Unlocking the Power of the Fundamental Mapper

Fundamentals 28: The Fundamental Mapper simplifies investment analysis to enable actional insights.

Lysaght Galvanized Steel Bhd share price has been trending up since the start of the year. You are kicking yourself because you failed to notice it with so many stocks to look at from a fundamental perspective.

You were wondering whether there is a platform that can simplify complex investment analysis to enable actionable insights. Look no further as the Fundamental Mapper can resolve your problem.

Today's investors are inundated with data, making it challenging to distill valuable insights from the noise. The Fundamental Mapper simplifies this process by plotting companies on a matrix based on two key dimensions - relative fundamental performance and margin of safety.

This innovative tool can help investors reduce the time spent on fundamental analysis and aid in investment decision-making.

The Fundamental Mapper can enhance decision-making by providing a clear visual representation of investment opportunities and risks. At the same time, it is an educational tool as it helps investors understand the fundamentals of investing and the importance of valuation.

In this article, we will explore how to use the Fundamental Mapper and highlight its benefits with examples from each of the four quadrants formed by the intersection of good-poor fundamental performance and high-low margin of safety.

Contents

- Understanding the Fundamental Mapper

- Benefits of the Fundamental Mapper

- Using the Fundamental Mapper

- Company perspective – case studies

- Overcoming shortcomings

- Behind the Fundamental Mapper

- Conclusion

- Disclaimer

|

Understanding the Fundamental Mapper

Comprehensive business analysis and valuation require both quantitative and qualitative studies and will be time-consuming.

This is where the Fundamental Mapper comes in. It provides a picture of where the company stands from a quantitative business performance and valuation perspective. With this information, you can cut your analysis time by focusing on the qualitative aspects.

The Fundamental Mapper comprises the Business Performance – Investment Risk matrix as illustrated in Chart 1. The matrix consists of 4 quadrants created from the intersection between the Business Performance on the horizontal axis and Investment Risk on the vertical axis.

Each quadrant represents a different combination of Business Performance and Investment Risk.

- The business performance of a particular company was assessed by comparing its business fundamentals with those of its peers in the same sector. We have categorized it into Poor or Good.

- The Investment Risk was assessed by comparing the market price with its intrinsic value. A Low Risk is one where the market price is at least 30% lower than the intrinsic value. The High Risk is the opposite case.

Each of the quadrants has been named to reflect the various investment opportunities.

|

| Chart 1: Fundamental Mapper layout |

Downside protection

“Rule # 1: Don’t lose money. Rule # 2: Don't forget Rule # 1.” Warren Buffett

“The definition of an investment is an operation which, upon thorough analysis, promises safety of principle and a satisfactory return.” Benjamin Graham

The above 2 quotes suggest that capital protection is paramount to value investors. The Fundamental Mapper is based on this principle. As such the centrelines for the fundamental performance and risk are not based on the average of the respective distributions. Rather as part of its focus on downside protection:

- The centreline for the business performance is set at some % above the average relative performance.

- The centreline for risk is set at some % above the point where the business value = market price.

These ensure that there are some margins of safety and hence downside protection when mapping both the fundamental performance and risk of a company.

This is important as you look at the features of companies in the respective quadrants.

Goldmine

These are companies with strong fundamentals and priced significantly below their intrinsic value, offering a good investment opportunity.

While investing in good companies where the market prices are more than 30% below the intrinsic values can reduce risk, it is essential to manage risk effectively. You should diversify your portfolio across different sectors and industries to spread risk. Set strict entry and exit criteria for each investment, and be prepared to sell if the investment thesis no longer holds.

Gem

These are companies with strong fundamentals but are currently priced close to or above their intrinsic value.

Investing in companies here can be profitable if you can correctly identify businesses with strong growth prospects and are willing to hold for the long term. Investing in companies falling within this quadrant is following Warren Buffett's “wonderful companies at fair price” approach.

When hunting for companies in this quadrant the focus is on signs of improving profitability or reducing reinvestments. These will lead to better earnings that will lead to better margins of safety.

Turnaround

These are companies with poor fundamentals but priced significantly below their intrinsic value. They are potentially undervalued turnaround opportunities.

Companies here performed badly in the past. But if there is some fundamental change that would improve future business performance, the companies could move towards the Goldmine quadrant. Look for companies that have the potential to turn around their business performance. Investing in companies undergoing turnaround requires patience.

Quicksand

These are companies with poor fundamentals and priced close to or above their intrinsic value. Companies here have poor business fundamentals as well as being risky. They are not recommended as there are companies in other quadrants that are easier to assess.

Benefits of the Fundamental Mapper

The Fundamental Mapper for stocks offers a variety of benefits for both fundamental and technical investors:

For the fundamental Investors, the benefits can be classified into the following:

- Visual comparison. With the Fundamental Mapper, you can quickly compare companies on fundamental performance and margin of safety without going through detailed financial reports. You can see how companies stack up against each other in terms of fundamental health and investment risk. This gives you are quick view of the relative positioning.

- Investment insights. The Fundamental Mapper helps to identify value investment opportunities. You can spot undervalued companies with strong fundamentals. At the same time, it helps you evaluate the safety margin to understand the potential downside risks associated with the investment.

- Simplified analysis. The Fundamental Mapper provides a snapshot of key metrics, reducing the need for extensive individual analysis. As an educational tool, it helps investors understand fundamental analysis concepts through visual representation.

For traders that use a combination of technical and fundamental analysis, the Fundamental Mapper can also be useful in the following ways:

- Fundamental support. You can use the Fundamental Mapper to confirm technical analysis signals, increasing confidence in trading decisions. For example, stocks with strong fundamentals may be more likely to sustain long-term trends.

- Enhanced trading. You can use the Fundamental Mapper as a screen to narrow down stocks to those with both technical and fundamental strengths. You can also use the Fundamental Mapper to time entries and exits better by considering the fundamental backdrop.

- Diversification insights. The Fundamental Mapper can help you understand which sectors have fundamentally strong companies that align with current technical trends.

By integrating the Fundamental Mapper, investors can gain a clearer understanding of the market landscape, identify high-potential investments, and make more informed decisions, whether their approach is rooted in fundamental analysis or technical trading strategies.

Using the Fundamental Mapper

There are two main ways to use the Fundamental Mapper

- Sector overview

- Company perspective

The Fundamental Mapper considers 2 issues – business performance and market sentiments. In interpreting the results, you have to consider both of them.

Sector perspective

You can get a sense of the market sentiments by looking at the distribution of companies. I would normally expect that for a particular sector, there would be companies in each quadrant. A good example is shown in Chart 2.

|

| Chart 2: FM – companies in each quadrant |

Skew to the top or bottom

But when you have a case where they are all skewed to one side as shown in Chart 3, you must ask why all are rated as such.

The left part of Chart 3 illustrates a skew towards the low risk. One possible reason for this could be that the market might be in a “fear phase” where all stocks are underpriced.

The appropriate thing to do is to carry out a sector analysis to understand the characteristics, trends, risks, and opportunities. You can then decide the reasons for the sector profile in the Fundamental Mapper.

|

| Chart 3: FM – skewed to the bottom or top |

You can also have the reverse situation where most of the companies are on the high-risk side as illustrated in the right part of Chart 3. I would consider this a “bubble” scenario.

I would consider the skew to the top as rare due to the way the Fundamental Mapper was designed. The line separating the low-risk and high-risk was based on the margin of safety. The margin of safety in turn was based on comparing the business value with the market price.

The line separating the high and low risk was not set at business value = market price. Rather it was set for the business value = 1.3 of the market prices.

For all the companies to be skewed to the top it must mean that the market is so bullish that all the companies are trading at 130 % or higher than the business values. Not impossible but not under normal market conditions.

Empty quadrant

You can also have a scenario where there is no company within a quadrant. This is illustrated in Chart 4 where there is no company within the Gem quadrant.

One possible reason for this is that the market is being cautious without overpricing companies that are fundamentally sound.

|

| Chart 4: FM – empty quadrant |

Skew to the left or right

Any skew to the left or right can only be attributable to business performance.

The left part of Chart 5 illustrates a situation where there is a skew towards poor business performance. The possible reasons for the skew to the left are:

- This is a very challenging sector from a fundamental perspective. As such there are very few companies with strong performance over the past 6 years.

- This is a very concentrated sector where a few companies dominate the market. The rest of the companies in the sector are then left with demand at their break-even levels.

Faced with such a situation, I would focus on the sector structure to see whether the leaders have some strong and sustainable moats.

|

| Chart 5: FM – skewed to the left or right |

You can also have the skew to the right as illustrated in the right part of Chart 5. I would consider this rear because of the way the Fundamental Mapper was designed. The line separating the good and poor performance is not set at the average performance of the sector. Rather it was set to be some % above the average.

Distribution pattern

Most of the time, I would expect the plots for a specific sector to be distributed all over the Fundamental Mapper as illustrated in Chart 2.

If you have a situation where the plots are all close to the vertical centre line, it means that there are no outliers in this sector. Refer to the left part of Chart 6. All the companies’ performances are close to one another. If there is such a case, it means that there is much to differentiate the performance of the companies.

However, you can have a picture like that shown in the right part of the Chart 6. This meant that there were some market leader with a strong performance as well as lots of very poor performances. If you find such a scenario the obvious choice is to focus on the top performers.

Competitive analysis

The fundamental performance of a company within a sector gives you a picture of its competitive position. We are in the early stages of the Fundamental Mapper. But once there are about 5 years "maps" for a company, you can get a picture of how its relative position had changed over time I think this is a very easy way to assess the competitive position of a company.

|

| Chart 6: Distribution pattern |

Company perspective – case studies

When looking at a company in any quadrant, there should be 2 questions on your mind:

- Will the business performance continue? The fundamental performance in the Fundamental Mapper is based on the past 6 years' historical performance. You should ask whether the future is going to be the same, better or worse.

- Why is the market pricing the stock to cause it to be mapped as such? The risk position in the Fundamental Mapper is based on comparing the past 6 years' business value with the current market price. A “greedy” market sentiment will lead to overpricing (high risk) while a “fearful” market sentiment will lead to under-pricing (low risk).

When looking at companies in the Goldmine and Gem quadrants, you want business performance continuity or improving business performance in the future.

When looking at companies in the Turnaround or Quicksand quadrants, you want business improvements. For companies in the Quicksand quadrant, you also want market sentiments to change quickly to provide you with an entry opportunity.

Goldmine

The Fundamental Mapper shows the business performance vs margin of safety at a particular point in time. Business performance and share prices are not static.

I like to illustrate this dynamic picture with Lii Hen.

Lii Hen Industries Bhd manufactures and sells furniture in North America, Asia, Oceania, Africa, and Europe. The Fundamental Mapper at the end of 2019 identified it as a company in the Goldmine quadrant. In Jan 2020, it was trading at RM 1.00 per share.

Even with a strong position at the end of 2019, the Fundamental Mapper should be used in conjunction with other analysis tools to assess potential risks. One such analysis is the article “Is LIIHEN one of the better Bursa Malaysia furniture stocks?”

When I dug deeper into LiiHen's performance, I found that from 2015 to 2019, revenue grew at 11 % CAGR. It also had good returns, a low Debt Equity ratio, a negative Reinvestment rate (Reinvestment/NOPAT), and good cash flow conversion. These metrics suggest that it delivered strong performance.

The strong position of LiiHen at the end of 2019 does not negate the need for ongoing risk assessment and monitoring. The importance of complementing the Fundamental Mapper's other analysis is illustrated by the March 2024 map.

By March 2024, the Fundamental Mapper showed that it had shifted to the Gem quadrant. Its market price at the end of March 2024 was RM 0.98 per share.

|

| Chart 7: Liihen |

You can see that while Lii Hen is still fundamentally sound, its business performance has deteriorated a bit relative to the sector. As such while its share price today is lower than that in 2020, its declining business performance meant that its intrinsic value in March 2024 is lower than that in 2020.

If you had bought Lii Hen in Jan 2020 and held it till March 2024, you would have a 4 % compounded annual gain. This is inclusive of the dividends and capital gain.

Key takeaways - What the case study illustrates is that if you have a long-term investment horizon, you have some downside protection when investing in Goldmine companies. Business fundamentals do not change daily. When you find companies in the Goldmine quadrant, tracking the investment risk regularly can help improve the entry points.

|

| Chart 8: Liihen share price |

Gem

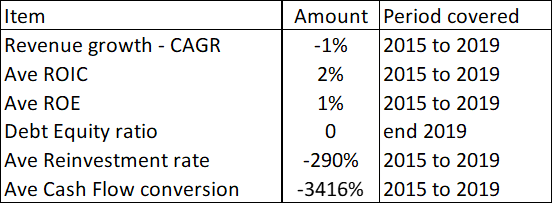

Lysaght Galvanized Steel Berhad manufactures and sells galvanized steel products in Malaysia and internationally. Its products included galvanized steel poles, masts, galvanized lighting columns, gantries, transmission and telecommunication towers.

At the end of 2019, the Fundamental Mapper identified it as a Gem. This meant that it was fundamentally sound but overpriced by the market. A detailed analysis showed that its revenue growth was about equal to the GDP growth rate. But it had good returns with a good reinvestment rate. The only concern I have is the cash flow conversion rate as I would have preferred something greater than 100%.

|

| Table 2: Lysaght Performance |

In March 2024, Lysaght remained a Gem. In other words, there was no significant change in its business performance relative to the sector. At the same time, the market continued to price it above its business value. For more insights into the company refer to "Is Lysaght a value trap?"

|

| Chart 9: Lysaght |

If you bought the stock in Jan 2020 and held it till March 2024, you would have achieved a 1% compounded annual gain.

Key takeaways - One objective of the Fundamental Mapper is to identify companies to avoid if you are not an experienced fundamental investor. Companies in the Gem quadrant are good examples. While the companies did well from a business perspective, the market has overpriced them. Unless you have in-depth knowledge about the business, it would be challenging to make money.

|

| Chart 10: Lysaght share price |

Turnaround

Companies in the Turnaround quadrant did not perform well over the past 6 years (relative to when the analysis was run).

While the management in these companies wants to improve the business performance, there is no assurance that they can be successful. I will illustrate 2 examples here:

- Choo Bee whose performance did not improve.

- Rhong Khen International (RKI) which improved its performance.

Choo Bee Metal Industries Berhad manufactures and sells flat-based steel products in Malaysia and the rest of Asia. The Fundamental Mapper in 2020 identified it as a company in the Goldmine quadrant. In Jan 2020, it was trading at RM 0.84 per share.

However, the steel sector is cyclical as shown below. You can see that the steel prices from 2016 to 2020 were low relative to prices in 2021/22. We are currently at the downtrend leg of the cycle. Choo Bee's performance tends to follow the steel cycle.

|

| Chart 11: Steel prices |

When I dug into Choo Bee fundamentals from 2015 to 2019, I found that its performance was nothing to shout about. Revenue declined and its returns were low. It had a poor cash flow conversion rate given the negative ratio.

|

| Table 3: Choo Bee Performance |

The Fundamental Mapper shows the relative business performance of the companies in the sector. If the sector is facing a low-price period such as the steel sector from 2015 to 2019, its actual results as illustrated by Choo Bee may not be good.

As such you should not be surprised to see that Choo Bee continued to be a Turnaround in March 2024.

|

| Chart 12: Choo Bee |

If you bought Choo Bee in Jan 2020, you would have a 3% compounded annual gain today. Of course, if you know how to invest in cyclical companies, you will exit at the peak of the price cycle. In the context of Choo Bee, you would have exited in 2022 when the steel price was at its peak.

|

| Chart 13: Choo Bee share price |

Rhong Khen International Berhad (RKI) manufactures and sells wooden household furniture and components in Malaysia, Vietnam, and Thailand. The company provides bedroom collection, dining room collection, and living room collection sets, as well as small and home office sets.

At the end of 2019, the company fell into the Turnaround quadrant. A detailed analysis of the 2015 to 2019 performance showed low revenue growth but it had good returns. However, it had a high average Reinvestment rate suggesting that there is not much left from the NOPAT for shareholders. Its cash flow conversion rate was also less than 100 %.

|

| Table 4: RKI Performance |

You should not be surprised to see that it is a Turnaround. By 2024, its business performance had improved to move to the Goldmine quadrant.

|

| Chart 14: RKI |

While the market price peaked in 2021, it is today about what it was in 2020. As such it remained underpriced. If you had bought RKI in 2020 and held onto it till today, you would have achieved a 2% compounded annual gain.

|

| Chart 15: RKI share price |

Key takeaways - These 2 examples showed that there is no automatic gain when investing in Turnaround. Unless you are prepared to put in the effort to get an in-depth understanding of the business, it would be hard to judge the likelihood of a turnaround in the business.

Quicksand

Companies in this quadrant did not perform well over the past 6 years. Notwithstanding this, the market has overpriced them relative to the business value. Unless you have great insights about a particular company, you should avoid them.

It is hard to tell where it will move. Notion Vtec is a good example of being wrong-footed by the Fundamental Mapper.

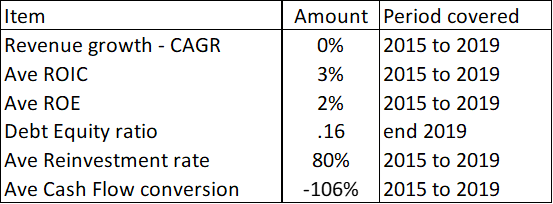

Notion VTec Berhad, designs, manufactures, and sells precision components and tools. It faced a challenging time from 2015 to 2019 and as such fell into the Quicksand quadrant.

A fundamental analysis from 2015 to 2019 showed why it is in the Quicksand quadrant. There was no revenue growth and its returns were low. It had a high Reinvestment rate and poor cash flow conversion. However, it had a low debt-equity ratio.

I had a detailed fundamental analysis of Notion and concluded in early 2024 that it was a tough business.

|

| Table 5: Notion Performance |

|

| Chart 16: Notion |

Notion remained a Quicksand when mapped in March 2024. In other words, the business fundamentals from 2020 to LTM March 2024 did not improve.

If you had bought Notion in Jan 2020 and held onto it till March 2024, you would have an 11 % compounded annual loss.

But as you can see from the price chart, the company benefited from the US vs China trade tiff and its businesses improved tremendously in the first quarter of 2024. The market reacted and its share price shot up.

Unless you are an insider, you will not have any knowledge of such changes in the business fortune.

Key takeaways - The Fundamental Mapper is not going to help you identify companies undergoing such changes in business fortunes before they announce the latest results. From an outsider's perspective, it is easier to hunt for Goldmine companies and avoid the Quicksand one.

|

| Chart 17: Notion share price |

Overcoming shortcomings

There are of course shortcomings in any system. The Fundamental Mapper is no different. I would like to think that we have taken steps to minimize them as follows:

- Simplification of complex data. The Fundamental Mapper reduces complex financial data into 2 dimensions. It was intended to do so. The key then is not to use the results by themselves. Rather see the Fundamental Mapper as a way to enable you to focus your time on detailed analysis of likely prospects.

- Static nature. We have tried to mitigate this by updating the market price daily. At the same time, the valuation and business performance are updated quarterly. Since most Bursa stocks are mature companies, I think we have addressed the static nature of the analysis.

- Reliance on past 6 years data. The Fundamental Mapper works for mature and/or cyclical companies where the past provides a good picture of the future. I would be wary of using it to map companies facing digital disruption, start-ups, and companies in financial distress.

- Quantitative focus. The Fundamental Mapper is a quant approach. It does not cover the qualitative aspects. As such the best approach is to complement the results of the Fundamental Mapper with some qualitative analysis

The Fundamental Mapper was not designed to be a type of robo-adviser. Rather it was meant to provide a better way to identify companies for more detailed analysis.

Fundamental analysis is time-consuming and requires a lot of effort. You do not want to spend the time to find out at the end of the analysis that there is no investment opportunity.

The Fundamental Mapper reduces this risk. You have an indication at the start of your analysis whether the stock would be a quality-value stock, a wonderful company in the Buffett sense, or a turnaround candidate.

Behind the Fundamental Mapper

Fundamental investors differentiate between market price and intrinsic value.

- Market price results from the supply and demand for a particular stock. In the short term, it is driven more by market sentiments.

- Fundamental investors believe that the market price will reflect the business fundamentals in the long term. Refer to Appendix 1.

When they find that the market price is significantly lower than its intrinsic value, they see this as an opportunity to buy. They believe that the market has yet to recognize the business prospects. They expect to gain when the market re-rates the stock to reflect the intrinsic value.

That is why fundamental investors put in a lot of effort to estimate the business prospects and intrinsic value. To do this well, you need to understand the company's business performance, its competitive position, and the industry trends. This meant studying at the minimum the company’s Annual Reports, its competitors’ Annual Reports as well as industry reports.

This is where the Fundamental Mapper comes in. It provides a picture of where the company stands from a quantitative business performance and valuation perspective. With this information, you can then cut down your analysis time by focussing on the qualitative aspects.

The Fundamental Mapper uses 4 factors to assess the business fundamentals of a company in comparison with its sector peers. At the same time, it uses the past 6 years of financial data to project the performance required for the valuation.

Given the sheer number of data points, it would be very challenging to do this manually. The Fundamental Mapper solves this problem by using INSAGE’s (Xifu’s sister company) database and computing power.

Investing is inherently future-oriented, as it involves a company allocating resources with the expectation of generating returns or benefits over time. While we do not have a crystal to see the future, the Fundamental Mapper uses historical data to serve as the base case.

Determining the Business Performance

The Business Performance of each company was determined based on 4 factors – profitability, growth, reinvestments, and risks. These are the factors that drive shareholders’ value creation.

We use 5 different metrics to capture the various nuances associated with the performance of each factor. A weighted composite score for each company was then ascertained based on its past 6 years' results. This composite score is updated quarterly.

Determining the Investment Risk

The Investment Risk for each company is determined by comparing its market price with its intrinsic value. A low-risk investment is one where the intrinsic value is at least 30% higher than the market price and vice versa.

The intrinsic value of each company was estimated using a multi-stage discounted cash flow model. The valuation is updated quarterly taking into account its latest 6 years quarterly and annual performance as appropriate.

The market price vs intrinsic value comparison is carried out daily based on the previous day's closing market price and the latest estimate of the intrinsic value.

Conclusion

The Fundamental Mapper is a powerful tool that can transform how investors approach investment decisions. By visually representing the intersection of fundamental performance and margin of safety, it simplifies complex data and supports more informed decision-making.

Whether you are identifying strong buy opportunities, cautious holds, or potential turnaround plays, the Fundamental Mapper offers a strategic advantage in navigating the financial markets.

By integrating the Fundamental Mapper into your investment analysis, you can differentiate yourself in a competitive market. To get the most out of the Fundamental Mapper, the first-time user should follow these steps:

Step 1. Understand what each quadrant represents in terms of fundamentals and margin of safety (risk). Review the case studies for companies in each quadrant to get the nuances of each quadrant.

Step 2. Use the insights from the Fundamental Mapper to guide your investment choices:

- Prioritize the Goldmine companies for safer, undervalued investments.

- Consider the Gem companies for strong growth potential despite higher valuations.

- Approach the Turnaround companies very cautiously, looking for potential turnarounds.

- Avoid the Quicksand companies unless there is a compelling reason for a speculative bet.

Step 3. Carry out a qualitative analysis to assess whether the future will be the same, better, or worse than the past. Your focus is on cases where the future would be the same or better.

|

Disclaimer

A thorough fundamental analysis requires both quantitative and qualitative analyses. The Fundamental Mapper summarizes our fundamental quantitative analysis.

The position of a company in the Fundamental Mapper was based on the past 6 years' historical performance and the previous day's closing market price. It is a purely fundamental quantitative analysis to provide a picture of where a company stands relative to its peers.

While it is a historical picture, it can be a good representation of the future for mature companies. But it may not be a good picture of the future for those companies undergoing some fundamental change.

Appendix 1

The assertion that in the long term, the market price for a stock depends on its business fundamentals is rooted in several core principles and theories of finance and economics.

In summary, while short-term stock prices can be influenced by a variety of factors including market sentiment, speculative activity, and external events, the long-term price of a stock is fundamentally anchored to the company's financial health, performance, and growth prospects. This principle is widely accepted in finance.

Intrinsic Value Theory

According to this theory, the value of a stock is determined by the present value of its future cash flows. This involves discounting the expected earnings, dividends, or free cash flows of a company to their present value. The market price of a stock, in the long run, tends to converge to this intrinsic value, which is fundamentally driven by the company's financial performance, growth prospects, and risk profile.

Efficient Market Hypothesis (EMH)

The EMH posits that stock prices fully reflect all available information. While short-term price movements can be influenced by market sentiment and speculative trading, over the long term, prices are believed to reflect the underlying business fundamentals. This is because rational investors will eventually act on accurate information about a company's financial health, thereby correcting any mispricings.

Reversion to the Mean

Stock prices often exhibit mean reversion over the long term. This means that prices tend to move back towards their historical average valuations, which are based on fundamental measures. When a stock is overvalued or undervalued relative to its fundamentals, market forces eventually bring the price back in line with its intrinsic value.

Market Anomalies and Corrections

Short-term anomalies and mis-pricings can occur due to irrational behaviour, speculative bubbles, or market manipulation. However, these anomalies are usually corrected over time as rational investors take advantage of mis-pricings. This correction process aligns stock prices with the underlying business fundamentals.

Behavioural Finance

Behavioural finance acknowledges that while psychological factors and cognitive biases can drive short-term market movements, in the long run, rational decision-making based on fundamentals prevails. Investors learn from past mistakes and adjust their strategies to focus more on the intrinsic value of companies.

Earnings and Dividend Growth

A company's ability to generate consistent and growing earnings and dividends is a key driver of its stock price. Stocks of companies with strong and stable earnings growth and a track record of returning value to shareholders through dividends are typically valued higher. Over the long term, sustained growth in earnings and dividends tends to be reflected in a higher stock price.

END

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

If the above article was useful, you can find more insights on how to make money in my e-book. The e-book is now available from Amazon, Kobo and Google Play.

PS: If you are in Malaysia or Singapore, the e-book can only be download from Kobo and Google Play.

How to be an Authoritative Source, Share This Post

|

Disclaimer & DisclosureI am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment