Is CBIP a money making opportunity? Find out using Shareinvestor.

Value Investing Case Study 35-1: This is a worked example of how I used the Shareinvestor WebPro to analyse and value a company. It uses CB Industrial Product Holding Bhd as the case study in this fundamental analysis.

There are many online platforms providing quantitative information and analysis of listed companies. They are generally based on data extracted from the financial statements.

With so much readily available information and analyses, how do you decide which metrics to use for your fundamental analysis?

I approach this from a value investor’s perspective. As a value investor, there are 2 critical questions when carrying out a fundamental analysis:

- Would the performance of the company in the next 5 to 10 years be better than in the past?

- Would the market price of the shares in the next 5 to 10 years be higher than currently?

The metrics I used are the ones that would enable me to answer these 2 questions. For the first question, I looked at the prospects of the company creating shareholders’ value. To answer the second question, I looked for whether the current market price is trading at a discount to its intrinsic value.

Join me as I carry out a fundamental analysis of CB Industrial Product Holding Bhd (CBIP or the Group) to determine whether it is an investment opportunity. The platform that I used is Shareinvestor WebPro (SWP). I assumed that you are familiar with using the various reports under the Fundamental page of SWP.

This is a worked example so there would be comments and other notes throughout the article. The analyses were carried out towards the end of Sept 2022.

Should you go and buy the stock? Well, read my Disclaimer.

Contents

- Concepts

- CBIP background

- Performance

- Management

- Prospects

- Valuation

- Investment Thesis

- Discussions

Any fundamental analysis usually covers both quantitative and qualitative analysis. Like many financial platforms, SWP do not provide enough qualitative information. At the same time, while SWP has a lot of quantitative analyses, it is a general platform serving a variety of investors.

As a long-term value investor, I have my analytical approach. The issue then is the extent I can extract the information from SWP for my quantitative analysis. To give you a sense of this, I have provided Case Notes in boxed sections throughout this article.

This is also a worked example of how I used SWP to develop my Investment Thesis. As such I have presented my Investment Thesis at the end as it pulls together the threads from the various analyses.

Concepts

I have earlier stated that I chose the metrics that are related to creating shareholders’ value. This meant focusing on those metrics that relate to intrinsic value.

Consider the following 2 versions for estimating the intrinsic value:

- Based on Free Cash Flow to the Firm model of intrinsic value = [ Free cash flow X (1 + g) ] / (r - g).

- Based on the transformed version of the Dividend Discount Model of intrinsic value = Book Value X [ (ROE - g) / (r - g) ].

where:

- Free cash flow = EBIT X (1 - tax rate) - Reinvestment.

- EBIT = earnings before interest and tax.

- Reinvestment = Capex + Changes in Working Capital - Depreciation & Amortization.

- r = cost of funds.

- g = growth rate.

As you can see, the factors that affect the intrinsic value of a company can be grouped into:

- Profitability – earnings, and returns.

- Growth - growth rate and reinvestments.

- Cost of funds. This is the discount rate which in turn is affected by risks.

Thus, for the fundamental analysis, I focused on those metrics that affect one or more of the profitability, growth, or risk factors.

My approach

The goal of fundamental analysis is to determine the performance and value of a company in the future. Peering into the future is very challenging.

I have spent the past 2 decades running 2 publicly listed companies. As an insider, I have all the information as well as being part of the team that developed the various strategies. We developed 5 years business plan with profit and return projections. Looking back, the reality is that I would be lucky to get more than 70% of the 5 years projections correct.

As a retail investor, your main source of information is the company’s Annual Reports. You are not likely to know the management team. Can you imagine trying to forecast the company’s performance as an outsider?

As such when it comes to fundamental analysis, I look at the historical performance and value as the base case. These are known with certainty. I then judge whether the future would be worst, the same, or better than the base case. I find that it is easier to forecast the future on a relative basis than project the cash flows over the next 10 years.

Preliminary outlook

Fundamental analysis is a time-consuming process. You want to check that there is a good chance that the company can be an investment opportunity before you spend the time and effort.

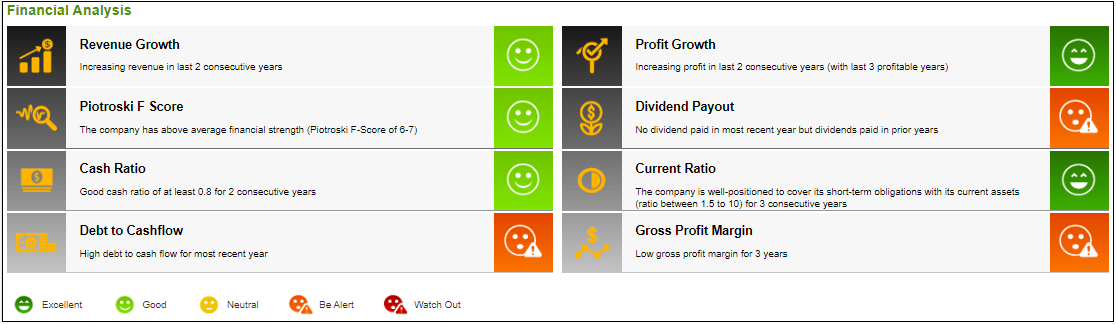

SWP has a Financial Analysis pictorial summary that can be used for this purpose. Chart 1 below is copied from the SWP Fundamental, Factsheet page. The many green ratings indicate that this can be a good candidate for detailed analysis.

|

| Chart 1: CBIP financial overview from SWP |

I only use the information in Chart 1 as a back-of-envelop check as the metrics covered the performances for the past one or two years. For my fundamental analysis, I want to look at the past 10 years of data.

This is because companies’ performances are affected by the business cycle. The past 10 years’ performance would provide a good picture of how they have performed over at least one business cycle.

All businesses have their ups and downs. It would be misleading if projections were based on periods when the company is either in the up part or down part of the cycle. As such I normalized the performances by taking the past 10 years average values.

CBIP background

Since 1979, CBIP has been equipping palm oil mills in Malaysia and around the world with high-quality processing equipment and replacement parts. The products enjoy a healthy market share in Malaysia as well as foreign markets.

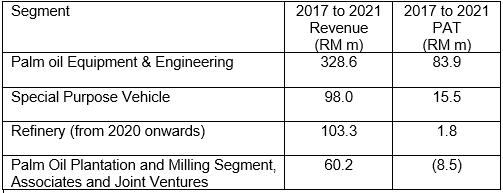

The Group today comprises 4 segments with the following average past 5 years revenue and PAT. You can see that the Equipment & Engineering segment is the largest revenue and profit contributor.

|

| Table 1: Segment Average Performance |

The Equipment & Engineering and Special Purpose Vehicle (SPV) businesses are project-based ones. I suspect that the Group ventured into the Refinery and Plantation businesses to have a recurring-income stream.

|

Performance

To get a sense of the overall performance, I tracked 3 metrics – revenue, profits, and gross profitability. Information for these is readily available under the SWP Financials page of the Fundamental tab as illustrated in Chart 2.

|

| Chart 2: Financial Performance from SWP |

However, the 3 metrics are of different scales. As such to see them together on one chart, I created indices for each of them by dividing the values of the various years by the respective 2013 values. In other words, I set 2013 as the bases with the values of 1.0.

The results are plotted as shown in Chart 3. You can see that:

- Revenue and PAT started to decline in 2016/17 before recovering in 2020. While the revenue in 2022 is above that of 2013, the PAT had yet to fully recover.

- Gross profitability had been declining since 2014 before leveling off in 2019. This was despite the improvements in profits.

If I was going to use historical performance to judge future performance, I needed to understand the reasons for the decline and recovery. Similarly, I also needed to know why gross profitability over the past few years is only about half of that in 2013.

This high-level picture helps to focus on where to dig for the answers.

|

| Chart 3: Performance Indices Note: The 2022 performances were based on the Jun 2022 Trailing 12 months. |

I found the answers in the Annual Reports.

- The lower profits in 2017 were due to forex losses of RM 39 million. This was 1/3 of the 2016 PAT.

- The revenue in 2018 decreased by 1/3 as compared to that of 2017 due to the reduction in activities in the SPV segment.

Segment analysis

Based on the above, I tracked the segment performances as shown in Charts 4 and 5. The reasons for the decline in the revenue and PAT were:

- The SPV segment ceased to have any significant revenue and profit after 2018.

- The Plantation and Refinery segments started to make significant revenue contributions after 2019. But the profits were not significant.

|

| Chart 4: Segment Revenue |

|

| Chart 5: Segment EBIT |

|

Returns

Returns are a measure of how effectively the assets have been used. I normally focus on 3 metrics – gross profitability, ROE, and ROA. These metrics are readily available from SWP as illustrated in Chart 6.

|

| Chart 6: Returns from SWP |

I extracted the data for the 3 metrics and plotted them as shown in Chart 7. You can see the decline in the returns from 2013 with the trough in 2019. From 2013 to 2022, CBIP achieved the following average returns:

- 13.7 % Gross profitability.

- 7.6 % ROA.

- 10.9 % ROE.

|

| Chart 7: Returns Trends |

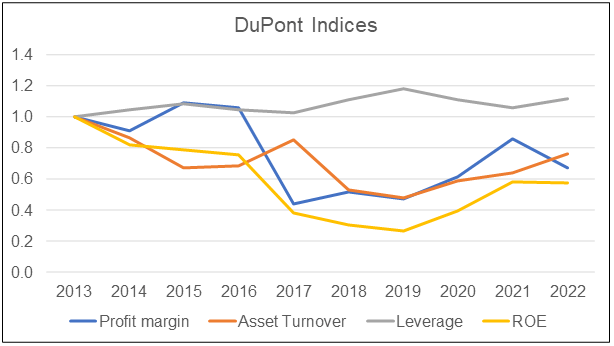

DuPont Analysis

I normally would dig deeper to find the reasons for the return pattern. One quick way is to use the DuPont Analysis. This breaks down the ROE as follows:

ROE = Profit / Equity

= (Profit / Revenue) X (Revenue / Assets) X (Assets / Equity)

= Profit Margin X Asset Turnover X Leverage

Each of these metrics is readily available from the Financials section, Fundamental tab of SWP.

As they are of different scales, I extracted and converted them into indices as shown in Chart 8. You can see that the bulk of the changes in the ROE is due to changes in the profit margins and asset turnover.

From 2013 to 2022, total assets increased by 75 %, but revenue only increase by 33 %. You should not be surprised to see a declining Asset Turnover.

Profit margins had also declined. While revenue increased by 33 % from 2013 to 2022, PAT declined by 15 %.

|

| Chart 8: DuPont Analysis |

Segment returns

Given that the 4 segments had different revenue and profit contributions, I wanted to see whether they had different returns as well. To get a picture of this, I compared the average segment EBIT over the past 10 years with the 2021 segment net assets.

Unfortunately, the information for such an analysis had to be extracted from the Annual Report. Table 2 summarizes the results.

- The SPV segment had the best returns despite the low-profit contributions over the past few years. This is because the shareholder’s funds allocated here were very small.

- The Equipment and Engineering segment generated the best EBIT. But this also used up a significant portion of the shareholders’ funds.

For the past 10 years, the average ROE of the Group was 10.9%. You can see from Table 2 that the ROE was low because about 1/5 of the shareholder’s funds did not have any return. The Group was not firing on all cylinders.

Financial strengths

I would rate CBIP as financially strong based on the following. These were based on information extracted from the Financials section, Fundamental tab of SWP.

- It had RM 85 million cash as of Jun 2022 with a 0.17 Debt Equity ratio.

- Over the past 10 years, it had generated a cumulative positive cash flow from operations. Except for 2022, it achieved positive yearly cash flow for 9 years in a row.

- It had an interest coverage ratio of 13 as of Jun 2022. Based on Professor Damodaran’s synthetic rating, CBIP would have a triple-A rating.

I would not worry about the financial risk. Rather the more critical ones are whether the Group could build back the SPV business and improve the returns from its Plantation and Refinery segments.

My main concern is the reinvestment rate. I defined reinvestment rate = reinvestment/profits.

From 2013 to 2022, CBIP had an average reinvestment of RM 75 million per annum. This is about 92 % of the average PAT over the same period. This is a very high reinvestment rate as the Group was developing the Plantation and Refinery businesses.

- In 2013, the Plantation segment had planted 4,400 hectares of its landbank. By 2022, the planted area had increased to 13,780 hectares.

- The Refinery segment started operating only in 2020.

This 92 % reinvestment rate is not sustainable. I would expect the reinvestment rate to come down due to:

- An increase in the profits from the Plantation and Refinery segments.

- A decrease in the investments as the Plantation and Refinery segments businesses mature.

Management

Warren Buffett opined the following when asked about how the average investor can assess the quality of a company’s management team.

- “I think you can learn a lot about that by reading about both what they’ve accomplished and what their competitors have accomplished, and seeing how they have allocated capital over time.”

- “We look for three things when we hire people. We look for intelligence, we look for initiative or energy, and we look for integrity. And if they don't have the latter, the first two will kill you, because if you're going to get someone without integrity, you want them lazy and dumb.”

I thus assessed management by comparing their results with those of its peers. I also looked at how they had allocated the cash flow from operations. From a qualitative perspective, I looked for consistency and transparency when reading the Annual Reports.

SWP provided a list of CBIP's peers under the Factsheet section, Fundamentals tab. An example is shown in Chart 9. SWP provided both local and international peers.

I selected only the local peers as over the past 10 years about 2/3 of CBIP revenue was from Malaysia. Note that this geographical revenue statistic was based on the segment reports in the Annual Reports.

|

| Chart 9: Peer Analysis from SWP |

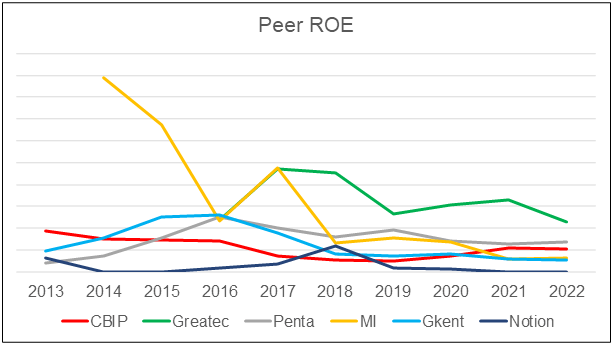

I wanted to compare the past 10 years’ revenue trends and the ROE achieved by the peers. Thus, I extracted the individual peer's data from SWP into Excel for further analysis.

There were 12 local companies listed as peers. To ensure an apple-to-apple comparison, I excluded those whose 2022 revenue was either + 50 % or - 50% of CBIP’s past 3 years’ revenue. This left me with 5 peers.

Chart 10 and 11 shows the comparative revenue and ROE trends for CBIP and its peers. CBIP had the largest absolute revenue among its peers.

|

| Chart 10: Peer Revenue |

|

| Chart 11: Peer ROE |

However, the picture is different when you look at revenue growth as shown in Table 3. I took the growth and average from 2016 to 2022 as two of the peers did not have data from 2013.

You can see that CIBP revenue growth and average ROE were in the bottom half of the peer panel.

|

| Table 3: Peer Average Performances |

Capital allocation

One way to assess capital allocation performance is to see how they have used its funds over the past 10 years. There are 3 main uses:

- Invest in assets than can generate future returns.

- Return monies to investors through dividends and/or share buybacks.

- Reduce debt.

The worse is to build up the cash hoard as the returns from holding cash are very low.

From 2013 to 2022, CBIP had RM 886 million of funds from the following sources:

- RM 636 million from Cash Flow from Operations.

- RM 190 million from an increase in net Debt.

- RM 60 million from a reduction in cash holdings.

These were deployed as shown in Chart 12. I would consider this a reasonable asset allocation.

|

| Chart 12: Capital Allocation |

Share buyback

From 2020 to 2022, based on SWP Company Buyback page under the Fundamental tab, the Group bought back shares at prices ranging from RM 0.81 per share to RM 1.66 per share. The volume weighted average price for these share buybacks was RM 1.01.

As can be seen from the Valuation section, the buybacks were at prices below the intrinsic value. In other words, the buyback added value to CBIP. Kudos to management.

Transparency

I have some concerns about management transparency. The first is the consistency in the reporting of its order book. The Equipment & Engineering and SPV segments are project-based businesses. As such having a sense of the order book and its trends will give a good picture of the short-term income potential.

The Group used to provide the status of its order book in the Annual Reports. But I could not find such information from 2019 onwards. I hope that this is not because the revenues from the Equipment & Engineering and SPV segments were no longer growing.

The Group grew its Equipment & Engineering segment on the back of its patented continuous sterilization technology. The patent for this expired in 2021. I expected some mention of this and the Group plans moving forward in the 2020/2021 Annual Reports. But I could not find any.

Shareholders’ value creation

One of the goals of management is to create shareholders’ value. I assessed this based on 3 metrics:

- Are the returns greater than the cost of funds?

- Is the total return (capital gain + dividends) greater than the cost of equity?

- Was the share buybacks carried out a prices less than the intrinsic values?

Shareholders' value would be created if the answers are "Yes" for all of them. I have earlier concluded that its share buyback added to shareholders value. The answers for the other 2 are not so clear-cut.

I normally determine the cost of equity and the cost of funds using the Capital Asset Pricing Model. For simplicity in this worked example, I just assumed that the cost of equity for CBIP was 10%.

From 2013 to 2022, CBIP achieved a 10.9 % ROE. This is just slightly better than the 10% cost of equity.

As for the total return, SWP reported this under the Factsheet page, Fundamental tab as illustrated in Chart 13. You can see that based on a 5 years window, the total shareholders’ return was negative.

|

| Chart 13: Total Return from SWP |

How would you rate management based on the peer comparison, asset allocation, share buyback, transparency and shareholders' value creation? I would rate CBIP management performance as average.

Generally it is hard to separate management's performance with the company's performance. Nevertheless, I have a separate analysis on management as this is the party that would be driving the future performance.

If there is any change in management, you will have to judge whether the historical performance can be used as a guide for the future. In the case of CBIP, the Executive Directors in 2013 continued in this role till 2021. They are currently in their 60s and it looks as if they would continue to be with the Group over the next 5 to 10 years.

|

Prospects

Except for the SPV segment, the other 3 business segments are tied to the palm oil sector. This is good as the palm oil sector is not a sunset industry.

“The global palm oil market…is anticipated to grow at a CAGR of 5.1% in terms of revenue from 2022 to 2030. The market is driven by exponentially growing demand from the food, beverage, biofuel, energy, personal care, and cosmetics industries.” Grandview Research

While the 5.1% points to a mature industry, there are opportunities for the Group to grow.

- The Group grew the Equipment & Engineering segment over the past 2 decades with the patented continuous sterilization technology. But the patent for his technology expired in 2021. I do not expect growth from this product. But there is the possibility that the Group can repeat history with the zero-discharge technology that is being commercialized.

- There is still growth for the Plantation segment as in 2021, the Group planted acreage was only 45 % of its landbank.

- The Refinery business is only about 2 years old. There is hardly any return from this segment as shown in Table 2. Any improvements in the return will contribute to earnings growth.

Remember my first question? Will the performance in 5 to 10 years time be worse, the same or better than the past? Based on the various analyses, I concluded that it would not be worse. Most likely it would be better. A pessimistic view would judge it as the same. I thus assessed the Group as fundamentally sound. The next step is to bring this perspective into the valuation.

Valuation

I considered 3 valuation approaches in order to triangulate the margin of safety.

- Asset-based using the Net Asset Value.

- Earnings-based using the Discounted Free Cash Flow to the Firm model. I ignored growth given the historical performance ie I used the Earnings Power Value (EPV).

- Relative valuation based on the Acquirer’s Multiple. A ratio of 6 or less is considered cheap.

Table 4 summarized the values and the margins of safety.

You can see that there are margins of safety under both the Asset Value and EPV. At the same time, the stock is cheap based on the Acquirer’s Multiple.

Note that the EPV was based on historical values. I would expect the future to be better than the past because:

- The Plantation segment still has land for further plantings.

- The Refining segment business is still in its early stages.

- There is the potential commercialization of the zero-discharge technology.

The historical EPV is a conservative view. This was because there were no significant contributions from the Plantation and Refinery segments. A more optimistic approach would be to build some profits from these 2 segments into the projected earnings. However since there is already a margin of safety from the historical EPV, I did not do this.

Given these growth potentials, I would take the Asset Value as the floor value. There is a 36 % margin of safety with this floor value.

Insider trades

Insiders have better information than the retail investors. They are in a better position to know the prospects of the Group. While many may not have corporate finance background, they tend to have some general understanding of the value of the company.

That is why looking at insider trades can give you a sense of whether the current market price is trading at a discount or premium to the intrinsic value. A lot of insider buying would suggests confidence in the future and possible underpricing of the shares. A lot of insider selling would be a red flag.

SWP has an Insider Trades page under the Fundamental tab. Based on this, insiders were buying CBIP at prices ranging from RM 1.26 per share to RM 1.60 per share over the past 9 months. The volume weighted average buying price was RM 1.34 per share. This is a good smell test for the computed intrinsic values.

|

Investment Thesis

CBIP is a Group in transition. The bulk of the returns is currently generated from one segment – Equipment & Engineering – resulting in an average 10.9 % ROE. This segment appears to be a mature business. But there is a possibility of segment growth if the Group can commercialize the zero-discharge technology.

There are also potential growths from the Plantation and Refinery segments. But these will need reinvestments. The SPV segment is project-based and should not be depended on for improvements in the ROE.

CBIP is financially strong. Historically it funded the reinvestments required for growth without affecting its dividends. At the same time, there is a sufficient margin of safety based on the various valuation metrics.

Given the above, CBIP is an investment opportunity from both business fundamentals and valuation perspectives.

|

Discussions

The goal of the fundamental analysis is to determine whether:

- It is a good company. A good company is one that is fundamentally strong. I have defined this as one with prospects of creating shareholders’ value.

- It is a good investment. I define this as one that can enable you to make money. This requires it to be trading at least 30 % discount to the intrinsic value.

The idea is to have both a good company and a good investment. But as a contrarian, I have also invested in situations where the companies are not sound fundamentally but were trading at a huge discount to the intrinsic values.

We are lucky with CBIP as it is both a good company as well as a good investment. Although there are issues with growth, I did not factor this into my valuation.

Fundamental analysis requires both a quantitative and qualitative analysis. SWP provides about ¾ of the quantitative information that I required as it does not have segment analysis.

When I first started value investing 2 decades ago, there were no affordable financial platforms. I have to manually input all the financial statement data into Excel. With SWP, I am freed of this clerical task and can focus my time on interpreting the numbers.

While I am a numerical person, I always remember what Warren Buffett said:

"It is better to be approximately right than to be precisely wrong."

As such in my analysis, I look for broad trends. I triangulate the intrinsic values.

As shown in this case study, I am interested in what is happening behind the numbers. For this, I have to rely on qualitative analyses. A good part of the information for the qualitative analysis comes from the Annual Reports. SWP is useful here as it has collated all the Annual Reports for easy download.

As a retail investor, you do not have the opportunity to meet with management. You also do not have the time and resources for fieldwork. As such, I focus on desk research. There are lots of readily available online resources on industry trends and issues. I use them to identify secular trends and issues that can affect performance as illustrated in the Prospects section of this article.

When it comes to valuation, the key is to ensure that it is not a mindless number-crunching exercise. That is why the company analysis part is critical. It helps ensure that the assumptions used are realistic.

While SWP has some valuation calculators, there is not enough information on the assumptions used. As such I have not used the SWP calculator for my valuation.

I would say that SWP is one toolkit a fundamental investor should have. It saves clerical work and provides a first-cut picture. But if you consider investing as a zero-sum game, you cannot expect to win by following the crowd. Basing your investment decision just on what is readily available from SWP does not provide differentiation.

I hope I have shown you how to be different while using SWP.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment