Are there Bursa proxies for gold?

Case Notes 26. This article explores whether there are Bursa Malaysia gold proxies. It also considers whether an investor would be better off investing in a Bursa Malaysia gold proxy rather than gold. Revision date: 24 Sep 2023.

The world is currently experiencing high inflation. While Malaysia has yet to see an inflation rate over 8 %, many believe that this is due to price controls and/or subsidies. In times of high inflation, gold is seen as an inflation hedge.

For thousands of years, gold has been used as money and considered a store of wealth. Gold is an excellent choice of investment for many reasons. It can be used as a hedge against inflation and will always be of value due to scarcity. It is also a great portfolio diversifier.

If you are looking to invest in gold, you can invest in physical gold or gold funds. This is because the values of gold funds move closely with the price of gold. Alternatively, you can consider at investing in gold miners as proxies for investing in gold. This is because many think that gold mining and gold are similar.

I have a 3-minutes video that gives you an overview of the issues to consider when investing in gold proxies. It also touches on whether there are Bursa proxies for gold.

There is only one active Bursa Malaysia gold mining company. But there are Bursa Malaysia-listed gold jewellers. In this article, I will explore 4 such companies to see whether they can be proxies for investing in gold. They are:

- Poh Kong Holdings Bhd (Poh Kong) – jeweller.

- Tomei Consolidated Bhd (Tomei) – jeweller.

- Bahvest Resources Bhd (Bahvest) – gold miner

- Niche Capital Emas Holdings Bhd (NICE) - jeweller.

Should you go and invest in them? Well, read my Disclaimer.

Contents

- Company profiles

- Gold vs gold proxies

- Are there Bursa Malaysia gold proxies?

- Are you better off investing in gold?

- Method

- Conclusion

|

Company profiles

As of 3 Sep 2023, iSaham listed 9 gold/silver stocks under Bursa Malaysia.

- Bahvest

- Bornoil

- Nice

- MuiProp

- PohKong

- Tomei

- YongTai

- YXPM

- Zhulian

In my original article in Sep 2022, I covered only 4 of them. They were those with financials from 2007 to 2021 period. The other companies did not meet my analysis criteria. In this update, these 4 companies continue to meet my criteria. Refer to the Method section for the rationale I omitted the 5 other companies.

The 4 companies covered in my analyses are of different sizes as shown in Table 1.

|

| Table 1: Size |

To wash out the size effect, I constructed indices and compared the performance of these indices with that of gold.

I had covered Poh Kong in my blog some time back. For details of this company refer to “Is Poh Kong a proxy for gold?”

Brief profiles of the other 3 companies are:

- Tomei was founded in 1968 as a jeweller designer and manufacturer. It was listed on Bursa Malaysia in 2006. Today it has more than 50 retail outlets in Malaysia under 4 different brands. Tomei also exports its products to Singapore, Vietnam, Thailand, Indonesia, and Europe.

- Bahvest was listed on the KLSE’s ACE market in 2005. The group engages in the gold and silver mining business in Malaysia. Its gold mine deposit covers a total mining area of 318 hectares located in Tawau, Sabah. The group also has an aquaculture operation, but this accounted for less than 10% of the group's revenue in 2021.

- NICE is principally involved in investment holding, trading, distribution and retail of jadeite stones, gold jewellery and ornaments, construction and project management. The non-gold segments accounted for about 43 % of the group's revenue.

Gold vs gold proxies

A gold proxy stock is a publicly traded company whose financial performance and stock price are closely correlated with the price of gold. Investing in gold proxy stocks allows investors to gain exposure to the price movements of gold without actually owning physical gold. These stocks are often associated with companies involved in the exploration, mining, production, or distribution of gold.

Resource World Magazine has the following view on the difference between gold and gold miners.

“A popular misconception about gold and gold miners being similar has to do with the symbiotic relationship between the two. Mining companies have claims to, or outright ownership of, gold that is in the earth. The gold resources need to be extracted, processed and then sold to cover the costs of operations for the company to make a profit.

Gold in the ground is very different than a gold coin that can easily be transferred from a seller to a buyer. Mining companies are dependent on the price of bullion in relation to fiat currencies. Specifically, if gold is too low in price, a mining company is unable to extract the gold from the ground, because it is uneconomical…The higher the price of gold, the more economical it becomes to dig for lower-grade sources of gold. Mining shares can move up significantly as gold moves higher, but that is not always the case.”

Gold proxies such as gold miners or jewellers use gold as their raw materials. Investing in gold proxies is thus investing in companies where gold is one of the factors of production. Whether gold is a big component of the factor of production will depend on the nature of the business.

The following quote from ETF.com illustrates the point.

“…In the end, a miner is a company that seeks to maximize profits for shareholders. Profitability is going to vary for each of the miners depending on their output, cost structure and other considerations…Miners can hedge their output providing steady profits for the firm…Management can have a tremendous impact on profitability.”

For those investing in gold proxies, they hope that there is a “multiplier” effect of gold on the profits. This in turn will lead to a larger share price movement compared to the gold price movement. At the same time, there are the potential dividends.

This is different from investing in gold where the only way to make money is from the gold price movements.

Why gold proxies?

Investing in gold proxy stocks can be an attractive option for investors for several reasons:

- Diversification. Gold has historically had a low correlation with traditional asset classes like stocks and bonds. Adding gold proxies to your portfolio can help diversify your investments and reduce overall portfolio risk.

- Inflation hedge. When the purchasing power of fiat currencies erodes due to rising inflation, the value of gold tends to rise. Investing in gold proxies can help protect your wealth during inflationary periods.

- Risk Mitigation. Gold proxies can provide a way to benefit from this safe-haven demand without the need for physical storage or security concerns.

- Liquidity. Many gold proxies such as gold mining stocks, are highly liquid. They can be bought and sold easily, providing flexibility for investors.

- Speculation. Some investors are attracted to the potential for significant capital appreciation in gold proxies. For example, gold mining stocks can offer leveraged exposure to the price of gold, which means their prices can rise more sharply than the actual metal when gold prices increase.

- Portfolio Balancing. Gold proxies can be used strategically to rebalance a portfolio.

- Dividend Income. Some gold proxies may pay dividends to shareholders.

- Accessibility. Investing in gold proxies is often more accessible and cost-effective than purchasing physical gold.

- No Storage Costs: Unlike physical gold, gold proxies do not require storage costs or security measures, making them more cost-effective for some investors

But when you consider the investment benefits of gold vs gold proxies, you have to also look at the impact on the portfolio. This is because physical gold and mining stocks react differently within a properly diversified portfolio.

|

Impact on portfolio

According to Resource World Magazine,

“Gold is the most negatively correlated asset class to traditional financial assets such as stocks and bonds…Multiple studies show that a portion of physical gold held within an investment portfolio improves returns and reduces risk, whereas shares of gold mining companies increase the amount of risk within a portfolio, and can negatively affect returns over the long run.”

The chart below illustrates this. You can see that a portfolio with gold will provide better risk-adjusted returns compared to a portfolio with gold mining stocks.

|

| Chart 1: Portfolio Comparison Source: Resource World Magazine |

Downside and risks of gold proxies

While investing in gold proxies can offer various benefits, it's crucial to be aware of the potential downsides and risks associated with them. Here are some of the key downsides and risks:

- Volatility. Gold proxies can be highly volatile.

- Market risk. The performance of gold proxies is closely tied to the price of gold, which can be influenced by a variety of factors - economic conditions, interest rates, geopolitical events, and currency movements.

- Company-specific risks. If you invest in stocks, you are exposed to the specific risks associated with the companies themselves.

- Investment costs. Investment vehicles have associated costs, including management fees and trading commissions. These costs can erode your returns over time.

- Tax. Depending on your jurisdiction, there may be tax implications associated with gains made from gold proxies.

- Currency risk: If you invest in gold proxies denominated in a foreign currency, exchange rate fluctuations can impact your returns when you convert back to your home currency.

- Regulatory. Regulatory changes related to gold or the financial markets in general can affect the performance and availability of gold proxies.

Are there Bursa Malaysia gold proxies?

To answer this question, I compared the performance of the 4 Bursa companies with the price of gold. I looked at two scenarios.

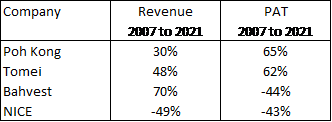

In the first scenario, I compare the gold price movements with the fundamental performance of these companies. I covered 15 years from 2007 to 2021 looking that the year-end prices with the results for the year. I used 2 metrics to represent the fundamental performance – revenue and PAT.

In the second scenario, I compared the gold price movements with the share price movements. I looked at two situations.

- The first covered the year-end prices over 15 years from 2007 to 2021.

- The second situation was for a shorter time frame from Jan 2019 to Aug 2022. I knew that gold prices had a significant jump around mid-2020 and I wanted to see the impact of this. For this analysis, I look at the prices every 10 days.

Refer to the Method section for other details of the approach.

Fundamentals

The rationale for this analysis was that gold represented the raw materials for these companies. Any changes in the price of gold would affect the revenue and profit margins.

If these companies are proxies for gold, there should be significant correlation between the price of gold and their performance. I would consider a 70% of higher correlation as significant.

Table 2 summarizes the correlation between the year-end price of gold and the revenue and profits for the year. You can see that only Bahvest had any significant correlation, but this was based on its revenue. There was a negative correlation when it came to profits. In other words, it lost money as the price of gold increased.

I would consider the correlation between gold prices and profits to be borderline for both Poh Kong and Tomei.

The analysis suggests that there are other factors rather than the price of gold that drove the profits of these 4 companies. Since dividends are generally tied to profits, investors should not hope for higher dividends when the price of gold increases.

|

| Table 2: Correlation between Gold Prices and Fundamentals |

Share prices

The share price of a company is a function of the business fundamentals and market sentiments. Rather than try to explain which has a greater impact, this part of the analysis merely takes the share price as one variable. The other variable is the gold price.

I look at 2 situations:

- In the first situation, I took the perspective of a long-term investor by looking at year-end prices over 15 years.

- In the second situation, I took the perspective of a shorter-term investor looking at more frequent price changes.

Table 3 summarizes the results of the correlation between gold prices and stock market prices of these 4 companies.

You can see that there is no significant correlation based on the year-end prices. But when you look at price changes every 10 days, we can see significant correlations for Poh Kong, Tomei and NICE. The links between the gold price and the share price can be seen in Chart 2.

|

| Table 3: Correlation between Gold Price and Share Prices |

According to Merriam-Webster, a proxy is an agency that acts as a substitute for another. In the investing context, a gold proxy is then an instrument that behaves like gold when it comes to gold price movements.

The analyses show that when looking for gold proxies, we should not consider the fundamental metrics such as revenue or profit. Rather we should look at prices. Even then we should look at price movements within short durations.

On a short interval basis, only Bursa Malaysia gold retailers can be considered as proxies for gold. Forget about the one Bursa Malaysia gold mining company.

Are you better off investing in gold?

To answer this question, I compared the gain from the various investments based on the short-term situation ie 2019 to 2022.

From 4 Jan 2019 to 26 Aug 2022, gold appreciated by 8.5 % CAGR. If you have invested in the Bursa gold jewellers, your compounded annual gains are shown in Table 4. The gains comprises both capital gains as well as dividends.

You can see that Bahvest did not achieved a better compounded annual total return than that for gold. I would consider those from Poh Kong and Tome to be more representative. On such a basis there is no advantage to investing in gold.

|

| Table 4: Shareholders' Gain |

Other studies

The conclusion that it is better to invest in gold rather than Bursa Malaysia proxies seems to be limited to Malaysia. There are different conclusions for other parts of the world.

Chart 3 is extracted from “New Evidence on Whether Gold Mining Stocks Are More Like Gold or Like Stocks”. This is a graph showing the price per share of the Market Vectors Gold Miners ETF (GDX), SPDR Gold Shares ETF (GLD), and the SPDR S&P 500 ETF Trust (SPY). You can see that you are better off investing in gold compared to gold miners.

You could of course argue that they were comparing gold miners which could be different from jewellers. Note that Bahvest is a gold miner.

|

| Chart 3: Gold Mines vs Gold Source: cais.org |

Swiss Gold opined as follows:

“…physical metal outperforms gold miners over the long run, and it should always be the preferred precious metals investment…Mining stocks are attractive because they are leveraged; this means that when gold prices go up, these stocks tend to move up MORE due to debt and financial leverage.

In the short term, mining stocks seem to outperform gold. However, gold mining equities carry many risks that physical metal does not have. Gold mining stocks can fail even if precious metals are in a bull market.”

Chart 4 reinforces this view. It shows the relative performance of gold and gold miners since 2000. Gold is in gold colour and the miners are in dark blue. Over the period from 2000 to 2018, gold has gone from below $300 an ounce to $1350. The HUI has gone from just below $75 to $182. The HUI is up around 150%, while gold is up around 350%.

Note: The NYSE Arca Gold BUGS Index, better known as the HUI Gold Index, is an index of publicly-traded gold-mining companies.

|

| Chart 4: Gold Mines vs Gold Source: Bullion Vault |

Method

The reasons why I have not covered the following companies in my analysis were as follows:

- Bornoe Oil Bhd (Bornoil). The group has various business segments that are broadly categorised under, Food & Franchise Operations, Property Investment & Management and Resources & Sustainable Energy. The company had announced its gold reserves in May 2022. But there was no reporting of this being in operations in its 2022 Annual Report.

- MUI Properties Bhd (MuiProp). According to the Oct 2020 Edge article, the group had exposure to gold by way of its 40.7% stake in Australian-listed gold exploration company Nex Metals Explorations Ltd. But it exited from gold mining interest when the Australian counterpart rejected MuiProp's option for loan stock conversion into shares and returned all investment plus interests in 2020.

- Yong Tai Bhd (Yong Tai). This is a property development group. In 2021 one of its subsidiaries obtained the exclusive right to undertake exploration works on a 100ha site in Bukit Kenderak in Pahang. But in its 2022 Annual Report, the company stated that “… will not proceed with the venture due to the unsatisfactory results expected from the gold exploration works.

- YX Precious Metals Bhd (YXPM). The group is involved in wholesaling, design and manufacturing of gold jewellery and was listed on the ACE Market of Bursa Malaysia Securities in 2022. Note that part of this group was part of the listing group of Tomei in 2006.

- Zhulian Corporation Bhd (Zhulian). This is a multi-level marketing company initially distributing gold-plated jewellery through its channel. However, in 2021, jewellery accounted for about 10% of the total revenue. As such I have not included it in my analysis.

The sources for my analysis were as follows:

- The financial data for the 4 companies were extracted from TIKR.com.

- The share price data for the 4 companies were extracted from Yahoo! Finance.

- The gold prices from 2017 to 2022 were downloaded from Bullion Vault.

- The annual gold prices from 2007 to 2021 were extracted from Macrotrends.

To compute the correlations, I first converted the respective values for each metric into indices. This was obtained by dividing the values at various points in time by the respective initial value. For example;

- The 2007 to 2021 revenue indices for Poh Kong was obtained by diving the annual revenues by Poh Kong’s 2007 revenue.

- The 2019 to 2022 share price indices for gold was obtained by dividing the gold prices on the various dates by the gold price as of 4 Jan 2019.

Note that the gold prices from Bullion Vault were based on prices every 10 days starting from 4 Jan 2019. When matching the share prices for a particular day, there were days when there were no share prices.

I then took the share price of the nearest day to represent the share price for that day. Sometimes this was one day before the reference date. Sometimes it was one day after. Most of the time, the share prices for the day before and after the reference day were the same.

Conclusion

The article looked at 2 questions:

- Can gold miners or jewellers be proxies for gold?

- Are you better off investing in gold or gold proxies?

To determine whether an instrument is a proxy, I looked at the correlation between the gold price and the appropriate metric. The analysis shows that there is no correlation between revenue or PAT and gold prices. There is only a significant correlation when we look at the stock prices on a short interval basis.

In the Bursa Malaysia context, investing in gold jewellers can be proxies for investing in gold. But I would not draw the same conclusion for the sole gold miner.

You should not be surprised by this result.

- In the short term, share prices are influenced more by market sentiments than business fundamentals. Over intervals of 10 days (as covered in the analysis), business fundamentals do not change significantly. Besides companies only announce their business performance quarterly.

- An investor can only guess how the business fundamentals would change as a result of daily or weekly changes in gold prices. But this is enough to influence market sentiments and hence changes in market prices.

As for the second question, the approach is to compare the gain from investing in gold with the gain from investing in proxy companies. In the Bursa Malaysia context, it is better to invest in gold proxies. This conclusion is different for other parts of the world that focus on gold miners rather than jewellers.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment