Is NAIM one of the better Bursa Malaysia stocks?

Value Investing Case Study 31-1: I started to invest in NAIM in 2017 as a turnaround candidate. In this article, I share my plans for this stock based on a fundamental analysis of the Group.

I first bought Naim Holdings (NAIM or the Group) in April 2017 at RM 1.61 per share. For the FYE 2016, NAIM had a NTA of RM 5.52 per share. But in terms of earnings for the year, it just broke even.

NAIM was listed on Bursa Malaysia in 2003 and it had been profitable for every year since then. I saw its problems in 2016 as hiccups in its construction business as well as a slowdown in the property development business.

I bought it on the basis that it was a turnaround investment and I expected to hold it for several years before the market re-rated it.

It had been a wild ride as NAIM exposure is not just to the construction and property development sectors, but also to the Oil & Gas industry. The NTA of the Group is today half of what it was when I first invested in the Group. This was on top of a rights issue.

If nothing else, this is a good example of why investing with a margin of safety is very important. It is also a good example of why you need to have a long-investment horizon and the ability to withstand volatility when you value invest.

Join me as I share my investing experience in NAIM and why I am still holding onto the shares.

Should you go and buy it? Well, read my Disclaimer.

Contents

- NAIM’s background

- My investments

- NAIM’s financial position

- Performance track record

- Valuation

- Conclusion

|

NAIM’s background

The Group is today a fully-integrated property and construction player. It focuses on integrated property developments, construction, civil engineering, oil and gas and infrastructure projects.

It also provides oil and gas services through its investment in Dayang Enterprise Holdings Bhd (Dayang) and Perdana Petroleum Bhd (Perdana)

There are actually 3 Bursa Malaysia listed companies in the Group as shown in the corporate structure below.

|

| Chart 1: Corporate Structure |

NAIM started in 1995 with its landmark property development in Miri. The Group then ventured into construction in 1997. NAIM today is a Class A Contractor with ISO 9001 certification. It is also one of Malaysia’s leading Bumiputera contractors. It had carried out more than RM 5 billion worth of works (including its own development projects).

The Group today has the following flagship property developments:

- NAIM Bandar Baru Permyjaya in Miri.

- NAIM Kuching Paragon, NAIM Desa Ilmu and NAIM Riveria in Kuching.

- NAIM Bintulu Paragon.

The Group is also an Oil & Gas player via its investments in Dayang which in turns owns Perdana. For details on Dayang refer to the following articles:

My investments

I first bought 144,500 shares NAIM in Apr/May 2017 at an average price of RM 1.62 per share. NAIM then had a rights issue in 2019 which I subscribed for 216,750 shares at RM 0.45 per share. This reduced my average purchase price to RM 0.92 per share.

|

| Chart 2: Share Price. Source: TIKR.com |

The price of NAIM shares has been declining since I first bought in 2017. Refer to Chart 2. But after the rights issue in Jan 2019, its share price began to spike and I sold 100,000 shares in March 2019 and Feb 2020.

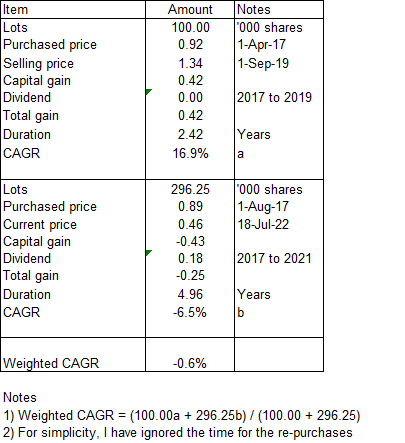

My average selling price was RM 1.34 per share. When the price declined in 2020, I bought back 35,000 shares. While in total I had bought 396,250 shares because of the sale and re-purchases, I would see my investments as shown in Table 1:

- I had a tranche of 100,000 shares (or 25 % of my total number of shares) where I had a 16.9 % compounded annual return. This was for the shares sold.

- I still have a balance of 296,250 shares (75 % of my total original shares). As of 18 July 2020, there is a compounded annual loss of 6.5 % from this tranche.

- On an overall weighted basis, I have a compounded annual loss of 0.6 %.

|

| Table 1: My Returns |

What is my expected return moving forward?

For the balance tranche of 296,250 shares to achieve the same compounded annual return, the price of NAIM has to be RM 2.09 per share. This is assuming that this will happen within the coming year and there is no dividend further declared. This will of course result in a 16.9 % overall compounded annual return.

If the price only went up to RM 1.34 per share (similar to the selling price of the tranche sold), I would achieve a CAGR of 9.3 % for the balance. The overall compounded annual return would then be 11.2 %

Looking at the past 5 years of NAIM’s prices, I am not confident that it would hit RM 2.09 per share. But I think it is possible to hit RM 1.34 per share. The 2019/2020 price spike was due to the performance of Dayang and given the current oil prices, it is possible for another run up in Dayang’s share price. But of course, this is relying on market sentiments.

NAIM’s financial position

I have learned over the years that turnarounds often take longer than expected. As such one of the key requirements for investing in a turnaround is that the company must be financially sound.

When I first bought NAIM in 2017, it had RM 479 million of debt resulting in a Debt Equity ratio of 0.5. At that juncture, the Group had RM 64 million of cash.

The Group undertook a Rights Issue in 2018/19, raising about RM 119 million to fund its property development activities.

I would rate NAIM today as financially sound for the following reasons.

- As of end Mac 2022, it had a Total Capital Employed (TCE) of RM 1.5 billion. Of this, 81 % was contributed by direct equity while debt accounted for 21 % of it.

- As of end Mac 2022, it had RM 283 million cash. This is about 19 % of the TCE.

- Over the past 12 years it had an average Cash Flow from Operations of RM 29 million.

- Based on its interest coverage ratio, I would give it a synthetic S&P rating of BB.

|

| Chart 3: Sources and Used of Funds |

Performance track record

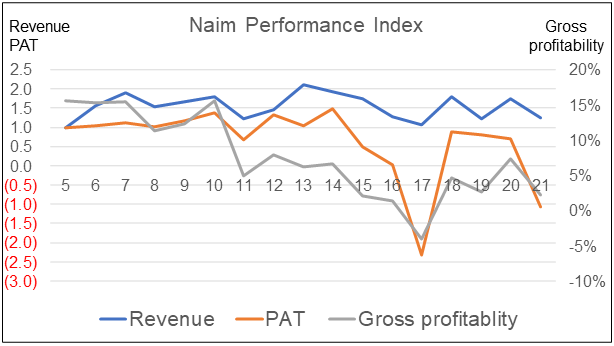

Chart 4 shows the key performance metrics of NAIM. I have tracked the Revenue and PAT trends using the values in 2005 as the bases of 1.00

The Group’s revenue for the period has been greater than that in 2005. However, PAT had been very volatile with losses in 2017 and 2021.

The Group suffered its first loss of its 23 years of operations in 2017. This after-tax loss of RM 168 million came from:

- Losses of about RM 121 million mainly from the construction of the 6 stations project for MRT. The Group had admitted that this was a complex project with a steep learning curve for the Group.

- A significant deterioration in the share of results of Dayang. At the same time there was the dilution in equity interest in Dayang.

- The drop in both property revenue and profit due to lower development progress achieved as well as increase in financing costs.

The after-tax loss of RM 77 million in 2021 was mainly due to impairment losses from Dayang and Perdana.

|

| Chart 4: Performance Index Note: PAT excluded the gain from the sale of shares in associates |

Gross Profitability = Gross Profits / Total Assets. According to Professor Novy-Marx, this has the same power as PBV in predicting stock returns. I used this metric to see the prospects of a turnaround.

You can see that Gross Profitability had declined from 16 % in 2005 to – 4 % in 2017. However there seemed to be a recovery from 2018. This metric is driven by the construction and property businesses and I see this as a good turn around sign.

Peer Performance

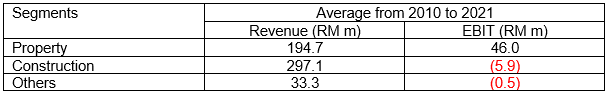

The majority of the Group’s revenue came from the Property and Construction segments. However, as can be seen from Table 2, the main profit contributor has been the Property segment.

Both the Malaysian property and construction sectors have been facing soft markets over the past few years. This started even before the Covid-19 pandemic.

I had earlier compiled the base rates for the Malaysian Property and Construction sectors. These were based on the respective Bursa Malaysian companies. Refer to

Both the sectors are cyclical and are currently facing soft market. I had concluded that it would be another 3 to 4 years before we see strong uptrends.

The key question then is whether the performances of these 2 segments were in line with the market. If the businesses were down due to the market, the Group would turn around when the property and construction markets recover.

|

| Table 2: Segment Performance |

I thus compared NAIM’s Property and Construction Segments’ performances with the respective industry performances. Note that for the industry, I used the average values for the industry.

Property

Looking at Chart 5, I would rate Naim performance as below average. The sector revenue performance peaked some time in 2015/17. NAIM’ revenue peaked in 2013. Note that NAIM’s performance in 2020 was boosted by a land sale.

Construction

NAIM Construction segment revenue did worse than the Malaysian construction sector average revenue. While the sector revenue had grown and generally was better than the 2005 revenue, the same could not be said for NAIM.

NAIM Construction segment PAT also performed worse than the Malaysian construction sector average PAT. NAIM even had 6 years of losses.

I would conclude that NAIM performance did not correlate with those of the Malaysian sectors. This is supported by the correlation analysis as per Table 3.

- If you are pessimistic, you would conclude that as the sectors turn around, it would take NAIM some time later to do so.

- If you are optimistic, you would say that NAIM could turn around faster than the sector.

In the first 10 years since its IPO, NAIM achieved an average ROE of 13 %. Over the past 10 years, it achieved an average ROE of 2 %. Given the market situation and the correlation, I would not expect a 13% ROE over the coming decade. If I had to make a forecast, I would use a 7 % average ROE.

|

| Table 3: Correlation between Naim and Industry Note. For the Property segment, I computed the correlation between NAIM and the average of the Malaysia Medium companies. |

|

Valuation

My valuation of NAIM was based on my standard approach.

- Earnings value was based on the average of the Free Cash Flow to the Firm method and the Residual Income Method.

- I took the time weighted average values for the past 12 years as the “normalized” values.

- The WACC was derived as per Damodaran’s approach based on a risk-free rate of 2.3 %, Unlevered cash adjusted Beta of 0.76 and weighted Equity Risk Premium of 5.4 %.

I valued NAIM as

- Asset value = RM 2.48 per share.

- EPV = RM 1.73 per share.

- Earnings with growth = RM 2.31 per share

|

| Chart 7: Valuation |

The market price of NAIM as of 18 July 2022 was RM 0.46 per share. This is even lower than its Graham Net-Net of RM 0.87 per share.

You will note that the average purchase cost of my balance shares was RM 0.90 per share which is about the Graham Net-Net. Both the Asset Value and Earnings Value provided sufficient margins of safety for my purchased cost.

Note that the Asset Value of NAIM had declined from RM 2.69 per share in 2019 to RM 2.48 per share due to the 2021 losses. Even if I factor in the same loss for a few years, there would still be a sufficient margin of safety.

The question then is not the margin of safety but how long it will take for the market to re-rate NAIM.

Conclusion

NAIM is not just a property and construction group. Because of its 25 % shareholdings in Dayang, it is also an Oil and Gas services provider.

Leaving aside the Covid-19 years, the performance of the Group had been affected by the soft property and construction market. At the same time, it had suffered losses due to the impairments suffered by Dayang.

It may take a few more years to see significant uptrend in the property and construction sectors. But the Oil and Gas sector is currently experiencing buoyant prices. This would translate into more investments in the Oil and Gas sector thereby boosting the demand for the services provided by Dayang. If this turns out, it would be a catalyst for the market to re-rate NAIM as what happened in 2019.

My first tranche in NAIM (representing 25 % of my total investments in NAIM) achieved a compounded annual return of 16.9 %. However, the balance 75 % of my total investments in NAIM is currently suffering a compounded annual loss of 6.5 %. I would need NAIM share price to more than double its current price to breakeven for this remaining tranche.

Will this happen? Prices in the past few years (post Rights) have gone as high as RM 1.34 per share. As such I am confident that this will happen. Yes. The problem is I do not know when this will happen.

I have a long-term investment horizon with an average holding period of 8 years. The average holding period of the remaining tranche is about 5 years currently. It is still below my average holding period.

I can afford to wait as there is a sufficient margin of safety at my purchased cost. At the same time, NAIM is financially sound and able to withstand a long soft market condition. It has a track record of good returns during more positive market conditions. I am confident that it will be able to turn around. For these reasons, NAIM is one of the better Bursa Malaysia stocks to invest in.

End

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

How to be an Authoritative Source, Share This Post

|

Disclaimer & Disclosure

I am not an investment adviser, security analyst, or stockbroker. The contents are meant for educational purposes and should not be taken as any recommendation to purchase or dispose of shares in the featured companies. Investments or strategies mentioned on this website may not be suitable for you and you should have your own independent decision regarding them.

The opinions expressed here are based on information I consider reliable but I do not warrant its completeness or accuracy and should not be relied on as such.

I may have equity interests in some of the companies featured.

This blog is reader-supported. When you buy through links in the post, the blog will earn a small commission. The payment comes from the retailer and not from you.

Comments

Post a Comment