The ultimate look at how to assess management from an investor perspective

Fundamentals 19: Fundamental investors have to assess whether they can rely on management to run the company in the best interest of shareholders. This article looks at the various ways to carry out such an assessment.

|

| “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.” Warren Buffett |

Warren Buffett believes that the quality of a company’s management is a key factor on whether a stock will be a good investment.

He made the following comments during Berkshire Hathaway’s annual shareholders meeting in 1994.

“I think you judge management by two yardsticks. One is how well they run the business, and I think you can learn a lot about that by reading about both what they’ve accomplished and what their competitors have accomplished, and seeing how they have allocated capital over time.”

“You want to figure out...how well...they treat their owners. Read the proxy statements, see what they think of...see how they treat themselves versus how they treat the shareholders…The poor managers also turn out to be the ones that really don’t think that much about the shareholders, too. The two often go hand in hand.”

If you are working in a company, you have time to get to know management. As an insider, not only can you look at the results, you can also see how management behaves during times of crisis. You can gauge management attitude towards customers and staff.

As a retail investor, your contact with management is possibly only at the annual general meetings. There is hardly enough time to get to know them.

You have to take a different approach in assessing management. This article shows how to do this.

Contents

1. Background checks

2. Operating track record

3. Capital allocation track record

4. Shareholders’ value creation

5. Knowledge, experience and tenure

6. Honesty and transparency

7. Alignment of interests

8. Insider transactions

9. Obsession with share price

10. Board structure

11. Pulling it all together

|

I looked at the following to assess management:

- Background checks.

- Operating track record.

- Capital allocation track record - acquisitions.

- Shareholders value creation - share buybacks and Q Rating.

- Knowledge, experience and tenure with the company.

- Honesty and transparency - quality of earnings, strategic goals and cost consciousness.

- Alignment of interests - compensation and related party transactions.

- Insider share transactions.

- Obsession with share price.

- Board structure - independent chairman and the number of non-executive directors.

You can find most of the information in the Management Discussion and Analysis (MDA) section of the Annual Reports and statutory filings. Sometimes you have to refer to the company website and interviews given by management to the press and analysts.

1. Background checks

I was fortunate. I was in the senior executive positions in several public listed companies in Malaysia before I started to learn value investing.

This gave me the chance to meet many of the senior managers in the companies I was researching. That gave me an advantage when assessing the management of these companies.

What can you do if you don’t have this advantage? I did not have this advantage when I began to research US companies.

I think we are lucky to be investing in the digital age. Nowadays, it is simple to Google a name and read all the information available in the public domain.

If a person is senior enough or worse still have been involved in shady practices, there would be news about him.

You should use this as the first round to get background information about the Board members and the senior executives. Look at the track record, interests and conflict with the authorities.

"You look for three things: you look for intelligence, you look for energy, and you look for integrity. " Warren Buffett

The internet is a quick way to check whether the members of the management team have integrity issues.

|

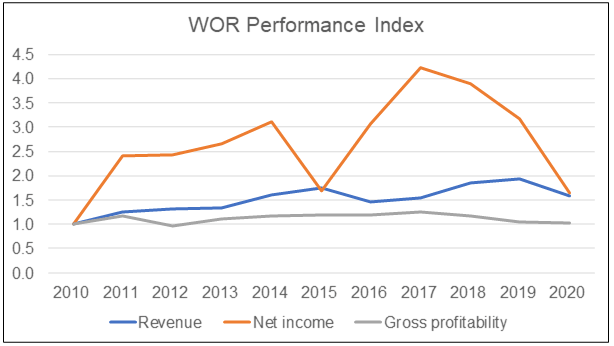

| Chart 1: WOR Performance Index |

2. Operating track record

I look at 2 categories of metrics when assessing whether management has a good operating track record:

- Time series analysis of revenue, earnings and gross profitability as illustrated in Chart 1.

- Comparing revenue and returns with the peers.

Charts 1 to 3 illustrate these two categories. These were taken from my Worthington Industries case study. I did rate management performance as better than average in this case.

|

| Chart 2: WOR Peer Revenue |

|

| Chart 3: WOR Peer ROA |

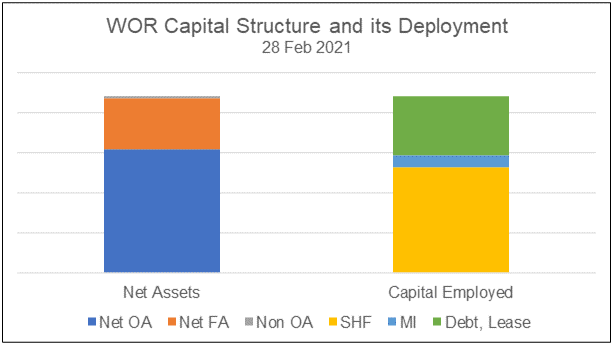

3. Capital allocation track record

There are 2 dimensions to this analysis.

The first is to see how the company has allocated its funds. You want to see that there is a good balance between returning cash to shareholders and investing for the future.

The other is to view the capital structure to check that there is no excessive debt and that most of the funds have been deployed for operating assets.

The charts below illustrate this for Worthington Industries.

|

| Chart 4: WOR Deployment of Cash Flow from Ops and Loans |

|

| Chart 5: WOR Sources and Uses of Funds |

Different businesses have different growth strategies. There are many companies where growth is achieved through mergers and acquisitions.

For such companies, I generally assess the acquisitions to see whether they have reasonable payback periods. If these were done some time ago, I try to assess the contribution from the acquisitions compared to what management had reported when they were first acquired.

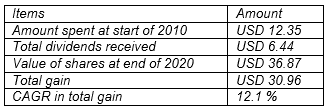

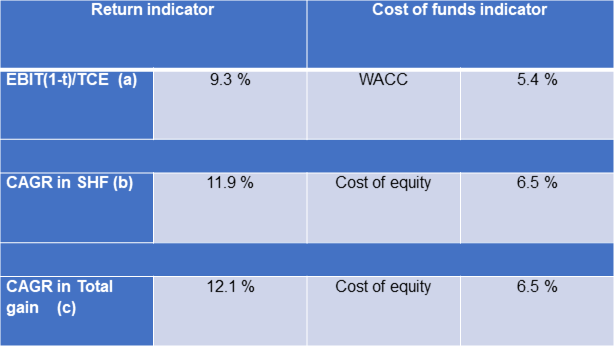

4. Shareholders’ value creation

The role of management is to create shareholders value. I assess this directly using the following metrics:

- Compare returns with the cost of funds. Value is created if the returns are greater than the cost of funds.

- See the gain for a long-term shareholder. Value is created if the CAGR in the gain is greater than the cost of equity.

- Share buybacks. These should be at prices that are less than the intrinsic value.

- View the Q Rating.

The chart below illustrates the comparisons I did for my Steel Dynamics case study. You can see why I concluded that there was value creation.

|

| Table 2: Shareholders Gain |

4.1 Share buybacks

In his 1984 Letter to Berkshire shareholders, Warren Buffet penned the following:

“By making repurchases when a company's market value is well below its business value, management... enhance the wealth of shareholders..."

"...shareholders and potential shareholders increase their estimates of future returns from the business. This upward revision, in turn, produces market prices more in line with intrinsic business value."

"...Investors should pay more for a business that is lodged in the hands of a manager with demonstrated pro-shareholder leanings... than for one in the hands of a self-interested manager marching to a different drummer.”

If a company undertakes a share buyback, I check to see that these were carried out at prices below the intrinsic values. When this happens, it adds to shareholders value.

The example below illustrates one such analysis based on my Tempur-Sealy case study.

4.2 Q Rating

The Q Rating is an indicator I developed based on the many analyses and valuations of Bursa Malaysia companies. It provides a visual assessment of the various drivers of intrinsic value.

The chart below illustrates the analysis based on my CSC Steel case study.

|

| Chart 6: CSC Q Rating |

5. Knowledge, experience and tenure

Most Annual Reports and/or statutory filings profile the Board members and senior management team. You can then assess their knowledge and experience.

It would be unusual to find that senior management did not have the relevant industry or functional experience.

But when it comes to the Board, do not be surprised if there are some Board members who may not have the relevant experience. These are generally nominees of the controlling shareholders. And are likely to be related in the case of family-controlled companies.

As a shortcut, I generally check on the age and length of service of the Board members and management team. I pay special attention to changes in the Board and management.

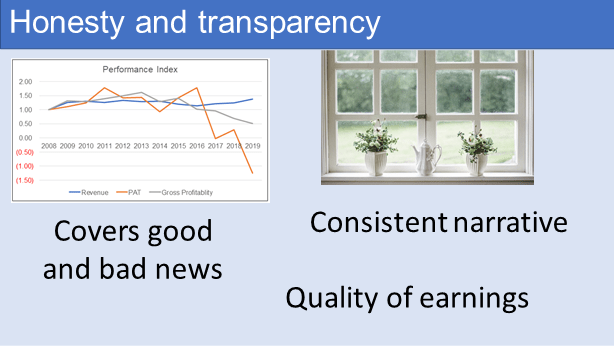

6. Honesty and transparency

I judge this by looking at the MDA section. I read the past 12 years report to see whether:

- Management has been consistent in their narrative. I have come across cases where the business plan kept changing every 3 or 4 years. I avoided such companies as this implied that management may not have a long-term game plan.

- The good and bad points have been mentioned. I have come across cases where some performance statistics were not reported during the bad years. When the times were good, there were tons of statistics presented.

6.1 Quality of earnings

I find that honesty and transparency is one of the most difficult aspect to judge. In addition to what was presented earlier, I also looked at quality of earnings indicators. The metrics I used here are:

- Beniesh M-score. This uses financial ratios and eight variables to identify whether a company has manipulated its earnings.

- Accruals. In the long run, Cash Flow from Operations should match profits. Otherwise, they can point to accounting irregularities. I thus monitor accruals as a check for accounting irregularities.

I would recommend that you read the following books if you want to know more about quality of earnings:

- Financial Shenanigans by Howard Schilit.

- Quality of Earnings by Thorton LO’Glove.

6.2. Strategic goals

If you are investing in a company because it is a compounder or is undergoing a turnaround, you would want to know its business plans. These are generally provided in the MDA section. If you cannot find any, you should avoid the stock.

You should then compare the actual achievement against these goals. If you have an honest and transparent management, these would be reported in the MDA.

6.3 Cost consciousness

When a company is facing some difficult times, most of time management will talk about the steps taken to control costs. I actually do not pay too much attention when management only does this when they are in trouble.

The role of management is not only to drive revenue growth, but to continuously improve the operations. This could be looking at ways to improve productivity and being cost conscious.

So, look at whether management provides such productivity or cost improvement statistics. For example,

- In oil palm plantation companies, it is common for management to provide statistics on yield per acre and oil extraction rates.

- For steel manufacturers, it is common to see reports on plant utilization in addition to sales and output in steel tonnage.

An honest and transparent management would provide such info on an ongoing basis.

7. Alignment of interests

Investopedia has the following view of management.

- The management of a publicly traded company is in charge of creating value for shareholders.

- Management should have the business smarts to run a company in the interest of the owners.

Of course, it is unrealistic to believe that management only thinks about the shareholders. Managers are people too, and are like anybody else, looking for personal gain. Problems arise when the interests of the managers are different from the interests of the shareholders.

The theory behind the tendency for this to occur is called agency theory. It says that conflict will occur unless the compensation of management is tied to the interests of shareholders. Management must have some actual reason to be beneficial to shareholders.

I also find it very challenging to assess this alignment.

In the Asian context there are many family-owned public listed companies. I take the easy way out by assuming that a management or Board with a controlling shareholder automatically meet this criterion. In the US scene, I also assumed that company that is founder led (such a Worthington Industries) meets this criterion.

The only exception would be where a background check revealed that there were previous regulatory issues. This could apply to both members of the Board or senior management team.

If management does not have substantial share ownerships, I looked at the incentive plans. I check that there are elements to ensure that management acts in the best interest of shareholders.

A good example of such an incentive plan is the following from Leggett & Platt.

|

| Chart 7: LEG Incentive Plan |

7.1 Compensation

I generally look at the Board and senior executives’ compensation. I check that they are not excessive relative to the earning power of the company.

- One measure is to check that the total remuneration including incentives and value of stock options should not exceed 5 % of the net profit.

- I would also like to see a variable remuneration. This meant that during bad times the remuneration of management staff would be reduced according. In my UOA case study, I found that the base salaries of the senior executives were reduced in 2020 compared to 2019. This was because the industry was facing challenging times.

Data on management’s remuneration is available in the Annual Report of the company.

7.2 Related party transactions (RPT)

RPT is one of the most important section of the Annual Report to look at when assessing management alignment.

This reports the company's transactions with shareholders, management and their relatives’ entity, etc.

This is the most preferred route to siphon money from the company. This is one way to benefit certain shareholders and management at the cost of minority shareholders.

Each RPT items should be studied to see that they are carried out at arms-length basis.

8. Insider transactions

Insider transaction refer to the buying or selling of shares in a corporation by a director, officer, or executive within the company.

Insider transaction is not the same as insider trading. The latter refers to corporate insiders making stock purchases based on non-public information. These are illegal in many countries.

For example, management who know of circumstances that could cause the stock price to move, buys or sells their shares in the company. This could be knowledge about new product launches or corporate exercises.

On the other hand, insider buying can occur when an executive of a company believes that the public is not valuing its shares properly. That is, the insider feels that the stock is at attractive levels and represents a worthwhile investment.

Insider transaction is not a crime when the buying or selling is based on public information. Since insiders have insights into their own companies, they often buy when they believe that the stock is undervalued. That is why people pay attention to insider transactions.

Studying insider transactions is more about getting additional clues about the value of the business. I consider it as a margin of safety exercise.

9. Obsession with share price

I am a firm believer that the role of management is to create shareholders value. They do this by running the operations and having a good capital allocation plan. It is all about the business.

Management should focus on shareholders' value creation via running the business. My view is that management should not focus on the share price.

There are times when management should promote the share price. This could be when there is some merger and acquisition plans via a payment in shares.

There are also financial engineering ways to affect the share price such as share buybacks and dividends.

However, management should not be obsessed with the company share price.

The share price of a company is a function of market forces and ultimately a reflection of the company’s performance and future prospects.

But, in the shorter term the market does not behave in any predictable fashion. There are too many factors affecting markets at any given point of time. I tend to think that it is more influenced by market sentiments.

If the decision-making of the management is influenced by fluctuation of its share price, then it could be a matter of concern. Management should ideally keep a long-term view of the company and not worry about short-term hiccups in the price.

How do you judge that management is spending too much time worrying about the share price? I see the following as tell-tale signs:

10. Board structure

From a corporate governance perspective, many advocate that the Chairman of the Board should be different from the CEO. At the same time, the Board should not have too many executive directors.

I think these are cosmetic issues. At the end of the day, you want:

- A Board that serves as a bouncing board for management.

- A Board that represents the interests of shareholders.

At the same time, you want a management team that is focused on the business and acts in the interests of shareholders rather than its own interests.

I do not think that the Board structure alone can achieve these. Rather it is very dependent on the attitude of the Board and management. And these have to be assessed by looking at the various factors that I have covered in this post.

Think of the family-controlled or founder-led company. They control the Board and management. If the controlling shareholder has no intention to look after the interest of all shareholders, the Board structure is not going to help.

11. Pulling it all together

Assessing management is part of a company analysis. There are 3 aspects in assessing management:

- Background checks on the knowledge, experience and length of service.

- Looking at track record and other numerical historical evidence.

- Judging management behaviour.

On the track record side, I would suggest that you cover the following:

- Comparing its operating and capital allocation performance with those its peers.

- Comparing its returns with the cost of funds.

When judging management behaviour look at the following:

- Are they honest and transparent when reporting issues in the Annual Report?

- Does management report its business plans and goal and provide metrics to judge its progress?

- How does the company align management interests with those of the shareholders?

- How did management behave on related party transactions and insider transactions?

I hope the article have provided you with examples on how to carry out the above.

Assessing management is an important aspect of a fundamental analysis. As you can see, it more than just some quantitative analysis. You need to dig through the past Annual Reports to get insights.

Of course, you may decide that it is too troublesome to do all of them. One way out is to then rely on third parties to do the fundamental analysis for you.

There are several financial advisers who provide such analyses.

Those who do this well include people like Seeking Alpha.* Click the link for some free stock advice. If you subscribe to their services, you can tap into their business analysis and valuation.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment