Is Deleum a value trap?

Value Investing Case Study 43-1. Deleum: Cyclical resilience or value trap? Unveiling its turnaround potential in the oil & gas sector.

Crude oil prices are cyclical. Over the past 12 years, crude oil price declined from its 2012/13 peak to reach the bottom in 2016. Then the uptrend was affected by COVID-19 that resulted in another sharp drop that bottomed in 2020. Oil prices are today more than double the 2016 bottom prices.

Given the cyclical prices you should not be surprised to see yo-yos in the fortune of many Bursa oil and gas companies. There were some that went into financial trouble because of this.

But those who survived are probably in a better shape to take advantage of the upturn.

This article delves into the performance of Deleum Bhd (Deleum or the Group), a Bursa oil and gas services company. I am happy to note that following my fundamental analysis and valuation, Deleum is not a value trap but is an investment opportunity. It is one of the better Bursa stocks.

Should you go and buy it? Well, read my Disclaimer.

Contents

- Investment thesis

- Business background

- Operating trend

- Financial position

- Risks

- Valuation

- Deleum is not a value trap

|

Investment Thesis

Deleum provides a range of products and services to the Malaysian oil and gas exploration and production sector. And as such its prospects are tied to the performance of the sector.

The Group did well when crude oil prices were high. But when oil prices were in the trough part of the cycle during 2015 to 2019, the company performance deteriorated. Its performance improved over the past 2 years due to the better crude oil prices.

Over the cycle, the Group delivered average returns that were greater than its cost of funds. The Group is also financially sound.

A valuation based on the performance over the cycle, showed that there is more than 30% margin of safety. Given the improving crude oil prices and Deleum strong fundamentals, this is an investment opportunity.

|

Business background

The Group provides a diverse range of supporting specialised products and services to the oil and gas industry, particularly in the exploration and production sector. It has 3 business segments:

- Power & machinery. The sales of gas turbine packages and after-sales support and services accounted for 81 % of this segment revenue in 2022. The balance came from valves and flow regulators.

- Oilfield services. In 2022, 95% of this segment revenue came from slickline and other well services.

- Integrated corrosion services.

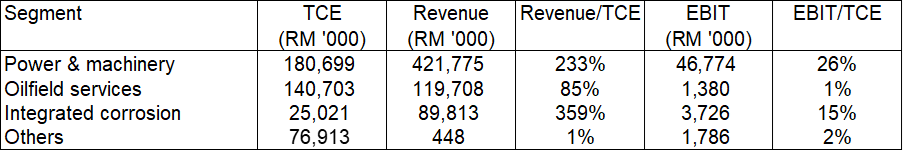

The Power & machinery segment is the biggest revenue and earnings contributor over the past 12 years. Refer to the Chart 1. In 2022, it accounted for about 72 % each of the Group revenue and EBIT.

Not all the segments were pulling the same weight. Refer to Table 1 where I have estimated the return (based on EBIT/TCE) from each segment.

- The Power & machinery segment used the most capital and delivered the best return.

- Although the Oilfield services segment used the next highest amount of capital it delivered the worst operating return.

|

Operating trends

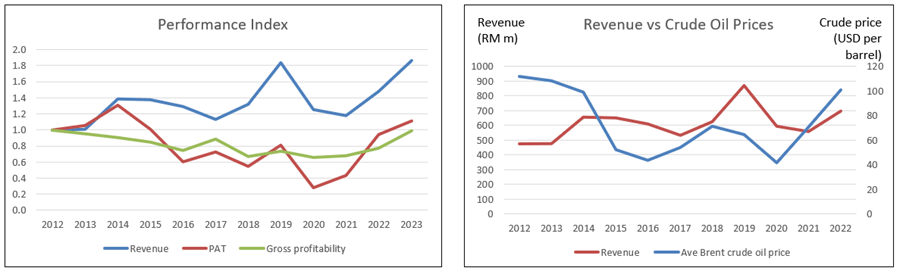

I looked at 3 metrics to get an overview of the overall performance – revenue, PAT, and gross profitability (gross profits / total assets). Refer to the left part of Chart 2.

Revenue over the past 12 years showed a cyclical pattern growing at 5.8 % CAGR. The revenue spike in 2019 was due to growths in the Power & machinery and Integrated corrosion segments. Refer to Chart 1.

As an oil & gas services company, the performance of Deleum would be correlated to the crude oil prices. Refer to the right part of Chart 2. From 2012 to 2022:

- There was a negative 0.25 correlation between revenue and Brent crude oil for the same year.

- There was a negative 0.84 correlation between current year revenue and Brent crude oil in the following year.

I would not consider any correlation less than 0.7 as significant. While there is some correlation, it is not so straight forward as there is some time lag issue. But it shows that Deleum performance is tied to crude oil prices.

|

| Chart 2: Performance Index and Revenue vs Crude Oil Note that the 2023 values were based on the Sep 2022 LTM results. |

PAT was relatively volatile peaking in 2014 before trending down for many years to reach the bottom in 2020. It started to recover post 2020. But even then, the profit in 2023 is lower than the 2014 peak.

The declining PAT given the increasing revenue was because of declining gross profit margins.

- In 2012 to 2014, the average gross profit margin was 24%.

- This declined to an average of 18 % from 2018 to 2020. The company attributed this to the declining price environment.

Given the declining gross margins, you should not be surprised to see gross profitability declining. It started to decline from 2012 but appeared to have recovered so that in 2023 it was back to the 2012 level.

The key takeaway here is that Deleum looks like a stock that have managed a turnaround.

Returns

Given the “U” shape pattern of the PAT, you should not be surprised to see similar patterns for the returns as illustrated in the left part of Chart 3. Over the past 12 years,

- ROE ranged from 4.1 % to 23.2% with an average of 13.4 %.

- Operating return (after tax EBIT / Total capital employed) ranged from 6.7 % to 26.8 % with an average of 15.3 %.

|

| Chart 3: Returns and DuPont Analysis |

A DuPont analysis showed that the uptrend in the Operating return post 2021 was due to better operating margin, asset turnover and leverage. Refer to the right part of Chart 3.

Competitive profile

There are about 2 dozen Bursa listed companies under the Energy Infrastructure, Equipment & Services sector.

In my Nov 2022 article, I provided a summary of the sector performance from 2013 to 2022. Refer to “Are there opportunities in the Bursa Energy Services sector?”

I compared Deleum revenue and return with the sector median. Overall, Deleum delivered better performance than the sector. Refer to Chart 4.

- Deleum had better revenue growth compared to the sector median revenue. While there was revenue growth for Deleum, the sector revenue in 2022 was lower compared to that for 2013.

- Deleum delivered better ROE over the period compared to the sector.

|

| Deleum Chart 4: Sector comparison |

Financial position

I would rate Deleum as financially sound based on the following:

- As of the end of Sep 2023, it had RM 230 million cash. This was equivalent to 36 % of its total assets.

- It had a debt-equity ratio of 4 % as of Sep 2023.

- Over the past 12 years, it generated positive cash flow from operations every year.

- Over the past 12 years, it generated RM 748 million cash flow from operations compared to RM 536 million of PAT. This is a very good cash conversion ratio.

- The Group also had a good capital allocation track record as shown in Table 2. You can see that its cash flow from operations was well deployed for CAPEX and dividends.

|

| Table 2: 2012 to 2023 Sources and Uses of Funds |

Reinvestment

Growth needs to be funded and one metric for this is the Reinvestment rate. This is defined as:

Reinvestment with acquisitions = CAPEX & Acquisitions – Depreciation & Amortization + Net Changes in Working Capital.

I then determined the Reinvestment rate = Reinvestment / after-tax EBIT.

Acquisitions are an integral growth driver for the company. As such I have included the annual acquisition expenditure as part of the CAPEX.

Over the past 12 years, the total Reinvestment amounted to RM 104 million. The after-tax EBIT for the same period came to RM 472 million. This resulted in a Reinvestment rate of 22 %. This is a good rate.

Note that the low Reinvestment rate was because of the low Reinvestments. This in turn was because there were several years when the Depreciation & Amortization far exceeded what was spent on CAPEX and Net Changes in Working Capital.

Shareholders’ value creation

I looked at the following metrics when assessing shareholders’ value creation:

- Comparing returns with the cost of funds.

- Comparing the gains by an investor who bought a share at the end of 2011 with the cost of equity.

- Looking at the Q Rating which is based on several valuation metrics. A high score relative to the panel meant that the company had the potential to create shareholders’ value.

Deleum created shareholders' value as all the metrics exceeded the appropriate cost of fund. Refer to Table 3.

|

| Table 4. Estimating the shareholders’ gain |

At the same time, Deleum had an overall Q Rating of 0.47. This places it at the average position among the panel companies. You can see that it did well in the risk and financial ratings.

|

| Chart 5: Q Rating |

Risks

I look at risks through the following lenses:

- Crude oil prices.

- Privatization.

- Depletion of Malaysian oil reserves.

Link to crude oil prices

Oil prices have been cyclical as can be seen from Chart 6. While prices in 2023 have been high, it was not the historical high which occurred in 2012/14.

|

| Chart 6: Brent Crude Oil Price. Source: Statista |

Crude oil prices and CAPEX by oil and gas companies are interrelated. When oil prices are high, companies are more likely to increase their CAPEX to take advantage of the favorable pricing environment and expand their operations.

Conversely, in periods of low oil prices, CAPEX tends to be reduced to manage costs and conserve capital. These dynamics can contribute to the cyclical nature of the oil and gas industry and have a significant impact on the performance of the oilfield services companies.

The US Administration expects the average Brent crude prices to be:

- USD 61 per barrel in 2025.

- USD 88 per barrel in 2035.

- USD 91 per barrel in 2045.

Looking at the above forecast for the price of crude oil, it does not look much different from the past 12 years. The Group should not do any worse than what it achieved over the past 12 years.

Secondly, we should look at the performance over the cycle when determining the margin of safety.

Privatization

In the case of Deleum, I would rate the privatization risk as low. If the controlling shareholder had any plans to privatize it, it would have been more cost effective to do so in mid-2021. At that juncture, the share price was around RM 0.50 per share compared to the current share price (25 Dec 2023) of RM 0.96 per share.

Depletion of Malaysian oil reserves

Deleum business is very dependent on the performance of the Malaysian oil & gas sector.

The main concern here is the depletion of Malaysian oil & gas reserves. The positive side is that the Malaysian oil reserves can probably provide the Group with another decade-plus of work. This should give it time to seek alternative ventures.

For further discussions on the Malaysia reserves, refer to my article “Is Dayang one of the better Bursa stocks?”

Valuation

My value of Deluem is summarized in Chart 7.

- I estimated its Asset Value as RM 0.99 per share broken down into Graham Net Net, NTA, and Book value. Note that the Book value is value close to the NTA due to the small intangibles.

- I estimated its Earnings Value as RM 1.75 per share. You can see that the non-operating assets accounted for about 41 %of this value. A significant part of the balance came from its Earnings Power Value.

At RM 0.96 per share (25 Dec 023), Deleum is trading significantly below the Earnings Power Value. There is more than a 30% margin of safety.

Over the past 5 years and even currently, the market price of Deleum share has been below the Earning Power Value.

|

| Chart 7: Valuation |

Valuation model

My Earnings Value of the company was derived based on the average values from 2 valuation approaches:

- Free Cash Flow to the Firm model as per Damodaran.

- Residual Income model as per Penman.

For both models, I used the past 12 years’ time-weighted average value to represent the normalized value.

The cost of capital used in the model was based on the Capital Asset Pricing Model. I followed Damodaran’s approach to determine the Beta and the risk premiums.

These resulted in 8.0 % each for the cost of equity and WACC. Note that the values for both are about the same due to the low debt situation.

Valuation risks and limitations

There are 3 critical assumptions in my valuation.

- Cost of capital.

- Turnaround.

- Cyclical sector.

The cost of capital was derived based on the risk-free rate and equity risk premium as of 2022. We currently have the Ukraine invasion and the Israel-Gaza conflict. The parameters do not reflect the higher-risk situation.

As such you should see the Earnings Value as an optimistic one. The only mitigating point is that the margin of safety is sufficiently large.

Deleum seems to be coming out of a turnaround. My valuation model assumes that the past 12 years' performance is a good reflection of the future. In a company coming out of a turnaround, this is a very conservative picture.

Finally, I assumed that Deleum is a cyclical stock. According to Damodaran

“Cyclical and commodity companies share a common feature, insofar as their value is often more dependent on the movement of a macro variable (the commodity price or the growth in the underlying economy) than it is on firm-specific characteristics…the biggest problem we face in valuing companies tied to either is that the earnings and cash flows reported in the most recent year are a function of where we are in the cycle, and extrapolating those numbers into the future can result in serious misvaluation.”

To overcome the cyclical issue, we have to normalize the performance over the cycle. I have assumed that the 2012 to 2023 period is a good representation of the business performance over the cycle.

|

Deleum is not a value trap

My analysis of Deleum showed that it had turned around its poor performance resulting from the low oil prices.

The company is fundamentally sound based on the following:

- It is financially sound with a strong cash holding and a good cash conversion ratio.

- The returns are showing uptrends. The average returns were greater than the cost of funds indicating that it had been able to create shareholders value. Note that the average returns were based on its performance over the cycle.

- Despite going through the trough of the 2015 to 2019 crude oil cycle, there were no significant asset written off.

It is a cyclical business and I value it as such. My valuation showed that there is more than 30% margin of safety based on the Earnings Power Value.

You may be concerned that this is a value trap. A value trap is a company that looks cheap but is cheap for a fundamental reason. The trap springs after you bought it.

This is not the case with Deleum. It has strong fundamentals. The comparatively low market price is due to market sentiments rather than business performance.

Deleum’s intrinsic value is greater than the market price. This is a value estimated on its performance over the cycle. As such I do not consider Deleum a value trap. Rather, it is one of the better Bursa companies to invest in.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment