Is Protasco an investment opportunity?

Value Investing Case Study 50-1. Protasco: A road maintenance giant or a fading star? Unveiling its turnaround potential! I also used the analysis to see whether to continue holding onto my investment in Protasco.

I first bought Protasco Berhad (Protasco or the Group) in 2010. At that juncture, it was a booming business with a low Debt Equity ratio. I thought that with about a 20% margin of safety based on its Asset Value, it was a good value stock.

However, the returns peaked a few years later and the Group's performance has been declining since then. I have been holding onto my shares for the past 10 years. Of course, the construction sector was badly hit by the Covid-19 measures.

Now that Covid-19 is behind us, I wanted to review Prostaco's business prospects. This article is an assessment of the current business of Protasco and to see whether I should continue to hold onto my shares. At the same time, if you are new to OSK, you would be interested to know whether it is an investment opportunity.

Join me as I show why I should continue to hold onto my investments. However, I do not think that it is an investment opportunity for a fresh investor.

This is not to suggest that Protasco is not a value stock. From a value investment perspective, it is a value investment opportunity and not a value trap. It is just that there are better construction companies available.

Should you go and buy it? Well, read my Disclaimer.

Content

- Background

- Performance

- Financial strengths

- Peer comparison

- Valuation

- My investment in Protasco

- Investment Thesis

- Conclusion

|

Background

The history of the Group can be traced back to the 1990s when its founders, Dato Hasnur Rabianin and Dato Chong Keet Pen started the road maintenance business.

The company was then listed in 2003 with the following businesses:

- Road rehabilitation and maintenance services. This accounted for 75 % of the 2002 revenue.

- Engineering services.

- Trading and manufacturing. This was the second largest revenue contributor in 2002 accounting for about 14 % of the Group's revenue.

- Training and higher education.

Since then, Protasco has diversified and restructured so that in 2023 it reported 11 business segments.

- Maintenance. The Group has maintained more than 28,000 km of federal, state, and rural roads awarded through two federal road maintenance agreements and various long-term contracts lasting through to the year 2029.

- Construction. The construction segment undertook both in-house and external projects. Some of the recent external projects included the government housing projects in Putrajaya as well as the infrastructure works for Pulau Indah Industrial Park.

- Property. The Group's premier project is De Centrum City, a mixed development on a 100-acre freehold land in South Kuala Lumpur. The current project for De Centrum City is Rimbawan Residency, a 517-unit Condominium project. The Group is also currently developing Jade Hill in Tampin, Negeri Sembilan, a 137-acre development of landed housing.

- Engineering & Consultancy. This is spearheaded by Kumpulan Ikram Sdn Bhd which offers comprehensive and integrated engineering services.

- Trading & Manufacturing. The segment’s products, materials, and equipment range from pavement maintenance products to construction building materials, petroleum-based products, highway safety products, and equipment.

- Education. Since more than two decades ago, Infrastructure University Kuala Lumpur has been providing quality education and professional services in various fields.

- Clean Energy. This covers solar panel installation contract works and supply of power and electricity derived from the solar power plant.

- Hotel and Hospitality. The Group owns Park Inn by Radisson Putrajaya.

- Asset Management. The only info for this came from the Q4 2023 Announcement which described the income coming from office rental.

- Agriventure. The only info I could find was the acquisition of Tenggara Food Industries.

- Others.

Note that the Asset Management, Agriventure, and Others segments were introduced in 2023. As my article was written before the release of the 2023 Annual Report, I could not find much info on them.

These 11 segments had different revenue and profit contributions as shown in Chart 1.

The Maintenance segment continued to be the largest revenue and profit contributor to the Group. About 1/3 of the Group's total equity (shareholders’ funds plus Minority Interests) was deployed for this segment in 2022. Refer to Table 1.

- In 2023, the Maintenance segment alone contributed about 63 % of the Group’s revenue. This declined from 73 % in 2012.

- In 2023, the Maintenance segment achieved RM 46.4 million PBT compared to the Group’s consolidated PBT of RM 34.8 million. The consolidated PBT was smaller than the Maintenance segment PBT due to losses from the other segments. This picture had not changed over the past 12 years as in 2012 the Maintenance segment accounted for 96 % of the Group’s consolidated PBT.

|

| Table 1: Segment Performance 2022 |

Diversification

In 2014, the Group rolled out its five-year Business Strategy Framework. Note that elements of this Framework were picked up from the various Annual Reports. According to the 2016 Annual Report, there were six elements to the initial Framework:

- Business process automation.

- Branding and CSR.

- Human capital management.

- Strategic planning for business divisions.

- Risk management.

- Strategic Cost Optimisation.

“…would have seen us arrive at our target of achieving RM100 million in PATANCI by 2018. However, poor market conditions in 2016 and continuing uncertainty in the coming year have forced us to push the targeted deadline back by two years, to 2020.”

Looking at Chart 1, it is obvious that the Group fell short in meeting the profit goal of this Framework.

From the revenue and earnings perspective, I would view the Group as a road maintenance company that has been trying to diversify its earning base since its IPO days.

- It diversified into property development in 2007/08.

- It tried to venture into the Oil & Gas sector in Indonesia in 2012. This did not work out and there is still a pending court case to recover the USD 27 million paid for the disastrous venture.

- It tried to invest in coal trading in 2013. This was another misadventure with the Group still trying to recover the RM 18.9 million paid for the coal trade deposit.

- In 2017, its Clean Energy segment received a Letter of Acceptance of Offer for the development of a large-scale solar PV plant of 6.8 MW at Masjid Tanah, Melaka.

- In 2020, the Group ventured into the hospitality business with the opening of Park Inn by Radisson, Putrajaya.

- In 2023, the Group reported its venture into the agriculture sector.

While the Group had been trying to diversify its earnings base for more than a decade, its revenue and profit track record from the diversification was not good. Refer to Table 1. Despite its efforts, the Maintenance segment today is still the main earnings contributor.

The other deduction from Table 1 is that 2/3 of the Group’s funds have not been generating returns. You can either see this as a terrible performance or an opportunity for the Group to turn around.

I would also like to take the opportunity to comment on the Annual Reports. The company has not been very transparent in much of its reporting. Examples are:

- When it first ventured in the Oil & Gas sector, there was not much information on the proposed venture. Most of the details came out only during the shareholders fight over the venture.

- Another was the way it reported its Business Strategy Framework.

Performance

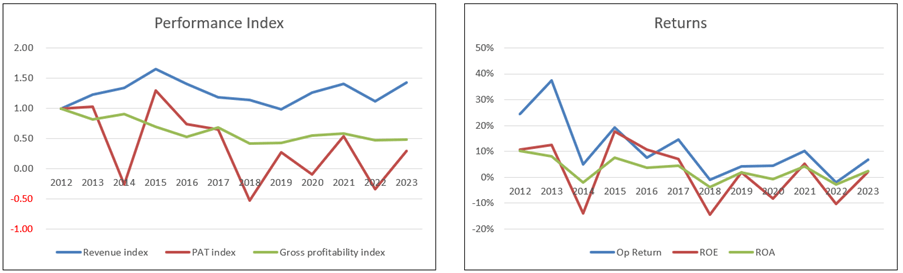

I looked at Protasco’s performance over the past 12 years starting from 2012. To get an overview I looked at 3 metrics – revenue, PAT, and gross profitability (gross profits/total assets). The left part of Chart 2 illustrates the trends for these 3 metrics:

- From 2012 to 2023 revenue grew at 3.3 % CAGR. You can see that revenue showed a cyclical pattern with at least 2 peaks during the past 12 years.

- PAT was very volatile with a declining trend. The PAT in 2023 lower was than that in 2012. There were even 4 years where the Group incurred losses.

- Gross profitability reduced by about half over the past 12 years from 29.8 % in 2012 to 14.3 % in 2023.

Given the profit picture, you should not be surprised to see declining returns from the Operating Return (Operating profit/Total capital employed), ROE, and ROA perspectives. Refer to the right part of Chart 2.

|

| Chart 2: Performance |

Over the past 12 years, the Group achieved:

- An average Operating Return of 11%.

- An average ROE of 2%. The ROE was derived based on the profit after tax due to the shareholders divided by the shareholders’ equity (ie excluding Minority Interests).

The big difference between these 2 returns is that a significant part of the operating income came from joint venture operations. I have mentioned earlier that the bulk of the profits came from the Maintenance segment.

Over the past 12 years, the portion due to Minority Interests amounted to a bit more than 2/3 of the Group PAT. To derive the ROE, we had to leave out profits due to Minority Interests. As such, for the Group to achieve a ROE > 10 %, the Operating Return should be greater than 20%.

You can see from the left part of Chart 2 that the Group did not achieve this threshold for most of the past 12 years.

- Operating margins had declined from 8.9% in 2012 to 2.4 % in 2023.

- There has not been much improvement in Asset turnover. This was because while there was revenue growth, there was also a corresponding growth in assets.

- Leverage has declined because debt grew at a faster rate than equity or total assets. This is not a good sign.

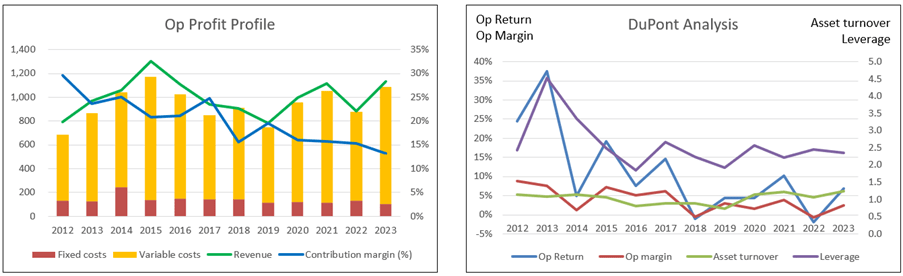

The left part of Chart 3 analyzes the operating profits into fixed and variable costs. The gap between the revenue and total costs (fixed and variable costs) for the year denoted the profits for the year.

There were 2 key takeaways from this chart:

- Fixed costs including Selling, General, and Administration (SGA) expenses were a small part of the total costs. These seemed relatively “stable” over the past 12 years.

- The was a declining contribution margin. It went from 30% in 2012 to 13 % in 2023. This was in line with the declining gross profitability. Gross profit margins went from 26.3 % in 2012 to 11.6 % in 2023.

I have mentioned that the Maintenance segment was the main profit contributor to the Group. To give you a picture of the reason for the declining gross profit margin, I looked at the PBT margin for the Maintenance segment.

In 2012/14, the gross profit margin averaged 17 %. This had declined to an average of 6% in 2022/23. This was despite the average revenue in 2022/23 being about 14% higher than that for 2012/13.

To summarize the picture for Protasco.

- Despite efforts to diversify, the Maintenance segment is still the main earnings contributor. The peak earnings for the Group were in 2014/15. You can see from Chart 1 that this was when the Maintenance segment revenue was at its peak.

- The margins for the Maintenance segment had been declining.

- The bulk of the Maintenance segment business is carried out via joint ventures. The segment's Operating Return will have to be greater than 20% to result in a 10% ROE for the shareholders of Protasco.

- The Group did not have a good track record in diversifying into other ventures. This is looking at the monies written off as well as the returns generated by the still-existing ventures since 2012.

Financial strengths

Despite its poor business performance, I would rate Protasco as financially sound based on the following:

- As of the end of Dec 2023, it had RM 170 million cash and short-term investments. This is about 19 % of its total assets.

- It has a DE of 0.67 as of Dec 2023 compared to my cut-off of 1.0.

- It currently has an interest coverage ratio of 3.4. I defined this as EBIT/interest. This is equal to a BB (Fitch) synthetic rating as per the Damodaran approach.

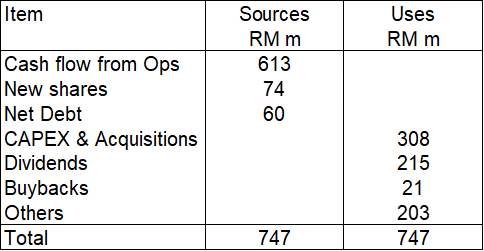

- During these 12 years, it generated a cumulative RM 613 million cash flow from operations compared to a cumulative PAT of RM 327 million. This is a very good cash conversion cycle.

- It had a good capital allocation plan. As can be seen from Table 2, its cash flow from operations was sufficient to fund its CAPEX & Acquisitions, dividends, and buybacks.

|

| Table 2: Sources and Uses of Funds 2012to 2023 |

The key negative point is that it only generated positive cash flow from operations annually for half of the past 12 years.

But looking at Table 2, I would consider it a good cash cow. The only concern I have is that over the past 12 years, some of the funds were badly deployed into ventures with dubious return such as the Oil & Gas and coal ventures.

Peer comparison

The sector performance was based on the base rates data presented in my article "Making sense of the Bursa Malaysia construction sector". They covered the 2010 to 2021 period.

Protasco did better than the sector mean for all the metrics. This probably meant that Protasco's poor performance was because of the headwinds in the construction sector.

|

| Table 3: Comparative performance |

To put the sector in perspective, this is still a growing sector:

“Malaysia's construction industry is expected to grow by 6.6% in real terms in 2023, supported by the implementation of large-scale infrastructure projects….expected to continue its growth…recording an annual growth of 4.4% in 2024…expected to register an annual average growth rate of 5.8% between 2025 and 2027…” Research and Market

“The Malaysia Construction Market size is estimated at USD 38.55 billion in 2024, and is expected to reach USD 58.10 billion by 2029, growing at a CAGR of 8.55% during the forecast period (2024-2029).” Mordor Intelligence

Valuation

I triangulated Protasco's intrinsic value based on both its Asset Value and Earnings Value

- The Asset Value was based on its Book Value of RM 0.61 per share.

- The Earnings Value of RM 0.70 per share was based on its Earning Power Value (EPV). I broke this down into non-operating assets and the value of the operating assets.

I adopted the EPV approach because Protasco was undergoing a turn around. In such a case, it was more conservative to assume zero growth.

The EPV was estimated based on the average from a Free Cash Flow to the Firm approach as per Damodaran and the Residual Income approach as per Penman.

Chart 4 illustrates the valuation. You can see that there is more than a 30% margin of safety under both the Asset Value and EPV.

|

| Chart 4: Valuation |

Limitations and risks

In interpreting the valuation results, you should consider the following:

- Historical basis.

- Renewal of road maintenance contracts.

- Non-operating assets.

I have assumed that the past 12 years' performance is a good picture of the future. While the performance had declined, I assumed that the performance would improve in the “reverse” historical order.

Looking at Chart 1, this meant that it would take some time before the performance reached the 2014/15 peak performance. I suspect that there would be some time yet before we see improved results for the market to re-rate it.

The biggest revenue contributor is the Maintenance segment. The contracts for this business are set to expire in 2029. In my valuation, I have assumed that the Group would be able to extend or renew the contracts. This is not an unreasonable assumption as Prostaco had managed to do this for the past 20 years.

A more conservative approach valuation approach would be to value the Maintenance business as one with a finite life. But to do this, I would have to use a sum-of-parts approach. Given that many of the other business segments are not profitable, it would have been difficult to get a realistic earnings-based sum-of-parts value. As such I did not do this. One mitigation measure is to look for a higher margin of safety.

You can see from Chart 4 that about half of the value under the EPV basis came from the non-operating assets. These came mainly from cash and cash equivalents. If I ignore this, the EPV would be RM 0.32 per share. This is still higher than the market price.

|

My investment in Protasco

I first invested in Protasco in 2010 at RM 1.05 per share. I then increased my investment over the years so that together with the bonus issue, my average purchased cost was RM 1.11 per share.

I estimated that my average holding period till the end of Dec 2023 was 10.1 years. The market price as of the end of 2023 was RM 0.20 per share.

There is of course a capital loss. While there were dividend payments, they were not sufficient to offset the capital loss. As such there was a compounded annual loss of 1.7 %. Refer to Table 4.

|

| Table 4. Estimating my total return. |

If you look at the share price trend per Chart 5, you can see that the price peaked in 2014/15 at around 1.34 per share. The NTA of Protasco in 2014 was about RM 0.99 per share. With hindsight, I should have sold my shares for about 30% or more total gain (inclusive of dividends). But I was greedy and held onto the shares.

|

| Chart 5: Protasco share price trend |

Based on my valuation, Protasco is still worth RM 0.60 per share. I would expect the market price to match this. Assuming that this price is reached in 2 years, my expected loss would turn into an expected gain of 0.7 % CAGR.

OK, it is not a great return. But it is still better than a loss.

If I exit now at RM 0.20 per share, based on the 35 shares shown in Table 4, I would crystalize a capital loss of 35 X (1.11 – 0.20) = RM 31.85. After accounting for the dividends, this would be reduced to RM 16.34.

The cash received from the sale would be 35 X 0.20 = RM 7.00. If I invest this RM 7.00 in a new undervalued stock, to achieve the 0.7 % CAGR, I would have first to recover the RM 16.34. This meant that the new investment must be a multi-bagger.

Unfortunately, I do not have such multi-bagger results frequently. Given this picture, it makes more sense for me to bet on Protasco achieving a turnaround and being re-rated to its Book Value.

Investment Thesis

The performance of Protasco has declined over the past 12 years. Although the Group had tried to diversify into other businesses, the road maintenance business is still the main revenue and profit contributor.

The Group is undergoing a turn around. This would depend on it improving its road maintenance margin as well as finding a profitable venture. I am not sure that it could rebuild the road maintenance margin. The other challenge is that it had a poor diversification track record.

While there is a margin of safety, the business fundamentals are not that good. While the construction sector is not a sunset one, I think that there are construction companies with similar margins of safety but better business fundamentals. As such I would not recommend Protasco for a fresh investor.

However, since I am already invested, it makes more sense to bet on a turn around than exit and incur a loss.

|

Conclusion

There are two general questions value investors ask before investing in a company:

- Is it a good company? In other words, is it fundamentally strong?

- Is it a good investment? I assess this by looking at whether there is a sufficient margin of safety (> 30 %) at the current price.

Protasoc did not meet the first test. But it did well on the second test.

From a fundamental perspective, while it is a cash cow and financially sound, it had a declining performance. It is dependent on the road maintenance contract for most of its earnings. This has experienced declining margins and I am not sure whether the Group can rebuild back the historical good margin.

I suspect its future would depend very much on how it develops the other non-road maintenance business. Again, its diversification track record has not been good.

You can see the various challenges to rebuilding back to its historical peak performance. However, my valuation is not based on Protasco matching its historical peak performance. Rather it was based on the past 12 years' performance covering the peak and decline.

On such a basis, there is a sufficient margin of safety. From a value investment perspective, this can be an opportunity. However, you should not look at Protasco in isolation. Rather look at other construction companies to see whether there are companies with better business fundamentals and similar margins of safety.

I have of course done this and found better companies from the fundamental perspective. As such I would not consider Protasco my first choice if I was a fresh investor.

This is not to suggest that Protasco is not a value stock. From a value investment perspective, it is a value investment opportunity and not a value trap. It is just that there are better construction companies available.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment