Baby steps in maintaining a stock portfolio

Fundamentals 06-2: There are two aspects in managing any stock portfolio - construction and maintenance. This post focuses on the maintenance of a stock portfolio while the construction issues are covered in "Baby steps in constructing a stock portfolio."

Imagine that you have purchased a group of stocks making up your initial stock portfolio. You have constructed your stock portfolio.

Since you consider yourself as a long-term value investor, do you hold onto the stocks forever? There are also a host of other questions that come to mind as you manage the stock portfolio:

- How do you grow wealth with the stock portfolio?

- What do you do with the dividends you receive?

- How do you assess the portfolio performance when you put in more funds?

Constructing the stock portfolio is the first step. You now have to address these and other questions as a part of the management process.

I will share my views on maintaining the stock portfolio. This is from a bottom-up, stock-picking, fundamentals-based value investing perspective. I have also provided many illustrative calculations so that you can use them as templates in assessing your own portfolio.

I am assuming that you have the interest and numerical skills to analyze and value companies. If you do not, all is not lost and there are several financial advisers who will them for you. Those who do this well include people like Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can tap into their business analysis, valuation, and risk assessment.

|

Contents

- What to consider at the start?

- Assessing performance

- Assessing risk

- Periodic review and Rebalancing

- Pulling it all together

What to consider at the start?

What is at the core of portfolio management? It is about monitoring the performance of the portfolio against its objectives. And then taking action to achieve the objectives.

As covered in Part 1 of this series, managing a stock portfolio is about balancing two objectives - returns and risks.

You should track the portfolio return and risk performance and understand the options available to manage them. But first, consider some of the common questions on stock portfolio management

What is the difference between asset management and stock portfolio management?

Asset allocation refers to spreading your net worth to several asset classes. Asset management then relates to monitoring and rebalancing the amount invested to meet the asset allocation objectives.

Stock is one of the many asset classes and stock portfolio management relates to managing the stocks in the portfolio.

Both are about spreading your money between various investments. They differ only in the level or depth of investments.

How long should you hold onto a stock?

“Our favourite holding period is forever.” Warren Buffett

If you are able to select stocks that will forever be the best stocks based on their business fundamentals, you should hold onto them forever.

- The businesses of these companies will continue to be the best and the intrinsic values of these companies will continue to grow.

- The market value of these companies will continue to increase in the long term.

- The value of the stock portfolio will thus increase over time. Furthermore, if you reinvest the dividends, you will add to the value of the portfolio.

You will then have a passive portfolio management process.

I do not have the ability to identify such “forever” stocks. I suspect all retail investors will not have this ability as well. My approach is:

- To hold onto the stocks until they are overvalued.

- I then sell them and use the money to reinvest in other undervalued stocks.

- Every sale will increase the amount invested. If you can achieve consistent portfolio returns over decades with this, you can grow wealth through the power of compounding.

What is the difference between active and passive portfolio management?

- Active management involves requires frequent selling and buying of stocks to meet the portfolio objectives.

- Apart from being able to identify the “forever best” stocks, the practical way to have a passive stock portfolio is to invest in an index fund or ETF

I have previously invested in an index fund/ETF but found that the returns have not been as good as what I have achieved with a stock-picking approach. As such, I have focused on being an active stock-picker.

How to grow wealth with your stock portfolio?

Based on the discussions in the previous sections, there are two ways to grow wealth:

- Select and hold onto stocks that will forever be the best. The value of the portfolio will increase as the underlying businesses of these stocks flourish.

- Have a portfolio of stocks that you will sell and reinvest based on your investment criteria. The amount invested in the portfolio will increase with the reinvestment.

In the former, you grow wealth as the businesses you own grow. You are acting as a business owner. To achieve this, you need to be able to identify the companies that will forever be the best.

In the latter, you grow wealth by having consistent returns with an increasing investible amount. To achieve this, you need to invest for decades with high returns. I would think that you will need at least a 10 % CAGR.

Seeing what has happened to Nokia and Kodak, I would think that it would be difficult to identify companies that will be the best forever.

While achieving consistently good returns can be challenging, it is more doable than identifying the ‘forever good” companies.

When to sell individual stocks

From a value investment perspective, there are 3 main reasons for selling a stock in the portfolio:

- When it is overvalued.

- When it is no longer a value stock.

- When you have made a mistake.

The first is the easiest to handle. If you track the stock price and update your stock valuation, you will know when the market price exceeds the intrinsic value. My approach is to scale down the position when the market price is about the same as my computed intrinsic value. I would have divested fully when the market price is 50% higher than my computed intrinsic value.

As for the second reason, there are times when the business prospects of a company deteriorate. This could be due to some unforeseen secular trend, digital disruption, or political development. If you update the stock valuation periodically, you would be able to pick this out. When faced with such a situation I sell.

Finally, if I find out that I have made an error in my analysis or valuation such that the market price is greater than the updated intrinsic value, I sell. There were times when the price of the stock remained low for 7 to 8 years. I tend to classify such a stock as an error as well.

What to do with dividends

A common piece of advice for retail investors is that you should reinvest the dividends in the same stock that paid the dividend.

But as an active stock-picker, I do not reinvest into the same stock that paid the dividend. This is because:

- I may have other better-undervalued stocks to add to the portfolio.

- Increasing the amount invested in the stock paying the dividend may affect my diversification plan.

- Sometimes I want to invest the money into other assets as part of the asset allocation plan.

Once in a while, I want to spend the money. But even leaving this aside, you can see that there are valid reasons not to reinvest the dividend into the same stock that paid the dividend.

Assessing performance

Keeping tabs on your portfolio performance is an important part of investing. It enables you to adjust the investments as needed to stay on track toward the financial goals.

When it comes to assessing performance, you have the following options:

- Look at absolute returns.

- Compare your returns with those of the benchmarks.

- Compare the returns on a risk-adjusted basis.

How to measure portfolio returns

Let me begin by differentiating gain with % return as follows:

- The following equation represents the gain from an investment over a specific period. Total Gain = current value - previous value + dividends + any uninvested money.

- The return for the period = gain divided by the previous portfolio value.

The current and previous values refer to the value of the portfolio assuming it is liquidated.

As such, I used the market value of the stocks in the portfolio to calculate the portfolio value. It is the sum of the market value of the respective stocks.

The market value of a particular stock = number of shares held X market price. The number of shares held currently may be different from the number of shares held before due to bonus issues and or other corporate activities.

To ensure that I am comparing apple to apple, I also include any dividends or money that I have received that has not been reinvested.

- This could be money pending reinvestment.

- This could also be money taken out.

The dividends refer to all the dividends paid during the measurement period. Since there is a likelihood that you may reinvest the dividends, I look at the after-tax value of the dividends received.

How to account for new funds added or fees and commission

If you have added new funds to the portfolio, you should include the amount of the fund to the previous portfolio value. This will give you a more realistic picture of your return for the period.

Then to see the return over a longer time frame when you have added new funds, you should use an index. For this index, the start of your portfolio is set to 100.

When it comes to fees and commissions, I treat them as part of the cost of the transaction price.

- If I bought the share at RM 2.00 and there was RM 0.02 of fees and commissions, then I would treat the purchased price as RM 2.02.

- If I bought the share at RM 4.00 and there was RM 0.05 of fees and commissions, then I would treat the selling price as RM 3.95.

I chose this method to account for the fees and commissions as I am looking at the total return perspective.

Worked example for computing absolute returns

During the course of your investment, you will receive monies from dividends or from the sale of some stocks. If you reinvest all these monies, computing returns would be straightforward.

Real-life is a bit more complicated as you sometimes take money out of the portfolio to spend. You may also put in new funds to increase the investible sum.

To illustrate the computation with the above issues, imagine that you have the following scenario.

The transactions for the various years are summarized in the following table

|

| Table 2 Notes Portfolio value - the market value of all stocks in the portfolio Cum sale - from the part sale of stock B (a) 3 X $ 3.00 Total - portfolio value for the year + cum dividend + cum sale |

The total gain in RM amount as well the % return for each of the years are computed as shown below:

|

| Table 3: Notes a) The RM 20 is accounting for the purchase of Stock C at the start of year 2 b) To include

the purchase of Stock C from the new funds |

To cater to the changing fund size, we should convert the gains into an index format as shown below

|

| Table 4: |

The above is of course an illustration for computing total returns. It is a conservative estimate as it assumed that the money taken out does not have any other gain.

I don’t worry about the returns for the money taken out. This is because if it is invested in other assets, the returns would be captured under the asset portfolio performance.

Benchmarking returns

Now whether a computed return is a good performance can only be gauged by comparing with some reference performance ie benchmark. There are 2 ways to use the benchmarks.

- You can see where you rank relative to the performance of many funds.

- You can compare your returns with those of the benchmarks.

The following is an example of the former:

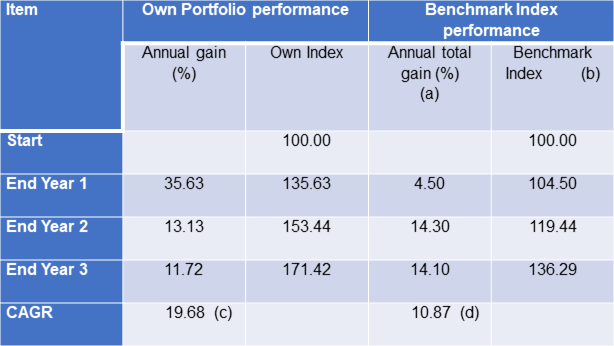

- As per the example in the previous section, the 3 stocks portfolio has achieved a 19.68 % CAGR for the past 3 years.

- There are 156 funds that invested in Bursa Malaysia companies in that year. You rank your fund performance against these 156 funds. To get the other funds' performances, I rely on Lipper what publishes the total annual returns achieved by each fund over the past 3 years.

- You can then assess that your fund is ranked No 15 terms of the past 3 years CAGR putting you into the top decile of performance.

The following is an example of how to compare your returns with those of a benchmark.

- The first step is to select the benchmark. One common benchmark is the stock market index of the stock exchange in which you are investing.

- In my case, I benchmark against the Bursa Malaysia composite index, the KLCI.

- If you have stocks from several stock exchanges, you may have to construct a weighted composite index of the various stock exchanges.

- The most important thing to remember is that you are comparing apple-to-apple. In this case, we are looking at total returns. Most stock exchanges also report total return performance for their indices.

How to choose a benchmark

When you assess the portfolio return, you are assessing the investment strategy. You are assessing whether the selected stocks are delivering better returns.

When you use a benchmark as the reference, the benchmark should be viewed as the alternative investment.

If you are not performing better than the alternative investment, you should be switching to the alternative. This is especially if you are seeking to maximize returns.

In my case, since I am investing in Bursa Malaysia companies, my benchmark will be the stock index of companies under Bursa Malaysia.

- There is no all-companies index for Bursa Malaysia. In fact, the KLCI is only the index for the top 30 companies in the stock exchange. Unfortunately, in the absence of an all-companies index, I use the KLCI as the benchmark.

- When it comes to the ranked comparison, I selected all the funds that invest only in Bursa Malaysia. I thus excluded those funds that had bonds and or non-Bursa Malaysia stocks.

Worked example for comparing numerical returns with a benchmark

The example below compares the returns of the earlier 3 stocks portfolio with the Bursa Malaysia composite index, the KLCI.

The results of the computation showed that your own portfolio achieved a 19.68 % CAGR compared with the benchmark 10.87 % CAGR.

Assessing risk-adjusted returns

The examples so far assessed the portfolio performance based only on the rate of return. If you view volatility as risk, you can include volatility in your assessment of the portfolio performance.

In practice, there are 4 such measures:

- Treynor ratio.

- Sharpe ratio.

- Jensen alpha.

- Information ratio

I do not view volatility as a risk. But I do use the CAPM concept especially the Beta in determining the cost of capital. As such I assess my portfolio performance using the Information ratio and the Jensen alpha.

Worked example for assessing portfolio performance with the Information ratio

“The information ratio (IR) is a measurement of portfolio returns beyond the returns of a benchmark, usually an index, compared to the volatility of those returns.” Investopedia

The formula for calculating the IR as per Investopedia is

The IR = 9.19 / 19.01 = 0.48

This is interpreted as your portfolio outperforming the benchmark by 0.48 % per unit of volatility over the 3 years period.

The above is the calculation over 3 years. You can calculate the information ratio monthly or quarterly if you have the information.

Worked example for assessing portfolio performance with Jensen alpha

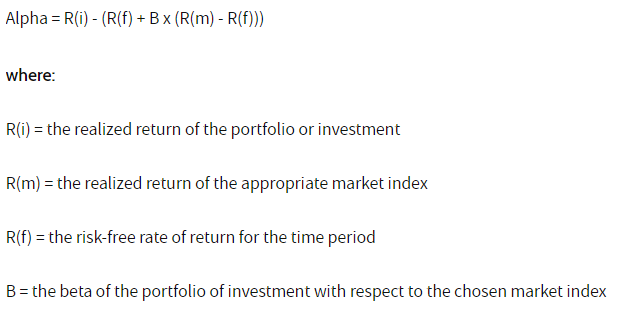

"The Jensen's alpha is a risk-adjusted performance measure that represents the average return on a portfolio or investment, above or below that predicted by the Capital Asset Pricing Model (CAPM), given the portfolio's or investment's beta and the average market return. This metric is also commonly referred to as simply alpha.” Investopedia

The alpha is one way to determine if a portfolio is earning the proper return for its risk level. The formula for calculating the alpha as per Investopedia is:

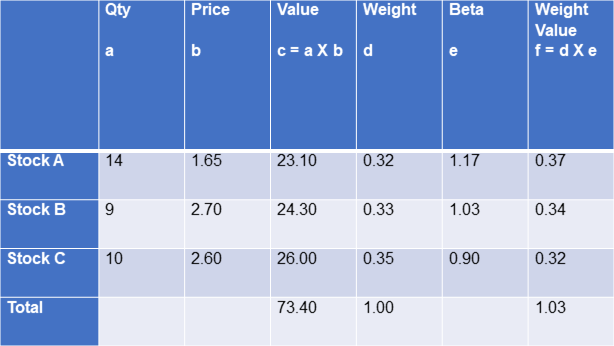

The portfolio beta is the weighted average betas of all the stocks in the portfolio.

Refer to the 3 stocks portfolio at the end of Year 2

- The portfolio return is 13.13 %.

- The index return is 14.30 %.

- The beta of the respective stocks is shown in the table below.

- The risk-free rate of return for the year is 2.60 %.

The portfolio beta is computed to be 1.03

Alpha = 13.13 - [ 2.60 + 1.03 X (14.30 - 2.60) ]

= 13.13 - 14.65

= (1.52)

The alpha represents the amount of the portfolio return that is attributable to your stock picking ability. The negative results showed that you did worse ie you don't have the ability.

- The Capital Asset Pricing Model predicts the expected return of your portfolio taking into consideration the risk (beta) in the portfolio.

- The alpha reflects the amount above the expected return.

Summary

- It is important to assess the portfolio performance as it enables you to make the necessary adjustments to meet the portfolio financial goals.

- There are 3 ways to assess returns - absolute returns, compared to some benchmarks, and comparing on a risk-adjusted basis.

- To ensure apple-to-apple comparison, you have to adjust for money taken out, new funds added, and dividends.

Assessing risk

When I constructed my stock portfolio, I followed a number of guidelines to ensure that I have a diversified portfolio. Refer to Part 1

The risk assessment task is then to review how the current portfolio has performed relative to these criteria.

The table below summarizes one such assessment.

Maintaining a diversified portfolio is only one of the risk mitigation measures. There are other measures that do not relate directly to portfolio management. Refer to “How to mitigate risk when value investing”

Volatility as risk

If you view volatility as risk, your risk assessment would include

- Comparing the current portfolio variance or Beta with the targeted ones.

- Comparing the current portfolio risk-adjusted performance measures eg Treynor and Sharpe ratios with the previous ones.

I do not compare the portfolio performance in such a manner as I do not manage risks in such a manner.

Periodic review and Rebalancing

As a long-term investor, I do not track my portfolio weekly or monthly.

Of course, I do track individual stock prices several times a week but this is to screen for overvaluation or for new under-valued stocks.

In the context of the portfolio, it is “updated” every time there is a sale or purchase. Apart from such situations, I update the stock value and risk position quarterly.

This is because there may be a need to re-balance the stocks to bring the portfolio back in line with the diversification criteria.

But these are not some automatic adjustments. My risk criteria are guidelines and I only sell to bring it down to the criteria level if the price situation is not some temporary ones.

I consider it temporary if the price is going to revert within 3 months period. This is of course a judgment call, but it is in the context that I bought the stocks based on value investing principles.

For the example shown in Table 8 above, one of the groups within the market cap category has exceeded the target.

But the current price situation is due to the Covid-19 pandemic. Looking at the vaccine programme, I would expect the prices to revert within the next 3 months. As such I am not planning to re-balance due to the deviation in the market cap profile.

Cut Loss

During the review, you may come across situations where the intrinsic values are still higher than the market price. You may consider selling:

- If you find that you have better investment opportunities elsewhere, but don’t have enough funds available. You then may sell one of the less performing ones.

- If after keeping the stocks for 7 or 8 years, the market has yet to re-rate it. I often find such stocks in the Net-Net category.

Pulling it all together

- Review your stock portfolio quarterly to ensure that it is still in line with the return and risk objectives.

- There are 2 critical review areas - the portfolio returns and the portfolio risk.

- There are 3 ways to assess the portfolio returns - absolute basis, compared with benchmarks, and risk-adjusted basis.

- To assess risks, compare the current diversification against the portfolio diversification criteria

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment