Hunting for Bursa REITs to invest in

Case Notes 27. This article looked at the Bursa Malaysia REITs and identified the better REITs for further investigation. It also compiles the base rates for the sector.

In my article “In Malaysia, which has better returns; Stock market or Property?”, I showed that if you have a 30 years investment horizon, you are better off investing in properties.

But we all know the challenges of investing directly in properties.

- It requires a significant amount of time and energy to be successful. You have to deal with tenant issues, maintenance emergencies, and liabilities if there are any accidents on the property.

- Financing is another disadvantage. You may need to take on a mortgage or some other type of financing to pay for the investments.

- It is an illiquid asset.

As such, many see Real Estate Investment Trusts or REITs as an alternative. According to Investopedia, REITs allow individual investors to make money on real estate without having to own or manage physical properties.

Given the above, I wanted to see whether there are Bursa Malaysia REITs that can be considered for investments. My analyses identified 3 for further investigations - ALAQR, ATRIUM, and KIPREIT.

Should you go and invest in them? Well, read my Disclaimer.

Contents

- What are REITs

- Performance

- Screening for investment opportunities

- Method

- Appendix

|

There were 2 goals of my analyses:

- To derive the base rates for the sector.

- To identify the potential REITs for further analysis.

As of mid-Sep 2022, there were 19 REITs on Bursa Malaysia. However, 2 of them were listed relatively recently – AME (in 2022) and IGB Commerce (in 2021). As my analyses covered the performance over several years, I excluded these two.

At the same time, although AHP was taken private by mid-Sep 2022, its information was available till 2021. As such I have included AHP in my compilation of base rates.

In the case of KIPREIT, its earliest data was from 2014. As such I thus left it out in the base rate analysis. However, I included it when screening for REITs to invest in.

As such a total 17 REITS were covered in my base rates. But not all of these 17 REITs had 15 years of historical data. As such, I split them into 2 categories.

- Those with financials from 2007. There were 12 REITs in this category.

- Those with financials from 2012. There were 17 REITs in this category.

Refer to Appendix 1 for the list of REITs in each category.

What are REITs

A REIT is an investment vehicle that pools monies from many investors for investment in properties. According to Investopedia,

- A REIT is a company that owns, operates, or finances income-producing properties such as apartments, data centres, offices, and shopping malls.

- REITs generate a steady income stream for investors but offer little in the way of capital appreciation.

- Most REITs are publicly traded like stocks, which makes them highly liquid (unlike physical real estate investments).

The US National Association of Real Estate Investment Trusts opined the following:

“REITs offer investors the benefits of commercial real estate investment along with the advantages of investing in a publicly traded stock. The investment characteristics of income-producing real estate have provided REIT investors with historically competitive long-term rates of return that complement the returns from other stocks and from bonds.”

The history of REITs in Malaysia can be traced back to two decades ago. It began life as a “property trust” with the first listing in 1989 by Amanah Harta Tanah PNB 2. This was followed by the Arab Malaysian First Property Trust soon after. “Property trust”, however, never took off in the Malaysian market until its rebranding in 2005 to REITs. This followed the Securities Commission Malaysia’s introduction of the “Guidelines on Real Estate Investment Trusts” under s 377 of the Capital Markets and Services Act 2007. Source: Introduction to REITs in Malaysia, Lee Hishammuddin Allen & Gledhill.

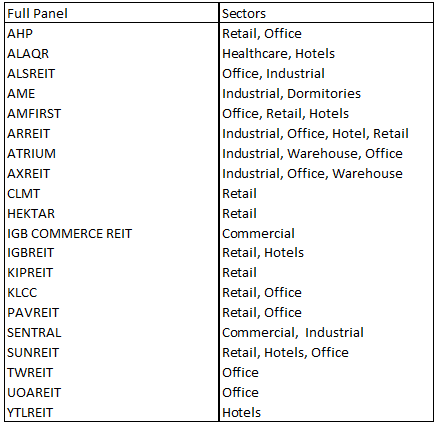

As of mid-Sep 2022, 19 REITs were operating in Malaysia under several sectors. Refer to Table 1. Note that I have included AHP in the panel so that the total came to 20 REITs.

The REITs are generally not exclusive to one sector. Some operate in multiple sectors.

Performance

To collect base rates data, I tracked the past 15 years (2007 to 2021) performance of the REITs.

While there were 20 REITs as of mid-Sep 2022, only 12 had data from 2007. To get a more comprehensive representation, I also consider 17 with data from 2012. I thus looked at 2 categories:

- Those with 15 years of history from 2007 to 2021 – the Selected 12.

- Those with 10 years of history from 2012 to 2022 – the Selected 17.

Refer to the Appendix for the list of these companies. Refer to the Method section for details on how I computed the various metrics.

My focus was on the Selected 12 when looking at the trends over the years. However, if I wanted further information on the past few years, I referred to the Selected 17. The profiles of these companies are shown in the following table.

|

| Table 2: 2021 Profile of the REITs Note: Except for the profile info, KIPREIT data was not included in the base rates analyses. |

You can see that the REITs ranged in size:

- The 2021 Equity of the panel ranged from RM 263 million to RM 13.1 billion with an average of RM 2.3 billion. To give you a sense of the scale, the average Equity for the KLCI component companies was about RM 22 billion.

- The 2021 revenue of the panel ranged from RM 30 million to RM 1.2 billion with an average of RM 248 million. In contrast, the average revenue of the KLCI component companies was about RM 13 billion.

You will notice that the Equity and revenue for the majority of the panel companies were smaller than the industry average. In other words, this is a sector where are few large REITs skewed the average results.

The sector as represented by the Selected 12 had a very challenging performance over the past 15 years.

- The mean revenue only grew at 5.3 % CAGR while the mean PAT declined at a compounded 12.7 % per annum.

- While rental grew from 2007 to peak in 2019, rental yield did not show such a growth pattern. The mean gross rental yield ranged from 6.8 % to 9.0 % from 2007 to 2021.

- Real estate assets grew at a 6.6 % CAGR from 2007 to 2021. This growth was funded by growth in Equity and Debt. However, Debt grew at a higher rate. This resulted in an average Debt Equity ratio for 2019 to 2021 of 0.64 compared to the 2007 to 2009 average of 0.42.

- FFO per share declined at a compounded annual rate of 8.4 % from 2007 to 2021. This is the result of a declining FFO and an increasing number of shares resulting from increased Equity.

Details of the sector’s performance are presented in the following sections.

Revenue

From 2007 to 2021, the mean revenue of the Selected 12 grew at a CAGR of 5.3 %. But as can be seen from Chart 1, the revenue peaked in 2019 as the 2020 and 2021 performances were affected by the Covid-19 pandemic.

Note that there was a decline in revenue in 2011. This was mainly due to the rationalization of the YTLREIT (then known as Starhill REIT). Two of its properties were sold to the Starhill Global Real Estate Investment Trust in Singapore in 2010.

The other salient feature of the Selected 12 was that the means were higher than the upper quartile values (denoted by Q3 in the chart). This was because there were a few relatively large companies (refer to Table 2) that skewed the mean values.

However, when you look at a larger group, the mean values fell below the upper quartiles as can be seen in the Selected 17 part of Chart 1.

|

| Chart 1: Revenue Note: In my charts, I have shown the sector mean as columns. The other metrics – median, lower quartile (Q1), and upper quartile (Q3) are shown as lines |

Rental

The largest contributor to the revenue of a REIT is rental. You should not be surprised that the rental trends (as per Chart 2) show the same pattern as those for the revenue.

The mean rental for the Selected 12 grew at a CAGR of 5.4 % from 2007 to 2021. The impact of Covid-19 on the sector can be seen from the Selected 17 part of Chart 2.

- The mean rental declined by 10% from 2019 to 2021. There was another 3 % decline from 2020 to 2021.

- The large companies suffered the worst as can been seen from the upper quartile line.

Despite having long-term tenancy agreements, the sector experienced a decline during the Covid-19 years. The takeaway is that during extraordinary periods, there is no rental protection for the REITs.

|

| Chart 2: Rental |

PAT

The net income for the sector was very volatile as illustrated in Chart 3. I had earlier mentioned the unusual characteristic of the mean being above the upper quartile for the revenue for the Selected 12. We see a similar picture for the PAT for the Selected 12.

The sector PAT peaked in 2012 and had been on a downtrend since then. From 2007 to 2021, the PAT declined at an annual compounded rate of 12.7 %,

The only positive picture was that the 2021 PAT was higher than that for 2020. This was despite lower revenue in 2021.

The interesting feature was that the PAT profile did not match that of the rental. Rental grew from 2007 to peak in 2019. However, PAT did not have this growth pattern. Rather PAT had an up-and-down pattern from 2007 to 2019

|

| Chart 3: PAT |

Gross Rental Yield

For investment properties, the key metric is gross rental yield. Rental yield essentially compares the amount of money generated by a property as a percentage of the property value. It gives you a better idea of the ongoing return you will earn on your investment.

Looking at Chart 4, you would conclude that while rentals grew from 2007 to peak in 2019, rental yield did not show such a growth pattern.

- The mean gross rental yield for the Selected 12 ranged from 6.8 % to 9.0 % from 2007 to 2021.

- The mean gross rental yield for the Selected 17 had a smaller range of 6.7 % to 7.8 % over the past 10 years.

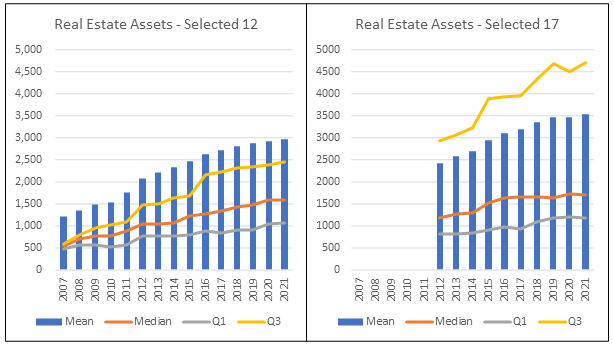

The only explanation for this was that property values increased at the same time as rentals went up. You can get a sense of this from Chart 5 which shows the trends in the value of the real estate assets of the REITs.

|

| Chart 4: Gross Rental Yield |

|

| Chart 5: Real Estate Assets |

Returns

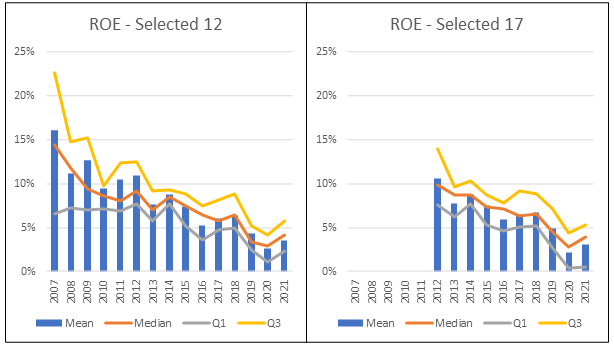

As can be seen from Chart 6, the ROE has been on a declining trend since 2007. It did not matter whether you are looking at the mean, median, or quartiles.

- Based on the Selected 12, the values in 2021 were lower than the respective values in 2007. From 2007 to 2021, the mean ROE declined at a compounded annual rate of 10.4 %.

- Over the past 10 years, we see a similar declining ROE. From 2012 to 2021, the mean ROE declined at a compounded annual rate of 12.7 %.

|

| Chart 6: ROE |

Capital structure

Unlike normal stocks, REITs are unique in that they pay out their dividends from their free cash flow. As REITs pay out almost all their cash flow as dividends, they retain very little cash flow to carry out growth initiatives, such as purchasing new properties.

To grow, REITs need to tap the capital markets. You can see this by looking at the balance sheet of a typical REIT.

Assets = Equity + Liabilities

In other words, the managers of the REIT can fund the new purchases or other capital requirements either by adding to the equity or liabilities.

As can be seen from Chart 5, the real estate assets of the REITs have grown yearly. Based on the Selected 12, real estate assets grew at a 6.6 % CAGR from 2007 to 2021.

How have they funded this growth? You can see from Charts 7 and 8 that both Equity and Debt have been growing.

|

| Chart 7: Equity |

|

| Chart 8: Debt |

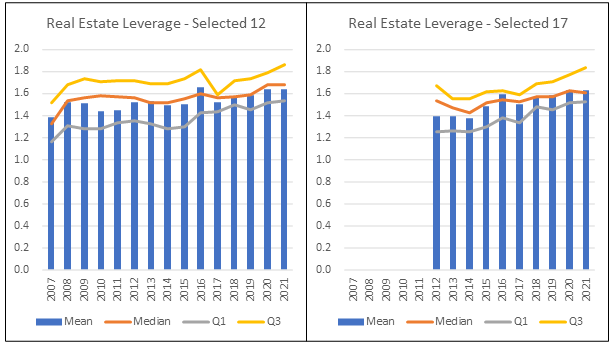

However, Debt has been growing at a higher rate than Equity so overall, the Debt Equity ratio has grown. Based on the Selected 12, the 3 years mean DE ratio for 2007 to 2009 was 0.42. This had increased to 0.64 from 2019 to 2021.

Another perspective of the Debt position is to look at the leverage. This was derived as real estate assets divided by Equity.

As can be seen from Chart 10, the leverage for the sector has increased over the past 15 years. Based on the Selected 12, the mean leverage was 1.4 in 2007. This had increased to 1.6 in 2021.

|

| Chart 10: Leverage |

Funds Flow from Operations (FFO)

FFO refers to the figure used by REITs to define the cash flow from their operations. Real estate companies use FFO as a measurement of operating performance.

I computed the FFO by adding depreciation, amortization, and losses on sales of assets to earnings and then subtracting any gains on sales of assets.

You can see from Chart 11 that the FFO for the Selected 12 has been very volatile. It had a coefficient of variation (ratio of standard deviation to the mean) of 0.23. Given the way FFO was computed, you should not be surprised that the FFO profile is very similar to that of the PAT.

However, when you look at the FFO per share as per Chart 12, you can see a declining trend. This is the result of a declining FFO and an increasing number of shares resulting from increased Equity. Based on the Selected 12, FFO per share declined at an annual compounded rate of 8.4 % from 2007 to 2021.

Many would consider FFO per share as a good valuation metric for REITs. On such basis, the analyses showed that this was a tough sector to make money over the past 15 years.

|

| Chart 12: FFO per share |

Screening for investment opportunities

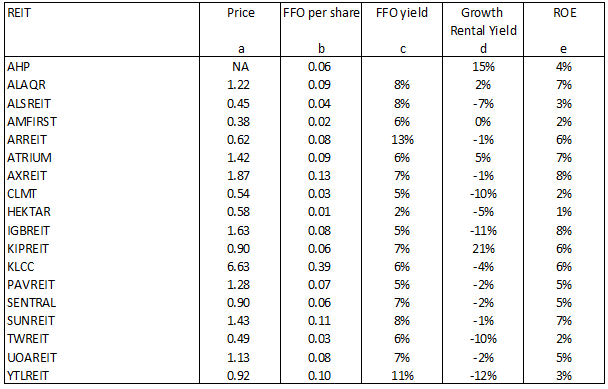

I used 3 metrics to screen for investment opportunities. The first relates to valuation while the other 2 relate to the fundamentals. For consistency, I considered the average performance from 2017 to 2021. This was the period with data for all 18 REITs (including KIPREIT).

- FFO Yield > 5 %. This was derived by taking the average FFO per share divided by the market price as of 15 Sep 2022.

- ROE > 5 %. My target is to have a return greater than the average ROE of the 18 REITs.

- Growth in rental yield > 0 %.

Table 3 summarizes the performance of the 18 REITs. Note that I have included AHP in the screen even though it is no longer listed. This is just to provide a comparison of the fundamental metrics.

I used a simple Pass (denoted by 1 in the table) and Fail (denoted by a blank in the table) to test each REIT. The results of the test are shown in the following table.

3 REITs passed all the 3 criteria – ALAQR, ATRIUM, and KIPREIT. I am not suggesting that you invest in them. Rather I recommend that they are candidates for further fundamental analysis if you want to invest in them.

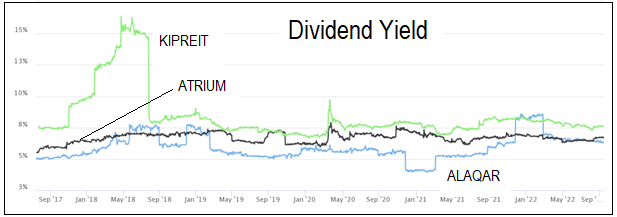

This would require you to look into the types of properties, the occupancies, and the tenants’ profiles. However, as a back-of-envelop test, I would look at the two common investment metrics – capital gain and dividend yield. In the case of the 3 shortlisted REITs,

- ATRIUM had the best capital gain from 2017 to 2022 while you lost money with ALAQAR. Refer to Chart 13.

- In terms of dividend yield, KIPREIT had the best results from 2017 to 2022 while ALAQAR had the worst. Refer to Chart 14.

Based on these 2 metrics, I would investigate ATRIUM first.

|

| Chart 13: Market Price of the 3 Shortlisted REITs |

|

| Chart 14: Dividend Yield of the 3 Shortlisted REITs |

Method

The data for the base rates were extracted from the Financial Statements for each REIT for the period 2007 to 2021. Note that it is comprised of REITs with different financial year ends.

The Financial Statements were taken from a platform/app called TIKR.com.

I have 2 types of analyses:

- The average of the sector. This measures the central tendency. The mean is the most frequently used measure of central tendency because it uses all values in the data set to give you an average. For data from skewed distributions, the median is better than the mean because it is not influenced by extremely large values.

- The distribution of individual REITs making up the panel. For these, I extracted the quartiles for each year based on the ranking of the respective metric.

When you analyze a panel, there are two perspectives. The first is to look at the performance of the panel as a whole. The second is to focus on the performance of the individual REITs.

If you want to see examples of the difference between these 2 perspectives, refer to the Methodology section in “Hunting for Bursa Malaysia ICT services and software companies”

Base rates details

In his book “Thinking Fast and Slow” Daniel Kahneman presented his ideas about the inside and outside view. This is a useful model when analyzing companies.

When you analyze a company, the inside view may lead to unrealistic expectations. To counter this, you need an outside view. This is where base rates come in. The performance of the industry would give you a basis to check on your analysis and projections.

The information on the base rates presented in this article is a summary of the various metrics. There are a lot of details with me. Different investors look for different things when analyzing companies. If you need specific details, feel free to contact me at i4valueasia@gmail.com.

For a fundamental investor, base rates are important. They help ensure that the assumptions used in the analyses and valuations are realistic. If you do not have such information but still want to invest based on fundamentals, one way is to rely on third-party analyses and valuations.

As you can see, fundamental analysis requires expertise and time. Visualizing a company’s business performance and investment risk (by comparing market price with intrinsic value) is one way to shortcut the process. The Fundamental Mapper helps investors make informed decisions as it provides such insights in an easy-to-see format.

Download the Fundamental Mapper app now on Xifu to get investment insights into Bursa Malaysia companies.

Appendix – List of Panel REITs

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment