Baby steps in Asset Allocation for a Value Investor

Fundamentals 05: Basics on how to allocate your net worth to several asset classes from a value investor's perspective. The article was first published on 29 Nov 2020. I have since updated it so that there is a clear “how-to” section as part of section 1. Revision date: 14 Feb 2021

|

| "You should have a strategic asset allocation mix that assumes that you don't know what the future is going to hold." Ray Dalio |

You invest your savings to protect the purchasing power from being eroded by inflation. You grow your wealth at the same time.

If you know which assets will give the best return, you would be an idiot not to put all the savings into this one asset.

In reality, you do not know how the future will turn out so you spread your savings into several asset classes. You hope that if one does badly, the others will do well enough to more than offset the bad performance.

This is asset allocation.

There are two goals in asset allocation:

- How to achieve returns under all economic scenarios

- How to have peace of mind so that you can stick to the plan

The asset allocation strategy will then depend on how you address both of them. You should not be surprised that it boils down to addressing returns and risks respectively.

This article describes my asset allocation plan based on the following perspectives:

- View risk as a permanent loss of capital rather than as volatility.

- A stock-picking value investor rather than being a quant or indexer

- An investor with a long-term investment horizon

I hope that it can provide a framework to help you determine your own asset allocation plan.

|

Contents

1. Key questions in asset allocation

2. Shortcomings of the conventional asset allocation guidelines

3. Volatility

4. Performing under different economic scenarios

5. Peace of Mind

6. Long term investment horizon

7. My asset allocation plan

8. Pulling it all together

9. Appendix

I view asset allocation as diversification of net worth. This means a 2-tiered approach

- Allocation of net worth to several asset classes

- Selecting the various items for each respective asset classes

This article focuses on the allocation of net worth.

At its core, asset allocation is an integral component of your risk management plan.

When it comes to risks there are 2 schools of thought

- Those that view it as volatility

- Those that view it as a permanent loss of capital

Your asset allocation plan will also be influenced by how you view risks.

1. Key questions in asset allocation

“In short, during the next 20 or 30 years, there will be a single, best allocation that in retrospect we will have wished we have owned. The only problem is that we haven't a clue what that portfolio will be. So, the safest course is to own as many asset classes as you can; that way you can be sure of avoiding the catastrophe of holding a portfolio concentrated in the worst ones” William J. Bernstein, The Four Pillars of Investing.

By investing in more than one asset class, you will be able to counteract your losses in one asset class with better returns in another asset class. Overall, you get better returns.

1.1 Why asset allocation is important?

Studies have shown that asset allocation accounted for most of the returns in an investment portfolio compared to selecting the items within an asset class.

You should not be surprised by this. Let me give you an analogy.

Suppose that you are betting on the winner of a race where there are 5 different participants - car, bus, motorbike, bicycle, and horse.

- I am sure you would place most of your money in the car. Even the slowest car would beat the fastest bicycle. This is the asset allocation analogy.

- However, if you know that there a broken bridge ahead crossing the river, you would choose the horse. Risk has also to be considered.

- If the race is to see 10 people reaching the finishing line first, you would choose the bus. You have to take into account constraints.

It is no brainer to see that choosing the best vehicle (asset) will contribute more to the returns than selecting the best items among the worst asset.

The example also illustrates that asset allocation is not only balancing returns and risks. There are also constraints to consider.

At the same time, each asset class will deliver different returns over time. As such the allocation to these asset classes has to be rebalanced back to the target allocation.

Furthermore, rebalancing is also required as your risks and requirements change over time.

|

1.2 How to construct and manage your asset portfolio

If you define the asset portfolio as a collection of assets you have selected, the basic questions are then:

- How many asset classes should you have?

- How do you determine the amount in each asset class?

- How do you maintain them ie the rebalancing plan?

An asset allocation plan that answers these 3 questions is one where the portfolio

- Performs well under all economic scenarios

- Provides you with peace of mind

The former is focused on external factors while the latter is dependent on individual characteristics.

1.3 What factors to consider in asset allocation

The amount that you allocate to each of the asset classes takes into consideration the following parameters.

- Risk tolerance - how much you can lose without losing sleep

- Financial goals - income vs wealth building.

- Investment time frame

- Whether you are in the accumulation or withdrawal phase

If you view risk as volatility, it influences each of the above parameters.

- If you are risk-averse, you would have less exposure to those assets which are volatile such as stocks. Unfortunately, stocks have much better returns than other less volatile assets such as bonds.

- If you are looking for income you would focus on those assets that have regular payments. This could be interest from bank savings, coupons from bonds, or dividends from stocks. If you are risk-averse, you would have less exposure to volatile assets such as stocks.

- If you have a short investment horizon and are risk-averse, you would not invest in the volatile assets

- If you are in the withdrawal phase you are exposed to the “sequence-of-return” risk. If you are risk-averse, you would not invest in volatile assets because of this.

If you are risk-averse and also believe that volatility is risk, you are cutting yourself off from assets that could generate better returns.

But, if you view risk as a permanent loss of capital, you would adopt other measures to handle volatility. You can then focus on those assets that generate better returns.

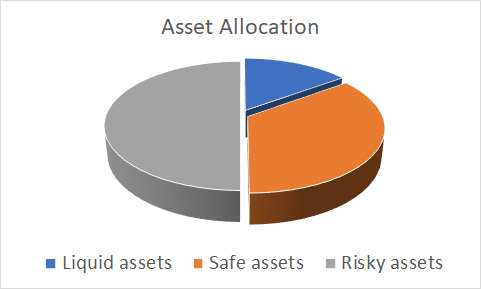

1.4 How to allocate your net worth

a) Have 3 asset classes.

This will ensure that the overall asset portfolio can perform under all economic scenarios. Refer to section 4.0

It should also enable you to balance between growing wealth and ensuring that you have some cover for emergencies. This should provide peace of mind. Refer to section 5.0

|

| Chart 1: Have 3 Asset Classes |

b) How to maintain them

If your net worth is spread to at least 3 groups of assets as per above and they are allocated rationally, a 6 monthly review should be sufficient as the value of some assets eg real estate do not change frequently. Refer to section 6.0

c) Template

I have provided examples of my own asset portfolio for the accumulation and withdrawal phases so that you can see how I have pulled together the various concepts. Refer to section 7.

2. Shortcomings of the conventional asset allocation guidelines

The conventional asset allocation advice focuses on the proportion of safe assets to invest compared to risky assets

- Safe assets ie low volatility - those that protect the principal eg bonds

- Risky assets ie high volatility - those that generate higher returns

They focus on choosing between these two asset classes. Examples are:

- 60:40 with 60% in stocks and 40% in bonds

- Age rule where the amount allocated to stocks is reduced by an age formula

- All-weather where the proportion of bonds and stocks is based on having the same risk under 4 different economic situations

- Risk parity where the proportion of each asset is based on some targeted return and risk

However, there are also other guidelines that cover more than 2 asset classes eg

- Functional asset allocation (FAA) with the proportion of each asset based on the goals

- 3 Buckets with guidelines for spending, income, growth OR now, soon, later

A brief description of each of the above is provided in the Appendix.

Then when it comes to rebalancing there are many overlapping approaches

- Strategic Asset allocation - setting target allocations and rebalancing

- Tactical Asset Allocation - actively rebalancing

- Insured Asset Allocation - setting a base asset value from which the portfolio should not drop.

- Dynamic Asset Allocation - adjusting the investment proportion based on the highs and lows of the market and the gains and losses in the economy.

Many of the conventional asset allocation guidelines do not offer a satisfactory solution for value investors as

3. Volatility

Most of the conventional asset allocation guidelines are based on viewing risk as volatility. And this means that if you want higher returns you will have to bear greater risks.

If you are risk-averse, the conventional advice would be to have a greater proportion of assets with low volatility. This generally results in lower returns as the assets with low volatility generally have low returns.

But if you don’t consider volatility as risk, you can then allocate a greater amount to those with higher returns and volatility.

How then do you protect yourself against the negative effects of volatility?

In practice, volatility comes into the picture only if you sell the volatile assets when the prices are at the low points. The only reason you do this is that you are forced to, and not because you want to.

There are two common reasons for this “forced sale”.

- You need the funds to cover some unforeseen emergencies

- There are statutory reasons to sell eg it is part of some privatization exercise.

If so, then one way to mitigate the negative effects of volatility are

- Have some emergency funds so that you are not forced to sell at the wrong time

- Select assets with a low risk of “forced sales”

3.1 Volatility and stock picking

An Alpha Architect guest article “Questioning Everything You Knew about Asset Allocation” opined

- If risk is a permanent loss of capital, you should allocate the majority to stocks

- This is because stocks provide the best returns in the long run.

However, this view assumed that you would not suffer any permanent loss of capital with stock investing.

I have a problem reconciling this with a stock-picking strategy

- If you have a strategy of selling the winners to invest in new potential ones, there is always the risk that the updated portfolio may suffer a permanent loss of capital. This could be due to bad luck, valuation error, or deterioration in the business fundaments.

- So even if you take a permanent loss of capital as a definition of risk, you cannot equate it with no risk

- Given this logic, there must be some amount allocated to safe assets

Another article in Medium titled “Low Volatility Strategies: Defying Assumptions About Risk and Return” suggested that following a low volatile strategy can improve the risk-return profile of a portfolio.

Apart from basing this on volatility as a measure of risk, the strategy is more about factor investing rather than a stock-picking investment strategy.

My point is that low volatility is not minimizing a permanent loss of capital.

Conclusions?

- Viewing risk as a permanent loss of capital rather than volatility when investing in stocks does not mean zero risk

- As long as there is a probability of some loss of capital for any assets, it means that you cannot allocate all your net worth to one particular asset class. Moreover, any asset allocation strategy must involve some asset class that protects the capital.

4. Performing under different economic situations

If the goal of asset allocation is to spread your net worth in order to do well in all economic situations (or conversely to protect against the downside) then the all-weather concept provides another lens to allocate assets.

The challenge here is then to:

- Identify the various economic scenarios

- Know how each asset perform under the various economic scenarios

I have adopted Ray Dalio’s approach that there are 4 economic scenarios that are relevant here.

These are the results of the combination of inflation vs deflation and economic growth vs depression.

You allocate your net worth so that you have the chance to benefit in each of the 4 economic scenarios.

Examples of assets that perform well under the various economic scenarios are shown in Table 1.

|

| Table 1 |

To assess the portfolio return under the various economic scenarios, you need to estimate the returns of each of the asset classes under the 4 economic scenarios.

You could use historical records as the starting point.

To illustrate, assume that you have a portfolio of an equal amount invested in different assets that behaved as shown in Table 2.

|

| Table 2 |

The overall return under each economic scenario is the average return of all the assets in the portfolio under the respective economic scenarios.

Accordingly, for the example above you have the results as shown in the upper half of Table 3.

|

| Table 3 |

The overall expected return for the portfolio assuming that the 4 economic scenarios are equally likely to occur is then the simple average ie 3.25 %

The above illustrations assume that an equal amount is allocated to each asset class.

If different amounts are allocated, you would then weigh the assets by the amount allocated to arrive at the respective returns.

If the economic scenarios have different probabilities of occurring, the formula should incorporate them.

To illustrate, suppose the historical probabilities are as shown in the bottom half of Table 3. (Note that is based on the economic performance for Malaysia over the past 40 years).

Based on the return and probabilities above, the portfolio expected return is 4.29 % derived as follows

= (4.75 X 0.7) + (4.0 X 0.16) + (2.5 X 0.11) + (1.75 X 0.03)

5. Peace of mind

There are several ways in which you can define peace of mind.

I adopted the idea that it is an allocation plan that allows you to sleep easily at night. To me this means

- I don’t have to worry about emergencies

- I have some floor net worth to fall back on in case all my risky investments tank

- I have risk mitigation plans for each of my risky assets

To translate the above into practice, I have some of my net worth in

- Liquid assets to cover emergencies eg cash.

- Safe assets that protect the principal. This will serve as a floor net worth.

Taking this to the logical conclusion it must mean having at least 3 groups of assets in your asset allocation plan

- Liquid assets

- Safe assets. While risky assets provide the best returns, you can also suffer losses. The safe assets are meant to provide some floor for your net worth in event of such losses. At the same time, safe assets also provide better returns under certain economic scenarios

- Risky assets. You can suffer some permanent loss of capital with these investments. But these have returns that stand out during the favourable economic scenarios. They overshadow the poor performance during the bad times. It is risky so you need to learn how to invest in them and to be able to adopt a host of risk mitigation strategies.

In the context of achieving peace of mind, having a proven analytical and valuation approach in your investment process is also important. If you are just starting out, one way to supplement the lack of experience is to rely on other advisers with good track records eg Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can be assured that they a long history behind their business analysis, valuation, and risk assessment.

5.1 Risk mitigation

Both the volatility school and the permanent loss of capital one advocate asset allocation as a way to manage risk.

The difference between both schools is then about how each identifies and manages risks.

- The volatility schools focus on systemic risks and demand higher returns for bearing higher risks.

- The permanent loss of capital school will look at the threats that lead to impairment of capital and adopt a host of measures to mitigate this.

There are 4 ways that you can suffer a permanent loss of capital. (Refer to the post "Baby steps in assessing permanent loss of capital")

- Deterioration in intrinsic value due to changes in the fundamentals

- Market risk

- Analytical errors

- Behavioral issues

If you adopt a host of measures to mitigate the permanent loss of capital, you cover more of the threats associated with behavioral, analytical, and even market risks.

The one that you don’t have much control over relates to the changes in the business fundamentals.

Taking this to its logical conclusion, it means that you cannot have all your assets allocated to risky ones. This is irrespective of how good your risk mitigation measures can be.

5.2 Higher returns without higher permanent loss of capital

An overlooked point for the permanent loss of capital school is that you don’t have to take on higher risks for expecting higher returns

To achieve this, you will need to adopt a host of measures to mitigate against permanent loss of capital.

How do you achieve this? Refer to the following posts

If you can achieve this,

- You can allocate more to the ones with higher returns without following the conventional view that this may mean more risk

- You can continue to hold onto the risky assets as you enter the withdrawal phase. The conventional view that as you grow older, you have less time to recover from a loss would not apply.

6. Long-term investment horizon

We have looked so far at the factors to be considered if you are a stock-picker and if you view risk as permanent loss of capital.

The final consideration is the impact of a long-term investment horizon.

It is obvious that with a long-term investment horizon, rebalancing will be required. But even leaving aside this issue, there are other constraints with this investment horizon.

A long-term investment horizon for a stock-picker does not mean that the portfolio remains unchanged.

It meant that you are willing to wait for a long time for the investment to generate the required return. In the meantime, you must have other income sources if this is required.

The long investment horizon also means that you may transition from the wealth accumulation phase to the withdrawal phase.

At this juncture, you have to take into account the sequence-of-returns risk.

What is the sequence-of-returns risk?

- This is the risk that comes from the order in which your investment returns occur.

- For example, a market decline in the early years of retirement paired with ongoing withdrawals could reduce the amount you have and hence the life of a portfolio.

In other words, the sequence-of-returns risk is the risk that your withdrawals reduce your investible sum.

But if you are still diversified and all the other risk mitigation still holds after the withdrawal, there is no permanent loss of capital.

If you could suffer a permanent loss of capital when you withdraw money from the portfolio, you need an emergency fund so that you don't have to sell your risky assets when the market is down.

Clearly, the sequence-of-return risk is not about volatility. It can cause a permanent loss of capital.

If so, you may need separate asset allocation guidelines for an accumulation phase compared with a withdrawal phase.

7. My Asset allocation plan

“Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance, and investment horizon” Investopedia

If risk is not a function of returns, we can then have a separate process to mitigate risk while selecting a plan that maximizes return.

- Then allocate the net worth to several asset classes as each serves a specific objective

- Since there is no one “best” allocation strategy, we should look at the risk-return from various perspectives

In terms of rebalancing, the goal is to bring the current allocation back to its original allocation goal.

- If the allocation is out of balance due to volatility, from a permanent loss of capital school perspective, this should be ignored.

- If it is out of balance due to some permanent loss of capital, then rebalancing is required

- Furthermore, you also rebalance if there is a change in the investment goal

Given all the above considerations, I have adopted the following in my asset allocation plan

- Look at asset allocation from several perspectives

- From the liquid, safe and risky assets perspective so that there is some floor to the net worth

- From the FAA perspective so see that it covers all the asset allocation goals

- From an all-weather perspective to benefit under all economic scenarios

- There may be more than 3 asset classes since it needs to meet several perspectives

- As a long-term investor ignoring volatility, you can rebalance annually. A tactical or dynamic asset allocation may not be necessary especially if there are frequent reviews of the items within each asset class.

My asset allocation plan based on the above guidelines are summarized below.

7.1 Asset Allocation for Accumulation Phase

- 2 years of annual expenditure as cash. This assumes that should you lose your job, you can survive for 2 years

- Start with an equal amount of safe and risky assets. There is no guarantee that you would not suffer any permanent loss of capital from investing in risky assets

- The safe assets are the ones that provide some returns in a depression or deflation environment. The risky assets are the ones that provide the returns in economic growth or inflationary environment.

- As you build up your net worth, you will reach a stage where you have 10 years of annual expenditure each in both the safe and risky assets. At this juncture cap the safe assets at 10 years of annual expenditure and allocate all the “excess” to the risky assets

- Rebalance annually based on the additional savings from your income as well as the returns generated from the various investments.

7.2 Asset Allocation for Withdrawal Phase

- Still maintain the cash at 2 years annual expenditure

- Rebalance over a 5-years transition period from accumulation to withdrawal so that the safe assets are the same amounts as the risky assets. This probably means transferring some from the risky assets to the safe assets.

- During the transition, your risk mitigation measures for the risky assets should provide some comfort level.

- The equal amount in the safe and risky assets would cover the risk for all the economic scenarios

- After the transition, rebalance annually to take into account what you have withdrawn.

7.3 My portfolio

The charts below show is how my net worth looks like for the accumulation and withdrawal phases from the lenses of 3 Buckets, FAA and All-Weather.

|

| Chart 2: My Asset Profile in the Wealth Accumulation Phase |

- When you compare the accumulation phase with the withdrawal phase, remember that the net worth at the withdrawal stage is about doubled that at the accumulation phase. While the % of cash may be smaller at the withdrawal phase, the reality is that the quantum is about the same.

- Under the All-Weather lens, the goal was to have about the same ratio in real estate, stocks, and fixed income to cover the various economic scenarios.

- In the Malaysian context, depending on the time frame, the stock market and properties can provide good returns. Refer to "In Malaysia, which has better returns, stock market or property?"

- I did try to invest in commodities but because of the poor track record, I have not considered this asset class. I am relying on the stocks to provide the safety net in a stagflation environment.

|

| Chart 3: My Asset Profile in the Wealth Withdrawal Phase |

8. Pulling it all together

- There are 3 questions when it comes to asset allocation

- How many asset classes?

- How to determine that amount for each class?

- How do you rebalance?

- Any asset allocation plan should satisfy at least 2 goals:

- Perform well under various economic situations,

- Provide you with peace of mind

- There are 4 main economic scenarios that we live through. These are the results of the combination of inflation vs deflation and economic growth vs depression.

- Peace of mind comes from having an asset allocation plan that you can stick with and sleep peacefully at night. In my case, it should satisfy the following

- Covers emergencies

- Provides a floor net worth

- Includes a risk mitigation plan for each of your risky asset classes

- At its core asset allocation is about risk mitigation and should take into account your investment style. My asset allocation plan taking these into consideration covers the following:

- Have 3 groups - liquid, safe and risky assets. Within each group, you can have a few different types of investments

- View the asset allocation through several lenses - 3 Buckets, FAA, and All-Weather.

- When starting out young and at the accumulation phase, have an equal amount for the safe and risky assets. As your wealth increases cap the amount for the safe assets so that more is channeled to the risky assets.

- At the withdrawal phase, have an equal amount in the safe and risky assets

It is obvious that the asset allocation plan will differ for different people as we all have different investment paths, demographics, and risk tolerances.

But I hope that the article has provided you with a framework to think about the issues so that you can establish your own asset allocation plan.

END

9. Appendix

1) 60:40 rule

- The rule dictates 60% of the portfolio is invested in stocks and 40% in bonds or other “safe” classes

- The portfolio should provide equity-like returns while smoothing out the extreme highs and lows (volatility) that come with an equity-only portfolio.

- Schroders' analysis shows that investment over the last 30 years, based on this strategy, has been effective both in terms of smoothing out volatility but also delivering a superior return.

2) Age rule

- The basic principle behind age-based asset allocation is that your exposure to portfolio risk needs to reduce with age since retirees don’t have the luxury of waiting for the market to bounce back after a dip.

- If you follow the 100 minus age rule to find your % equity allocation, subtract your current age from 100.

- Because of the increased life expectancy, many have advocated using 110 or 120 rather than 100.

3) All-weather

- This was created by Ray Dalio so that the portfolio works in 4 economic scenarios resulting from a combination of inflation vs deflation and economic growth vs economic stagnation.

- The portfolio consists of 55% U.S. bonds, 30% U.S. stocks, and 15% hard assets (Gold + Commodities).

- Every asset performs differently based on what is happening in the 4 macroeconomic environments, so the portfolio allocation reflects this. The key idea is that it works no matter what the future holds.

4) Risk parity

- This is based on the Modern Portfolio Theory. It focuses on the allocation of risk, usually defined as volatility, rather than the allocation of capital.

- An investment portfolio can include stocks and bonds. However, the investment class proportions are determined by a targeted risk and return level.

- This is often achieved by using leverage to weight risk equally among different asset classes using the optimal risk target level.

5) Functional basis

- This was developed by Bert Whitehead and incorporates elements of Modern Portfolio Theory on the investment side with an added layer of scrutiny into the needs, values, and goals.

- It focuses on the annual growth of a client’s “total marketable net worth” by dividing the assets into three categories:

- Interest-earning (Cash savings and Bonds) to preserve capital

- Real Estate to protect against inflation

- Equities to get the best returns

6) Bucket strategy

- Pioneered by Harold Evensk, it divides assets into different “buckets”. It was developed to deal with the problem of “mental accounting”

- There is a goals-based bucket strategy where people design investment buckets around specific goals they have.

- Then there is the time horizon bucket strategy - now, soon or later.

- The amount to be allocated to each bucket depends on the goals and rebalancing among the buckets is critical.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment