Bursa REITs, Property Stocks, or Properties – how to choose?

Case Notes 29. REITs, Property Stocks or Properties are all investment in real estate. This article looks at the factors to consider when deciding how to choose among them.

A Real Estate Investment Trust (REIT) is a corporation that owns, operates, or finances income-producing real estate or real estate-related assets. REITs pool the capital of numerous investors.

According to Bursa Malaysia, real estate is a key asset class in an investment portfolio. Before REITs were introduced, an investor will have to choose between Property Stocks or physical Properties to get exposure in the real estate sector. With REITs, investors now have an alternative.

If you are a long-term investor in real estate, how do you choose between REITs, Property Stocks, or physical Properties? I define a long-term investor as someone with at least 10 years of investment horizon. This is to differentiate it from the property “flippers” and the stock traders.

Secondly, I am looking at investments from a retail investor perspective. In practice, this means limited capital for investing. I am also looking from an investment perspective. In other words, the investment in a physical Property is not for own use.

In the Malaysian context, the evidence points to REITs as providing the best returns among these 3 investment types.

Should you go and buy the REITs? Well, read my Disclaimer.

Contents

- Comparing the 3 investments

- Choosing the investments

- Historical returns

- Conclusions

- Method

- Appendix

Comparing the 3 investments

While there are many articles that compare these 3 investments, very few look at them collectively. Most of them compare two at a time ie

- REITS vs Property Stocks.

- REITs vs physical Properties.

- Property Stocks vs physical Properties

If you are going to choose among the 3 of them, I think it is more appropriate to look at them collectively. Table 1 summarizes such a comparison where I have grouped them into 3:

- Business characteristics.

- Advantages and disadvantages to the investor.

- Risks to the investor.

You can see that as a stock market instrument, a REIT shares many of the characteristics of a stock. Investing in physical Properties is very different from investing in REITs or Property Stocks.

|

| Table 1: Comparing REITs, Property Stocks and physical Properties |

Choosing the investments

I am a firm believer that to make money from your investments, you need to develop the appropriate investing skills. The skills for investing in physical Properties are different from those required for the stock market.

If you are going to invest directly in Properties, you should develop the following traits and or knowledge:

- Understand Cash flow.

- Understand the property market conditions and risks as well as the tenant’s behaviour and demands.

- Be patient and persistent.

- Have good negotiation skills.

On the other hand, if you are going to invest in REITs or Property Stocks, I recommend that you approach it as a value investor. This requires you to be able to analyze the company as well as value them.

Assuming that you have the appropriate skills, how do you decide between REITs, Property Stocks, or physical Properties? I suggest that you should consider the following factors:

- Potential returns and risks.

- Funding requirements.

- Ease of investments.

Leaving aside the returns, I would suggest the following basis for choosing among them:

Physical properties

- You can afford the upfront and ongoing costs.

- You don’t mind managing your property.

- You prefer direct control over your properties.

- You want to take advantage of leverage.

REITs

- You have limited capital.

- You don’t want the hassle of buying and managing a physical property and prefer convenience when it comes to investments.

- You are looking for a steady income stream.

- You want to hold a diverse portfolio of real estate.

Property Stocks

- You have limited capital.

- You prefer convenience when it comes to investments.

- You not only want to hold a diverse portfolio of real estate but also want exposure to property development activities.

- You are looking for total returns (capital gains + dividends).

In many cases, it is not an either/or choice. You will find that many investors own a condo to rent out, while also owning REITs.

On a personal note, I own physical Properties as well as shares in REITs and Property Stocks. From a convenience perspective, REITs and Property Stocks are better choices. I do not like to deal with tenants and I have had a few “tenants-from-hell”. These are people who messed up the house and where I had to evict them.

From an asset allocation perspective, I have an equal amount invested in each of the 3 investment types.

- I own REITs for the dividend income while I focus on capital gain from my Property Stocks.

- While I have rental income from the physical Properties, the Malaysian rental yields tend to be low. So, I focus on capital gains. Over the past few decades, I have sold some of the Properties and reinvested in new ones. I do not consider myself a property flipper as I held onto the Properties for at least 5 to 6 years before they were sold.

Historical returns

The Motley Fool opined the following:

- Over the past 45 years, the FTSE Nareit Composite Index achieved a compounded annual average total return of 11.4%. That was only slightly less than the S&P 500's return of 11.5% per year during the same period.

- One reason REITs have generated solid total returns over the long term is that most pay attractive dividends. For example, as of mid-2021, the average REIT dividend yield was more than double that of stocks in the S&P 500.

The above view is supported by Forbes:

From 1977 to 2010, REITs have returned more than 12% annually. This is in comparison to the roughly 10% return of the S&P 500 and the 6% - 8% return of private real estate funds during the same period. And over the past 5 years (from 2017), REITs have had an average annual return of around 9% while the average annualized return of direct real estate investing is at or below 8%.

The above views are for the western world. In my article “In Malaysia, which has better returns; Stock market or Property?”, I have shown that the conclusions for Malaysia are different from those for the western world.

I thus wanted to see the historical performance of Bursa REITs compared to Bursa Property Stocks and Malaysian physical Properties. I considered two perspectives when looking at returns:

- Changes in market prices. These changes are due to a combination of market sentiments as well as business fundamentals.

- Changes in fundamentals. These ignored market sentiments.

To track the performance of the REITs, I looked at the market price and fundamental performance of a panel of 11 Bursa REITs. These were the ones that had both financial and pricing data from 2007 to 2021. Refer to Appendix 1 for the list of REITs.

To track the performance of the Property Stocks, I used the KLCI Property Index to track the changes in the stock prices. To track the changes in fundamentals, I looked at the performance of Bursa Malaysia Property Companies with 2020 shareholders funds greater than RM 1 billion. Refer to the Appendix for the list of these companies.

To track the price performance of physical Properties, I used the Housing Price Index (HPI).

Market prices

Chart 1 shows the comparative gains for the REIT Index, KLCI Property Index, and HPI. Refer to the Method section for the details of these indices.

As can be seen, from 2007 to 2021,

- The gain from REITs at a 5.3 % CAGR was comparable to that for the physical Properties. However, it was more volatile.

- The worst gain was from investing in Property Stocks with a compounded annual loss of 2.3 %.

- You are better off investing in physical Properties. The HPI had a 6.1 % CAGR over the past 15 years.

|

| Chart 1: Market Price Indices |

Note that the changes in the indices represented capital gains. In other words, we ignored the rental income in the case of physical Properties and the dividends in the case of REITs and Property Stocks.

From a total return (capital gain + rental or dividends) perspective, I would rate REITs better than physical Properties for the following reasons:

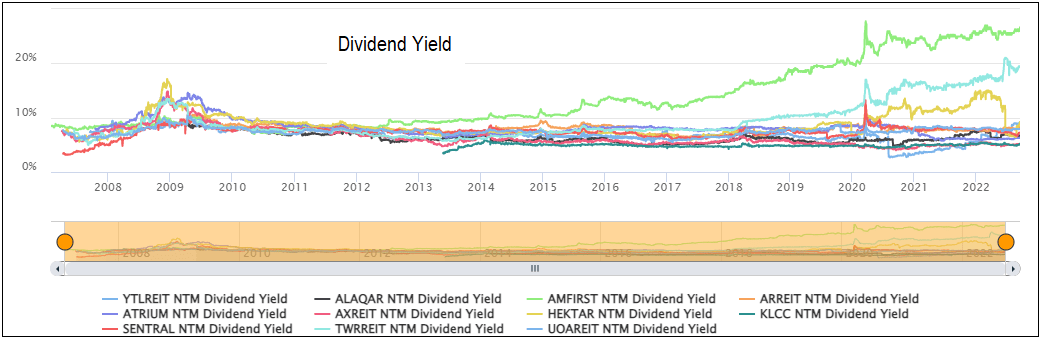

- The average dividend yields for REITs tend to range from 6 % to 8 % as can be seen from Chart 2.

- According to Savills Malaysia managing director Datuk Paul Khong, Malaysian residential…rental yields are usually low at about 4% per annum which could hardly cover housing loan repayments. (Source: EdgeProp Aug 2020)

|

| Chart 2: REITs' Dividend Yields |

You may argue that we are not comparing apple-to-apple as the REITs mostly represented offices and commercial properties (refer to Appendix 1). The HPI represented residential properties.

But I would argue that a retail investor would be more likely to invest in residential properties than say a shopping mall or an office complex. So, the HPI is an appropriate metric.

Fundamentals

Fundamentals refer to the basic factors that contribute to the financial performance of an asset. The 3 investments represent different types of businesses. You would expect them to have different fundamental drivers. As such I have compared them based on the following metrics

- REITs. The most critical measure of performance is Free Funds from Operations (FFO). This is calculated by adding depreciation, amortization, and losses on sales of assets to earnings and then subtracting any gains on sales of assets. I used the median FFO of the panel REITs here.

- Property Stocks. I used the median PAT of the panel as the key performance metric.

- Physical Properties. The HPI not only reflects the changes in the value of the properties but is also a proxy for rental income.

Chart 3 shows the results of the analysis. You can see that

- The REITs had a compounded annual decline of 3.8 % for the past 15 years.

- The Property Stocks had a compounded annual decline of 4.1 % from 2007 to 2015. It was the most volatile among the three.

- The HPI has the best performance with compounded annual growth of 6.1 %

|

| Chart 3: Fundamental Performance |

The results of the fundamental analysis differ from those from price changes. You can see the differences clearly in Chart 4. REITs have performed better than Property Stocks even though both sectors face the same economic environment.

- The correlation between prices and FFO for the REITs was – 0.04.

- The correlation between prices and PAT for the Property Stocks was 0.61

From a price return perspective, I would choose REITs over Property Stocks. This was because the REITs price in 2021 was higher than that in 2007. The market seemed to have ignored the changes in the fundamentals. This could be because of the high dividend payment nature of REITs.

The fundamental analyses here is a simple one as I have only considered one metric to represent the fundamental performance. However, the FFO and PAT are key performance metrics and as such are indicative of the general direction.

|

| Chart 4: Price vs Fundamentals |

Conclusions

While I have presented the financial returns of the 3 investments, they were based on an aggregated picture.

- The REIT panel represented different types of non-residential properties such as offices and shopping malls.

- The KLCI Property Index covered all the Property Companies. My Property Stocks fundamental index focused on the large companies. Many of them have non-property businesses.

- The HPI represented the performance of various types of residential properties in different parts of the country.

The returns for each of them represented investments in diversified assets.

As a retail investor, you are probably only able to invest in a few physical properties. In the Malaysian context, there are no funds or ETFs that can enable you to invest in all the REITs or Property Stocks.

You can then argue that as a retail investor, the results presented may not applicable since you cannot hold similarly diversified assets. If you are going to stock pick and/or property pick, your returns would also be influenced by your investment-picking ability.

At the same time, with a more concentrated investment vis-a-vis investment picking, the risk to the retail investor would also be much higher.

Given the above, I would advise that a retail investor should give equal weight to the qualitative and return factors when deciding which to choose.

My advice is to invest in REITs. This is because:

- Most retail investors would have limited financial resources.

- There would be lower financing and location risks. With REITs, it is easier to have a diversified property compared to investing in physical Properties.

- It is more convenient to manage your investments compared to investing in Properties.

- REITs provided better total returns (capital gain + dividends) than Property Stocks or Properties.

However, REITs are stock market instruments. You do not simply buy REITs as and when you like. You have to learn to invest in REITs. If you are a value investor, you will look for under-priced opportunities. You should also invest in several REITs to cover all the various types of properties.

Method

REITs, Property Stocks, and Properties are different instruments with different scales of operations. To ensure that we are comparing apple-to-apple, I establish indices for each of them.

These were obtained by dividing the values for each year by the respective 2007 values. In other words, 2007 was taken as the base of 1.0. Table 2 is an illustration of how the Property Index was computed for 3 years.

|

| Table 2: Illustration of how to compute the Property Index |

Sources of information

I extracted the data from the following sources for the market price comparisons.

- REIT Index. This was based on the median market cap for each year for the panel of 11 REITs. These were the REITs that had data from 2007 to 2021. The market cap was derived by taking the year-end prices multiplied by the number of shares (units) at the end of the year. Data for both were extracted from TIKR.com

- KLCI Property Index – The value for each year was the 1 Jan data for the following year. Data was extracted from Tradingveiw.com.

- Housing Price Index – Data were from the Valuation and Property Services Dept, Malaysia.

Data for the fundamental comparisons were sourced from the following:

- REIT Index. This was the median FFO for each year for the panel of 11 REITs. Data to compute the FFO were extracted from TIKR.com.

- KLCI Property Stocks. These were the median PAT for the large companies. Large companies were defined as those with RM 1 billion of shareholders/ funds as of 2020. The values were extracted from TIRK.com.

Measures of central tendency

There are 2 common measures of central tendency – the mean and the median.

- The mean is the simple average value of the panel. The advantage is that it makes use of every data to compute the central tendency. However, if there are outliers, the average would be skewed.

- The median. This is the mid-point value of the data that were sorted in descending order. The median then provides a better picture of the central tendency if there are outliers.

For my analysis, I used the median to represent the central tendency as there were outliers in both the REITs and Property Stocks.

Appendix 1 – List of REITs to compute the REIT Index

Appendix 2 – List of Property Companies with SHF > RM 1 billion as of 2020.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

hi

ReplyDelete