Retail investors need a different valuation perspective

Case Notes 33. As a retail investor, you are a part-owner of a company. But you should look at the value of the company you invest through a different lens than the controlling shareholder. This is because you don’t control the assets or management.

The general advice for value investors is that when buying a stock, the market price should be at least 30 % below its intrinsic value. This represents a good margin of safety.

This then requires you to first estimate the intrinsic value of the stock. You assumed that the intrinsic value is driven by the fundamentals of the company’s underlying business.

While there are several ways to estimate intrinsic values, they generally take the view that you own the business. This is where the danger lies for the retail investor. As a retail investor, you are technically a part-shareholder. But not all the assets are accessible to you.

I would argue that the intrinsic value as normally estimated serves the large or controlling shareholders. It may not provide the appropriate margin of safety for the retail investor.

Furthermore, a retail investor is not an activist investor. If there are under-utilized assets, you cannot improve the utilization. If there are better profit strategies, you cannot make management adopt them. You will have to accept the strategies as they are and value the company based on them.

This is unlike an acquirer who can change management and or adopt strategies to improve the business. As such, a retail investor cannot use the same valuation metrics as the acquirer.

Join me as I elaborate on the above points. I will illustrate them with some of my Bursa Malaysia investments.

Should you go and buy them? Well, read my Disclaimer.

Content

- Asset Value

- Earnings Value

- Acquirer’s Multiple

- Greenwald analysis

- Focus on dividends

- Conclusion

|

I triangulate the margin of safety based on 3 metrics:

- The Asset value.

- The Earnings value.

- The Acquirer's Multiple.

If you are a controlling shareholder, the margins of safety based on all the above are relevant. But as a retail investor, you don’t control or manage the company. Not all the assets, liabilities, or even profits are accessible to you.

The retail investor only gets what is distributed by the company. As such I would argue that your view of the margin of safety should be different from that of the controlling shareholder.

I will share with you some of my bad experiences in using each of the above valuation metrics to compute the margin of safety. I would then suggest one alternative if you want a purely retail investor perspective. I would conclude with the view that whether you use the retail perspective will depend on the type of stocks you are investing in.

Asset Value

As a retail investor, you are a part-owner of the company. But this does not mean that you can control the use or distribution of the assets of the company. If you don’t control the use or distribution, can you consider the Asset Value as the intrinsic value?

For example, in the mid-90s I invested in Malaysian Tobacco Company Bhd (MTC), a Bursa Malaysian company. I bought it at RM 4.00 per share. A few years after I had bought it, the company sold off the tobacco business and was left was cash. It became a cash-holding company and it sought to acquire other businesses.

As per the 2000 Balance Sheet, the company had RM 3.77 per share of cash. By then because of the dividends received, my net cost was RM 3.12 per share. I thought that I was in a good position from a margin of safety perspective.

The company failed several times to acquire other businesses. Finally in 2002, the company acquired the satellite business serving Astro for cash. The company was renamed Measat Global Bhd. The value of the company was then dependent on the value of the satellite business.

But as can be seen from Chart 1, the market price of the shares did not rise above my purchased price. I subsequently sold it off at RM 1.30 per share in 2008 at a loss.

My point is that even though MTC was essentially a cash-holding company for many years, cash was not accessible to me. I depended on management to decide what to do with the cash.

|

| Chart 1: Measat Global Share Price: Source: Standard & Poor |

Another more recent and more positive (for retail investors) example is my investment in Affin Bank which I bought about a decade ago.

In 2022 Affin Bank completed the divestment of its subsidiary, Affin Hwang Asset Management, for RM 1.418 billion. The bank then decided to pay out about 28.2 % of the divestment sum as a special dividend amounting to about RM 0.18 per share. The balance was retained to fund the bank’s growth and/or working capital requirements.

The % retained was of course set by management. My point is that as a retail investor, you do not have much influence on how the assets of the company are deployed or distributed.

Yes, technically all major asset sales and distributions are subject to shareholders’ approval. But unless you are an activist shareholder with substantial shares, it is very hard to vary any resolution or even proposed new ones.

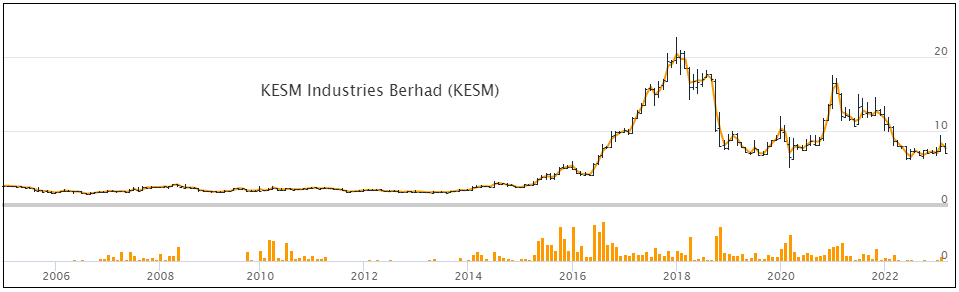

In 2007, I bought KESM, a Bursa Malaysia electronics-testing company, at RM 2.17 per share. At that juncture, it had an NTA of RM 3.63 per share with RM 2.13 per share in cash. I thought it had a good margin of safety.

But the share price remained below my purchased cost for most of the time. By 2015, I have held the stocks for about 8 years and I had lost hope that the market would re-rate the company.

I thought that I could make up for the low capital gain if the company distributed some of the excess cash. The annual average cash used in investments from 2000 to 2014 was RM 0.25 per share. The cash holding continued to remain high amounting to RM 2.28 per share in 2015.

I decided to write to the Board suggesting this. You should not be surprised by the company’s reply. KESM said that it was a capital-intensive business and as such would prefer to retain the cash. Because of this, I sold my shares at RM 2.50 per share in 2015.

With hindsight, it was not a smart move as the share price hit a high of RM 20 per share in 2018. Refer to Chart 2. I could have gotten a 10-bagger. But this is a different story for another day.

|

| Chart 2: KESM Share Price |

If you cannot influence the use of the assets, can you say that it all belongs to you?

When you adopt the Asset-based valuation approach, you are looking at the assets as a store of value. For this to be an accurate picture of the intrinsic value, the assets, and liabilities should be based on the current market values.

The Book values of the assets, especially the fixed assets, are generally based on historical costs. Analysts then adjust the Book values to reflect the current situation when determining the Asset Value.

Many property companies have land that was acquired years ago. To account for the current market value of the land, many analysts derived what is known as the Revised or Revalued Net Asset Value or RNAV. For example, the Book Value of Glomac Bhd was RM 1.40 per share in 2019 but Maybank Investment Bank estimated its RNAV to be RM 1.76 per share.

These adjustments generally meant that the revised Asset Values are higher than the Book Values. The logic is that you used these revised Asset Values to represent the intrinsic values.

But if you are not in control of the assets as represented by the Book Value, why would you be able to control the revised values?

Earnings value

The Earnings Value of a company is based on how the assets are used to generate returns.

I used the DCF method to estimate the value of the operating assets. I then estimated the value of the company by adding the value of the non-operating assets to the DCF value of the operating assets.

There are times when the value of the non-operating assets is a large component. Excluding these may result in no margin of safety.

One example is my investment in Warisan TC, a Bursa Malaysia company founded by the people behind Tan Chong Holdings. Warisan is in travel and car rental, industrial machinery and equipment, automotive, and consumer products.

In 2007, Warisan had about RM 0.80 per share in cash and RM 0.47 per share of Debt. It was trading at RM 1.89 per share compared to its average annual profits since 2002 of RM 0.27 per share.

Based on a cost of funds of 10%, I estimated the value of the operating assets as RM 2.70 per share. I considered its cash as non-operating assets.

The value of the firm including the non-operating assets = RM 2.70 + RM 0.80 = RM 3.50 per share

The value of equity after deducting Debt = RM 3.50 – RM 0.47 = RM 3.03 per share.

I thought that the Earnings Value provided a good margin of safety of 60%. But if I excluded the non-operating assets, the margin of safety became 18%.

After holding the stock for several years, I realized that the controlling shareholders did not intend to distribute the cash. It was going to be an under-utilized asset and would drag down the overall return.

Furthermore, there was not much growth in profits. In 2011, the past 11 years of annual average PAT amounted to about RM 0.22 per share. As such when the price went up to RM 2.48 per share, I decided to exit.

As a retail investor, you may have to exclude the non-operating assets when determining the margin of safety based on the Earnings value. You are not in control of the company and cannot deploy the non-operating assets into more profitable ventures. At the same time, you cannot get management to distribute them to shareholders.

|

Acquirer’s Multiple

The Acquirer’s Multiple = Enterprise Value / Operating Earnings. This is the metric acquirers use to find takeover targets. According to Tobias Carlisle, portfolios of stocks with a low rank based on the Acquirer’s Multiple offered market-beating returns over time. Stocks with an Acquirer’s Multiple of 6 or lower are considered cheap.

But as the name implies, the Acquirer’s Multiple works for the acquirer because he then controls the company. But as a retail investor, you are in no position to control the company.

The only logic for the retail investor to use the Acquirer’s Multiple is if you are hoping for re-rating due to takeovers by others. But if you are in a country, such as Malaysia, with very few takeover activities, this is not a relevant metric for the retail investor.

The common way to use relative valuation is to compare the value of a company with those of several peers. I do not consider this approach an intrinsic valuation one. But I do use relative valuation in an intrinsic value sense. I compared the values with some benchmark numbers derived from studies or theoretical basis.

The Acquirer’s Multiple with the value of 6 is one good example of this. Along the same lines, a PE of 10 or less is a good EPV measure as this assumes a discount rate of 10%.

Greenwald analysis

According to Professor Bruce Greenwald, you can get strategic insights by comparing the Asset Value with the Earnings Power Value.

Greenwald suggested that the Asset Value of a company should be based on its Reproduction Value. This is the cost to reproduce all the assets and liabilities of the company. This meant adjusting the PPE to reflect the current market price. You also include some amount to represent the value of the customer relationships.

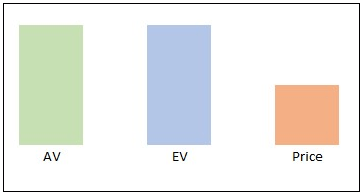

I have often used the Greenwald comparison framework to assess the margin of safety. I do this by comparing the price with the Asset Value (AV) and the Earnings Value (EV). There are 4 possible Scenarios as illustrated below.

|

| Scenario 1 - the best margin of safety is when the price is lower than both the AV and EV |

|

| Scenario 2 - there is no margin of safety when the price is higher than both the AV and EV. |

|

| Scenario 3 - You have a more than acceptable margin of safety if the price is above the AV but below the EV. |

|

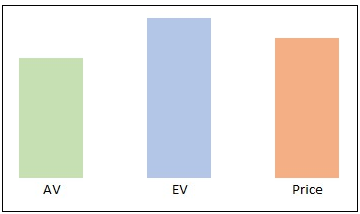

| Scenario 4 – I used to think that you have an acceptable margin of safety when the market price is higher than the EV but below the AV. |

Scenario 4 is a case of the under-utilization of assets. I now believe that for the retail investor, there is no margin of safety under Scenario 4. For the retail investor not all the components of the Asset Value are accessible. Secondly, the retail investor is not able to get the company to adopt strategies to turn around the business. A retail investor is better off focusing on earnings.

Under-utilized assets

Under-utilized assets can lead to 2 consequences:

- Low overall returns.

- Impairments.

Low overall returns can happen if a company has a large component of non-operating assets. In the case of KESM cited earlier, the company achieved an ROE of 7 % in 2011. This was because cash amounted to 45% of equity. If cash was excluded, the return as measured by EBIT/TCE was 11 %.

But low overall returns can also occur if all the cylinders of a company are not firing. A good example is Plenitude which has Property development and Hospitality businesses. As can be seen from Table 1, the Hospitality segment had poor returns pulling down the overall return.

|

| Table 1: Plenitude returns |

The worst part of under-utilized assets is the potential impairment. I bought Tropicana, a Bursa Malaysia property company about 9 years ago at RM 1.08 per share. Since it was a property company, I relied on the Net Assets of RM 2.25 per share to provide the margin of safety.

Over the past decade, the company had an average ROE of 5%. This low return was because the company had an excessive landbank. For example, in 2021 the company had 2,452 acres of land with a potential GDV of RM 152 b GDV. Over the past 10 years, the average annual revenue was RM 1.3 b. You can see the land was far in excess of the annual requirements.

Then in 2022, following some disposal of land, the company made a provision for foreseeable losses for the land. This reduced the Net Assets from RM 3.21 per share to RM 2.17 per share, a 1/3 reduction.

By then the share price had gone up to RM 1.45 per share. I was concerned about the “reliability” of the Net Asset. I thus decided to exit even though on paper, there was still some margin of safety based on the Net Assets.

You should be wary of impairments when investing in cyclical companies. This is because in the downtrend part of the cycle, assets could be under-utilized and accounting rules may require them to be impaired.

A good example of this is my investment in Dayang Enterprise Holdings, a Bursa Malaysia oil and gas company. The company suffered in a loss in 2017 partly due to a write-off of RM 33 million of PPE. Then in 2021, there was another much bigger write-off amounting to RM 349.8 million on property, plant and equipment, and goodwill.

Moral of the story? Assets may be a store of value, but if its is under-utilized, it would have bad consequences.

Focus on dividends

As an investor, your gain comes from both dividends and capital gains.

Your investment return = (Dividend + Capital gains) / Purchased cost.

= (Dividend / Purchased cost) + (Capital gains / Purchased cost).

The first term is the dividend yield based on the purchased cost. The second term is the capital return based on the purchased cost. When looking at margins of safety as a retail investor, I focused on the first term. The capital gain is the bonus margin of safety.

I consider it a good investment if the dividend yield is greater than my expected return. In the Malaysian context, the minimum expected return would be 3 %. This is the average long-term FD rate. In practice, I target 5 % to 6 %. This is the average return from the EPF (statutory retirment scheme) or even Amanah Saham (national investment fund). These are good risk-free returns for Malaysian retail investors.

My point is that dividends depend on earnings. While there were times when dividends were declared even when there were losses, this cannot go on for long. At the same time, capital gains depend on market sentiments. You are more likely to have a positive gain if the company is profitable. Again, earnings are important.

Conclusion

As a value investor, you have been told that you should consider yourself a part-owner of the company. This means that you focus on the long-term business prospects rather than the day-to-day price movements.

Then when you value companies, you assumed that management behaves rationally. The assumption here is that if there are shortcomings or threats, the company will address them.

But I argued that this part-ownership perspective can lead to trouble for the retail investor.

If you own and manage the company you can take steps to address weaknesses. However, as a retail investor, you are a minority shareholder without any means to influence management.

You rely on management to behave rationally and see the issues as you do. The concern is that sometimes management does not behave rationally. They may not see things the way you do.

This is important because investment opportunities tend to arise when a company is facing some issues. You assumed that the company will act so that the issue is temporary.

Because of this, some of the value investing concepts have to be modified for the retail investor.

- Looking at Asset value may not be appropriate. Treat earnings as key.

- Even if you look at Earnings value, you may have to ignore the non-operating assets.

- The safest is to look at the value based on the dividend model.

Notwithstanding the above, this is only part of the picture. Most of the times, I used the retail investor perspective as the first cut. I then looked at the margins of safety from the controlling shareholders perspective. This is because I am a long-term investor and a lot of my capital gains came from some M&A activity. The market then re-rated them because of this.

I seldom invest in the stocks making up the FTSE KLSE Composite Index. But when I do so, I tend to use the retail perspective to determine the margin of safety. This is because these are large companies that are unlikely to have any privatization exercise or be taken over.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment