Is Affin a value trap?

Value Investing Case Study 44-1. Affin Bank: Undervalued opportunity or a classic value trap? Unveiling its true potential!

There are currently 10 Bursa Malaysia banks. Affin Bank (Affin) is one of them.

I first invested in Affin in 2017 at RM 2.17 per share. Over the next few years, I continued to build up my investment. Today it is among the top 5 investments (in terms of market capitalization) in my portfolio.

My average purchase price was RM 2.66 per share compared to the current market price of RM 2.39 per share (as of 10 Jan 2024). But the book value of Affin as of Sep 2023 was RM 4.79 per share. You can imagine the questions going through my mind:

- Is this a value trap that would prevent new investors from buying?

- Is the low price due to market sentiments or business issues?

- Should I continue to hold or exit?

Join me as I assess Affin's performance and valuation by comparing them with those of its peers. I hope that the various data that I have compiled here for the banks can serve as base rates when I look at other banks.

My conclusion is that Affin is not a value trap and there is potential for the market to re-rate it higher. I will continue to hold.

Should go and buy it? Well, read my Disclaimer.

Contents

- Introduction

- My investment in Affin

- Base Rates

- Peer comparison

- Valuation

- Method

- Affin is not a value trap

|

Introduction

The Malaysian banking system is a linchpin in the nation's economic architecture. Under the oversight of Bank Negara Malaysia, Malaysia's financial institutions have evolved into a dynamic and sophisticated network.

The Malaysian banking landscape is characterized by a diverse array of institutions. These ranged from domestic giants to international players. This diversity not only promotes healthy competition but also ensures a broad spectrum of financial services, catering to the varied needs of businesses and individuals.

There are currently 10 banks listed under Bursa Malaysia.

- In terms of total assets, they ranged from RM 70 billion to RM 1,001 billion with an average of RM 359 billion.

- In terms of market capitalization, they ranged from RM 5 billion to RM 109 billion.

|

| Table 1: Bursa Malaysia banks size |

In global terms, except for CIMB and Maybank, the Bursa Malaysia banks are small. To give you a sense of the scale on a global basis, I used HSBC as a reference.

HSBC's presence in Malaysia dates back to 1884 when the Hongkong and Shanghai Banking Corporation Limited established its first office in the country. HSBC in Malaysia has a network of more than 50 branches.

HSBC Holdings Ltd which is listed on the LSE has a total asset of RM 1,581 billion and a market cap of RM 718 billion.

Secondly, many of the Bursa-listed banks are universal banks. Universal banks diversify their offerings beyond traditional banking services. They may provide retail banking services (loans, deposits, and basic financial services), insurance products, investment banking services (underwriting, mergers and acquisitions), and stock broking services.

|

My investments in Affin

Affin Bank is a commercial bank and the financial holding company of Affin Islamic Bank, Affin Hwang Investment Bank Berhad and Affin Moneybrokers.

Generali Life Insurance Malaysia (formerly known as AXA Affin Life Insurance) and Generali Insurance Malaysia (formerly known as AXA Affin General Insurance) are the associate companies of Affin Bank.

Affin’s operations are principally conducted in Malaysia and comprises the following main segments:

- Commercial banking. Its activities are generally structured into three key areas, corporate banking, enterprise banking and community banking. In 2022, this segment accounted for RM 1,507 million of the group PBT (before inter-company elimination).

- Investment banking. This segment focuses on business of a merchant bank, stock-broking, fund and asset management. In 2022, this segment accounted for RM 55 million of the group PBT (before inter-company elimination).

- Insurance. This segment includes the business of underwriting all classes of general and life insurance businesses in Malaysia. In 2022, this segment contributed RM 9 million to the group PBT (before inter-company elimination).

- Others. This includes operation of investment holding companies, money-broking and other related financial services. In 2022, this segment accounted for RM 2 million of the group PBT (before inter-company elimination).

I first bought Affin in 2007 when I first started to learn about value investing and wanted to have a bank stock as part of my portfolio. At that juncture, the bank was part of Affin Holdings Berhad.

There were 3 reasons for choosing Affin:

- In 2007 Affin Holdings Berhad entered into a strategic partnership with The Bank of East Asia, Limited (BEA). This was largest independent local bank in Hong Kong. BEA had the expertise and technical know-how to help position the group as a major player in the financial services industry. Affin’s vision then was not just to be a Malaysian bank but also to expand regionally to meet the challenges of a liberalized banking arena.

- Being new to value investing, I felt that the BEA purchase price could serve as a benchmark for the valuation of Affin Holdings.

- I happen to know one of the Directors of Affin Holdings and that gave me confidence about its corporate governance practices.

To make a long story short, I built up my investments over the next few years so that today Affin is among the top 5 stocks (in terms of market cap) in my portfolio.

In terms of total returns, this has not been a great investment as the market price today is below my average purchase cost. Refer to Table 2. Over the past 11 years, I have achieved a 2.1 % CAGR in the total return.

This is well below the interest I could have received by placing my money as a fixed deposit with the bank. The bulk of the returns have been due to the dividends received.

|

| Table 2: My Affin investment return |

Base rates

Daniel Kahneman, a Nobel Prize-winning psychologist, and behavioral economist, introduced the concepts of "inside view" and "outside view". These concepts are particularly relevant in understanding how individuals approach forecasting and estimating the likelihood of future events.

- The inside view refers to an individual's subjective, often biased perspective when making predictions or decisions about a specific future event. People tend to focus on the unique details and circumstances of the particular situation at hand, relying heavily on specific information and factors that are directly in front of them.

- The outside view involves taking a more objective and detached perspective by considering general information and statistical base rates. Instead of focusing on the specifics of the current situation, individuals using the outside view look at similar past situations and consider the broader trends and probabilities associated with those cases.

Kahneman emphasizes the importance of incorporating base rates - general statistical information about the likelihood of an event occurring - when taking the outside view. Base rates provide a benchmark or reference point for understanding the probability of an outcome based on historical data.

Kahneman recommends combining the inside view with the outside view. This involves considering both the specific details of the current situation (inside view) and the general probabilities derived from base rates (outside view).

Integrating base rates helps to balance the tendency to be overly influenced by unique circumstances and allows for a more realistic assessment of the likelihood of success or failure.

I hope that the data I present in the following section can serve as base rates when looking at the performance of Bursa Malaysia banks.

Peer Comparison

I am a long-term value investor holding onto stocks for 6 to 8 years. As such I am more interested in how the sector and Affin performed over the past decade. I thus covered the performance of the banks from 2009 to 2023. For more details on the computation, refer to the Method section.

In my report, I used the terms “peer” and “sector” interchangeably to mean the 10 Bursa banks including Affin.

I classified the performance of the banks into 4:

- Returns.

- Efficiency.

- Loan performance.

- Capital adequacy.

Returns

I look at both the ROE and ROA. Both metrics are essential for assessing a bank's financial health. While ROE is more centred on shareholders' interests, ROA provides a broader view of the overall efficiency of the bank's operations.

I wish to point out that in their 2012 research paper “Factors affecting the profitability of Malaysian commercial banks”, the authors concluded that ROA is the best profitability indicator.

You can see from the left part of Chart 1 that the sector ROE grew from 2009 to peak in 2010/11. It then began to decline to reach the bottom in 2020/21. Compared to the peers, Affin's performance was worse than the peer median ROE. Refer to the right part of Chart 1.

|

| Chart 1: ROE |

The main reason for the declining trend was the declining macroeconomic environment. The following extracts from Affin's Annual reports give you a picture of this:

“…The banking industry continued to be pressured by compressed net interest margins (NIMs) which, along with competition, created a challenging business environment…” 2013 Annual Report.

“…declining export revenues, capital outflows, and weaker investor sentiments towards Malaysia. For the banking sector, all of these translated into less than favorable domestic demand, softer loan growth, greater pressure on earnings, and concerns over asset quality from the possible rise in impaired loans.” 2015 Affin Annual Report

“…private consumption contracted…which was also reflected in the services sector…This translated into lackluster domestic demand, easing loan growth, greater pressure on earnings, and concerns over asset quality from the possible rise in impaired loans.” 2017 Annual Report

“…Macroeconomic conditions remained volatile and the banking sector continued to accommodate and adjust to regulatory and industry changes. Business and household lending were tepid, while deposits growth moderated further…” 2019 Annual Report

Given the poor macroeconomic situation, you should not be surprised to see similar patterns for the ROA. Refer to Chart 2.

|

| Chart 2: ROA |

Net interest margins and efficiency

The net interest margin (NIM) is a key determinant of a bank's overall profitability. A wider margin suggests that the bank is more efficient in earning interest income compared to its funding costs.

Banks with a higher NIM may have a competitive advantage in the market, as they can potentially offer more attractive deposit rates or more competitive loan terms while maintaining profitability.

I also looked at another efficiency metric – the efficiency ratio. This measures the operational efficiency of a bank by evaluating how well it manages its operating expenses relative to its revenue. It is expressed as a percentage and provides insights into the cost-effectiveness of a bank's operations.

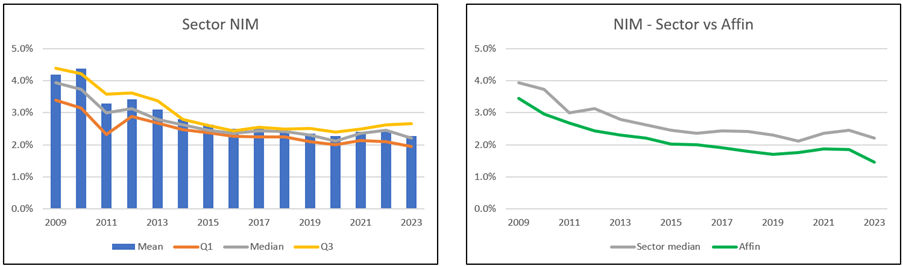

Chart 3 shows the sector and Affin NIM. You can see that the NIM in 2023 was lower than that in 2009. The drop in 2011 was explained by Affin as follows:

“…lower net interest income following a contraction in net interest margin as Bank Negara Malaysia raised the Overnight Policy Rate by 25 basis points.” 2011 Annual Report.

|

| Chart 3: Net Interest Margins Note: Net interest margin (NIM) computed as net interest income/net loan. |

One of the reasons for the declining net interest margin was the higher cost of funds. Chart 4 shows the trends in the deposit interest rates. You can see that the rates from 2011 to 2019 were higher than that for 2009.

But while the rates in 2022 were comparable to that for 2009, there was no significant improvement in the NIM for 2022.

|

| Chart 4: Deposit interest rates. Source: Statista |

When you look at the operating efficiency, you can see from the left part of Chart 5 that there were no significant trends for the sector. However, Affin experienced a deteriorating efficiency ratio. Its non-interest expense as a ratio of its net revenue was higher in 2023 compared to that in 2009.

With the worst NIM and efficiency ratio of its peers, it does not look good for Affin.

|

| Chart 5: Efficiency ratio Note: Efficiency ratio computes as total non-interest expenses/net revenue. |

Loan performance

I looked at two metrics here:

- Gross loan-to-deposit ratio (GLDR).

- Non-performing loans (NPL) ratio.

The GLDR is an important indicator for assessing a bank's liquidity and risk exposure. A lower GLDR suggests that the bank has a higher proportion of deposits compared to loans, indicating a more conservative approach to lending. In contrast, a higher GLDR implies that the bank is relying more on loans for its operations and may have a lower liquidity buffer.

A higher GLDR may indicate a higher risk for the bank, as it suggests a larger portion of the bank's funds are tied up in loans. If a significant portion of these loans becomes non-performing (defaulted), the bank may face challenges in meeting its obligations.

The GLDR can also provide insights into a bank's sensitivity to changes in interest rates. If a bank has a higher proportion of fixed-rate loans and interest rates rise, the interest income from these loans may not increase as quickly as the interest expense on deposits, potentially impacting the bank's profitability.

Looking at the left part of Chart 6, you can see that over the past 15 years, there was an increase in the GLDR in 2015. This ratio then remained about the same over the next 8 years.

We see the same pattern for Affin. But as shown in the right part of Chart Chart 6, Affin’s ratio was consistently lower than the sector median ratio.

I could not find any explanation from the Affin, AMMB, CIMB, or Maybank Annual Reports for 2015 on why there was an increase in the GLDR.

|

| Chart 6: Gross Loan to Deposit ratio |

While the GLDR focuses on the quantity of loans in relation to deposits, it doesn't directly address the quality of the loans.

I thus look at the NPL ratio. This is a key indicator of a bank's asset quality. A higher NPL ratio suggests a larger proportion of the bank's loan portfolio is at risk of default, indicating potential credit risk and deteriorating asset quality.

A rising NPL ratio may indicate weaknesses in the bank's credit risk management practices.

A high NPL ratio can negatively impact a bank's financial health and profitability. If a significant portion of loans becomes non-performing, the bank may face challenges in meeting its obligations and maintaining regulatory capital adequacy.

The positive sign is that when you look at the NPL ratio performance over the past 15 years, we see an improving trend. Refer to the left part of Chart 7.

Unfortunately for Affin, its NPL ratio increased from 2017 to peak in 2020 before declining. Overall Affin did worse than the sector median.

|

| Chart 7: NPL ratio Note: NPL ratio = Non-performing loan/total loan. |

Capital adequacy ratio (CAR)

I looked at 2 ratios - Tier 1 capital adequacy ratio and total capital adequacy ratio. These measures are used to assess a bank's capital adequacy. However, they differ in the components of capital they consider. Table 3 highlights the key differences.

|

| Table 3: Comparing Tier 1 and Total Capital |

The denominator in the capital adequacy formula is risk-weighted assets, which account for different levels of risk associated with various types of assets. This makes the capital adequacy ratio a risk-adjusted measure, reflecting the bank's capital in relation to its risk exposure.

Investors, analysts, and rating agencies often consider the Tier 1 CAR when evaluating a bank's financial health and risk profile. A strong Tier 1 CAR is generally seen as a positive indicator of a bank's stability and prudential risk management.

In this context, the Tier 1 capital adequacy ratio for the Malaysian listed banks has been improving over the past 15 years. Refer to the left part of Chart 8. We also see improvements for Affin where since 2019, the Affin ratio was better than the median of its peers.

|

| Chart 8: Tier 1 capital adequacy ratio |

As can be seen from Table 3. the total capital adequacy ratio is a financial metric that measures a bank's overall capital adequacy and its ability to absorb potential losses arising from various risks.

It is a regulatory requirement to ensure that banks maintain a sufficient level of capital relative to their risk exposures. The Total CAR takes into account both Tier 1 and Tier 2 capital, providing a comprehensive assessment of a bank's capital strength.

You should not be surprised to see that the trends for the total capital adequacy ratio show a similar pattern as that for the Tier 1 capital adequacy ratio. Refer to Chart 9.

|

| Chart 9: Total capital adequacy ratio |

Affin’s performance

Based on these 4 groups of metrics, I would rate Affin's performance as below the sector median.

- The gap in the returns between Affin and its peers widened over the past 18 years.

- While the gap in the NIM did not widen over the past 18 years, we cannot say this for the efficiency ratio. Affin was a less efficient company in 2023 compared to 2018.

- Affin was more conservative than its peers when it came to lending. However, this did not prevent it from incurring higher NPL from 2017 to 2020.

- The only positive sign was that Affin's capital adequacy ratio had improved relative to its peers over the past few years.

From an outsider's perspective, I would say that while this is a safe bank from a capital adequacy perspective, it is not well run. There is room for significant improvements.

I hasten to add that because of their universal banking model, we may not be comparing apples to apples by looking at NIM and loan performance.

Valuation

According to Damodaran, there are 2 challenges in valuing banks:

- The cash flows to a bank cannot be easily estimated, since items like capital expenditures, working capital, and debt are not clearly defined.

- Most financial service firms operate under a regulatory framework that governs how they are capitalized, where they invest, and how fast they can grow. Changes in the regulatory environment can create large shifts in value.

He argued that financial service firms are best valued using equity valuation models, with actual or potential dividends, rather than free cash flow to equity. The two key numbers that drive value are:

- The cost of equity, which will be a function of the risk that emanates from the bank’s investments.

- The return on equity, which is determined both by the bank’s business choices as well as regulatory restrictions.

As such I will compare the values of the various banks based on the following:

- Earnings value (EV) derived from 3 DCF methods – dividends, notional dividends and residual income.

- Asset value (AV) based on its tangible book value.

I would say that since the bank's assets and liabilities are marked to market, the tangible book value serves as a floor value. This is especially true if the banks have been profitable every year.

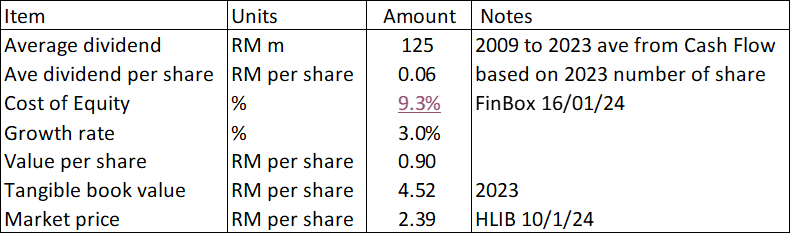

Dividend discount model

The Earnings Value under the dividend discount model was derived from the following equation:

EV = Dividends X (1+g) / (Cost of equity – g).

Dividends per share = average past 15 years' total dividends / 2023 number of shares.

g = growth rate. I assumed this to be 3%.

Cost of equity = This was based on Gurufocu's cost of equity as of 10 Jan 2024.

The computation for Affin is shown in Table 4.

|

| Table 4: Dividend discount model for Affin |

Notional dividend discount model

In this model, the cash flow is the notional dividend.

I first computed the 2009 to 2023 average ROE.

I next derived the normalized PAT = average ROE X 2023 Equity.

The notional dividend payout = 1 – (growth / average ROE).

Notional dividend = normalized PAT X notional dividend payout.

The intrinsic value is then estimated following Table 4 using the notional dividend.

Residual income

This is based on Penman’s method where the value:

= 2023 Equity + (Present value of Residual income).

I first estimated the Residual income for each year from 2009 to 2023.

Residual income for each year = PAT to equity holders – Capital charge.

Capital charge = Equity X Cost of equity.

I then estimated the present value using the single-stage valuation model with the average Residual income as the cash flow item.

Margin of safety

Once I have determined the intrinsic value with each of the above 3 methods, I took the simple average as the Earnings value.

I next estimated the margins of safety under the Earnings value and Asset value.

The margin of safety = (value / market price) – 1.

Table 5 summarizes the margins of safety for the 10 banks. I look for a 30% margin of safety.

- Only BIMB, HLFG and RHB meet the 30% margins of safety under the Earnings value.

- Some banks have negative margins of safety under the Asset Value.

In the case of Affin, there is not enough margin of safety under the Earnings Value. You should not be surprised given its low and declining returns. But there is more than a 30% margin of safety under the Asset Value.

|

| Table 5: Margins of safety |

|

Method

The data for my analysis were extracted from the TIKR.com platform. While the platform provided data as far back as 2002, not all the banks were in operation for that long. As such the starting year for the analysis was pegged to the year when all the 10 banks had information ie 2009.

Secondly, not all the banks had the same financial year-end. I took the reporting year as presented by TIKR.com as the calendar year. In this context for 2023, some banks had their financial year end as Dec 2023. When I started on this analysis, these banks had yet to announce their 2023 results. As such I used the Sep LTM results as the 2023 results.

I first computed the relevant metrics eg ROE for each company. Then for each metric, I tabulated the 2009 to 2023 performance for all 10 companies. I then use the appropriate EXCEL function to derive the quartiles, median, and mean for each year.

Limitations

Affin is a universal bank. In 2022 it reported the following PBT (before elimination):

- Commercial banking - RM 1,507 million.

- Investment banking - RM 55 million.

- Insurance - RM 9 million.

The above is the profile for Affin. The other banks will have their respective profile. My analysis, especially on the NIM, loan performance and capital adequacy focus on the commercial banking metrics. You can argue that it is not the full picture.

Even on the commercial banking side, I have not dug deeper to look at other banking ratios such as the CASA ratio (current account and savings account), loan deposit ratio.

Similarly, I have not assessed the qualitative aspects such as the adoption of digital technology, customer satisfaction and brand performance.

Affin is not a value trap

A value trap is a company that while appearing cheap is cheap because it is facing fundamental issues.

While Affin has not been performing well relative to its peers, it is not a loss-making bank. While it has low returns, it has been profitable every year. If the dividends paid are less than the profits, the equity of the bank will continue to grow.

The other metric in assessing whether it is a value trap is the margin of safety. Affin has a margin of safety of over 30% based on its tangible book value. However, there in not enough margin of safety based on its Earnings Value.

While it may not be a value trap, you may be overpaying for the bank based on its Earnings Value. The reality is that the market places more emphasis on the Earnings Value rather than the Asset Value. So, if you are investing hoping for a re-rating, there must be some expectation of better performance.

In this context, I would like to point out The Edge article on 8 Jan 2024 titled “Affin Bank touches five-year high as Sarawak explores stake increase.”

The gist of the article is that the Sarawak state government is looking to increase its stake in Affin from 4.94 % currently by another 15%. If this transaction goes through it will become another major shareholder in Affin.

As such there may be a potential change in the management. At the same time, there are considerable infrastructure projects in Sarawak. Affin could be a beneficiary of this project if the Sarawak state government is a major shareholder.

I see this as a potential catalyst for improving the business performance of Affin.

If you have not invested in Affin, you may think that this is not good enough to overcome the negative margin of safety (from an EV perspective).

But I am already a shareholder of Affin. I would rather hold onto my shares and see whether this change of ownership would happen. If it does, I think it can be a catalyst for a re-rating.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment