Is MNRB a value trap?

Value Investing Case Study 45-1. MNRB: A national reinsurer or a value trap? Unveiling the real story behind the discounted share price!

MNRB Holdings Berhad (MNRB or the Group) is Malaysia’s national reinsurance company. You would think that given this stature it would be a stock market darling.

Unfortunately, it is currently trading at about 1/3 its Book Value. As a financial institution, MNRB comes under the purview of Bank Negara. As such I am very confident that all its financial assets and liabilities are marked to market. In other words, the Book Value is a good reflection of its net asset value.

So why is MNRB trading at such a huge discount to its Book Value? This is because the market tends to focus on Earnings Value. And MNRB failed in this respect. For example, its average ROE over the past 12 years was only 7%.

However, MNRB is not a company facing financial losses. Nor is it operating in a sunset sector. Is there an investment opportunity or is it a value trap?

Join me as I argue the following:

- If you are thinking of MNRB as a fresh investor, there are better Bursa insurance companies to consider.

- If you are already an investor, whether to hold or cut loss depends on your entry price. I belong to this category and I will show you why I am holding onto MNRB.

If you are currently a shareholder, should you hold like me or sell? Well, read my Disclaimer.

Content

- Investment Thesis

- MNRB’s background

- My investment in MNRB

- Method

- Bursa Malaysia insurance companies

- Industry Overview

- Peer comparison

- Valuation

- Is MNRB a value trap?

|

Investment Thesis

While MNRB had been able to grow its revenue at 5.2 % over the past decade, PAT only grew at about half the rate. When I compared MNRB's performance with those of the other Bursa insurance companies, I found that it is at best just below the sector average.

MNRB's problems are more about poor operating fundamentals – profitability, underwriting performance, and investing its float. There is no indication of improving trends. Most of the historical trends point in a deteriorating direction.

While the Asset Value provides more than a 30% margin of safety, there is no margin of safety based on its Earnings Value. As such I think that there a better Bursa insurance companies to look at. Is it a value trap then? Yes.

|

|

MNRB’s background

Malaysian National Reinsurance Berhad, the country’s national reinsurer was set up in 1972 to reduce the outflow of reinsurance premiums overseas. The Company commenced operations on 19 February 1973.

In 2005, as a result of a restructuring exercise within the MNRB Group, the Company’s reinsurance license, business, and assets were transferred to its subsidiary company, Malaysian Reinsurance Berhad. Under the restructuring, Malaysian National Reinsurance Berhad became an investment holding company and changed its name to MNRB Holdings Berhad. Today, MNRB is listed on the Main Market of Bursa Malaysia.

The Group comprises a leading wholesale provider of reinsurance and takaful as well as two takaful operators. Its reinsurance subsidiary stands tall among the top reinsurers in the region, writing lines of general businesses locally and abroad. In Malaysia, its takaful operators are amongst the pioneers in the provision of financial protection services based on the takaful system.

The Group today has the following key subsidiaries:

- Malaysian Reinsurance Berhad that underwrites all classes of general reinsurance business. It also underwrites general and family retakaful businesses through its retakaful division.

- Takaful Ikhlas Family Berhad offers a comprehensive range of family takaful products.

- Takaful Ikhlas General Berhad offers a comprehensive range of general takaful solutions which comprises motor and nonmotor general takaful protection products.

- Malaysian Re (Dubai) Ltd is engaged in developing business for its sister company, Malaysian Reinsurance Berhad in the Middle East.

In 2023, the Reinsurance business accounted for about 60% of the Group’s premiums. The Takaful operations accounted for 38 % of the Group’s premium with the balance of 2% from the Retakaful operations.

My investment in MNRB

I first bought MNRB in 2012 at RM 2.60 per share on the basis that it was trading well below its then Book Value of RM 3.30 per share. I assumed that because of Bank Negara's oversight, the Book Value would be a good representation of its intrinsic value. I further argued that as the national reinsurance company, it would probably have some monopoly power.

Over the next couple of years, I built up my shareholdings from a combination of new purchases, bonus issues, and rights issues. Today it is among my top 5 shares in terms of cost in my stock portfolio.

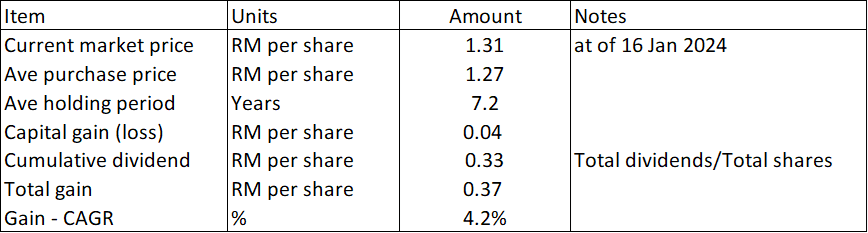

My current total return from the investment in MNRB is about 4.2 % CAGR. Refer to Table 1. You can see that the bulk of the returns came from dividends.

|

| Table 1: My investment returns. |

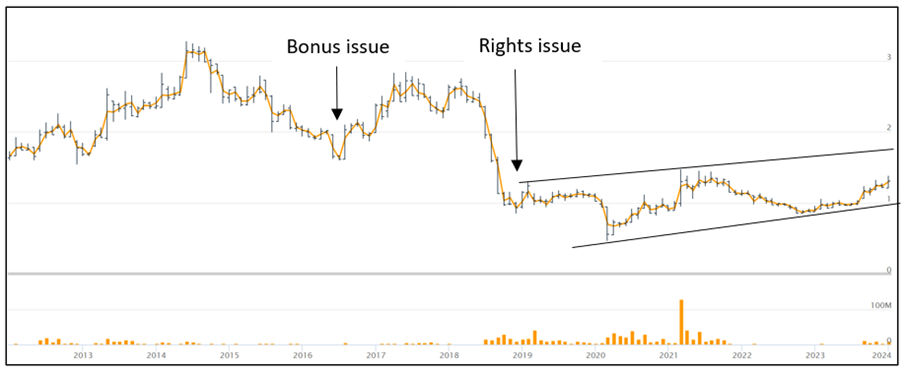

It is not a fantastic return as there had not been much upside in the share price as shown in Chart 1.

|

| Chart 1: MNRB share price trends |

Method

I hope that the data I present in the following sections can:

- Serve as base rates when looking at the performance of Bursa Malaysia insurance companies. For further info on base rates, refer to my article on the Bursa Malaysia banks titled “Is Affin a value trap?”

- Be a basis to assess MNRB performance relative to the median values of the panel.

In my peer comparison for MNRB, I compared MNRB with the panel median values. The panel in this context refers to all 8 companies including MNRB.

This is a purely quantitative analysis. I have not assessed the qualitative aspects such as the adoption of digital technology, customer satisfaction, and brand performance.

In this article, I used the word “peer”, “panel” and “sector” interchangeably to mean the 8 Bursa Malaysia companies listed in Table 2.

The data for my analysis were extracted from the TIKR.com platform. While the platform provided data as far back as 2002, not all the insurance were in operation for that long. As such the starting year for the analysis was pegged to the year when all 8 companies had information ie 2012.

Secondly, not all the companies had the same financial year-end. I took the reporting year as presented by TIKR.com as the calendar year. In this context for 2023, some companies had their financial year end as Dec 2023. When I started on this analysis, these companies had yet to announce their 2023 results. As such I used the Sep LTM results as the 2023 results.

I first computed the relevant metrics eg ROE for each company. Then for each metric, I tabulated the 2012 to 2023 performance for all 8 companies. I then use the appropriate EXCEL function to derive the quartiles, median, and mean for each year.

Bursa Malaysia insurance companies

The Malaysian insurance sector is characterized by a competitive landscape of both domestic and international players. It encompasses life and non-life insurance, with a growing focus on digitalization to enhance customer experience and operational efficiency.

Regulatory frameworks, such as the Malaysian Financial Services Act, govern the sector, ensuring stability. Key players include Prudential, Allianz, and Great Eastern. The sector is adapting to evolving consumer needs, offering diverse products, including health and motor insurance.

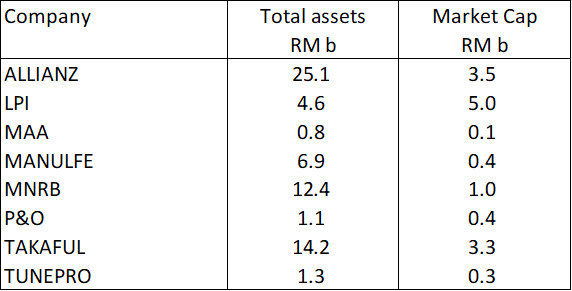

As of Jan 2024, there were 8 Bursa Malaysia insurance companies.

- They ranged from RM 1.1 billion to RM 25.1 billion in terms of total assets. In terms of market capitalization, they ranged from RM 0.1 billion to RM 5.0 billion. Refer to Table 2.

- In terms of products and services, they cover both life and general insurance companies. MNRB is the only one with significant reinsurance activities.

In terms of total assets and market cap, MNRB is ranked among the top 3.

|

| Table 2: Profile of Bursa Malaysia insurance companies |

|

Industry Overview

The Malaysian insurance industry especially the takaful sector is not a sunset one. I provide 2 sets of quotes to illustrate my point.

The first is from the Jan 2024 Asia Insurance Review.

“According to the Malaysian Takaful Association (MTA), the takaful industry posted strong growth in 2022…with family takaful seeing a penetration rate of 20.1% last year compared to 18.6% in 2021. Meanwhile, general takaful business generated… a year-on-year increase of 21.1% over 2021.”

“Statistics from the General Insurance Association of Malaysia (PIAM) also showed a similar trend for the insurance industry. Nonlife insurers recorded an increase in gross direct premiums of 10% to MYR19.4bn for the full year 2022 compared to 2021.”

The second quote is from the Deputy Governor of Bank Negara at the Malaysian Life Reinsurance Group Berhad Retakaful Launch in Dec 2023,

“Malaysia’s takaful industry has also expanded nearly three times to where it was a decade ago… the aspiration to achieve 4.8% to 5% insurance and takaful penetration rate out of GDP has been outlined in the Financial Sector Blueprint 2022-2026.”

Peer Comparison

I looked at the following groups of metrics to assess MNRB performance relative to the peers.

- Revenue

- Returns

- Underwriting performance

- Investments

- Float

- Solvency

Note that in the following charts, the left part shows the sector performance. The right part compares the sector performance with that of MNRB.

Revenue

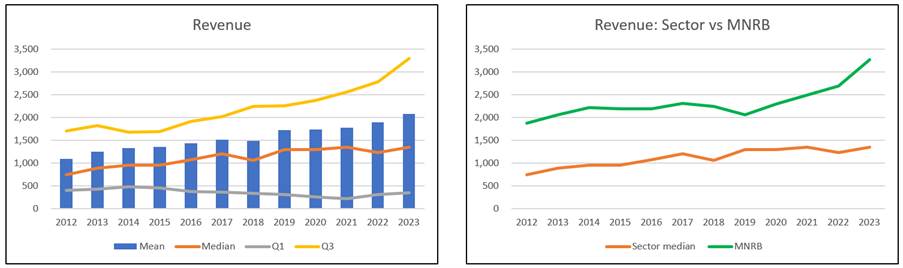

Revenue came from premiums, dividends, and investment income. Over the past 12 years, premiums accounted for 82% of the revenue for the sector. In the case of MNRB, premiums averaged 87 % of its revenue over the past 12 years.

Revenue and premiums for the sector and MNRB showed uptrends. From 2012 to 2023:

- The sector median total revenue grew at 5.6 % CAGR whereas MNRB only achieved 5.2 % CAGR. Refer to Chart 2.

- The sector’s median premiums growth of 6.8 % CAGR was much higher than the MMRB growth rate of 4.9 %. Refer to Chart 3.

|

| Chart 2: Revenue |

Compared to the sector median, MNRB's total revenue and premiums were much larger.

You can see that there was a drop in MNRB’s revenue and premium in 2019. These were due to lower gross premiums and contributions from both the reinsurance and takaful subsidiaries. This resulted from a conscious decision not to renew some unprofitable businesses.

|

| Chart 3: Premiums |

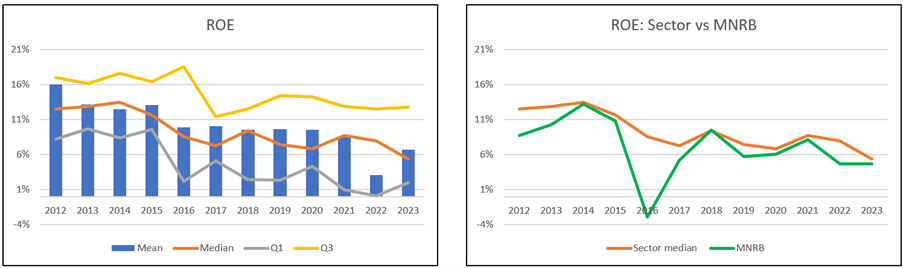

Returns

Despite the growth in revenue and premiums, the sector experienced declining returns over the past 12 years. As can be seen from Charts 4 and 5, both the ROE and ROA declined.

As will be shown in the latter sections the declining returns were due to declining underwriting margins coupled with declining investment yields.

|

| Chart 4: ROE |

|

| Chart 5: ROA |

MNRB even experienced a negative return in 2016. This was because it incurred a net loss due to:

- Abnormally higher claims from the overseas business and an exceptionally higher number of large domestic claims. The Group suffered significantly high claims from explosions at the Port of Tianjin in China, the Taiwan Earthquake, and South Indian floods.

- The takaful business included one-off adjustments made during the period.

But you can see the Group bouncing back to profitability in the following year. Nevertheless, that the Group ROE and ROA performances were lower than the sector medians.

At the same time, its ROE over the past 12 years averaged 7.0 %. %This is about half its cost of equity of 13.0 % (as estimated by Finbox). In other words, it failed to create shareholders’ value.

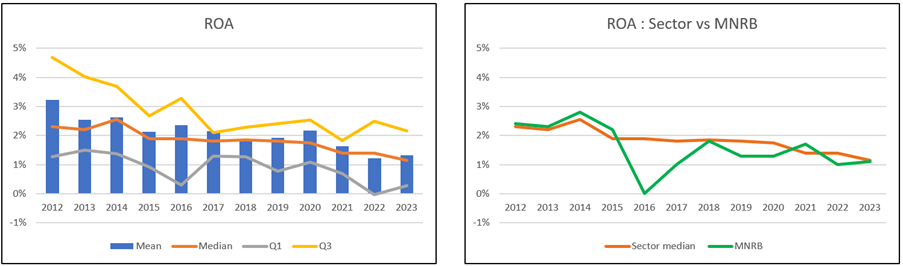

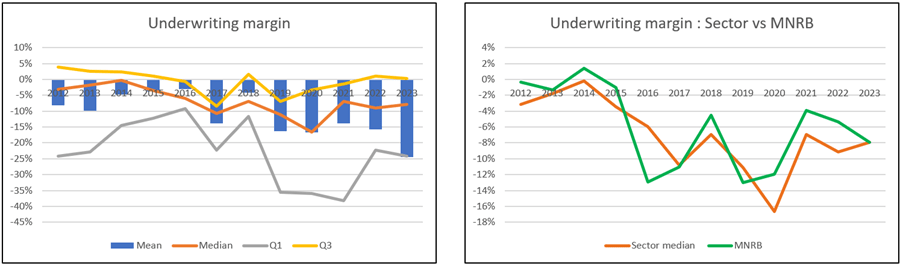

Underwriting performance

I looked at 2 key metrics here – underwriting margin and claims ratio.

The underwriting margin is a measure of the profitability of an insurance company's underwriting operations. It represents the difference between the premiums earned by the insurer and the total costs associated with underwriting, primarily incurred losses and underwriting expenses.

I determined the underwriting margin from the following formula.

Underwriting Margin = 100 % − Combined Ratio.

Combined ratio = (Claims and expenses) / (Premiums and annuity) X 100.

Note that the expenses included Selling, General, and Administration expenses, salaries, and loan losses as classified by TIKR.com. They excluded interest expenses, asset write-downs, and forex losses.

You can see from Chart 6 that the Bursa insurance companies incurred negative margins most of the time. Over the past 12 years, the sector median underwriting margin averaged negative 7.0 % compared to MNRB’s average of negative 6.0 %.

This meant that the bulk of the profits were contributed by the investments.

|

| Chart 6: Underwriting margins |

The claims ratio, also known as the loss ratio, is a measure of how much of the premium income is used to cover claims. It is an indicator of an insurer's underwriting performance and the efficiency of its claims management. It reflects the insurers’ ability to manage and price risks effectively.

The claims ratio is calculated using the following formula:

Claims or Loss % ratio = incurred losses/premiums X 100

In the context of the TOKR.com platform, this is the item categorized under “policy benefits”.

Chart 7 shows the claims ratio trend for the sector and MNRB over the past 12 years. You can see that the claims ratio for the sector median reduced in the middle of the past decade but has since deteriorated (gone higher).

In the case of MNRB, we see an opposite pattern where it got worse in the middle of the past decade before improving a bit in the past few years. Overall, MNRB had a higher claim ratio than the sector median.

|

| Chart 7: Claims or loss ratio |

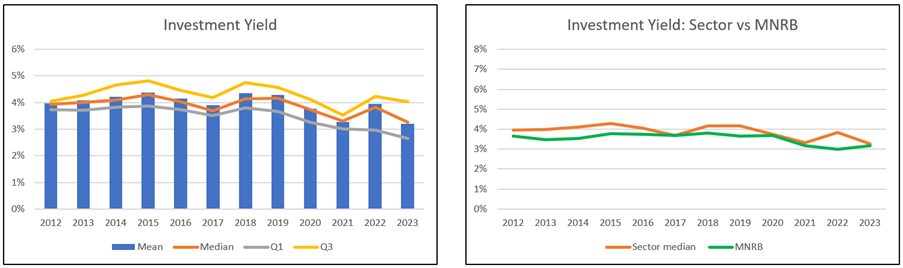

Investment performance

My first metric here is the investment yield. This is a measure of the return generated from an insurance company's investment portfolio relative to its total invested assets.

In the context of the TIKR.com platform,

Investment yield = total dividend and interest income from the P&L / total investments from the Balance Sheet.

A higher investment yield is generally favorable, as it indicates that the insurer is earning a higher return on its investment portfolio.

Chart 8 shows the investment yield for the past 12 years. There were slight deteriorations of 1.7 % CAGR for the sector median and 1.3 % for MNRB.

|

| Chart 8: Investment yield |

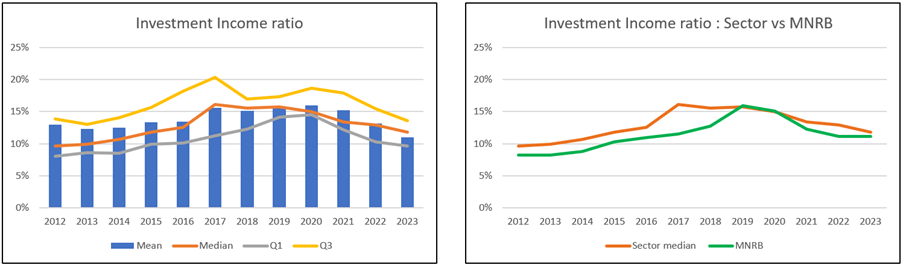

My second metric here is the investment income ratio. This ratio measures the relationship between investment income and premiums earned. It helps assess the contribution of investment activities to an insurance company's overall income.

In the context of TIKR.com, I computed this ratio from the P&L as follows:

Investment income ratio = total interest and dividend income/premium and annuity revenue

As shown in Chart 9, the investment income is becoming a bigger contributor as time goes by.

|

| Chart 9: Investment Income ratio |

Float

I first came across the concept of float when reading about Warren Buffett's investment history. He famously said that insurance companies got it wrong when they classified a lot of the insurance payables as liabilities. To him, these are “free” money that can be used to generate returns.

He referred to his company's substantial insurance float as "the engine that has propelled our expansion since 1967." Berkshire Hathaway has used its insurance float to make significant investments in various businesses.

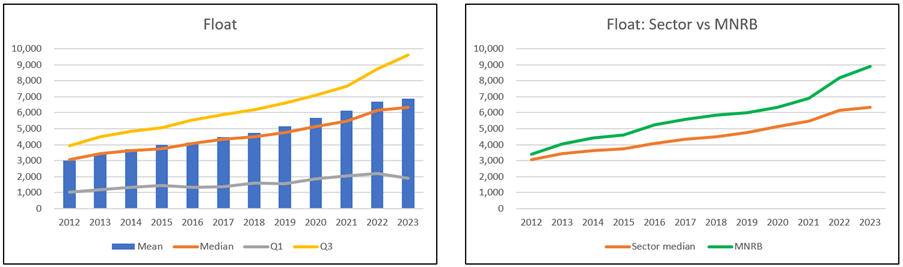

Float represents the funds provided by policyholders that are temporarily held by the insurer. It is a critical component of the insurance business model and is essentially the difference between the premiums collected from policyholders and the claims paid out.

In the context of TIKR.com, I estimated the float from the Balance Sheet as = insurance and annuity liabilities, unpaid claims, and unearned premiums.

I look at the following float metrics.

- Size of the float.

- Investment income to float ratio.

- Float turnover.

- Float leverage

As shown in Chart 10, the float for the sector and MNRB had been trending up. You should not be surprised as premiums and annuities have been trending up.

|

| Chart 10: Size of the float |

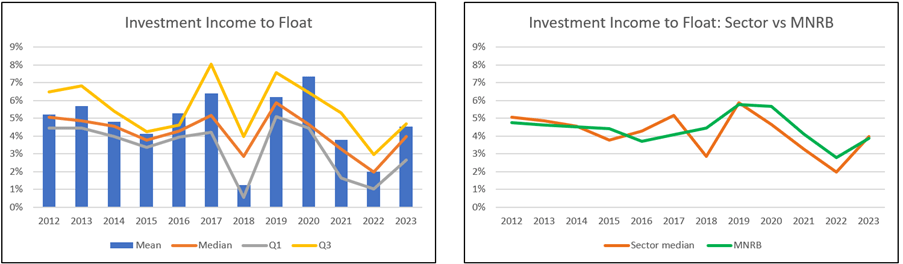

The investment income to float ratio measures the relationship between the investment income and the size of its insurance float. This ratio provides insights into how efficiently the insurer is using its float to generate investment income.

The ratio for the sector and MNRB is shown in Chart 11. It does not show a good picture as the sector has not been able to improve the ratio. Furthermore, MNRB performance is only about similar to the sector median despite having a much bigger float.

I would say that the sector and MNRB do not have a “Warren Buffett” in their investment team. Of course, I have not considered the broader context of the economic situation or the changes in the risk profile of the investments.

|

| Chart 11: Investment income to float ratio. |

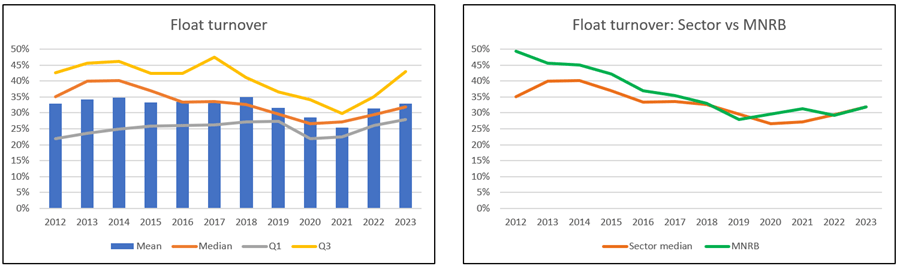

The float turnover measures how many times the float is replenished over a specific period. A higher float turnover suggests that the company is efficiently using the float to underwrite new business.

It is calculated as:

Float Turnover = Premiums Written / Average Float

Chart 12 shows that the sector is facing a deteriorating float turnover. Again, this is not a good sign for the investment team.

|

| Chart 12: Float turnover |

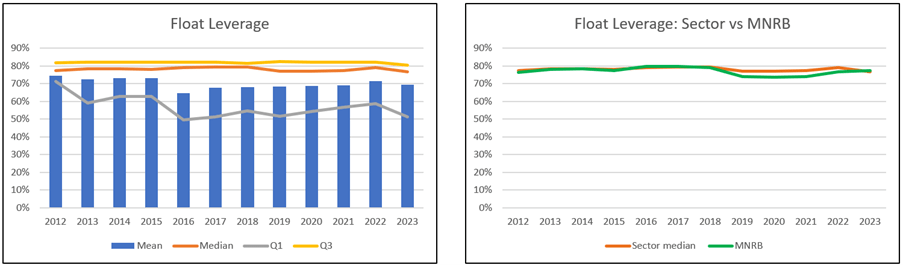

My final float metric is the float leverage. This is a ratio computed as float divided by the total float and total equity. This ratio is used to assess the degree to which an insurance company relies on float, relative to its total equity, as a source of funds for its operations and investments.

Chart 13 shows that the float leverage for the sector and MNRB has been relatively stable over the past 12 years. On average the float is about 78% of the float and equity.

|

| Chart 13: Float leverage |

Solvency

I assessed the insurance companies' long-term solvency using the Debt Equity ratio. Refer to Chart 14.

MNRB has a much higher Debt Equity ratio than the sector. The only good sign is that the MNRB ratio today is much lower than that in 2012.

|

| Chart 14: DE ratio |

The cash flow margin is defined as cash flow from operations/revenue. I normally use this margin to indicate a company's ability to convert its sales into cash. It provides insights into the efficiency and sustainability of its core business operations. A higher operating cash flow margin generally indicates that a company is effectively managing its working capital, covering operating expenses, and generating positive cash flow from its primary activities.

You can see the sector margins improving from 2013 but it dropped recently. MNRB had lower margins than the sector median. Refer to Chart 15.

|

| Chart 15: Cash Flow from Operations/Revenue |

Summary of MNRB performance

While the sector and MNRB had revenue growth, they experienced deteriorating operating performance. In most cases, MNRB shares the same trend as the sector median.

I would rate MNRB's performance as below average relative to the sector based on the following:

- It has lower revenue growth rates.

- Both its ROE and ROA were lower than the sector median returns.

- While its underwriting is a bit better than the sector median, MNRB had a higher claims ratio.

- On the investment side, MNRB did marginally worse than the sector median.

- At best, I would say the MNRB float performance was comparable to the sector median.

- It had worse solvency ratios.

I would not rate MNRB as a wonderful company. But I also would not consider it as having poor fundamentals.

Valuation

The challenges in valuing insurance companies are very similar to those in valuing banks. For a more comprehensive discussion on these, refer to “Is Affin a value trap?”

As such I used the same approach as that in valuing Affin ie

- The Asset Value is based on the Book Value.

- The Earnings value is based on the average of the values obtained from estimating the present value of dividends, notional dividends, and residual income.

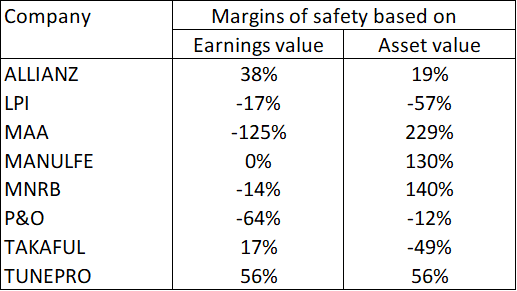

Table 3 summarizes the margins of safety for the 8 insurance companies. I look for a 30% margin of safety.

Only TunePro met the 30% margin of safety under both the Asset Value and Earnings Value perspective.

In the case of MNRB, there is no margin of safety under the Earnings Value. You should not be surprised given its low and declining returns. But there is more than a 30% margin of safety under the Asset Value.

|

| Table 3: Margins of safety Note: The cost of equity used to estimate the Earnings Value was all taken from Finbox. |

Is MNRB a value trap?

A value trap is a company that appears cheap but is cheap because it is facing fundamental problems.

While it is not a wonderful company, MNRB is not a loss-making one. The insurance and reinsurance sectors are not sunset sectors. MNRB problems appear to be more operational – declining efficiencies, worsening insurance risk management, and deteriorating investment performance.

But until it delivers these improvements, I think it would be difficult for the market to rerate it even though it is trading at a significant discount to its Asset Value. The market tends to focus on Earnings Value.

Given these, MNRB is a value trap. There are better insurance companies to consider.

However, if you are like me which an existing investor in MNRB, the picture is different. As shown earlier, I had obtained a compounded annual return of 4.2 %. The bulk of the return was due to dividends. I think that it is not difficult to get some capital gain. This is especially true when I can see a long-term price uptrend as per Chart 1. I will continue to hold.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment