Is CSC Steel one of the better Bursa steel stocks?

Value Investing Case Study 04: Company analysis and valuation of CSC Steel, a cold roll company listed on Bursa Malaysia. This is an update where I have also pulled together the findings from my earlier articles. You would also be re-directed here if you tried to access the earlier CSC Steel articles. Revision date: 28 May 2023.

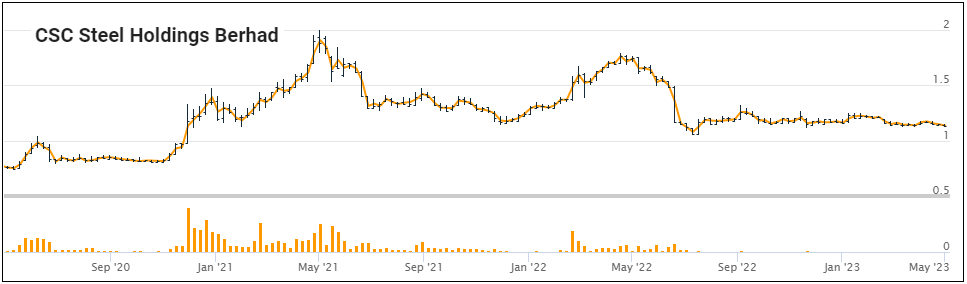

When I first published this article in Sep 2020, CSC Steel Holdings Berhad (CSC Steel) was trading at RM 0.835 (as of 1 Sep 2020) per share compared to its Graham Net Net of RM 1.53 per share (as of 30 Jun 2020).

The price has gone up and down since then as can be seen from the chart below. But as of 3 May 2023, with a price of RM 1.13 per share, it was still trading below its Graham Net Net of RM 1.88 per share (as of end Dec 2022).

|

| Chart 1: CSC Share Price |

The video provides the key findings and the latest investment thesis.

The Graham Net Net is often considered a proxy for the company’s liquidation value. Ben Graham spent most of his time investing in Net Net companies.

Why is CSC Steel trading below its liquidation value then? Is the market suggesting that it is not even worth its liquidation value?

Is this a value trap or a steal?

A value trap is one side of the value investing coin. The other side is that it is a steal, a hidden gem. A steal would make it one of the better Bursa steel stocks to invest in.

CSC Steel has RM 0.75 cash per share (as of the end of 2022), zero borrowings, and a good operating track record. Its value is intact. It is not a value trap.

Join me as I lay out my case on why the market is wrong.

There is an investment opportunity given the mispricing. Does it mean that you should go and buy – well read my Disclaimer?

This is an update of the article that was originally published in 2020. For the update, I looked at the performance till end 2022.

Contents

- Investment Thesis

- What is so unique about CSC Steel?

- Has it used its Funds in the Best Way?

- Can you describe the Current Performance as Outstanding?

- Is there a Rich and Unique History?

- Is there a Great Future?

- How well did Top Management Seize Opportunities?

- Is there a great Buying Opportunity?

- Will Shareholders’ Value continues to be created?

- How to minimize risk and secure your investments?

- How to Gain from the Case Study

|

Investment Thesis

CSC Steel is trading below its Graham Net-Net. The Net-Net is often considered a shorthand for the liquidation value. There is no reason for CSC Steel to be liquidated. Furthermore, there is no reason for any impairment of its assets.

The Asset value is a good indicator of the intrinsic value. Even if you consider the EPV, there is a 61 % margin of safety. CSC Steel is a company with strong fundamentals. As such CSC Steel is not a value trap but an investment opportunity.

|

Rationale

- CSC is financially sound with zero Debt and cash of RM 0.75 per share.

- It has managed to be profitable in 2020 despite the Covid-19 pandemic restrictions.

- Its 2021 performance has been boosted by the current uptrend in the price cycle.

- There has not been any major change in the way to Group is managed. Management still has good operations and capital allocation track record.

- But it did not create any shareholders’ value over the past 15 years. Part of the reason for this is that it has substantial cash that generated low returns.

- There is less risk today to invest in CSC Steel compared to 2020.

|

What is so unique about CSC Steel?

The iron and steel sector in Malaysia can be classified into two major product groups:

- Flat products such as hot-rolled coils, cold-rolled coils, and coated coils. These are used as intermediate raw materials for downstream applications. Examples are automotive parts and components, equipment, and fabricated products.

- Long products such as steel bars, wire products, angles, and sections. These are used in the construction and civil engineering industry.

Flat products are produced by rolling metal billets. Billets are thick cross-section metal produced by steel mills. The metal billets are then reduced in thickness in the hot roll mills. They can further be reduced to thinner sheets by cold rolling.

CSC Steel is the leading cold roll mill in the country (based on the companies in production). The plant in Melaka has the capacity to annually produce:

- 440,000 metric tons of cold-rolled steel,

- 40,000 metric tons of pickled and oiled steel,

- 240,000 metric tons of galvanized steel (GI) and

- 120,000 metric tons of pre-painted galvanized (PPGI) steel.

Its products are branded as:

- ‘Realzinc’ and ‘Realzinc Enhance’ for GI products and,

- ‘Realcolor' for PPGI products.

CSC Steel's main raw material, hot rolled steel, is mainly supplied by its parent company and related companies in Taiwan and Vietnam. They are in the upstream of the steel value chain and involved in iron making, steel making, casting, and hot rolling.

CSC Steel's downstream customers are those that use steel coils. Examples are steel pipe makers, steel drum makers, roofing sheets, and cladding roll formers as well as steel service centres.

Its main market is in Malaysia (94 % of sales in 2022) and the balance is exported mainly to the South East Asian region.

The China Steel Corporation of Taiwan, the largest steel company in Taiwan, is the controlling shareholder of CSC Steel. It manages it as part of the China Steel Corporation of Taiwan’s group of companies.

Has it used its Funds in the Best Way?

Table 1 shows how CSC Steel’s SHF accounted for all the Total Capital Employed (TCE). You can see that it had grown since Jun 2020 due to the retained earnings.

But only about less than 2/3 of the TCE is deployed for its operations. The balance is held as cash, investments in securities as well as investment properties. The Non-Operating Assets in Jun 2020 were mainly for an investment property that has since been sold off by Dec 2022.

|

| Table 1: Sources and Uses of Funds |

Can you describe the Current Performance as Outstanding?

I track performance based on 3 metrics – revenue, PAT, and gross profitability. Gross profitability is defined as gross profits/total assets. According to Professor Novy-Marx, this metric has the same power as PBV in predicting cross-section returns.

Chart 2 tracked the performance of the Group since 2008. Covid-19 affected the Group sales in 2020 but this has recovered. But gross profitability and PAT in 2022 were much lower than those in 2008.

|

| Chart 2: Performance Index |

The performance of CSC Steel over the past 15 years can be described as “standstill”:

- Over the past 15 years, the revenue was below that 2008 level most of the time.

- The profits have shown a bigger variance c/w with the 2008 profits. During the past 15 years, the profits were above the 2008 level for only 1/3 of the time. CSC Steel even sustained a loss in 2014.

- Gross profitability has declined over the past 15 years.

- From 2008 to 2010 the average ROE was 10 %, but for the past 3 years, it averaged 5 %.

Looking at Table 1, you could say that the returns were low because not all the cylinders were firing. CSC Steel would not get good returns from the financial assets (cash).

What would be the returns from just the steel operations?

The table below shows that over the past 15 years the steel operations generated an average PBT of RM 48 million per year. This is about a n 8 % return on the current TCE.

But note that this is on a pre-tax basis. On such a basis, it is not a good return considering that its WACC is 8.2 %.

On a positive note, CSC Steel has generated an average positive free cash flow of RM 48 million annually over the past 15 years.

Case Notes From a fundamental analysis perspective, the goal of the company analysis part is to get a sound understanding of the business and its prospects so that the assumptions you use in the valuation are grounded in reality. This is one of the reasons why I shy away from using the SWOT analysis. Such analysis is useful if you are managing a business and trying to develop its strategy. However, as a minority shareholder, you are not likely to change the business direction. You have to accept the company's results and direction as they are and vote with your feet if you do not agree with them. Secondly, I am a long-term value investor so my interest is not so much in the quarterly results but the long-term prospects. The analysis is thus structured to get such insights. As you can see, fundamental analysis requires expertise and time. Visualizing a company’s business performance and investment risk (by comparing market price with intrinsic value) is one way to shortcut the process. The Fundamental Mapper helps investors make informed decisions as it provides such insights in an easy-to-see format. Download the Fundamental Mapper app now on Xifu to get investment insights into Bursa Malaysia companies. |

Is there a Rich and Unique History?

In December 2000, China Steel Corporation of Taiwan acquired its first offshore steel company, namely CSC Steel Sdn. Bhd and Group Steel Corporation (M) Sdn. Bhd both in Malaysia.

In January 2004, China Steel Corporation of Taiwan established Ornasteel Holdings Berhad. In the same year, Ornasteel Holdings Berhad acquired both the above-mentioned Malaysian companies.

Ornasteel Holdings Berhad was subsequently listed on Bursa Malaysia in December 2004. China Steel Corporation of Taiwan with 45 % interest became the major shareholder.

Ornasteel Holding Berhad was renamed CSC Steel Holdings Berhad in 2008.

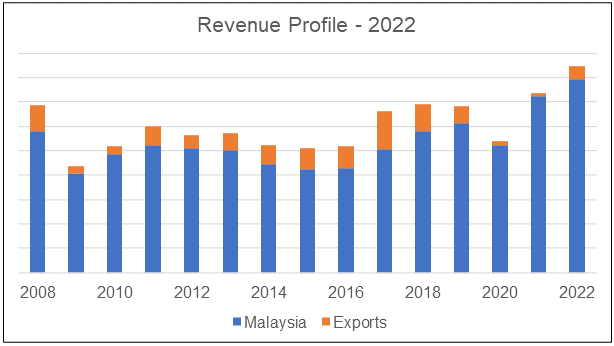

Over the period from 2008 to 2022, the revenue grew at 1.5 % CAGR.

- On average about 13% of the revenue is from exports.

- In 2009 the market was affected by the US financial crisis. Then in 2004/15, the market was affected by the excess steelmaking capacity in China. Of course, in 2020, we had Covid-19.

|

| Chart 3: Revenue History |

The Performance Index as per Chart 2 showed that the variation in profits is far greater than that in revenue. Over the 15 years period, the coefficient of variation (defined as the standard deviation divided by the mean) was:

- 0.18 for revenue.

- 0.77 for the operating profits.

This was due to the large variation in the gross profits over the 15 years. This meant that CSC Steel had problems matching product prices with raw material costs.

- During 2008 – 2010, the average gross margin was 11 %.

- From 2020 to 2022, the average gross margin was 5 %.

Apart from the revenue and profit challenges, CSC Steel had 2 poor investments both of which were made in 2012 into:

- CSC Bio-Coal Sdn Bhd.

- Tatt Giap Steel Centre.

CSC Bio-Coal

CSC Steel initially invested RM10.2 million in a pilot bio-coal plant. This was its very first venture into renewable energy.

The plant uses palm fibre, a waste product of palm oil mills, to produce bio-coal (charcoal) using the torrefaction process.

However, bio-coal production was discontinued in 2015. CSC Bio-Coal was disposed to the China Steel Corporation of Taiwan Group for RM 1 million.

By then CSC Bio-Coal had RM 14.5 million in liabilities compared with RM 12.2 million in total assets ie a loss of RM 2.3 million.

China Steel Corporation of Taiwan Group rescued CSC Steel turning the losses into RM 3.3 million gain on disposal.

Tatt Giap Steel Centre

Tatt Giap Group Berhad is a steel group that was listed on Busa Malaysia in 2010 with a SHF of RM 77.9 million. It has been a customer of CSC Steel for many years before this listing.

In 2012 Tatt Giap Group Berhad divested 49% of Tatt Giap Steel Centre Sdn Bhd to 3 parties. They were CSGT International Corporation Taiwan, CSC Steel, and Hanwa Co Ltd Japan.

CSC Steel invested RM 8.3 million to purchase 20% equity in the Tatt Giap Steel Centre. The goal of the investment was stated as:

“.. the business co-operation between the two companies could be further strengthened and enhanced thereby benefiting both companies in the long run”.

The acquisition was completed in April 2013 and from the start, Tatt Giap Steel Centre experienced operating losses.

CSC Steel started making provisions for impairment and by 2018, it had fully written off its RM 8.3 million investment.

Note that by 2016, Tat Giap Group’s SHF had been reduced to RM 24.9 million. Tatt Giap Group Berhad has been renamed Dynaciate Group Berhad following the emergence of Dynaciate Engineering Sdn Bhd as the largest shareholder in January 2019. Dynaciate Group Bhd is now known as Ingenieur Gudang Bhd.

Investment Properties

Tatt Giap Steel Centre was not the only “assistance” provided by CSC Steel to the Tatt Giap Group.

On December 31, 2015, CSC Steel agreed to buy from Tatt Giap Group two pieces of leasehold land together with a factory building for RM 41 million.

The transaction was completed in 2016. The total consideration together with RM 1.5 million of other related costs was paid via the following:

- The utilization of trade debts owed - RM 21.0 million.

- Cash payment - RM 21.5 million.

- Total - RM 42.5 million.

These properties were previously classified as Investment Properties in CSC Steel’s Balance Sheet.

As you can see, the purchase of this investment property is to recover RM 21 million of debt owed by Tatt Giap Group. These properties were sold in 2021/22 with a RM 2.5 million gain.

Is there a Great Future?

Steel is an alloy of iron with typically a few percent of carbon to improve its strength and fracture resistance compared to iron.

Today, steel is one of the most common manmade materials in the world. The steel industry is often considered an indicator of economic progress.

The Malaysian steel industry can be classified into the following sub-sectors and product types

- Primary - billets, and slabs.

- Rolling/finished - plates, hot roll, and cold roll coils.

- Secondary (longs) - wire mesh, bars.

- Secondary (flats) - galvanizing, colour coatings.

CSC Steel is a mid-stream steel producer with its cold roll, galvanized, and pre-painted galvanized flat sheet steel.

It is in a sector characterized as follows:

- Margins affected by the spreads between international hot roll coil and imported cold roll coil.

- Steel products are commodities.

- The industry is cyclical.

- It is heavily intensive in both materials and energy.

- Its profitability is very dependent on government trade policies.

Imports challenge

Charts 4 and 5 below shows that there is a base demand for cold roll steel products in Malaysia.

This is irrespective of the economic performance of the country. However, the Malaysian demand for steel can be met by both local producers and imports.

|

| Chart 4: Malaysia Cold Roll Steel and Related Products Consumption |

The biggest challenge faced by the Malaysian steel cold roll industry is imports. The charts show that over the past few years, domestic consumption from the local mills has been affected by imports.

Margins being squeezed

Steel products are commodities. They are manufactured according to several global product standards and design specifications.

In many instances, the “quality” of the products is dependent not only on a company’s manufacturing process but also on the “quality” of the raw material.

CSC Steel is a commodity producer in the global industry.

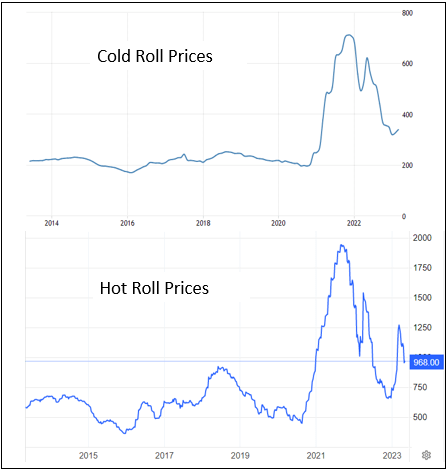

Its margins are affected by the international prices of the raw materials (hot roll coil) and the finished cold roll coils. As the chart below indicates, the margins were thin for 2018/19.

|

| Chart 6: Malaysia Prices for Hot Roll and Cold Roll Source: Mycron Steel Bhd Annual Report 2019 |

The chart below illustrates how the prices for hot and cold roll coils have fluctuated considerably over the last 10 years. We will continue to see these price fluctuations in the future.

|

| Chart 7: Hot Roll and Cold Roll Prices: Source: Trading Economics |

Competitors profile

Currently, there are 3 public-listed local cold roll coil producers operating in Malaysia

- CSC Steel.

- Mycron Steel Bhd.

- Eonmetal Group Berhad.

Until April 2019, YKGI Holdings Bhd was a large cold roll coil player. But it sold its plant to Japanese outfit NS Bluescope Malaysia Sdn Bhd.

The problems faced by the Malaysian cold roll sector are very aptly described in Mycron Steel Berhad's 2019 Annual Report.

“The last decade has truly been a harsh and hostile environment for Malaysian Steel mills, with the rising domestic cost of electricity, natural gas, and minimum wage, whilst grappling with the turmoil caused by surging steel imports that manipulate Free Trade Agreements (“FTA”) and World Trade Organization (“WTO”) laws.”

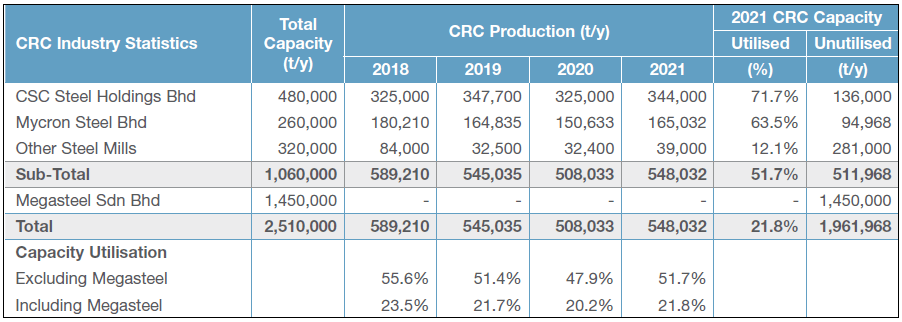

Globally, steel companies need around 70% to 80% capacity utilization to be sustainable.

In 2021, Malaysia’s total installed capacity for cold roll coils was 2.51 million metric tons. But consumption from the local mills was a mere 0.55 million metric tons or less than 22 % utilization.

But if you look at CSC Steel’s capacity utilization, you can understand why it is profitable.

|

| Chart 8: Malaysia steel capacity. Source: Mycron Steel 2022 Annual Report |

Trade protection

In the past, the local cold roll mills complained that the Malaysian Government has not protected them. For example, there is no duty on foreign imports.

This is in stark contrast to other countries such as:

- Indonesia, which in 2019 levied anti-dumping duties on hot-rolled plates from China. These duties also covered steel products from Singapore and Ukraine.

- Thailand, which in December last year extended the anti-dumping duties on cold roll coils from China, Vietnam, and Taiwan.

This is now changing. For example, in Oct 2021, the government announced that it will impose anti-dumping duties between 7.42 % and 42.08 % on certain cold-rolled products originating or exported from China, the Republic of Korea (South Korea), and Vietnam.

Only time will tell how effective these and future actions are to the cold-rolling industry in the country. But I think these are positive signs.

Furthermore, in 2019, the Malaysian Iron and Steel Industry submitted a White Paper to the Ministry of International Trade and Industry. It was a culmination of efforts by the industry, for the industry. The objectives of the White Paper were:

- To provide policy recommendations for a stronger, more resilient, and advanced Malaysian and Iron Steel Industry.

- To advance towards a self-sufficient and sustainable nation-building future.

- To regain regional steel leadership within Southeast Asia.

Industry performance

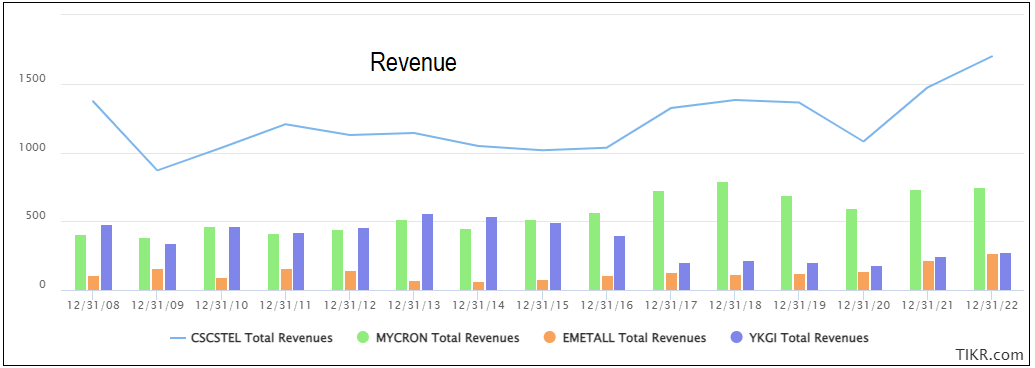

If you look at the performance of the peer companies in this industry as per the chart, you will conclude that it has been tough for the past 15 years.

|

| Chart 9: Peer Revenue |

|

| Chart 10: Peer Gross Profit Margins |

CSC Steel has been able to maintain its revenue and be profitable despite the various challenges highlighted above. This is due to the following strategies:

- Moving up the value chain by increasing its market share into higher-grade steel products and also beefing up its overseas market.

- Enhancing existing product quality and new product development. This is achieved with the support from its parent company.

- Continual upgrading of its production facilities. This ensures that the Group can maintain its competitiveness.

With the protective measures by the Malaysian Government, CSC Steel's profitability will be enhanced, provided of course that MegaSteel does not come back in a big way.

How well did Top Management Seize Opportunities?

CSC Steel is managed as if it was part of the Taiwanese parent company.

Over the years, the Managing Director of CSC Steel has always been seconded by the Taiwanese parent company. And each served only between 1 to 2 years in CSC Steel.

In its 2016 Annual Report, CSC Steel went as far as to state:

“… stakeholders can be rest assured that the frequent changes of the Managing Director will not adversely affect the organizational effectiveness...”

In 2022, there were 8 members on the Board of Directors comprising:

- The Group Managing Director and Executive Director cum Vice President of Finance that were seconded by the parent company. They were appointed to the Board of CSC Steel in 2021.

- 3 Non-Independent Non-Executive Directors and 3 Independent Non-Executive Directors.

There were also changes to the senior management team in 2022 compared to that in 2019.

- The size of the team was increased from 5 members in 2019 to 6 members in 2021. Note that the team included the MD and ED.

- In 2019, there were 3 Taiwanese on the team - the 2 Executive Directors and the Vice President for Production. This was reduced to 2 moving into 2022 – the MD and the VP of Finance. In Dec 2020, the Malaysian who served as Asst Vice President of Production was promoted to the Vice President of Production.

- There were 2 new appointments, both at the Asst Vice President of Production levels. Both were Malaysians.

Due to this organizational structure,

- Our review of whether management interests are aligned with those of the shareholders is not relevant.

- Any review of top management as capital allocators and operators is actually a review of China Steel Corporation of Taiwan’s strategies.

How have top management and the parent’s “strategists” performed?

I have shown earlier that they are not so good at investing in new ventures.

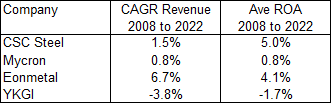

The chart and table below shows how CSC Steel has performed compared to other cold-roll steel players in the country. Note the following in the comparison:

- Mycron - we excluded the pipe operations.

- Eonmetal - we covered only the steel and flats segment.

- YKGI - we excluded the gain from property revaluation and assumed that the cold roll plant has not been sold.

In terms of revenue growth, I rate CSC Steel’s performance as average. However, CSC Steel is the best performer in terms of ROA.

The performance appears more credible when you compare the size of the Total Assets of these companies at the end of 2022.

- CSC Steel - RM 939 million.

- Mycron (flats segment) - RM 489 million.

- Eonmetal (steel segment) - RM 263 million.

- YKGI (before the sale of coated coil business and property revaluation) - RM 237 million.

|

| Table 3: Peer Comparison |

|

| Chart 11: Peer Revenue |

|

| Chart 12: Peer ROA |

When it came to capital allocation, from 2008 to 2022, the Group generated RM 913 million in cash from operations. Of these:

- RM 496 million was paid as Dividends. Compared to the total PAT of RM 662 m for the period, this was equal to 75 % of the PAT.

- RM 311 million was spent on net CAPEX (CAPEX less sale of PPE).

- Cash increased by RM 92 million.

I would conclude that this was a good capital allocation programme.

About 47 % of the profits after tax was reinvested into the Property, Plant, and Equipment. This gives credibility to the top management position of upgrading its production facilities.

You can conclude that the top management is a good operator and capital allocator, in spite of the bio-coal and Tatt Giap blip.

Is there a great Buying Opportunity?

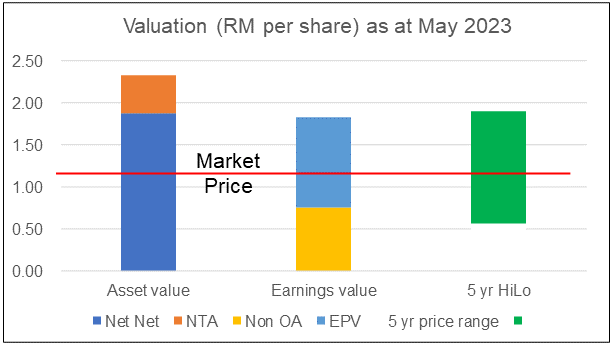

I determined the intrinsic value of CSC Steel based on the following:

- Asset value. This is broken down into the Graham Net-Net and Book Value.

- Earnings value. This is broken down into Non-Operating Assets and Earnings Power Value (EPV).

In deriving the Earnings value, I assumed that the future will be similar to the past 12 year’s performance. If you believe that the future is better, then you will ascribe a higher value than that derived and vice versa.

I have ignored the Earnings value with growth. This is because the returns are less than the cost of funds. As such growth will not create value. In other words, the Earnings value with growth will be lower than the EPV.

The chart and table sum up CSC Steel’s valuation.

- The Earnings value is below the Asset value. This is not surprising as the return on total capital employed is below its cost of capital.

- Over the past 5 years and even currently, CSC Steel’s share price has been below the Asset value.

- Over the past 5 years, CSC Steels’ share price was trading above its Earning Power Value for only a month or two. This was between the end of 2016 and the beginning of 2017.

|

| Chart 13: Valuation |

In the table below, I compared the current valuation with those that I have shared in the past in my blog.

|

| Table 4: Valuation History |

You can see that it has been trading below its Graham Net Net for some time. Given its profit track record and its ability to generate cash, there is an ample margin of safety.

But even if you ignore the assets, the current price is below its Earnings Power Value.

In deriving the Earnings value, I have assumed the past 12 years' average performance represents the future. This means that:

- If you believe that the future is better, then CSC Steel’s EPV will be higher.

- However, if you think that it will be worst, then the current EPV per share is over-estimated

When you look at the peer companies’ performance, you will conclude that the past 15 years have been very challenging for the industry.

Even with this challenging situation, CSC Steel Earnings Value is conservatively estimated.

I would conclude that there is an ample margin of safety for the Earning Power Value given the market price.

Cyclical sector

CSC Steel serves the cyclical steel sector. According to Damodaran"

“Cyclical and commodity companies share a common feature, insofar as their value is often more dependent on the movement of a macro variable (the commodity price or the growth in the underlying economy) then it is on firm-specific characteristics…the biggest problem we face in valuing companies tied to either is that the earnings and cash flows reported in the most recent year are a function of where we are in the cycle, and extrapolating those numbers into the future can result in serious misvaluation.”

To overcome the cyclical issue, we have to normalize the performance over the cycle. Damodaran suggested 2 ways to do this:

- Take the average values over the cycle.

- Take the current revenue and determine the earnings by multiplying it with the normalized margins.

In the case of CSC Steel, there was not much revenue growth. It did not matter whether I used the former or the latter. The key was to ensure that I covered several cycles.

If you remember the steel price charts, you can see that over the past 15 years, there were at least 2 price cycles. By taking the values over the past 15 years, I have computed the value of CSC Steel over the cycle.

Will Shareholders’ Value continue to be created?

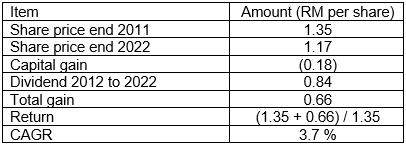

I looked at the following metrics when assessing shareholders’ value creation:

- Comparing returns with the cost of funds.

- Comparing the gains by an investor who bought a share at the end of 2008 with the cost of equity.

- The Q Rating.

Overall, the returns were lower than the respective cost of funds. Furthermore, the Q Rating was not better than 2/3 of the panels. I would conclude that the Group did not create any shareholder value.

|

| Table 6: Shareholders Gain |

CSC Steel had an overall Q Rating of 0.55. This places it above the 75 % position among the panel companies. It is better than average The rating reflects the strong financial position and low-risk profile. Its position has improved compared to that in 2020.

|

| Chart 14: Q Rating |

The main reason for the poor shareholders’ value creation is that only about 2/3 of the TCE were deployed for the operations. The balance was mostly in cash which generated low returns.

I could not understand why CSC Steel has such a high cash position. The Group can generate positive cash flow from operations. At the same time, there is no aggressive expansion programme requiring a large amount of investment. Even if such an investment is required, there is the option of funding part of it with debt.

Given its poor track record in venturing into new areas, returning cash to the shareholders is a better choice. It would also help to reduce the shareholders’ funds and boost their returns.

Furthermore, if there is a positive change in the operating environment eg trade protection measures, the performance of CSC Steel would be much better.

As a cyclical industry and given the importance of the steel industry to the country, both of these are likely to happen.

Conclusion?

- CSC Steel will continue to add to shareholders’ value even if it just performed as it did over the past 12 years.

- But for this to benefit the shareholders, the return must be greater than 10%. This will be dependent on an upturn in the steel cycle. Also, if there are some trade protection measures, the returns will improve.

Case Notes You have to differentiate between a good company and a good investment.

You try to answer the former with a comprehensive company analysis. To answer the latter, you need an in-depth valuation so that you can compare the current price with the value to see whether there is an opportunity for capital gain. At the same time, I looked at historical shareholders' returns to get a sense of the track record. Fundamental analysis can be time-consuming and challenging. If you don’t have the time or have yet to acquire the skills, one way to look at what others have done. Sites such as Seeking Alpha.* have lots of relevant articles, especially for US stocks. Click the link for some free stock advice. If you subscribe to their services, you can then just read their analysis and assessment. |

How to minimize risk and secure your investments?

The 2 main risks that you have to be aware of when investing in CSC Steel are

- Privatization risk.

- Cyclical risk.

Privatization

You have to worry about privatization in the current economic environment. This is because the share prices of many Bursa Malaysia listed companies are trading below their fair values.

You may think that you would be able to invest in companies at a significant discount to fair values. And you gain when the market eventually comes to its senses and re-rates them based on the fundamentals.

However, this investment thesis assumes that these companies would not be privatized.

The history of privatization exercises over the past year is that he offer prices are definitely above the market prices. But they would be below the intrinsic values.

According to the Malaysian Minority Shareholders Watch Group, there was 13 Bursa Malaysia privatization offers during 2019 - 2020. Of these, 12 were offered at discounts to their fair values.

I had a privatization experience with DeGem Berhad.

- The offer price was RM 1.10 per share compared to its net asset of RM 1.93 per share.

- I had gone in at RM 1.05 per share some time back thinking that there was a large margin of safety. The privatization offer killed such hopes.

Most independent advisers would state that the offer is not fair but reasonable.

- It is not fair because it is lower than the fair value.

- It is reasonable because it provides an exit at a price greater than the historical market price.

Unless you were lucky to have gone in at the rock bottom price, you are most likely left feeling dissatisfied with the privatization offer.

But this is the risk of investing in the prevailing economic environment. There will be some controlling parties taking advantage of the situation. This was well summed up by one Malaysian research house early this year.

Kenanga Research had in its April 2020 report on the property sector opined that

“… a window of opportunity could open up for major shareholders to take private their listed companies at bargain-basement prices.”

Would CSC Steel be privatized?

- With owning about 46.3 % of CSC Steel (as of March 2023) and at the market price of RM 1.13 per share, it would cost the parent company RM 193 million to take CSC Steel private.

- Given CSC Steel RM 275 million cash and cash equivalent (as of the end of 2022), this could be achieved with a capital reduction exercise. The parent company does not have to come up with any funds.

CSC Steel would still be left with substantial cash after the privatization exercise.

You have to judge for yourself.

On the positive side, you can argue the following:

- If the parent company wanted to gain from any privatization exercise, it would have done so in March 2020 when it was trading at RM 0.44 per share.

- Since its listing in 2004, CSC Steel has focussed on operations and there have not been any corporate activities

Cyclical risk

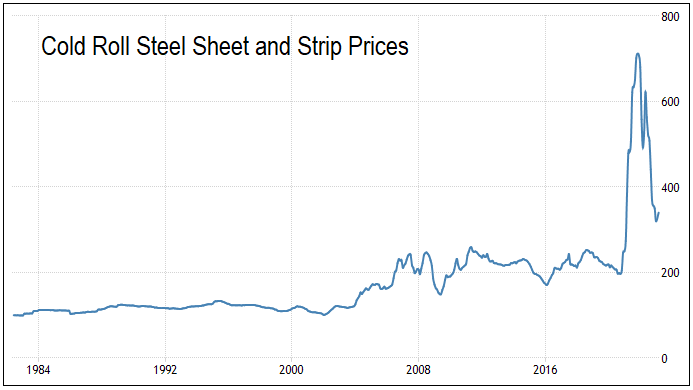

Steel is a cyclical industry and the 40 years price chart illustrates this aptly.

- The price movements were more volatile post-2005 compared to the period before 2005.

- Over the past 15 years, the sector has undergone two cycles.

- In 2021/22 there were extraordinarily high prices.

- We are currently in the down part of a cycle but the current price is not as low as that in 2009 or 2016. It may not be the bottom yet.

|

| Chart 15: Cold Roll Steel Prices |

Investopedia has this to say about cyclical risk.

“Cyclical risk is the risk of business cycles or other economic cycles adversely affecting the returns of an investment, an asset class, or an individual company's profits.

Cyclical risk does not typically have a tangible measure but instead is reflected in the prices or valuations of assets that are deemed to have higher or lower cyclical risks than the market.”

The cyclical risk if you invest in CSC Steel today can be summarized as follows:

- Both the business and your investment will benefit if the industry has reached the bottom of the current cycle.

- If the bottom of the current cycle has yet to be reached and steel prices decline further, your margin of safety is from the conservative valuation.

Remember that the Earnings Power Value is based on the past 12 years' performance which covered the low prices of the 2016 period.

The main point is that you are not investing at the peak of the cycle if you take a stake in CSC Steel currently.

How to Gain from the Case Study

The above analysis has shown that CSC Steel is fundamentally strong. Management has a good track record as an operator and capital allocator.

While it has not been able to create shareholders’ value, if you invest at the current price, you have a sufficient margin of safety. At the same time, you can expect some dividend yield.

So, while waiting for the market to re-rate, the dividends will provide a return that is much better than keeping your money with a bank.

I expect the results in 2023 to be one of the better ones compared to the past 12 years. To quote the company:

“…there are some positive signs of the steel market recovering in the early of year 2023. The border reopening of China although has uplifted the steel market sentiment…

As for domestic steel market outlook, the Group expects that the newly formed government will introduce stimulus measures to spur the activities of Malaysia economy, though it may take time to see the effect of it….”

These will provide the catalyst for re-rating.

There is another potential upside. The Group currently has about RM 275 million cash. Over the past 12 years, the lowest cash position was about RM 160 million cash. And this was only for one year. Most of the time, the annual closing cash was above RM 200 million.

This meant that there is excess cash that could be returned to shareholders as I do not foresee the Group investing in new ventures. There is currently excess capacity in Malaysia. I do not see the parent company authorizing any new investments (apart from the normal CAPEX).

For these reasons, I consider CSC Steel one of the better stocks in Bursa Malaysia to invest in. There is a potential upside while the Asset value provides the downside.

END

Reading guide

If you are a first-time visitor to this blog, you may not be familiar with some of the concepts that I have used in my analysis and valuation. I suggest that you check up the Foundations series - Fundamentals 01, Fundamentals 02, and Fundamentals 03. I also have a Definitions page in case you are not familiar with the terms I have used.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment