Is Petronas Chemicals an investment opportunity?

Value Investing Case Study 94-1: How Petronas Chemicals Quietly Reinvented Itself — and Why It Matters.

Petronas Chemicals Group Berhad (PETCHEM) is one of Malaysia’s largest listed companies and a key subsidiary of the national oil company, PETRONAS.

Over the past decade, PETCHEM has undertaken a major transformation - from a domestic, commodity-focused chemical producer to a globally diversified player with a growing specialty chemicals footprint.

This article explores whether PETCHEM, amid its strategic shift and recent market developments, offers an attractive investment opportunity today. By analyzing its operating performance, financial strength, peer comparisons, and intrinsic value, I assess both the sustainability of its business model and the margin of safety for potential investors.

The findings are synthesized using a value investing lens, showing that this is an investment opportunity.

Should you go and still buy it? Well, read my Disclaimer.

Contents

- Company background

- Operating performance

- Financial position

- Valuation

- Conclusion

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you. Learn more. |

Company background

PETCHEM is best categorized as a diversified, integrated chemical manufacturer, with operations spanning the commodities and specialty chemicals segments.

Over the past decade, the Group has undergone a significant transformation in terms of business model and strategic priorities. The Group repositioned from a volume-driven commodity player to a value-driven specialty player.

- Business Model Evolution

- 2015–2016: Focused on basic petrochemicals (methanol, olefins, polyolefins, ammonia, urea) with a regional footprint and a traditional petrochemical manufacturing model centred in Malaysia.

- 2023–2024: A global integrated chemical producer with 19 manufacturing sites across 9 countries (including Europe, China, and North America). The business expanded from basic commodities to include specialty chemicals.

- Strategic Shift: Two-Pronged Strategy

- First-Prong (2015–2024): Continued emphasis on operational and commercial excellence in basic petrochemicals.

- Second-Prong (2018 onward): Shift to selective diversification into derivatives and specialty chemicals to reduce cyclicality and capture higher value segments. Key moves included:

- Acquisition and startup of specialty plants (e.g., ethoxylates, polyether polyols, nitrile butadiene latex).

- Entry into advanced chemical recycling and refined Maleic Anhydride production

The impact of these changes was the transformation of PETCHEM into a more diversified group, both in terms of business segments and geographic footprint.

- You can see from the right part of Chart 1 that in 2024 Malaysia accounted for only about 24 % of the Group’s revenue down from 39 % in 2019.

- As shown in the left part of Chart 1, the Group introduced the Specialities segment in 2022. These cover 6 product groups - resins, engineered fluids, silicones, additives, and specialty polymers - targeted at niche applications.

|

| Chart 1: Revenue Profile |

Operating performance

The impact of PETCHEM’s strategic and business model shifts - particularly its diversification into specialty chemicals and global expansion - is reflected in the post-2020 discontinuity in its revenue trend, marking a departure from its historical commodity-driven growth pattern.

However, while revenue grew significantly post-2020, profits had a different path. While it spiked in 2021 and 2022, it had dropped dramatically in 2023 and 2024, such that these were lower than the 2015 profits. Refer to the left part of Chart 2. Returns followed a similar pattern as shown in the right part of Chart 2.

- The surge in profits in 2021 and 2022 was driven by strong post-COVID demand, high petrochemical prices, and contributions from new specialty acquisitions.

- The profits declined sharply in 2023 and 2024 due to margin compression from falling product prices, weaker global demand, particularly from China, and rising operational costs. Higher depreciation, integration-related expenses, and reduced contributions from joint ventures further weighed on earnings.

|

| Chart 2: Performance Index and Returns |

Chart 3 showed that the main reason for the profit picture was the declining gross profit margin. This is reflected in the significant declining contribution margin from 43% in 2015 to 23% in 2024.

At the same time, there was also an uptrend in the Selling, General and Administration (SGA) margins. This caused the fixed cost margin to increase from 15 % in 2015 % to 16% in 2024.

The company attributed these changes to:

- Rising feedstock and energy prices - especially natural gas and naphtha – post-2020, as a major cause of margin compression. These costs surged due to geopolitical tensions, OPEC+ production controls, and global inflationary pressures.

- Particularly in 2023 and 2024, weaker global demand and oversupply (especially from China) led to lower average selling prices.

- Higher operational and maintenance costs.

The Group frequently framed margin compression during these years as a reflection of external market dynamics beyond its control.

Note that from 2015 to 2024, there was a 90 % correlation between Brent crude oil price and PETCHEM revenue. This is a surprisingly high correlation despite being a downstream player and not a crude oil producer.

Crude oil prices are cyclical. Given the high correlation, it makes sense to look at PETCHEM from a cyclical perspective.

The other feature is its cost structure, where the fixed cost was on average about 21% of the total cost. This low fixed-cost base implies lower operating leverage, meaning the company is more resilient during downturns, although revenue increases have a more muted effect on profit.

Low tax rates

Over the past decade, PETCHEM had an average effective tax rate of 15%. This is lower than the statutory 24 % tax rate because of the following.

- Global Incentive for Trading (GIFT): This was the most significant contributor to the lower effective tax rate. Under the GIFT scheme, certain income was qualified for preferential tax treatment, which had a major impact.

- Tax-exempt income and incentives: PETCHEM received tax incentives and earned tax-exempt income across multiple years, reducing the tax burden further. These were typically related to government-promoted investments or operations qualifying for preferential treatment.

- Deferred tax benefits not recognized.

- Income subject to different tax rates: Some of the Group’s income, especially from overseas or special jurisdictions, was taxed at lower rates than Malaysia’s statutory rate.

The key point is that the returns would have been much lower if the Group did not have these tax breaks.

Peer comparison

I compared PETCHEM's performance with several companies recognized as its competitors in the global petrochemical and specialty chemicals industry. These companies operate in similar sectors and markets, offering comparable products and services.

- Clariant AG (CLN). A Swiss specialty chemicals company, Clariant focuses on innovative and sustainable solutions across various industries, including personal care, agriculture, and energy.

- Dow Inc. (DOW) An American multinational corporation, Dow offers a diverse portfolio of chemicals, materials, and plastics, serving various industries worldwide.

- LyondellBasell Industries N.V. (LYB) Headquartered in the Netherlands, LyondellBasell is one of the largest plastics, chemicals, and refining companies globally, with operations in over 100 countries.

- PTT Global Chemical Public Company Limited (PTTGC), based in Thailand, is a leading integrated petrochemical and refining company in the Asia-Pacific region.

- Saudi Basic Industries Corporation (2010). A leading global chemical manufacturer based in Saudi Arabia, this company produces a wide range of chemicals, industrial polymers, and fertilizers.

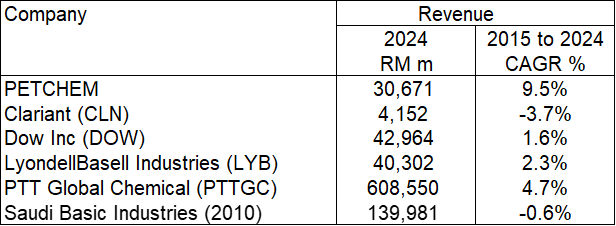

As shown in Table 1, while PETCHEM was among the smaller companies in terms of the 2024 revenue, it delivered the best revenue growth rate.

|

| Table 1: Peer Revenue |

I compared PETCHEM performance based on 4 metrics as shown in Charts 4 and 5.

- While initially, PETCHEM ranked No. 2 in terms of return on capital, it did not manage to sustain this performance, so that over the past few years, its returns were average.

- While PETCHEM had the best EBIT margin for most of the period, this declined to rank No 3 over the past 2 years.

- PETCHEM managed to improved its levered free cash flow margin over the past decade. It went from among the worse a decade ago to be the best over the past 2 years.

- PETCHEM had a more stable EPS compared to its peers. I would even rate its performance as good as over the past 2 years. You can see that the peers’ 2024 EPS were lower than their respective 2015 EPS.

|

| Chart 4: Peer Return on Capital and EBIT Margin |

|

| Chart 5: Peer Levered Free Cash Flow Margin and EPS |

PETCHEM demonstrated a mixed performance relative to its peers over the past decade. But taken together, PETCHEM shows strong financial discipline and earnings stability, though its waning returns and narrowing margins suggest increased competitive pressure or internal operational headwinds.

|

Financial position

I would consider the Group as financially strong.

As of Dec 2024, it had RM 9.9 billion in cash. This is equal to 17 % of its total assets.

As of Dec 2024, it had a debt-equity ratio of 13 %.

Over the past decade, it had an average 48 % Reinvestment rate (Reinvestment/NOPAT). Excluding acquisition, the rate reduced to 17 %.

- Reinvestment = CAPEX & Acquisition – Depreciation & Amortization + increase in Net Working Capital.

- The Group incurred RM 11.2 billion in 2022 to acquire Perstorp Holding AB, a global specialty chemicals company based in Sweden. This large acquisition skewed the Reinvestment rate (with acquisitions), as over the past decade, the Group's total amount spent on acquisition amounted to RM 11.5 billion.

- This meant that a big part of the NOPAT could be returned to shareholders if there was no acquisition.

Over the past decade, it generated positive cash flow from operations every year. During this period, it generated RM 54.8 billion in cash flow from operations compared to the total PAT of RM 36.7 billion. This is a good cash flow conversion ratio.

It had a good capital allocation plan. Refer to Table 2. The cash flow from operations was sufficient to fund its CAPEX and acquisitions. Excess was returned to shareholders.

|

| Table 2: Sources and Uses of Funds 2015 to 2024 |

Valuation

My analysis showed that while PETCHEM delivered a high single-digit revenue growth rate from 2015 to 2024, its profits declined. The main reason for the profit picture was the declining gross profit margin, coupled with an uptrend in the SGA margins.

The 2022 acquisition changed the margin and cost profile. As such, I assumed the following in my valuation of PETCHEM.

- The base revenue is the 2024 revenue growing at 10 % in Year 1. The growth rate would reduce proportionately to the terminal growth rate of 4 % per annum in Year 6.

- The base contribution margin and capital turnover would be the 2022 to 2024 average values. There would not be any change to these over the valuation period.

- The fixed cost margin would be the average 2022 to 2024 fixed cost margin and remains unchanged over the valuation period.

- The base Reinvestment would be the past decade's average values (based on the Reinvestment margin). This would reduce so that in the terminal year, the Reinvestment rate would be one given by the fundamental growth equation.

- The tax rate would be the past decade's average rate of 15%.

On such a basis, I obtained an intrinsic value of RM 5.19 per share compared to the market price of RM 3.45 per share (8 May 2025). There is a 50% margin of safety.

The Book Value of PETCHEM as of the end of Dec 2024 was RM 4.82 per share with a NTA of RM 3.69 per share. The stock is even trading below the NTA.

Is the market suggesting that there will be some asset-write down and/or impairments? Note that over the past decade there did not seem to be any significant asset write-down or impairment. Unless you think that some of the assets are going to be impaired, the Book Value is a good floor value.

The share price has been trending down over the past 1 year from RM 6.96 per share about a year ago. I suspect that the market has overshot on the way down to reach the bottom of RM 2.95 at the start of April 2025.

Valuation model

I valued PETGAS based on a multi-stage valuation model, as shown in Table 3. The basic equations used in the model are:

Free Cash Flow to the Firm or FCFF = EBIT(1 – t) – Reinvestment.

EBIT = Revenue X Contribution margin – Fixed cost. The earning was based on the business model shown in the left part of Chart 3.

Reinvestment was derived from the Reinvestment margin.

The fixed cost was derived from the fixed cost margin.

The cost of funds was based on the first page results of a Google search for “Petronas Chemical Group WACC”. Refer to Table 4.

|

| Table 4: Estimating the cost of funds |

Risks and limitations

PETCHEM operates in the oil and gas sector, which is a cyclical one. The high correlation between PETCHEM revenue and Brent crude oil price suggests that this is a cyclical company.

As such it makes more sense to consider PETCHEM performance over the cycle. As can be seen from Chart 6, the average value from 2015 to 2024 is one possible cyclical value.

However, given the changing business profile over the past decade, using the past decade's values to represent the cyclical value may not represent the current business profile.

But if you look at Chart 6, you can see that the 2022 to 2024 performance seemed to be at the past 2 decades' average price cycle performance. Thus, my assumptions based on the 2022 to 2024 average values can be considered cyclical values.

You may argue that since the acquisition of Perstorp Holding AB was completed in Oct 2022, it may be more appropriate to consider the 2023 to 2024 average values as the cyclical values.

If I use this shorter period to estimate the contribution margin, fixed cost margin and capital turnover, (all else being the same as per the Notes to Table 3) I would get an intrinsic value of RM 0.41 per share. You can see that the assumption of the cyclical period has a critical impact of the intrinsic value.

Given that Perstorp is a substantial acquisition and that it would take some time for the synergies of the acquisition to be realized, I will stick to the 2022 to 2024 average as the better representation of the cycle.

|

| Chart 6: Brent Crude Oil Price |

Apart from the assumption on how to represent the cyclical performance, there is one other key assumption - revenue growth.

I have assumed that PETCHEM would have a revenue growth rate of 10% in Year 1. The implicit assumption here is that the Group would continue with its large acquisitions.

If I assumed that there was no acquisition, and that revenue growth would be at 4% from Year 1, the intrinsic value reduces to RM 4.13 per share, resulting in a 20% margin of safety.

I believe that my assumptions are not optimistic based on the following:

- The average ROIC over the valuation period was 8.3 % compared to the 2022 to 2024 average of 8.9 %.

- The average EBIT margin over the valuation period of 12% seemed to be about the peer average over the past decade. Refer to the right part of Chart 4.

Conclusion

Over the past decade, PETCHEM has evolved from a regional commodity producer into a diversified global player with a growing specialty chemicals portfolio. This strategic shift has positioned the Group for more stable and higher-value growth. This is even as recent years have seen pressure on margins and returns due to external headwinds like weak global demand and rising input costs.

Despite these challenges, PETCHEM has maintained strong financial fundamentals, demonstrating solid cash flow generation, a healthy balance sheet, and prudent capital allocation. Peer comparisons further reinforce its relative strength in earnings stability and free cash flow performance.

While near-term conditions remain uncertain, PETCHEM’s strategic direction, operating resilience, and undervaluation together present a credible case for consideration.

What ultimately sets PETCHEM apart at this point is valuation. With an estimated 50% margin of safety, the current market price provides a meaningful buffer for long-term investors. The current market price is even below its Book Value.

Investment thesis

PETCHEM's shift from a commodity-focused model to a value-driven specialty chemicals strategy has enhanced earnings quality, reduced cyclicality, and expanded its geographic footprint. The Group is financially sound, and peer comparisons highlight its resilience, particularly in EPS stability and capital efficiency.

Valuation-wise, the stock traded at a significant discount to intrinsic value, offering a 50% margin of safety. This combination of strategic repositioning, financial strength, and margin of safety makes PETCHEM a compelling candidate for value-oriented investors with a long-term horizon.

|

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment