Investing in a high inflation environment

Case Notes 23. Using US and Bursa Malaysian companies as examples, this post looks at the issues to consider when investing in a high inflation environment.

The IMF said that inflation could hit 8.7% in emerging economies and developing countries this year (2022). (Source: Yahoo News)

- The annual inflation rate in the US as of the end of Mac 2022 was reported to be 8.5%.

- The Consumer price index in the UK rose by 7% in the 12 months to March 2022.

Many opined that the high inflation is due to a combination of the Ukraine war and the disruption in the supply chain. There are also those who think that this is the result of the various economic measures taken to combat the economic impact of Covid-19.

Malaysia is not immune to this. While according to Bank Negara, Malaysia’s inflation is expected to average between 2.2 % to 3.2 % in 2022, many think that is because of the various subsidies.

If you are like me, you are unlikely to stop investing in stocks just because of high inflation. As such we should get a better understanding of the impact of high inflation on stock picking and valuation. We can then see how to tweak our value investing process during periods of high inflation.

Join me as I explore this topic. I will look at what value investors like Warren Buffett recommend as well as see what we can learn from valuation theory.

Disclaimer: I have used actual companies to illustrate my points in this article. But I am not suggesting them as candidates for investment. Such a decision should be based on comprehensive fundamental analyses of the various companies. I have not done so here.

Contents

- Buffett’s criteria for inflation-beating companies.

- Good business economics.

- Inflation and valuation - the theory.

- Conclusion.

|

Buffett’s criteria for inflation-beating companies

“Inflation swindles the bond investor...it swindles the person who keeps their cash under their mattress, it swindles almost everybody...” Buffett, 2022 Berkshire Hathaway shareholders’ meeting.

Over the years Warren Buffet has made several comments on the types of business to invest in during inflationary periods.

“The best businesses during inflation are the businesses that you buy once and then you don’t have to keep making capital investments subsequently...” 2015 Berkshire Hathaway shareholders’ meeting.

“…must have two characteristics: (1) an ability to increase prices rather easily… without fear of significant loss of either market share or unit volume, and (2) an ability to accommodate large dollar volume increases in business…with only minor additional investment of capital.” 1981 letter to shareholders.

In the context of fundamental analysis, I would translate the above into the following:

- The company must have pricing power. One sign of this is a “stable” gross profit margin.

- The ROE should be higher than the expected inflation rate.

- The company should have low capital needs. One sign of this is a low reinvestment rate. I defined reinvestment = CAPEX - Depreciation & Amortization + Net Working Capital. The reinvestment rate = Reinvestment / EBIT(1-tax).

US example

I have an article in Seeking Alpha where I identified Generac Holdings Inc (GNRC) as a company to invest in during inflationary periods. This was based on the above criteria. Refer to “Generac: Not Running On Full Power As The Earnings Seem To Be From Generators”.

Table 1 summarizes the historical performance of GNRC for the 3 metrics.

GNRC’s gross profit margins have been quite “stable” over the past 12 years as can be seen from Chart 1. It actually had a standard error of 4.2 %. This was despite the past 3 years’ average revenue being 3.3 times the average revenue from 2010 to 2012. This indicates pricing power.

Secondly, the average 28% ROE will mean that there is a strong likelihood that GNRC will outperform the US inflation rate.

Thirdly, GNRC’s past 12 years’ average reinvestment rate was zero. This was because that were periods when the amount spent on CAPEX and Working Capital was much lower than the Depreciation and Amortization. Over the past 12 years, the revenue of GNRC had grown significantly. It thus indicates that this is a company with low capital needs.

Malaysian example

Among the KLCI component companies, Nestle Malaysia Berhad (Nestle) had the following performance:

|

| Table 2: Nestle (M) Performance Notes (a) Same definition as per item (a) in Table 1 |

I would conclude that Nestle would be able to meet Buffett’s inflation-beating criteria.

- Nestle’s gross profit margins were also “stable” with a standard error of 6.2%. However, the average revenue for the past 3 years was only 1.3 times the average revenue from 2010 to 2012. Nestle’s products are probably towards the “necessities” end of the necessity vs luxury scale.

- Secondly, with 85 % ROE, there is almost certainty that Nestle will outperform the Malaysian inflation rate.

- Finally, the average reinvestment rate is 2%. This was because there were also certain years when the amount spent on CAPEX and increase in Working Capital was less than the Depreciation and Amortization.

Warren Buffett focuses on the price effect. I would argue that during periods of high inflation, the issue is not just addressing high prices. There will also be economic growth challenges resulting from the government’s efforts to combat the high inflation.

When looking for companies to invest in, you also want those who are financially strong and where management has a good track record. You want companies that can withstand a combination of high prices and low economic growth or even stagflation.

Good business economics

In a recent Seeking Alpha article, I argued that an investment for a high inflation environment is one with good business economics. Refer to “NVR: A Good Jockey On A Strong Horse Riding Into A High Inflation Environment.”

The gist of the article was:

- In a high inflation environment, companies have to worry not only about higher costs. They also have to contend with the economic impact of the various measures taken to control inflation.

- The homebuilding sector has the business economics to overcome high prices and low or negative economic growth.

- Homebuilders that will do well are those with a strong management team and good business economics. This will be reflected by a track record of strong returns, shareholders’ value creation, and strong financials.

- But this requires you to view them from a long-term perspective and through a cyclical lens.

US example

I had argued that the US homebuilding sector fits the above criteria. I examined the key drivers of business performance for this sector for the past 46 years from 1975 to 2021.

I first looked at 2 key metrics for the homebuilding sector. The first is the number of houses constructed as represented by the Housing Starts. The other is house price as represented by the House Price Index (HPI).

I looked at how these 2 metrics changed compared to inflation over the past 46 years. Refer to Chart 2.

You can see that the HPI increased at a higher rate than the Inflation Index. At the same time, the Housing Starts index did not show any long-term uptrend. I would interpret the results as follows:

- There is no long-term growth in the average Housing Starts. Long-term volume growth for any homebuilder has to come from taking market share from its peers. If there is no track record for this, you have to assume a long-term average sales volume that is pegged to the long-term average Housing Starts.

- Even if there is no long-term volume growth, there will be long-term revenue growth due to the growth in house prices.

To get an indication of whether the homebuilders would be able to pass on their costs, I next plotted on the same chart the Building Cost Index. As can be seen from Chart 2, the cost index increased at a slower rate than the HPI. I interpret this as a positive sign.

But this is not the full picture as inflation will affect the demand for houses.

I am not an economist so I would not try to project the short-term impact of high inflation on the housing industry. Rather it is better to take a long-term view of the sector. Over the past 70 years, the Housing Starts have gone through several cycles with no uptrend in the long-term average annual units as shown in Chart 3. Note that these covered several high inflation periods.

I interpret this as a positive sign. The long-term average Housing Starts are not affected by high inflation.

|

| Chart 3: US Housing Starts |

In my Seeking Alpha article, I have identified NVR Inc (NVR) as a homebuilder with good business economics and strong fundamentals.

- It had the best average performance among the top 5 home builders in the US.

- It is financially sound. I consider this from 3 perspectives - DE ratio, capital structure, and cash flow from operations.

- It has a track record in creating shareholders’ value. I looked at 3 metrics comparing the returns with the respective cost of funds.

For details refer to the Seeking Alpha article.

Malaysian example

Chart 4 shows how the HPI compared with the Inflation index for Malaysia over the past 18 years. Although it is a shorter history than the US, you can see a similar pattern of the HPI outgrowing the inflation rate.

The Housing Starts index also showed a similar “no-long-term growth” pattern. I could not get the equivalent construction cost index. But the chart does show that the property companies in Malaysia are good inflation-beating bets.

|

| Chart 4: Malaysia - Impact of Inflation |

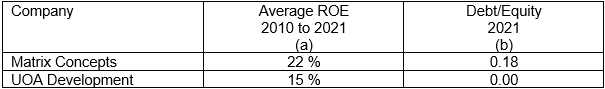

I used the same criteria as those for the US homebuilders to identify the Bursa Malaysia property companies. Table 3 shows the metrics for 2 such companies that could perform well in a high inflation environment. They are Matrix Concepts and UOA Development. Refer to Table 3.

|

| Table 3: Examples of Malaysia Property Companies Performance Notes - If you refer to my blog post “Will the Malaysian Property Sector turn around by 2024” for the large companies, you will find that (a) The average median ROE from 2010 to 2020 was 7 %. (b) The median DE ratio in 2020 was 0.44. (c) By having an ROE greater than the cost of funds, the companies would be able to grow shareholders’ value. |

Inflation and valuation - the theory

I will use the single-stage Free Cash Flow to the Firm (FCFF) valuation model to illustrate how inflation will impact the valuation of a company. It is meant to show that the impact of inflation is not so straightforward as it affects more than one parameter driving the value of a company.

Value = FCFF X (1+g) / (r - g)

Where:

FCFF = EBIT(1-T) X (1 - Reinvestment rate)

EBIT = (Revenue X Gross Profit margin) - SGA

Reinvestment = CAPEX - Depreciation & Amortization + Net Working Capital

Reinvestment rate = Reinvestment / EBIT(1-T)

T = tax rate

g = growth rate = Reinvestment rate X Return

r = cost of funds = WACC

WACC = Risk free rate + Beta X (Equity risk premium)

If you look at the model, there are 3 main parameters that affect the value - Free Cash Flow, growth, and the WACC.

Inflation and Free Cash Flow

In an inflationary environment, the cost of inputs will increase. If the company is not able to pass the price increase to its customers, the gross profit margins will decrease. Even if the company can pass the cost increase, it must be able to do so without affecting its demand.

A company with pricing power is then one that can achieve higher earnings during inflationary times.

But this is not the full picture. Consider a company that has high reinvestment rates. In other words, high CAPEX and Net Working Capital relative to the Depreciation and Amortization. In times of inflation, it will incur higher Reinvestments.

If the increase in earnings is not sufficient to offset the increase in reinvestments, there will be a decrease in the Free Cash Flow. You can see why Buffett opined that an inflation-beating company is one with strong pricing power and low capital needs.

Inflation and growth

Conceptually growth is a function of the reinvestment rate and return. With higher CAPEX and Working Capital, the reinvestment rate will be higher in an inflationary environment.

But this will lead to higher capital employed and if the earnings do not increase appropriately the return will decline. You can see the challenges of maintaining growth. And we have yet to consider the duration of the high inflation.

I have shown a simple one-degree impact. In practice, there are probably second-degree effects so it is not so simple to predict the impact on a particular company.

Inflation and WACC

Many expect the authorities to raise interest rates to combat inflation. This will of course lead to an increase in the risk-free rate.

For those companies with Debt, there will be a rise in the interest rates. If the earnings do not increase substantially, the interest coverage ratio will drop. In other words, the default risk will go up leading to a higher cost of debt.

At the same time, the equity risk premium will also go up. Even if we assumed that there is no change to the Beta, you can understand why many expect the cost of funds ie the discount rate to go up with inflation.

All else being equal, an increase in the cost of funds will reduce the value of the firm. The only way to avoid this is for the Free Cash Flow to increase substantially to more than offset the increase in the WACC.

|

Conclusion

There are 2 aspects of fundamental analysis - company analysis and valuation. Valuation is based on how the company will perform in the future. While we do not have a crystal ball, looking at how a company had performed historically can provide insights into its future.

That is why I believe company analysis and valuation go hand in hand.

The challenge in a high inflation environment is that determining how the company will perform in the future is not so clear. The future is different from the past. This is especially if the company has no history of operating in such a high inflation environment.

This is especially true for most US and ASEAN companies. I don’t think we will end up like Venezuela (2,300 + % inflation in 2020) or Zimbabwe (557 % inflation in 2020). But I am sure we will be looking at high single digits in the coming one or two years.

I hope this article gives you some insights when assessing companies going into such an environment. The main point is that it is not so simple to forecast the impact of high inflation on the value of a company as there are many moving parts.

We don’t know how high the inflation rate will go or how long it will last. Worse still, we do not know what the various counter inflation measures will do to the economy.

That is why I believe that companies with the following characteristics are the ones that will do well in a high inflationary environment:

- High ROE with low capital needs.

- Financially sound.

- A management team with a good track record.

In the parlance of Warren Buffett, we need a good jockey riding on a good horse.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment