How To Mitigate Risks When Value Investing

Fundamentals 03: Risks differ depending on the type of assets and investment style. This post looks at risk and risk mitigation from the perspective of a stock-picking value investor. Note that there is a PowerPoint presentation of this article on SlideShare under "Baby steps in managing investment risks". Revision date: 10 May 2023

|

| "Risks come from not knowing what you are doing" Warren Buffett |

When you invest in equities, the goal is of course to get a better return compared to keeping monies in fixed deposits.

Unfortunately, the returns from equity investment are not guaranteed. There will be times when you will make less than what you can from fixed deposits.

Worst still there will be times when you lose all your investments. The challenge is how to mitigate against risk.

There are 2 schools of thought when it comes to risks

- Those that treat risk as some form of variance

- Those that consider risk as a permanent loss of capital

I have a 3-minutes video that gives you an overview of my risk management approach. Watch it if you have the time. It will show how I mitigate against risk.

This post is about how to mitigate against permanent loss of capital. This is because I look at investments from a long-term perspective. Any variance is a paper loss or gain that I do not worry about.

BTW, this is not some textbook treatise. Rather it is based on what I have adopted over the years. I hope it will be of some practical use as you invest.

Contents

- What is risk?

- Comprehensive approach

- Risk management and Portfolio construction

- Managing risk at the individual stock level

- How to use the margin of safety

- Risk and Valuation

- Why rate companies?

- Risk tolerance

- Pulling it all together

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you. Learn more.

|

What is risk?

Some would consider risk as to the likelihood of not earning what you expect. However, I would argue that if you still have some money left, there is a chance that you can make back what you lost.

However, this is not the case if you lose all your investment. I thus consider this as the real risk of investing in equities, what Warren Buffet refers to as a permanent loss of capital.

Over the years, I have suffered such permanent loss of capital from 3 situations:

- Selling during a temporary price drop thereby converting the temporary loss into a permanent loss. I think I no longer have this risk having learned to invest for the long term. At the same time, I do not invest using borrowings so that there is no pressure to sell an investment at the wrong time.

- A deterioration in the intrinsic value to permanently below the purchase price. Over the past 15 years, I have had 3 cases of such losses. Two were due to outright fraud by the companies while the other was due to business risks.

- Privatization by the controlling shareholders. There have been occasions where I have benefited from a privatization exercise. But there were a few privatization exercises where the offered price was below my purchase price. OK, you can argue that I should have bought the shares with more margin of safety.

What is the moral of the story here? Having a margin of safety is often seen as a way to protect against bad luck and valuation errors. However, no amount of margin of safety can protect you against fraud.

Apart from the risk arising from valuation errors and outright fraud, you are also exposed to the company’s fundamental risks (business and financial) as well as the country’s macroeconomic risks.

Finally, there is also a risk in the type of investments you make.

- It is definitely riskiest to invest in turnarounds. These are companies facing some problem that needs to be addressed to return to profitability. There are lots of upsides if the company can achieve the turnaround as the market would probably have priced the company as if there is no hope

- If you invest in a high-quality company, there is less risk of a permanent loss of capital. Of course, the gain may be less than what you would get from investing in a turnaround.

|

Comprehensive approach

Risk pervades all aspects of investing. As such when you talk of mitigating investing risk, you need a comprehensive approach.

I suggest a 3-level approach:

- Have an asset allocation plan. This will determine the amount of the net worth you set aside for risky assets such as stocks.

- For each asset class, have a portfolio. For example, in the context of stocks, establish a stock portfolio.

- At the individual item level, learn how to invest and have an investment process that mitigates risk. When it comes to stocks, I chose value investing and I have an investment process that is risk-focused.

Each of the above will require several blogs posts each to cover them well. I will provide an overview of each of them here so that you know how to mitigate against risk.

Asset allocation

There are many who believes that this is the heart of investing risk. If you get this wrong, it is very hard for the other 2 levels to offset the mistakes made at this level.

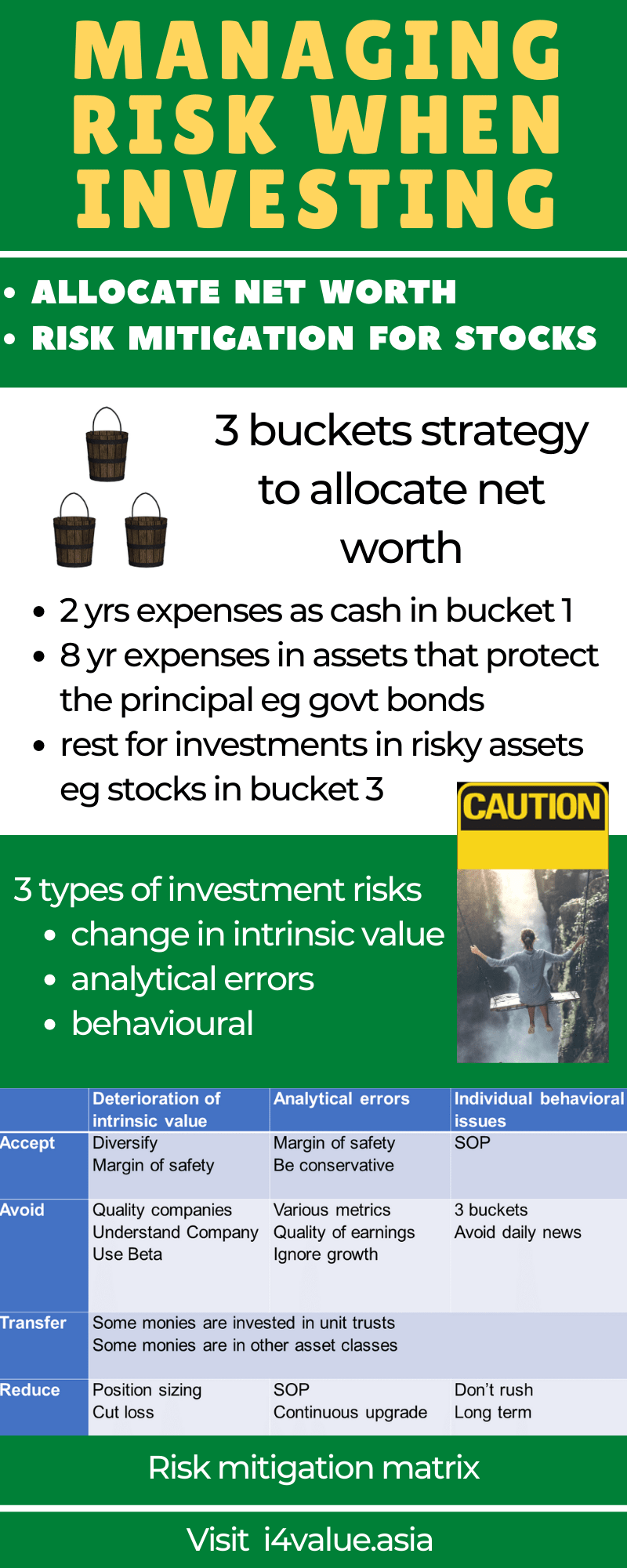

There are many asset allocation plans. I chose the 3 Buckets strategy as it is a risk-focussed approach. For details refer to “Baby steps in asset allocation for a value investor.”

The 3 Buckets strategy is about dividing your net worth into 3 parts

- Bucket 1 - have 2 years of your annual expenditure as cash. This is meant for emergencies so that you do not have to sell risky assets at the wrong time

- Bucket 2 - have another 8 years of your annual expenditure in those assets that protect the principle. These could be government bonds or properties. The goal is not to make monies from these assets. Rather it is to assure that you have some savings.

- Bucket 3 - the balance of your net worth is in this bucket. This is for investing in risky assets whose prices can vary over time. By having some of your net worth in Buckets 1 and 2, you can take a long-term view and ride our market variations.

- Periodically re-balance so that you maintain the amount allocated to each Bucket

Risk management and Portfolio construction

The main goal of having a portfolio of stocks is to mitigate against risk. You want a diversified portfolio so that if anything bad happens to one company, you are still OK on an overall basis.

But for this to serve its purpose, academic research shows that you need at least 30 different stocks to be well-diversified. These 30 stocks should be from different sectors. I generally slice and dice them so that they are also from different market cap and investment styles (eg turnaround vs Graham Net Nets).

The real challenge is how to determine the amount to be invested in each stock ie the position size.

There is a relationship between the number of stocks in the portfolio, the position size, and the total amount allocated to the portfolio.

- Imagine that you have RM 100,000 set aside for the portfolio.

- If you decide to have an equal amount invested in each of the 20 stocks, then you would invest RM 5,000 in each stock so that they sum up to RM 100,000.

- You can also decide to have 20 stocks with a total investment of RM 100,000 but with different position sizes.

So how do you determine the position size? I adopt a risk management approach to position sizing

- I divide my portfolio into 3 groups based on conviction.

- The ones with the best conviction are those with the largest margin of safety, compounders, and dividend-paying history

- The ones with the least conviction are those facing turnarounds. These are deep-value investments with a poor dividend track record

- To simplify things, I have about an equal number of stocks in each category

How do I allocate my funds?

- The ones with the least conviction are allocated RM X each.

- Then I would allocate RM 2X to each of those with the best conviction

- The ones in between will receive RM 1.5X each

- You can determine X mathematically so that the total amount invested comes up to the amount set aside for stocks.

You can develop your own formula, but the key point is that it should have some risk mitigation basis. Otherwise, it defeats the goal of having a portfolio.

For further details on stock portfolios, refer to the following:

I also have a series where I take you through a step-by-step on managing a stock portfolio that I established. Refer to the first of the series “How to construct a winning stock portfolio for 2022.”

Managing risk at the individual stock level

Once you have determined the amount to be set aside for stocks and plan to have a stock portfolio, the first step is to establish the stock investment process.

This is about identifying individual stocks to invest in. The challenge is then adopting an investment process that has risk mitigation as its core.

The starting point is to identify the various ways you can suffer a permanent loss of capital. Then you establish the various measures to mitigate against risk.

Risk management

My approach to protecting against risk is to first identify all the things that can go wrong in the valuation process.

Then I adopt several measures to protect against the various risk items.

From a value investing perspective, I would categorize all the things that can go wrong into 3

- Those that lead to a deterioration in intrinsic values. These are generally due to changes in the business fundamentals. These in turn are due to socio-economic, political, secular, and business strategies changes.

- Those due to analytical errors. These could be computation errors. There is even misleading information in the financial statements due to creative accounting. I would also place outright fraud here.

- Those due to behavioral biases.

To minimize the impact of the above risks, I adopt four standard risk-mitigating strategies.

- Accept: With some risks, the expenses involved in mitigating the risk are more than the cost of tolerating the risk. In this situation, accept the risks and carefully watch them.

- Avoid: In general, avoid risks that involve a high probability impact for financial loss and damage.

- Transfer: Mitigate risks by sharing or transferring them.

- Reduce: The most common mitigation strategy is risk limitation

Following this approach, you then have a matrix with the 4 risk mitigation measures on one axis and the 3 risk categories on the other axis. For further details, refer to “Baby steps in assessing permanent loss of capital”

You then identify what can be done in each of the cells formed by the intersection of the items in each axis.

An example of my risk mitigation strategies using this framework is shown in the chart below.

Over the years, I have learned that risk is not some number. There are many ways to suffer permanent loss of capital.

The best is to approach risk analysis and risk mitigation from several angles. I slice and dice what could go wrong in many ways.

The risk mitigation framework above is only one perspective.

The sections below provide other perspectives to mitigate against risk.

Risk mitigation measures

Since risk can come from many sources, you will need to cover it from many angles as follows:

1) Adopt a conservative approach in the valuation. Use conservative estimates for the various valuation parameters.

For example, if there are growing trends for the profits and/or cash flows, any valuation that assumes zero growth will be conservative.

2) Have different levels of the margin of safety depending on the nature of the investment.

For example, have a larger safety margin for companies going through a turnaround compared to one with a "consistent" track record. I also choose companies with some dividend track record as I consider dividend payment as some form of margin of safety.

3) Focus on quality stocks and those with a long operating history to guard against fraud and the business environment.

I have incorporated several academic quality and risk indicators in my analysis. Examples are the Beneish M Score, the Piostroski F Score, and Altzman Z Score.

To help in this evaluation, I have also developed a Q Rating system.

4) Diversify. I adopt a 2-tiered diversification plan.

- Firstly, I invest in several asset classes with equity as only one of them.

- Secondly, I hold a portfolio of about 30 to 40 companies. These are from different sectors, and market capitalization categories of investments. (Refer to the valuation posting to see how I categorize my investments)

5) Understand the company. Get a good picture of how it got to its present position.

Understanding its business model and strategies helps me get a handle on its fundamental and macroeconomic risks.

6) Invest in the long-term. This helps to mitigate any short-term economic upheavals.

7) Be prepared to cut loss if the investment thesis is no longer valid.

I have done this several times. While there are some initial losses, I can more than make up for the losses by investing the money in other companies with better prospects.

8) Invest more in those where you have more confidence. This is related to the position sizing strategy.

9) Incorporate Beta into the valuation. When I first started, I used one discount rate in my valuation. To account for the risks, I now use the Capital Asset Pricing model to determine the discount rate. Refer to “Considering both volatility and permanent loss of capital as risk”

OK, this is a bit more technical and you can get more info from my Definitions page.

10) At the end of the day, the best risk mitigation strategy is to look at the investment from the downside protection perspective. Let the upside take care of itself. Don’t think of the returns that can be made. Rather think of how to prevent losses.

I am sure that there are many other ways to protect yourself. If you have other ideas, I would be delighted if you could share them with me. Then I could build a more comprehensive way to mitigate against risk.

How to use the margin of safety

Warren Buffet considered "margin of safety" as the 3 most important words in investing.

The concept of the margin of safety in investing was popularized by Benjamin Graham, the father of value investing.

It refers to the extent to which the market price of a company is below the estimates of its intrinsic value. It offers you some protection in case you made some error in estimating the intrinsic value.

Accordingly, the margin of safety is also an indication of the potential upside for the investment

But more importantly, you make many assumptions in valuing companies. Just because it is mathematically correct does not mean that it reflects reality. The margin of safety is recognizing this imperfection.

It is obvious that how you approach valuation would impact the margin of safety. If you are very gung-ho and use very optimistic assumptions, you will have a bigger margin of safety compared to if you adopted a conservative approach. The general advise is to determine the intrinsic value based on conservative estimates.

But I would argue that there is more to the margin of safety that just looking at the intrinsic value-price discount. Let me illustrate with a few examples.

- When valuing cyclical companies, I look at the performance over the cycle. You may have a situation where the current profits are very much higher than the cyclical profits. I consider the profits in the current year that is in excess of the cyclical profits as an additional margin of safety. This is because the intrinsic value is based on the cyclical profits.

- The intrinsic values are based on the Free Cash Flow available. The general assumption is that this can be distributed to shareholders. Some companies have aggressive share buyback programmes that may boost share prices. In such cases, I consider the potential share buyback as another margin of safety.

- I value companies using the FCFF model. One of the input parameters is the Total Capital Employed (TCE). In many instances the TCE used is lower than the actual current TCE. In other words, the current TCE is in excess of what is used in the valuation model. I consider this excess an additional margin of safety. Depending on the situation, I some times add this excess as part of the non-operating assets.

- Your returns come from both capital gains and dividends. Comparing intrinsic value and market price focus on the capital gains side. If a company has a good dividend track record, I also consider the dividend yield as an additional margin of safety.

- When I value companies, I based it on its historical performance. In most cases I ignore any plans that the companies have to improve the profits. If the company has a management team with a good track record of profit improvements, I would consider such plans as another margin of safety.

You can see that not all the margins of safety can be quantified. But if I can get a 20 % margin of safety based on the standard intrinsic value-to-price comparison, I would consider the qualitative margins.

The requirement for the margin of safety is that you must first be able to determine the intrinsic value. If you do not have the skills to do so, and you still want to invest as a value investor, one way is to rely on other experts to assess and value companies for you. Those who do this well include people like Seeking Alpha.* Click the link for some free stock advice. I suggest that you try them out.

Risk and Valuation

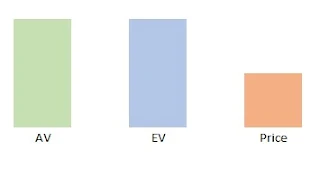

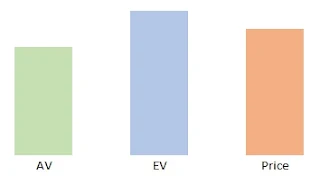

To bring risk to the valuation analysis, I adapt Professor Bruce Greenwald's approach of comparing Asset value (AV) and Earnings value (EV).

I look at the margin of safety in the context of the AV and EV analysis with the following 4 scenarios:

Scenario 1: Excellent margin of safety. In this case, the market price is significantly below both the AV and EV

Scenario 1: Excellent margin of safety. In this case, the market price is significantly below both the AV and EV

Scenario 2: Acceptable margin of safety. In this case, the market price is higher than the EV but lower than the AV. If you invest in a company under this scenario, it must be because you believe that the company would be able to turn around and that in the worst-case scenario, the value of the assets would offer some protection if the business fails.

Scenario 3: Better than an acceptable margin of safety. In this case, the market price is higher than the AV but lower than the EV. In this scenario, you believe that the company’s competitive edge would provide you with some margin of safety.

Scenario 4: Poor margin of safety: In this case, the market price exceeds both the AV and EV. The only rationale for investing in such a company is that you believe that the EV will increase over time i.e. you believe that this is some growth company whose future value has yet to be captured in the current EV.

Why rate companies?

Benjamin Graham, the father of value investing has 10 criteria in his stock selection process.

Half of the criteria relate to stock valuation while the balance covers the fundamentals of the company.

The basic message is that any company you invest in must meet both your valuation target as well as the business performance target.

You assess the business performance both qualitatively as well as quantitatively. But when it comes to quantitative evaluation many use some rating system.

I found that many US investment advisors develop their rating system to quantify the "quality" and or risk of a company.

So given my engineering background, I reverse-engineered what I could find. This enabled me to come up with a quantitative evaluation method.

In investing, I would consider "quality" from the perspective of creating shareholders' value.

- A high-quality company is one with a good chance of increasing its shareholders' value

- A poor-quality company is one that may even destroy shareholders' value

Imagine a rating system that is pegged to all the metrics driving shareholders' value. This is the basis of my Q Rating. It is a visual way to help mitigate against risk.

Q Rating.

The result is a rating system (referred to as a Q Rating) based on 34 metrics covering 5 main parameters

- Profitability.

- Growth.

- Financial.

- Other risks.

- Business model

It is a simple 1 or 0 scoring scheme for each metric.

- The scores for each of the main parameters are the average score of all the metrics associated with the parameter.

- I then compute the overall Q Rating by computing the simple average scores of the 5 parameters.

Most of the information for the metrics is extracted from the company’s financial statements.

As the financial statements for financial institutions are different, the Q Rating does not apply to them.

Several academic and research concepts such as the Beneish M score, Piotroski F score, Altzman Z score, and Intensity of Core Earnings are part of the 34 metrics.

I have back-tested the Q Rating against many performance indicators such as total return, ROE, and growth. I found that a high Q Rating score points to a likelihood of positive total return in the coming 4 years.

I analyze about 80 – 100 companies every year and I update the Q Rating accordingly.

- I have found that the Q Rating for a specific company varies with the economic climate.

- The Q Rating is a relative rating scheme ie how does a particular company score relative to the rating of all the companies covered?

The table below the range of the Q Rating for 3 sample periods

|

| Table 1: Distribution of Q Ratings for various years |

To help such an assessment, I determine the Q Rating quartile score for the year and then compare individual company Q Rating against this quartile score.

You can see that the scores have reduced over the years. This is partly to the change in the samples. But more importantly, the performance of the panel has declined. Since the Q Rating is a relative rating scheme, I would use the latest distribution when interpreting the results.

There are several ways to interpret the Q Rating:

- Use it as a “quality” or performance indicator that is independent of the price or value of a company. A relatively high score meant a higher “quality” company.

- I often use the Q Rating as a proxy for risk where are low Q Rating means a riskier company.

- Use it as a ranking scheme to categorize companies into types of investments. Investing in a company with a high score is equivalent to investing in a high-quality company whereas investing in a company with a low score meant investing in a turnaround case.

The key point is to see the Q Rating as another assessment tool.

To help visualize the results, I generally chart the results as shown below

Risk Tolerance

Risk tolerance is a term that you will come across frequently when you read about investment risks. It is the degree of risk that an investor is willing to endure in an investment.

All investments involve some degree of risk and knowing their risk tolerance level helps investors plan how they invest. Based on how much risk they can tolerate, investors are classified as aggressive, moderate, and conservative

Greater risk tolerance means that you will be more willing to lose more money. Many financial advisers then have some questionnaire that is supposed to help assess your risk tolerance.

I have a simpler approach. Your risk tolerance is reflected in the following:

- The amount you allocate between the safe and risky assets in the 3-Buckets asset allocation plan. A more risk-taking person will have a greater amount allocated to risky assets.

- The margin of safety you use. A more risk-taking person will settle for a lower margin of safety.

- How you use the margins of safety in the context of risk and valuation. A very risk-averse investor would only look for cases when the market price is lower than both the Asset Value and Earnings Value.

My point is that you don’t need questionnaires to assess your own risk tolerance. You will know based on the way you addressed the above.

Pulling it all together

Risk is not a number. For a long-term value investor, it is not some variance.

It is about a permanent loss of capital. Risk mitigation is about doing all the things to prevent or minimize such a permanent loss.

- It starts with how you allocate your net worth using the 3 buckets strategy

- Then you allocate what has been set aside for risky assets into several asset classes. For example, I invest in properties and stocks.

- For stocks, I invest as a value investor using a host of concepts to protect against risk>

- Adopt the risk mitigation matrix.

- Follow a list of mitigation measures.

- Incorporate risk into valuation based on Bruce Greenwald's approach.

- Rate companies using the Q Rating.

- Construct your portfolio with risk mitigation in mind.

It is a frame of mind and what I have presented above are various tools in your toolkit to help you mitigate against risk.

Depending on your background you may lean towards the more quantitative approaches or the more qualitative ones. The key point is that you should use both.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

ReplyDeleteHey what a brilliant post I have come across and believe me I have been searching out for this similar kind of post for past a week and hardly came across this. Thank you very much and will look for more postings from you Best lost money recovery services service provider

ReplyDeleteIt’s great to come across a blog every once in a while that isn’t the same out of date rehashed material. Fantastic read. Best antminer l7 service provider.

Great and valuable info shared by you I am doing my online MBA course in financial management this info really helpful for me. keep sharing.

ReplyDelete

ReplyDeleteThank you for sharing .....https://digitalrudhra.in/