Parkson Holdings - how to handle a price decline

Value Investing Case Study 12-4: A review of my holdings in Parkson Holding. I also share my framework for determining what to do in cases where the price had declined substantially.

- Buying a fair company at a wonderful price. In many instances, this meant buying companies in trouble and hoping for them to turnaround.

- Buying a wonderful company at a fair price. This meant buying successful companies that have moats and long growth runways. They can compound shareholders’ value.

Warren Buffett started his investing life with the first approach but later adopted the second approach. He had credited the second approach for Berkshire Hathaway success.

We all like to follow Berkshire Hathaway success. But I have 2 challenges with the second approach.

There are few compounders under Bursa Malaysia. You are looking for companies with double-digits ROE and long growth runway. Even if I could find such companies, I would have difficulty estimating the fair value.

I ended up with more turnarounds than compounders in my portfolio. The problem with turnarounds is that not all return to profitability. Losses could continue as you hold them.

How do you decide whether a company should be given the time to turn around or to sell and cut your losses?

Let me share with you how I have handled this predicament using my Parkson Holdings (PHB) investment as a case study.

Should you go and buy it? Well, read my Disclaimer.

Contents

- My PHB investment history

- My Exit or Hold Decision Framework

- PHB Case Study

- Conclusion

|

I am a value investor in the Graham sense - buying fair companies at wonderful prices.

Unfortunately, most of the times, this meant buying out-of-favour stocks. If the stocks are popular, they are unlikely to be trading at wonderful prices. The common reason for a stock to be out-of-favour is a deterioration in the business performance. There could even be a few quarters or years of losses.

Given this scenario, you should not be surprised to find that some of my stocks belong to the turnaround category. To make money here, the company has to show a few years of improving profitability before the market becomes excited about the stock again.

Since we do not have a crystal ball to foresee the future, there is no guarantee that a company would be able to turn around. Even if the company can turn around, you do not long how long it would take.

The question then is how do you decide whether a turnaround is unlikely to happen or that it still needed more time.

This is an important investment question. If the turnaround is unlikely to happen ie you had made a mistake, you get out. But if the turnaround needed more time, you should continue to hold.

Over the years, I have had situations when I sold off my stocks too early. I later found out that a year or two after I have sold it, the business returned to profitability and the stock price rose up. I lost money when I sold it off. If I had held onto it, I would have made money.

I have also the bad experience of holding onto the stocks for too long. The stocks never returned to profitability. One or two became bankrupt. There were a few occasions that they were delisted before they had the chance to recover. In such instances, I lost more money compared to the situation if I had sold earlier.

I have since adopted a decision-making framework that helps to reduce the mistake of selling off too early or holding on for too long.

I will illustrate this with my investment in Parkson Holdings (PHB). If you are not familiar with the company, I suggest that you first read "Will Parkson Holdings turn out to be a dud?"

My PHB investment history.

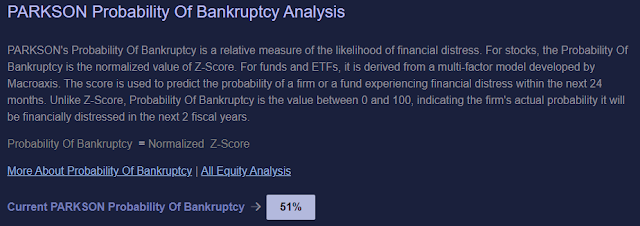

The table below summarizes my purchase history. You can see that I had built-up my investments over a 3 years period. The bulk of my purchases were in 2016 and 2017 when the Group were suffering losses. It was a turnaround investment.

When I first bought PHB in 2014 at the average price of RM 3.02 per share, I had estimated the EPV to be RM 3.75 per share. This was seen as a “quality” investment.

- It had 12-years’ average historical EPS of RM 0.47 and dividends of RM 0.13 per share.

- Based on a trendline analysis, revenue was growing at 8 % per annum.

- It had a brand value of RM 0.98 per share that was not accounted for in its books.

When I bought the 2016 tranche it was based on the results till 2015. PHB reported a loss of RM 12.9 million for 2015. In its 2015 Annual Report, it stated that:

“…the Group continued to witness increasing complexities in the market place with the rapidly evolving retailing environment, ever more demanding and sophisticated consumers, growing competition and rising costs”

But, it was not that gloomy then as:

- It had marginally higher gross sales proceeds of 3% in 2015 as compared to that in the previous year.

- The Group’s financial position in 2015 remained healthy with RM 2.8 billion cash and shareholders’ funds of RM 2.5 billion.

My average cost of investments in PHB in 2016 was RM 0.84. I had estimated that there was a sufficient margin of safety then as:

- The NTA was RM 0.89 per share. The Book Value was RM 2.44 per share.

- The average EPV was RM 1.70 per share. Note that I used both the Free Cash Flow and Residual Income models to determine the EPV.

When I bought the 2017 tranche, it was clear that PHB was a turnaround investment. The Group had incurred losses since 2015. The loss in 2016 was much larger than that in 2015. In its 2015 Annual Report, the Group stated the following:

“It has been a challenging year…where the Group operates continuing to face headwinds…China continued to experience market slowdown…The Malaysian economy remained adversely affected by the weak commodity and oil prices and depreciating Ringgit…our Vietnam operations has largely been impeded by the increase in new retail space...”

But I considered the following from the 2016 Annual Report as positive for a turnaround. It suggested that management had recognized the problem and had a strategy to address it.

“…its journey of transforming into a lifestyle concept retail business began to gain momentum…coupled with its strong financial position, the Group will continue to execute its strategies in order to stay ahead…”

I bought the 2017 tranche at an average price of RM 0.64 per share. There was still a margin of safety. I did not focus on Earnings Value as this would require me to project the future profits.

Rather I looked at the Asset Value to provide the margin of safety:

- The NTA in 2016 was RM 0.84 per share. This did not include the brand value. There was also an investment property surplus of RM 0.04 per share that was not accounted for in the NTA.

- I had estimated the Look Thru NTA to be RM 1.12 per share.

My thesis was that the Group’s Omnichannel marketing strategy would enable it to continue to be relevant in the digital economy. Also, the Group had also diversified into consumer credit and mall ownership.

The Group still had the financial strengths. It had then a DE ratio of 0.7 and a 1.1 current ratio. The net debt to EBITDA of 2.5 was much lower than my 4.0 cut off. And the Group still had RM 1.83 cash per share.

I figured that the Group had the financial strengths and track record to turn around. But I had not anticipated the impact of Covid-19.

The Group continued to incur losses so that as of end Dec 2021, its NTA had reduced to RM 0.35 per share. The market price of PBH as of 13 May 2022 was RM 0.165 per share.

The question of whether to exit or hold is a relevant one.

|

My Hold or Exit Decision Framework

This decision framework assumed that the current market is significantly lower than the purchased price. I established this decision framework to avoid two types of mistakes:

- The first is to sell wrongly. I thought that it was an investment mistake when in fact the investment thesis was still valid. I sold at a loss when I could have made money if I had held onto it.

- The other mistake is to continue to hold when I should have sold. I then later sold it for a much bigger loss. There was not only a bigger loss but also an opportunity cost of not selling earlier.

I would summarize the decision framework with the following decision tree.

|

| Chart 1: Hold or Exit Decision Framework |

You can see that there are 3 Decision stages (denoted by the blue box), 2 Sell positions and 2 Hold positions

Decision 1. When the price drops below your purchased cost, the first question you need to ask is whether your cost is still lower than the intrinsic value. You should review the intrinsic value to cater for the changing prospects.

Decision 2. If there is still a margin of safety, you should ask whether the business is a buying opportunity if you did not own any shares. You would analyse the business prospects as well as the downside risk. I have this step to avoid the various behavioural biases.

Decision 3. The reason to sell and incur the loss is because you think you can make better returns with other stocks. But this is not guaranteed. You want to check that the returns from an alternative investment far outweigh the prospects of the stock turning around.

Sell 1. The sell decision is because the intrinsic value had declined to be below your purchased cost. From a value investment perspective, it would be tough for the price to rise above the intrinsic value.

Sell 3. The sell decision is because you are more likely to make money from the alternative investment than with the existing stock. This is even if the purchased cost is lower than the intrinsic value.

Hold 2. You hold because this is still a good investment.

Hold 3. While you would not buy more, you hold because it is still better than alternative investments.

PHB case study

I will illustrate how I used the framework for the PHB investment.

Stage 1

The market price of PHB as of 13 May 2022 was RM 0.165 per share. My purchased cost of PHB was RM 0.80 per share. The current market price is below my purchased cost and the latest estimate of the intrinsic value.

The NTA of PHB as of the end of Mac 2022 was RM 0.23 per share. But this was before accounting for a fair value gain of RM 1.56 per share for its investment properties. The revised NTA would then be RM 1.79 per share.

From 2015 to 2021, the NTA reduced from RM 0.89 per share to RM 0.35 per share. This was equal to about RM 0.09 per share per year. If the NTA continue to reduce at this rate, it would take about 11 years for the revised NTA to drop to my purchased cost level. There is a sufficient margin of safety.

I did not sell and thus proceeded to Stage 2.

Stage 2.

There were two issues to consider - the business prospects and the financial risks.

In the case of PHB, the turnaround will depend on whether it has met the digital disruption challenge.

The Group has two major operations - China and Malaysia - which accounted for about 70 % and 23 % of the Group’s revenue.

There were signs that the Group had reinvented itself in China when the Group achieved a 5% growth in same store sales in 2019. In 2018, the same store sales contracted by 2%.

But then Covid-19 hit in 2020 and the same store sales in China contracted by 23%. I could not find any information on this for 2021 but I do not expect any growth.

The main challenge is that China is still adopting the zero Covid-19 policy. As such there is no clarity on how long it will take for the retail sector to recover. On the positive side, the revenue from China in 2021 was higher than that in 2020.

As for Malaysia, the 2021 revenue was about half of that in 2019. The positive thing is that Malaysia has opened it borders in May 2022 and I expect the business to recover.

Overall, I concluded that PHB could turn around.

Financial risk

I would not rate PHB as financially strong. As of the end of Dec 2021, the Group had the following:

- Current ratio of 0.6.

- Debt Equity ratio of 1.6.

- Interest coverage ratio of 0.29 based on the past 12 years EBIT and 2021 interest incurred.

- Net Debt/EBITDA of 3.3.

- It had positive Cash Flow from Operations for the past 5 years.

- An estimated C rating.

Damodaran has a simple way to estimate the rating of a company. He looked at the interest coverage ratio. With 0.29 interest coverage ratio and based on Damodaran’s Jan 2022 datasets, the Group would have a C rating. Such a rating is indicative of a threat of default.

In the 2020 and 2021 Annual Reports, the auditors had commented about material uncertainty that may cast significant doubt on the Group’s ability to continue as a going concern.

I was also concerned that PHB could be a PN17 company. PN17 stands for Practice Note 17/2005 and is issued by Bursa Malaysia relating to companies that are in financial distress. PN 17 companies will need to submit their proposal to restructure and revive the company in order to maintain the listing status.

However, PHB had issued the following statement on 13 Apr 2022.

“…does not trigger any of the prescribed criteria pursuant to PN17…for the…financial period ended 31 December 2021. Hence, the Company is not an affected listed issuer pursuant to PN17 of the Main LR.”

What this meant is the PHB is not in any imminent danger of being a PN17 company. But it does not mean that the financial risk has been fully addressed as it will depend on how it recovers its business.

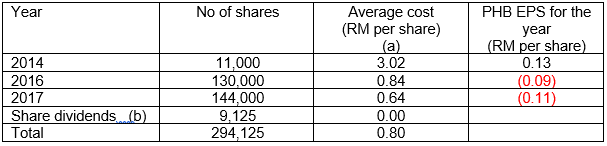

A Google search for “Parkson bankruptcy risk” had 2 relevant articles as shown below:

|

| Chart 2: Probability of Bankruptcy Source: Macroaxis |

|

| Chart 3: Probability of Financial Distress Source: Gurufocus |

Because of the financial risk, I would not buy PHB at the current price. I would thus proceed to Stage 3.

Stage 3.

Over the past 20 years, I have achieved a compounded 10 % total return with my stock portfolio. Based on this, and assuming no dividend, it would mean doubling the share price in about 7 to 8 years. I used this as the alternative investment benchmark.

If I sell PHB shares now at RM 0.165 per share to invest in another underprice stock, on a per share basis:

- I would lose RM 0.80 – RM 0.165 = RM 0.635.

- The gain from the alternative investment = RM 0.165 ie doubled my investment.

- There would be a net loss of RM 0.635 – RM 0.165 = RM 0.47

On the other hand, if I hold onto PHB, would it rise to RM 0.33 so that my net loss is also RM 0.47?

In other words, could PHB share price be RM 0.33 in 8 years’ time? Assuming a PE of 10, this would be about RM 0.033 EPS. If you believe that the Group could turn around, this EPS is something easily achieved.

At the current price, the alternative investment did not stands out compared to holding onto PHB. The conclusion would be different if the share price of PHB was RM 0.50 per share as the earnings would have to be much higher.

I thus held onto PHB. In the context of the decision framework, I ended up at Hold 3.

Conclusion

When you buy a stock, there is no guarantee that the price will go up. There may be a large drop in price after you have bought it. When this happens, you need a framework to think about whether to hold or to cut loss.

I hope that if you ever meet such a situation, instead of reacting emotionally, you can use my framework to think it through.

It is of course a value investing framework where the comparison between price and intrinsic value is still core. Also, it addresses the various behavioural biases and opportunity costs when deciding whether to hold or exit.

If you face a situation where the market price is lower than your purchased cost, you should review the stock position periodically. The Stage 1 and Stage 2 decisions are dependent on the intrinsic values. As such you should review the situation whenever there is an update on the business results/prospects. For those stock exchanges that require quarterly filing of financial results, this meant reviewing the position quarterly.

I also hope that this case study of my PHB investment have illustrated the nuances. The decision framework is not without its weaknesses:

- Stages 1 and 2 depends on how you value the company in a turnaround scenario.

- Stage 3 is dependent on how you determine the return from the alternative investment.

- This is not a mechanical process and there are still judgment calls.

Nevertheless it is better than reacting emotionally. There is a consistent basis to formulate your hold or exit hypothesis.

I am very sure that all investors would have faced this hold or exit situation. I hope I have provided a useful framework. If you have a different approach, I would be very interested to hear from you.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment