the conclusion?

- The Group had not been able to grow its legacy products and services. At the same time, it had not been able to grow its new products and services (introduced in 2014) to be sizeable.

- The gross margins of the Group had been declining. I would interpret this as the market becoming more competitive for its legacy products and services.

- The Group had recognized the need to diversify into a new customer base (ie no public sector) and new products and services. But, it had not been able to achieve any success.

The Group has spent the past 10 years trying to address these issues. I do not think that the next 10 years would provide a different picture of the current product and services. I would say that without a new venture, the Group would not be able to regain its historical ROE.

HTPadu financial strengths

As of the end of Dec 2021, HTPadu had a Total Capital Employed (TCE) of RM 219 million. About half of this was funded by Debt resulting in a Debt Equity ratio of slightly more than 1. This is about the borderline DE ratio I looked for in my companies.

The only positive thing is that over the past 10 years, it generated a cumulative positive cash flow from operations. This averaged about RM 22.9 million per year despite an average loss of RM 7.9 million per year. Considering that its average cash flow for investment was RM 8.1 m, the Group did not burn cash.

The Group incurred interest charges amounting to RM 3.9 million in 2021. The balance cash flow from operations is thus sufficient to service the interests. The challenge is whether it can repay the loan principal or get replacement loans when the time comes. Note that about ¾ of the Debt is current.

Given the above, I would not rate HTPadu as financially strong.

|

| Chart 6: HTPadu Sources and Uses of Funds |

|

HTPadu competitive performance

Warren Buffett believes that the quality of a company’s management is a key factor in whether a stock will be a good investment. He made the following comments during Berkshire Hathaway’s annual shareholders’ meeting in 1994.

“I think you judge management by two yardsticks. One is how well they run the business, and I think you can learn a lot about that by reading about both what they’ve accomplished and what their competitors have accomplished...”

The table below compared HTPadu’s revenue and ROE with those of several listed companies in the ICT sector.

You will notice that we can segregate the companies into 2 groups:

You can see that except for MyEG, the revenue of the same size (or large) group shrank from 2012 to 2021. On the other hand, the revenue for the small group generally grew. The exception was Dataprep.

We see the same results for the ROE. Except for MyEG, all the companies in the same size group had average negative ROE for the period 2012 to 2021. For the small group, only Dataprep had negative ROE compared to the positive ROE for the rest of the companies in the small group.

I would conclude that if you were a large company, you needed several e-government projects to be profitable. Securing large government system integration-type projects is no longer the path to profitability. For the companies in the small group, profitability seems to lie in being focussed.

For HTPadu, the route to the 2001 returns seemed to be in new ventures eg e-government type projects. The Core 3 business segment was set up for such purposes. While there is an MOU signing ceremony regarding an e-government venture, nothing came out of it.

The charts below provide another perspective. They compared HTPadu's revenue and ROE with the sector median revenue and ROE. For the sector, I have divided them into those under Bursa Malaysia ACE Board and those under Bursa Malaysia Main Board. You can see that HTPadu performance did not stand out.

|

| Chart 7: HTPadu compared with Sector Revenue |

|

| Chart 8: HTPadu compared with Sector ROE |

When you look at the ROE trends, you can see that it had been volatile for both the ACE and Main Board companies. Both groups had several years of negative ROE although the periods with the negative ROE were different.

Conclusion

The fundamental analysis suggests that HTPadu is not likely to return to its 2001 performance any time soon.

I do not expect significant revenue growth from its current products and services. At the same time, the past decade of results showed that its margins (relative to those in the early part of the period) are being squeezed.

From an investment perspective, the current 10 lots cost me RM 1.04 per share. If there are no prospects of dividends, then I can only hope for capital gain.

What are the catalysts for capital gain? I can think of 3 scenarios:

- It has to be a new source of revenue from a fundamental perspective.

- There could be a market-sentiment spike following some announcement of government contracts for the current products and services. While this may create excitement, I have doubts about its bottom-line impact.

- There could be a price spike following some insider transactions. For example, the controlling shareholder recently acquired half a million shares in the open market. At that juncture, the market price was hovering just below its Book Value.

I do not expect the first scenario. However, the second scenario coupled with more insider purchases could be the catalyst to propel the price higher.

You will notice that this is not about fundamentals. Rather it is about reading market sentiments and this is not something that I have done well. My goal is to exit when it goes above RM 1.30 per share and then invest the proceeds in other undervalued stocks.

At this juncture, the Book Value of RM 1.07 best reflects the intrinsic value of HTPadu. The only problem with this is that the Book Value had been declining from RM 1.95 per share in 2007 to the current price today.

The exit price is about 20% above the intrinsic value. I see this as about the best option given it poor earnings prospects.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment