The stock picking portfolio dipped but buy more

Fundamentals 20-4: I established a stock picking portfolio at the start of 2022. This Sep 2022 review showed further losses but I am buying as there are better margins of safety.

In Jan 2022, I constructed a stock portfolio based on the companies that I had analyzed and valued over the past year. The goal was to track the portfolio performance to provide insights on establishing and managing a stock portfolio.

This is my third quarterly review. The goals of each review are:

- To determine the portfolio return.

- To ensure that the portfolio still meets the diversity criteria.

While the stock prices as of end Sep 2022 had declined for most of the stocks, there was no reason to sell them. The intrinsic values are still intact.

Join me as I show you the mechanics of the review as well as what to do with the results. As there are now sufficient data, I have also illustrated how to compute the Information ratio and the Jensen alpha.

Due to the declining prices, I have taken the opportunity to add to the portfolio.

Should rush to buy them? Well, read my Disclaimer.

This post builds on the data from the various tables presented in my earlier articles in this series. To benefit from this article, you should first read the following:

Contents

- Tracking performance

- End Sep 2022 Return (before buying new shares)

- End Sep 2022 Diversity (before buying new shares)

- Buying more

- Conclusion

|

To recap, I started with a USD 100,000 investment fund. I did not use all the monies when I established the portfolio and as such, that is some balance cash. When looking at performance, I will look at it from the fund perspective rather than just the stock portfolio perspective. For the avoidance of doubt:

- The portfolio refers to the stocks that I invest in.

- The fund refers to both the value of the stock portfolio and the unutilized cash.

During the period from the 1st of Jan 2022 to the end of Sep 2022, the stock markets where I invested declined considerably. Many attributed this to the high inflation environment and the news about possible recessions in the US and Europe.

I did not sell any of the portfolio stocks. In the first place, the falling prices meant that there was no opportunity to take profits. But more importantly, the intrinsic values of the stocks were still intact.

Given the declining market, I took the opportunity to invest in new shares. For simplicity, I assumed buying at the end of Sep 2022.

Tracking performance

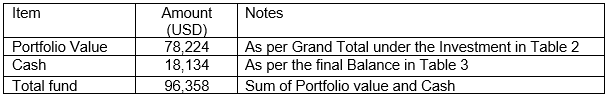

The total fund value as of the last review date (end of Jun 2022) was USD 96,358 comprising the following:

|

| Table 1: Total Fund Value as of end Jun 2022 |

|

| Table 2: Portfolio as of end Jun 2022 |

|

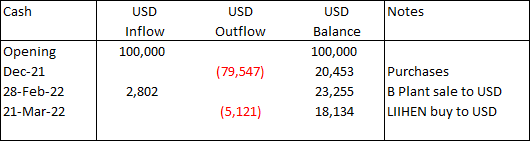

| Table 3: Cash Position as of end Jun 202 |

Let us consider the situation at the end of Sep 2022 before I bought the new shares. Since I did not buy or sell any stocks, the only changes are in the stock prices.

To update the portfolio, I entered the end of Sep 2022 stock prices as per Column A in Table 4 and EXCEL then did the rest. Refer to Table 4.

|

| Table 4: Portfolio as of end Sept 2022 (before any new share purchase) |

You can see that the total portfolio value had declined to USD 70,281 (refer to Table 4) compared to USD 78,224 as of the end of June 2022 (refer to Table 2). The value of the portfolio had declined by USD 7,943.

The total fund value by the end of Sep 2022 then became USD 88,415 as per Table 5.

|

| Table 5: Total Fund Value end Sep 2022 (before any new share purchase) |

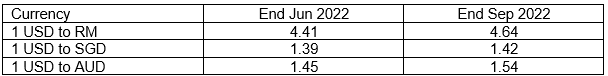

At the same time, I also have used the updated forex rates as per Table 6. Note the changes in the rates as of the end of Sep 2022 compared to the end of Jun 2022.

|

| Table 6: Forex rates |

You can see that the changes in the value of the portfolio are partly due to changes in the forex rates. Without the changes in the forex rates, the value of the portfolio would be USD 73,027 compared to USD 70,281. About 1/3 of the portfolio losses from the end of Jun 2022 to the end of Sep 2022 were due to forex losses.

End Sep 2022 Return (before buying new shares)

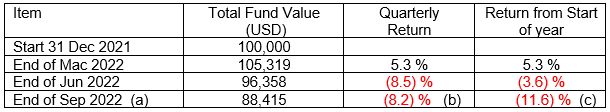

I started the investment with an initial USD 100,000 set aside for the portfolio. Table 7 shows how the value of the Fund had changed over the past few quarters.

Recap

I would like to recap what I said previously regarding returns. When it comes to assessing performance, you have the following options:

- Look at absolute returns.

- Compare your returns with those of the benchmarks.

- Compare the returns on a risk-adjusted basis.

When it comes to the fund or stock portfolio, the return is complicated by the following situations:

- During the period, some of the stocks could be losing money. You could have a negative total gain if there is a capital loss that is larger than the dividends.

- You could have sold off some stocks and been holding cash. Alternatively, you could be holding onto some dividends in cash form rather than have them reinvested during the review time.

- You could have also allocated additional cash to the funds. In other words, the amount set aside for investment is bigger not because of any gain, but because of additional funds.

To cater to such situations, I define the total gain and return in the following manner.

- Total Gain = current value - previous value + dividends.

- The returns for the period = gain divided by the previous value.

- The fund value includes any un-invested cash.

I used the market value of the stocks in the portfolio to calculate the portfolio value. It is the sum of the market value of the respective stocks. The current and previous values refer to the value of the portfolio assuming it is liquidated.

The market value of a particular stock = number of shares held × market price. The number of shares held currently may be different from the number of shares held before. This could be due to bonus issues and or other corporate activities.

To ensure that I am comparing apple-to-apple, I also include any dividends or money that I have received that has not been reinvested.

- The dividends refer to all the dividends paid during the measurement period. Since there is a likelihood that you may reinvest the dividends, I look at the after-tax value of the dividends received.

- The money could be money pending reinvestment or money taken out.

You can see from the transactions that there are currently no dividends or any cash added to the fund. I will cover dividends in the coming end Dec 2022 review.

Benchmarking returns

You can see that I had incurred losses when looking from both the quarterly and year to date bases. Now whether the loss is a “good performance” can only be gauged by comparing it with some reference performance or benchmark.

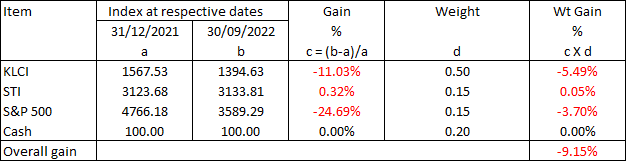

In my previous article, I created a benchmark based on the following:

- KLCI for Bursa Malaysia.

- STI for SGX.

- S&P 500 for the US.

The weights for each benchmark are the value of funds allocated to the respective stock exchange at the beginning of the period. Refer to Tables 8 and 9.

Comparing the returns

Table 10 summarized the performances of the fund with those of the benchmark. You can see that the YTD performance of the fund (from the start) was worse than the benchmark.

|

| Table 10: Fund Returns vs Benchmark Note a) Before buying new shares. |

As covered in my earlier articles, the example so far assessed the performance based only on the rate of return. If you view volatility as risk, you can include volatility in your assessment of the performance. In practice, there are 4 such measures:

- Treynor ratio.

- Sharpe ratio.

- Jensen alpha.

- Information ratio.

I consider risk as permanent loss of capital. Nevertheless, I view volatility, as represent by Beta as one proxy of risk. I use the CAPM concept, especially the Beta in determining the cost of capital. As such I also assess the portfolio performance using the Information ratio and the Jensen alpha.

Information ratio

Table 11 illustrate the data for the computation of the Information ratio.

|

| Table 11: Computation of Information Ratio (Before buying of new shares) |

Note

d) Before the buying of new shares.

Fund relative performance = fund return - benchmark return = (3.8) % - (3.3) % = (0.5) %.

Tracking error = Standard deviation of the differences = 4.0 %.

Information ratio = (0.5) % / 4.0 % = (0.125).

This information is interpreted as the fund underperforming the benchmark by 0.125 per unit of volatility over the past 3 quarters.

Jensen alpha

“The Jensen’s alpha is a risk-adjusted performance measure that represents the average return on a portfolio or investment, above or below that predicted by the Capital Asset Pricing Model (CAPM), given the portfolio…beta and the average market return. This metric is also commonly referred to as simply alpha.” Investopedia

The alpha is one way to determine if a portfolio is earning the proper return for its risk level. The formula for calculating the alpha as per Investopedia is:

Alpha = R(i) - [ R(f) + B × { R(m) - R(f) } ].

Where:

R(i) = the realized return of the portfolio.

R(m) = the realized return of the appropriate market index or benchmark.

R(f) = the risk-free rate of return.

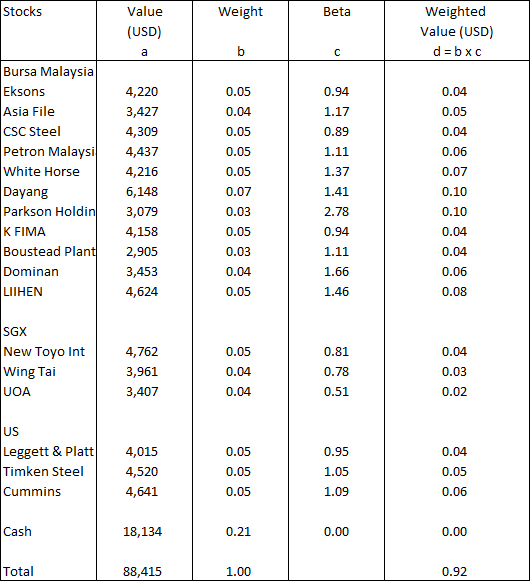

B = beta of the portfolio for the chosen market index. The portfolio beta is the weighted average betas of all the stocks and cash in the fund.

Table 12 shows the computation of the fund beta.

The YTD alpha for the fund is then:

- The fund return is (11.6) %.

- The Benchmark return is (9.2) %.

- The risk-free rate of return for the year based on USD is 1.51 %.

- The portfolio beta is computed to be 0.92.

Alpha = (11.6) - [ 1.51 + 0.92 × {(9.2) – 1.51} ] = (3.3)

The alpha represents the amount of the portfolio return that is attributable to my stock-picking ability. The negative results showed that I did worse.

The Capital Asset Pricing Model predicts the expected return of your portfolio taking into consideration the risk (beta) in the portfolio.

End Sep 2022 Diversity (before buying new shares)

The goal of a portfolio is to have about 20 to 30 uncorrelated stocks. You will have difficulty computing the covariances required to determine the correlations. As such, I used a rule of thumb to ensure diversity.

- Single stock concentration - the market value of a stock should not be more than 10% of the market value of the total portfolio.

- Group concentration - the market value of the stocks within a group should not be more than 30% of the market value of the total portfolio.

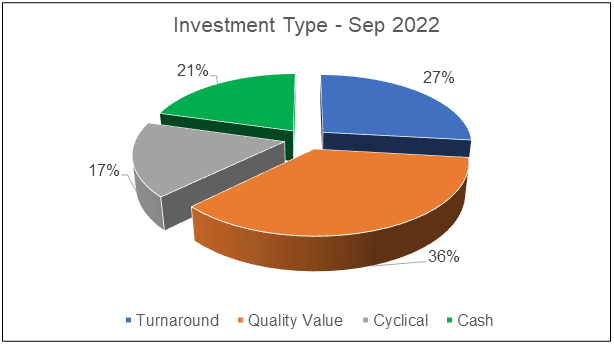

Refer to my earlier posts on this series for the details. The following charts show the profile of the portfolio as of the end of Sep 2022:

|

| Chart 1: Location Profile (before any new share purchase) |

|

| Chart 2: Sector Profile (before any new share purchase) |

|

| Chart 3: Investment Type Profile (before any new share purchase) |

|

| Chart 4: Size Profile (before any new share purchase) |

You can see from Charts 1 to 4 that we have the following breaches.

- Location. 51 % of the portfolio is invested in Bursa Malaysia stocks. This is because I am familiar with investing in Bursa Malaysia. Having said this, I will look for investment opportunities in other countries to reduce this exposure.

- Investment type. 36 % of the stocks are Quality Value ones. I would not worry too much about this as Quality Value stocks are my base investment type.

There was no breach under the Sector or Size criteria.

|

Buying more

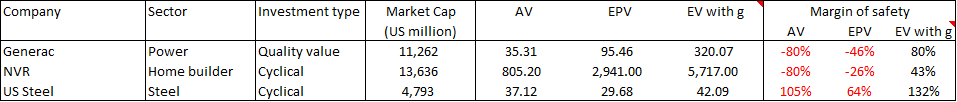

The market had declined since the beginning of the year. I would argue that this is due to price volatility rather than a reduction in the intrinsic values of the stocks. This can be seen in Table 13 which shows that there are still margins of safety even with the end of Sep 2022 stock prices.

|

| Table 13: Current Margin of Safety Notes a) For Boustead Plantation and New Toyo Int, I relied on the Asset Value. b) For the US companies, I relied on either the EPV or EV with growth. |

Given the price decline, I believe that there are buying opportunities and as such have used the balance cash to invest in 3 US companies. Refer to the following for the Investment Thesis:

The margins of safety for these 3 companies are summarized in Table 14

|

| Table 14: Profile of new companies added to portfolio |

Table 15 summarizes the stock profile of the portfolio post the buying of the 3 new stocks. You can see from Table 16 that cash has been reduced to USD 4,147.

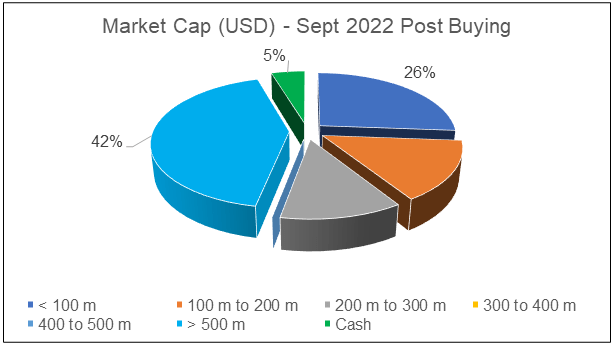

At the same time, I also have to check on the diversity given the additional 3 stocks. These are summarized in Charts 5 to 8.

- Comparing Chart 1 and Chart 5, you can see that the amount allocated to the US has increased. It is now just above the 30% single-sector border.

- Quality value stocks increased from 36 % to 41%.

- The large market cap stocks increased from 27 % to 42 % as all the 3 new stocks fall under the large market cap category.

Should you be worried about breaching the market cap? Let me have your thoughts.

|

| Table 15: Portfolio profile end Sep 2022 - Post buying new shares |

|

| Table 16: Sep 2022 Cash Position - Post buying new shares |

|

| Chart 5: Location Profile - Post buying new shares |

|

| Chart 6: Sector Profile - Post buying new shares |

|

| Chart 7: Investment Type Profile - Post buying new shares |

|

| Chart 8: Size Profile - Post buying new shares |

Conclusion

You will note that there are two aspects in maintaining the stock portfolio.

- Keeping track of the various transactions.

- Reviewing and interpreting the results.

I consider portfolio construction and maintenance another set of skills to develop. As you can see, these involve tracking various transactions. That is why being familiar with EXCEL can reduce a lot of the computation work so that you can focus on the interpretations.

There are three key foci when interpreting the result – returns, diversity, and margins of safety. I hope the examples in the post illustrated what to do.

So far, I have ignored dividends. This is because I look at dividends from an annual perspective. I would cover the dividend aspect in the next end Dec 2022 review.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment