Should you rush to buy a house anticipating high inflation?

Case Notes 24. This post takes the contrarian view that you should not rush into buying a house despite the expected high inflation environment.

The Western world is currently experiencing high inflation. But Bank Negara in May 2022 projected Malaysia’s headline inflation to average between 2.2 % to 3.2 %.

There is anecdotal evidence to suggest that if we ignore the price-controlled items, the inflation rate would be higher.

- The price of petrol RON 97 at the end of May 2022 was 19 % higher than that at the end of April 2022.

- The head of the Mydin hypermarket chain has urged the government to raise the ceiling price for standard chicken by 11 % from RM 8.90 per kg to RM9.90 per kg. (Source: FMT)

Malaysia may be entering a high inflation phase. The general view is that house prices will go up in a high inflation situation. But the effects of high inflation are not on prices per se. We also have to contend with the measures taken by the authorities to control inflation.

Interest rates may go up. Steps may be also taken to cool the economy that in the worst-case scenario leads to an economic contraction. We know that higher interest rates will mean higher mortgages. An economic depression may affect household income, which in turn, may affect the buyer’s ability to secure the housing loan.

These are of course general views. But do they apply to Malaysia and do you need to rush to buy a house in anticipation of high inflation?

Based on the historical evidence, there is no need for Malaysians to rush into buying a house during periods of high inflation. Read on if you want to know how I came to such a conclusion.

Contents

- Inflation Indicators

- High Inflation History

- High Inflation vs % Change in HPI

- High Inflation vs Borrowing Rates

- High Inflation vs Household Income

- Conclusion

There is a correlation between house prices and inflation rates. In the Malaysian context, over the long term, house prices as represented by the HPI will increase at a faster rate than the CPI.

Refer to the iProperty.com article “Malaysia’s house price: Will there be a market boom in 2022?”

Many have thus projected the same pattern in a high inflation environment. In words, house prices are projected to spike during periods of high inflation. On top of this, there may be other impacts resulting from the authorities’ efforts to control inflation eg interest rates may go up.

Given these, many may think that a house buyer should buy a house immediately as the effects of a high inflation environment have yet to be fully felt. But is this true?

I will show that the historical evidence does not support such a proposition.

Inflation Indicators

According to Investopedia, inflation is the decline of purchasing power of a given currency over time. The result then is a rise in the general level of prices for goods and services.

The most common way to quantify inflation is to use the Consumer Price Index (CPI). This is a price index based on a fixed basket of goods and services that represents the spending of an average consumer.

Apart from the CPI, there are other ways to measure the increase in the prices of goods and services. Examples of other inflation indicators are:

- Producer Price Index (PPI). The PPI measures change in the prices paid to the producers of goods and services. The PPI is a measure of wholesale inflation, while the CPI measures the prices paid by consumers.

- Gross Domestic Product Price Deflator Index (GDP Deflator). The GDP Deflator measures the changes in prices for all the goods and services produced in an economy. The GDP Deflator is a more comprehensive inflation measure than the CPI because it is not based on a fixed basket of goods.

Chart 1 below illustrates the index trends for the Malaysian CPI, PPI, and GDP Deflator for the past 20 years.

|

| Chart 1: Various Inflation Indicators - Malaysia |

As they have different basis of measurements, you should not expect the CPI, PPI, or GDP Deflator to give the same results. For example, from the end of Dec 2021 to the end of March 2022 (Source: Trading Economics) for Malaysia:

- The CPI increased by 0.9 %.

- The PPI increased by 5.8 %.

- The GDP Deflator increased by 3.6 %.

Because of the many price-controlled items in the CPI, you should not be surprised that the CPI has the lowest rates.

In the context of this article, I will use the CPI as the reference point. If the CPI indicates high inflation, you can be sure that the PPI and GDP Deflator will have higher rates.

High Inflation History

What is considered high inflation? The US and most European countries have a target 2 % inflation rate.

- The US reported an 8.3 % annual inflation rate in April 2022 (Source: The Guardian).

- The UK Office for National Statistics reported an annual change in the CPI of 7.8 % for April 2022.

The news reported that both US and UK are currently facing high inflation. I assumed that an inflation rate that is 4 times the target rate could serve as a basis that a country is experiencing high inflation.

In the case of Malaysia, Bank Negara does not have a target inflation rate although its goal is price stability. However, the median annual inflation rate for the past 30 years was 2.3 %. As this is close to the 2% target inflation rate for the US and UK, we can refer to 8 % as high inflation for Malaysia.

Chart 2 shows the annual inflation rates for Malaysia for the past 60 years. You can see that there were 2 years when the annual inflation rate exceeded 8 %. They were:

- 17.3% in 1974 following the OPEC Oil Crisis .

- 9.7 % in 1981 when the Malaysian economy was affected by the fall in commodity prices. This was the result of the oil price hike and the interest rate increases in the US.

After 1981, there were no periods with more than 8 % annual inflation rates. However, there were 2 peaks rates after 1981:

- 5.3 % in 1998 following the Asian Economic Crisis.

- 5.4 % in 2008 following the US Subprime Financial Crisis.

Does it mean that there were no high inflation periods during the past 30 years? Yes, from a CPI perspective. But this is due to the price-controlled and subsidized nature of goods and services in Malaysia. If you accept that the PPI and the GDP Deflator would be higher than the CPI, then we may have high inflation in 1998 and 2008.

|

| Chart 2: Malaysia Annual Inflation Rate |

The interesting Malaysian feature is that the high inflation periods only lasted a year. The inflation rate in the subsequent year dropped significantly.

I am not an economist so I will not be go into the economic reasons for this. I would take this as a positive sign that Malaysia had a good track record of quickly bringing high inflation under control.

High Inflation vs % Change in HPI

There are a lot of articles about inflation and house prices. Examples are the iProperty.com articles “Is residential real estate still a good hedge against inflation in Malaysia?” and “The effect of INFLATION on housing prices”

We know that in the Malaysian context, house prices as reflected by the Housing Price Index (HPI) tend to go up faster than the inflation rate. From an expenditure perspective, it meant that it is more cost-effective to buy a house today as compared to a few years ago.

But these analyses looked at the changes in the HPI over the long term. I am looking at periods where the annual inflation rate is considered high.

In the Malaysian context, over the past 30 years, there were 2 years where the inflation rate was greater than 5 % - 1998 and 2008. How did the HPI change during such periods?

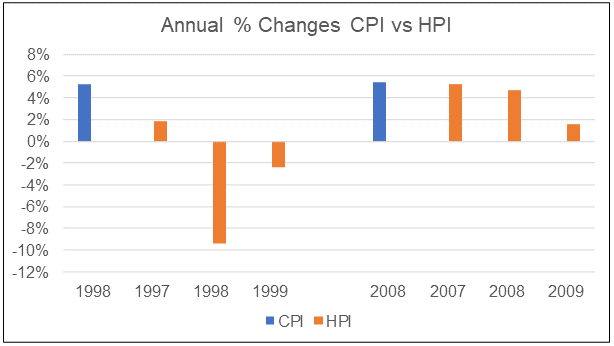

Chart 3 compared the annual inflation rate with the annual changes in the HPI. I looked at 3 periods – the year before, the reference high inflation year, and the year after.

- For 1998, the HPI decreased during the high inflation year and continued to decline the year after.

- For 2008, while there was no decline in the HPI, it increased at a slower rate than the CPI for the reference year and the year after.

The conclusion from this limited dataset is that the % annual changes in the HPI are lower than the inflation rates. This applies to both the high inflation year and the following year. As such there is no urgency to buy a house during high inflation periods. House prices are not expected to increase at a higher rate than the high inflation rate.

|

| Chart 3: Annual Changes in CPI c/w HPI |

You should not be surprised by the results. This is because house prices are determined not just by the cost of inputs (that are affected by high inflation). According to Investopedia, there are several factors that affect property prices. These include demographics, interest rates, economic conditions, and government policies.

In the Malaysian context, it would seem that the other factors overshadow high input prices.

High Inflation vs Borrowing Rates

The impact of high inflation is not just on the prices of goods and services. There are also the effects of the various measures undertaken by the authorities to control inflation. During periods of high inflation, one of the tools that the central bank uses to control inflation is to increase the bank lending rates.

Any increase in the bank lending rates will of course affect the mortgage rates. The house buyer will have a higher borrowing cost. This is on top of paying more due to a higher house price (if any).

Chart 4 compares the Malaysia Bank Lending Rate with the inflation rates for 1998 and 2008.

- You can see the large increase in the lending rates in 1998. However, we do not see such an increase in 2008.

- For both 1998 and 2008, you can see that there are reductions in the bank lending rates the year after the high inflation year.

|

| Chart 4: Malaysia Bank Lending Rate Source: CEICDATA Note: The blue bar represents the inflation rate for the year. The purple line represents the average bank lending rate |

The above is of course a simplistic analysis. The lending rates set by the bank are dependent on not only the central bank measures, but also other economic factors. Looking at inflation rates alone is not enough.

The Malaysian history is that a 5% CPI rate may not mean a higher bank lending rate. And even if there is a higher interest rate, it is short term relative to the long mortgage period of generally more than 20 years.

Furthermore, the impact on the individual house buyers would depend on their mortgage plan. The impact on a fixed interest rate plan is different from a variable interest rate plan. This would also depend on whether thee buyer is borrowing for the first house or second house.

The conclusion is that there may be a short-term pain during periods of high inflation from a long-term mortgage perspective.

High Inflation vs Household Income

“…in the 25 years between 1995 and 2019, Malaysia’s median household income expanded by about 6.2% pa on a compound annual growth rate (CAGR) basis. This is slightly lower than the country’s nominal GDP growth of 7.7% pa during the period…” The Edge in an interview with Malaysia Rating Corp.

During the same period, the CPI increased at a CAGR of 2.4 %. This meant that over the 25 years, the household income increased at a faster rate than inflation.

This augurs well for the Malaysian house buyer from the perspective of the house price as well as getting a mortgage. However, the short-term impact is not so clear-cut.

Chart 5 compares the annual inflation rate for 1998 and 2008 with the % change in the median household income.

- In 1999 there was a contraction in the median household income compared to that in 1997. This was because the Malaysian GDP contracted by 7.4 % in 1998 although it grew by 6.1 % in 1999.

- In 2009, the median household income increased compared to that in 2007. It grew at a higher rate than inflation. This was despite the GDP contracting by 1.5 % in 2009 although it grew by 7.4 % in 2010.

|

| Chart 5: Malaysia - Changes in Household Income c/w Changes in CPI Note: The changes in the household income are for 2 years eg 1999 compared to 1997. Source: Median Household Income from DOSM |

Given the contraction in 1999, the house buyer would have problems with securing a bank loan in 1999 compared to 2009.

The analysis showed that when looking at the impact of high inflation on household income, you have to look beyond price increases. Other economic factors are more important compared to inflation.

Conclusion

There is a correlation between house prices and inflation rates. In the Malaysian context, over the long term, house prices as represented by the HPI will increase at a faster rate than the CPI. Many have thus projected the same pattern in a high inflation environment.

On top of this, there may be other impacts resulting from the authorities’ efforts to control inflation. Accordingly, many project the following in a high inflation situation:

- Higher increase in house prices. If the inflation rate is 5%, we would expect that house prices would increase by more than 5%.

- Mortgage costs would go up resulting in a higher repayment sum than for a “normal inflation” period.

- Household income may not keep pace with high inflation. Alternatively, there may a decline in household income if there is a lower economic growth or a recession.

Is the above a realistic scenario? Based on the evidence over the past 30 years, I would conclude that

- The HPI did not increase at a faster rate than the CPI for both the high inflation year and the following year.

- It is uncertain that the bank lending rate would increase.

- Other economic factors rather than inflation may have a bigger impact on household income.

From an overall perspective, I would suggest that there is no need to rush to buy a house in anticipation of a high inflation period. This is because

- House prices are not likely to shoot up.

- There may be a risk of higher mortgage rates that may affect your ability to get financing.

- There may be a short-term risk to your earnings.

More importantly, history shows that high inflation is transitory. Given the borrowing and income challenges, it may be better to wait.

After all, while house prices will continue to go up in the long run, so will income. Between 1995 and 2019:

- Malaysia’s median household income expanded by about 6.2% CAGR.

- The HPI increased by 4.6 % CAGR.

When you invest in a house, you should take a long-term view. From such a view, there is no additional benefit from rushing to buy a house in anticipation of a high inflation environment.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment