Valuation Library

Value Investing Case Study 89-1: In-depth valuations of companies featured in my videos. Revision date: 4 July 2025

Welcome to the Valuation Library of Investing For Value, where I break down the numbers behind every stock I analyze. Each valuation here is a detailed follow-up to my fundamental analysis videos, providing the full calculations, assumptions, and risk factors that drive my investment conclusions.

If you have watched my videos and want to dive deeper into the “why” behind the valuation, this is the place to be.

How to Use This Library

- Watch the video first. If you have not seen the analysis yet, check out the fundamental breakdown on my blog.

- Click on a company below. Find the stock you are interested in and explore its valuation details.

- Compare and learn. Use the insights to refine your own investment strategy.

Valuation Reports

- Aumas

- ASTEEL

|

1. Aumas

I valued Aumas based on the following picture.

Aumas will deliver 16% growth in Year 1 which will reduce proportionately to 4% in the terminal year (Year 6). This 16% is the CAGR in revenue from 2020 to 2024. The base revenue would be the 2024 revenue.

The company would improve its operating efficiency so that the contribution margin in the terminal year (Year 6) would be 10 % higher than the base value. The base contribution margin was the 2021 to 2024 value.

Note that this contribution margin picture assumes that gold prices remain at the current level. In other words, the current gold price is assumed to be the long-term cyclical price.

The company would increase its Reinvestment rate so that it follows the fundamental growth equation in the terminal year. The base Reinvestment rate would be the past 10 years average.

I assumed a nominal tax rate of 24%.

On such a basis I obtained an intrinsic value of RM 0.70 per share compared to its market price of RM 0.95 per share (6 Feb 2025). There is no margin of safety.

1.1 Valuation model

I valued Aumas based on a multi-stage valuation model as shown in Table 1.

The basic equations used in the model are:

Free Cash Flow to the Firm (FCFF) = EBIT(1 – t) – Reinvestment.

EBIT = Revenue X Contribution margin – Fixed cost. The earning was based on the operating profit model shown in the left part of Chart 1.

Reinvestment was derived from the Reinvestment margin.

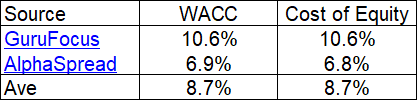

The cost of funds was based on the first page results of a Google search for “Aumas WACC”. Refer to Table 2.

|

| Aumas Table 2: Estimating the cost of funds |

1.2 Risks and limitations

I consider my valuation of Aumas a reasonable one. Refer to Chart 1.

The valuation model resulted in the following:

- Average 21 % ROIC compared to the 2023 to 2024 average of 14 %.

- Average RM 0.03 EPS per year compared to the 2023/24 average of RM 0.02 per share.

- Average 17 % EBIT margin compared to the 203/24 average of 27 %.

I would think that they are not unrealistic.

Is there an upside to the valuation? My valuation model is sensitive to changes in the improvement in the contribution margin

For example, if I assumed the long-term gold price increases by 25% (leading to a 25% increase in the base contribution margin), I would obtain the current market price. I will leave it to you to judge whether this gold price is reasonable.

2. ASteel

I valued ASTEEL based on the following picture.

The is a mature and cyclical company. As such I expect revenue to grow at the long-term GDP growth rate of 4%. I assumed the base revenue to the 2024 revenue.

The company would improve its operating efficiency so that the contribution margin in the terminal year (Year 6) would be 10 % higher than the base value. The base contribution margin was the 2019 to 2024 average value. This is the post-divestment of the coated coil business.

The base fixed cost margin would be the 2019 to 2024 average value. I also assumed that this would improve proportionately over the valuation period to be 90% of the base value in the terminal year.

The base capital turnover would be the 2019 to 2024 average value. Note that this would change during the valuation period in line with the changes to the Reinvestment rate.

The base Reinvestment rate would be the past 10 years average of zero. I think that the zero rate is not sustainable. The company would increase its Reinvestment rate so that it follows the fundamental growth equation in the terminal year.

I assumed a tax rate of 19% based on the past decade positive tax rate and excluding those greater than 100 %.

On such a basis I obtained an intrinsic value of RM 0.10 per share compared to its market price of RM 0.07 per share (30 May 2025). There is a 43 % margin of safety.

2.1 Valuation model

I valued ASTEEL based on a multi-stage valuation model as shown in Table 2.

The operating model is based on the one shown in the left part of Chart 2 where I break down the cost into a variable and fixed cost component to derive the contribution.

The basic equations used in the model are:

Free Cash Flow to the Firm (FCFF) = EBIT(1 – t) – Reinvestment.

EBIT = Revenue X Contribution margin – Fixed cost.

Reinvestment was derived from the Reinvestment margin.

Fixed cost was derived from the fixed cost margin.

2.2 Cost of funds

The cost of funds was derived based on Damodaran’s approach as summarized in Table 3.

2.3 Risks and limitations

I consider my valuation of ASTEEL an optimistic one. Refer to Chart 2.

- The projected FCFF is a steady uptrend and above the projected FCFF based on the log-normal trendline. You can see that the historical FCFF post-2018 was volatile.

- The projected terminal revenue is higher than the base revenue.

|

| Chart 2: History vs Projection |

The valuation model resulted in the following:

- Average 5 % ROIC compared to the 2019 to 2024 average of negative 3.6 %. The peers (steel flats producers) had an average median ROIC of 2% from 2019 to 2024.

- Average RM 0.02 EPS per year compared to the 2019 to 2024 average of loss per share.

- Average 4 % EBIT margin compared to the 2019 to 2024 average of 2 %. The peers operating margin average 2% from 2019 to 2024.

You can understand why I think my valuation is an optimistic one.

Note that without the improvements in the gross profit margin and SGA margin and assuming the historical zero Reinvestment rate, I would get an intrinsic value of RM 0.05 per share. I have already stated that a zero Reinvestment rate is not realistic over the long term.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment