White Horse is still not a value trap

Value Investing Case Study 06-4: White Horse: A hidden opportunity in the tile industry? I first covered White Horse in Nov 2020. This is an updated fundamental analysis taking into account the financials till FYE 2022. Where relevant, I have incorporated the analyses from the previous articles here.

On 2 Nov 2020, White Horse Bhd (White Horse or the Group) was trading at RM 0.60 per share. At that juncture, the price was lower than its Graham Net-Net of RM 0.76 per share (as of 30 Jun 2020). I presented my rationale then for why White Horse was not a value trap.

There has not been much change to the price since then. As of 25 Oct 2023, it was RM 0.58 per share. At the same time, the Graham Net-Net also increased to RM 1.28 per share (as of 30 Jun 2023).

From 2018 to 2020, the Group incurred losses. While it managed to turn around in 2021, the profit in 2022 was lower than that in 2021.

You could be forgiven for thinking that it is going to be tough for the Group to deliver a good performance. But if you are an investor with a long-term investment horizon, you should look beyond the immediate performance.

Join me as I argue why White Horse is still not a value trap and can be one of the better Bursa Malaysia stocks to invest in.

At the current price, there is an investment opportunity. Should you go and buy it? Well, read my Disclaimer.

Contents

- Investment thesis

- Rationale

- Business background

- Operating trend

- Financial position

- Risks

- Valuation

- White Horse is still not a value trap

|

Investment Thesis

As of 23 Oct 2023, White Horse was trading below its Graham Net-Net. The Graham Net-Net is often used as a shorthand for the liquidation value. I do not expect White Horse to be liquidated.

The Group’s problem is due to the soft property market that showed signs that it has reached the bottom as there were increased transactions in 2022.

The market situation had resulted in the Group operating below or around its breakeven levels for the past 5 years. However, it has taken steps to address this with cost-down programs and disposal of excess capacity.

The ceramic tile is not a sunset industry. White Horse has the brand name and distribution setup. Together with its cost reduction program, it would be able to benefit from the property market recovery. At the same time, the Group is financially sound and has the financial resources to withstand the soft market.

|

Rationale

- White Horse is financially sound with an 11.7 % debt-equity ratio. Despite the losses since 2018, the Group has been able to generate positive cash flow from operations for 11 out of the past 12 years.

- The losses were due to operating below its breakeven level. The Group has taken steps over the past few years to address this through its cost reduction plans.

- The disposal of its Vietnam assets in 2021 would improve the capacity utilization of the Malaysian plants.

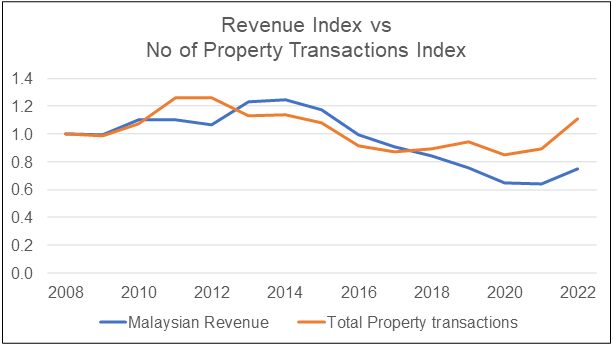

- There is a 0.63 correlation between Malaysian sales and the number of property transactions. The number of property transactions has been on an uptrend since 2021.

- Once the property market recovers, we will see White Horse returning to profitability. Ceramic tile is not a sunset industry and the Group has the brand name and distribution network to ride the recovery.

- The Group has good operations and capital allocation track record. The only weak area is the poor track record for creating shareholders' value.

- There is enough margin of safety based on the Graham Net-Net.

The supporting details are presented in the following sections.

|

Business background

White Horse started in Johore in 1992 as a joint venture between Taiwanese, Malaysian, and Singaporean parties.

From an initial set-up of only 2 kilns, the Group has since grown so that today it has 15 kilns. It is also recognized as one of the leading ceramic tile manufacturers in the Asia-Pacific region.

The Group currently has 2 manufacturing facilities in Malaysia.

- The Group initially manufactured and distributed red bricks and roofing tiles. Today the Group produces ceramic floor and wall tiles, interchangeable floor and wall tiles, and also porcelain tiles.

- Its products are sold in Malaysia, and Vietnam, and exported to more than 30 countries around the world.

The major accolades of the Group included:

- The Malaysian Brand Laureate Awards 2010 – 2021.

- Ceramic World, the Group’s showroom is recognized by The Malaysia Book of Records as the largest tile showroom in Malaysia.

- The Readers Digest Platinum Trusted Brand Award 2010 - 2020 in the Wall & Floor Tiles Category.

- The first tile manufacturer in Malaysia to be invited by the Italian Association of Ceramic as one of the exhibitors of CERSAIE since 2012. White Horse is ranked 18th on CERSAIE’s leading companies in terms of world production and consumption.

The Group business was carried out in Malaysia until 2012 when it first reported exports amounting to 13 % of its revenue.

Before this, there were also some exports. For example, from 2008 to 2011, the Group sold about RM 20 million of products and raw materials to a related party in Vietnam. These averaged about 4 % of the annual sales.

As can be seen from Chart 1, international sales peaked in 2018 at 34 % but had since declined to 13% by 2022. Note that the % of international sales was skewed by the declining Malaysian sales.

|

| Chart 1: Revenue trends |

You can see from Chart 1 that the Group sales peaked in 2014 and declined to reach the bottom in 2020. This was partly due to the declining contribution from Malaysia due to the slowdown in the property sector.

The sales decline has impacted several operating fronts.

- The cash conversion cycle which averaged 230 days from 2008 to 2010 has deteriorated to an average of 276 days from 2020 to 2022.

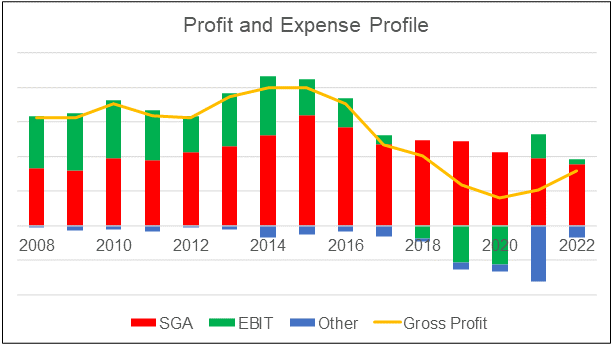

- The administrative, selling, and distribution expenses averaged 17 % of sales from 2008 to 2010. They rose to an average of 24 % of sales from 2020 to 2022.

- The lower production volume has meant that the gross profits have declined from an average of 33 % from 2008 to 2010 to 14 % from 2020 to 2022.

|

| Chart 2: Profit and expense profile |

Since hitting its peak revenue in 2014, the Group has implemented several measures to improve the bottom line.

- Introduced new products as well as rationalizing its inventory control system.

- Lowered production costs eg heat recycling projects, downsizing of manpower.

- Stopped major capital expenditure since 2016.

- Sold off the manufacturing assets in Vietnam in 2021.

Operating trends

I looked at 3 metrics to get an overview of the overall performance – revenue, PAT, and gross profitability (gross profits / total assets). Refer to Chart 3.

- Revenue grew from 2008 to peak in 2014 and has been declining since then. But it seemed to have leveled off from 2020.

- The Group incurred losses from 2018 to 2020.

- The positive sign is that while gross profitability had been declining since 2010, it seemed to have turned around in 2021.

|

| Chart 3: Performance Index |

It should be pointed out that during the period from 2014 to 2019, the Group generated a total EBIT of RM 102.4 million after deducting RM 82.3 million for the following:

- RM 15.5 million (net) from written-off and/or written-down inventories.

- RM 31.2 million from impairment of Property, Plant, and Equipment.

- RM 35.6 million of unrealized forex losses.

The long-term outlook of the Group would be different if these were considered as a one-off expenditure.

IH 2023

The revenue for the first six months of 2023 was 13% lower than that for the same period last year.

The Group incurred a loss of RM 30.2 million in the first half of 2023 compared to a loss of RM 6.6 million for the same period last year. Last year's result included a non-operating profit of RM 15 million.

The gross profit margin for the first 6 months of 2023 was 2.2 % compared to 22.7 % last year. The Group attributed this to

“…higher production cost, in particularly the fuel cost for natural gas and electricity, which were increased by 34% and 40% respectively…”

I am a long-term value investor and I consider quarterly performance as “noisy”. As such I focus on long-term trends.

Competitive profile

There are 3 other Bursa tile companies. A comparison between White Horse and its peers as per Chart 4 from 2014 to 2022 showed the following:

- White Horse's revenue declined more than those of its peers.

- All experience declining ROE with the bottom in 2018/19. I would rate White Horse's performance as among the better ones.

|

| Chart 4: Peer performance |

Breakeven analysis

The losses and low profits for the past 5 years were because the Group was operating below the breakeven level. To turn around, the Group needs to operate above its breakeven level. The breakeven level is dependent on the volume, variable cost, and fixed costs.

There is not enough information in the Annual Report to determine the breakeven picture accurately. But to illustrate the breakeven position, I assumed the following in my breakeven chart:

- Sales and costs from the various years were used as proxies for changes in volume.

- Variable cost = Cost of sales less depreciation.

- Fixed cost = Selling, General and Admin expenses + depreciation.

As can be seen from Chart 3, the differences between sales and the total costs (variable costs + fixed costs) had been declining since the mid-2000s. By 2018, the Group incurred losses.

To return to profitability, the Group has either to increase its sale quantities, sell at higher unit prices, or lower its costs. The Group had taken steps to address all of them.

- By disposing of the Vietnam operations, it would reduce its annual production capacity. This would reduce part of the fixed costs associated with the manufacturing facility. At the same time, it would result in higher capacity utilization for the Malaysian plant thereby reducing the variable cost.

- The Group had taken steps to address its variable and fixed costs even before the Vietnam plant disposal.

- The sales would depend on both the quantity sold and the unit selling price. These would depend on the market but if White Horse could bring down the production costs, it could be profitable with lower sales volume.

This is of course a back-of-envelope analysis as I do not have the production quantity or sales quantity. But it illustrates the direction to return to profitability.

Capacity utilization

According to its website, the Group has an annual production capacity of 35 million m2 of tiles. This is from both Vietnam and Malaysian operations.

|

By disposing of the Vietnam operations, the annual production capacity would be reduced to 22 million m2. I derived this by deducting the Vietnam capacity of 13 million m2 of tiles.

In my previous articles, I had stated the following:

- In terms of capacity, the Group produced about 16 million m2 of tiles in 2019 compared to its annual production capacity of 35 million m2. Production in 2019 has declined compared to the 2018 production of 22 million m2.

- I estimated that at its peak in 2014, the Group produced about 34 million m2 to 35 million m2 of tiles.

- To break even, (based on 2017 performance) the Group probably needs to produce and sell about 29 million m2 of tiles.

- Furthermore, in 2018 and 2019, the Group’s annual production was only 22 million m2 and 16 million m2 respectively.

With the disposal of the Vietnam facilities, the Group would have a better capacity utilization. In other words, the Group would not have to produce and sell 29 million m2 of tiles (based on the 2017 performance as per above) to break even.

The Group did not provide any information on the quantity of tiles produced in 2022. But it looks like breakeven.

Link to the property sector

The past decade has been very challenging for the Malaysian property industry. The industry started the 2010 decade on a very positive note. However, the government soon instituted several cooling measures to reduce speculation. For example:

- The Developer Interest Bearing Scheme (DIBS) was banned.

- Real Property Gains Tax (RPGT) was increased.

- The minimum property purchase price for foreigners was raised from RM 500,000 to RM 1 million.

- The was a cap on the loan-to-value ratio for the third house.

Many of these measures were implemented in the first half of the decade but their effects persisted long after this. As can be seen from Chart 6, the number of property transactions had been declining since 2011 but seemed to have picked up in 2022.

There is a 0.63 correlation between White Horse revenue and the number of property transactions. What does this all mean for White Horse going forward?

|

| Chart 6: White Horse Malaysian revenue vs Malaysian Property transactions (residential and commercial) |

As the property sector improves, I expect White Horse Malaysian revenue to follow.

In my article “Will the Malaysian Property industry turn around by 2024?” I had concluded that the financial performance of the property sector would only turn around in a couple of years because of the “big ship” effect.

Financial position

I would rate White Horse as financially sound based on the following:

- As of the end of Jun 2023, it had RM 125 million cash. This was equivalent to 18 % of its total assets.

- It had a debt-equity ratio of 11.7 % as of Jun 2023. This is much lower than its peak debt-equity ratio of 32.8 % in 2015.

- Over the past 12 years, there was only one year (2022) where it had negative cash flow from operations.

- Over the past 12 years, it generated RM 527 million cash from the cash flow from operations compared to RM 145 million of PAT. This is a very good cash conversion ratio.

The Group also had a good capital allocation plan as shown in Table 1. You can see that its cash flow from operations was well deployed for CAPEX and dividends.

|

| Table 1: 2011 to 2022 Sources and Uses of Funds |

In the context of capital allocation, it is useful to look at the Group acquisition and “disposal” of the Vietnam operations. It points to:

- Prudent financial management.

- Protection of shareholders' interest in the related party acquisition.

White Horse Vietnam

The Group acquired White Horse Vietnam in 2013 for RM 64.74 million (USD 21 million) from White Horse Investment (S) Pte Ltd.

- There was a Total Guaranteed Profit of USD 12 million by the vendor to be achieved over 4 years.

- Any shortfall in the Total Guaranteed Profit was to be settled by offsetting the loan made by the vendor to White Horse Vietnam. In 2013, White Horse Vietnam owed the vendor USD 23.7 million.

- The White Horse Vietnam 2016 financial statements were to be used to determine the shortfall.

Over the period from 2013 to 2019, the Vietnam operations ran at a loss. The total accumulated losses for the period amounted to RM 56.3 million.

In the Circular to the acquisition of White Horse Vietnam, it was stated that

“… with the expected increase in White Horse Vietnam export sales and optimization of capacity utilization of at least 80% of its capacity over the next 3 years after Completion, White Horse Vietnam would be able to reduce its overall unit production costs and accordingly improve its gross profit margin.”

This was not achieved.

The Group started to provide for this shortfall as a “contingent indemnification asset” in 2013. This was classified as “Other Assets” of RM 19.023 million in the 2013 Balance Sheet.

In its 2016 Annual Report, it was stated that White Horse Vietnam could not meet the profit guarantee. As such the USD 12 million was re-classified to set off the balance owned by White Horse Vietnam to the vendor.

With the completion of the profit guarantee, the Group acquired White Horse Vietnam for RM 64.74 million compared to its 2019 net asset of RM 69.1 million

In 2021, the Group disposed of its assets in Vietnam for RM 113.5 million comprising

- RM 55.2 million for the value of the construction works.

- RM 58.3 million for the machinery and equipment.

The selling price was based on about 90 % of a valuation by an independent registered valuer.

The Group reported a gain of RM 73.8 million for the disposal.

Shareholders’ value creation

I looked at the following metrics from 2011 to 2022 when assessing shareholders’ value creation:

- Comparing returns with the cost of funds.

- Comparing the gains by an investor who bought a share at the end of 2011 with the cost of equity.

- Looking at the Q Rating which is based on several valuation metrics. A high score relative to the panel meant that the company had the potential to create shareholders’ value.

As can be seen from Table 2, White Horse returns were lower than the respective cost of funds. In order words, the Group did not create any shareholders’ value. You should not be surprised given its losses over the past few years.

|

| Table 3. Estimating the shareholders’ gain |

At the same time, White Horse had an overall Q Rating of 0.41. This places it just below the average position among the panel companies. Again, it illustrated that it had been challenging for the Group to create shareholders’ value.

On the positive side, the Q Rating had improved from 0.35 in 2020.

|

| Chart 7: Q Rating |

Risks

When you look at the risks of investing in White Horse, I would see the main ones as:

- Privatization risk.

- Turnaround risk.

Privatization

I have mentioned in the past postings that at the current market prices, it is very attractive to take companies private.

White Horse is no different.

In the White Horse case, the Board members collectively control about 40 % of the company. Any plan to acquire the remaining 60 % at the current market price of RM 0.58 per share would need about RM 77 million.

The company has cash and securities of about RM 125 million (as of June 2023).

So, it would be possible to privatize it via a mix of capital reduction and external funding by the Board members.

Would the controlling shareholders privatize the company then?

You will have to judge for yourself.

Turnaround risk

To turn around the business, the Group has to:

- Recover its Malaysian business.

- Expand its exports.

The decline in Malaysian business is due to the soft Malaysian property and construction sectors. I think we are at the bottom of the property sector.

Accordingly, I would expect the industry to recover. The risk is whether the Group has the resources to withstand a few more years of a soft property and construction market.

I think that the Group would be able to do so given:

- The Group's track record of positive cash flow from operations.

- It's low gearing.

- The efforts it has taken to control cost.

The Group has also to re-grow its exports. The opportunities are there as summarized in the next section.

The positive sign is that there is no sign of any substitute material to threaten the use of ceramic tiles. I would conclude that White Horse is not in a sunset industry that can hinder any turnaround.

If the current performance is tied to technology or green issues, I would have assessed the turnaround risk as high.

Global demand

The ceramic tile market is global.

According to Research and Market, the global ceramic tiles market is expanding as consumer spending on home remodeling grows, highlighting an increased demand for ceramic tiles used primarily in kitchens and bathrooms.

It projected the global ceramics tile market industry to grow at 10.4 % CAGR from 2023 to 2030.

Other market research groups also paint positive reports;

- Market and Market estimated that the market for ceramic tiles will grow at a CAGR of 7.1 % from 2022 to 2027.

- Grand View Research estimated the global ceramic tiles market will grow at a CAGR of 7.1 % from 2022 to 2030.

The general view is that the global demand for ceramic tiles is growing at a higher rate than global GDP growth.

In terms of the advantages and environmental issues regarding ceramic tiles, the following were reported:

- Research and Market - Ceramic tile manufacturing is an environment-friendly process. Recent technological advancements have also enabled manufacturers to further reduce the emissions of carbon and other harmful gases during production.

- Grand View Research - Ceramic tiles are durable, rigid, and environment-friendly materials. They comply with green building standards.

Valuation

My value of White Horse is summarized in Chart 8.

- I estimated its Asset Value as RM 3.57 per share broken down into Graham Net Net, NTA, and Book Value.

- I estimated its Earnings Value as RM 0.69 per share. This was estimated based on its Earnings Power Value. You can see that the non-operating assets accounted for the bulk of this value.

At RM 0.58 per share, White Horse is trading significantly below the Graham Net-Net of RM 1.28 per share and the non-operating assets of RM 0.63 per share.

The Graham Net-Net is commonly used as a shorthand for the liquidation value. Given that there are signs of a return to profitability, I do not expect White Horse to be liquidated.

Looking at the above, I would conclude that there is a sufficient margin of safety. It is not a value trap as the existing operations are still viable and generating good returns.

|

| Chart 8: Valuation |

Valuation model

My Earnings Value of the company was derived based on the average values from 2 valuation approaches:

- Free Cash Flow to the Firm model as per Damodaran.

- Residual Income model as per Penman.

For both models, I used the past 12 years’ time-weighted average value to represent the normalized value.

I have taken a conservative view and ignored the growth in my valuation. At the same time, I have used the past 12 years’ time-weighted average EBIT as the earnings. In other words, I have ignored the potential turnaround.

The cost of capital used in the model was based on the Capital Asset Pricing Model. I followed Damodaran’s approach to determine the Beta and the risk premiums.

These resulted in both 12.2 % cost of equity and 9.7 % WACC.

Valuation risks and limitations

There are 2 critical assumptions in my valuation

- Cost of capital.

- Continuation of historical performance.

The cost of capital was derived based on the risk-free rate and equity risk premium as of 2022. We currently have the Ukraine invasion and the Israel-Gaza conflict. The parameters do not reflect the higher-risk situation.

As such you should see the Earnings Value as an optimistic one. The only mitigating point is that the margin of safety is based on the Graham Net-Net.

My valuation model assumes that the past 12 years' performance is a good reflection of the future. In a company undergoing a turnaround or venturing into new areas, this is a very conservative picture.

If you think that the future would be better than the past, then my Earnings Values are conservative. Of course, if you think that the future would be worse, my Earnings Values are optimistic.

I had earlier stated that the Group wrote off about RM 82 million from 2014 to 2022. Without these, the EPV would be about 80% higher.

Normally for a company undergoing a turnaround, I would use a 2-stage growth model to value it. I would first project the change in earnings from a loss to a profit. Next, I would assume some steady earnings. I did not do this for White Horse as there is already a margin of safety under the Graham Net-Net.

|

White Horse is still not a value trap

A value trap is an investment that while appearing cheap is facing insurmountable problems. It is cheap for a reason. White Horse does not fall into this category.

My analysis showed that the Group is financially sound. It has the resources to see it through a turnaround. I have shown that:

- The business suffered losses because it was operating below the breakeven level. But the Group had taken measures to reduce the breakeven level.

- There is a strong link between the Group’s revenue and the performance of the Malaysian property sector.

- The Malaysian property sector is probably at the bottom of the cycle. There has been an increase in the number of property transactions in 2022 compared to 2021.

The Group is undergoing a turnaround. The return to profitability is dependent on the property market turning around. I do not expect the Malaysian property market to remain soft forever. The property sector is cyclical. Furthermore, the ceramic tile industry is not a sunset one.

The steps taken by the Group to reduce cost and capacity will help it to be profitable at a lower production volume. At the same time, the Group has the brand name and distribution set up to benefit from any turnaround.

I have also estimated that there is a sufficient margin of safety from a Graham Net-Net perspective. White Horse is more than a cigar butt investment strategy as there is still potential for the business to grow.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment