The stock picking portfolio has lost money – do not panic.

Fundamentals 20-3: I established a stock picking portfolio at the start of 2022. While the Mac 2022 review showed that it made money, this end of Jun review indicated a loss. My advice is to continue to hold as the intrinsic values are still intact.

In Jan 2022, I constructed a stock portfolio based on the companies that I had analysed and valued over the past year. The goal was to track the portfolio performance over the years to provide insights on establishing and managing a stock portfolio.

I carried out the first quarterly review of that portfolio at the end of March 2022 with two objectives:

- To determine the portfolio return.

- To ensure that the portfolio still meets the diversity criteria.

During the 3 months from the start of April 2022 till the end of June 2022, I did not add new stocks or sold any. In other words, there were no changes to the composition of the portfolio. You would think that because of this, there is no need to review the portfolio.

But stock prices did change during this period. As such the profile of the portfolio changed. So, there is a need to check that the portfolio still meets the diversity criteria. Besides I also wanted to determine the performance given the substantial decline in the stock market.

The Jun 2022 review showed that the current value of the portfolio was lower than the Jan 2022 starting value. But while prices have declined, intrinsic values have not. As such, there is no reason to panic.

Join me as I show you the mechanics of the review as well as what to do with the results. Should rush to sell or buy some of the stocks? Well, read my Disclaimer.

Contents

- Tracking performance

- End Jun 2022 Return

- End Jun 2022 Diversity

- Do not panic

- Conclusion

|

I started with a USD 100,000 investment fund in Jan 2022 (technically end Dec 2021). I did not use all the monies when I established the portfolio. When looking at a performance, I will look at it from the fund perspective rather than just the stock portfolio perspective. For the avoidance of doubt:

- The stock portfolio refers to the stocks that I invested in.

- The fund refers to both the value of the stock portfolio and the unutilized cash.

During the period from the 1st of April 2022 to the end of Jun 2022, the stock markets where I invested declined considerably. Many attributed this to the high inflation environment and the news about possible recessions in the US and Europe.

While stock prices have dropped, I did not enter the market even though I had cash. This was because I think the economic condition is not going to improve any time soon. In other words, there is still time to hunt for bargains over the next few months.

Secondly, I did not sell any of the portfolio stocks. In the first place, the falling prices meant that there was no opportunity to take profits. But more importantly, the intrinsic values of the stocks were still intact.

To benefit from this article, you should:

- Read the articles “How to construct a stock picking portfolio for 2022” and “Mac 2022 review of the stock picking portfolio”. This post builds on the data from the various tables presented in those articles.

- Read the Notes under each table presented in this article as they explain the computations and the rationales. The various tables can also serve as templates for your portfolio.

Tracking performance

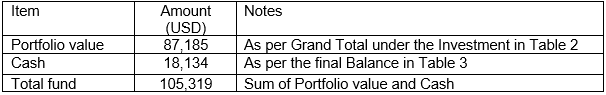

The total fund value as of the last review date (end of Mac 2022) was RM 105,319 comprising the following shown in Table 1:

|

| Table 1: Value of Fund as of end March 2022 |

|

| Table 2: Portfolio Profile as of end March 2022 |

|

| Table 3: Cash Position as of end March 2022 |

In my last article, I showed how I tracked the following using EXCEL:

- Individual stocks transactions.

- Changes in the cash position.

- Changes in the portfolio.

Since I did not buy or sell any stocks, the only change was in the stock price as of the end of June 2022. To update the portfolio, I entered the end of Jun 2022 stock prices as per Column A in Table 4 and EXCEL then did the rest.

You can see that the total portfolio value had declined to USD 78,224 (refer to Table 4) compared to USD 87,185 as of the end of Mac 2022 (refer to Table 2).

The fund value by the end of Jun 2022 then became USD 96,358 as per Table 5.

|

| Table 5: Fund Value as of end Jun 2022 |

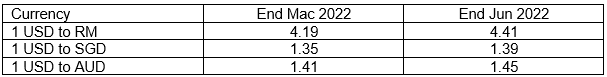

At the same time, I also have used the following exchange rate as per Table 6. Note the changes in the rates as of the end of June 2022 compared to the end of Mac 2022.

|

| Table 6: Forex Rate |

You can see that the changes in the value of the stock portfolios are partly due to changes in the exchange rates.

End Jun 2022 Return

If you can recall, I started the investment with an initial USD 100,000 set aside for the portfolio.

- The fund value as of the end of Mac was RM 105,319. Refer to Table 1.

- It was USD 96,358 at the end of Jun 2022. Refer to Table 5.

There are 2 goals for the periodic review. The first is to compute the return. The second is to ensure that the portfolio meets the diversity criteria.

Recap

I would like to recap what I said in my last article regarding returns. When it comes to assessing performance, you have the following options:

- Look at absolute returns.

- Compare your returns with those of the benchmarks.

- Compare the returns on a risk-adjusted basis.

When it comes to the fund or stock portfolio, the return is complicated by the following situations:

- During the period, some of the stocks could be losing money. You could have a negative total gain if there is a capital loss that is larger than the dividends.

- You could have sold off some stocks and be holding cash. Alternatively, you could be holding onto some dividends in cash form rather than have them reinvested during the review time.

- You could have also allocated additional cash to the funds. In other words, the amount set aside for investment is bigger not because of any gain, but because of additional funds.

To cater to such situations, I define the total gain and return in the following manner.

- Total Gain = current value - previous value + dividends.

- The returns for the period = gain divided by the previous value.

- The value here includes any un-invested cash ie the fund value.

I used the market value of the stocks in the stock portfolio to calculate the stock portfolio value. It is the sum of the market value of the respective stocks. The current and previous values refer to the value of the stock portfolio assuming it is liquidated.

The market value of a particular stock = number of shares held × market price. The number of shares held currently may be different from the number of shares held before. This could be due to bonus issues and or other corporate activities.

To ensure that I am comparing apple to apple, I also include any dividends or money that I have received that has not been reinvested.

- The dividends refer to all the dividends paid during the review period. Since there is a likelihood that you may reinvest the dividends, I look at the after-tax value of the dividends received.

- The cash could be money pending reinvestment or money taken out.

You can see from the transactions that there were no dividends or any cash added to the fund over the past 6 months. We will face these in later periods.

Fund Returns

You can see from Table 4 that the current total market value of the stocks in the stock portfolio was less that the cost of the stocks. In fact there was a loss of USD 4,889. As mentioned, I do not focus on the loss or gain. Rather I look at returns.

The total fund value as of the end of June was USD 96,358 as per Table 5.

The total fund value at the start of the period (1st April 2022) = USD 105,319 as per Table 1.

The return for the 3 months period = (96,358 – 105,319) / 105,319 = (8.51) %

Now if I look at the return of the fund from the start (end Dec 2021 or start of 1 Jan 2022), I have the return for the 6 months period = (96,358 – 100,000) / 100,000 = (3.64) %. Note that this is because I started with USD 100,000.

The above is of course an illustration for computing total returns. It is a conservative estimate as it assumed that cash or money taken out did not have any other gain.

I don’t worry about the returns for the money taken out. This is because if it is invested in other assets, the returns would be captured under the asset portfolio performance.

Benchmarking returns

You can see that I had incurred losses when looking from both the quarterly and half-yearly basis. Now whether the loss is a “good performance” can only be gauged by comparing it with some reference performance or benchmark.

In my previous article, I created a benchmark based on the following:

- KLCI for Bursa Malaysia.

- STI for SGX.

- S&P 500 for the US.

The weights for each benchmark are the value of funds allocated to the respective stock exchanges and cash at the beginning of the period. Refer to Tables 7 and 8.

Comparing the returns

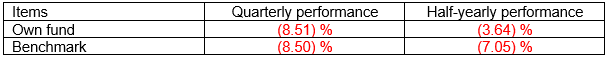

Table 9 summarized the performances of the fund with those of the Benchmark

|

| Table 9: Summary of Fund Performance |

You can see from Table 9 that our fund matches the Benchmark for the quarter but did better than the Benchmark on a half-yearly basis. Was it a good performance? I am a long-term investor and as such, I would give more emphasis on the half-yearly performance.

As covered in my earlier article, the example so far assessed the performance based only on the rate of return. If you view volatility as risk, you can include volatility in your assessment of the performance. In practice, there are 4 such measures:

- Treynor ratio.

- Sharpe ratio.

- Jensen alpha.

- Information ratio.

I do not view volatility as a risk. But I do use the CAPM concept, especially the Beta in determining the cost of capital. As such I assess my performance using the Information ratio and the Jensen alpha. But to compute these returns, we need returns from different review periods. As such I would cover these in the future.

End Jun 2022 Diversity

The goal of a portfolio is to have about 20 to 30 uncorrelated stocks. You will have difficulty computing the covariances required to determine the correlations.

My approach was to use a “back-of-envelop” approach to analyse the portfolio based on several criteria to ensure that there is diversity. I assessed the degree of concentration under the following criteria.

- Regions as represented by the stock exchanges.

- Sectors or industry.

- Market cap or size.

- Business performance - Turnarounds, Compounders, Cyclicals.

The idea is to select stocks based on different factors. These could be economic, political, technological, and even market sentiment factors.

For each criterion, I classified the stocks in the portfolio into several groups and use this as the basis to assess diversification. My rules of thumb for diversification are:

- Single stock concentration - the market value of a stock should not be more than 10% of the market value of the total fund.

- Group concentration - the market value of the stocks within a group should not be more than 30% of the market value of the total fund.

When the stock portfolio was first constructed, I checked to see that the profile met the above criteria. Then as prices change or when there are new transactions, you would expect the profile of the stock portfolio or fund to change.

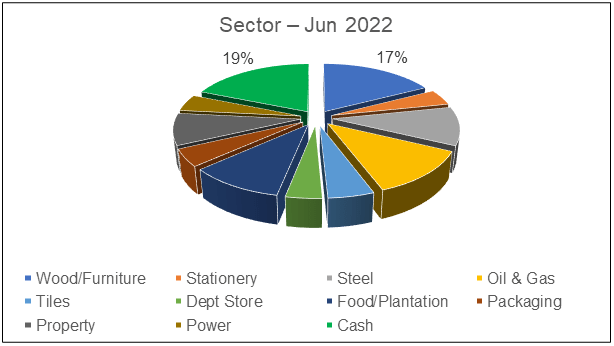

An important part of the review process is to ensure that the updated portfolio or fund still met the diversity criteria. The following charts show the profile of the fund as of the end of Jun 2022.

|

| Chart 1: Fund Profile by Regions end of Jun 2022 |

|

| Chart 2: Fund Profile by Sector end Jun 2022 |

|

| Chart 3: Fund Profile by Investment Type end Jun 2022 |

|

| Chart 4: Fund Profile by Market Cap end Jun 2022 |

You can see from Charts 1 to 4 that we have the following breaches.

- Regions/stock exchanges. 53 % of the fund is invested in Bursa Malaysia stocks. This is because I am familiar with investing in Bursa Malaysia. Having said this, I will look for investment opportunities in other countries to reduce this exposure.

- Investment type. 37 % of the fund is invested in Quality Value stocks. I would not worry too much about this as Quality Value stocks are my base investment type.

There was no breach under the sector or market cap criteria.

You will notice that the diversity picture is quite similar to that for the end of Mac 2022. My experience is that I seldom have to rebalance because of diversity reasons. I am not sure whether this is because of good selection in the first place or because there is a flaw in my approach. Let me have your thoughts on this.

|

Do not panic

You can see from Table 9 that the fund has not done too badly compared to the Benchmark. However, the value of the fund is lower than when I first established the portfolio.

- In my first quarterly review, the fund grew by 5.3 %.

- In the current quarterly review, the fund decreased by 8.5 % relative to the value at the end of the first quarter.

One can argue that the loss this quarter was due to volatility. Since I am a long-term value investor, I should not worry.

You should not dismiss the loss by attributing it to volatility. Every time the price of a stock goes below your purchase cost, you should check that the intrinsic value is still intact.

I have an article to show how to methodically carry out such an analysis. Refer to “Parkson Holdings - how to handle a price decline”

If you can recall, for every stock, I compared the market price with several estimates of intrinsic value. I have set up the comparison in EXCEL. Whenever there is any update in the prices or intrinsic values, the margin of safety is automatically updated.

The results of such a comparison as per the Jun 2022 review are shown in Table 10. If you refer to the earlier articles on the stock portfolio, you can find the initial basis of the margin of safety for each of the stocks.

For the current review, there were no changes to the intrinsic values. The only change was the market price. Even with the new market prices, there are still sufficient margins of safety.

|

| Table 10: Intrinsic Values Compared with Stock Prices |

There is no reason to panic as the intrinsic values are all still intact. While the stock prices may have fallen below the purchased cost, there is no change to the intrinsic values. There are still sufficient margins of safety between the purchased cost and the intrinsic values.

Conclusion

You will note that there are two aspects to maintaining the stock portfolio.

- Keeping track of the various transactions. I have an EXCEL worksheet for this so that when I update the prices, the returns are computed automatically. At the same time, the profile of the portfolio is updated.

- Reviewing and interpreting the results. There are three key foci here – returns, diversity, and margins of safety. I hope the examples in the post illustrate what to do. If you set up an EXCEL worksheet for your portfolio, you can then devote your time to this.

In the current quarter, the returns have deteriorated. However, there is still the required diversity. At the same time, while prices have declined, there are still sufficient margins of safety.

The purpose of having a stock portfolio is to balance returns and risks. You manage risks via:

- Having a diversified portfolio.

- Having a sufficient margin of safety for each stock.

As a long-term value investor, you believe that the market will rerate the stocks eventually. You believe that the market prices will be at least equal to the intrinsic values. In other words, the margin of safety also represents the potential gain.

The above is the logic of the stock portfolio. However, to benefit from it, you must let it takes its course. In other words, trust the process and do not panic when you see some losses. The real challenge is your behaviour. Can you sit tight and do nothing when the news is about doom and gloom?

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment