The ultimate look at how to invest in your 20s

Fundamentals 10: This is a beginners’ guide to investing in yours 20s. It covers how to invest money, the best way to invest and why to start to invest when in your 20s. This is general advice applicable irrespective of where you live.

|

| "In investing, what is comfortable is rarely profitable." Robert Arnott |

What is the difference between the following 2 questions?

- How to invest?

- How to invest in your 20s?

The former covers information on how to invest irrespective of your age while the latter focuses on people in their 20s. The latter is a subset of the former.

The latter presupposes that the way you approach investing when you are in the 20s would be different if you are of different age.

What differentiates people in the 20s from people of other ages? Those in the 20s are characterized by the following:

- In the early years of work life.

- Have low savings.

- Have a long future ahead.

- Do not have many dependents.

- Are tech-savvy.

I have seen many articles about investing in your 20s that miss the point as the advice is equally applicable when investing in your 30s, or 40s.

- They did not identify investment products that are only suitable if you are in your 20s.

- They did not show why investing in your 20s is different from investing when you are of other ages.

The reality is that there are no specific investment products or options that are only meant for people in their 20s. Rather the investment products or options are applicable to people of all ages. The premise that because of your age, you would approach investing differently when you are in your 20s is not so clearcut.

I will explore this premise in the article. I will focus on financial investments and as such I will not touch on issues relating to self-improvement and other lifestyle issues.

Furthermore, I will not cover what to invest in as there are no specific products meant only for those in their 20s.

Contents

1. Why start to invest in your 20s.

2. Is there evidence for differences in investing due to age?

3. How investing in the 20s will compound your wealth.

4. How investing in your 20s will give you more prime investing time.

5. How asset allocation will differ when you start in your 20s.

6. How to invest when you are in your 20s.

7. What to invest in your 20s.

8. Pulling it all together

|

1. Why start to invest in your 20s

There are several advantages to start investing in your 20s:

- You have a longer investment runway to enjoy the compounding effect.

- Investing is a skill and you need time to develop the skills. If you start young you have more time to invest like an expert.

- You have a different risk profile. You have more time to recover from any financial loss. As such you could allocate a bigger portion of your savings to the more volatile or risker assets that generally have better returns.

Against these, the challenges for starting to invest in your 20s are:

- You have fewer savings so asset allocation is more challenging. You meet the same challenges when you construct your investment portfolio.

- You have less life experience. This could be disadvantageous for certain styles of investing. For example, if you are value investing, business experience is an advantage in assessing and valuing companies.

2. Is there evidence for differences in investing due to age?

I am not referring to the many age-related rules for investing, especially for asset allocation. I am referring to actual evidence for differences in the investing approach due to age.

The studies and surveys are not conclusive for some of the age-related issues. This is because:

- The way people invest is not a function of age.

- We do not necessarily become better investors with age.

- Age is not the only factor that determines your risk tolerance.

You would have thought that given the many age rules for investing, there would be differences in how people of different ages invest. However, all the results do not point in the same direction.

- A Gallup poll found that 42 % of people in the US started to invest when they are in the 20s. The majority start to invest only when they are older.

- The chart below from the article “Investor preferences - by Age and Wealth” showed how the asset allocation of Australians changed with age. It was reported that Australians always had a propensity for investing in property. So, it is no surprise that this is the largest personal asset.

On the other hand, in the paper “How household portfolio shares vary with age” by John Ameriks and Stephen Zeldes, the authors concluded differently.

“We find no evidence supporting a gradual reduction in portfolio share with age.”

Interestingly, the authors cited other studies that reached opposite conclusions. For example, studies by Ven Der Hei, Galer, Quick, and Rea concluded that age-related patterns exist in the allocation of assets in retirement accounts. They found that the average share held in stock through equity funds, company funds, and balance funds declined from 76.8 % for participants in their 20s to 53.2 % for participants in their 60s.

There are two ways to interpret the results:

- Many do not follow the age rules.

- Since the studies covered different periods and countries, the way people invest differs with time and region.

The studies and surveys are not conclusive for some of the age-related issues.

2.1 Do we become better investors as we age?

One of the arguments for starting to invest in your 20s is that you have time to improve your investing skills.

However, there are studies that found that you do not necessarily become better investors as you age.

“…While people learn from experience as they age, older investors have adverse effects of cognitive aging. They are less effective at applying investment knowledge and exhibit worse investment skill…”. Does Investment Skill Decline due to Cognitive Aging or Improve with Experience? by George Korniotis and Alok Kumar.

In “Old Age and the Decline In Financial Literacy” Michael Finke, John Howe, and Sandra Huston concluded that increasing confidence and reduced abilities explain poor investment choices by older investors. Age is positively related to financial overconfidence, which can be a deadly sin when it comes to investing.

I would point out that the studies looked at a significant age gap. We are not comparing those in the 20s with those in the 30s. Rather it is between young adults and those in retirement.

2.2 Does risk tolerance vary with age?

Risk tolerance in the context of investing can be thought of as the amount of losses you can tolerate before deciding to exit the market.

Risk tolerance is an important component in investing. You should have a realistic understanding of your ability and willingness to stomach large swings in the value of your investments. Otherwise, you may sell at the wrong time.

In his paper “Retail investors' financial risk tolerance and their risk-taking behaviour: The role of demographics as differentiating and classifying factors” M. Kannadhasan opined the following.

“It is largely accepted that the risk behaviour of an individual depends on his/her age… However, the relationship may not necessarily be linear…Previous research found that financial risk tolerance decreases with age…Contrary to this, some studies find a positive relationship or fail to find a relationship with financial risk tolerance.”

While risk tolerance is often associated with age, it is not the only determining factor. It also depends on the investor’s financial situation, personality, and investment goals as follows:

- The younger you are, the more time you have to overcome any financial disasters. Hence you could take on more risks. If you are young, it is likely that you have fewer dependents eg children or aged parents to take care of. You could then take on more risks.

- Those with a higher net worth and more disposable income can also afford to take greater risks with their investments.

- “… different personalities prefer different levels of risk. Individuals who are more open to experience indicated a significant difference in risk tolerance levels compared to other personality types. The results for this article were comparable to previous research where only some of the personality traits play a role in investment decisions” Is financial risk tolerance influenced by personality traits? Susara Johanna Ferreira.

- Certain investments such as stocks and commodities are riskier than bonds.

3. How investing in the 20s will compound your wealth

“Compounding is the process whereby interest is credited to an existing principal amount as well as to interest already paid. Compounding can thus be construed as interest on interest - the effect of which is to magnify returns to interest over time…” Investopedia

To benefits from the effect of compounding, you need consistent returns over decades of investing.

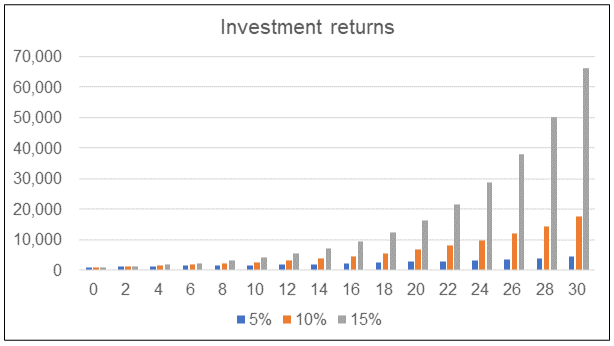

The chart below illustrates the returns that you can get by investing $ 1,000 at various rates of returns and for different investment years. Note that it assumed that you reinvest the annual gains.

You can see that the longer the investment horizon, the much larger the final amount you will have. This is because the growth is not linear but rather exponential. For example:

- If you invest $ 1000 for 20 years at a 10 % CAGR, you will have $ 6,727.

- If you invest the same amount and achieve the same annual return but for 30 years, you will have $ 17,499. This is an extra 1.6 times of money for an extra 0.5 times of investment period.

The compounding effect meant that if you start investing when you are in the 20s, you will have much more money when you reach 65 compared to someone who started to invest when he is in the 30s. This of course assumed that you both achieve the same rate of return.

Compounding is the most important factor why many recommend that you start investing as young as possible.

4. How investing in your 20s will give you more prime investing time.

The amount of money you have at the end of your investment life is dependent on not only the investment horizon but also the rate of return you achieve.

It goes without saying that to achieve a higher rate of return, you need the expertise and the skills.

Investing is a skill that has to be developed over time. This requires you to get the appropriate knowledge and then to practice what you have learned.

There are several investing styles eg technical, fundamental, factor investing. Each has its own concepts and behavioural requirements.

It doesn’t matter which style you focus on. They all need time to master. Based on my experience, you are talking of years rather than weeks or even months.

Let us assume that you take 5 years to reach a stage where you can achieve the same rate of return every year. Also, assume that you continue to invest till your dying days which I assumed to be 70.

If you start to invest when you are 25, you will then have 40 years of investing as an “expert”. Compare this with someone who starts to invest when he is 35. He will have 30 years of investing like an expert.

My point is that when you start in your 20s, you have a much longer time to enjoy the good returns that come with expertise.

Link this to the findings that your investing skills declined post-retirement age. It means that your prime investment age is between your 20s and 60s.

The younger you start to invest, the more prime investing time you will have.

5. How asset allocation will differ when you start in your 20s

If you know which asset class will give the best returns, you would be an idiot not to invest all your money in this particular asset. In reality. we don’t know the future so you spread your money to several assets. We hope that if one does badly, the other will do well enough to more than offset the bad returns.

This is the goal of asset allocation. It balances between risk and returns. Along the same lines, for a particular asset class, you should hold a portfolio of the instruments. For example, for your stock portfolio, you should have about 30 non-correlated stocks.

The challenge with asset allocation is that you need a minimum amount of money to be able to invest in several assets or instruments.

When you start to invest in your 20s, you may not have enough money to invest in several asset classes. You may not have enough to invest in a diversified portfolio of a particular asset.

How do you allocate your assets as someone in the 20s?

I follow a 3 buckets strategy when it comes to asset allocation. Refer to my post "Baby steps in Asset Allocation for a Value Investor" for details.

- Bucket 1 - Liquid assets eg bank savings. I have 2 years of annual expenditure here.

- Bucket 2 - Safe assets such as those that protect the principal. I have 8 years of annual expenditure here.

- Bucket 3 - Volatile or risky assets eg stocks. I have the balance of my net worth here.

The above plan is because I am in my 60s. When you are in your twenties, you will find that if you follow the above allocation amount, you may not have any money in Bucket 3. You have to tweak the amount in Buckets 1 and 2.

As a young investor, your investments should be concentrated on high-return assets. This is because of the compounding effect. You will have more to gain from high-return assets than from safe, interest-bearing ones.

That is why you should have assets allocated to Bucket 3 even in your 20s. We will cover this later on.

5.1 Age-related asset allocation plans

There are several rules of thumb for deciding how much to allocate between stocks and bonds.

- The first rule is “age in bonds.” A 20-year-old would have 20% in bonds.

- Another rule is [age minus 20] for bond allocation. If you are 20 years old, you do not hold any bonds. This also yields the 60/40 portfolio for a retiree at age 60.

- One old rule of thumb is [100 minus age] for stocks. If you are 20, you will have 80 % in stocks. But, with people living longer nowadays, many are recommending that the rule be changed to 110 or 120 minus age.

Generally speaking, these 3 formulas coincide with low, moderate, and high-risk tolerances respectively.

The age-related rule only covers stocks and bonds. In practice, there are many other assets to consider eg cash, properties. As such I would recommend that you follow the 3 Buckets strategy.

6. How to invest when you are in your 20s

I hope it is clear that there are no special investment products for people in the 20s. Rather they are the same products available to everyone else.

The only advantage you have is that you have a longer investment horizon to compound your wealth. But age does not mean that you will automatically be a better investor. You still need to learn how to invest like anybody else.

You can also afford to be more risk-tolerant in your 20s. But on the negative side, you have less money to start with.

How do you start to invest?

First, start to save. You invest to protect the purchasing power of your savings from being eroded by inflation. This assumed that you have savings.

- This comes from spending less than what you earned.

- If you have debt and the cost of the debt is higher than your investment returns, reduce your debt as this is equal to savings.

- Since the charges for credit cards are generally higher than what you can get from investments, pare down your credit card debt.

Because you have low savings, increasing your savings and minimizing fees will go further than trying to get an extra percent return.

- Invest in instruments with the lowest fees.

- Avoid trading ie frequent investments for these will mean more charges.

- Take advantage of any tax-free savings/investment schemes that are available to you.

Thirdly, given the limited investment options due to your low savings don’t lock up all your money. This is because as you grow older and have a bit more savings, there are other better investment options. One good example is properties that need a bigger financial commitment.

Fourthly, while there are no specific investment products for people in their 20s, there are some investments where age gives you an advantage. Focus on these. I am not talking about the compounding effect.

A good example is an insurance. The cost to get the same insurance coverage is definitely cheaper when you start at a younger age. Another example is that you can allocate more to stocks as you can afford to take on more volatility.

6.1 How to allocate your assets when in your 20s

While there are several age-related asset allocation plans, I would recommend the 3 Buckets approach.

If you are in your 20s, you have a smaller amount of savings. You may find that after you allocate your money to the liquid and safe assets based on annual expenditures, you may not have any left for the risky assets.

One way out is to have less liquid assets as this is meant for emergencies. If you still have other sources to help with emergencies eg your parents, this is one option to consider.

Secondly, there are two objectives for having safe assets:

- To generate returns when the risky assets are not performing.

- To serve as the floor net worth in case the risky assets tank.

Since you are still young and have time to recover from disasters, you could focus on the risky assets. In other words, reduce the amount held as safe assets.

Taking into account the above, I would suggest the following:

- Bucket 1 - liquid assets. It is always important to have an emergency fund in the form of liquid assets. The key is still to not be forced to sell volatile or risky assets at the wrong time. Because of this, I would still recommend that you have at least 2 years of your annual expenditure here. This is especially if you don’t have alternative sources to help out on emergencies.

- Bucket 2 - safe assets. Hold some assets that protect the principal to counterbalance the volatile or risky assets.

- Bucket 3 - volatile or risky assets. You can follow some of the age-related rules here to allocate between safe and risky assets. Excluding the liquid assets, have a bigger part of your savings in volatile or risky assets like stocks.

Work on the basis that the amount you allocated to each of the 3 Buckets will change as you get older. This could be due to either changing lifestyle, higher income, and different expectations.

7. What to invest in your 20s.

I do not think that there are specific products catering to only those in the 20s. However, there are some investments where you may consider differently when you are in your 20s. I will cover stocks and real estate as these are the 2 investments that most people will encounter.

7.1 How to invest in stocks in your 20s

I do not think that I have different recommendations for people in the 20s compared to those of other ages. Excluding the amount set aside for stocks of course.

First, learn to invest and master it before investing with real money. For the young who are tech-savvy, do not be mesmerized by the online platforms and apps. The attraction here is that it enables you to execute the trade easily or that you can invest with a little amount of money.

Remember that having a calculator does not make you good at solving maths problems. Think of the investment platforms and apps like a calculator. You still have to learn to invest.

While learning, if you still want to start investing, do so with a low-cost index fund. You can then switch out of the index fund when you have evidence that you can generate better returns than the index.

In this context, you may want to consider several age-based funds. These funds go by several names, such as age-based allocation models, or target-date funds. They are designed to automatically adjust your portfolio over the years as you approach the age at which you hope to retire. Age-based funds are also diversified. They can include stocks, bonds, cash, or other types of investments that many people may not understand.

Learning to invest is more than knowing what to buy, how much to buy and when to sell. You also have to learn how to mitigate risks.

If nothing else always have a diversified portfolio. If you are in your 20s you are probably tech-savvy. There are many online platforms and apps that will enable you to diversify even if you only have a small amount to invest. Nowadays it is possible to invest in fractional shares. Make use of this to have a diversified portfolio.

If you want to invest in stocks based on fundamentals, you must be able to analyze and value companies. If you don’t have the skills to do this but still want to invest based on fundamentals, you have to rely on third parties to do them for you. Those who do this well include people like Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can tap into their business analysis and valuation.

7.2 How to invest in real estate in your 20s

The advice for investing in real estate are applicable to all ages:

- Know the market.

- Know your goal - live-in or for rental.

- Save enough for the down payment.

- Do your due diligence on the seller/developer and agent.

- Have a financing plan.

In other words, learn about investing in real estate before investing with real money. Doesn’t this sound familiar?

The only advantage that you may have as someone in the 20s is that you could get a longer-term loan.

If you are buying to live-in, buy what you can afford first. Given your age, think in terms of scaling up over the years. Buy a smaller unit based on what you can afford and as you have more savings, you could switch to a bigger unit.

The downside to buying a home when you're young is that the relative permanence of homeownership may not be advantageous. For example, being early in your career, you may need to make a geographic move in the near future. If you do, owning your own home could make that move more challenging.

8. Pulling it all together

Your 20s are an important time in your financial life. It is the decade where you can build a strong foundation for decades to come.

There are several advantages to start investing when you are in your 20s. As such I recommend that you do so.

However, there are also investing challenges as you have a lower level of savings. But there are many online platforms and apps today that reduce this disadvantage.

So how do you invest when in your 20s:

- First, save.

- Look for those investments with low charges and fees.

- Don’t lock all your savings.

- Focus on those investments that give you an advantage because of your age and risk profile.

- Still have an asset allocation plan but tweak it to match your age and risk profile.

- Before you invest, learn how to invest and master it before investing with real money. This applies to stocks, properties, bonds, commodities, forex, and other financial instruments.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment