Is CJ Century an investment opportunity?

Value Investing Case Study 64-1. CJ Century Logistics: Logistics turnaround story or value trap? Uncover the truth behind its margin struggles.

You would think that with the popularity of online businesses, logistics companies would be having a roaring time.

However, when I looked at the performance of CJ Century, I found that its share price had been trending down since peaking in mid-2022. When I looked at its ROE, I also found that it had declined from its 2014 peak.

Does this imply that its business is being disrupted and that CJ Century is going the way of the Malaysian newspaper companies?

Join me as I carry out a fundamental analysis of CJ Century to see whether this is a value trap or an investment opportunity. My analysis shows that the logistics business is not yet a sunset one. While there is some threat of digital disruption, it is not an existential one.

But it is not going to be a walkover for CJ Century to rebuild its performance. To get a value equal to its NTA, the target improvement is not too great. I estimated it to be 11% better than the past 2 years average performance. But its track record in improving operations had not been too great.

Have a read and judge for yourself. Should you go and buy it? Well, read my Disclaimer.

Contents

- Investment Thesis

- Background

- Operating performance

- Financial position

- Valuation

- Conclusion

|

Investment Thesis

CJ Century is currently undergoing a turnaround. It has to re-grow its revenue following the divestment of the courier services business. But the bigger challenge is rebuilding the margins for its legacy businesses – total logistics and procurement logistics.

The EBIT margins for these 2 businesses have been declining since 2015. The Group needs to improve its operations to arrest the decline. However, it does not have a clear track record of delivering operating improvements.

But the Group is financially sound. The current margin of safety comes from the Asset Value. To deliver the same margin of safety from the Earnings Value, the Group needs to achieve 11% better performance than its past 2 years average. If you believe that this is not too tall a bar to leap over, this is an investment opportunity rather than a value trap.

|

Background

CJ Century was founded in 1970 as a small warehousing company providing storage solutions. Over the years, the Group expanded its services to include a broader range of logistics solutions such as freight forwarding, distribution, and transportation services.

The Group was listed on the Main Market of Bursa Malaysia in 2001. In 2016, CJ Logistics Corporation, a leading logistics company from South Korea, acquired a significant stake in the Group. This acquisition was part of CJ Logistics Corporation’s strategy to expand its footprint in Southeast Asia.

Today, the Group offers a comprehensive range of logistics services, including contract logistics, freight forwarding, transportation, and supply chain management. Its businesses can be categorized into:

- Total logistics where the Group offers highly customized and competitive supply chain solutions to its customers. These cover freight forwarding, contract logistics, transportation, and oil logistics.

- Procurement logistics. This covers sourcing, product assembly, packaging, warehousing, and distribution of home and electrical appliances.

As can be seen from Chart 1, the total logistics segment was the biggest revenue and EBIT contributor. But there was a decline in 2023 explained by the Group as follows:

“…freight rates suffered a significant decline during FY2023; resulting in a substantial reduction in our revenue, particularly derived from our freight forwarding operations.” 2023 Annual Report.

|

| Chart 1: Segment Profile |

In 2023, the Group assets included:

- 30 operating warehouses across Malaysia with about 4 million sq ft of warehousing space.

- 100 vehicles with a real-time fleet management system.

Operating performance

Over the past 12 years, revenue grew at 10.1% CAGR while PAT declined.

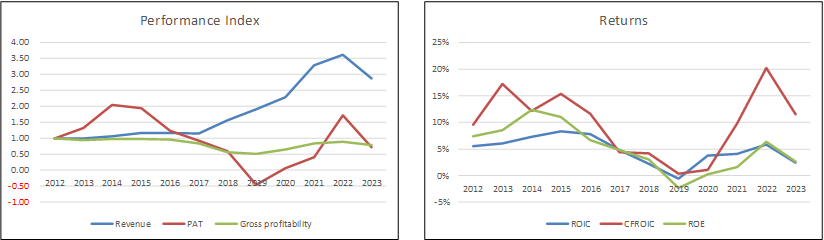

You can see from the left part of Chart 2 that the revenue growth was more prominent post-2016 after the entry of CJ Logistics Corporation of Korea.

Part of this was due to the extension of the range of services to include courier services. However, this did not work out as planned and the Group exited the courier services in 2021.

The poor performance of the courier services partly explains the declining profits. But profits started on a downtrend in 2015 before the courier services venture. The Group attributed the 2016 profit performance to "competitive environment resulting in cost pressure.”

The Group faced declining margins since then:

- Total logistics EBIT margin reduced from 15% in 2015 to 2% in 2023.

- Procurement logistics EBIT margin reduced from 12% in 2015 to 6% in 2023.

|

| Chart 2: Performance Index and Returns |

The declining profits led to declining ROIC and ROE. Refer to the right part of Chart 2. Over the past 12 years,

- ROIC ranged from negative 1 % in 2019 to positive 8% with an average of 5%. This average is lower than the current WACC of 8%.

- ROE ranged from negative 2% in 2019 to positive 12 %. Its 6 % average is lower than the current cost of equity of 10%.

The lower returns relative to the respective cost of funds indicated that the Group did not create shareholders' value.

The interesting picture is that the CFROI showed significant improvements over the past few years so the 2023 value was higher than that in 2012. This illustrates the cash flow-generating capability of the Group.

There were mixed signals when it came to operating efficiency:

- There was no improvement in capital efficiency as measured by gross profitability (gross profits / total assets). Refer to the left part of Chart 2.

- A DuPont Analysis showed that there was an improvement in asset turnover, especially over the past few years. Refer to the right part of Chart 3.

- I have already mentioned the declining EBIT margin. This was supported by the decline in the overall gross profit margin from 28 % in 2015 to 16 % in 2023.

- Selling, General, and Administration (SGA) margin declined (i.e. improved performance) from 15% in 2015 to 8% in 2023. You can see from the right part of Chart 3 that this is not a Group with high operating leverage. In 2023, fixed costs amounted to 19 % of total cost.

- Contribution margin declined since 2012 but seemed to have steadied over the past few years. Refer to the left part of Chart 3.

Market Demand

This is not a sunset sector. At the same time, this is not a high-growth sector exemplified by the following:

“Increasing demand for food, beverages, and manufacturing products in Malaysia, Government support through Third Industrial Masterplan (IMP3) and the Logistics and Trade Facilitation Masterplan are some of the factors that will contribute to the Malaysia Logistics Market growth over the period of 2022-2027F with a CAGR of 7.8%.” Ken Research

“The Malaysia Freight And Logistics Market size is estimated at 28.12 billion USD in 2024, and is expected to reach 38.28 billion USD by 2030, growing at a CAGR of 5.28% during the forecast period (2024-2030).” Mordor Intelligence

Based on Mordor Intelligence's estimated market size, CJ Century probably has only about 5% of the Malaysian market.

|

| Chart 4: Malaysia Freight and Logistics Market Source: Mordor Intelligence |

Digital disruption

I am surprised by the low projected growth rate. I thought that the rise of online trading would lead to more demand.

Nevertheless, the rise of online trading has significantly impacted the demand for services in the logistics industry:

- Complex supply chains. With a global customer base, online traders often source and sell goods internationally. This complexity has increased the need for sophisticated logistics services that can handle cross-border shipping, customs clearance, and international warehousing.

- Demand for speed and efficiency. Customers expect fast and reliable delivery, often within a few days or even hours. This has pushed logistics providers to improve efficiency and reduce delivery times.

- Growth of fulfilment services. These providers handle inventory management, packing, and shipping on behalf of the traders, leading to an increased demand for these specialized services.

- Advanced tracking and transparency. Customers and businesses alike expect real-time updates on the status of their shipments, which has driven logistics companies to invest in tracking technologies and transparent supply chain management systems.

- Scalability and flexibility. The fluctuating nature of online trading, with peaks during holidays or sales events, requires logistics services that can scale up or down quickly. This has led to a higher demand for flexible warehousing and transportation solutions.

- Returns management. The rise in online trading has also led to an increase in returns. Companies require services that can handle returns quickly and cost-effectively, ensuring customer satisfaction and reducing losses.

I believe that CJ Century and the other logistics companies are facing potential digital disruption.

“Logistics companies are facing an era of unprecedented change as digitization takes hold and customer expectations evolve. New technologies are enabling greater efficiency and more collaborative operating models…New entrants, whether they be start-ups or the industry’s customers and suppliers, are also shaking up the sector.” PWC

However, I do not think that the disruption to the logistics companies would have the same impact as the newspaper sector. Companies have adapted as the following examples illustrate:

“DHL, a global logistics leader, implemented real-time tracking to improve logistics tracking challenges.” Invensis

“…70% of companies have initiated a digital transformation in supply chain and logistics”. McKinsey

According to Chart GPT, the following are examples of leading Korean logistics companies adapting to digital disruption:

- CJ Logistics has been heavily investing in automation, AI, and big data to enhance its services. The company has also developed its digital platform to streamline operations and improve customer service.

- Lotte Global Logistics has been focusing on integrating advanced technologies into its logistics operations, including automated warehouses and smart logistics solutions to cater to the e-commerce market.

I would like to think that CJ Century would be able to reinvent itself since it can tap into the Korean experience.

Peer performance

I compared CJ Century's performance with several Bursa companies cited by Mordor Intelligence as important companies in the sector. These were:

- Arka – formerly known as Transocean Holdings (ARKA).

- FM Global Logistics Holdings (FM).

- Hextar Technologies Solutions (HEXTECH).

- Pos Malaysia (POS).

- Tiong Nam Logistics Holdings (TNLOGIS).

- Xin Hwa Holdings (XINHWA).

Table 1 summarizes the comparative size in terms of revenue. You can see that CJ Century ranked No. 3 in terms of the 2023 revenue. It also had the best revenue growth among its peers.

|

| Table 1: Peer revenue Note: I compared the revenue growth from 2015 as not all the peers had data going back to 2012. |

Over the past 12 years, CJ Century's performance was just below average relative to its peers based on 2 metrics – return on capital and EBIT margin. Refer to Chart 5.

|

| Chart 5: Peer return of capital and EBIT margin Note: I left out AKRA for the return on capital comparison as it did not have readily available data from 2012. |

Financial position

I would consider CJ Century as financially sound based on the following.

As of the end of March 2024,

- It had RM 61 million in cash and short-term investments. This is about 8 % of the total assets.

- It had a debt-capital ratio of 26 %. This had reduced from its 38 % high in 2019.

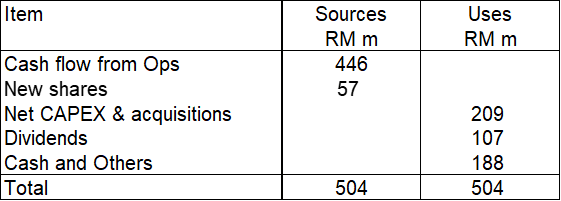

Over the past 12 years, it had positive cash flow from operations every year. During this period, it generated RM 446 million cash flow from operations compared to the RM 189 million PAT. This is a good cash conversion ratio.

Over the past 12 years, it had an average negative Reinvestment rate. I defined Reinvestment as = CAPEX + Acquisition – Depreciation & amortization + Increase in Net Working Capital. The negative Reinvestment arose because, in many years, the amount spent on CAPEX + Acquisitions was more than offset by Depreciation & amortization.

It has a good capital allocation plan as shown in Table 2. You can see that the cash flow from operations was enough to fund its CAPEX and acquisitions.

|

| Table 2: Sources and Uses of Funds 2013 to 2024 |

Valuation

The NTA of CJ Century was RM 0.74 per share (as of Mar 2024) compared to its market price of RM 0.33 per share (as of 22 Jul 2024).

While there is more than a 30% margin of safety under the Asset Value, the issue is whether this is a realistic picture.

I posit that this is a reliable estimate of the intrinsic value if the Group can continue to improve its performance.

In this context, the challenge for CJ Century is not revenue growth but operating improvements. In the context of my valuation, it is about improving 2 key parameters – contribution margin and capital turnover (revenue / total capital employed).

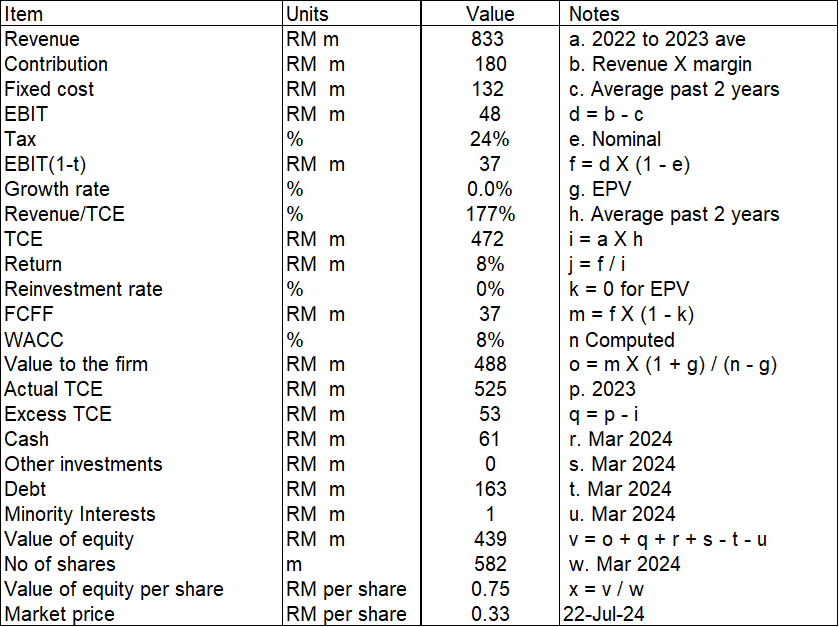

In estimating the Earnings Value of CJ Century, I looked at 2 Scenarios involving these 2 key parameters.

- Scenario 1. I reverse-engineered the market price to see the implied contribution margin and capital turnover.

- Scenario 2. According to Prof Bruce Greenwald, in a competitive environment, the Asset Value = Earnings Power Value. In this scenario, I look at the performance where the Earnings Power Value = NTA.

From a conservative perspective, I estimated the intrinsic value based on the Earnings Power Value case ie ignoring growth. I took the average 2022 and 2023 revenue as the base revenue.

On such a basis, I estimated that,

- Scenario 1. The market price of RM 0.33 per share implied that the Group would be able to deliver the past 2 years' average contribution margin and capital turnover.

- Scenario 2. The RM 0.74 per share implied that the Group must deliver 11% improvements to the past 2 years' average contribution margin and capital turnover.

Valuation model

The EPV was determined based on a Free Cash Flow to the Firm (FCFF) model where:

Earnings Power Value to the firm = FCFF / WACC.

FCFF = EBIT(1-t).

EBIT = Revenue X contribution margin – Fixed cost. This in turn was based on the operating model shown in the left part of Chart 3.

The cost of equity and WACC was based on Damodaran’s build-up approach.

Table 3 illustrates the computation for Scenario 2.

|

| Table 3: Valuation under Scenario 2 |

|

Risk and limitations

Historically the Group had delivered better performance than the past 2 years average. You may then think that achieving the performance under Scenario 2 should not be a great challenge.

But there are 2 differences today.

- First there has been a change in the controlling shareholder and management since 2016.

- The threat of digital disruption has become greater.

To be fair to management it is not as if they are not aware of what needs to be done:

“…Our focus in FY2023 continued to be cost optimization to further enhance our financial strength… Our Contract Logistics operation rolled out two main systems to further enhance operational controls, especially in inventory, fulfilment accuracy, and distribution optimization.”

My analysis showed that the track record for operating improvements had been mixed.

Secondly, the 11% improvement was based on the Earnings Power Value model. You could argue that with its revenue growth record, a more realistic model would be to use a single-stage FCFF model incorporating a perpetual growth rate.

A valuation with such a model with a 10% Reinvestment rate would require the past 2 years' average contribution margin and capital efficiency. You can see that this is a low bar to jump over.

Conclusion

Given the change in the ownership profile in 2016, it is more meaningful to look at CJ Century post-2016.

With the entry of the Korean shareholder, the Group ventured into courier services in 2016. Unfortunately, this did not turn out positive and the Group exited this business in 2021. As such the Group was left with the legacy segments – total logistics and procurements logistics.

However, the EBIT margin of these 2 segments had deteriorated since 2015. The losses from the courier services and these reduced margins led to declining returns.

We thus have a situation where the average past 2 years' returns – both 4 % for ROIC and ROE – are nothing to shout about.

For CJ Century not to be a value trap, the Group must be able to turn around its performance. My analysis shows that the challenge is not revenue growth. Rather it is improving operating efficiencies.

Unfortunately, the track record for improving operations was mixed. While there are some positive signs such as better asset turnover and SGA margins, there are declining contribution margins and gross profitability.

From an Asset Valuation perspective, there is more than a 30% margin of safety. At the same time, to have an Earnings Power Value = Asset Value, we would only require the Group to improve the past 2 years' average contribution margin and capital turnover by 11%.

Does this look like a bridge too far? If you believe that the Group can deliver this improvement over the next year or so, then this is not a value trap but an investment opportunity. But if you think otherwise, then go and look for other logistics companies.

I would consider CJ Century a stock in my watch list. I may consider it if there are no better opportunities.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment