Is Opensys an investment opportunity?

Value Investing Case Study 28-1: Opensys: Evaluating a hidden IT investment opportunity.

Last month, I published a post on the Malaysian ICT sector. Apart from compiling the base rates, I screened for investment opportunities in this sector. Refer to “Hunting for Bursa Malaysia ICT services and software companies.”

I identified Opensys as the only company that met my screening criteria. I used 4 metrics to screen for investment opportunities. The first three relate to the business fundamentals while the last relates to valuation.

- ROE. My target is to have a 10% return based on the average ROE over the 12 years.

- Growth in gross profitability. I consider gross profitability as the main metric to predict stock market returns.

- Positive cumulative Cash Flow from Ops. I used this as a proxy for financial strengths.

- Free Cash Flow Yield > 5%. I used this as the valuation metric.

This article is my investment thesis for Opensys. A detailed fundamental analysis shows that at the current market price of RM 0.35 per share (as of 13 June 2022) there is a sufficient margin of safety. In other words, Opensys is an investment opportunity from a long-term value investment perspective.

Should you go and buy it? Well, read my Disclaimer.

Contents

- Investment Thesis

- Rationale

- Group expertise

- Fundamentally sound

- Valuation

- Conclusion

|

Investment Thesis

Opensys (the Group) is an IT solutions provider that is currently serving banks with its cash and cheque processing equipment. The Group also provides bill payment services to telco and utility companies.

Although its revenue in 2021 was 40% lower than that for 2019, it was due to the various Movement Control measures taken to control the pandemic. With the opening of the economy, I expect the revenue to recover.

The Group had achieved double-digit revenue growth over the past 12 years driven by its Cash Recycling ATMs. While there is a limit to this market, I expect the Group to continue with its double-digit growth for the next 6 years. This will provide time for its new products/services to gain traction.

Its market price at RM 0.35 per share (as of 13 June 2022) has yet to reflect in its full business recovery value. I estimated its EPV at RM 0.40 per share and its Earnings value with growth at RM 0.47 per share.

There is a sufficient margin of safety and I would see it as an investment opportunity.

|

Rationale

- The Group’s growth for the past few years was driven by its Cash Recycling ATMs. While there is a limit to this growth, it is not going away any time soon. The Group had used this to grow its maintenance business and I expect this to be a major contributor in the event the equipment sales decline.

- The Group had also grown its third-party bill payment business. This is a business process outsourcing (BPO) niche serving the telco and utility companies.

- The Group is still in the growth phase of its life. Whether it can extend this growth period will depend on whether it can introduce new products with similar market size.

- The Group is fundamentally sound. It has a good track record in revenue growth and in maintaining its margins. It is also financially strong.

- It is currently undervalued. Reverse engineering showed that the market is pricing Opensys based on a revenue lower than that of 2021. The market had over-reacted to its past 2 years’ revenue decline which was due to the Covid-19 measures.

- A valuation of Opensys based on a single-stage growth model resulted in an Earnings Value with 3 % growth of RM 0.47 per share.

Group expertise

Opensys started in the 90s by providing software support for a big American MNC supplying ATMs and POS equipment to banks and retailers.

The Group has since grown so that today it has a nationwide support infrastructure with 24 West and East Malaysia centers. It dominates the Malaysian market for cash recycling ATMs, bill payment kiosks, and intelligent cheque processing solutions.

I would classify its revenue sources into 3:

- Providing cash recycling and cheque processing equipment to the financial institutions.

- Operating bill payments and cheque processing on behalf of 3rd parties.

- Providing maintenance and software services that are tied to the equipment sold.

Opensys IPO in 2004 and during the first decade of its listed history, it established itself with 2 key solutions:

- OpenSys pioneered the concept of non-cash-dispensing self-service called Efficient Service Machines (ESM). It allowed customers to make deposits of cheques and cash. Customers can also pay bills using different instruments such as cash, cheques, credit, and debit cards in one compact machine.

- Cheque truncation system (CTS). This is an image-based cheque clearing system that minimizes the physical movement of cheques. It converts cheques and standing instructions into electronic fund transfer instruments.

But the big break for the Group came when it worked with OKI of Japan to provide cash recyclers. These are self-service kiosks that combine the functions of cash dispensing and cash deposits.

Most banks deploy both dedicated cash dispensing ATMs and cash deposit machines (CDM). The cash recyclers combine the functions of both the ATM and CDM.

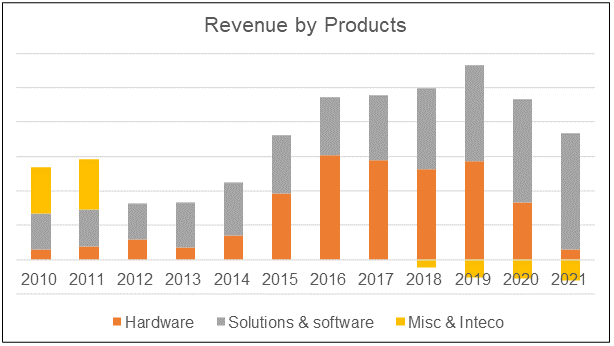

This was a very successful product/service as can be seen from the increase in revenue from 2014 onwards. Refer to Chart 1.

|

| Chart 1: Revenue |

Opensys has adopted a two-pronged approach to address the market:

- Providing cash and cheque processing equipment to the financial institutions. I estimated that the revenue from the sale of equipment amounted to about RM 6 million in 2021. Note that this had declined because of the Movement Control measures to control Covid-19. Pre-Covid-19, it was far larger. Refer to Chart 3.

- Operating bill payments and cheque processing on behalf of 3rd parties. Today, Opensys helps its clients collect RM17 billion annually or more than 20 million transactions per year. The main customers are the telecommunication and utility companies. In 2021, this accounted for about 1/3 of the Group revenue.

The Group has not provided its results by products/services or how it approached the market. But by looking at how its revenue had grown over the past 2 decades, I deduced the following:

- The cash recyclers contribute a bigger portion of the revenue than the ESM or CTS.

- The main customers for the cash and cheque processing equipment are the banks. The telecommunication and utility companies are the main customers for bill payments operations.

The Group also provides maintenance and software services as part of its product/service offerings. But these are linked to the existing products and services. I would not consider them independent businesses in the context of risk assessment or growth prospects.

Fundamentally sound

Opensys is a fundamentally sound Group based on the following:

- It had a CAGR in revenue of 7.8 % from 2010 to 2021. This was despite the drop in revenue in 2020 and 2021 due to the Movement Control measures to control the Covid-19 pandemic. If you ignore the pandemic periods, its revenue from 2010 to 2019 increased at 16.1 % CAGR.

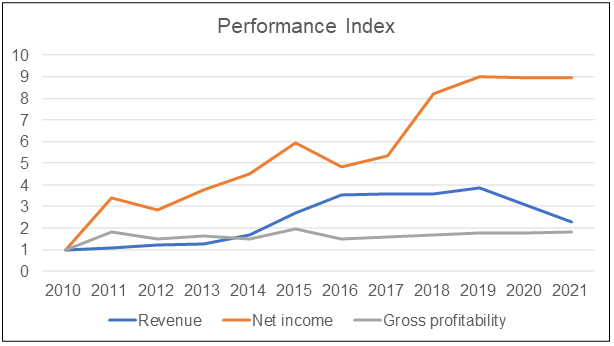

- Despite the drop in revenue in 2020 and 2021, PAT did not decline. Refer to Chart 2. From 2010 to 2021, PAT grew at 22 % CAGR.

- Over the past 12 years, it achieved an average ROE of 13.4 %.

- Its gross profitability had increased from an average of 23 % (2010 to 2012) to an average of 28 % (2019 to 2021). Gross profitability is defined as gross profit/total assets. Professor Novy-Marx opined that this metric performed as well as Price Book in predicting market returns.

|

| Chart 2: Performance Index |

I would also consider Opensys as financially strong:

- It has a Debt Equity ratio of 0.12 as of the end of Dec 2021.

- Its cash and securities accounted for about 44% of its Total Capital Employed (SHF + Debt) as of the end of Dec 2021.

- Over the past 12 years, there was only one year (2014) that it had a negative Cash Flow from Operations.

- It has an equivalent AAA rating. This was estimated based on Damodaran’s synthetic rating. This in turn is based on the interest coverage ratio.

Growth prospects

As can be seen from Chart 3, the revenue growth of the Group was driven by both growths in hardware sales as well as on the software side. Note that in 2020 and 2021, the hardware sales contracted.

|

| Chart 3: Revenue by Products Notes The Misc sales in 2010 and 2011 relate to computer equipment while from 2018 onwards, it related to inter-segment sales for the software and solutions segment. |

The Group’s growth prospects are based on the following assumptions:

- In Malaysia, cash transactions are still relevant.

- The penetration of cash recyclers in Malaysia is still low.

- There is still demand for out-sourced payment services in Malaysia.

Let us look at the evidence for each of the above.

Cash transactions

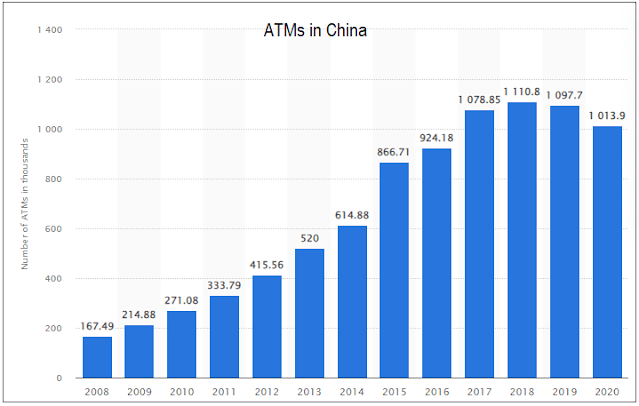

Charts 4 and 5 show the trends of ATMs in Malaysia and China.

- China is often touted as the most advanced digital payments/cashless society. According to Statista, 2019 was the first year in which the number of ATMs decreased. As mobile payments become more popular, the demand for cash and its related infrastructure decreases.

- The number of ATMs in Malaysia does not appear to be growing when comparing the 2020 numbers with those 8 years ago.

Comparing Malaysia with China, I would agree with the Group’s position:

“Despite the onslaughts from cards, Internet Banking, mobile payment, and e-Wallets, cash is still holding its ground. There are many factors and statistics to support that cash is not going away anytime soon.” Opensys 2019 Annual Report.

|

| Chart 4: ATMs in Malaysia Source: Statista |

|

| Chart 5: ATMs in China Source: Statista |

Market penetration

I quote the following from Opensys 2019 Annual Report:

“Due to the efforts of OpenSys, the number of CRMs increased dramatically from a small installed base of 200-300 units in 2014 to more than 5,000 units at end 2019. The total installed base of CRMs now only constitutes about 30 percent of total machine population of 17,000 units.”

While the 30% penetration is technically correct, it probably overstated the market. This assumes that a bank replaces one conventional ATM and one CDM with 2 CRM. Opensys has touted that one CRM does the work of the ATM and CDM together. I would have thought that if so, it is a 1 for 2 replacement. The addressable market for the CRM would be much lower than the 17,000 total machine population.

Assuming 1,000 units per year of sales (based on the past 5 years of installation), and 1 for 2 replacement, it would take 6 years to replace all the ATMs and CDM.

We can debate the replacement rate and the total addressable market. But the point is that there is a limit to the replacement market as far as the current CRM is concerned. Given the possible growth in the ATMs and the 1 for 2 replacement, I would think that there is at best a decade of product life.

On the other hand, it is not all doom and gloom.

“In a little more than 50 years, the ATM has come a long way to meet growing market trends - and it will continue to evolve to meet changing consumer demands…What seems certain is that the ATM…will continue to meet consumers’ expectations for easy, convenient, and digital first banking services well into the future.” NCR

But to tap into this NCR future, Opensys will have to innovate again.

Outsourced Bill Payments

According to the Group, the business process outsourcing (BPO) segment accounted for RM 20.09 million in 2021 compared to RM 21.85 million in 2020.

I could not find historical revenue for this segment. The closest was in 2010 with the following stated in the Annual Report:

“Our recurring income comprising life-cycle maintenance of equipment and business process outsourcing (based on click or transaction charges) is now at 75% of our total revenue.”

I estimated that the BPO segment revenue in 2010 to be about RM 11 million estimated as follows:

- Based on the 2010 Group’s revenue of RM 26.8 m, the maintenance and BPO revenue amounted to RM 20.1 million.

- In 2021, the maintenance and software services segment achieved RM 33.8 million in revenue. The Group provided maintenance services for more than 7,000 devices.

- In 2008, the Group stated that it had installed 1,800 machines. This is about ¼ of the number of devices covered under the maintenance segment in 2021.

- I guesstimate that the maintenance revenue in 2010 to be RM 9 million ie about ¼ of the RM 33.8 million. The BPO revenue in 2010 = RM 20.1 million - RM 9 million = RM 11 million.

Based on the above statistics I estimated that from 2010 to 2021:

- The BPO revenue doubled. This is about 6.5 % CAGR.

- The maintenance and software services grew at a 12.8 % CAGR.

The conclusions from the above analysis are:

- The BPO and maintenance businesses make up the bulk of the non-equipment sales. Over the past 2 years, these accounted for about RM 50 million of the external sales.

- From 2015 onwards, the equipment sale on average accounted for about half of the Group revenue. I guesstimate that the CRM accounted for ¾ or more of this revenue.

- The CRM is replacing the conventional ATM and CDM and as such there will be a limit to the Group revenue growth from equipment sales.

- However, I expect the maintenance segment revenue to be at least double the 2021 revenue when this limit is reached. This will provide a RM 100 million base revenue for the Group.

The above have not considered the new products/services that the Group is working on such as:

- The Branch of the Future.

- The white label payment kiosks.

- The buySolar.

Valuation

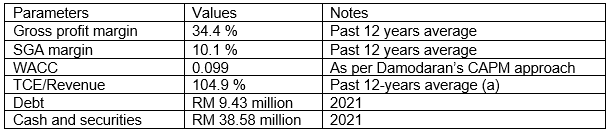

I valued Opensys using a single-stage discounted free cash flow to the firm (FCFF) model.

Value of the firm = FCFF X (1 + g) / (r - g)

FCFF = EBIT(1 - tax rate) - Reinvestment

EBIT = Gross profit - SGA

Reinvestment = CAPEX + Net Acquisitions - Depreciation & Amortization + Net Working Capital

r = WACC. I derived this following Damodaran approach with a 2.31 % risk-free rate, unlevered Beta of 1.41 for the information services sector, and a 27 % tax rate.

g = growth rate = Reinvestment rate X Return.

Reinvestment rate = Reinvestment / EBIT(1 - tax rate)

Return = EBIT(1 - tax rate)/TCE where TCE = SHF + MI + Debt - Cash

Gross profit = Revenue X Gross profit margin.

SGA = Revenue X SGA margin

The value of equity = Value of firm - Debt + Cash & Securities

The key assumptions used in the valuation are

|

| Table 1: Valuation Assumptions Notes (a) This is to determine the TCE relevant for the assumed revenue so that we can determine the Reinvestment rate. |

Based on this model, I reverse-engineered the RM 0.35 market price. I found that it would be equal to a scenario where the base revenue = 2021 revenue with a long-term growth rate of 3%.

You would agree that this is a very conservative estimate. A valuation based on RM 82 million base revenue and a growth rate of 3% resulted in the following:

EPV = RM 0.40 per share ie 14 % margin of safety.

Earning Value with 3 % growth = RM 0.47 per share ie 34 % margin of safety.

|

| Chart 6: Valuation |

Note that as a service company, the Asset Value would not reflect the Earnings Value as the majority of the Group’s assets are in intangibles such as the product development expenditure and its human capital. As such I would not look at the Asset Value.

Valuation risks

There were 2 key parameters in my RM 0.47 per share value - the RM 82 million base revenue and the 3 % growth rates.

The RM 82 million revenue was based on 2019 to 2021 average revenue. This is a conservative estimate because:

- The BPO and maintenance external revenue in 2021 was about RM 55 million. I expect this to double by the time the demand for the CRM is satisfied.

- The equipment revenue from 2010 to 2013 (to exclude the CRM) averaged RM 8 million. Even without the CRM, I expect this to be maintained.

- I expect the Group to develop and market new products so that there are other equipment sales when the CRM market is satisfied.

As for the growth rates, I have assumed that there is no high growth phase. But as can be seen from the historical growth rates, I would expect the double-digit growth rate to resume in 2022. This is because the sales of equipment in the past 2 years were derailed by the Covid-19 measures.

There is already a 34 % margin of safety based on the single-stage model. If I assume a high growth stage, I would value it with a two-stage growth model. There would be a greater margin of safety with a two-stage growth model.

Based on the above, I would argue that the valuation risk is low.

About the only item of concern would be the WACC. This was derived based on Damondaran’s Jan 2022 dataset. I am sure that it was based on the pre-Ukraine invasion situation. It probably did not consider the high inflation environment. Thus going forward, the risk would be higher and I would expect a higher WACC.

At this stage, I am relying on the margin of safety from the single-stage valuation model to more than cover the higher risk.

|

Conclusion

Opensys is a niche IT solutions provider with its cash and payment processing solutions. It has a strong track record among financial institutions, telco, and utility companies.

Given the digital disruption in the financial sector, its current products have limited lives. The Group has to continue to innovate and develop new products if it is to grow over the long term.

The challenge with analyzing and valuing such a Group is to look beyond its existing products. You have to assume that it can continue to develop solutions that its customers want.

I am confident that the current products/services would provide double digits growth for the next 6 years. With a bit of luck, it could be for 10 years.

We are lucky with Opensys in that the current market price does not reflect this growth path. Even a conservative estimate based on low growth rates and the past 3 years’ average revenue provided a sufficient margin of safety.

As such I would consider Opensys as an investment opportunity.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment