Are there opportunities in the Bursa auto sector?

Case Notes 28. This article looked at the Bursa Malaysia auto sector and identified the better companies for further investigation. It also compiled the base rates for the auto sector.

In July 2022, the Malaysian Automotive Association (MAA) projected the total industry volume of 630,000 new vehicles. This was up from 600,000 units set earlier this year. The revision stemmed from the expectation that Malaysia would continue its recovery. (Source: New Straits Times).

Kenanga Research in Jun 2022 upgraded the Malaysian automotive sector to overweight. It projected the earnings in later quarters to normalize to pre-pandemic levels. This was on the back of sector earnings growth of 22% in FY2023. (Source: The Edge Market)

But, UOB Kay Hian Research retains its underweight outlook on the Malaysian automotive sector. It opined that there would be downside risks. This was due to the ongoing weakening of the ringgit against the US dollar and the prolonged chip shortage. Based on the companies under its coverage, it forecasted a 6.8% and 4.6% fall in sector earnings and revenue in 2023. (Source: Focus Malaysia)

Given the above news, I wanted to see whether there are investment opportunities in this sector. Malaysiastock.biz listed 12 Bursa Malaysia automotive (auto) companies. I thus used this list to represent the sector.

Based on my screen, I identified Hong Leong Industries as a candidate for further analysis and valuation.

Should go and buy it? Read my Disclaimer.

Contents

- Sector background

- Performance

- Screening for investment opportunities

- Methodology

|

There were 2 goals of my analysis:

- To derive the base rates for the sector.

- To identify the potential companies for further analysis.

Note that Malaysiastock.biz has a separate list of Bursa Malaysia auto parts companies. There are 13 companies on this list. The companies on this list are different from those listed under the Bursa Malaysia auto companies. For my analysis, I only focussed on the auto companies and not the auto part ones.

Secondly, in looking at the sector performance, I used the published financials. These included two significant “discontinuities.”

- UMW exited the Oil and Gas business in 2016 with provisions for impairments that resulted in significant losses. Its total assets and equity were reduced by about 28 %.

- Sime divested its plantation and property business it 2016/17. This resulted in reducing its revenue by about 30% in 2016. Its total assets and equity were reduced by about 62 % in 2018.

These 2 are very large companies in terms of revenue and assets. As such these discontinuities should be noted when looking at the mean trends and growth rates. Accordingly, looking at median values may be more representative of the sector.

Sector background

According to the Malaysian Industrial Development Authority (MIDA), Malaysia continues to be an attractive base for global automotive manufacturers.

- Honda, Toyota, Nissan, Mercedes-Benz, and BMW are some of the automotive companies which have set up operations in Malaysia.

- Geely Auto Group, a leading automobile player from China acquired PROTON shares in 2017.

- Component manufacturers, such as ZF, Delphi, Continental, Denso and Bosch have also made Malaysia their base to launch their products in the region.

The Malaysian automotive industry has come a long way. The establishment of national car projects, PROTON and PERODUA transformed the country from a mere car assembler into a car manufacturer.

The industry remains an important and strategic part of the country’s manufacturing sector, contributing 4% to Malaysia’s GDP. It continues to be the 3rd largest automotive market in ASEAN. There are currently 28 manufacturing and assembly plants in Malaysia for passenger vehicles, commercial vehicles, motorcycles, and scooters, as well as automotive parts and components.

According to the MAA,

- The number of vehicles registered per year had declined from 605,156 in 2010 to 508,911 in 2021.

- The number of vehicles produced per year had declined from 567,715 in 2010 to 481,651 in 2021.

However, going by the results in the first half of 2022, the number of registration as well as production are expected to be higher than those in 2010. Refer to Chart 1.

You can see from Chart 1 that the automotive industry suffered a significant decline in 2016. According to the MAA, both domestic sales and production in 2016 compared to 2015 declined by 13 % and 11 % respectively. This was in tandem with the moderation economy, lower consumer spending and cautious business sentiments.

|

| Chart 1: Malaysian Vehicle Statistics |

Performance

To collect base rates data, I tracked the past 12 years (2010 to 2021) performance of the auto companies under the Main Board of Bursa Malaysia. There were 12 companies in the sector as of Sept 2022 (panel) as shown in Table 1. Refer to the Methodology section for details on how I computed the various metrics.

The profiles of these companies are shown in the following table.

The 2021 SHF of the panel ranged from RM 182 million to RM 15.8 billion with an average of RM 3.6 billion. To give you a sense of the scale, the average SHF for the KLCI component companies was about RM 22 billion.

The revenue of the panel in 2021 ranged from RM 30 million to RM 44.5 billion with an average of RM 6.8 billion. In contrast, the average revenue of the KLCI component companies was about RM 13 billion.

You will notice that the SHF and revenue for the majority of the panel companies were smaller than the industry average.

The sector had a very challenging performance over the past 12 years.

- The sector median revenue only grew at 4.4 % CAGR while the sector mean PAT declined at a compounded 8.5 % per annum. Not surprisingly, the sector ROE had been declining over the past 12 years. This decline began pre-Covid-19.

- The median SHF grew at 2.9 % CAGR from 2010 to 2021 while the median Debt declined at 7.1 % compounded annual rate. The result is that the median Debt Equity ratio of the sector declined at 2.2 % compounded annual rate.

- The positive news is that the median cash from operations also increased by a 13.9 % CAGR from 2010 to 2021.

Details of the sector’s performance are presented in the following sections.

Revenue

During the early part of the past decade, from 2010 to 2015 the industry mean revenue grew at a CAGR of 7.4 %. But then it dropped in 2016 and while it continued to grow thereafter, it has yet to reach the 2015 peak.

I had mentioned that the mean values were affected by the restructuring of UMW and Sime. As such, the median revenue is more representative. On such a basis the sector median revenue grew by a 4.4 % CAGR from 2010 to 2021.

The silver lining is that in the first year of the Covid-19 pandemic, the mean revenue declined by only 3.4 %. There was an 11.4 % growth between 2020 and 2021 despite the pandemic in 2021. In contrast, the Malaysian real GDP contracted by 3.4 % in 2020 and increased by 5.7 % in 2021 (Source: www.bea.gov/news).

Note that the post 2018 values were after the UMW and Sime restructuring. Hence the year to year mean value comparison reflected those of the sector.

|

| Chart 2: Revenue Note: In my charts, I have shown the sector mean as columns. The other metrics – median, lower quartile (Q1) and upper quartile (Q3) are shown as lines |

The other unusual characteristics of the sector profile can be seen from Chart 2. In many sectors, the mean values would lie somewhere in the middle of the interquartile ranges. But in the case of the auto sector, the mean is very near the third quartile values. It is skewed in this manner because of the relatively large revenues of a few big companies. You should not be surprised given the revenue profile as shown in Table 1.

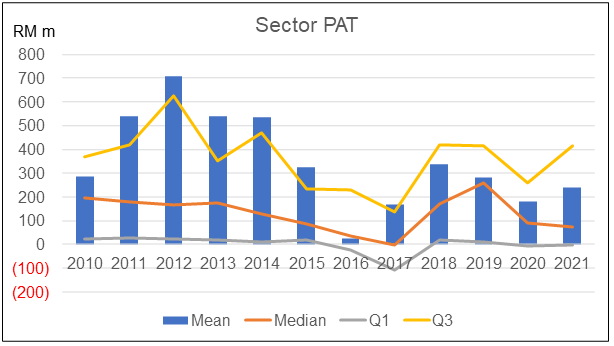

PAT

The net income for the sector was very volatile as illustrated in Chart 3. I had earlier mentioned the unusual characteristic of the mean being close to the third quartile. In the case of PAT, for the first half of the decade, the mean PAT was above the third quartile. But this fell to between the lower and upper quartiles thereafter.

The sector mean PAT had been declining since 2012 and reached the trough in 2016. It then started to recover but the 2020 Covid-19 situation derailed it. Although it started to recover again in 2021, the 2021 mean PAT is still lower than that in 2010.

We see the same trends for the median and quartiles. 4 of the 12 sector companies did not have any compounded annual growth from 2010 to 2021. This is not exactly a very profitable sector.

I had earlier mentioned the declining sales and production for the Malaysian automotive industry in 2016. You can see the impact of this on the PAT. The MAA had reported that there was heavy discounting and offers by its members to clear stock and maintain market share.

At the same time the sector mean PAT in 2016 was affected by the heavy losses incurred by UMW. These were due primarily to the impairments and provisions for its Oil & Gas businesses.

|

| Chart 3: PAT |

Returns

I considered 2 return metrics – ROE and ROA. Refer to Chart 4. The values in 2021 for both the ROE and ROA were lower than the respective values in 2010. It did not matter whether you are looking at the mean, median or quartiles.

From 2010 to 2021, the sector median ROE declined by a compounded annual rate of 4.9 % while the median ROA declined by a compounded annual rate of 5.5 %.

|

| Chart 4: Returns |

I also carried out a DuPont analysis of the sector median ROE. The DuPont analysis showed that the decline in the ROE was due to the decline in the Profit Margin. There were not significant changes to the Asset Turnover or Leverage. Refer to Chart 5.

|

| Chart 5: DuPont Analysis |

Capital structure

The sector median Equity grew at 2.9 % CAGR from 2010 to 2021. Notice the drop in the mean and upper quartile in 2016 due to the losses incurred by UMW. Given this growth together with the declining PAT, you should not be surprised to find that the ROE had been declining.

I would consider the median values when looking at the growth in SHF or Total Assets from 2010 to 2021. On such a basis, although there was growth in the median SHF, there was actually a small decline of 1.4 % compounded annual rate for the median Total Assets.

|

| Chart 6: SHF and Total Assets |

Chart 7 provides a picture of the financial position of the sector:

- The sector Debt Equity ratio is less than 1. Most of the time, the median Debt Equity is less than 0.4.

- The sector also had a relatively stable median leverage as measured by Total Assets/Equity.

|

| Chart 7: Debt Equity and Leverage |

Cash flows

The cash from operations had a more favourable picture compared to PAT. The median cash from operations in 2021 was higher than that for 2010. The cash flow trends seemed to be positive compared to the PAT trends.

At the same time, only one of the 12 panel companies had negative cumulative cash flow from operations from 2010 to 2021. And it is not even UMW.

|

| Chart 8: Cash Flows |

I also computed a simple Free Cash Flow metric = Cash Flow from Operations – Cash used in Investments.

You can see from Chart 8, the most of the period the median Free Cash Flow is positive. Free Cash Flow is a metric I used in valuing companies and this is a good sign.

Gross profitability

Gross profitability is defined as gross profit divided by total assets.

Professor Robert Novy-Max, University of Rochester, has done considerable research into this metric. According to him, it has roughly the same power as book-to-market in predicting the cross-section of mean returns.

Over the period 2010 to 2020, the sector had a declining median gross profitability. It ranged from 18 % in 2010 to 11 % in 2019. If you follow the Novy-Max concept, this meant that the industry returns in the immediate future is not going to be rosy.

|

| Chart 9: Gross Profitability |

This view is supported by the gross profit margins and SGA margins picture as illustrated in Chart 10. You can see the declining median gross profit margins. At the same time, the SGA margins is increasing.

The silver lining here is that the cash generating feature of the sector. Referring to Chart 11, you can see that the sector has:

- Median cash to PAT ratio of around 1 or less. This indicates the quality of the earnings.

- Median cash conversion cycle of below 100 days.

|

| Chart 10: Gross Profit and SGA Margins |

|

| Chart 11: Cash Flow from Ops/PAT and Cash Conversion Cycle |

Screening for investment opportunities

I used 4 metrics to screen for investment opportunities. The first three relate to the business fundamentals while the last relates to valuation.

- ROE. My target is to have a 10% return based on the average ROE over the 12 years.

- Positive cumulative Cash Flow from Ops. I used this as a proxy for financial strengths. Normally I would look at the DE ratio. However as shown earlier, this sector has conservative borrowings and low leverage. As such I chose Cash Flow as the more appropriate metric.

- Growth in gross profitability. I consider gross profitability as the main metric to predict stock market returns. As such I am looking for companies with improving gross profitability.

- Free Cash Flow Yield > 5%.

I used a simple Pass (denoted by 1 in the table) and Fail (denoted by a blank in the table) to test each company. The results of the test are shown in the following table.

|

| Table 2: Screen |

There was only one company – HLInd that pass all the 4 criteria.

HLInd or Hong Leong Industries Berhad is an investment holding company. The group manufactures and sells consumer and industrial products in Malaysia and internationally. The company operates through Consumer Products and Industrial Products segments.

- The Consumer Products segment manufactures, assembles, and distributes motorcycles, scooters, and related parts and products. It also manufactures and sells ceramic tiles, as well as distributes and provides services in marine related products.

- The Industrial Products segment manufactures and sells fiber cement under the PRIMABOARD brand. It is also involved in the rental of properties.

I am not suggesting that you invest in HLInd. Rather I recommend that it be a candidate for further fundamental analysis if you want to invest in them.

Methodology

The data for the base rates were extracted from the Financial Statements for each company for the period 2010 to 2021. Note that it is comprised of companies with different financial year ends. For many companies, the 2021 values were the LTM values.

Note that Solid did not have the Balance Sheet and Cash Flow statements for 2010 and 2011. In such cases, the statistics ignored them. Since most of the statistics were based on median and quartile values, this did not affect the analysis too much.

The Financial Statements were taken from a platform/app called TIKR.com.

I have 2 types of analyses:

- The average of the sector. This measures the central tendency. The mean is the most frequently used measure of central tendency because it uses all values in the data set to give you an average. For data from skewed distributions, the median is better than the mean because it is not influenced by extremely large values. In this analysis, I have used the median as the measure of central tendency.

- The distribution of individual companies making up the panel. For these, I extracted the quartiles for each year based on the ranking of the respective metric.

When you analyse a panel, there are two perspectives. The first is to look at the performance of the panel as a whole. The second is to focus on the performance of the individual companies. I have the following example to illustrate the difference between these 2 perspectives.

Suppose that there are 9 companies in the panel with the Revenue, PAT, and Profit Margin (PAT/Revenue) as shown in the table below.

|

| Table 3: Sample Panel |

To get the distribution of the Profit Margin, the companies were ranked based on Profit Margin with the results shown as per the table below. Note that they are in descending order.

This is then used to determine the quartile and median values.

|

| Table 4: Ranked Sample Panel |

There are then 3 ways to measure the central tendency of the profit margin.

- The mean profit margin for the sector is derived by dividing the total PAT for the panel by the total revenue. In the example, the Profit Margin = 121 / 865 = 14.0 %. This is looking at the central tendency of the panel as a whole.

- You can also get the mean profit margin by adding up individual company Profit Margin ie 132.3 and dividing by 9 = 14.7% as shown in the table. This is looking at the distribution of individual profit margins.

- The median of the sample is 12.5 %. This is looking at the distribution of the individual profit margins.

If the distribution is skewed, the mean and the median will be different. In this analysis, we have outliers that skewed the measure of central tendencies. As such I have used the median to represent the central tendency.

At the same time, I am more interested in the performance of individual companies rather than the panel as a whole. As such whenever I used the mean, I refer to the computation as per the second bullet point.

Base rates details

In his book “Thinking Fast and Slow” Daniel Kahneman presented his ideas about the inside and outside view. This is a useful model when analysing companies.

- The inside view generally refers to a conclusion reached using an individual own experience and reasoning. It is the perspective of someone looking at the problem from “the inside”. The focus is on the specific situation rather than looking at a broader class of similar situations.

- The outside view refers to the perspective of someone looking at the problem "from the outside". It is the view taking into consideration the actual experience of other people.

When you analyse a company, the inside view may lead to unrealistic expectations. To counter this, you need an outside view.

This is where base rates come in. The performance of the industry would give you a basis to check on your analysis and projections.

All valuations are based on assumptions and the base rates will help to ensure that the assumptions are realistic. I hoped you can assess the performance of a particular company with the average and interquartile ranges.

The information on the base rates presented in this article is a summary of the various metrics. There is actually a lot of details with me. Different investors look for different things when analysing companies. As such if you need specific details, do feel free to contact me at i4valueasia@gmail.com.

For a fundamental investor, base rates are important. They help ensure that the assumptions used in the analysis and valuations are realistic. If you do not have such information but still want to invest based on fundamentals, one way is to rely on third-party analysis and valuation.

As you can see, fundamental analysis requires expertise and time. Visualizing a company’s business performance and investment risk (by comparing market price with intrinsic value) is one way to shortcut the process. The Fundamental Mapper helps investors make informed decisions as it provides such insights in an easy-to-see format.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment