An Effective Way to Screen for Value Traps

Case Notes 02: Value trap and other Pointers from Ekson's case study. Revision date: 20 Sep 2020

Can you screen for value traps?

First thing first.

If you have not read the Eskons case study (Part 1 and 2), I suggest that you do so in order to maximize the value from this post.

Investopedia defined a value trap as

“… investment that appears to be cheaply priced because it has been trading at low valuation metrics…The danger of a value trap presents itself when the stock continues to languish or drop further after an investor buys into the company.”

"Value trap" is a common search for phrase as the Google Trend report shows.

The chart indicates that there is some interest in value traps over the past 5 years. It is not surprising to note that during the current pandemic, there has been a slight increase in interest in value traps.

You would have thought with the sustained interest, there would be a common understanding of what the phrase meant.

However, a survey of the top 100 sites ranked by Google for the phrase “value trap” showed that there are differences in interpretation. (Refer to Note 1 for details of the list of sites and the method)

Value traps and bargains are two sides of the value investing coin and as such, it is fundamental to value investing. It should be assessed by comparing the current price to intrinsic value and not historical price.

|

Contents

- A Survey of Industry Thoughts

- What is a value trap really?

- Being wrong regarding “cheapness”

- Avoiding value traps

- All value investing involves value traps

- Can you build a better value trap screen?

- Pulling it altogether

- What came out of my value trap screen

- How to conclusively avoid a value trap

- Can you shortcut the process?

- Takeaways

A Survey of Industry Thoughts

Based on the Investopedia definition, there are 2 key concepts for a value trap:

- It is about being cheap relative to some measure

- It is about being wrong about the “cheapness”

The keyword seems to be “cheap”.

But when it comes to “cheap” relative to some measure, there are two yardsticks:

- Cheap relative to the market price. This could be in reference to historical prices, or some benchmark companies or industries prices

- Cheap relative to intrinsic value. Even then, there are differences in the way intrinsic value is assessed.

There are some who do not make a distinction between the price and value yardsticks.

An analysis of the top 100 sites showed that there are some who consider value trap as an investment that is cheap relative to its historical price. This could either be viewed from an individual stock perspective or from a fund or index perspective.

There are even some sites that confuse the picture further. These talk of value traps as being cheap based on historical prices as well as some multiples.

We can agree that comparing the historical prices is wrong. This is merely speculation and should not be thought of as a value trap.

The “true” value trap should be comparing price with intrinsic value.

However, it is no surprise that not all agree on what is the best way to assess intrinsic value.

The survey showed that 61% of the top 100 sites use some form of market multiple to assess intrinsic value.

Multiples may not be a good indicator of intrinsic values because they are relative valuations. But this should not distract you from using intrinsic value as the basis to compare with the price when it comes to a value trap.

What is a value trap really?

If it is cheap relative to market prices, then it should not be called a value trap.

You are buying into the company because you think that the market has got it wrong based on price information alone. I would call this a “price trap”.

If you have invested because it is cheap relative to some price benchmarks and the price dropped further – too bad as you were speculating.

But it is cheap relative to your assessment of its intrinsic value, and you are wrong about its intrinsic value, then it is a value trap.

The essence of a value trap is that

- It is cheap when comparing the stock price with your estimate of the intrinsic value

- Your estimate of the intrinsic value was wrong

But, if it is cheap relative to its intrinsic value which has been estimated correctly, it cannot be a value trap. It is a bargain.

Being wrong regarding “cheapness”

I can think of 2 scenarios when it comes to being wrong about the “cheapness” in order for the stock to be a value trap.

a) Firstly, even though the price is significantly lower than the intrinsic value, the market continues to misprice it. There is no fundamental reason for the price to be lower than its intrinsic value.

Any mispricing is because the market has not recognized the value. Now whether the market will recognize the mispricing is another story but market mispricing per se should not be the criterion for a “value trap”.

This is where I differ from Investopedia. As a long-term value investor, I would not consider the following as a value trap without any deterioration in the intrinsic value.

“continues to languish or drop further after an investor buys into the company”

If you have invested because it is cheap relative to its intrinsic value and the price dropped further even though there is no deterioration in its intrinsic value – then you may need to be patient. The value is still intact. This is not a value trap.

b) Secondly, you could have made a mistake in assessing the intrinsic value. You could have used some inappropriate valuation methods. Or you could have assessed the fundamentals wrongly. In this case, it was not cheap in the first place. This is the real value trap

In this context, if some form of multiple is used to assess “cheapness”, there is a good chance that the stock would be a value trap. This is because relative valuation is not an attempt to find the intrinsic value.

Avoiding value traps

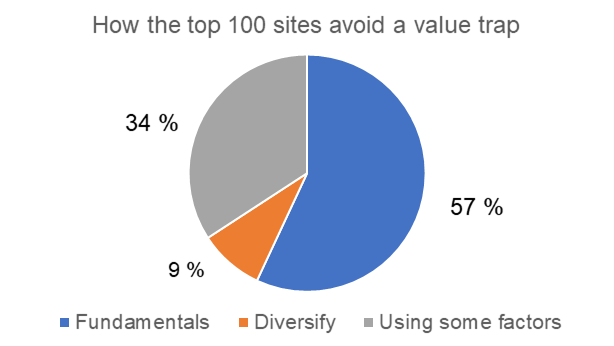

How does the surveyed group think about avoiding a value trap?

There are 2 groups when it comes to avoiding a value trap.

- Those that advise you to look at fundamentals either directly or using a set of factors

- Those that don’t mention fundamentals but advise some form of diversification

There are two interesting points:

- The group that viewed a value trap based on comparing it with historical prices. The majority here advised checking with fundamentals to avoid value traps.

- Those sites used multiples to assess value traps. Of these 80% of them also said that you need to consider other factors and fundamentals in order to be conclusive.

From a fundamental perspective, valuations are based on assumptions about the future. If your assumptions are not based on reality or if there is a black swan event that affects the prospects, then you could have a misleading valuation.

Instead of investing at a price that was much lower than the intrinsic value, you actually invested at greater than the intrinsic value.

How do you avoid such cases? You need a good valuation approach.

One way is to triangulate the Asset value with the Earnings value as well as other indicators.

But more importantly, ensure that the assumptions are built up from detailed business analysis.

All value investing involves value traps

If you are a value investor, you would be investing when the price is at a significant discount to intrinsic value. The question is whether your assessment of intrinsic value is accurate

- If your valuation is wrong, then the stocks are really cheap for a reason and you have a value trap

- But if your assessment of intrinsic value is correct, then you have a bargain

From the above perspective, value traps and bargains are two sides of the value investing coin.

More importantly, value investing is about confronting the value trap question.

A value trap is fundamental to value investing.

Can you build a better value trap screen?

The survey showed that 34% of the top 100 sites used some form of screens to avoid value traps.

But using factors or characteristics is only a proxy for determining intrinsic values. It is not as good as using intrinsic values.

We all know the challenges of trying to estimate the intrinsic value. It is laborious work and so you would think that it would not be practical to have a value trap screen based on intrinsic value.

But there are actually certain situations where we can achieve this. And I am not talking about using multiples as the measure of intrinsic value.

For financial institutions, most of their assets and liabilities are financial instruments and accounting rules require them to be “marked to market”.

In layman's terms, the figures in the Balance Sheet reflect the market prices and we have a quick way to determine intrinsic value.

We could also argue that for real estate companies most of their assets relate to land and buildings.

- In many instances, if these are properties held for investments, they would most likely be stated at market prices. Again, we have a shortcut for assessing intrinsic value.

- Most of the land held for development or under development would have been stated at historical prices. The asset values represent conservative estimates of the intrinsic values.

The book values of financial institutions and real estate developers are very good proxies of their intrinsic values.

We can use them to screen for value traps.

Pulling it altogether

- Relate value trap to intrinsic values and not pricing

- Value traps and bargains are two sides of the value investing coin.

- Value traps are fundamental to value investing and are about confronting the value trap question.

- There are ways to screen for value traps using multiples and/or a set of factors. But this is not as accurate as using intrinsic values

- Book values of financial institutions and real estate companies are good proxies for intrinsic values. Use them to good screen for value traps in these sectors

What came out of my value trap screen

With the financial institutions and property companies in mind, I then decided to screen for Bursa main board companies which are not likely to be value traps using a readily available KLSE Screener.

Taking a conservative approach, I set the following criteria

- Price < 0.80 Book value to build in some margin of safety

- Companies to be profitable for a continuous 3 years

- ROE > 10% so that there is a good chance that they are earning more than the cost of capital

What are the results?

There are 7 Bursa main board companies that met the above criteria

|

Sector |

Company |

Price 22/06/20 |

P: Book |

ROE |

|

Financial Services |

ECM |

0.205 |

0.50 |

14.18 |

|

Financial Services |

Allianz |

14.48 |

0.68 |

12.65 |

|

Property |

Paramon |

0.91 |

0.35 |

35.22 |

|

Property |

MBWorld |

0.99 |

0.56 |

19.71 |

|

Property |

Ewein |

0.345 |

0.39 |

12.36 |

|

Property |

DBHD |

0.39 |

0.64 |

12.35 |

|

Property |

SYMLIFE |

0.395 |

0.24 |

10.86 |

Should you go out and buy these counters?

Personally, I have not invested on the basis of screening alone.

I have used screens to narrow down the companies for more in-depth investigations. But I must admit that these are candidates for further analysis.

What is the key point here?

If you can have a way to assess the intrinsic value from the various metrics in a screen, then you can develop your own value trap screen.

Many publicly available screens incorporate market multiples as part of the screen's metrics. I have already mentioned that there is a theoretical link between the market multiples and intrinsic values as computed using the earnings-based method.

Conceptually you could then modify the market multiples so that they are good proxies for intrinsic values.

Viola! You have a screen for value traps.

Unfortunately, we have not reached this part of our learning curve yet.

How to conclusively avoid a value trap

The Eksons’ case study provides a framework to avoid a value trap. It covered the two important questions that investors looked for when considering an investment

- Is this a good business?

- Is it trading at a bargain?

If you look at Ekson’s case study, you will notice that I have used a series of questions as the headings for several sections.

If the answers are a strong yes to all of them, then you have both good business and a bargain price.

Let me list the questions/section headings used in the Eksons’ case study in the context of the above two investment questions:

Is this a good business?

- Is there Anything Special about the Group’s Expertise?

- Is there Concern about how it Uses its Funds?

- Is the Current Performance Outstanding?

- Tracing the Group’s Rich and Unique History

- Is there a Great Future?

- Did Top Management Seize Opportunities?

Is it trading at a bargain?

- Is there an Awesome Buying Opportunity?

- Will there be Spectacular Growth in Shareholders’ Value?

- How to Secure Your Investment by Minimizing Risk

In the Eksons’ case study, I have presented information based on publicly available information in relation to each of the above questions so that by the time you finish reading the particular section, you will have a good sense of the answers for that section.

Of course, the various sections have been organized to help the train of thought. In reality, you should look at the overall picture as well.

As you can see, fundamental analysis requires expertise and time. Visualizing a company’s business performance and investment risk (by comparing market price with intrinsic value) is one way to shortcut the process. The Fundamental Mapper helps investors make informed decisions as it provides such insights in an easy-to-see format.

Download the Fundamental Mapper app now on Xifu to get investment insights into Bursa Malaysia companies.

Can you shortcut the process?

With so much work involved, do you need to look at the business prospects all the time?

When Warren Buffett first started out investing, he followed Graham's style of focussing on buying cheap companies without paying too much attention to the business prospects.

Graham's concept was that if it was really cheap (remember he focussed on those trading at ‘liquidation values”), the business prospects did not matter.

Warren Buffet referred to this as “cigar butt” investing. The analogy was that you found a cigar butt at a bargain that was good enough for one more puff.

So you invest, and then get out when the market re-rates the company. You don’t hang around as the future may not be bright.

Later Warren Buffett evolved into what has been described as a “business-oriented value investor”.

That is where the business analysis side of the case study comes into play. He invested in companies for the long run as these are companies with a competitive edge that can compound shareholders’ value over time.

If you are investing in turnarounds or those that can compound shareholders’ value then there is no substitute for the business analysis.

However, sometimes you are fortunate to find “cigar butts” trading below its Graham Net Net. In such situations, I have often skimped the business analysis and bet that there is enough margin of safety by virtue of it being a Net Net.

So far I have not been wrong on such bets over the past 15 years.

But for investing in both the turnarounds and compounders, there is no substitute for comprehensive business analysis, valuation, and risk assessment.

There are lots of articles on the web about how to avoid value traps. If you type “value trap” into Google search, you will get more than a hundred sites with advice ranging from what is a value trap to how to avoid them.

When you get to the heart of how to avoid a value trap by each one of them, it is all about looking for signs that the business is in trouble.

The reality is that there is seldom a shortcut for detailed business analysis.

Takeaways

- Relate value trap to intrinsic values and not pricing

- There are ways to screen for value traps. But this should be the starting point. You need further analysis.

- To avoid value traps – answers all the questions posed in the case study headings.

Note 1

The survey was carried out based on the top 100 sites based on the top 12 pages ranked by Google search for the phrase “value trap”.

The actual literature review was carried out in the first half of September 2020. However, as the Google rank actually changed from day to day, the final list was determined on 14th September 2020.

Furthermore, 12 pages were involved as I ignored:

- Advertised sites, Podcasts, and YouTubes

- Those that required a subscription to view eg The Wall Street Journal

- Those that appeared more than once as there could be more than one article that involved a value trap

In analyzing the results, note the following

- There were 8 sites where I could not discern what was used as the basis for a value trap. Rather they were more focused on avoiding one. I ignored these in analyzing the basis of the value trap definition

- There were 3 sites that appeared to refer to both historical price and multiples as the basis of defining value traps. I counted them in both categories.

- There were only 79 sites with specific advice on how to avoid value traps. I used 79 as the total in computing the %.

The alphabetical lists of the top 100 sites covered in the survey are

1. Acropolis

2. Advisor Perspectives

3. Alpha Sense

4. Arbor Investment

5. Asia One

6. Benzinga

7. Bloomberg

8. Broken Leg Investing

9. Business Insider

10. Business Standard

11. Cantech Letter

12. Catana Capital

13. CFI

14. Citywire

15. CNBCTV

16. Columbia Business School

17. Currency.com

18. Deccan Chronicle

19. Donkey Stock

20. Economic Times

21. einvestingforbeginners

22. ETF Trends

23. Fidelity

24. Financial Adviser

25. Financial Dictionary

26. Financial Highway

27. Financial Review

28. Firstlinks

29. Forbes

30. FR24 News

31. Franklin Templeton

32. Fund Selector Asia

33. GAM Investments

34. Get Money Rich

35. Groww

36. Gulf Times

37. Hedgeye

38. Hexavest

39. Hindustan Times

40. Infimoney

41. Institutional Investor

42. International Banker

43. Invest like a Guru - book

44. Investing.com

45. Investment Master Class

46. Investopedia

47. Investor Words

48. Investorplace

49. Investors Friend

50. Just another investor

51. KLSE.i3investor

52. Lightspeed

53. Live Wire

54. Magzter

55. Market Watch

56. Master Investor

57. Miller Value Partners

58. Mint

59. MOI Global

60. Moneysense

61. MorningstarUK

62. Motley Fool

63. MyPF

64. NAOS

65. Nasdaq

66. Old School Value

67. Quora

68. Real Money The Street

69. Research Gate

70. Reuters

71. Safal Naveshak

72. Schroders

73. Seeking Alpha

74. Shabbir Bhimani

75. Shares magazine

76. Shartruwealth

77. South China Morning Post

78. Spaceship

79. Stockaholics Facebook

80. Stockopedia

81. Systemic risk and systemic value

82. The Acquirer's Multiple

83. The Balance

84. The Defensive Investor - book

85. The Edge

86. The Fifth Person

87. The Free Press Journal

88. Timeless Investor

89. Tradebrains

90. Traderspro

91. TSI Daily Wealth Advise

92. UK Value Investor

93. Undervaluedjapan

94. US News

95. Value Spreadsheet

96. Value Trap book by Nelson

97. Wall Street Mojo

98. Yahoo Finance

99. Yourmoney.com

100. Zacks

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment