Is New Hoong Fatt a value trap or smart investment?

Value Investing Case Study 82-1: Is New Hoong Fatt Holdings Bhd a hidden value play or a cigar-butt investment?

Over the past few decades, New Hoong Fatt Holdings Berhad (NHF or the Group) has transitioned from a trading entity to a prominent distributor and manufacturer of automotive components. It has also expanded from Malaysia to cover ASEAN and other countries.

NMF's strengths include a solid financial position, international expansion, and a strategic focus on operational efficiency. However, the company faces challenges that raise questions about its long-term performance. It has a relatively low market share in a mature market and delivers fluctuating financial performance.

Join me as I delve into NHF’s financial performance, market positioning, and strategic initiatives to provide a comprehensive analysis of its investment case. While I do not consider NHF a value trap but as an investment opportunity, it is not on the top of my investment list. Think of it as a cigar-butt investment.

Should you go and buy it? Well, read my Disclaimer.

Contents

- Company background

- Operating performance

- Financial position

- Valuation

- Conclusion

|

Company background

NHF was first listed on the Second Board of the Malaysian Stock Exchange in 1998. It then moved to the main Bursa Board in 2001.

NHF started as a trading company in 1977, selling original and alternative car parts. Over the years, it has grown into a leading distributor of automotive parts in Malaysia.

In 1989, NHF began manufacturing its own metal and plastic car parts, including doors, hoods, fenders, and bumpers. With modern production facilities and strong design expertise, NHF has become a top player in the alternative car parts market in Malaysia.

In 2011, NHF expanded internationally by opening subsidiaries in Jakarta, Indonesia, and Shanghai, China, focusing on trading and distributing car parts in those regions.

The company's headquarters and factories are located in Klang, Selangor, along with trading branches in Kuala Lumpur and Kota Kinabalu. NHF serves over 1,000 wholesalers and retailers across Malaysia and exports to more than 50 countries in Asia, Central and South America, Europe, and Africa.

Before 2017, the Group reported its performance under the manufacturing, trading, and investments segments. However, in 2017 the Group changed the reporting format and considered the manufacturing and trading as one operating segment.

Thereafter, the Group only continued with presenting the performance by region. As can be seen from Chart 1, Malaysia accounted for about half of the Group’s revenue.

|

| Chart 1: Revenue by regions |

The automotive parts and accessories market is a mature one with a single-digit growth rate in Malaysia.

“The estimated value of automotive products in Malaysia is projected to reach US$8.32 billion (RM39.76 billion) in 2024, with a compound annual growth rate of 5.71% expected from 2024 to 2028,” The Edge quoting the General Manager of Hong Leong Industries.

In its report for the listing of MSB Global Group Berhad, Protégé Associates, projected that the wholesale and retail sales of automotive parts and components in Malaysia to be 8.6 % CAGR from 2024 to 2028.

The picture for the ASEAN market is also about the same:

Statista stated that “value added in the automotive products market is projected to amount to US$56.5bn in 2024. A compound annual growth rate of 2.31% is expected (CAGR 2024–2029).”

Coherent Market Insights projected that the automotive aftermarket will grow at 9.8 % CAGR from 2023 to 2030.

Business direction

Since 2016, the Group has presented its key strategic thrusts in its Annual Reports. Table 1 summarizes them for certain years.

|

| Table 1: Strategic Thrusts for the various years |

I would commend the Group for clarifying its business direction that shows:

- Consistency and adaptability. The strategy shows a strong emphasis on core business growth and operational efficiency.

- Market orientation. There is consistent emphasis on strengthening and growing the core business. This suggests that the company recognizes the importance of solidifying its foundation before expanding further.

- Long-term vision. The sustained focus on performance culture and workforce development suggests a commitment to creating a resilient organization capable of adapting to changes in the business environment.

As part of my analysis, I would assess how far the Group has delivered on its strategic direction.

Operating performance

From 2013 to 2024, NHF revenue grew at 2.8 % CAGR. Comparing its revenue with those projected by the various market reports, I would conclude that NHF has less than 1% of the total addressable market.

Assuming that the projected growth rate has some resemblance to the historical one, NHF had a much lower revenue growth rate than the market. This implied that NHF lost market share.

These are not exactly good signs given that market growth was one of the key strategic thrusts.

The positive picture was that PAT grew at a higher rate of 6.5 % CAGR over the same period. Refer to the left part of Chart 2. You can see that profit growth was not steady with a spike in 2016 which the company described as follows:

“The Group’s net profit increased by 55.4%...on the back of the top line growth, higher production efficiency and productivity during the year as well as favourable impact from the foreign exchange rate.”

Unfortunately, this good result could not be sustained and profits declined in 2017 due “to

the rising raw material costs and the unfavourable foreign currency exchange rate impact.”

You can see that despite revenue growth, PAT only got back to the 2016 level by 2022/23.

|

| Chart 2: Performance Index and Returns Note that the 2024 performance was based on the LTM Sep 2024 results. |

Given the profit trend, you should not be surprised to see a similar trend in the returns. Refer to the right part of Chart 2. The good sign is that the returns seem to be trending up after the Covid-19 years.

Unfortunately, over the past 12 years, ROIC averaged 5.4 % while ROE averaged 5.2 %. These returns are lower than the current cost of funds suggesting that shareholders’ value was not created.

Efficiencies

In a low revenue growth environment, efficiency improvement is critical. To be fair, this is something that management has highlighted in the various Annual Reports.

“…the Group focuses on improving its manufacturing efficiency, optimizing costs, and actively working towards waste reduction.” 2023 Annual Report

“In addition, the Group continued to focus on enhancing its manufacturing efficiency to optimize cost and improve the profit margins as well as mitigating the impact of increasing manufacturing and raw material costs.” 2018 Annual Report

“These SOPs are continuously streamlined and consolidated to enhance efficiency and effectiveness.” 2013 Annual Report

To see whether these efforts have been translated into tangible results, I carried out the following analyses.

- I broke down the operating profits into fixed and variable costs as shown in the left part of Chart 3.

- I broke down the ROIC into various components as shown in the right part of Chart 3.

- I looked at the trends for several operating and capital efficiency metrics as shown in Chart 4.

|

| Chart 4: Efficiency trends |

There are mixed signals when I looked at the past 12 years trends:

- The following metrics had improving trends – ROA, operating profit margin, operating expense ratio, reinvestment margin, cash conversion cycle, and free cash flow.

- The following metrics had declining trends - gross profitability, contribution margin, inventory turnover, and asset turnover.

- I would assess that the following metrics have a flat trend – SGA margin.

The improving metrics suggest that the company is enhancing operational efficiency and profitability. However, the declining metrics raise concerns about cost management and asset utilization. The flat trend in the SGA margin indicates stability, which is beneficial in a fluctuating market.

The company may need to address the declining metrics to ensure sustainable growth and profitability moving forward. While the improvements in key operational metrics suggest a positive trajectory, the declining trends in profitability and efficiency metrics raise concerns.

I was a bit disappointed not to see more improving trends given the management's focus on efficiency. Of course, you could argue that without the strategic focus, the results would be worse.

Are the improvements sustainable, and will the Group be able to address the declining trends? I would state that the Group is better off today than 12 years ago because:

- The positive trends outweigh the negative ones.

- Its strategic thrusts will keep management focussed on what needs to be done.

Accordingly, there is a good chance that the future performance will be much better than the past one.

Peer comparison

I compared NHF's performance with several Bursa companies in the auto parts sector. Note that I excluded the battery suppliers and those in the tyre and upholstery sectors.

You can see from Table 2 that NHF 2023 revenue was lower than the peer average. However, its revenue growth from 2013 to 2013 was at the peer average.

|

| Table 2: Peer revenue |

I looked at the trends of 4 metrics to get a sense of how well NHF performed compared to its peers. Refer to Charts 5 and 6.

NHF shows potential in some areas but struggles with consistency.

- Return on capital. NHF shows fluctuations in its return on capital over the years. It appears to have periods of stronger performance compared to some competitors, especially in certain years where it peaks higher than others.

- EBIT margin. NHF's margin seems to follow a similar pattern to its return on capital, with noticeable peaks and troughs. In some years, NHF appears competitive, but other companies consistently outperform NHF, indicating that while NHF is strong, it may not lead in this metric.

- Leveraged free cash flow margin. NHF's margin shows variability, which may indicate changes in cash generation relative to debt levels. Other firms might show more stability, suggesting stronger cash management practices. NHF's performance here could be a concern if it consistently lags behind peers.

- EPS. NHF's EPS trends reveal fluctuations that could reflect earnings volatility or operational challenges. Other companies demonstrate more consistent EPS growth, indicating stronger overall profitability.

Overall, I see the following strengths and weaknesses:

- Strengths. NHF has periods where it outperforms competitors in return on capital and EBIT margin. This suggests it can be competitive in certain conditions.

- Weaknesses. The volatility in its financial metrics indicates potential risks that may affect investor confidence. Consistency in Leveraged Free Cash Flow Margin and EPS is a concern compared to peers.

|

| Chart 5: Bursa Peer Return on Capital and EBIT Margin |

|

| Chart 6: Bursa Peer Levered Free Cash Flow Margin and EPS |

|

Financial position

I would rate the Group as sound financially based on the following:

- As of Sep 2024, it had RM 120 million cash. This is equal to 18 % of its total assets.

- As of Sep 2024, it had a debt-capital ratio of 0.1 %. It was almost debt-free.

- Over the past 13 years, it generated positive cash flow from operations every year.

- From 2013 to 2024, it generated RM 632 million cash flow from operations compared to the total PAT of RM 276 million. This is a very good cash flow conversion ratio.

- It has a low average Reinvestment rate of 23 % over the past 12 years.

- It had a good capital allocation plan. Refer to Table 3. The cash flow from operations was sufficient to fund its CAPEX with excess being returned to shareholders.

|

| Table 3: Sources and Uses of Funds 2013 to 2024 |

Valuation

I adopted the following picture in valuing NHF.

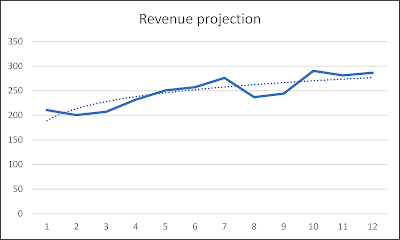

This is a mature company. As such I valued it at a 2.8 % perpetual growth rate based on the historical revenue growth rate. I assume the base revenue to be the 2024 revenue based on the best-fit log normal trendline to smoothen out the yearly fluctuations as shown in Chart 7.

|

| Chart 7: Revenue projection based on a log-normal best fit line |

I assumed that there was no improvement in the operating and capital efficiencies. As such I considered the 2013 to 2024 average contribution margin, capital turnover, and reinvestment margin to be the base values.

There will no longer be any tax incentives. I assumed a nominal 24% tax rate for my valuation.

On such a basis, I obtained an intrinsic value of RM 2.85 per share compared to its market price of RM 1.87 per share (13 Dec 2024). There is more than a 30% margin of safety.

I think that my valuation is a reasonable one. Based on the valuation model,

- The ROIC would be 6 % compared to the past 12 years average of 5 %.

- The average EPS would be RM 0.17 per share compared to the past 5 years' average of RM 0.14 per share.

I would also like to think that my assumptions are not aggressive ones as illustrated in Chart 8.

|

| Chart 8: Projections |

Valuation model

I valued NHF based on a single-stage valuation model as shown in Table 4.

The basic equations used in the model are:

FCFF = EBIT(1 – t) – Reinvestment.

EBIT = Revenue X Contribution margin – Fixed cost. The earning was based on the business model shown in the left part of Chart 3.

Reinvestment was derived from the Reinvestment margin.

|

| Table 4: Sample calculation |

The cost of funds was based on the first page results of a Google search for “NHFatt WACC”. Refer to Table 5.

|

| Table 5: Estimating the cost of funds |

Risks and limitations

I believe that I have taken a conservative approach in my valuation:

- I used the projected revenue based on a log-normal distribution as the base revenue. This is lower than the 2024 revenue.

- I assumed no improvements in the operating and capital efficiencies when there are signs of better performance in the future.

- I used the historical 2.8 % CAGR as the perpetual growth rate. This is lower than my usual 4% long-term GDP growth rate.

Yet with conservative assumptions, there is more than a 30 % margin of safety. To check on the margin of safety, I compared NHF performance based on other valuation metrics as summarized in Table 6.

|

| Table 6: Other valuation metrics Notes a) EV / (average 3 years Op profit + Depreciation). b) Historical Ave Free cash flow/market price. |

You can see that the Acquirer’s Multiple and Free Cash Flow yield points to market under-pricing.

Conclusion

One of the goals of my analysis was to see whether NHF was able to deliver what it set out in its strategic thrusts. I would rate its achievement as average.

- It was not able to grow revenue at the market rate. I would tend to think that it lost market share over the past 12 years.

- It probably delivered a big part of the efficiency and cost control goal.

- There is not enough information to conclude on its human transformation plan. I can only look at this indirectly by considering its financial performance.

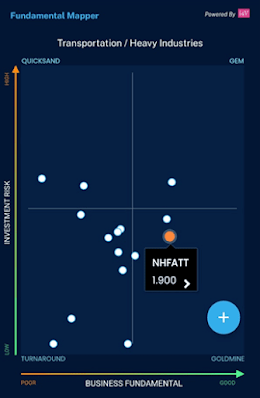

I would rate NHF as moderately sound from a fundamental perspective:

- It has a long history showcasing its experience in the automotive parts industry.

- It is financially strong.

- While not a high-growth sector, the auto parts sector is not a sunset one.

- It delivered PAT growth at a 6.5% CAGR from 2013 to 2024.

- Its strategic thrusts focus on core business growth and operational efficiency.

But I have some concerns such as:

- The low revenue growth rate with a small market share. NHF's revenue and growth are lower than peer averages.

- The low average returns seem to indicate that it did not create shareholders value.

- Mixed signals in operational efficiency metrics, with some indicators showing improvement while others, such as gross profitability and asset turnover, are declining.

There is currently a good margin of safety based on various valuation metrics. But is this a value trap?

NHF could be a value trap if it fails to address its declining market share and inconsistent performance. On the balance of probability, I would consider this an investment opportunity rather than a value trap.

However, as I did not give it top marks in its fundamental performance, I would not put NHF at the top of my investment list. I would consider it a cigar-butt investment rather than investing in a “wonderful company” in the Warren Buffett sense.

Investment thesis

Given its strategic thrusts, there is an opportunity for NHF to grow its revenue and profits more significantly than what it had achieved in the past. While there are mixed signals, there seem to be more positive efficiency trends. This can provide a base for profitability improvements.

Investing in NHF presents a balanced opportunity characterized by strong foundational elements, growth potential, and favourable valuation metrics. While there are risks to consider, the strategic direction, financial health, and market opportunities make NHF a cigar-butt investment.

|

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment