Is Suria Capital a value trap?

Value Investing Case Study 48-1. Suria Capital: A safe port investment or a slow growth value trap? This post summarized my investment thesis on why I should not wait for the market price to hit its asset value before I exit.

I first invested in Suria Capital (Suria Cap or the Group) in 2017 on the basis that it had both port operations and property development. The Malaysian property market was booming at that juncture and Suria Cap had a few years earlier formed joint ventures to develop residential and commercial properties around the port area in Kota Kinabalu.

Over the next few years, I built up my stake in Suria Cap via new purchases and bonus issues. If I rank my stock portfolio in terms of total purchase cost, Suria Cap is somewhere in the middle.

The Malaysian property market peaked around 2018/19 followed by Covid-19. One of the property JVs was mutually terminated due to this.

I thought it was time to re-look at my investment as the share price of Suria Cap is now trending upwards having reached the bottom in 2020.

In this article, I assessed the performance of Suria Cap to see whether I should continue to hold onto my shares. At the same time, if you are new to Suria Cap, you would be interested to know whether it is a value trap.

Join me as I show why I should continue to hold onto my investments and why it is not an investment opportunity for a fresh investor.

Should you go and buy it? Well, read my Disclaimer.

Content

- Background

- Performance

- Financial strengths

- Peer comparison

- My investment in OSK

- Valuation

- Investment Thesis

- Conclusion

|

Background

Suria Cap was incorporated in 1983 and has steadily grown into a diversified entity. Listed on the Main Market of Bursa Malaysia since 1996, it today provides port services and facilities in Sabah.

Suria Cap has also widened its business into logistics, bunkering, property development, construction, and seaport passenger gateway.

- Suria Cap has been the main port operator in Sabah since the port privatization exercise in September 2004. It operates eight (8) ports in Sabah.

- The Group diversified into property development to capitalize and maximize the value of its land assets located at the waterfront of the Central Business District of Kota Kinabalu.

In terms of revenue and profit contribution, the port operation is the largest contributor. Refer to Chart 1. Over the past 12 years, the port operations accounted for about 88 % of the Group revenue and 91 % of the consolidated EBIT.

The next biggest contributor is the property development segment. Over the past 12 years, this accounted for about 7 % of the Group revenue.

|

| Chart 1: Segment revenue and profit |

Port Operations

Suria Cap holds the concession for the operation and management of the major ports in Sabah for 30 years commencing from 1 September 2004 to 31 August 2034. On 22 November 2022, the State Cabinet of Sabah approved the extension of the ports’ concession period for a further 30 years to 31 August 2064.Extending the concession period would enable better planning of expansion projects for the ports.

- With a longer concession, Suria Cap will be in a better position to obtain financing facilities to build and invest in port infrastructures.

- The depreciation of assets will also be adjusted accordingly and this would generally have a positive impact on the Group’s bottom line.

- The extension will pave the way for the proposed collaboration with strategic partners to entice investments into the State.

|

| Chart 2: Port throughput |

The Group focuses mainly on the streamlining of port operations, planning, and acquisition of new cargo handling equipment. It also builds port infrastructure to ensure efficient port services and business sustainability. Its ports handle passengers and all types of cargo including container, liquid cargo, dry bulk, Roll-on Roll-off, and general cargo, as well as storage facilities.

As can be seen from Chart 2, the port activities have increased over the years. The extension would enable Suria Cap to build on this trend.

JQ Central, the first phase of the Jesselton Quay development was completed with an occupation certificate obtained on 19 January 2022. JQ Central comprises two towers of commercial suites, one tower of i-office adaptable as a 24-story hotel tower in the future, 218 units of Gallery Shoppes, a podium that houses a recreation club called BeachClub, and a seven (7) story carpark.

|

Property and Commercial Developments

Suria Cap had on 23 September 2016 received the sub-divided title of the master land title for the 23.25 acres of Kota Kinabalu port land. With the subdivision, the separate parcels of title would consist of:- 16.25 acres for the Jesselton Quay, a joint venture with SBC Corporation Berhad (SBC).

- 7.0 acres for the One Jesselton Waterfront joint venture with Gabungan AQRS Berhad.

JQ Central, the first phase of the Jesselton Quay development was completed with an occupation certificate obtained on 19 January 2022. JQ Central comprises two towers of commercial suites, one tower of i-office adaptable as a 24-story hotel tower in the future, 218 units of Gallery Shoppes, a podium that houses a recreation club called BeachClub, and a seven (7) story carpark.

Phase two, which is also the last phase of the JQ project to be developed on the remaining land parcel is expected to complete in 2030. It consists of hospitality towers, high-end residences, and a low-rise heritage precinct.

As a result of the Covid-19 pandemic which had hindered the implementation of One Jesselton Waterfront, the joint venture agreement With Gabungan AQRS was mutually terminated on 30 September 2021.

In Feb 2024, Suria Cap announced that it had entered into a JV with EXSIM Development Sdn Bhd to develop two parcels of prime land within the Kota Kinabalu Port area.

- One parcel measuring approximately 2.543 hectares held under Town Lease 017561974 appears to be the original One Jesselton Waterfront plot.

- The other parcel of 11.69 hectares held under Country Lease 015722791, was alienated to Suria Cap by the State Government of Sabah in 2017 for the proposed development of an international cruise terminal.

|

Performance

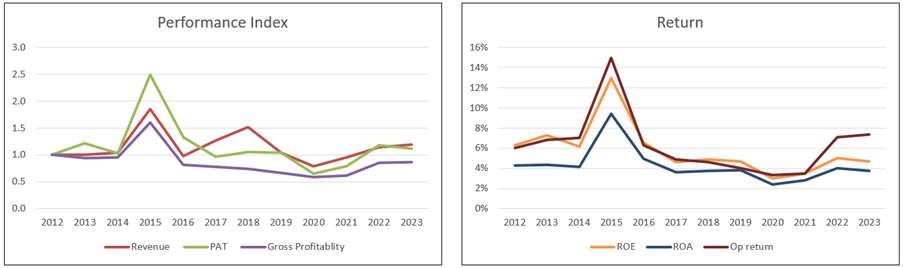

To get an overview of Suria Cap’s performance, I looked at 3 metrics – revenue, PAT, and gross profitability (gross profits/total assets). The left part of Chart 3 illustrates the trends for these 3 metrics.

This is not a growth company. From 2012 to 2023, revenue and PAT grew at 1.6 % and 1.0 % CAGR respectively. You can see a revenue and profit spike in 2015. This was due to a one-off sale of the land to its joint venture partner.

Note that over this period, the revenue from the port operations only grew at 1.9 % CAGR. You should not be surprised given the low growth rate of the annual cargo throughput of 0.7 % CAGR from 2012 to 2022. Refer to Chart 2.

Of course, the cargo growth was impacted by Covid-19. But even considering the growth between 2012 to 2018, the annual cargo throughput only grew at 4.3 % CAGR.

The other concern I have is the declining gross profitability. The gross profitability in 2023 was 13 % lower than that in 2012.

|

| Chart 3: Performance Index and Returns |

We can see a similar spike pattern in returns. The troubling sign is the declining returns in the ROE and ROA. The ROE and ROA in 2023 were lower than those in 2012.

The only positive sign is that the operating return (NOPAT / total capital employed) in the past 2 years was higher than that in 2012. A DuPont analysis showed that this was due to the higher NOPAT margin over the past 2 years.

Financial strengths

Suria Cap is sound financially. I would consider it a cash cow.

- As of the end of Sep 2023, it had RM 245 million in cash and short-term investments. This is about 16% of its total assets.

- It has a DE of 0.06 as of Sep 2023.

- It currently has an interest coverage ratio of 118. I defined this as EBIT/interest. This is equal to a AAA (Fitch) synthetic rating as per the Damodaran approach.

- Over the past 12 years, it generated positive cash flow from operations every year. Over this period, it generated RM 1 billion of cash flow from operations compared to its RM 694 million PAT. This is a very good cash conversion ratio.

- It had a good capital allocation plan. As can be seen from Table 1, its cash flow from operations was able to fund its CAPEX and dividends.

|

| Table 1: Sources and Uses of Funds 2012 to 2023 |

Peer comparison

I compared Suria's performance with the following Bursa port companies:

- Bintulu Port Holdings Berhad (BIPORT).

- Perak Corporation Berhad (PRKCORP).

- Westports Holdings Berhad (WPRTS).

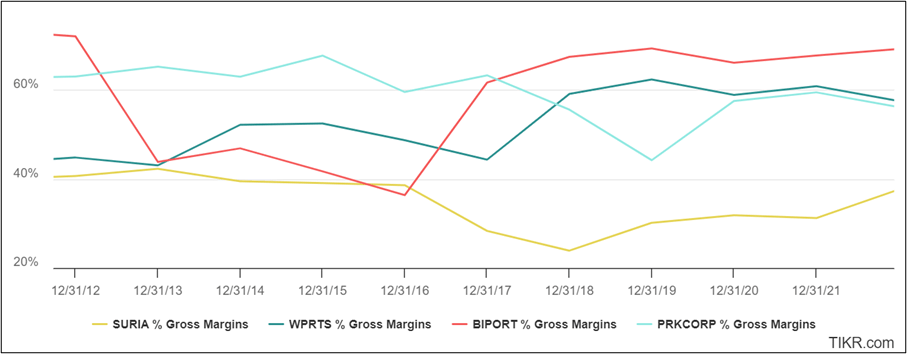

This is not a growth sector as can be seen from Chart 4.

- From 2012 to 2022, Perak Corp's revenue declined at a 0.5 % compounded rate.

- The revenue for the market leader, Westport, grew at 3.3 % CAGR.

- Suria Cap and Bintulu revenue grew at 1.4 % and 4.5 % CAGR respectively.

|

| Chart 4: Peer Revenue |

You can see from Chart 5 that Suria Cap had the worst ROA over the past few years. The best performance was from Westport with an average ROA of around 10% over the past 12 years.

Suria Cap poor ROA performance was because it had the worst gross profit margin. Refer to Chart 6.

|

| Chart 5: Peer ROA |

|

| Chart 6: Peer Gross profit margins |

My investment in Suria Cap

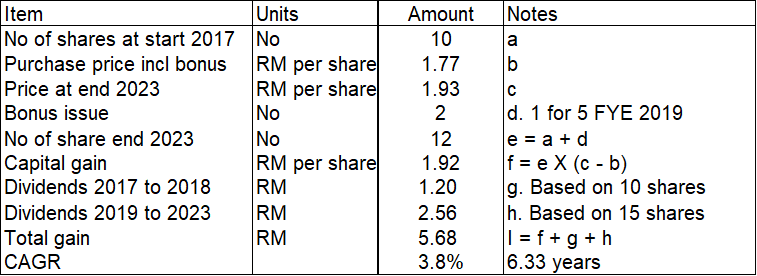

I first invested in Suria Cap in 2017 at RM 2.13 per share compared to its NTA of RM 3.24 per share. From a value investing perspective, I thought that the Asset Value offered a good margin of safety.

I then increased my investment over the next few years so that together with the bonus issue, my average purchased cost was RM 1.77 per share.

I estimated that my average holding period till the end of Dec 2023 was 6.33 years. The market price as of the end of 2023 was RM 1.93 per share.

Taking into account the bonus issue, my investment had generated a total return of 3.8 % CAGR. Refer to Table 2. This is about the same as keeping my money in a fixed deposit.

You can see that dividends accounted for about 2/3 of the total gain.

|

| Table 2. Estimating my total return |

The market price of Suria Cap has been declining since 2017 to reach the bottom in Jul 2020. Since then, the market price has been trending up. Refer to Chart 7.

When you look at the trend of Suria Cap ROE as per Chart 8, you can see that since reaching its bottom in 2020, the ROE has been trending up. This is probably one of the reasons why the share price is trending up.

If you follow this logic, this means that if Suria Cap can continue to improve its ROE, we may yet see higher share prices.

|

| Chart 7: Suria Capital share price |

|

| Chart 8: Suria Capital ROE |

Valuation

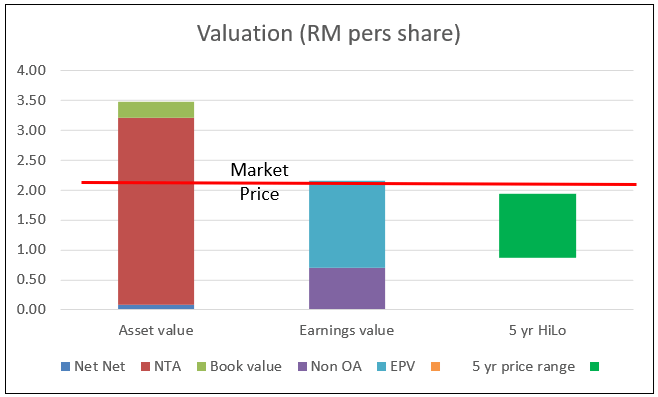

I valued Suria Cap based on its Asset Value and Earnings Power Value.

- I broke down its Asset Value of RM 3.49 per share into its Graham Net Net, NTA, and Book Value.

- I broke down its Earnings Power Value of RM 2.17 per share into non-operating assets and operating assets. The non-operating assets comprised cash and investments in securities.

Chart 9 summarizes the value of Suria Cap compared to its market price of RM 2.18 (as of 9 Feb 2024). You can see that there is no margin of safety based on the Earnings Power Value. But there is more than a 30% margin of safety based on the NTA or Book Value.

|

| Suria Capital Chart 9: Valuation |

The lower Earnings Power Value suggests that the assets are under-utilized. You should not be surprised given the low ROE and ROA. Unless Suria Cap can improve the earnings from the port operations, I am not sure how the Earnings Power Value can increase.

Valuation model

Because of the low growth history, it is more appropriate to value Suria Cap based on its Earnings Power Value ie assumed zero growth.

My Earnings Power Value was based on the average of 2 valuation methods:

- A Free Cash Flow to the Firm model as per Damodaran.

- A Residual Income model as per Penman.

In both cases, I used the 12-year time-weighted average values to represent the normalized performance.

The WACC of 8.0 % was based on the Damodaran build-up approach where the Beta was built up based on the various sectors Suria Cap was operating.

Limitations and risks

In interpreting the valuation results, you should consider the following:

- Historical performance.

- Payment for land in SBC JV.

My Earnings Power Value assumes that the past is a good representation of the future. You may think that with the extension of the port concession period, the depreciation and amortization would be lower. In other words, better profits in the future. But this is an accounting perspective that would not change the Free Cash Flow.

This is because the Free Cash Flow is based on deducting Reinvestments from the NOPAT. And I have added back the depreciation and amortization in determining the Reinvestments.

When Suria Cap formed the joint venture with SBC in 2013, SBC was to pay Suria Cap for the land. RM2 million was received upon execution of the JVA in 2013.

The remaining estimated proceeds of RM322 million were to be received in tranches within 7 years from the presentation date of the instrument of 3rd party charge on the said land. This was presented in 2018.

In 2021 and 2022, Suria Cap signed two supplemental letters with SBC agreeing to vary the mode and timing of payments from SBC in the form of cash and property.

On 30 November 2022, Suria Cap signed an Amended and Restated Agreement with SBC whereby the outstanding debt due from SBC of RM 206 million would be fulfilled by RM 32 million in cash and RM174 million in-kind in the form of completed commercial properties.

- RM 75 million of the Gallery Shoppes were transferred in 2022. The estimated fair value of these properties in 2022 was RM 82.8 million.

- There was an increase in the Capital pre-payments (classified as other assets under the long-term assets) to RM 138.4 million in 2022.

- For agreeing to vary the mode of payments and other terms, the Group received additional entitlement in the form of car park units from SBC valued at RM 28.8 million. These car park units were recognized as property, plant, and equipment in 2022. Consequently, Suria Cap's profit before tax for the year increased by RM 28.8 million with the additional entitlement.

With these variations, it is very hard to estimate the earnings from property development. From a conservative perspective, I would say that the various property-related part of the Asset Value is a better reflection of the value of the property segment.

In other words, a better estimate of the intrinsic value of Suria Cap is for a sum-of-parts valuation.

- The property business should be valued based on its Asset Value.

- The port and other non-property operations would be based on its Earnings Power Value.

- The intrinsic value of Suria Cap is then the sum of these 2 values.

On such a basis, I estimated the value of Suria Cap to be RM 2.20 per share. Refer to Table 3. This is lower than the Asset Value but marginally higher than the Earnings Power Value.

Investment Thesis

Suria Cap is the concession holder for all the major ports in Sabah. These port operations accounted for 91 % of the consolidated EBIT over the past 12 years. But this is not a high-growth sector as the growth in annual cargo throughput was 0.7 % CAGR from 2012 to 2022.

The Group tried to extract value from its port land in Kota Kinabalu by developing it into a residential and commercial centre. This was carried out via joint ventures with other established property developers. Over the past 12 years, this contributed only about 7 % of the Group revenue.

The result is that the Group only achieved an average ROE of 5.8 % over the past 12 years. It is not a fantastic performance compared to its WACC of 8 %. Among the 3 other port operators in the country, Suria Cap achieved the worst performance over the past few years.

Given the above, the Earnings Power Value of Suria Cap is much lower than the Asset Value. At the current market price of RM 2.18 (as of 9 Feb 2024), there is no margin of safety based on the Earnings Power Value. This is not an investment opportunity.

|

Conclusion

From a fundamental perspective, Suria Cap has a mixed performance. While it is financially sound, its operating results are nothing to shout about.

- It has low revenue growth in line with those of its peers.

- Its ROE is lower than its cost of funds. This meant that it did not create shareholders' value.

While there is a margin of safety based on its Asset Value, this is because a big part of the Asset Value came from its cash, securities, and property assets.

Furthermore, a large part of the value of the property assets came from the sale of its land to its JV partner. While this was recognized as profits when it was first sold in 2015, a significant part was to be paid in kind some of which has yet to be developed.

From a conservative perspective, I would rely more on the Earnings Value as a better estimate of its intrinsic value. There is no margin of safety on such a basis.

As such I would not consider this an investment opportunity for a fresh investor. Since the market price is not cheap, I do not think the question of the value trap is relevant.

In the context of my investments, I have currently achieved a 3.8 % compounded annual return. About 2/3 of the gain came from dividends.

To achieve a higher return of say 8 % CAGR, the market price will have to be around RM 2.60 per share.

- This does not look impossible given the current market price of RM 2.18 and the price uptrend.

- Furthermore, at RM 2.60 per share, it is still below its Book Value.

- And the recent announcements about its new property JV may be a catalyst for a re-rating.

You can understand why I will wait till it reaches this level to exit.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment