Is AmBank a value trap?

Value Investing Case Study 46-1. AmBank: A rebound story or a value trap? Unpacking its true potential in Malaysia's banking sector!

There are currently 10 Bursa Malaysia banks. AmBank (or the Group) is one of them.

I first invested in AmBank in 2016 at RM 4.42 per share. Over the next few years, I continued to build up my investment. Today it is among the top 5 investments (in terms of market capitalization) in my portfolio.

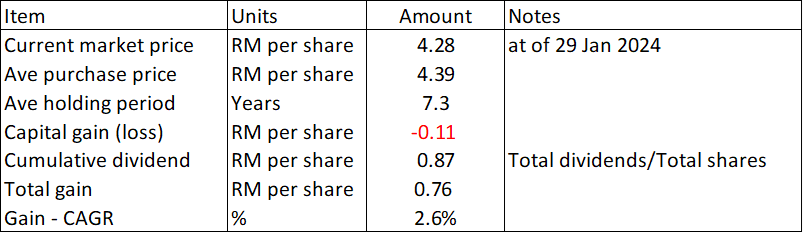

My average purchase price was RM 4.39 per share compared to the current market price of RM 4.28 per share (29 Jan 2024). But the book value of AmBank as of Sep 2023 was RM 5.60 per share.

You can imagine the questions going through my mind:

- Is the low price due to market sentiments or business issues?

- Is this a value trap that would prevent new investors from buying?

- Should I continue to hold or exit?

If you have been following my blog, you will see that they are similar questions in my review of Affin Bank. How did AmBank perform relative to Affin?

Join me as I assess AmBank's performance and valuation by comparing them with those of its peers and Affin.

My conclusion is that AmBank is not a value trap and there is potential for the market to re-rate higher. I will continue to hold.

Should you go and buy it? Well, read my Disclaimer.

Contents

- AmBank background

- My investment in AmBank

- AmBank performance

- Composite performance

- Valuation

- Method

- AmBank is not a value trap

|

AmBank background

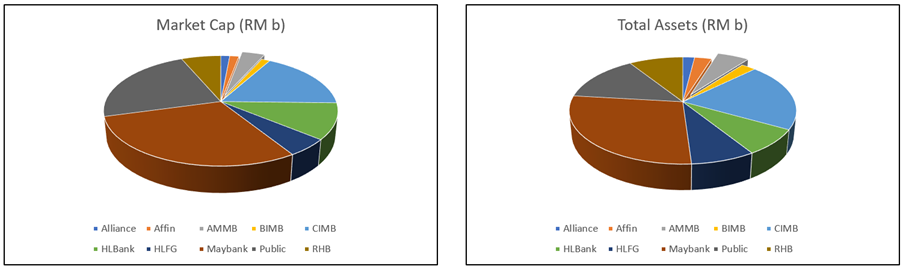

There are currently 10 banks listed under Bursa Malaysia.

- In terms of market capitalization, they ranged from RM 5 billion to RM 109 billion.

- In terms of total assets, they ranged from RM 70 billion to RM 1,001 billion with an average of RM 359 billion.

In terms of both market cap and total assets, AmBank ranks among the smaller banks.

|

| Chart 1: Bursa Malaysia banks size |

AmBank

The Group is a leading financial services group with over 40 years of expertise in supporting the economic development of Malaysia. As of 2023, the Group has over three million customers and employs over 8,000 employees.

The Group provides services in wholesale banking, business banking, retail banking, investment banking, and related financial services. The latter includes Islamic banking, insurance, family takaful, stock broking, futures broking, investment advisory, and asset management services.

The Group reported its 2023 performance based on the following segments:

- Retail Banking that continues to focus on building mass affluent, affluent, and small business customers.

- Business Banking that focuses on small and medium-sized enterprises.

- Wholesale Banking that comprises Corporate Banking, Group Treasury and Markets. Corporate Banking offers a full range of products and services to wholesale banking clients. Group Treasury and Markets includes proprietary trading.

- Investment Banking includes corporate finance, M&A advisory, equity and debt capital markets, private banking, and stockbroking services.

- Fund Management manages a broad range of investment mandates and unit trust funds. This segment also manages Private Retirement Schemes and Exchange Traded Funds.

- Insurance. The continuing operations include a broad range of general insurance, life insurance, and takaful products. The discontinued ones include a broad range of general insurance products.

- Group Funding and Others comprise activities to maintain the liquidity of the Group as well as support operations of its main business units and non-core operations.

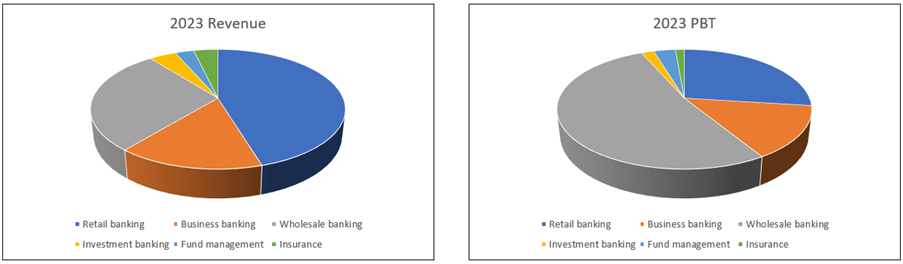

In 2023, the Retail Banking segment was the biggest revenue contributor, accounting for about half of the consolidated revenue. In terms of PBT, the Wholesale Banking segment was the biggest contributor with 60% of the consolidated PBT. Refer to Chart 2.

|

| Chart 2: 2023 Segment Revenue and PBT |

|

Revamping its operations

In Nov 2015, the Group appointed Dato’ Sulaiman Mohd Tahir as the new Group CEO. In the 2016 Annual Report, the Group unveiled its “four aspirations” plans to be achieved by 2020.

- To be Top four in its growth segments – mass affluent, affluent, SME, and mid-corporate.

- To be Top four in four key products – cards, transaction banking, markets, and wealth management.

- To sustain the Top four positions in its current engines – corporate loans, debt and capital markets, and asset management.

- To be a Top four employer in Malaysia.

With the completion of AmBank's Top 4 Strategy in 2020, the Group unveiled the Focus 8 strategies that are to be achieved by 2024.

- Attaining a Return on Equity (ROE) of ≥10%.

- Sharpening its segment play.

- Delivering holistic customer value proposition and leveraging a collaborative culture and partnerships.

- Pushing capital-light revenue.

- Ramping up the next wave of digital initiatives.

- Future-proofing the workforce.

- Integrating Environmental, Social, and Governance (ESG) considerations into its business.

- Exploring digital banks.

Some of the above are quantitative and I will refer to them when I review Ambank’s performance.

My investments in Ambank

I first bought AmBank in 2016 at RM 4.42 per share. At that juncture, it had a Book Value of RM 5.05 per share. Its past 5 years' average EPS was RM 0.54 per share.

From a simple valuation perspective, the Group was trading at about a Price Earnings multiple of 8.2. It looked like a bargain to me.

At the same time, the Group has just recruited a new Group CEO and the plans that he laid out to move the bank forward made sense.

To make a long story short, I built up my investments over the next few years so that today AmBank is among the top 5 stocks (in terms of market cap) in my portfolio.

In terms of total returns, this has not been a great investment as the market price today is below my average purchase cost. Refer to Table 1. Over the past 7 odd years, I have achieved a 2.6 % CAGR in the total return.

This is well below the interest rate I could have received by placing my money as a fixed deposit with the bank. The bulk of the returns have been due to the dividends received.

|

| Table 1: My AmBank investment return |

AmBank performance

In my Affin Bank article, I compiled the performance of the Bursa Malaysia banks. I will use these as the basis to compare AmBank's performance.

In this article, I will use the terms “peer” and “sector” interchangeably to refer to the 10 Bursa banks including AmBank.

I classified the performance of the banks into 4:

- Returns.

- Efficiency.

- Loan performance.

- Capital adequacy.

Returns

I look at both the ROE and ROA. Refer to Chart 3. Both metrics are essential for assessing a bank's financial health. While ROE is more centred on shareholders' interests, ROA provides a broader view of the overall efficiency of the bank's operations.

|

| Chart 3: Returns |

AmBank performance for the past 15 years was about the sector median performance. The sharp drop in 2021 was due not just to Covid-19, but also to one-off losses comprising:

- RM 2.83 billion settlement for the 1MDB issues.

- RM1.79 billion goodwill impairment for its conventional and investment banking businesses.

- RM148 million impairment on its investment in an associate (REIT Impairment).

The positive sign is that both the ROE and ROA appeared to have turned around over the past 2 years.

Net interest margins and efficiency

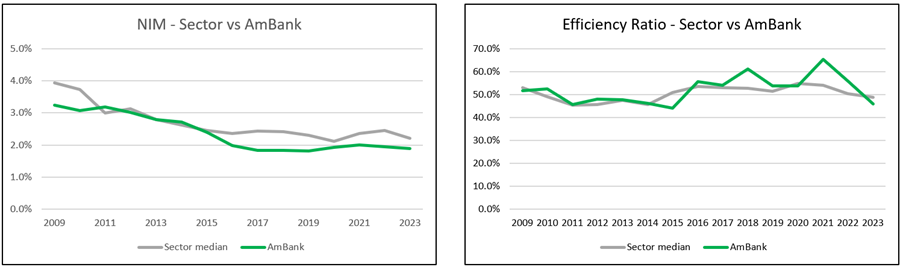

I considered 2 metrics here:

- The net interest margin (NIM) is a key determinant of a bank's overall profitability. A higher margin suggests that the bank is more efficient in earning interest income compared to its funding cost.

- The efficiency ratio evaluates how well it manages its operating expenses relative to its revenue. The higher the ratio, the less efficient the bank.

|

| Chart 4: Net interest margins and efficiency |

While AmBank followed the sector trends for both metrics, its lower NIM and higher Efficiency ratio suggest that it did worse than the sector median.

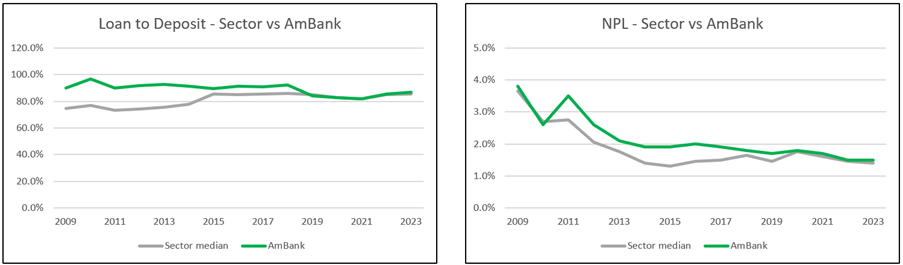

Loan performance

I looked at two metrics to assess how AmBank performed when it came to loans.

- Loan to deposit ratio. A higher ratio implies that the bank is relying more on loans for its operations and may have a lower liquidity buffer.

- Non-performing loans (NPL) ratio. A higher NPL ratio suggests a larger proportion of the bank's loan portfolio is at risk of default, indicating potential credit risk and deteriorating asset quality.

|

| Chart 5: Loan performance |

Looking at Chart 5, I would conclude that while initially, AmBank did worse than the sector, over the past few years, it has matched the sector's performance. This is a good sign.

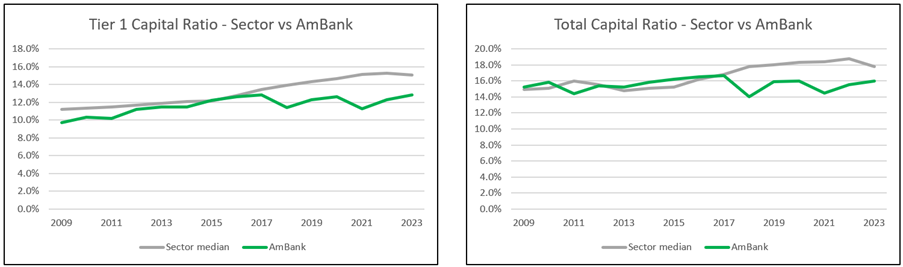

Capital adequacy

I looked at 2 ratios - Tier 1 capital adequacy ratio and total capital adequacy ratio. These measures are used to assess a bank's capital adequacy. However, they differ in the components of capital they consider. Refer to my Affin article if you want to know more about the differences between them.

|

| Chart 6: Capital adequacy |

AmBank had lower ratios compared to the sector median. The sector had improving trends for both ratios. In the case of AmBank, there was only an improving trend for the Tier 1 capital ratio. There was no significant trend for the total capital ratio.

Summary of Ambank's performance

Based on these 4 categories of metrics, I would rate AmBank's performance as below the sector median.

- If you take into consideration the 2019 one-off losses, AmBank’s average returns for the past 15 years were lower than the sector.

- While AmBank followed the sector trends for both metrics, its lower NIM and higher Efficiency ratio suggest that it did worse than the sector.

- Over the past few years, AmBank has improved its loan performance compared to the sector.

- AmBank had lower capital adequacy ratios compared to the sector.

Did it meet its strategic goals?

In the context of 2016 goals, the Group reported the following in its 2020 Annual Report:

“…continues to deliver a solid performance, largely due to efforts in driving the Group’s Top 4 Strategy (FY2016-FY2020) that focused on our growth segments, key products, and sustaining our position in current engines. In FY2020, compared to other industry players, we consistently ranked Top 3 in terms of growth across most of our key performance metrics. Moreover, we ranked first for Net Interest Income (NII) growth, Cost-to-Income (CTI) ratio improvement, and Profit Before Provision (PBP) growth in Malaysia.”

I do not have the statistics for the segments and key products. But Chart 7 below shows the total revenue and interest income trends. It does not look like AmBank improved its total revenue or interest income relative to the sector median.

Note that in my comparisons, I am looking at the Bursa banks. There are other non-bursa banks that AmBank may have used in the comparison panel eg HSBC, and Standard Chartered.

Nevertheless, I would give the bank the benefit of the doubt as I am sure they would not report wrong numbers. One conclusion I can draw is that despite achieving the Top 3, this did not contribute much to growing revenue or interest income.

To be fair to AmBank, it did achieve the following comparing 2020 with 2016 for the Bursa banks;

- It has the highest CAGR in interest income.

- It ranked No. 4 in terms of improving the efficiency ratio.

|

| Chart 7: Top line Note: The total revenue comprised net interest income and non-interest income. The interest income shown is before interest expenses ie it is not net interest income. |

In the context of the Focus 8 strategies, there is still one more year to go. However, there are 2 quantitative metrics – ROE and capital light revenue that are appropriate here.

- AmBank might just meet the 10% ROE target. Its 2023 ROE was 9.6 %.

- I am not sure of the appropriate metric to measure the capital-light revenue. However, when I looked at the revenue / total equity ratio, I found that it was 20 % in 2022. Its 2023 ratio was 22 %. In other words, more revenue was generated relative to the total equity. This is a good sign of better capital efficiency.

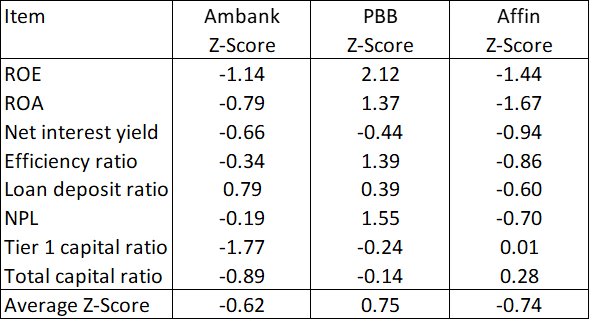

Composite performance

In the previous section, I compared AmBank's performance based on individual metrics. To provide a comprehensive overview of performance across different metrics, I used the Z-scores.

I first calculated the Z-scores for each metric and then averaged them to determine the overall Z-score. This score then represents the “composite” performance. Refer to the Method section for the details.

The Z-score represents the number of standard deviations a particular data point is from the mean of a distribution. It is a measure of how far and in what direction an individual data point deviates from the mean of a set of data.

- The mean is represented by a Z-score of 0.

- A negative Z-score denotes a below-average performance. The more negative a Z-score, the worse the performance.

- A positive Z-score denotes an above-average performance. The larger the positive score, the better the performance.

Table 2 summarizes the Z-scores for three banks.

- You can see that overall AmBank did worse than Affin.

- Both AmBank and Affin did worse than the average.

- PBB did better than the average.

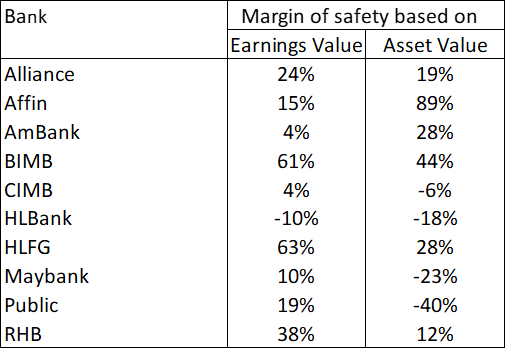

Valuation

I compared the values of the various banks based on the following:

- Earnings value (EV) derived from 3 DCF methods – dividends, notional dividends, and residual income.

- Asset value (AV) based on its tangible book value.

For details of the valuation, refer to the Affin article. Table 3 summarizes the margins of safety for the Bursa banks.

You can see that AmBank is about to meet the 30% margin of safety based on the Asset Value. However, it does not have a sufficient margin of safety based on its Earnings Value.

You should not be surprised by the Earning Value as the performance of Ambank is not exactly the best.

|

| Table 3: Margins of safety |

Method

The data for my analysis were extracted from the TIKR.com platform. While the platform provided data as far back as 2002, not all the banks were in operation for that long. As such the starting year for the analysis was pegged to the year when all the 10 banks had information ie 2009

Secondly, not all the banks had the same financial year-end. I took the reporting year as presented by TIKR.com as the calendar year. In this context, for 2023 some banks had their financial year end as Dec 2023. When I started on this analysis, these banks had yet to announce their 2023 results. As such I used the Sep LTM results as the 2023 results.

I first computed the relevant metrics eg ROE for each company. Then for each metric, I tabulated the 2009 to 2023 performance for all 10 companies. I then use the appropriate EXCEL function to derive the quartiles, median, and mean for each year.

Z-Scores

Z-scores, also known as standard scores, are a measure of how far away a particular data point is from the mean of a group of data. They are used to standardize and compare data points from different distributions.

Z-scores allow you to take data points drawn from populations with different means and standard deviations and place them on a common scale. This standard scale lets you compare observations for different types of variables that would otherwise be difficult.

The formula for calculating a z-score for a data point (X) in a distribution with mean (μ) and standard deviation (σ) is given by:

Z = (X− μ) / σ

The resulting z-score represents the number of standard deviations a data point is from the mean. A positive z-score indicates that the data point is above the mean. A negative z-score indicates that the data point is below the mean.

Z-scores are useful for comparing scores from different distributions that may have different units or scales. They provide a standardized way to assess the relative position of a data point within its distribution.

In a standard normal distribution (a normal distribution with a mean of 0 and a standard deviation of 1), a z-score of 1 corresponds to a data point that is one standard deviation above the mean. Similarly, a z-score of -1 corresponds to a data point that is one standard deviation below the mean.

Computing the Z-scores for the banks

I computed the Z-score for each metric in the following manner

- For each metric, I calculated the average values for each bank from 2009 to 2023. I treat the average values as representative of the performance of each company over the past 15 years.

- I then determined the mean and standard deviation for the metric based on the various representative performances (the average from 2009 to 2023 for each company).

- The Z-Score for AmBank was = (Ambank average – mean) / standard deviation.

I then derived the composite score by averaging the Z-scores for the various metrics. Note that in this approach I assumed that all the metrics have the same weights. In other words, they each contribute equally to the composite score.

|

Is AmBank a value trap?

I have shown that Ambank's performance is below the sector average. While its NIM and Efficiency ratio are not as good as the sector, there are some positive signs.

- Interest income and revenue were growing.

- Returns seemed to be turning around.

- Loan performance seemed to be improving.

- Capital adequacy is holding although there is room for improvements.

It is not a bank with dire fundamentals. Management had taken steps to improve the performance with first the Top 4 plans and currently the Focus 8 strategies.

A value trap is a company that while appearing cheap is cheap because it is facing fundamental issues. While AmBank has not been performing well relative to its peers, it is not a loss-making bank. While it has low returns, it has been profitable every year except for the extraordinary losses in 2019.

The other metric in assessing whether it is a value trap is the margin of safety.

- There is not enough margin of safety based on the Earnings Value.

- There is a 28 % margin of safety based on the Asset Value.

As a financial institution under Bank Negara's oversight, the Asset Value provides a floor value. Given the valuation and fundamental picture, AmBank is not a value trap.

While it may not be a value trap, you may be overpaying for the bank based on its Earnings Value. The reality is that the market places more emphasis on the Earnings Value rather than the Asset Value. So, if you are investing hoping for a re-rating, there must be some expectation of better performance.

I do not see any catalyst at this stage. As such if you have not invested in AmBank, you may think that this is not good enough to overcome the small margin of safety (from an EV perspective).

But I am already a shareholder of AmBank. I would rather hold onto my shares and see whether the achievement of Focus 8 will cause the market to re-rate it.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment