Do you really want to master value investing?

Tips D - This page summarizes the value investing insights extracted from my e-book “Do you really want to master value investing”. They are meant to be a guide to learn investing. Revision date: 27 Aug 2023

Warren Buffett said that investing is simple but not easy. This applies to value investing as well. It is simple in that there are few concepts. Even then the concepts are simple enough to understand.

But value investing is not easy in that you have to know how to apply the concepts in real life. There are many nuances when analysing and valuing companies. At the same time, success depends not only on applying the concepts but also behaving appropriately. This is probably the most difficult part.

The video summarizes the key ideas in the book.

My book "Do you really want to master value investing" is intended to show you how to translate the concepts into practice. I also hope that the various worked examples and case studies will help you see the various nuances. It is a text book to learn investing.

To master value investing, you have of course to go through the whole book. I do not expect you to learn investing just by running through all the infographics presented here. Rather the infographics are meant as “revision notes” to jog your memory. As such I have grouped the various infographics into topics.

Contents

- Overview of investing

- Value investing

- Company analysis

- Assessing management

- Valuation

- Discounted cash flow valuation methods

- Risks

- Stock portfolio

Overview of investing

You invest to protect your savings against inflation. There are many types of assets to invest in as well as several investing styles. The stock market is only one option. Similarly, value investing is one of the many ways to engage with the stock market.

You grow wealth from investing via the power of compounding. This requires consistent returns over decades of re-investing the gains.

But investing is not just about returns. There are also risks involved and I have made risk mitigation a central tenet while you learn investing.

|

1. Why Invest

You invest to prevent the purchasing power of your saving from being eroded by inflation. Of course, to achieve this goal, you have to achieve a rate of return that is greater than the inflation rate.

Why chose to invest in equities? This is because historically this asset has generated the best returns. The Pros and Cons of investing in the stock market are summarized in the chart in the infographic.

For the retail investor, there are 4 main ways to invest in the stock market.

- Based on Technical.

- Based on Fundamentals.

- Factor investing.

- Indexing.

2. How much can you make from the stock market?

You have to be realistic about how much you can make by investing in the stock market. The chart in the infographic summarizes the index returns from the world’s top 10 stock exchanges. I have shown the compounded annual return for 2 holding periods – 10 years and 20 years.

You can see that the returns vary both in terms of where you invest and the holding periods.

- You can get as high as 14.7 % compounded annual return from investing in the Nasdaq from 2010 to 2019.

- It drops to 3.9 % per annum when investing from 2000 to 2019.

Similarly, the Nasdaq can deliver a 14.7 % compounded annual return from 2010 to 2109. But if you had invested in the Shanghai Composite Index, you would not have made any money during the same period.

Your gain from the stock market comes from both capital gains and dividends. To grow wealth over time, you have to rely on the power of compounding. This is one key lesson as you learn investing. But this first requires you to master value investing.

3. Can you be a millionaire by investing in the stock market?

You get rich from investing through the power of compounding. This requires consistent returns over decades of investing.

The infographic show the gains from investing in the stock market under various conditions. I looked at the following parameters:

- Different investment periods.

- Different compounded annual returns. I looked at 8 %, 10 %, and 12 %.

- Different investment amounts – a one-off $ 1,000 investment and a regular annual sum of $ 1,000.

In the charts, the horizontal axis represents the investment period in years and the vertical axis represents the amount.

You can be a millionaire if you start with a one-off investment of $1,000 and achieve a compounded annual return of 12% over more than 65 years of investing. it is worthwhile to learn investing.

However, if you invest $ 1,000 every year, you just need to achieve a 10 % compounded annual return over 50 years to get $ 1 million at the end. Doable?

To be a millionaire by investing in the stock market, you need to start young. Then develop your investing skills so that you can achieve a consistent 10 % return. You should stay invested and ideally invest regularly with more than $ 1,000 each year.

What is the catch? You have to master value investing first.

4. How long do you hold onto a stock?

The stock holding period is a function of your investment style:

- If you are a day trader, it is obvious that you get out at the end of the day.

- If you are a trend follower, you get out at the end of the trend. This could be days or weeks.

- If you are a value investor, you get out when the price exceeds the intrinsic value.

The holding period is not something that you set upfront.

Many newbies think that value investing means holding a stock forever. Even Warren Buffett sells stocks. “Forever” is a term used to denote long-term and not a situation where you never sell.

You would sell if the business is no longer viable. If you see what happened to Kodak or Nokia, you know what I mean by not holding stocks forever.

5. Risk mitigation as the central tenet

While there are many value investing books, I have not found any that focus on avoiding permanent loss of capital as the central tenet. While we all want to make money, I firmly believe that we should adopt a style that focuses on risk as you learn investing.

I define risk as a permanent loss of capital. I have structured my book around how you can avoid permanent loss of capital when looking at the various aspects of value investing.

My key approach to master value investing is:

- Allocate only a portion of your net worth to stocks. I use a 3-Buckets approach for this

- Never invest in only one stock. Have a stock portfolio.

- Pick your stocks based on fundamentals. While there are several ways to invest from a fundamental perspective, I have chosen value investing.

6. How to manage risk

If you want to be risk-averse when you learn investing, start with a risk mitigation mindset. Look at the risk from a global perspective. There are 3 risk management levels to consider when investing in stocks:

- Determine the amount of your savings to be set aside for stocks. I used the 3 Buckets strategy for this.

- Have a stock portfolio.

- Choose an investment approach that focuses on risk mitigation. I recommend value investing as this focuses on the business rather than treating investing as buying and selling pieces of paper.

Risk management is part and parcel of the skills to master value investing.

Value Investing

Value investing is an investing philosophy. At the core, it is buying stocks at a discount. But then there are many interpretations of what constitutes a discount.

The starting point to learn investing is company analysis covering both quantitative and qualitative analysis. The goal is to be able to identify investment opportunities and avoid value traps.

Again, there are different ways to analyse companies. Along the same lines, there are different ways to value a company. Do not be surprised to find that different value investors will have different estimates of intrinsic value.

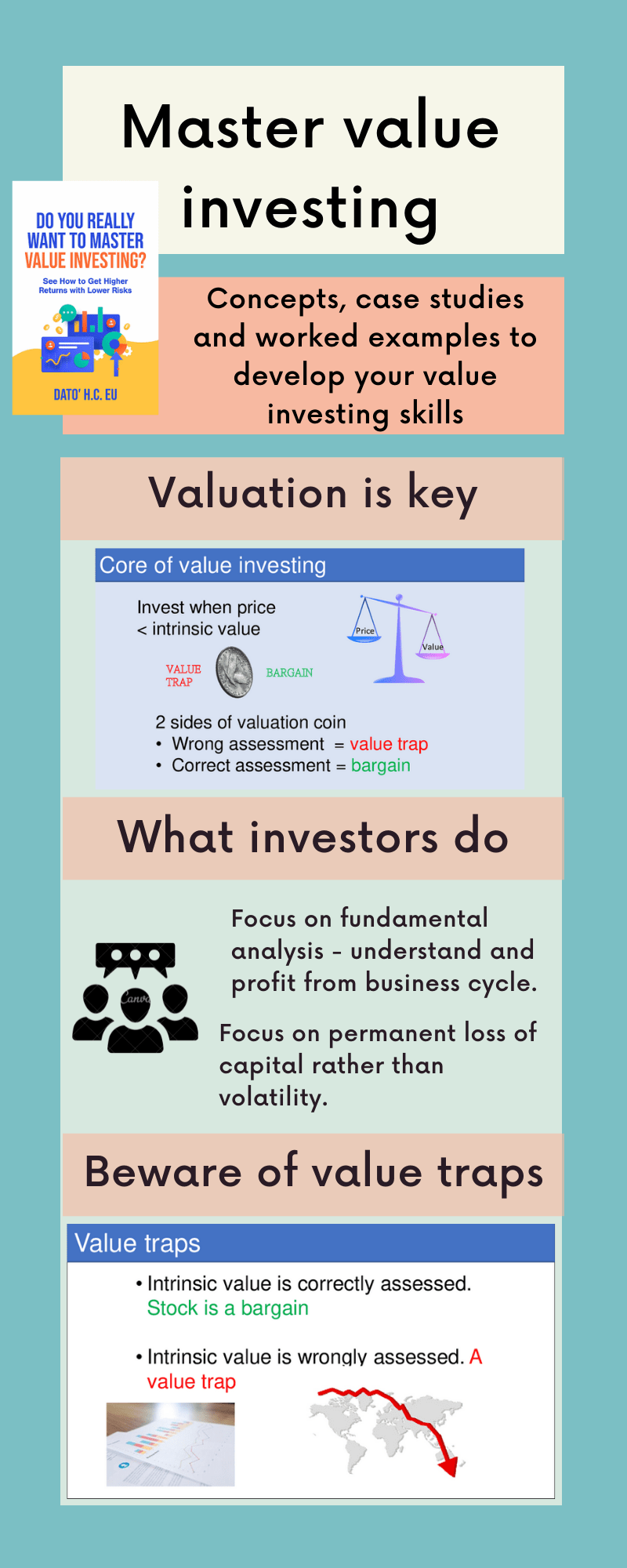

7. What is value investing?

I see the following as the key elements of value investing:

- Buy a bargain. This means determining the intrinsic value and buying at a discount to this value.

- Have a margin of safety. All valuations are based on assumptions. To protect yourself against errors, misjudgments, and plain bad luck, adopt the concept of a margin of safety in your analysis.

- Don’t lose money ie take care of the downside and let the upside take care of itself.

- Valuation is key. Without this, you cannot determine whether the stock is a bargain or whether you have a sufficient margin of safety.

Value investing is just one of the several forms of investing based on fundamentals. The others include growth investing and dividends investing.

After you master value investing, you can have some tailwind to put you on the winning side. But there is an element of luck to consider. If you consider human activity as a combination of luck and skill, you can see a continuum with pure luck on one end and pure skill on the other end.

- Chess is probably mostly skill.

- Gambling at roulette is mostly luck.

- In between you have value investing.

You can push investing towards the skill end as you master value investing but you cannot fully rule out luck.

8. What a typical value investor does

The world's greatest value investors have proven that beating the market is not mere chance. Rather it can be accomplished by trusting the process of careful stock analysis and selection. They have produced gains that, over time, have crushed the S&P 500 index's returns. Examples are:

- Benjamin Graham’s Graham-Newsome Corporation averaged 17% annual returns from 1934 until 1956.

- Warren Buffett in his partnership days achieved a 15 % compounded annual return.

- Joel Greenblatt’s Gotham Capital returned an annualized rate of 40% for 2 decades.

- Peter Lynch achieved an annual return of 29.2% in his time as the manager of the Magellan Fund at Fidelity Investments.

- Howard Marks’ Oaktree Capital has generated an annual return of 23% for the past 25 years.

A value investor typically focuses on fundamental analysis and avoiding permanent loss of capital. Once you master value investing, you can be a successful investor. I defined successful value investing as achieving a better CAGR on a total return basis than that achieved by the index over at least a decade. You need to do the following to be a successful value investor.

- Acquire the necessary knowledge and be skillful in applying the concepts.

- Internalize the value investing mindset.

- Follow what a typical value investor does.

9. Value investing skills

Investing is a skill that you develop over time. You need an iterative approach of getting a bit of knowledge and then practicing it. The best way is via practice. This is the "secret" to learning investing.

Skills don't come from reading books alone. You need to develop the following skills to master value investing:

- How to analyze companies.

- How to value them.

- How to mitigate against risks.

- How to construct and maintain a stock portfolio.

Company analysis involves collecting information relating to the company and assessing its performance. It involved both quantitative and qualitative analysis. The majority of the information comes from the company's Annual Reports. I then supplement that with competitors’ Annual Reports, industry reports, and government reports

I assess company performance in a relative sense - whether it is good, average, or poor. This is relative to its peers and trends. I then assess the future relative to the historical performance.

This relative approach will also help in my valuation. It is much easier to value a company based on historical data. I then judge whether the future value would be higher, the same, or worse than the historical value. This should be consistent with the relative assessment of the company’s performance.

Financial Statements analysis is an important element of company analysis. When doing this, focus on those metrics that affect the intrinsic value. You are not assessing a company for its creditworthiness. You are assessing to see whether it is a good company to invest in.

10. What it takes to be a value investor

To master value investing, it is not enough to have knowledge and experience. You also require the correct mindset. I would argue that behavioral requirements are equally as important as knowing the principles and concepts.

The are 4 key skills to be developed:

- How to analyse companies.

- How to value companies.

- How to mitigate risks.

- How to manage a stock portfolio.

11. Value traps

Once you master value investing, you would be investing when the price is at a significant discount to intrinsic value. The question is whether your assessment of intrinsic value is correct.

- If your valuation is wrong, then the stocks are cheap for a reason and you have a value trap.

- But if your assessment of intrinsic value is correct, then you have a bargain.

From the above perspective, value traps and bargains are two sides of the value investing coin. More importantly, value investing is about confronting the value trap question. Value traps are fundamental to value investing.

There are 2 main ways to avoid value traps:

- Have a good company analysis.

- Have a good valuation approach.

Think of them as part of the skills to master value investing.

12. What are value traps?

Value traps are stocks that appear cheap but are cheap for a reason. To be able to identify them you must first have the correct way to identify “cheapness”. It has to be cheap relative to the intrinsic value.

You should not use relative valuation to do this as you can be wrong about the “cheapness.” The more appropriate way is to determine the intrinsic value based on the discounted cash flow method.

If you are wrong about the cheapness, you have a value trap.

13. How to avoid value traps

Value traps and bargains are two sides of the valuation coin. To avoid value traps, you need both a good company analysis and a good valuation approach. These are skills to develop to master value investing.

All valuations are based on assumptions and the company analysis will ensure that these are realistic. A good valuation method will enable you to get reliable estimates of the intrinsic value.

You need to have a strong basis to judge whether it is a bargain or a value trap.

Company analysis - one of the key steps to learn investing

Warren Buffett said that you have to stay within your circle of competence when you invest. In other words, invest only in businesses that you understand.

Company analysis is about getting to know the business. It involved both quantitative and qualitative analysis. You look at the business model, its track record, and management.

There are two objectives when analysing companies. The first is to determine whether the company is fundamentally sound. The second is to ensure that the assumptions you use in your valuations are realistic.

14. What is a fundamental analysis?

The fundamental analysis of a company consists of 2 components:

- Company analysis. The goal here is to determine whether it is a good company to invest in. You assess whether the company is fundamentally sound. At the same time, a comprehensive company analysis will ensure that the assumptions you make in the valuation are realistic.

- Valuation. The goal here is to determine whether you can make money when investing in the company. You determine the intrinsic value and compare it with the market price. You invest only if there is a sufficient margin of safety.

15. Company analysis - overview

Company analysis involves collecting and analyzing information related to the company’s business. It covers its business set-up, history, products, and services as well as its financial performance. It is a necessary skill to develop to master value investing.

It covers both quantitative and qualitative analysis. The quantitative side involves looking at factors that can be measured, such as the company’s assets and profits. Financial Statements analysis is an important aspect of quantitative analysis.

The analysis of the non-numerical items is the other side of company analysis. The qualitative analysis involves studying the descriptive part of the Annual Reports. I also look at market research reports, trade journals, and government reports.

16. What is covered under a company analysis?

There are 2 key goals for a company analysis:

- To determine whether it is fundamentally sound.

- To ensure that the assumptions used in the valuations are realistic.

Many metrics can be considered in company analysis. I focus on those that help me answer these 2 questions.

A fundamentally sound company has good prospects of increasing shareholders’ value. I thus consider those metrics that relate to profitability, returns, growth, reinvestments, and risks. These are the metrics that drive intrinsic values. At the same time, by ensuring that these are realistic, I fulfill the latter goal.

17. How to carry out a company analysis.

When you analyse a company, the primary goal is to determine its future performance. Peering into the future can be very challenging. My approach is to do this on a relative basis. First, I determine the historical performance. This is known with certainty as all the data are readily available.

I then judge whether the future would be the same, worst, or better than the past. I find that it is easier to make such a relative judgment compared to say projecting the revenue and cash flow of the business over the next 5 to 10 years.

This relative approach will also help in my valuation. It is much easier to value a company based on historical data. I then judge whether the future value would be higher, the same, or worse than the historical value. This should be consistent with the relative assessment of the company’s performance.

18. Sources of information for company analysis

There are 2 main ways to collect the information for the company analysis – desk research and field research. As a retail investor, you do not have the resources to do field research. It is more cost-effective to do desk research.

There are many readily available resources for desk research. The Annual Reports provide much historical data and you can supplement it with industry and analyst reports.

My starting point is to look at what has happened in the past and then judge whether the future would be the same, better, or worst.

19. What is covered under the qualitative and quantitative aspects?

A company analysis covers both qualitative and quantitative analysis. The bulk of the information for these comes from the Annual Reports.

The main focus of the quantitative analysis is the financial statement analysis. This covers not only those of the company but also those of its peers. At the same time, industry and economic reports can provide a picture of the risks and opportunities for the company.

You are going to use the historical picture to judge whether the future is going to be the same, better, or worse than the past. As such you need to understand what is behind the numbers. This is where qualitative analysis comes in.

The bulk of the qualitative information can be extracted from the Management Discussion and Analysis sections of the Annual Reports.

20. Financial Statement analysis

There are many platforms that not only provide Financial Statements but also standard analysis.

These typically included liquidity, profitability, activity, leverage, and DuPont ratios. For my Financial Statements analysis, I extract the data from 2 sources:

- Annual Reports and/or statutory filings.

- Platforms or services that provide the company’s financials

I cover 3 things in my Financial Statements analysis – ratios, time series, and peer comparisons. I cover the following in my analysis:

- Risks.

- Products and services.

- Economic characteristics.

- Management.

It is obvious that this is one of the skills required to master value investing.

21. How to carry out a Financial Statement Analysis

You cannot hope to learn investing without learning how to carry out a financial statement analysis. The goal here is to determine whether this is a good company and to ensure that the assumptions used in the valuation are realistic.

There are 3 key ways to carry out a Financial Statement analysis.

- Trends. You are trying to assess how a particular metric changed over time. To compare metrics of different sizes, I convert them into indices.

- Ratios. Here you compare one metric with another. Examples are the Debt Equity ratio or Current Assets / Current Liabilities ratio. You are looking at efficiency, utilization, or effectiveness.

- Profiles. I used this to look at how the resources are distributed. A good example is the capital structure of a company broken down into Equity and Debt. Its assets can also be broken down into Operating Assets and Non-Operating Assets.

22. How to determine that a company is fundamentally sound

One of the goals of company analysis is to determine whether a company is fundamentally sound – a good company.

I do this by defining the criteria for this assessment. I set the targets for the returns, growths, and risks. These can be absolute targets or performances relative to their peers. I also looked at whether management has articulated its business direction and strategies.

I then compare the actual performance with the criteria. A good company does well in all the criteria.

23. Analysis covered in the book

The main goal of company analysis in the context of investing is to assess the prospects of the company. You also want to ensure that when you value it, the assumptions you use are grounded in reality.

When investing, you are trying to establish your investment thesis. You want the outlook of the business and its valuation assumptions to be realistic. In analyzing the historical performance, I looked at several areas:

- The products and services.

- The company and industry’s economic characteristics. I looked at the business model and its competitive edge.

- Operations, capital allocation, and financial strengths.

- Market potential.

- Management.

- Business risks.

It is obvious that to do all the above, you need to study not only the company’s Annual Reports and statutory filings but also those of its peers. I also looked at industry market research reports.

24. Examples of company analysis

There are many ways to carry out a company analysis. What you focus on depends on the objective. A bank seeking to extend a loan will be more interested in the credit standing of a company. This will be different from what an investor looks at.

I am a long-term value investor and my interest is in the performance and value of a company over the next 5 to 10 years. I thus focus on those metrics that will enable me to assess these. For consistency and avoidance of analytical errors, I have standard analyses and templates to serve as guides for my company analysis. You should do the same once you master value investing.

Assessing Management

Warren Buffett has famously said the following about assessing management:

“I think you judge management by two yardsticks. One is how well they run the business, and I think you can learn a lot about that by reading about both what they’ve accomplished and what their competitors have accomplished, and seeing how they have allocated capital over time.”

“You want to figure out...how well that they treat their owners. Read the proxy statements, see what they think of — see how they treat themselves versus how they treat the shareholders…The poor managers also turn out to be the ones that really don’t think that much about the shareholders, too. The two often go hand in hand.”

You can see that he talks about the performance as well as the behavioural aspects. I adopted this approach when assessing management.

Assessing management is a key skill to develop to master value investing.

25. Assessing Management

As a retail investor, your contact with management is only at the annual general meetings. There is hardly enough time to get to know them. You have to take a different approach to assessing management. I looked at the following:

- Background checks including knowledge, experience, and tenure with the company.

- Operating and capital allocation track record.

- Shareholders value creation - share buybacks.

- Honesty, transparency and the alignment of interests.

The goal is to ensure that management does not do things that benefit them rather than the company or shareholders. Secondly, business performance needs a long-term perspective. So, management should not forgo investments that only show results after several years.

26. How to assess management

There are 2 key dimensions to consider when assessing management – performance, and behaviour.

When it comes to performance, there are two key metrics – the company results and how well management has allocated its funds.

- Performance. You can get a good picture by comparing the company’s returns and growth over the past decade with those of its peers.

- Capital allocation. A good capital allocation is one where after allocating its funds for the future, there is sufficient left to reward shareholders.

For the behavioural side, you want management who is transparent and honest. You also want one whose interests are aligned with those of the shareholders.

27. How to assess management behaviour

The key here is that you are trying to assess whether management is honest and transparent. You also are looking at whether management interests are aligned with those of the shareholders.

I generally start by looking at management education, experience, and tenure with the company. This will give you a sense of their capabilities and commitment.

I then run through the past decade’s Annual Reports to see whether they have delivered what they said. This can provide a good picture of whether management is transparent and honest with the problems they faced.

Looking at how much time they spent promoting the company compared to running it will give clues on management thinking.

At the same time, I also look at the related party transactions to see that they are carried out in an arms-length manner.

28. Assessing management – Shareholders’ value creation

One way to assess management is to see whether it has created shareholders’ value over time. There are 2 main ways to do this.

The first is to compare the company returns with the cost of funds. You have to be consistent in your comparison:

- If you use ROE as the return measure, you should compare it with the cost of equity.

- If you use EBIT(1 -t) / Total Capital Employed as the return measure, you should compare it with the WACC.

The other way is to compare the total gain obtained by a shareholder with the cost of equity. Total gain = Capital gain + dividends. To derive the capital gain, you look at how the market price has changed over the assessment period. And of course, the dividends should be for the corresponding period.

I consider this an overlooked item when people learn investing.

Valuation - another key step to learn investing

There are 3 key skills required to master value investing:

- How to analyse companies.

- How to value companies.

- How to mitigate risks.

This section focuses on valuation.

Value investing is about buying undervalued stocks. This meant comparing a stock price with its intrinsic value. This is where valuation comes in. The process of calculating and assigning a value to a company or an asset is called valuation.

Valuation is part science and part art. To be able to value companies under various corporate structures you need to understand the principles. Valuation is highly complex because there are many valuation models and techniques.

29. Overview of valuation

If you belong to the Efficient Market school, you would view that market price as the fair market value. However, if you are a fundamental investor, you would view the worth of a company as the discounted cash flow generated by the company over its life. This is commonly referred to as the intrinsic value. To the fundamental investors, intrinsic value and market price may not be the same.

The investor is not the only person interested in knowing the value of a company. There are other situations where valuation is important:

- If the company wants to raise funds by issuing additional shares, then knowledge about the value of the company is important.

- A company undertaking a share buyback program should also be interested in the value of the company. Management should not be buying back overvalued shares.

- Valuation is also important for companies undertaking a merger or acquisition exercise.

- Knowing whether the value of a company has increased may also be an important component of senior management compensation.

30. Methods of valuation

There are 3 general ways to value companies. The simple way to understand them is to use the analogy of how properties are valued.

- Relative valuation. This is determining the worth of a company by comparing it with the worth of its peers.

- Asset-based valuation. This is looking at the assets of a company as a store of value.

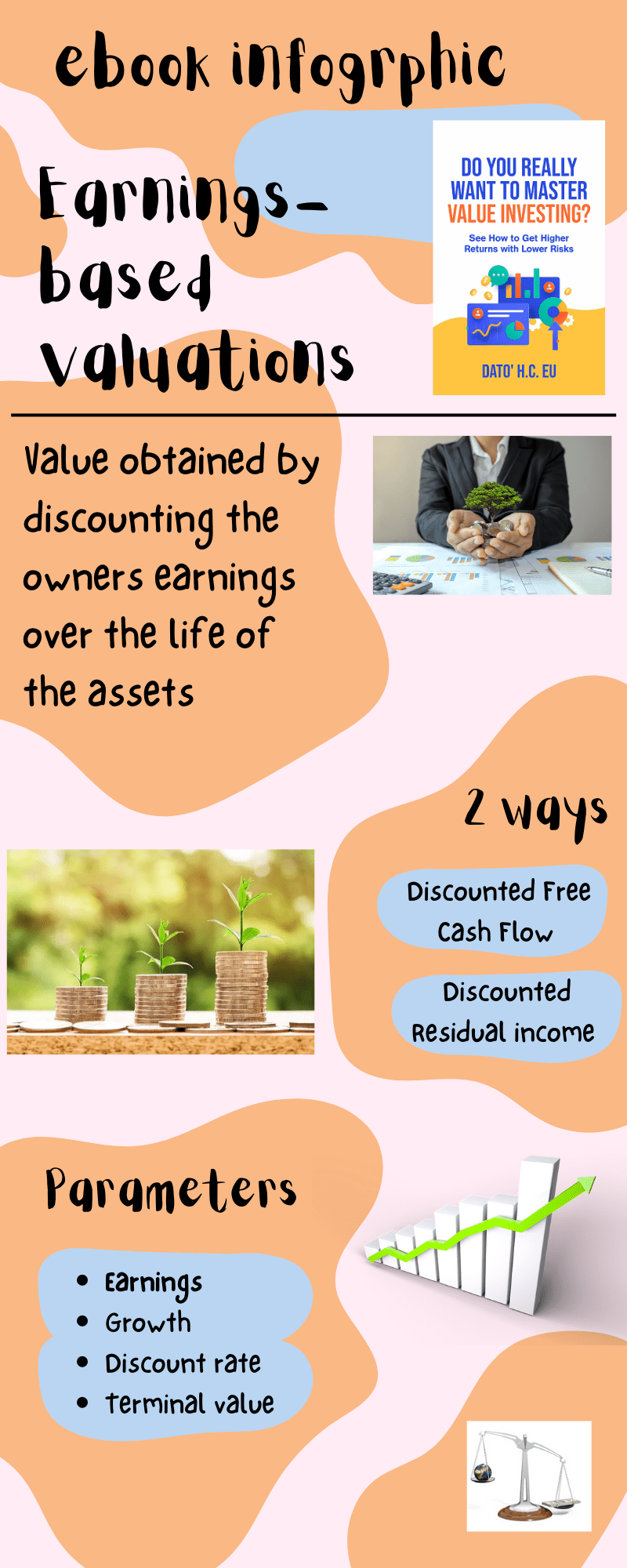

- Earnings-based valuation. This is looking at the assets as generators of value. This is derived by discounting the owners’ earnings over the life of the assets.

31. What is relative valuation?

Relative valuation is determining the value of a stock by looking at the value of comparable companies.

When it comes to valuing companies, there are several common bases for comparison such as earnings, Book Value, or revenue. And a common way to account for the different sizes of the companies is to consider the metrics on a per-share basis.

How then do you determine whether the stock is cheap or expensive? There are 3 common approaches:

- Compare it with the historical multiples of the company.

- Compare it with the multiples of comparable companies.

- Compare it with some benchmark values that were derived based on either finance theory or research.

32. What is Asset-based valuation?

Asset-based valuation focuses on the value of the company’s assets. In its most basic form, the Asset Value is equal to the company’s Book Value or shareholders’ Equity.

The Book Value may not necessarily reflect the market value of the assets or liability in the current environment. This is because the Book Value captures the historical costs. Furthermore, the depreciation rates may cause the Book Value of plants and equipment to differ from the current market values. At the same time, some intangibles such as patents and customer relationships may not be captured in the Book Value.

Because of this, many people adjust the Book Value when using the Asset-based approach to value a company.

There are several perspectives under this approach from the Graham Net-Net, NTA, Book Value, and Reproduction Value.

33. What is Earnings-based valuation?

Here you view the assets as a generator of value. The intrinsic value is the discounted value of the cash flow generated by the business over its life. The challenges here are then:

- Forecasting the cash flow. You need the initial cash flow as well as the growth rate.

- Determining the discount rate.

- Determining the life of the business.

I used two Earnings-based methods. The first is the Discounted Free Cash Flow approach as taught by Professor Damodaran of New York University. The other is the Residual Income method as taught by Professor Penman of the University of Columbia.

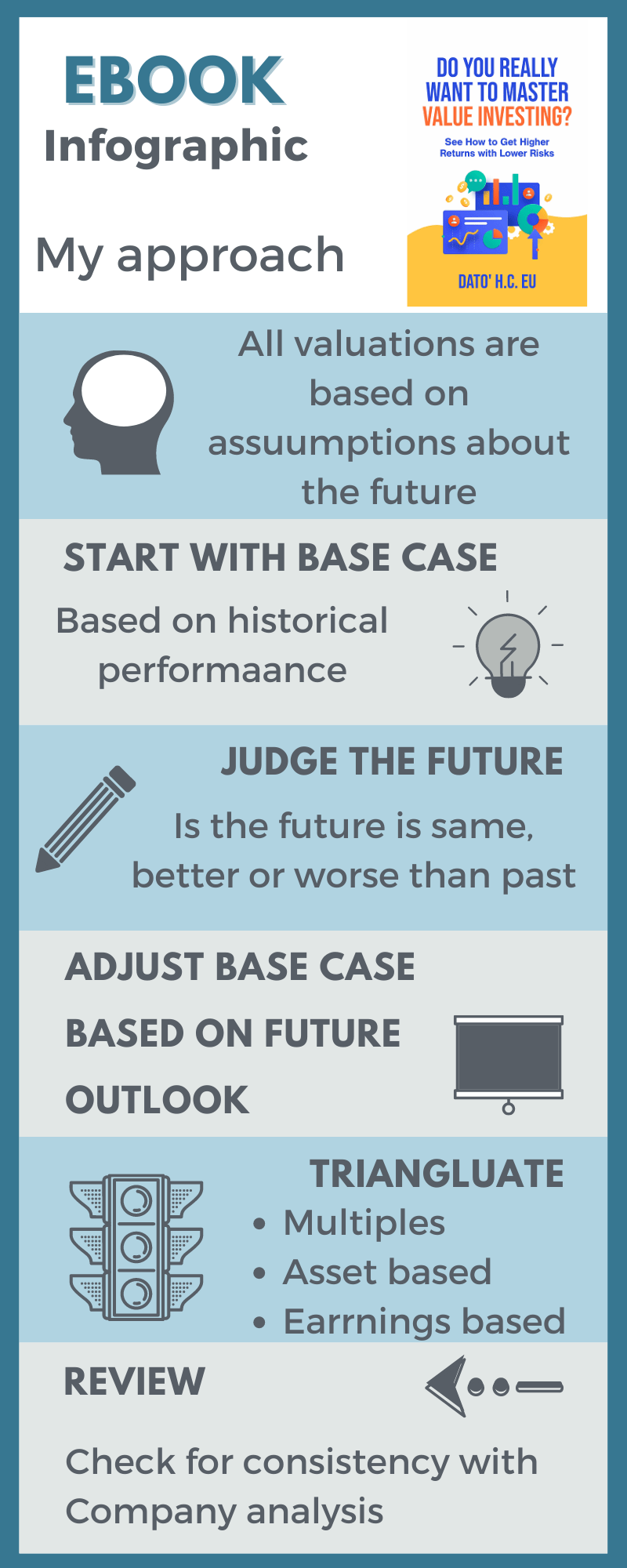

34. My valuation approach

All valuations are based on assumptions about the future. My approach can be summarized as follows:

- Have a base case based on the historical performance. I know this with certainty.

- I then judge whether the future will be better, the same or worse than the past (base case).

- I then adopt the appropriate “relative performance and value”.

I used both the Damodaran DCF model as well as the Penman Residual Income model to determine the Earnings-based value. Next, I determine the Asset-based value.

I then triangulate the intrinsic value. I compared the Asset-based and Earnings-based values with the Magic Formula and the Acquirer’s Multiple. I hope you adopt this approach after you master value investing.

35. Challenges of real-life valuation,

Real-life valuation is not like the textbook examples. Items do not necessarily fall into place. That is why understanding the principles is important so that you can make the appropriate interpretations.

The key to learning investing is to do a lot of valuations so that you can see all the nuances.

All valuations are based on assumptions and one of the challenges is value traps.

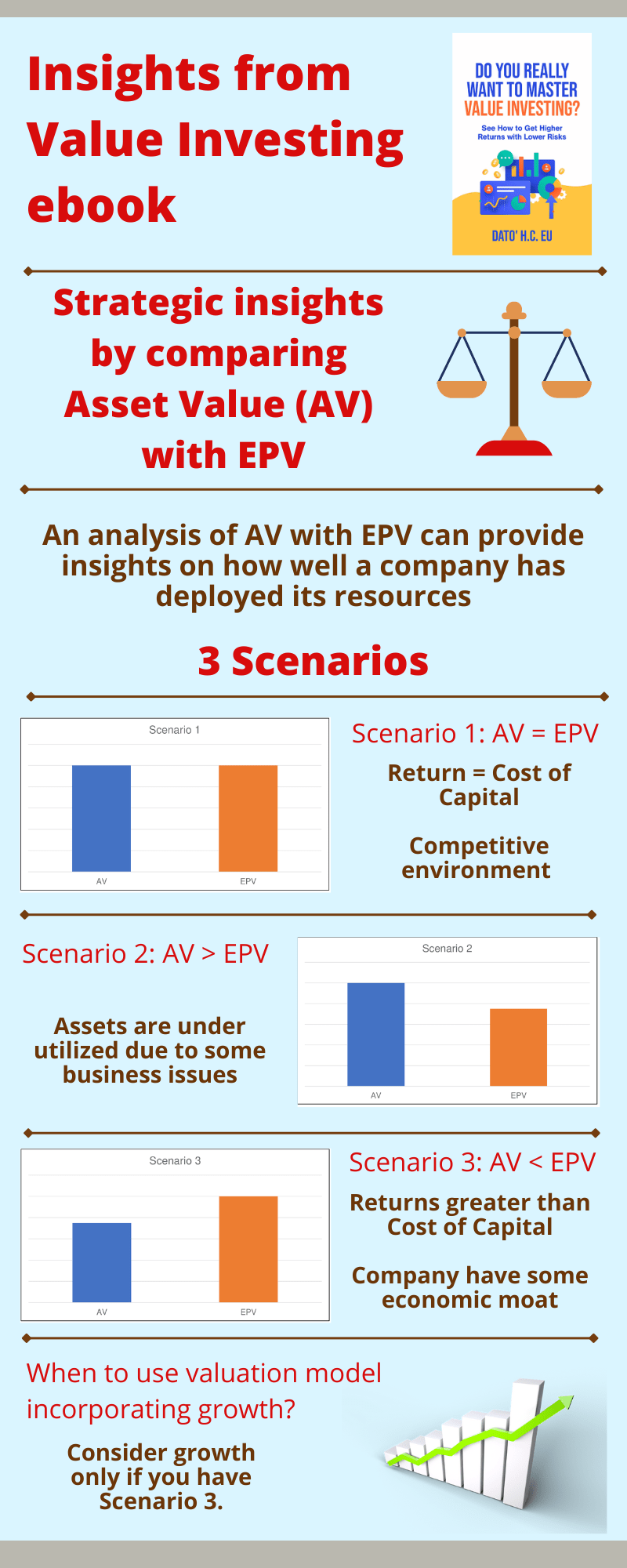

36. Strategic insights from valuation

According to Professor Bruce Greenwald, you can get strategic insights by comparing the Asset Value (AV) with the Earnings Power Value (EPV). There are 3 possible scenarios with such a comparison:

Scenario 1. AV = EPV

In a freely competitive environment, you would expect new entrants if the industry is earning high returns. This is especially if there is a low barrier to entry. This will drive the returns down so that eventually the return is equal to the cost of funds. Similarly, if the returns are low, companies will leave the sector and the returns will go up. Equilibrium is when the returns are equal to the cost of funds. You will then have AV = EPV.

Scenario 2. AV > EPV

Here the assets are underutilized. This could be due to some business issues eg poor management, industry facing some disruption. These are companies undergoing turnarounds. Successful turnarounds would revert to the AV = EPV situations where the EPV would increase. If the turnaround fails, there may be asset impairments so that AV = EPV.

Scenario 3. AV < EPV

Here the returns are greater than the cost of funds. For this to be sustainable, there must be some economic moat. This will ensure that there are no new entrants that can drive the returns down. You only consider incorporating growth into your valuation if you have this scenario.

37. How to avoid permanent loss of capital when valuing companies

I consider risk as the possibility of incurring a permanent loss of capital. To mitigate this, I adopt several strategies in my valuation.

I first adopt a conservative approach such as using conservative assumptions. I ignore growth where possible. I also check that the growth rate in the Terminal value is less than the GDP growth rate.

I do not rely on one valuation method. Instead, I use the Asset value, Earnings value, and the Acquirer’s Multiple to triangulate the intrinsic value. I also look for at least a 25 % discount on the computed intrinsic value when buying.

To avoid computation errors and biases, I have a standard financial model. I also use a simple model with only 4 or 5 key variables. When it comes to the discount rate, I check them against what others have done.

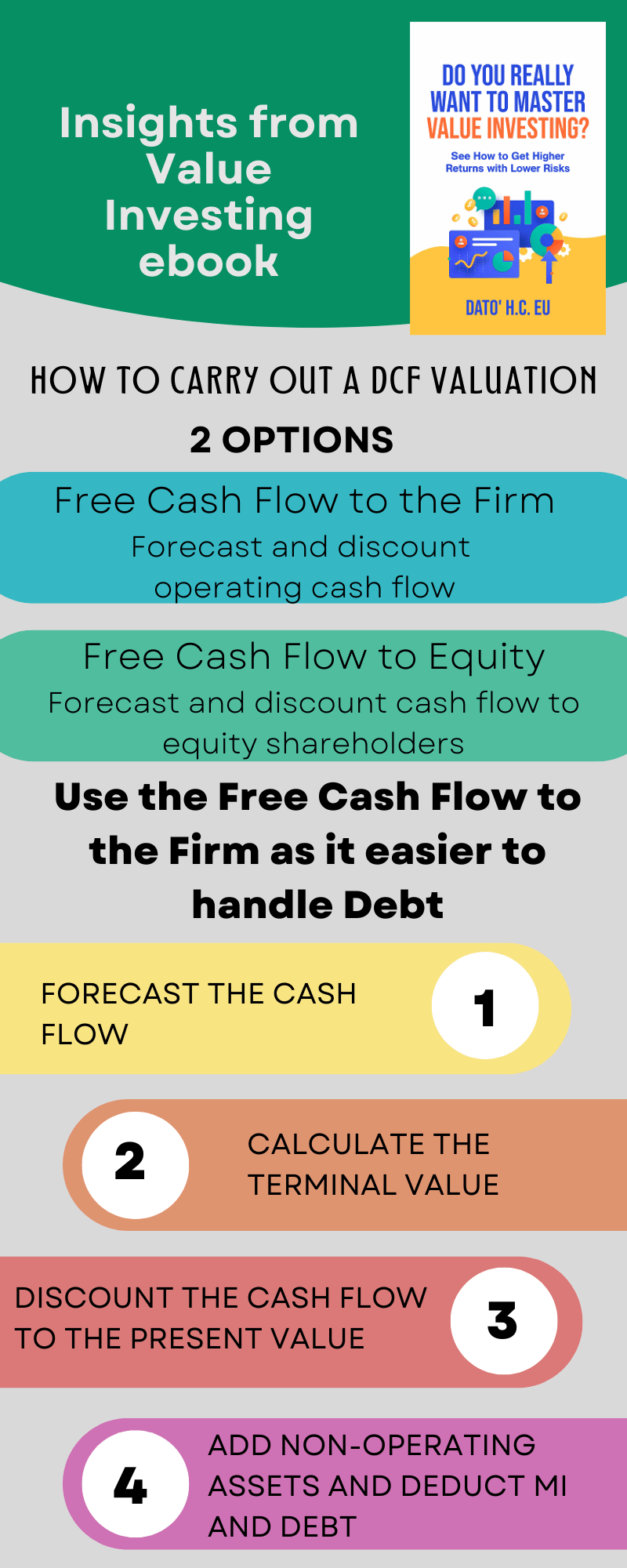

Discounted cash flow valuation methods

The intrinsic value of a firm is the net present value of the cash flows generated by the firm over its corporate life.

There are thus 2 key issues in using the discounted cash flow methods:

- What to use as the cash flows.

- The discount rates.

You have two choices when looking at the cash flows and discount rate. You can either determine the value to the Equity holders or all the providers of capital

In the former, you look at the cash flows to equity. This includes the cash flow to and from Debtors. The discount rate is then the cost of equity. In the latter, you are looking from the perspective of the firm. The cash flows are then before interest but after tax. The discount rate is then the weighted average cost of capital (WACC).

I prefer to use the cash flow to the firm as it is easier to handle Debt. The value obtained here is the value of the operating assets. To determine the total value to the firm you have to add the value of the non-operating assets. Then to determine the value to the Equity holders, you subtract the Minority Interests and Debt.

When looking at the cash flows, you also have to consider how they increase. At the same time, you cannot forecast the cash flow forever. At some point, you will have to assume that the cash flow reaches some terminal value.

There are thus 4 key parameters to consider:

- The starting cash flow.

- The growth rate.

- The Terminal value.

- The discount rate.

If you want to master value investing, you have to know how to determine each of the 4 parameters.

38. How to carry out a FCFF valuation

There are 2 ways to determine the intrinsic value of the operating assets of a firm:

- The discounted Free Cash Flow to the Firm (FCFF) method as per Damodaran.

- The discounted Residual Income method as per Penman.

There are 4 general steps in carrying out a FCFF valuation.

Step 1. Forecast the cash flows. You forecast EBIT(1-t) where EBIT is the earnings before interest & tax while t refers to the tax rate.

Stet 2. Calculate the Terminal value.

Step 3. Determine the present value of all the cash flows including the Terminal value. Effectively you discount each of the period FCFF by the relevant (1+WACC) term.

Step 4. Add the non-operating assets to the value estimated in Step 3. You then have to deduct Minority Interests and Debt to determine the value to the Equity holders.

39. How to carry out a Residual Income Valuation

There are two ways to carry out a DCF valuation – FCFF or Residual Income. If the assumptions are consistent, both will result in the same value.

The intrinsic value of the operating assets using the Residual Income method = Total Capital Employed + Present Value of Residual Income

Total Capital Employed (TCE) = Shareholders Funds + Minority Interests + Debt – Non-operating Assets.

Residual Income = After-tax Earnings – Capital Charge.

After-tax Earnings = EBIT(1-t) where EBIT is the earnings before interest & tax while t is the tax rate.

Capital Charge = WACC x Total Capital Employed.

There are 7 steps to estimate the intrinsic value using the Residual Income to the firm method.

Step 1. Forecast the earnings ie forecast EBIT(1-t) for each period.

Step 2. Forecast the TCE for each period. This will enable you to determine the Capital Charge for each period.

Step 3. Compute the Residual Income for each period.

Step 4. Calculate the Terminal Residual Income.

Step 5. Determine the present value of all the Residual Income including the Terminal Residual Income. You do this by dividing each item by the respective (1+WACC)^(n-1) where n is the number of years.

Step 6. The intrinsic value of the operating assets = TCE + Present Value of Residual Income.

Step 7. The intrinsic value of the firm = Value of operating assets + value of Non-operating Assets. You then determine the value to Equity by deducting the Debt.

40. How to handle special cases in valuation

To learn investing, we use case studies. Most of the time, the case studies focus on one topic. But real-life is messier. You will come across mixed situations.

When you value companies, there are some common situations that you have to take into account. Some examples are:

Large cash balance. The value of the operating assets assumed that you have the cash required for working capital purposes. But some companies have cash in excess of this. You should treat this excess as non-operating assets. In practice, I have difficulty differentiating between operating and non-operating purposes. As such I treat all cash as non-operating assets.

Brands and other intangibles. I consider them as part of the operating assets. As such the value of the operating assets using either the FCFF or Residual Income methods already covers the value of brands and other intangibles. There is no need to account for them separately.

Companies with negative earnings. Many companies in the start-up stage may have negative earnings. To value such companies, you have to project them to a stage where the earnings turn positive.

Cyclical companies. The performances of such companies are dependent on some macroeconomic variable. Valuing them based on where they are currently in the cycle can lead to a wrong picture. You should thus normalize their performances over the cycle first when valuing them.

Project-based companies. The earnings from such companies tend to be lumpy. Forecasting them can be a challenge if there is no long-term consistent history. I treat these as cyclical companies. When using the Asset Value, I consider the possibility of impairments.

41. How to value holding companies

Companies sometimes own other operating companies making it a holding companies. The holding company may or may not have operational control over the companies they own.

For holding companies without operational control, treat the companies they own as investments. They are non-operating assets. You use the Dividend Discount Model or the Asset Value to value the companies they own. You then add these values to the value of the operating assets of the holding company.

For the holding companies with operational control, you can value the consolidated cash flows. If there is sufficient information for the individual companies they own, you can value them separately. You then use the sum-of-parts valuation to determine the value of the holding company.

42. What can go wrong when valuing companies

You rely on the Financial Statements for your valuation. If these are not reliable, you will have issues.

I have personal experiences of things that went wrong because of unreliable financial statements. They cover both my Asset-based and Earnings-based valuations.

When you do an Asset-based valuation, you rely on the Balance Sheet. You assumed that the information provided is accurate. I have had experiences when this was not the case. For example, the Debt was not reflective of the real situation.

When you do an Earnings-based valuation, you rely on the accuracy of the P&L statement. I also have come across situations where the P&L statements do not provide an accurate picture. There were fictitious revenue and costs were understated.

Risks

We all agree that risk and opportunity are two sides of the investing coin. Some avoid the stock market because they fear the risk. At the same time, many are attracted to the stock market because of the perceived returns.

According to Warren Buffett, the key to investing is not to lose money. As such risk management management is another skill to pick up when you learn investing. There are 2 schools of thoughts when it comes to risks.

- Those that view it as volatility.

- Those that view it as a permanent loss of capital.

I follow the permanent loss of capital school. But I also adopt measures to ensure that I am not forced to convert paper losses due to volatility into a permanent loss of capital.

Risk management is one of the building blocks required to master value investing.

43. My risk-averse approach

Risk is not some number. It is about some events that can lead to a permanent loss of capital. If you take this view, then risk mitigation should involve every stage of your investment process.

Start with an asset allocation plan. Accordingly, the 3 Buckets asset allocation plan is part and parcel of the risk management plan. Dovetail this into your stock portfolio. The stock portfolio is another important building block in the risk management plan.

I use the risk management framework to assess risk and bring it into my investment process.

44. What is risk

For most investors, the risk they take when they buy a stock is that the return will be lower than expected. In other words, it is the deviation from the average return. Each stock has its standard deviation from the mean, which many calls risk. It is not hard to see why volatility is considered a risk.

The volatility school focuses on diversifying the non-systemic risks. It demands higher returns for bearing higher systemic risks.

When you invest in the stock market, you will suffer a permanent loss of capital when your total gain is negative. The total gain comes from both capital gain and dividends. The total return is defined as the total gain divided by the original investment sum. A permanent loss of capital occurs when you have a negative total return.

The risk of investing then is the threat that you incur a negative total return. When you think of such risks you have to think in terms of the various reasons you can suffer a negative return.

The permanent loss of capital school will look at the threats that lead to the impairment of capital and adopt a host of measures to mitigate them.

45. Overall risk mitigation approach

The key is not how you classify risks. You have to address all of them. I have a 3-stage risk mitigation plan for this.

- Asset allocation.

- Stock portfolio.

- Investment process of individual stocks.

The asset allocation plan addresses 2 situations commonly faced – volatility and permanent loss of capital. I allocate my net worth to 3 asset classes - liquid assets, safe assets, and risky assets.

By having some liquid assets for emergencies, I am not forced to sell the stocks at the wrong time. By having some safe assets, I will not lose all when the stock market tanks.

I also have a portfolio of 30 stocks to take care of non-systemic risks.

To minimize the systemic risks, I follow the value investing approach. At the same time, I have a stock risk mitigation framework to identify, assess and mitigate the various investment risks. They are part of the requirements to master value investing.

46. How to mitigate risks

There are 2 schools of thought when it comes to risks.

- Those that view it as volatility.

- Those that view it as a permanent loss of capital

The former has lots of academic literature where risk is broken down into systemic and non-systemic risks. After holding a diversified portfolio to handle non-systemic risks, you demand a higher return for taking on systemic risks. One way to achieve the latter is to incorporate Beta into your valuation.

I follow the permanent loss of capital school when it comes to risk. I use my risk mitigation framework to manage risk. This involved identifying the threats, assessing them, and adopting a host of measures to mitigate them.

47. How to suffer a permanent loss of capital

The risk of investing is the threat that you incur a negative total return. When you think of such risks, you have to think in terms of the various reasons you can suffer a negative return. There are several ways in which you can suffer a loss:

- Deterioration in the intrinsic value. This could be due to socio-economic reasons, political risks, and business risks. This in turn will cause the price to be permanently lower than the purchased price.

- Errors in analysis. These could be due to corporate governance issues. You mistakenly identify the stock as a good investment when in fact it is facing some insurmountable problems.

- Behavioural - those due to your biases. These could lead to errors in analysis or cause you to panic sell.

- Stock Exchange risks - trading suspension, liquidity issues, market manipulation. These could affect market sentiments and cause the price to decline

48. Risk insights from valuation

You can get insights about the margin of safety by comparing market price, Asset Value (AV), and Earnings Value (AV).

There 4 likely scenarios:

- Scenario 1: AV = EV where the market price is lower than both the Asset Value and Earnings Value. There is an excellent margin of safety here.

- Scenario 2: EV > AV where the market price is higher than the Asset Value but lower than the Earnings Value. I rate this as a better-than-acceptable margin of safety.

- Scenario 3: EV < AV where the market price is higher than the Earnings Value but lower than the Asset Value. I consider this as an acceptable margin of safety. The assets are under-utilized but they still provide some downside protection.

- Scenario 4: The market price is higher than both the Asset Value and Earnings Value. There is no margin of safety here irrespective of whether EV > AV or EV < AV.

49. My risk mitigation framework

How can you manage investment risk from a permanent loss of capital perspective? I would like to break down the process into 3 steps:

Step 1. Identifying the causes of risks. I used the Ishikawa diagram to help here.

Step 2. Assessing the risks using a Threat Matrix. I looked at the likelihood and impact of each of the risks.

Step 3. Adopting the measures to mitigate them. I used a Risk Mitigation Matrix to formulate the mitigation measures based on 4 strategies. These are avoiding, reducing, accepting, and transferring risks.

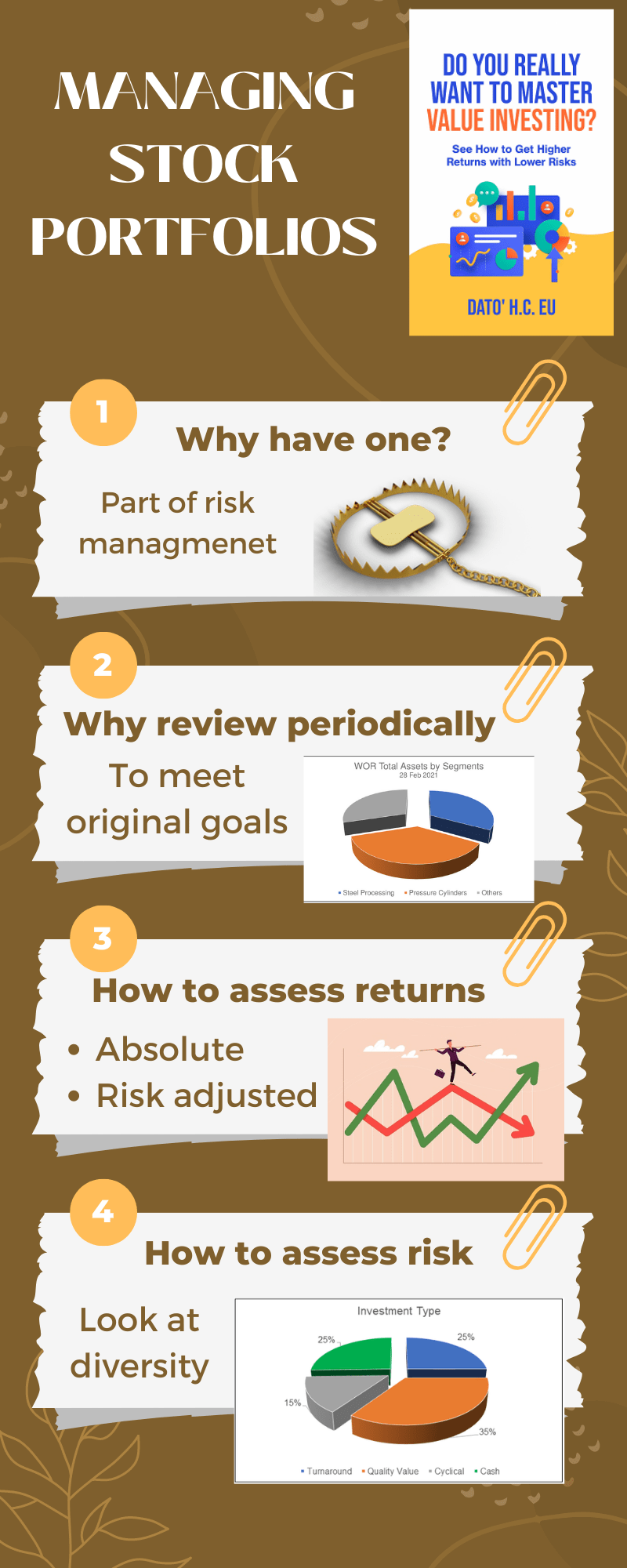

Stock Portfolio

If you know that a particular stock is going to give the best return in the future, you would be an idiot not to put all your money into this one stock. The reality is that we cannot foresee the future. So, we spread our money to several stocks. We diversify thereby establishing a stock portfolio.

The idea behind diversification is that if one stock does badly, we hope that the others will do well enough to offset the one that did badly.

Having a diversified stock portfolio then is about risk management. The extent of the diversification is dependent on having uncorrelated stocks.

50. Managing a stock portfolio

There are two aspects to managing a stock portfolio:

- How do you construct one?

- How do you maintain it?

The goal of a stock portfolio is to have a good balance between risk and return. The first step is then to set the target return and target risk.

While you can numerically set the target return, doing the same for risk can be a challenge. To handle this, I have several diversification rules of thumb such as:

- The maximum % for a single stock value relative to the portfolio value.

- The maximum % for a stock category eg sector value relative to the portfolio value.

These serve as my diversity targets. Once you have established the stock portfolio, you need to periodically review them to:

- Assess the returns.

- Check that the diversity targets are still met.

51. Construction of a stock portfolio

There are 4 key questions when it comes to constructing the stock portfolio:

- How do you select the stocks?

- How many stocks should you have?

- How much to invest in each stock?

- How do you establish the position?

Depending on your investment approach, the answers to the above 4 questions will vary. I adopted the following from a value investing perspective:

- The stocks in my portfolio were selected based on a bottom-up value stock-picking process.

- I target 30 stocks as studies have shown that beyond this number, the benefits of diversification become margins.

- I start with an equal amount allocated to each stock. But for those with more conviction, I allocate a higher amount, by taking it from those with the least conviction.

- I don’t buy the selected stock in one go. Rather I take time to scale in. Sometimes it may take a few months before I reach my target amount.

52. How do you select the stocks?

If you were a top-down investor, you would first identify the sectors and/or countries to invest in. Thereafter you identify the stocks that fit these criteria.

But I am a bottom-up value investor. I pick stocks based on whether there is a sufficient margin of safety. The stocks can come from different sectors or have different characteristics.

Technically I don’t construct a stock portfolio like that top-down approach. Rather my stock portfolio is a collection of stocks that I invest in. Then to ensure that I meet the diversification objective, I analyze them to see that they meet my diversification criteria.

In other words, the 30 stocks I target should come from different sectors, different sizes, different regions, and different investment types.

53. How much to invest in each stock?

I had a rule that the maximum amount invested for a particular stock should not be more than 10% of the total market value of the stock portfolio. If you follow this to the logical conclusion and allocate 10% to each stock in the portfolio, you would end up with 10 stocks.

You can see that there is a relationship between the 3 key parameters of a portfolio.

- The total amount to be invested in the portfolio.

- The number of stocks in the portfolio.

- The amount to be allocated to each stock - the position size.

Assuming 30 to 40 stocks in the portfolio, then the average amount invested in each stock will range from 2.5 % to 3.3 % of the total portfolio value. Of course, if the amount for each stock is not the same, then the range would be wider.

I mentioned earlier that there was an upper limit of 10% based on the risk mitigation criteria. How was the 10% determined? On one hand, the 10% represents the total amount I was prepared to lose in one stock. The amount would vary with the risk tolerance of an individual.

There are 2 concepts that I used to determine how much to invest in each stock:

- Expectancy.

- Kelly formula.

I have adapted them to come up with the following rules of thumb:

- I invest the most in the stock with the greatest probability of winning and the best win-size to loss-size ratio.

- This can be translated into investing more in those where you have the best conviction and/or highest margin of safety.

54. How to be diversified

With Modern Portfolio Theory, there is a quantitative approach to stock selection that balances risk and return.

However, I do not use Modern Portfolio Theory. I thus had to come up with a qualitative process to ensure diversity. I do this by ensuring that the portfolio comprises of stocks with different characteristics.

I focused on 4 characteristics – sector, market cap, region, and investment type. Investment type refers to the business performance eg start-ups, compounders, and quality companies.

There are several groups within each characteristic. For example, for the sector, I have steel, plantations, financial institutions, and tech companies.

I then have a rule of thumb where within a characteristic, the value of a group cannot exceed 30% of the total portfolio value.

I also have a rule that a single stock should not account for more than 30% of the stock portfolio value.

55. Assessing the portfolio

Over time, the value of the individual stocks in the portfolio will change due to changes in the market price.

These changes will lead to gains or losses for the portfolio. At the same time, the profile of the portfolio will also change. Your original diversity targets may be exceeded.

That is why you need to periodically review the stock portfolio. I normally carry out a quarterly review with 2 goals in mind:

56. How to assess portfolio returns

When it comes to the stock portfolio, the return for the portfolio is complicated by the following situations:

- During the period, some of the stocks could be losing money.

- You could have sold off some stocks and been holding cash.

- You could have also allocated additional funds to the portfolio.

To cater to such situations, I define the total gain and return from a stock portfolio as:

- Total Gain for the portfolio = current value - previous value + dividends + any un-invested money.

- The portfolio returns for the period = gain divided by the previous portfolio value.

Then when it comes to assessing returns, you can look at them on:

- An absolute basis.

- Relative to the benchmarks.

- Risk-adjusted basis using measures such as the Information ratio and the Jensen Alpha.

To be continued

The e-book is available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

Both Amazon and Kobo provide an opportunity for you to view a sample of the contents. - At the Amazon book page, click on the "Look Inside" button.

- At the Kobo book page, click on the "Preview Now" button.

- At the Google Play book page, click on the "Free Sample" button.

The e-book is available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

Both Amazon and Kobo provide an opportunity for you to view a sample of the contents.

- At the Amazon book page, click on the "Look Inside" button.

- At the Kobo book page, click on the "Preview Now" button.

- At the Google Play book page, click on the "Free Sample" button.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

You have given great content here.Money Trading in India I am glad to discover this post as I found lots of valuable data in your article. Thanks for sharing an article like this.

ReplyDeleteI should say this is an especially educated article as we have seen here. Your way to deal with creating is incredibly perfect and moreover it is an important article for us. Appreciation for sharing an article like this.Intraday tips provider India

ReplyDeleteThis article contains a lot of critical information. I'm staggered by the idea of the information and besides it is a useful article for us, Gratitude for share it.Best Option Trading Tips Provider In India

ReplyDeleteNotwithstanding, you can make extraordinary returns on the off chance that you figure out the idea of the investment.

ReplyDeleteExponent

This blogpost opened my eyes to a whole new perspective!

ReplyDeletestock market advisory company