Is MBSB an investment opportunity?

Value Investing Case Study 49-1. MBSB: A rising Islamic banking star or a value trap in disguise? There are better opportunities elsewhere for a fresh investor. But for someone who is already invested in MBSB with a low investment cost, it is better to hold.

I first invested in MBSB in 2015 at RM 1.53 per share. Over the next few years, I continued to build up my investment whenever the share price dropped below my estimate of its intrinsic value.

My average purchase price is today RM 0.74 per share compared to its tangible Book Value of RM 1.17 per share. MBSB ranks No 19 (from the top based on purchased cost) among the stocks in my portfolio.

My current total return is about 7.8 % CAGR. Not too bad considering that the market price as of 19 Feb 2024 was RM 0.78 per share. In other words, there is still room for prices to go higher when compared to the tangible Book Value.

Given that the market price is close to my average purchase price, should I continue to build up my investment in MBSB? This of course presupposes that MBSB is not a value trap but an investment opportunity.

Join me as I assess MBSB's performance and argue why it may not be an investment opportunity.

Should you go and sell it if you are already an investor? Well, read my Disclaimer.

Contents

- MBSB background

- My investment in MBSB

- MBSB performance

- Valuation

- Is MBSB an investment opportunity?

- Investment thesis

|

MBSB background

Malaysia Building Society Berhad (MBSB or the Group) has evolved from being the first property financier to a financial provider that offers a spectrum of innovative products and services throughout its branch network nationwide.

It is a financial services pioneer with roots that can be traced back to the Federal and Colonial Building Society Limited founded in 1950. The Federal and Colonial Building Society Limited was then rebranded to Malaya Borneo Building Society Limited in 1956.

In 1970, the business was transferred to the newly incorporated MBSB. MBSB was listed on the KLSE, now Bursa Malaysia on 14 March 1972.

MBSB was defined as a Scheduled Institution under the repealed Banking and Financial Institution Act 1989 (BAFIA). The status of an Exempt Finance Company was granted to MBSB on 1 March 1972 by the Ministry of Finance. This allowed MBSB to undertake a financing business in the absence of a banking license.

On 6 November 2017, MBSB entered into the Share Purchase Agreement with the shareholders of Asian Finance Bank Berhad (“AFB”) for the proposed acquisition by MBSB of the entire equity interest in AFB.

This was for an aggregate purchase consideration of RM 645 m to be satisfied by way of cash amounting to RM 397 million and the issuance of 225 million Consideration Shares at an issue price of RM1.10 per Consideration Share.

Under the aforementioned acquisition, AFB became a wholly owned subsidiary of MBSB on 7 February 2018. AFB undertook a rebranding exercise and on 2 April 2018, it changed its name to MBSB Bank Berhad.

The acquisition was a defining moment for MBSB as it propelled MBSB Bank to become Malaysia's second-largest standalone Islamic bank.

Subsequently, in Oct 2023, MBSB announced the acquisition of the entire equity interest of Malaysian Industrial Development Finance Berhad (MIDF) from Permodalan Nasional Berhad (PNB).

The purchase consideration of RM 1.01 billion was settled by the issuance of 1.05 billion new MBSB shares at RM 0.9652 per share (Final Consideration Shares), which were allotted to PNB on 2 October 2023.

Through this merger, MIDF is now a wholly-owned subsidiary of MBSB and PNB emerges as a substantial shareholder of MBSB with an equity stake of 12.78%. The Employees Provident Fund’s (EPF) shareholding in MBSB was reduced from 65.78% to 57.45%.

These acquisitions have transformed MBSB from a mainly property financier to an Islamic bank. MBSB has also grown in terms of size:

- Over the past 10 years, its total assets grew from RM 38 billion in 2013 to RM 58 billion in 2023.

- Its shareholder funds in 2023 are about 4 times that in 2013.

But bigger does not automatically mean better. For example, its total revenue in 2023 is only a bit larger than that in 2013. The PAT in 2023 of RM 391 million is smaller than that in 2013 of RM 598 million.

Journey 25

In 2019, MBSB introduced its long-term vision to bring MBSB to the next level i.e. continued strategies and targets for the future - the Journey 25 (J25). The Bank described J25 as follows:

“It sets out our plans and activities up to FY2025 to be a fully-matured Islamic Financial Institution by 2025...Under the J25, we intend to strengthen the business by going into new business streams, and frontiers and be more focused on our trade finance offerings. For operations, we aim to maintain the current level of cost-to-income ratio by managing our cost in a regimented way and process improvements which leads to efficiency….”

You can see that J25 has revenue growth as well as productivity/efficiency improvement goals. Refer to Chart 1.

|

| Chart 1: Journey 25 Aspirations |

My investments in MBSB

I first bought MBSB in 2015 at RM 1.53 per share. At that juncture, it had a Book Value of RM 1.73 per share (end 2014). Its past 5 years average EPS was RM 0.31 per share.

From a simple valuation perspective, the Group was trading at about a Price-earnings multiple of 5. It looked like a bargain to me from both the Asset Value and Earnings Value perspective.

I have increased my investments in MBSB since then. Apart from subscribing for the excess rights in 2016, I also bought some shares in 2020 when the price was around RM 0.60 per share. Today my investments in MBSB ranked No. 19 (from the top in terms of purchase cost) in my 34-stock portfolio.

In terms of total returns, this was a reasonable investment as the market price today is a bit higher than my average purchase cost. Refer to Table 1.

Over the years, I have achieved a 7.8 % CAGR in the total return. Note that the average holding period is about 4.9 years due to my 2020 purchases.

This is a good return compared to the interest rate I could have received by placing my money in fixed deposits with the bank. The bulk of the returns have been due to the dividends received.

|

| Table 1: My MBSB investment return |

MBSB performance

In my Affin Bank article, I compiled the performance of the Bursa Malaysia banks. Refer to Table 2. I will use these as the basis to compare MBSB's performance.

|

| Table 2: Bursa banks |

For details on how I compiled the sector data, refer to my Affin article. The data for the quantitative analysis of MBSB was extracted from the TIKR.com platform.

In this article, I will use the terms “peer” and “sector” interchangeably to refer to the 10 Bursa banks

I compared MBSB performance based on the following 4 parameters:

- Returns.

- Efficiency.

- Loan performance.

- Capital adequacy.

Returns

I look at both the ROE and ROA. Refer to Chart 4. Both metrics are essential for assessing a bank's financial health. While ROE is more centred on shareholders' interests, ROA provides a broader view of the overall efficiency of the bank's operations.

In absolute term, from 2018 to 2023, MBSB achieved an average ROE of 5.9 %. This is low compared to its cost of equity of 9.3 % (Source: Finbox 20 Feb 2024). This meant that MBSB did not create shareholders value since the acquisition of MBSB Bank.

|

| Chart 2: Returns |

MBSB performance in the first half of the past 15 years was better than the sector median performance. In the second half of the period, MBSB performance dropped to below the sector median. The main reason for this 2-period performance was the acquisition of AFB in 2018.

In the context of J25, I would expect MBSB to at least match the sector median for the vision to be achieved.

Net interest margins and efficiency

I considered 2 metrics here:

- The net interest margin (NIM) is a key determinant of a bank's overall profitability. A higher margin suggests that the bank is more efficient in earning interest income compared to its funding cost.

- The efficiency ratio evaluates how well it manages its operating expenses relative to its revenue. The higher the ratio, the less efficient the bank.

The challenge for MBSB is that a big part of its interest income was derived from Islamic financing. The definitions of interest income, net interest income, and revenue are different from those of non-Islamic banking companies.

For example, under the TIRK.com platform, a big part of MBSB’s Islamic financing activities was classified as non-interest income.

Given the possible differences in the definition of interest income, we would not be comparing apples to apples when comparing the NIM of other banks. We have the same issue when it comes to the Efficiency ratio. This is defined as non-interest expenses/total revenue. In the case of MBSB, we have an issue with what constitutes revenue.

TIKR defined the revenue as the interest income + non-interest income. For MBSB, the non-interest income came from Islamic financing.

- For 2022, TIKR had MBSB total revenue of RM 1.4 billion.

- In the MBSB Annual Report, the 2022 revenue was reported as RM 2.7 billion.

Given these issues, I do not think it is appropriate to compare MBSB NIM and Efficiency ratio with the sector. Nevertheless, the trends of the NIM and Efficiency ratio can be an indication of how MBSB is achieving the Journey 65 goals.

As can be seen from Chart 3, there were declining performances. The NIM over the past few years was lower than before the 2018 acquisition. We see similar trends for the Efficiency ratio where a higher % meant higher expenses relative to revenue.

I would not consider MBSB's performance as good.

|

| Chart 3: Net interest margins and efficiency |

Loan performance

I looked at two metrics to assess how MBSB performed when it came to loans.

- Loan to deposit ratio. A higher ratio implies that the bank is relying more on loans for its operations and may have a lower liquidity buffer.

- Non-performing loans (NPL) ratio. A higher NPL ratio suggests a larger proportion of the bank's loan portfolio is at risk of default.

Looking at Chart 4, I would conclude that while there are improving trends,

- MBSB's non-performing loan ratio was worse than the sector median.

- It also had a higher loan deposit ratio than the sector.

|

| Chart 4: Loan performance |

A higher loan deposit ratio implies that a larger percentage of MBSB’s deposits are being utilized for lending purposes. Here are some implications associated with a higher ratio:

- Risk and Profitability: A higher ratio can potentially lead to higher profits through interest income from loans. But it also exposes the bank to a greater risk of loan defaults if economic conditions deteriorate.

- Liquidity Risk: A higher ratio can indicate lower liquidity for the bank.

Capital adequacy

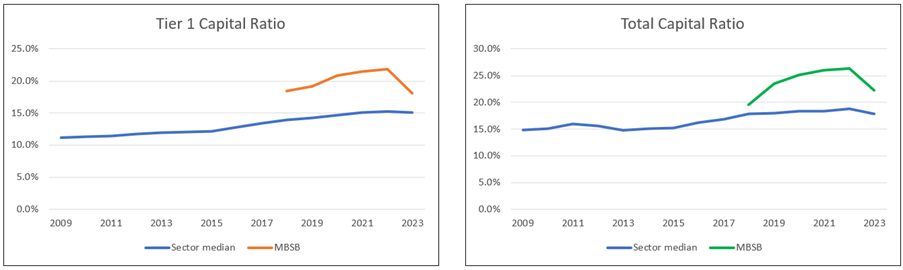

I looked at 2 ratios - Tier 1 capital adequacy ratio and total capital adequacy ratio. These measures are used to assess a bank's capital adequacy. However, they differ in the components of capital they consider. Refer to my Affin article if you want to know more about the differences between them.

As MBSB was only considered a bank after the 2018 acquisition, its capital adequacy data was only available from 2018. As can be seen from Chart 5, MBSB has better ratios than the sector median for both metrics.

|

| Chart 5: Capital adequacy |

Summary of MBSB performance

Based on the above, I would not rate MBSB's performance as fantastic.

- Its average ROE post-2018 acquisition was lower than its cost of equity. It did not create shareholders value.

- There was hardly any revenue growth over the past 10 years.

- MBSB returns were lower than the sector median.

- There were no improving trends in its NIM and Efficiency ratio.

- It had a higher loan deposit ratio and NPL than the sector.

- On the positive side, it had better capital adequacy ratios than the sector.

Did it meet its strategic goals?

In the context of J25 goals,

- There is no improving ROE trend.

- The lack of improvement in the Efficiency ratio implies that its cost-income ratio (CIR) goal is not met by 2023.

- The 2023 revenue is lower than that in 2019 when MBSB unveiled the J25 vision.

Of course, we are still in 2023 and there are another 2 more years to go. But it looks very challenging.

The Group reported the following in its 2022 Annual Report:

“Our Journey 25 Roadmap (J25) represents our long-term business strategy to realize MBSB Bank’s vision of becoming a mature Islamic financial institution by 2025… In 2023, we plan to dive into the following focus areas which are aligned to our strategy…” Refer to Chart 6.

|

| Chart 6: MBSB 2023 Plans |

I look forward to MBSB reporting progress on these plans.

Reading in between the lines, I would say that there has not been very significant achievement under J25. If there were, I am sure that MBSB would have shouted about them in the Annual Report. I hope to be proven wrong.

Valuation

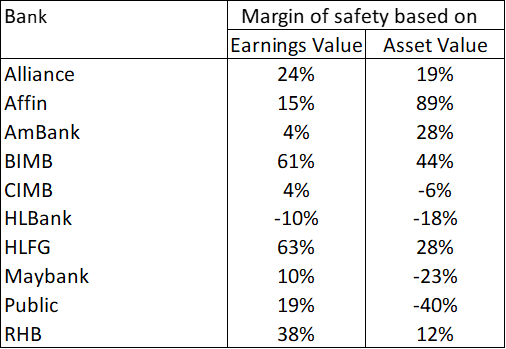

In my Affin article, I compared the values of the various banks based on the following:

- Earnings value (EV) derived from 3 DCF methods – dividends, notional dividends, and residual income.

- Asset value (AV) based on its tangible book value.

For details of the valuation, refer to the Affin article. Table 3 summarizes the margins of safety for the Bursa banks.

|

| Table 3: Margins of safety |

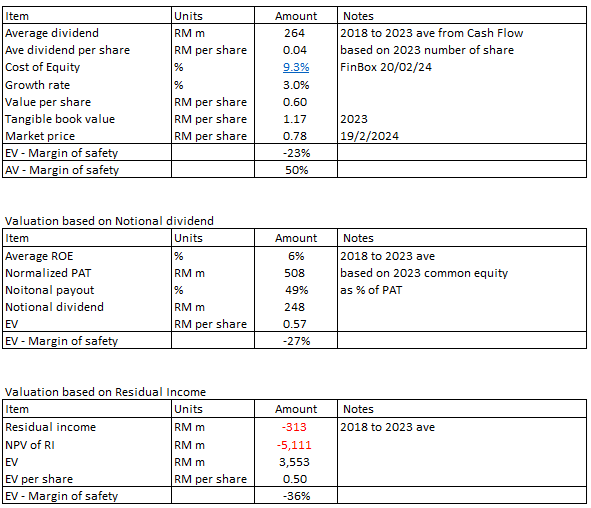

I valued MBSB in the same manner. The main difference between MBSB and the Bursa banks was the period used in deriving the average values.

- In the case of the Bursa banks, the average was based on 2009 to 2023.

- In the case of MBSB, the average was based on 2018 to 2023. This was because of the 2017 acquisition that transformed MBSB into a bank.

The Earnings Value of MBSB was estimated to be RM 0.50 per share compared to its tangible Book Value of RM 1.17 per share. Refer to Table 4 for the valuation details.

With the market price of RM 0.78 per share (19 Feb 2024), you can see that there is no margin of safety based on the Earnings Value. But there is more than a 30% margin of safety based on the Asset Value.

In the context of the margin of safety, MBSB is similar to most of the other Bursa banks as shown in Table 3. Most of them have margins of safety from the Asset Value rather than the Earnings Value.

|

| Table 4: Valuation of MBSB |

|

Is MBSB an investment opportunity?

I have shown that MBSB's performance is below the sector average. However, it is still a profitable bank with good capital adequacy ratios. But it is not an efficient bank when compared to other Bursa banks.

You may think that it is a value trap rather than an investment opportunity. A value trap is a company that appears cheap but is cheap because it has fundamental issues.

Islamic banking is relative when new compared to traditional banking. According to Fitch, Malaysia is the world’s third-largest Islamic banking market, with Islamic financing making up about 41% of local banking-system loans at end-2022 (end-2021: 38%).

Fitch expects the growth of Islamic financing to moderate in 2023 following robust growth of 13% in 2022. MBSB is fortunate to be in growing sector. There is of course the threat of digital banking, but MBSB as has also addressed this under its J25.

MBSB is not in a sunset industry. The main challenge for MBSB is improving its operating efficiency and productivity. While it has embarked on its J25, there are not significant results yet.

- There are no obvious improving productivity and efficiency trend.

- There is no significant revenue growth.

On the face of it, these look like fundamental issues for MBSB. The other metric in assessing whether it is a value trap is the margin of safety.

- There is not enough margin of safety based on the Earnings Value.

- There is a 50 % margin of safety based on the Asset Value.

As a financial institution under Bank Negara's oversight, the Asset Value provides a floor value. But the market tends to look at Earnings Value.

So MBSB is not cheap stock from the Earnings Value perspective. At the same time, it has not been able to improve its operations. This does not make MBSB an investment opportunity if you are a fresh holder.

I would define a good investment opportunity as a company with good business fundamentals and good margin of safety from an earnings perspective. MBSB does not fit this definition.

But I am already a shareholder of MBSB. I would rather hold onto my shares and see whether the achievement of J25 will cause the market to re-rate it.

But what if you are a fresh investor looking at MBSB? If you look at Table 3, there are other banks with better margins of safety from both the Asset Value and Earnings Value. It is a question of whether there are better investment opportunities. And there is.

Investment thesis

Over the past decade, MBSB has transformed itself from a property financier into an Islamic bank. While it had become a much bigger group in terms of equity and total assets, there has not been much revenue growth. The PAT in 2023 was lower than that in 2013.

The lower profits with higher equity and assets resulted in a declining ROE and ROA. The declining returns are supported by declining NIM margins and higher expense ratios. Compared to the Bursa banks, MBSA did worse.

There is a margin of safety based on the Asset Value. But there is no margin of safety based on its Earning Value. Together with the lack-lustre fundamentals, there are better bank stocks if you are a fresh investor. However, given an existing shareholder like me with a relatively low investment cost, it makes sense to hold.

|

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment